Professional Documents

Culture Documents

Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year Edition

Uploaded by

YA2301Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year Edition

Uploaded by

YA2301Copyright:

Available Formats

PitchBook & Grant Thornton

Private Equity Exits Report 2011 Mid-Year Edition

Sponsored by:

Private Equity: Data | News | Analysis

The PitchBook Advantage

Better Data. Better Decisions.

Table Of Contents

Grant Thornton Introduction ................................................. 3 Private Equity Exits Overview ................................................ 4-9

Deals and Exits Imbalance .................................................. Portfolio Inventory and Holding Period ............................ Exit Trends by Year and Quarter ....................................... Median Exit Value and Exit EBITDA Multiple ................... Exits by Size Bucket .............................................................. Exits by Region and Industry .............................................. Business Products and Services ......................................... Consumer Products and Services ...................................... Information Technology ...................................................... Healthcare ............................................................................. Financial Services ................................................................. Energy .................................................................................... 4 5 6 7 8 9 10 10 10 11 11 11

Industry Focus ........................................................................ 10-11

Cross-Border Exits .................................................................. 12 Exit Type ................................................................................. 13-16

Overview ............................................................................... Corporate Acquisition ......................................................... Secondary Buyout ................................................................ Initial Public Oering ........................................................... 13 14 15 16

COPYRIGHT 2010 by PitchBook Data, Inc. All rights reserved. No part of this publication may be reproduced in any form or by any means graphic, electronic, or mechanical, including photocopying, recording, taping, and information storage and retrieval systems without the express written permission of PitchBook Data, Inc. Contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Nothing herein should be construed as any past, current or future recommendation to buy or sell any security or an oer to sell, or a solicitation of an oer to buy any security. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon as such or used in substitution for the exercise of independent judgment.

2 Private Equity Exits - 2011 Mid-Year www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Private Equity Exit Activity

Theres a lot of research and data out there regarding M&A activity. Most of this information relates to overall trends or perhaps a segregation of data by transaction size or industry sector. There is even a fair amount published on private equity acquisition activity. However, one area that doesnt seem to get quite as much attention is private equity exits. For that reason, Grant Thornton LLP and PitchBook have teamed up to explore this topic. On a bi-annual basis, we will present the current state of private equity exit activity, historical trends, and our thoughts and insights. We hope this publication helps you better understand this increasingly important element of the transaction market. In this installment, we look at private equity exit activity as of mid-2011 specically as of June 30, 2011. Overall, 2011 has continued to be a year of recovery for the M&A market. For private equity, the data and trends yield a number of interesting observations: Private equity acquisition activity built to a crescendo and peaked at nearly 2,000 deals (excluding add-ons) in 2007. However, exits dropped signicantly during the recession leaving a record level of portfolio companies (nearly double the number from ve years ago). A third of these portfolio companies have been owned for more than 5 years. Exit activity is starting to recover, but it is still o from the peak levels of 2006 and 2007. Activity in the rst half of 2011 exceeded the rst half of 2010. However, activity at the end of 2010 was strong, spurred in the fourth quarter with the scheduled expiration of certain tax breaks, which were eventually extended. One piece of good news is that exit multiples for private equity-backed companies are well above levels seen in the early part of the decade. The median EBITDA multiple is down from the peak in 2007, but that would not surprise anyone in the industry. Private equity exits were fairly well disbursed geographically, with the Midwest seeing the largest proportion of transactions during the rst half of 2011. From an industry point-of-view, the Business Products and Services segment represented nearly one-third of the exit activity, while Financial Services represented the lowest, after undergoing a 20% decline compared to 2010. These highlights are a few high level observations from the data presented in this publication. As a private equity owner, you may nd specic areas of interest based on the particular size, industry, and stage of development (i.e., how close you are to an exit) of your portfolio companies. We hope this information sheds some light on market dynamics as you assess your particular exit alternatives. Stephen McGee

Practice Leader Grant Thornton Corporate Finance

The people in the independent rms of Grant Thornton International Ltd provide personalized attention and the highest quality service to public and private clients in more than 100 countries. Grant Thornton LLP is the U.S. member rm of Grant Thornton International Ltd, one of the six global audit, tax and advisory organizations. Grant Thornton International Ltd and its member rms are not a worldwide partnership, as each member rm is a separate and distinct legal entity. Grant Thornton LLP oers private equity rms and their portfolio companies a broad array of services tailored to their individual needs and goals. Our professionals are responsive and dedicated, with strong experience in audit, tax, transaction and other advisory services. More importantly, we bring valuable ideas and insights to help our private equity clients achieve their objectives to build and realize exceptional value.

