Professional Documents

Culture Documents

Short Term Budgeting For Special Transaction

Uploaded by

Kimberly PalmeroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Short Term Budgeting For Special Transaction

Uploaded by

Kimberly PalmeroCopyright:

Available Formats

lOMoARcPSD|3827926

Short-Term Budgeting for Special Transaction

Accounting for Special Transactions and Business Combinations (Batangas State

University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Module 3

Short-Term Budgeting

Introduction

Repeated references to budget allowances have been made throughout previous chapters and

we have seen how closely accounting and budgeting are related and how one depends on the

other. Accounting draws some of its data from planned performances established in the budget;

in turn, recorded historical data provide a basis for determining budget estimates.

Intended Learning Outcomes

After studying this chapter, students should be able to

1. Define budgeting and other related terminologies

2. Understand the uses of the process of budgeting

3. Understand the functions and composition of budget committee

4. Determine the relationships between operating and financial budgets

5. Identify the different types of budgets or the major composition of the master budget

6. Prepare a master budget and its supporting schedules

7. Prepare operating and financial budgets using the flexible budget model

8. Describe the different models of budgeting

9. Relate budgeting to standards-setting, planning and controlling functions of management

Budget defined

A budget is a financial plan of the resources needed to carry out tasks and meet financial goals.

It is also a quantitative expression of the goals the organization wishes to achieve and the cost

of attaining these goals.

The act of preparing a budget is called budgeting. The use of budgets to control a firm’s

activities is known as budgetary control.

The overall or master budget (also known as planning budget or budget plan) indicates the

sales level, production and cost levels, income and cash flows that are anticipated for the

coming year.

The master budget is a summary of all phases of a company’s plans and goals for the future.

In short, it represents a comprehensive expression of management’s plan for the future and how

these plans are to be accomplishe.

The Budgetary System

The CEO has a mission to accomplish and an objective to achieve. Otherwise, he has no

business keeping his job. To achieve the objectives, he has to devise strategies to win people

and optimize other resources in the organization. The key paradigm is “winning people”. To do

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

this and to unleash the power of organizational oneness, the CEO must encourage employee

participation and involvement and enlist their commitment towards the organizational objectives.

These could be done through the process of budgeting, which has the following uses:

1. Communication.

The most important process of management is communication. Vision, mission, goals,

objectives, plans, standards, and performance evaluation measures must be clearly articulated

and understood among officers and personnel. More than understanding, man in the

organization must believe, get involved and work with commitment in achieving organizational

goals. This could be done by clearly delineating the lines of communications i.e., an

organizational structure should clearly define the lines of authority and responsibility.

2. Motivation

As communication lines are cleared and made more transparent, people will understand the

end-results of organizational plans and ask. As they are made part in conceptualizing the plans,

they get involved and become more committed in attaining plans. This process moves people to

act in accordance with organizational goals.

3. Standards.

After the actions, results should be summarized and evaluated. At the very onset, the

measurement to be used in evaluating performance must be established. These measures of

performance are called “standards”. They must be clearly defined and agreed-upon between

the person, whose performance is evaluated, and the evaluator. If standards are too high or

improbable to achieve, people get demoralized as there is no fair chance of getting a high

performance rating. If standards are too low, people are not motivated to exert their best effort,

thereby encouraging mediocre results. Standards are set to motivate. They are also an

important basis for planning and controlling. Standards to be objective, are normally expressed

in quantitative form (e.g., amount, units, hours, thirst, kilograms, number of invoices processed,

etc.,). Still, the most objective mode of expressing standards is in terms of money.

4. Planning

As standards are set, plans could be done better. A good plan must be S. M. A.R. T.

(i.e., specific, measurable, attainable, realistic, and time-bounded). Plans must be specific to be

clear, measurable to be fair in the evaluation process, attainable to elicit outstanding

performance, realistic to allow people to relate to, and time-bounded to impress urgency and

deadlines. The design and development of a plan must be participated in by people in the

organization. This means an effective appetizer to increase one's desire in achieving an

objective. As plans are developed, men must start developing a “sense of ownership“, and

eventually, commitment. Questions such as, “what resources are needed?”, “How do we do it?”,

“When do we do it?“, “Who will do it?“, And “where do we do it?“ need to be resolved with

acceptable certainty. Planning is an act of approximating the future and preparing resources,

systems, strategies, structures and methods that could best seize the opportunities in a given

condition to increase the equity or wealth of an organization.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

a. Organizing and Directing

As plans are framed, resources are organized accordingly. Policies, systems, operational

strategies, methods and means are devised as activities are mapped-out and lined-up to

execute plans. People are trained, machines brought in, materials outsourced, systems and

standards strictly implemented, and offline and online performances monitored. Revisions of

plans may be done in-progress and remedial actions are devised and executed when

necessary. All along, acts are done in accordance with organizational plans, goals and

objectives. In this context, the importance of operational management cannot be undermined.

The effectiveness and fitness of managerial judgment are tested. Resources are not only

marshaled but are organized and operationally managed. Actions, processes, and

transformations are done to meet the objectives of the organization.

5. Controlling and Performance Evaluation

Controls are to be devised and installed prior to business and operational processes. Controls

are also done during the process. Controls are classified as feedback controls, concurrent

controls, and feedforward controls.

Feedback controls pertain to completed activities, concurrent controls refer to ongoing

processes, feedforward controls anticipate and prevent problems. Questions such as, “what

structures are best for our operation?“, “what systems and policies are best applicable under the

circumstances?”, “why are we not meeting our targets or why are we extending our targets?“,

“why are machines and men not performing as expected?”, “ what methods are applicable

under the circumstances?“, “why is the market behaving differently?“, And “why do our financial

results differ from our estimates?“ need answers.

The Budget Committee … develop an executive team!

Top executives should primarily subscribe to organizational objectives. The CEO must therefore

exercise competence in leading and managing his top executives. Top executives must not only

be capable and competent but must have “ownership“ of organizational goals. There must be

trust and openness in communication. One way to achieve this is through the creation of a

Budget Committee.

A budget committee is normally composed of top executives in the administrative, operational

and financial areas of business such as the Vice Presidents for Sales, Production,Purchasing,

Human Resources, Information Technology, Engineering and Quality, Administration, and, most

especially, Finance. The Budget Committee is also known in practice as the management

committee (i.e., MANCOM) or executive committee (i.e., EXECOM).