3 Private Equity Exits - 2011 Mid-Year www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Private Equity Exit Activity

The U.S. private equity lifecycle over the past decade has appeared to be limited to raise fund, invest fund, raise another but bigger fund, make more new investments and repeat. What has been missing is a signicant focus on completely realizing mature investments. This has not been the case for all private equity rms, but looking at the chart below and considering that the remaining value of PE funds between ve and ten years old is 57% of their total value (notably that 57% usually includes the funds entire prots), it appears to be a widespread phenomenon. To be fair, the unforeseen nancial crisis and ensuing economic recession only exacerbated this imbalance between new investments and exits, as it hit during many PE portfolio companies exit window, forcing PE rms to push that window further back and wait for balance sheets, performance and valuations to recover. This has left U.S. private equity portfolios bursting at the seams with a record 6,107 companies, over 4,000 of which are older than three years and 2,000 of which are older than ve years. The resulting general imbalance is causing rms to reevaluate their focus and limited partners to hold back from any further commitments until they see more distributions. PE rms have been able to nd some liquidity in their portfolios through dividends, dividend recapitalizations and partial sales, but most, if not all, of the prot isnt realized until the nal sale of the company. The criteria for PE rms to successfully raise another fund now not only includes having a track record of good investments but also having a track record of being able to exit those investments and returning capital to their limited partners. This is why exits are so critical to private equity, more so now than ever before. The rest of this report will dive deeper into the current investment-to-exit imbalance and then cover, in detail, U.S. private equity exit activity for the rst half of 2011 and recent years. It will explore the types of companies being sold, how they are being sold and to whom they are being sold in an eort to uncover the trends in todays U.S. private equity exit activity.

U.S. Private Equity Investments and Exits

*Through Q

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

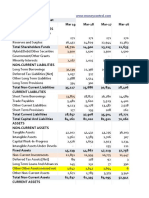

Private Equity Company Inventory

The number of companies currently owned by U.S. private equity rms is 6,107, a slight increase from where it stood at the end of 2010 (6,001), but almost double where it was just ve years ago. The steady growth of PE-owned companies, pictured in the chart below, shows not only the growth of the industry since 2005 but also how the imbalance of new investments to exits has led to record portfolio sizes. The sustainability of this growth is questionable, and likely why the growth appears to be leveling o in 2011. The fact is that at some point all of these companies will have to be sold by their investors; some, like the 1,000 that are over seven years old (dark blue region), sooner than later. These mature portfolio companies represent prime opportunities for other PE rms and strategic acquirers with cash available for investments and acquisitions. Company Inventory

Number of PE-Backed Companies

Median Holding Period

All Previous Years

This chart breaks down the current 6,107-company private equity overhang by the date of original investment. Using the current median holding period of ve years, this chart shows that there are almost 2,000 companies that are past due for an exit and approximately another 2,000 more that are within a year of it. It will be worth watching the inventory levels for 2006-2008 vintage investment closely to see if PE rms will be able to exit them in good time or if they will lead to a serious case of portfolio indigestion.

5 Private Equity Exits - 2011 Mid-Year

The median time to nal exit from initial investment climbed to almost ve years by the end of the rst half of 2011, a new record. The reason for the continued growth in 1H 2011 has been the need for PE rms to hold on to companies that are ripe for an exit in hopes of realizing a higher valuation on the back of another quarter or two of earnings growth. The median holding period will likely continue to increase as PE rms work through their inventory of aging portfolio companies.

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Private Equity Exit Activity

Having established the importance of private equity exits, what does the current U.S. private equity exit activity actually look like? The two charts below detail the number of exits and the aggregate exit deal amount for each quarter since the beginning of 2008, and for each year since 2006. They show a mixed picture, but the general trend over the past couple of years is towards an increase in activity, although on a level well below the 2006/2007 peak and far from the level needed to signicantly reduce the current company inventory. The nancial crisis and ensuing economic recession clearly put a big brake on almost all private equity exit activity in 2009, much like it did for private equity investment. However, since then activity has picked up and was especially spurred on in the fourth quarter last year with the scheduled expiration of certain tax breaks (which were eventually extended). This had the eect of clearing out the pipeline of exit deals going into 2011, leading to the dip in activity during the rst quarter of this year. The good news was that the second quarter showed improvement and was actually the second best quarter for exits since 2008. The prole of a typical exit during the rst half of 2011 was for a company in the Business Products & Services or Consumer Products & Services industries, likely located east of the Mississippi and valued at somewhere around 8x EBITDA with a price tag of between $50 million and $250 million. The buyer was usually another company acquiring it for strategic purposes, almost certainly a U.S.-based company. There are a number of positive trends developing in exit activity and the second half of the year should see a continued uptick in activity. Private equity rms are patient investors that have proved themselves in the past to have an uncanny ability to exit companies at the optimal point. However, that patience is wearing thin for private equity rms and even thinner for their limited partners, who have been waiting six to seven years now to see prots on their investment. These factors, combined with the sheer number of mature PE investments, are likely to drive exit activity during 2H 2011 and well into 2012.

Exits by Year

Exits by Quarter

*Through Q

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Median Exit Value ($M) by Exit Type

Despite a decrease in the median exit size during 1H 2011 from 2010 highs, the median exit for private equity-backed companies continues to be above the levels seen before 2010. For corporate acquisitions, the size drop was by 23% to $170 million, and for secondary buyouts, it was 16% to $295 million. The B2B industry, accounting for one-third of PE exits, was the key contributor to the decline of exit deal sizes in the rst half of 2011, with the industry median exit size dropping to $120 million from $168 million in 2010. The drop in median exit size is likely a reection of smaller companies being sold by PE rms, as opposed to a decline in the values of the PE companies being sold, since the exit size/EBITDA multiple has held steady.

Median Exit EBITDA Multiple

The median exit multiple (exit deal size/EBITDA) for private equity-backed exits so far in 2011 has stayed on-par with 2010 at 8x. Under the surface though multiples have been changing in the rst half of 2011, strategic acquisitions have increased to 9.6x from 8.5x, while exit multiples for IPOs and secondary buyouts decreased. Exits in the information technology and energy sectors closed with the highest multiples, both at 13.7x, followed by consumer products and services at 8x.

Private Equity Exits - 2011 Mid-Year

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Number of Exits by Size Bucket

There were two main changes in the breakdown of exit activity by deal size during the rst half of 2011: a decrease in deals between $500 million $1 billion and an increase in deals above the $1 billion mark. Despite the increase in large exits, it is important to note that it is the lower- and middle-markets that account for 83% of private equity exit activity. This is a positive sign for the industry, as the vast majority of private equity investments fall within this range and hopefully an encouraging sign to investors that exit opportunities are available across the company size spectrum.

Exit Deal Size by Size Bucket

While lower- and middle-markets see the most exits, larger exits, $1 billion and above, account for the majority of capital proceeds. Private equity-backed exits above $1 billion totaled $42.47 billion in aggregate deal size and represented 70% of exit sales in the rst half of 2011. The largest part of that total comes from exits above $2.5 billion, which during the rst half of 2011 totaled eight, ve more than in all of 2010. The top industry for these mega exits in 2011 has been Healthcare, having tallied four to its credit so far.

Private Equity Exits - 2011 Mid-Year

Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Exit by Region 1H 2011

Private equity exits were fairly geographically dispersed during the rst half of 2011. The Midwest led the pack with 19% of the exits, followed by the Northeast and Southeast with 18% of the exit activity apiece. The two regions that have experienced recent increases in exit activity are the Northeast and Mid-Atlantic. The Northeast saw a 50% increase in activity from the rst half of 2010 and the Mid-Atlantic a 53% increase from the second half of 2010. Falling out of favor for exits during the rst half of 2011 have been companies in the West Coast and Southwest regions, both posting declines in exit deal activity of over 30% compared to the rst half of 2010.

Exit by Industry 1H 2011

Exit activity was dominated by the Business Products & Services and Consumer Products & Services industries during the rst half of 2011. Information Technology continued to hold its position as the third most active industry for the third year running, followed closely by Healthcare. Exit activity was weak in the remaining sectors, a trend that reaches back to the beginning of 2009. In the B2B industry, exits were evenly split between the Commercial Products and Commercial Services sectors with 26 deals apiece. In the B2C space, exit activity was more widespread with thirteen in the Consumer Non-Durables sector, nine in Consumer Durables and seven in Transportation. In the remaining industries, there were pockets of concentrated exit activity, such as the sixteen exits from Software companies, nine from Healthcare Services companies and six from Energy Services companies. The industries that saw the biggest decline in exit activity during 1H 2011 compared to 1H 2010 were Energy with a 36% drop, Materials & Resources with a 29% decline and Financial Services with a 20% decline.

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Business Products and Services

The Business Products and Services (B2B) industry, which includes the Commercial Products, Commercial Services and Transportation sectors, has led private equity exit activity over the past three years with a total of 282 transactions. This would be expected as the B2B industry has also consistently led private equity investment. There were 59 exits completed during the rst half of 2011 in the industry, an increase of 31% from the same period last year and totaling $9.45 billion in aggregate. Both the Commercial Products and Commercial Services sectors ended the rst half with 26 exits each.