The Budget Committee, which is normally headed by a Budget Director, administers the

budgetary process. It is concerned at developing the budget manual that includes a budget

planning calendar and distribution instructions for all budget schedules. A budget planning

calendar is the schedule of activities for the development and production of the budget. It

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

includes a list of dates indicating when the specific information is needed to be provided to other

departments or units until the entire budgetary process is completed. A budget manual includes

distribution instructions for all budget schedules to show that a segment’s budget is an input to

another department or business unit in the preparation of their own budget. Without distribution

instructions, someone who needs a particular schedule might be overlooked, and delays may

occur. A planning calendar integrates the entire budgetary activities. Along the way, men should

be educated about the purpose, forms, and processes of the budgetary system. They should be

taught how to make their own budget using the standard chart of accounts and the standardized

budget schedules, know the relevance of their schedule to another schedule, and the model of

performance evaluation. The bottom-line is, everybody should be made aware of and be

involved.

The Master Budgets … a financial process model!

Budgets are plans expressed in quantitative form, primarily in financial expression. When plans

are expressed quantitatively, they are more objective, understandable, and measurable.

The budgetary process is dependent on the organizational structure and purposes. As such, the

budget normally stay in answering the basic question, “Is there a market for the business?” This

question directs the master budgeting process to start in the sales budget. The normal

budgetary sequence is shown in figure 5.1.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Normally, the development of business is driven by its demand. In this perspective, the

budgeting process starts from the sales budget. Once it is projected, the production budgets,

operating expenses budgets, and the budgeted statement of profit or loss follow (i.e., operating

budgets). Then, the financial budgets leading to the budgeted statement of financial position

and the budgeted statement of cash flows with supporting schedules on collections from

customers and payments to suppliers (i.e., financial budgets). The entirety of the operating and

financial budgets comprise the master budgets of the enterprise at a given level of activity in a

given business period.

If there is a limitation on organizations resources such as materials and parts, direct labor hours,

machine hours, financial, cultural, and regulatory aspects, the starting point in preparing the

master budget shall be defined by such limitation.

Types of Budget

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

The types of budgets or the major composition of the master budget are:

1) The Operating budget

2) The Financial budget

3) The Capital budget

The following is a simplified subclasfficiation of the above-mentioned types of budget for a

manufacturing firm:

A. Operating Budget

1. Budgeted Income Statement

a. Sales budget

b. Production budget

1) Materials cost budget

2) Direct labor cost budget

3) Factory overhead budget

4) Inventory levels

2. Cost of Sales Budget

3. Selling and Administrative expenses budget

4. Financial Expense budget

B. Financial Budget

1. Budgeted Statement of Financial Position

2. Cash Budget

C. Capital Investment Budget

Budgeting Terminologies Defined

Budgeted Income Statement

- Refers to projection of revenue, expenses, and results of operations for a definite period

of time.

Cash budget

- A period-by-period statement of cash at the start of a budget period, expected cash

receipts classified by source; expected cash disbursements, classified by function,

responsibility, and form; and the resulting cash balance at the end of the budget period.

Financial Budget

- Refers to the budget of the financial resources as reflected in the budget statement of

financial position and cash budget.

Fixed Budget

- Projection of cost at a particular or one level of production (usually at normal capacity)

for a definite time period.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Flexible (variable) budget

- Projection of cost at different levels of production for a definite period of time

Participative budget

- Budget prepared using employees at all levels in the organization

Physical budget

- Budget that is expressed in units of materials, number of employees or number of man-

hours or service units rather than in pesos

Planning budget (static budget)

- Another term for master budget

Production budget

- Production plan of resources needed to meet current sales demand and ensure

adequate inventory levels

Program budget

- Budget for the major programs or projects that the company plans to undertake

Operating budget

- Refers to the plans for the conduct of business for the planning period; it includes the

budgeted income statement and all its supporting budgets.

Responsibility budget

- Budget for a responsibility center

Rolling (continuous, progressive) budget

- Budget which is prepared throughout the year, that is, as one month elapses, a budget is

prepared for one more month in the future

Sales budget

- Budget that shows the quantity of each product and the revenue expected to be sold

Traditional budgeting

- A system of budgeting which concentrates on the incremental change from the previous

year assuming that the previous year’s activities are essential and must be continued.

Zero-based budgeting

- A system of establishing financial plans beginning with an assumption of no-activity and

justifying each program or activity level

The Sales Budget

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Sales indicate meeting customers' wants, demands, needs, and desires. It fundamentally drives

the creation of business activities. It is the initiating motive of business organization and the

genesis of normal business planning.

Mathematically, the sales are affected by the unit sales price and quantity sold. The unit sales

price is affected by cost, competition, product substitutes, market trends, regulations, demand

and supply behavior, and estimated profit, among other things. The number of units sold is

affected by the unit sales price.

Other factors influencing sales forecast include the past sales volume, general economic and

industry conditions, relationship of sales to economic indicators (such as gross domestic

product, gross national product, personal income, employment, prices in industrial production),

relative product profitability, market research studies, advertising and other promotions, quality

of salesforce, seasonal variations, production capacity, and long-run sales trends for various

products. In forecasting sales, factors that have strong correlation with sales pattern are

identified and used.

Basically, there are three ways of making escalates for the sales budget:

a. statistical forecasting based on analysis of general business conditions, market

conditions, product growth curves, etc.

b. Make an internal estimate by collecting the opinions of executives and sales staff.

c. Analyze the various factors that affect sales revenue and then predict the future behavior

of each of these factors.

The estimated number of units sold could be estimated per product line, department,

geographical area, model, and market classification. In projecting units to be sold, several

forecasting techniques are employed which normally apply the concept of probability and best

estimates models, statistics, and simulation analysis. The study of probability and other

forecasting techniques are reserved in the chapter for quantitative techniques applied in

business.

Sample Problem 3.1. Estimated Sales in Units and Pesos

The management of New corporation is considering three state economic conditions: strong,

fair, and weak. Based on some macro studies, it has been agreed that the economy in the

coming year may be 40% strong, 50% fair and 10% weak. The projected number of units are

120,000 units, 90,000 units, and 50,000 units for strong, fair, and weak economic conditions,

respectively. The budgeted unit sales price given the estimates in units sold is P 120. Five

percent (5%) of the gross sales are estimated to be uncollectible.

Required:

1. Budgeted units to be sold in the coming year

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

2. Budgeted amount of sales, net of doubtful accounts.

Solutions/ Discussions:

1. The budgeted sales in units shall be determined as follows:

Economy Projected Sales Units Probability Budgeted Unit Sales

A 120,000 40% 48,000

B 90,000 50% 45,000

C 50,000 10% 5,000

Total 93,000

2. The budgeted net sales in pesos shall be:

Budgeted sales in units 93,000

x Unit sales price P 120

Budgeted gross sales in pesos P 11,160,000

Less: Allowance for doubtful accounts

(P 11,160,000 x 5%) 558,000

Budgeted net sales in pesos P 10,602,000

Once the sales units are projected and the sales amount already budgeted, the budgeted costs

and expenses would now be estimated, then the financial budgets all in connection with the

strategic plan of the business.