Consumer Products and Services

The Consumer Products and Services (B2C) industry, which includes the Apparel; Consumer Durables; Consumer Non-Durables; Media; Restaurants, Hotels and Leisure; Retail; Transportation and Consumer Non-Financial Services sectors, saw a total of 233 exits over the past three years. There were 42 exits in the rst half of 2011, a decrease of 20% from the same period last year. The most active sector in the B2C industry was Consumer Non-Durables with thirteen exits, which was led by the Food Products sub-sector with six transactions. The 42 exits in 1H 2011 totaled $6.6 billion, led by $2 billion of exits in the Consumer Durables sector.

Exit by Sector

Information Technology

The Information Technology (IT) industry, which includes the Communication and Networking, IT Hardware, Semiconductors, IT Services and Software sectors, saw 166 exits completed in the past three years. The rst half of 2011 ended with 32 completed exits, an increase of 14% from the same period last year. The Software sector led the rst half of 2011 with sixteen completed exits, followed by the Communications and Networking sector with six. The combined total of the industrys exits was $4.04 billion for the rst half of 2011, the lowest amount of any industry.

10

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Healthcare

The Healthcare industry, which includes the Devices and Supplies, Healthcare Technology Systems, Pharmaceuticals and Biotechnology and Medical Services sectors, saw a total of 124 exits during the last three years. There were 26 exits completed during the rst half of 2011, on par with the same period last year. The most active sector in the Healthcare industry was Medical Services with nine exits. The Healthcare industry was the most active industry in terms of capital proceeds during the rst half of 2011 with a total of $18.2 billion.

Financial Services

The Financial Services industry, which includes the Capital Markets and Institutions, Commercial Banks and Insurance sectors, completed 55 exits in the past three years. With only eight completed transactions in the rst half of 2011, the industry was the least active industry in terms of private equity exits. The industry has seen a very low level of exit activity stretching back a number of years despite a signicant amount of past private equity investment. This will be one industry to keep an eye on to see if and how and when private equity rms are able to successfully exit their portfolios of mature investments.

Exit by Sector

Energy

The Energy industry, which includes the Equipment; Exploration, Production and Rening; Energy Services and Utilities sectors, has seen only 57 exits in the past three years, a number equivalent to only about 15% of the 374 Energy companies PE rms invested in during this same time frame. A total of nine exits were completed in the rst half of 2011, a 36% decrease from the same period last year. Energy Services was the most active sector in the Energy industry during the rst half of 2011 with six completed exits totaling $4.3 billion.

11

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

International Company Exits by U.S. Investors

Consumer Products and Services (B2C)

This chart details the exit activity of non-U.S. company investments sold by U.S. private equity rms over the last seven and a half years. Western Europe and Northern Europe have not surprisingly been the most active regions, accounting for over half of the U.S. PE investor international exits over the last few years. Europe attracts a signicantly higher number of U.S. PE investments compared to other regions, and the large exit volume is likely a reection of this investment trend. So far in 2011, there has been a clear jump in exit activity in China and Canada, a trend worth monitoring.

International Buyers in U.S. Company Exits

U.S. PE rms traditionally look to sell their portfolio companies to other U.S. companies and investors, but this has been changing over the last few years. The amount of PE-backed companies sold to non-U.S. investors or companies now accounts for about 10% of all exits. With the Canadian dollar on par with the U.S., Canadian investors and companies are nding a lot more opportunities south of the border and have accounted for almost 40% of non-U.S. buyer activity in 2011. European buyers have slightly decreased their activity from years past, while Chinese buyers have stepped up to account for about 15% of non-U.S. buyer exits.

12 Private Equity Exits - 2011 Mid-Year

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

When it comes to fully exiting investments (not just generating some liquidity) private equity rms rely heavily on three main strategies: sales to strategic acquirers (corporate acquisitions), sales to other private equity rms (secondary buyouts) or taking the company public (IPOs). Over the years, the mix of these exit strategies has largely stayed consistent with corporate acquisitions accounting for the majority, followed by secondary buyouts and then IPOs. So far in 2011, there has been little change to the status quo, as shown by the breakdown of exit types in the stacked bar chart below. However, in the 4Q 2010 exit rush, there were a large number of secondary buyouts, 66 to be exact, as private equity rms turned to other private equity rms. There are multiple explanations for this, including PE rms need at the time for the quick closing ability of PE-to-PE deals and the easy sourcing of buyers from existing industry relationships.