In the following discussions, the unit sales price and projected sales in units are normally given.

The Production Budget

Budgeted production is based on budgeted sales and inventory policies. An inventory policy is

normally based on the number of units to be sold in the following period. The formula for the

budgeted production could be derived from the traditional method of determining number of

units sold which states that finished goods inventory-beginning plus production less finished

goods inventory-ending equal budgeted sales. You tweak the formula and the computation for

the budgeted production is as follows:

Table 3.1. Pro-Forma Budgeted Production

Projected sales x

Add: Finished goods invty - end x

Total Goods Available for Sale x

Less: Finished Goods Inventory - Beg x

Budgeted Production x

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Once the budgeted production is set, the budgeted materials, direct labor, and variable

overhead may now be prepared.

The budgeted fixed overhead is based on normal capacity (e.g., normal production) which is

considered flat or constant over the periods (e.g., months) covered by the budget. It differs from

the master budget where its level of capacity varies from one month to another.

An illustration of Budgeted Production Schedule is presented on schedule 3 of Sample Problem

3.3.

The Direct Materials Budget

The raw materials budget is based on budgeted production. There are two (2) materials budgets

to be estimated;

1. Budgeted direct materials used

2. Budgeted direct materials purchases

Budgeted direct materials used budget

Multiply the budgeted production by the standard materials per unit of finished goods and you

get the budgeted direct materials to be used, or the budgeted direct materials requirements.

This makes the standard costing system a “sine qua non” in the budgetary process.

The standard cost is used in the preparation of the direct materials budgets, direct labor,

variable overhead, fixed overhead, selling expenses, and administrative expenses budgets as

well.

Budgeted direct materials purchases budget

Direct material purchases is direct materials used add the materials inventory ending, then

deduct the materials inventory beginning.

This procedure is derived from the traditional computation of raw materials used which is raw

materials inventory-beginning plus materials purchases less raw materials inventory-ending.

From this standpoint, the raw materials purchases budgets are derived, as follows.

Table 3.2. Pro-Forma Budgeted Direct Materials Used and Purchases

Budgeted direct materials used x (Budgeted production x Std. materials per unit)

Add: Materials Inventory End x

Total Materials for Use x

Less: Materials Inventory - Beg x

Budgeted direct mat. Purchases in units x

x Materials cost per unit x

Budgeted materials purchases in pesos P x

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

An illustration of Budgeted Direct Materials Used and Purchases is presented in Sample

Problem 3.4, Schedule 4.

The Direct Labor Budget

Let us assume a labor intensive operation where workers are paid by the hour. On this premise,

the budgeted direct labor hours is budgeted production times the standard direct labor hour per

unit produced. The standard direct labor rate per hour is multiplied to budgeted direct labor

hours to get the budgeted direct labor cost.

The standard direct labor hours per unit and the standard rate per hour are to be provided by

the standard cost sheet.

The pro-forma computation of the budgeted direct labor cost is as follows:

Table 3.3. Pro-Forma Budgeted Direct Labor

Budgeted Direct Labor hours x (Budgeted production x Std. DLH per unit)

x DL Rate per hour P x

Budgeted DL cost P x

The budgeted direct labor hours would determine the number of production personnel needed

to be employed for a given budgetary period.

An illustration of Budgeted Direct Labor is presented in Sample Problem 6.5, Schedule 6.

The Factory Overhead Budget

The factory overhead should be budgeted separately for the fixed overhead in the variable

overhead components.

Fixed overhead is constant in total while the standard fixed overhead rate is computed based on

the normal capacity. In short-term budgeting the standard fixed overhead rate is considered

constant.

Total variable overhead costs change in relation to the level of production while unit variable

cost is constant.

The computational guideline for the factory overhead is as follows:

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Table 3.4. Budgeted Factory Overhead Computations

Budgeted variable overhead x (Budgeted production x Std. Var OH per unit)

Budgeted fixed overhead P x (Normal capacity x Std. Fx OH rate/ unit)

Budgeted total overhead P x

The standard hours per unit and standard overhead rates per hour are to be based on the

standard cost sheet developed by the business.

An illustration of Budgeted Factory Overhead is presented in Sample Problem 6.5, Schedule 7.

The Budgeted Statement of Cash Flows

Cash may be considered as the alpha and omega of the business process. Investors interest

would boil down to the ability of the business to return their money and how much more could

be given to them as premium for accepting the risk of investing in the business.

Managers are also interested in the daily and regular cash position of the business to effectively

monitor operating activities. An analysis of cash inflows and outflows would provide

management vita information on the liquidity needs of the business. Several models of cash

management, presentation and analyses have been developed for management use, as

follows:

1. Cash budget model

2. Economic cash flow model

3. Accounting statement of cash flow model

The presentation formats of these cash report presentation models are presented in each of the

boxes in the following page.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Fig. 6.2 Cash Report Presentation Models

Model 1 - The Cash Budget Model Model 2 - The Economic Cash Flow Model

Cash balance - begP x Cash inflows P x

Add: Cash receipts (operating Less: Cash outflows x

and investing) x Net cash inflows (outflows) x

Total cash for use x Add: Cash balance - beginning x

Less: Cash payments (operating Cash balance - end Px

and investing) x

Cash balance before financing x

+ Financing inflows (outflows) x

Cash balance - end Px

Model 3 - The Statement of Cash Flow Model

Cash from operating activities

Cash inflows from operating activities x

Cash outflows from operating activities (x) Px

Cash from investing activities

Cash inflows from investing activities x

Cash outflows from investing activities (x) x

Cash from financing activities

Cash inflows from financing activities x

Cash outflows from financing activities (x) x

Net change in cash and cash equivalents Px

The cash management model separates the operating and investing cash performance before

the financing activities. This gives the management a vital perspective on the ability of the

business activities (i.e., operating and investing) to generate cash. The financing section

includes the receipts from short-term financing and long-term financing as well. However, the

short-term financing is always prioritized for operating cash management purposes. The

financing section also includes the payments to interest, principal, and return of equity.

Cash flows are classified as financing, investing, and operating activities. This classification may

be traced from understanding the general contents of the Statement of Financial Position and

Statement of Profit or Loss.

Statement of Financial Position

INVESTING ACTIVITIES FINANCING ACTIVITIES

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Inflows Outflows Inflows Outflows

Sale of Noncurrent assets ✔ Long-term borrowing ✔

Acquisition of noncurrent ✔ Payment of long-term debt ✔

assets

Issuance of shares of stock ✔

Retirement of shares of ✔

stock

Purchase of treasury stock ✔

Re-issuance of treasury ✔

stock

Dividends paid ✔

Statement of Profit or Loss

OPERATING ACTIVITIES

Inflows Outflows

Cash sales ✔

Collections from credit customers ✔

Receipts from other revenue ✔

Cash purchases ✔

Payments to merchandise suppliers ✔

Payments to operating expenses ✔

Payments to other expenses ✔

Operating activities employ current assets and current liabilities. The difference of current assets

and current liabilities is called the working capital. It is the fundamental resource used by the

management in managing revenues, costs, and profit. As such, current items pertain to

operating activities and are excluded from financing and investing activities.

Investing activities basically refer to those of noncurrent assets and marketable securities.

Financing activities essentially relate to long-term debt and equity transactions.

Under the International Financial Reporting Standards, specifically in International Accounting

Standard No. 7, interest expense may be classified as operating or investing activities

depending on the reason of its incurrence. Accordingly, if interest expense is incurred to sustain

the operating activities of the business, such interest is classified as an operating item. If an

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

interest is incurred arising from the raising of financing money, such interest is classified as a

financing item.

Dividend income may be classified as either operating or investing activity depending on the

nature of the investment from which the dividend is derived and the purpose of dividend

distribution.

An illustration for Cash Budget is presented in Sample Problem 3.7, Schedule 13.

Schedule of Accounts Receivable Collections

Credit sales are collected over a period of time. Collection patterns are to be established to

more accurately estimate the inflows of cash from operations. A schedule of Accounts

Receivable collections from credit sales is to be done. Total collections from receivables include

those from credit customers and cash sales.

Schedule of Accounts Payable Payments

Credit purchases are not usually paid in the period of purchase. Normally, payments are spread

over a number of months. A schedule of account payables payments is to be made to more

accurately determine timing of cash outflows to merchandise suppliers.

Accruals and Prepayments

There are also accrued and prepaid (deferred or unearned) income and expenses. In the

budgeted statement of cash flows, only the cash portion of the accrued and prepaid items are

considered.

Let us revisit the contents of the accrued and prepaid expenses accounts to determine the

amount of expenses paid, as shown below:

Accrued Expenses Prepaid Expenses

- + + -

PAID x Beg Bal x Beg. Bal x INCURRED x

End Bal x INCURRED x PAID x Beg Bal x

Using the T-account analysis, the “expenses-paid” would be computed as:

Operating expenses incurred P x

Add: Accrued expenses, beg. P x

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Prepaid expenses, end x x

Total

Less: Accrued expenses, end x

Prepaid expenses, beg. x x

Operating expenses paid P x

In determining the amount of income received, let us also revisit the contents of accrued and

deferred income accounts, as shown below.

Accrued Income Deferred Income

+ - - +

Beg. Bal x RECEIVED x EARNED x Beg Bal x

EARNED x End Bal x End Bal x RECEIVED x

Using the T-account analysis, the “income received” is computed as follows:

Income earned P x

Add: Accrued income, beg. P x

Deferred income, end x x

Total

Less: Accrued income, end x

Deferred income, beg. x x

Income received P x

Operating Expenses

Operating expenses budget should also be estimated in details in accordance with the

principles of accrual accounting. There shall be separate budget schedules each for marketing,

selling, and administrative expenses. It would be truly of great value if the expenses are further

classified as direct to the segment or otherwise, and controllable or noncontrollable as to the

authority of the segment manager.

Operating expenses could also be classified based on the new model of business functions

such as: research and development expenses, design engineering expenses, marketing

expenses, distribution expenses, and customer services expenses. The production costs are

assembled, grouped and reported as part of the cost of goods manufactured and sold.

Research and Development

Leading companies in their industry or line of business, or companies that operate in a

technology- based business environment, need to allocate resources for research and

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

development to stay competitive and relevant in the upcoming period. Detailed research and

development budget would provide important information to managers in their strategic and

tactical decisions.

Research has at least three phases: basic research, applied research, and developmental

research. These researches are focused towards cost reduction, product improvements and

development of new products. Distribution as to the overall budget allotment to these research

phases and focuses should be clearly projected, summarized and presented.

Budgeting Models

There are several budgeting models used by organizations. Some examples are flexible

budgeting, fixed (or static) budgeting, continuous budgeting, zero-based budgeting, life-cycle

budgeting, activity-based budgeting , kaizen budgeting, and government budgeting.

Flexible budgeting separates costs as to either variable or fixed. In this model, budgeted costs

are determined at any level of business activity. Flexible budgeting uses standard costs to

prepare budgets for multiple activity levels. Total fixed costs remain constant while total variable

costs increase as production increases. The budgeted costs based on actual level of production

become the standard costs and are compared with the actual costs to get and analyze cost

variances.

An illustration of flexible budgets follows:

Sample Problem 3.2. Flexible Budgeting

Fixed or static budgeting does not segregate cost into fixed and variable components. Costs are

estimated only at a single level of activity. Actual cost are compared with the budgeted cost

regardless of the actual level of production and cost variances are obtained and analyzed

accordingly.

Continuous or rolling budgeting maintains a particular time frame (or period) covered in

budgeting (say 12 months). When a time segment (e.g., month) had passed, it is dropped from

the budget frame and a new month is added to maintain the same period of time covered by the

budget.

Zero-based budgeting (ZBB) does not consider past performances in anticipating the future.

Budgeted cost should be classified and packaged based on activities which must be prioritized

and justified as to their incurrence. The aim is to encourage objective examination of all costs in

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

the hope that cost could be better controlled. ZBB starts from the lowest budgetary units of the

organization. It needs determination of objectives, operations, and costs for each activity and

the alternative means of carrying out that activity. Different levels of service or work effort are

evaluated for each activity, measurements and performance standards are established, and

activities are ranked according to their importance to the activity. A decision package is prepared

that describes various levels of service that may be provided, including at least one level lower

than the current one. Each expenditure is justified for each budget period and costs are

reviewed from a cost-benefit perspective.

Life-cycle budgeting intends to account for all costs incurred in the stages of the “value chain”,

from research and development to design, production, marketing, distribution, up to customer

services. Costing in this model is important for pricing decisions. Revenues generated from the

product should cover not only the costs of production but the entire business costs incurred. It is

also analyzed in line with the product life-cycle concept where products have four life stages

such as infancy (or start-up stage), growth stage, expansion stage, and maturity (or decline)

stage.

It is estimated that about 80% of all costs are already committed (may not yet be incurred)

before the business begins. Life-cycle budgeting emphasizes the potential for locking in

(designing in) future costs since the opportunity of reducing costs is great before production

begins. In the whole-life cost concept, the budget includes the “after-purchase costs“ closely

associated with the life-cycle cost. After-purchase costs include the costs of operating, support,

repair, and disposal incurred by customers.