Number of Exits by Exit Type

Percentage of Exits by Exit Type

The rst half of 2011 showed that the dierent exit strategies were ring on all cylinders for private equity investors with strong competition from strategics and buyout rms in auction sales and more successful IPOs than in years past. There are currently a plethora of positive trends occurring across corporate acquisitions, secondary buyouts and IPOs that bode well for the second half of 2011 and on into 2012. They are covered in more detail on the following pages.

13

Private Equity Exits - 2011 Mid-Year

www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Corporate Acquisition

Number of Coroprate Acquisition Exits

Companies (strategic acquirers) have long been the biggest buyers of private equity-backed companies and that shows no sign of changing this year with 101 such deals totaling $39.5 billion completed in the rst half of 2011. Over the past ve years corporate acquisitions have accounted for about 60% of PE exit deals, although this has dipped slightly with the recent increase in IPOs and secondary buyouts. The median corporate acquisition deal amount so far in 2011 has been $170 million, the second highest amount ever as PE rms take advantage of the deep pockets of strategics. Among the companies buying PE companies in 2011 are a number of Fortune 500 companies such as General Electric (NYSE: GE), Coca-Cola (NYSE: KO), Sara Lee (NYSE: SLE) and Southwest Airlines (NYSE: LUV), as well a number of medium sized businesses such as Loomis Fargo, Saputo Cheese and Helen of Troy (NASDAQ: HELE). The industry breakdown of corporate acquisition deals in 2011 has largely been spread out equally among four main industries, but looking deeper, there are clusters of activity around a few sectors, mainly Commercial Products, Consumer Non-Durables, Pharmaceuticals and Biotechnology, and Software. With the amount of cash on corporate balance sheets and the need for companies to nd growth in the current low growth environment, the dynamics for more corporate acquisitions certainly exist and could lead to a busy rest of the year.

Median Holding Period

Corporate Acquisitions by Industry - 1H 2011

14

Private Equity Exits - 2011 Mid-Year

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Secondary Buyout

Number of Secondary Buyout Exits

Private equity to private equity deals, known as secondary buyouts, have received a lot of attention this year, but so far there has not been the speculated increase in these deals. They have been chugging along at around 28% to 32% of exit deal ow for the last two and half years with the exception of 4Q 2010, when there was a spike in secondary activity. During 4Q 2010, there were 66 secondary buyouts with a combined deal value of $23.5 billion. It took the rst two quarters of 2011 to reach 66 secondary buyouts totaling only $12.4 billion. The secondary buyouts so far in 2011 have been disproportionally centered on the Business Products and Services industry with 29 deals, followed by the Consumer Products and Services industry with 15 deals. In 2011, secondary buyout exits have on average come ve years after a PE rms initial investment in the company. This is in line with what was seen in 2010 but a full year longer than what it was between 2006 and 2008. All of the conditions are in place for an increase in secondary buyout activity with a $470 billion private equity capital overhang and a record inventory of 4,633 PE-backed companies at or beyond the normal exit period. Look for more secondary buyouts to take place in the second half of 2011 and really gain momentum in 2012.

Median Holding Period

Secondary Buyouts by Industry - 1H 2011

15

Private Equity Exits - 2011 Mid-Year

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

Initial Public Oering

Number of IPO Exits

Private equity rms have faced a rough time with the public markets over the past several years with only 101 IPOs completed since the beginning of 2008, as compared with the 118 in 2006 and 2007. The good news though is that PE rms in the past 18 months have been able to take advantage of the recovering stock market by taking 63 companies public. Leading the charge was Hospital Corporation of America (NYSE: HCA) with the largest PE-backed IPO ever at $4.3 billion, as well as other large oerings such as Kinder Morgan (NSYE: KMI) and The Nielsen Company (NYSE: NLSN). Most of the companies though were more modest in size with the median market cap at time of IPO being $835 million. It is important to note that in most of the recent private equity company IPOs the PE rms are selling very few of their shares, if any. Most IPOs proceeds are instead being used by the companies for debt repayment and other corporate purposes. This drawn out exit is likely why there is a four-year hold time before IPOs are completed, as opposed to ve years for both secondary buyouts and corporate acquisitions. IPOs are highly aected by the equity markets, but with 82 PE-backed companies sitting in IPO registration, there is potential for an active second half of the year.

Median Holding Period

IPOs by Industry - 1H 2011

16

Private Equity Exits - 2011 Mid-Year

*Through Q www.grantthornton.com www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

The PitchBook Advantage

Better Data. Better Decisions.

The PitchBook Platform now gives you more...

Aggregated Analytics Custom Charts

Detailed, customizable analytics directly from your search results Create presentation-ready charts tailored to your needs on the y Customize layouts and information to download to Excel

Custom Downloads One Simple Search

See all related investors, deals, funds, service providers and more with one search

Just Released!

Discover the dierence for yourself.

Click Here to Request a Demo

Sales: 1-877-267-5593 demo@pitchbook.com Full Landscape of Private Equity Unparalleled Intelligence Comps & IRR

From fundraising to exits, investments to returns, we track it all. 50K+ deals, 14K+ investors, 157K+ professionals and thousands more. Public & private comps and IRR tools make pricing and analysis easy.

Private Equity Exits - 2011 Mid-Year

www.pitchbook.com | demo@pitchbook.com | 1-877-267-5593

LEMMINGS DONT WIN.

Rebels win. Challengers win. Pioneers win. The status quo may have won in the past. But that was yesterday. The worlds most dynamic companies know what wins today. Maybe thats why so many choose to work with us. See what wins at gtwhatwins.com.

Grant Thornton LLP is the U.S. member firm of Grant Thornton International Ltd.

You might also like

- Altman Z ScoreDocument19 pagesAltman Z ScoreShadab khanNo ratings yet

- The Industrial Organization of The Global Asset Management BusinessDocument114 pagesThe Industrial Organization of The Global Asset Management Businesssantiago pachecoNo ratings yet

- Pimco Corp. Opp Fund (Pty)Document46 pagesPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongNo ratings yet

- IDX5315 - Al Shafar Invest Palm Jumeirah - TSSR - V1.1Document19 pagesIDX5315 - Al Shafar Invest Palm Jumeirah - TSSR - V1.1LijithYesodharanNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Centrum Private Credit Fund - Annual NewsLetterDocument17 pagesCentrum Private Credit Fund - Annual NewsLettersuraj211198No ratings yet

- Dynamic Capital Structure ModelDocument30 pagesDynamic Capital Structure ModelShan KumarNo ratings yet

- Premier Hedge Fund Conference Agenda 2017 PDFDocument4 pagesPremier Hedge Fund Conference Agenda 2017 PDFLuwei ShenNo ratings yet

- Lateritic NickelDocument27 pagesLateritic NickelRAVI1972100% (2)

- LM2TB8 2018 (Online)Document252 pagesLM2TB8 2018 (Online)SandhirNo ratings yet

- Fmi NotesDocument30 pagesFmi NotesAnshita GargNo ratings yet

- Blackstone Purchase of HiltonDocument40 pagesBlackstone Purchase of HiltonChiku209100% (1)

- Investment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerDocument17 pagesInvestment Banking, Equity Research, Valuation Interview Handpicked Questions and AnswerStudy FreakNo ratings yet

- Bushcraft Knife AnatomyDocument2 pagesBushcraft Knife AnatomyCristian BotozisNo ratings yet

- The Liquidity Crisis Its Impact On The Hedge Fund Industry (July 2010)Document58 pagesThe Liquidity Crisis Its Impact On The Hedge Fund Industry (July 2010)Zerohedge100% (1)

- Guidelines On Real Estate Investment Trusts: Issued By: Securities Commission Effective: 21 August 2008Document162 pagesGuidelines On Real Estate Investment Trusts: Issued By: Securities Commission Effective: 21 August 2008Nik Najwa100% (1)

- Enabling Long Term Infrastructure Finance in Local Currency GuarantCoDocument13 pagesEnabling Long Term Infrastructure Finance in Local Currency GuarantCoMohammed BusariNo ratings yet

- CDR Writing: Components of The CDRDocument5 pagesCDR Writing: Components of The CDRindikuma100% (3)

- Hilton Black Stone CaseDocument13 pagesHilton Black Stone CaseAman Baweja100% (1)

- HAYAT - CLINIC BrandbookDocument32 pagesHAYAT - CLINIC BrandbookBlankPointNo ratings yet

- LG Sigma+EscalatorDocument4 pagesLG Sigma+Escalator강민호No ratings yet

- Cfap-02 Claw Sir Atif Abdi Updated Notes For Summer 2022Document637 pagesCfap-02 Claw Sir Atif Abdi Updated Notes For Summer 2022msofian msofianNo ratings yet

- MBA 485 - BTC Written ReportDocument14 pagesMBA 485 - BTC Written ReporthannatinambunanNo ratings yet

- Pricing of A Revolutionary ProductDocument22 pagesPricing of A Revolutionary ProductiluvparixitNo ratings yet