Whole-life cost equals the life-cycle cost plus the after-purchase costs. Life-cycle costing is

related to target costing and target pricing. A target price is determined in a given market

condition and costs and profit margin are adjusted accordingly.

Activity-based budgeting is applied when the activity-based management system is used. It

breaks down processes into activities and permits the identification of value-adding activities

and their cost drivers. Activities are grouped according to their homogeneity and costs drivers

are established per homogeneous pool. It tracks down cost incurrence based on the behavior of

its cost driver such as number of set-ups, downtime, number of units produced, machine hours,

number of employees square footage, number of kilowatt used, number of customer complaints,

and many more.

Kaizen (continuous improvements) budgeting assumes the continuous improvement of products

or processes by way of small innovations rather than major changes. Budgets are normally not

reached unless innovative improvements occur. Kaizen budgeting is based on learning curve

theory where cost decreases as time passes by and experiences are gained. Kaizen is also

related to product life-cycle costing.

Governmental budgeting is not only a financial plan but is also an expression of public policy

and a form of control having the force of the law. A government budget is a legal document, a

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

law enacted by the congress, which must be complied with by heads and personnel of various

government agencies. Since government budgeting is not profit-centered, the use of budgets in

the appropriation process is of major importance. One budgeting concept in government

budgeting is “line budgeting” where the emphasis is more on the control of expenditures. Each

line expense should be disbursed according to the limits of the approved appropriations.

APPENDIX 3.1 MASTER BUDGET SCHEDULES

This section illustrates the computations, mechanics and interrelationships in a master budget.

Although the illustrative data are presented separately per sample problem, they are however

interrelated. The concept is to individually show budgetary computations per major account and

later will be consolidated in budgeted financial statements. The data pertain to Charmaine

Corporation.

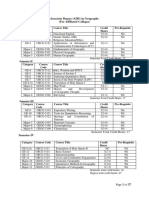

Sample Problem 3.3. Projected Sales and Estimated Collections from Customers

Charmaine Corporation made the following projections on its sales in the coming year, 2020:

Projected units sold

Economy Q1 Q2 Q3 Q4 Probability

Good 74,000 92,000 80,000 102,000 50%

Fair 50,000 80,000 70,000 90,000 30%

Bad 40,000 50,000 45,000 60,000 20%

The unit sales price is expected to be constant at P 20. All sales are made on credit.

Receivables from customers are collected 60% in the quarter of sales, 30% in the quarter

following sales, and 8% in the second quarter following sale. The remaining 2% is considered

uncollectibles. The account receivables balance on December 31, 2019 is estimated to be P

640,000; 25% of which is coming from the 3rd quarter sales of 2019.

Required:

1. Schedule 1. Projected sales in units and in pesos per quarter and for the year 2020.

2. Schedule 2. Estimated collections from customers per quarter and for the year 2020.

Solutions/ Discussions:

● The projected sales in units are computed by considering the probability of occurrence.

Expected units sold

Q1 Q2 Q3 Q4

Good (projected sales x 50%) 37,000 46,000 40,000 51,000

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Fair (projected sales x 30%) 15,000 24,000 21,000 27,000

Bad (projected sales x 20%) 8,000 10,000 9,000 12,000

60,000 80,000 70,000 90,000

(*) For example: Q1 (74,000 units x 50%) 37,000 units

Q2 (50,000 units x 30%) 15,000

Q3 (40,000 units x 20%) 8,000

Expected sales in units 60,000 units

Schedule 1. Budgeted Sales

Q1 Q2 Q3 Q4 Total

Budgeted sales in units 60,000 80,000 70,000 90,000 300,000

X Unit sales price P 20 P 20 P 20 P 20 P 20

Budgeted sales in pesos P 1,200,000 P 1,600,000 P 1,400,000 P 1,800,000 P 6,000,000

Schedule 2. Budgeted Collections from Customers

From sales of Credit sales Q1 Q2 Q3 Q4 Total

Q3, 2019 P 1,600,000 P 128,000 P 128,000

Q4, 2019 1,200,000 360,000 96,000 456,000

Q1, 2020 1,200,000 720,000 360,000 96,000 1,176,000

Q2, 2020 1,600,000 960,000 480,000 128,000 1,568,000

Q3, 2020 1,400,000 840,000 420,000 1,260,000

Q4, 2020 1,800,000 1,080,000 1,080,000

Budgeted collections from P 1,208,000 P 1,416,000 P 1,416,000 P 1,628,000 P 5,568,000

customers

● The collection pattern is 60% - 30% - 8%. The receivables are collected in 3 quarters. Sixty percent in the

quarter of sales, thirty percent in the quarter following sales, and 8% in the second quarter following sales.

● The credit sales in the third quarter of year 2019 were P 1,600,000 (i.e., P 640,000 x 25% / 10%). Ninety

percent (90%) of this sales has been collected at the end of 2019. Hence, to get the total sales from the

third quarter of 2019, we have to divide the remaining receivable from this quarter by 10%, which is the

remaining receivable balance.

● The credit sales in the fourth quarter of 2019 were P 1,200,000 (i.e., P 640,000 x 75% / 40%). Sixty

percent (60%) of this sales has been collected by the end of 2019. As such, to get the total sales, we

have to divide the remaining receivable from this quarter by 40%, which is the remaining receivable

balance.

Sample Problem 3.4. Budgeted Production, Materials Purchases, and Payments to

Suppliers

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Charmaine Corporation has the budgeted units sales of its product in 2019 up to the first quarter

of 2020 as follows:

2019 1st quarter 60,000

2nd quarter 80,000

3rd quarter 70,000

4th quarter 90,000

2020 1st quarter 75,000

The company has a policy of maintaining finished goods inventory equal to 20% of the next

quarter’s sales and materials inventory of 30% of current quarter’s requirements. It takes 3 lbs.

of material AX-23 to produce unit of product. The materials inventory at the start of the year was

recorded at 75,000 pounds.

Material AX-23 costs P 1.20 per pound to purchase. The terms of the purchase is 2/30, n/45.

The company pays 55% of its purchases in the quarter of purchase and avail of the 2% trade

discount. The remaining balance is paid in the following quarter. The accounts payables at

December 31, 2019 are valued at P 81,000.

Required: For the year 2020:

1. Schedule 3. Budgeted production per quarter and in total.

2. Schedule 4. Budgeted materials purchases per quarter and in total.

3. Schedule 5. Budgeted payments to merchandise suppliers.

Solutions/ Discussions:

Schedule 3. Budgeted Production

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Budgeted sales in units 60,000 80,000 70,000 90,000 300,000

+ Finished gods - end 16,000 14,000 18,000 15,000 15,000

Total needs 76,000 94,000 88,000 105,000 315,000

- Finished goods - beg 12,000 16,000 14,000 18,000 12,000

Budgeted sales in pesos 64,000 78,000 74,000 87,000 303,000

● Finished goods-end = 20% x next quarter’s sales

Q1 = 80,000 units x 20% = 16,000 units

Q2s = 70,000 units x 20% = 14,000

Q3 = 90,000 units x 20% = 18,000

Q4 = 75,000 units x 20% = 15,000

● Finished goods - beg = the ending of the previous quarter

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Q1 = 60,000 units x 20% = 12,000 units

● The ending inventory of the fourth quarter is the ending inventory of the year and the beginning

inventory of the first quarter is the beginning of the eyar.

Schedule 4. Budgeted Materials Purchases

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Budgeted production 64,000 78,000 74,000 87,000 303,000

x Standard materials per unit 3 lbs 3 lbs 3 lbs 3 lbs 3 lbs

Budgeted materials usages(in 192,000 234,000 222,000 261,000 909,000

lbs)

+ Materials inventory - end 57,600 70,200 66,600 78,300 78,300

Total materials needs 294,600 304,200 288,600 339,300 987,300

- Materials inventory - beg 75,000 57,600 70,200 66,600 78,300

Budgeted materials purchases 174,600 246,600 218,400 272,700 912,300

(in lbs)

x Materials cost per lb P 1.20 P 1.20 P 1.20 P 1.20 P 1.20

Budgeted materials purchases P 209,520 P 295,520 P 262,080 P 327,250 P 1,094,760

(in pesos)

Materials inventory end = 30% x Current quarter’s needs

Q1 = 192,000 units x 30% = 57,600 lbs.

Q2s = 234,000 units x 30% = 70,200

Q3 = 222,000 units x 30% = 66,600

Q4 = 261,000 units x 30% = 78,300

Schedule 5. Budgeted Payments to Merchandise Suppliers

To purchases Credit Q1 Q2 Q3 Q4 Total

of Purchases

Q4, 2019 P 180,000 P 81,000 P 81,000

Q1, 2020 209,520 112,931 P 94,284 207,215

Q2, 2020 295,520 159,501 P 133,164 292,665

Q3, 2020 262,080 141,261 117,936 259,197

Q4, 2020 327,040 176,382 176,382

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Budgeted payments to P 193,931 P 253,785 P 274,425 P 294,318 P 1,016,459

merchandise supplier

● The payment pattern is 55% - 45%. Payments to merchandise suppliers are made in 2 quarters; fifty-five

percent are paid in the quarter of purchase and forty-five percent are paid in the following quarter after

purchase.

● The credit purchases in the fourth quarter of 2019 were P 180,000 (i.e., P 81,000 / 45%). The 55% have

been paid in the quarter the purchases were made.

● The payment made to suppliers in the quarter of purchase accounting for 55% of all purchases is subject

to 2% trade discount. Example, payment made in Q1 of 2020 for purchases made in Q1 of 2020 is P

112,931 (i.e., P 209,520 x 55% x 98%). The payment made in the following quarter accounting for the

remaining 45% of the purchases is not subject to 2% trade discount.

Sample Problem 3.5. Budgeted Direct Labor and Factory Overhead

Charmaine Corporation pays its production personnel at a rate of P 20 per direct labor hour. It

takes 0.25 standard hours to complete a finished unit. The corporation pays its labor costs in the

month the payroll is recorded.

The standard variable overhead rate is P 5 per direct labor hour and the standard fixed

overhead rate is P 4 per direct labor hour. The company’s normal capacity is 75,000 units or

18,750 direct labor hours. Thirty percent (30%) of the total fixed overhead is non-cash.

Overhead costs are paid 90%in the quarter the overhead is incurred and the remainder is paid

in the month following the quarter of incurrence. The overhead costs incurred in the fourth

quarter of 2019 are P 84,000 variable and P 70,000 fixed.

The budgeted production in units for 2020 are estimated at: Q1, 64,000 units, Q2, 78,000 units;

Q3, 74,000 units, and Q4, 87,000 units.

Required: For the year 2020:

1. Schedule 6: Budgeted labor costs per quarter and in total.

2. Schedule 7: Budgeted factory overhead in quarter and in total.

3. Schedule 8: Budgeted cash payments for labor and overhead in quarter and in total.

Solutions/ Discussions:

Schedule 6. Budgeted Labor Costs

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Budgeted production 64,000 78,000 74,000 87,000 303,000

X Standard direct labor 0.25 hr 0.25 hr 0.25 hr 0.25 hr 0.25 hr

hours per unit

Budgeted direct labor 16,000 9,500 18,500 21,750 75,750

hours

X Direct labor rate per P 20 P 20 P 20 P 20 P 20

hour

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Budgeted direct labor cost P 320,000 P 390,000 P 370,000 P 435,000 P 1,515,000

Schedule 7. Budgeted Factory Overhead

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Variable factory overhead P 80,000 97,500 P 92,500 P 108,750 378,750

Fixed factory overhead 75,000 75,000 75,000 75,000 300,000

Budgeted factory overhead P 155,000 P 172,500 P 167,500 P 183,750 P 678,750

● Variable factory overhead = Production x Variable Overhead rate per DLH

Q1 = 16,000 DLH x P 5 = P 80,000

Q2s = 19,500 DLH x P 5 = 97,500

Q3 = 18,500 DLH x P 5 = 92,500

Q4 = 21,750 DLH x P 5 = 108,750

● Fixed factory overhead = Normal capacity x Fixed overhead rate per DLH

● E.g., Q1 = 18,750 DLH x P 4 = P 75,000

Schedule 8. Budgeted cash payments to labor and overhead

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Direct labor cost P 320,000 P 390,000 P 370,000 P 435,000 P 1,515,000

Factory overhead 132,550 148,250 145,500 159,625 585,925

Budgeted payments to P 452,550 P 538,250 P 515,500 P 594,625 P 2,101,200

conversion costs

a. Payments of factory overhead

Amount Q1 Q2 Q3 Q4 Total

Variable

Overhead

Q4, 2019 P 84,000 P 8,400 P 8,400

Q1, 2020 80,000 72,000 P 8,000 80,000

Q2, 2020 97,500 87,750 P 9,750 97,500

Q3, 2020 92,500 83,250 9,250 92,500

Q4, 2020 108,750 97,875 97,875

Budgeted payments to variable 80,400 95,750 93,000 107,125 376,275

overhead

Cash fixed overhead

Q4, 2019 (70,000x70%) P 49,000 P 4,900 P 4,900

Q1, 2020 (75,000x70%) 52,500 47,250 P 5,250 52,500

Q2, 2020 (75,000x70%) 52,500 47,250 P 5,250 52,500

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Q3, 2020 (75,000x70%) 52,500 47,250 5,250 52,500

Q4, 2020 (75,000x70%) 52,500 47,250 47,250

Budgeted payments to variable 52,150 52,500 52,500 152,500 209,650

overhead

Total payments to overhead P 132,550 P 148,250 P 145,500 P 159,625 P 585,925

(Thirty percent (30%) of the fixed overhead is noncash.)