- Foreign Roadshow Book PDFDocument50 pagesForeign Roadshow Book PDFSurangaFernandoNo ratings yet

- Quanta Services Inc. Initiating Coverage ReportDocument12 pagesQuanta Services Inc. Initiating Coverage Reportmikielam23No ratings yet

- Guide To P2P Lending - InfographicDocument1 pageGuide To P2P Lending - InfographicPrime Meridian Capital ManagementNo ratings yet

- V V V V:) V) V5V$V VV V VV9V8) VVDocument2 pagesV V V V:) V) V5V$V VV V VV9V8) VVBhavneesh ShuklaNo ratings yet

- Ibps Capsule Part - 1: by Spread The KnowledgeDocument10 pagesIbps Capsule Part - 1: by Spread The KnowledgePratiksha KapoorNo ratings yet

- Annual Report 2011Document68 pagesAnnual Report 2011djokouwm100% (1)

- HEXA TP FinancialsDocument60 pagesHEXA TP FinancialsKanmani FX21015100% (1)

- PE Pulse: Quarterly Insights and Intelligence On PE TrendsDocument27 pagesPE Pulse: Quarterly Insights and Intelligence On PE Trendslaunchpad1No ratings yet

- NVCA Yearbook 2014Document127 pagesNVCA Yearbook 2014gmswamyNo ratings yet

- NIC Bank 2012 Annual ReportDocument128 pagesNIC Bank 2012 Annual ReportGeorge MSenoir100% (1)

- 2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALDocument66 pages2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALJamesMinionNo ratings yet

- Tax Calculator 2022-2023Document3 pagesTax Calculator 2022-2023Entertainment StudioNo ratings yet

- Blume Investment Report 16 Q3 2015 PDFDocument3 pagesBlume Investment Report 16 Q3 2015 PDFAbcd123411No ratings yet

- Chapter 4 GF & SRFDocument27 pagesChapter 4 GF & SRFSara NegashNo ratings yet

- Investing in Blue EconomyDocument18 pagesInvesting in Blue EconomyKamran TanoliNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Treasury Presentation To TBAC ChartsDocument47 pagesTreasury Presentation To TBAC Chartsrichardck61No ratings yet

- Pitchbook: The Private Equity 2Q 2012 BreakdownDocument14 pagesPitchbook: The Private Equity 2Q 2012 BreakdownpedguerraNo ratings yet

- Guide To U.S. Anti-Money Laundering Requirements: Fourth EditionDocument372 pagesGuide To U.S. Anti-Money Laundering Requirements: Fourth EditionHR YadavNo ratings yet

- The Hirers Guide To Remote Hiring V6Document71 pagesThe Hirers Guide To Remote Hiring V6Doa Sri SucintaNo ratings yet

- Banking HND SyllabusDocument178 pagesBanking HND SyllabusGoodnews AdeshinaNo ratings yet

- BS MobDocument3 pagesBS MobProject AtomNo ratings yet

- Aviation Strategy in The Last DecadeDocument24 pagesAviation Strategy in The Last DecadeFilippo CapitanioNo ratings yet

- Hurdle Rate Versus High Water Mark: What The Difference?Document2 pagesHurdle Rate Versus High Water Mark: What The Difference?ajayNo ratings yet

- A Strategic Analysis of Peloton 2: April 2021Document23 pagesA Strategic Analysis of Peloton 2: April 2021PedroNo ratings yet

- Who's Running The Company? A Guide To Reporting On Corporate GovernanceDocument76 pagesWho's Running The Company? A Guide To Reporting On Corporate GovernanceInternational Finance Corporation (IFC)100% (1)

- Financial Markets and ServicesDocument16 pagesFinancial Markets and Servicesriddhima anandNo ratings yet

- Ebix Investor Presentation WebDocument40 pagesEbix Investor Presentation Webyash.chandraNo ratings yet

- Hilton Black Stone CaseDocument6 pagesHilton Black Stone CaseLavanya RamanNo ratings yet

- Analysis of Financial Statements: Jian XiaoDocument115 pagesAnalysis of Financial Statements: Jian XiaoLim Mei SuokNo ratings yet

- 2021-10-28 HFSC Republican Letter To Sec. Yellen On International Affairs FinalDocument8 pages2021-10-28 HFSC Republican Letter To Sec. Yellen On International Affairs FinalMariano BoettnerNo ratings yet

- Master Circular On Rbi Circular - Circular On Forex Risk ManagementDocument95 pagesMaster Circular On Rbi Circular - Circular On Forex Risk ManagementBathina Srinivasa RaoNo ratings yet