(Overhead is paid 90% in the quarter incurred and 10% in the succeeding quarter.)

Sample Problem 6.6. Budgeted Statement of Profit or Loss

Consider the data and solutions in sample problems “5.3” to “5.5”. The standard costs of

Charmaine Corporation are summarized below:

Units Rate Cost per unit

Direct material 3 lbs. P 1,20 per lb. P 3.60

Direct labor 0.25 hr . 0.20 per hr. 0.05

Variable factory overhead 0.25 hr. 5.00 per hr. 1.25

Fixed factory overhead 0.25 hr. 4.00 per hr. 1.00

Total P 5.90

The standard costs are the same from year 2019 to 2020. The work-in-process inventories are

estimated at 10% of the current production put into the process. The work-in-process on

December 31, 2019 is determined at P75,000. Operating expenses are budgeted at 20% of

sales in a quarter. Non-cash operating expenses including accruals and prepayments are

estimated at 20% of sales. Other income from operations are projected at 5% of sales. The

actual of 2019 and the estimated accrued and prepaid items in 2020 are as follows:

Q4 2019 Q1 Q2 Q3 Q4

___________________________________________________

Accrued expenses P 12,000 P 15,000 P22,000 P 14,000 P 15,000

Prepaid expenses 3,000 6,000 6,500 7,400 8,800

Accrued income 4,400 900 3,500 7,900 8,600

Prepaid income 2,100 3,300 4,400 9,700 8,200

The income tax rate is 40%

Required: For the year 2020

1. Schedule 9. Budgeted cost of goods manufactured and sold.

2. Schedule 10. Budgeted statement of profit or loss.

3. Schedule 11. Budgeted cash payments to operating expenses.

4. Schedule 12. Budgeted cash receipts from other revenues.

Solutions/Discussions.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Schedule 9. Budgeted cost goods manufactured and sold.

Reference Quarter 1 Quarter 2 Quarter 3 Quarter4 Total

Materials used Schedule 4 P 230,400 P 280,800 P 266,400 P 313,200 P 1,090,800

Direct labor Schedule 6 320,000 390,000 370,000 435,000 1,515,000

Factory overhead Schedule 7 155,000 172,500 167,500 183,750 678,750

____________________________________________________________________

Total factory cost 705,400 843,300 803,900 931,950 3,284,550

+WIP inventory, beginning 75,000 64,440 84,630 80,290 3,284,550

____________________________________________________________________

Total costs put in process 780,400 912,740 887,530 1,012,240 75,000

-WIP inventory ending 69,440 84,630 80,290 94,395 94,395

Cost of goods manufactured 710,960 828,110 808,240 917,845 3,265,155

+FG inventory, Schedule 3 70,800 94,400 82,600 106,200 70,800

beginning

_____________________________________________________________________

Total goods available for sale 781,760 922,510 890,840 1,024,045 3,335,955

-FG inventory, Schedule 2 94,400 82,600 106,200 88,500 88,500

Ending

_____________________________________________________________________

Cost of goods sold Schedule 1 P 687,360 P 839,910 P 784,640 P 935,545 3,247,455

==================================================================

● Material used = Materials used in units x Standard materials cost per unit

Q1 = 192,000 lbs. X P1.20 = P 230,400

Q2 = 234,000 lbs. X P1.20 = P 280,800

Q3 = 222,000 lbs. X P1.20 = P 266,400

Q4 = 261,000 lbs. X P1.20 = P 313,200

● The work-in-process of December 31, 2019 is the beginning work-in-process of 2020.

● Work-in-process inventory, ending = 10% x current production costs put into process.

E.g., Q1 = P694,400 x 10% = P69,440

● Finished goods inventories = FG on hand x Standard unit cost (i.e., P5.90)

Units Costs

________________ _____________

FG - beg FG - end Unit Cost FG - beg FG - end

________________________________________________________________________

Q1 12,000 16,000 P 5.90 P 70,800 P 94,400

Q2 16,000 14,000 5.90 94,400 82,600

Q3 14,000 18,000 5.90 82,600 106,200

Q4 18,000 15,000 5.90 106,200 88,500

Schedule 10. Budgeted Statement of Profit or Loss

Reference Quarter 1 Quarter 2 Quarter 3 Quarter4 Total

Sales Schedule 1 P 1,200,000 P 1,600,000 P 1,400,000 P 800,000 P 6,000,000

Cost of goods sold Schedule 9 687,360 839,910 784,640 935,545 3,247,455

-Operating expenses1 240,000 320,000 280,000 360,000 1,200,000

+other income2 60,000 80,000 70,000 90,000 300,000

____________________________________________________________________

Income before income tax 332,640 843,300 803,900 931,950 3,284,550

-income tax (40%) 133,056 208,036 162,144 237,782 741,018

____________________________________________________________________

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Profit (loss) P 199,584 P 312,054 P 243,216 P 356,673 P 1,111,527

=================================================================

1Operating expenses = 20% x Sales; 2Other income = 5% x Sales

Schedule 11. Budgeted Cash Payments to Operating Expenses

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Operating expenses incurred P 240,000 320,000 280,000 360,000 1,200,000

+ Accrued expense - beg 12,000 15,000 22,000 14,000 12,000

Prepaid expenses - end 6,000 6,500 7,400 8,800 8,800

Total 258,000 341,500 309,400 382,800 1,220,800

Less: Accrued Expenses - end 15,000 22,000 14,000 15,000 115,000

Prepaid Expenses - beg 3,000 6,000 6,500 7,400 3,000

Operating expenses paid 240,000 313,500 288,900 360,400 1,202,800

● Refer to computational guidelines. The beginning accrued expenses balance in quarter 1 (i.e., P 12,000) is

the beginning of the year. The ending prepaid expenses balance in quarter 4 is the ending balance of the

year.

● Accrued expense and expense balances do not accumulate. They are continuous and are carried from one

period to another. This observation is also true with regard to accrued income and deferred income.