- Gta 5Document8 pagesGta 515 Saad HassanNo ratings yet

- Introduction To Idrac6 PDFDocument23 pagesIntroduction To Idrac6 PDFMac LoverzNo ratings yet

- PP 10 21 Landry Signe - 1Document40 pagesPP 10 21 Landry Signe - 1Ross TookieNo ratings yet

- The Commercial Observer - May 11, 2010Document55 pagesThe Commercial Observer - May 11, 2010Jesse CostelloNo ratings yet

- Ecobank Financial Report For 2018Document186 pagesEcobank Financial Report For 2018Fuaad DodooNo ratings yet

- Barclays CoCoDocument97 pagesBarclays CoCoInvestment Banker CyclistNo ratings yet

- Solutions BD3 SM24 GEDocument4 pagesSolutions BD3 SM24 GEAgnes ChewNo ratings yet

- Sustainable Financial System 2021 - FINALDocument26 pagesSustainable Financial System 2021 - FINALSustainably MeNo ratings yet

- Symfonie P2P Lending FundDocument29 pagesSymfonie P2P Lending FundSymfonie CapitalNo ratings yet

- Canada-Net Pay CalculationsDocument20 pagesCanada-Net Pay CalculationsShaik ShafiNo ratings yet

- Earnings Reports What Do Quarterly Earnings Tell YouDocument5 pagesEarnings Reports What Do Quarterly Earnings Tell YouUNLV234No ratings yet

- Davis Fund Fall 2013Document10 pagesDavis Fund Fall 2013William ChiaNo ratings yet

- Aig Best of Bernstein SlidesDocument50 pagesAig Best of Bernstein SlidesYA2301100% (1)

- 02-10-2012 - EOTM - Der KommissarDocument3 pages02-10-2012 - EOTM - Der KommissarYA2301No ratings yet

- Bank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewDocument31 pagesBank of America Merrill Lynch Q3 2010 Hedge Fund Industry OverviewYA2301No ratings yet

- ArcGIS Shapefile Files Types & ExtensionsDocument4 pagesArcGIS Shapefile Files Types & ExtensionsdanangNo ratings yet

- WinCC Control CenterDocument300 pagesWinCC Control Centerwww.otomasyonegitimi.comNo ratings yet

- #Angles Are in Degrees: EGR2313 HW SOLUTIONS (2021)Document4 pages#Angles Are in Degrees: EGR2313 HW SOLUTIONS (2021)SolomonNo ratings yet

- Countable 3Document2 pagesCountable 3Pio Sulca Tapahuasco100% (1)

- LavazzaDocument2 pagesLavazzajendakimNo ratings yet

- Product Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1Document4 pagesProduct Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1David MooneyNo ratings yet

- Tree PruningDocument15 pagesTree Pruningrita44No ratings yet

- Protection in Distributed GenerationDocument24 pagesProtection in Distributed Generationbal krishna dubeyNo ratings yet

- CL RouterAndSwitches AE Kn1of3 AnswerDocument19 pagesCL RouterAndSwitches AE Kn1of3 Answereugene ngNo ratings yet

- Power System Planning and OperationDocument2 pagesPower System Planning and OperationDrGopikrishna Pasam100% (4)

- Health and Safety For The Meat Industry: Guidance NotesDocument198 pagesHealth and Safety For The Meat Industry: Guidance NotesPredrag AndjelkovicNo ratings yet

- TRICARE Behavioral Health Care ServicesDocument4 pagesTRICARE Behavioral Health Care ServicesMatthew X. HauserNo ratings yet

- Microeconomics Term 1 SlidesDocument494 pagesMicroeconomics Term 1 SlidesSidra BhattiNo ratings yet

- Antibiotics MCQsDocument4 pagesAntibiotics MCQsPh Israa KadhimNo ratings yet

- HandsoutDocument3 pagesHandsoutloraine mandapNo ratings yet

- Advent Wreath Lesson PlanDocument2 pagesAdvent Wreath Lesson Planapi-359764398100% (1)

- CV ChristianDocument2 pagesCV ChristianAlya ForeferNo ratings yet

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- Cad Data Exchange StandardsDocument16 pagesCad Data Exchange StandardskannanvikneshNo ratings yet

- Schneider Contactors DatasheetDocument130 pagesSchneider Contactors DatasheetVishal JainNo ratings yet

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Document94 pagesN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESNo ratings yet

- T-Tess Six Educator StandardsDocument1 pageT-Tess Six Educator Standardsapi-351054075100% (1)

- Dissertation 7 HeraldDocument3 pagesDissertation 7 HeraldNaison Shingirai PfavayiNo ratings yet