Schedule 12. Budgeted Cash Receipts from Other Revenues

Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Other revenues earned P 60,000 80,000 70,000 90,000 300,000

+ Accrued income - beg 4,400 900 3,500 7,900 4,400

Deferred income - end 3,300 4,400 9,700 8,200 8,200

Total 67,700 85,300 83,200 106,100 312,600

Less: Accrued income - end 900 3,500 7,900 8,600 8,600

Deferred income - beg 2,100 3,300 4,400 9,700 2,100

Other Revenues Received 64,700 78,500 70,900 87,800 301,900

Sample Problem 3.7. Budgeted Cash Flows

Consider all the data and solutions in sample problems “3.3. To 3.6”. Other cash transactions

and information are as follows:

a. Non-current assets are to be acquired in the second and third quarters of 2020 in the

amounts of P 200,000 and P 145,000, respectively. Some old non-current assets are to

be sold at its book value for P 174,000 in the third quarter.

b. Dividends are to be paid in February for P 400,000 and July for P 250,000.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

c. The minimum cash balance is set at P 400,000. In case of deficit, the corporation can

avail a credit line in multiples of P 25,000 from a financing institution at a rate of 14% per

annum. Interest is paid quarterly based on the outstanding balance at the beginning of

the quarter. Payments to borrowings in multiples of P 25,000 are made whenever cash

is available determined at the beginning of the quarter. The cash balance on January 1,

2020 is expected to equal the minimum cash balance.

Required: For the year 2020:

1. Schedule 13. Cash budget

2. Schedule 14. Budgeted Statement of Cash Flows.

Solutions/ Discussions:

Schedule 13. Cash Budget

Reference Quarter 1 Quarter 2 Quarter 3 Quarter4 Total

Cash Balance - P 400,000 P 436,219 P 469,934 P 659,009 P 400,000

Add: Cash Receipts

Collections from customers Schedule 12 1,208,000 1,416,000 1,416,000 1,628,000 5,668,000

From other revenues Schedule 12 64,700 78,500 70,900 87,800 301,900

Sale of noncurrent assets 174,000 174,000

Total cash available for use 1,672,700 1,930,719 2,130,834 2,372,809 6,543,900

_____________________________________________________________________

Less: Cash payment

Merchandise purchases Schedule 5 (193,931) (253,785) (274,425) (294,318) (1,016,459)

Direct labor Schedule 6 (320,000) (390,000) (370,000) (435,000) (1,515,000)

Factory overhead Schedule 8 (132,500) (148,250) (145,500) (159,625) ( 585,925)

Operating expenses Schedule 11 (240,000) (313,500) (288,900) (360,400) (1,202,800)

Acquisition of noncurrent assets (200,000) (145,000) - ( 345,000)

Dividends (500,000) (250,000) - ( 750,000)

Total Cash Payments (1,386,481) (1,305,535) (1,473,825) (1,249,343) (5,415,184)

Cash balance before financing 286,219 625,184 657,009 1,123,466 1,128,716

Financing Cash:

Borrowings (at beginning) 150,000 150,000

Payments to borrowings (at end) - (150,000) (150,000)

Interests paid (at end) - ( 5,250) ( 5,250)

Net financing 150,000 (155,250) ( 5,250)

Cash balance - ending 436,219 469,934 657,009 1,123,466 P 1,123,466

● Cash balance - ending = Total cash available for needs - Total cash payments + Net Financing

● The cash balance for the year is the cash balance at the beginning of the first quarter and the

ending balance of the year equals the ending balance of the fourth quarter

Schedule 14. Budgeted Statement of Cash Flows

Reference Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

Operating activities

Collections from Customers Schedule 2 P 1,208,000 P 1,416,000 P 1,416,000 P 1,628,000 P 5,668,000

From other revenue Schedule 12 64,700 78,500 70,900 87,800 301,900

To merchandise suppliers Schedule 5 (193,931) (253,785) (274,425) (294,318) (1,016,459)

To direct labor Schedule 6 (320,000) (390,000) (370,000) (435,000) (1,515,000)

To factory overhead Schedule 7 (132,550) (148,250) (145,500) (159,625) (585,925)

To operating expenses Schedule 11 (240,000) (313,500) (288,900) (360,400) (1,202,800)

Net operating inflows (outfolws) 386,219 388,965 408,575 466,457 1,649,716

Investing activities

Sale of noncurrent assets - - 174,000 - 174,000

Acquisition of noncurrent assets - (200,000) (145,000) - (345,000)

Net investing activities - (200,000) 29,000 - (171,000)

Financing activities

Dividends paid (500,000) - (250,000) - (750,000)

Borrowings 150,000 - - - (150,000)

Payments to borrowings - (150,000) - - (150,000)

Interests paid - (5,250) - - (5,250)

Net financing activities (350,000) (155,250) (250,000) - (755,250)

Net cash inflows (outflows) 36,219 33,715 187,075 466,457 723,466

Add: Cash Balance - beginning 400,000 436,219 469,934 657,009 400,000

Cash balance - ending P 436,219 P 469,934 P 657,009 P 1,123,466 P 1,123,466

● The business needs to borrow in the first quarter of the year to maintain the minimum cash balance of P

400,000. The amount borrowed is computed as follows:

Cash balance - beginning P 400,000

Net operating cash inflows 363,769

Dividends paid (500,000)

Cash balance before financing 263,769

Minimum cash balance (400,000)

Cash need P 136,231

Borrowings (in multiples of P 25,000) P 150,000

● The cash balance at the end of the second quarter is P 426,869 which i P 26,869 in excess of the minimum

balance of P 400,000. This excess shall be used to pay borrowing in multiples of P 25,000.

● The beginnng cash balance of the first quarter is the beginning cash balance of the year, and the ending cash

balance of the fourth quarter is the ending cash balance of the year.

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

lOMoARcPSD|3827926

References used:

Agamata, Franklin T. Management Services 2019 Edition. GIC Enterprises & Co., Inc, 2019

Cabrera, Ma. Elenita B.Management Accounting Concepts and Applications. GIC Enterprises &

Co., Inc, 2014

Downloaded by Kimmy HK (kimberlypalmero12345@gmail.com)

You might also like

- Short Term Budgeting UpdatedDocument23 pagesShort Term Budgeting UpdatedNineteen AùgùstNo ratings yet

- Short Term Budgeting Lecture Notes 3 CompressDocument30 pagesShort Term Budgeting Lecture Notes 3 CompressGwyneth TorrefloresNo ratings yet

- MODULE 1 - Short-Term BudgetingDocument30 pagesMODULE 1 - Short-Term BudgetingSugar TiuNo ratings yet

- Smu AssignmentsDocument22 pagesSmu AssignmentsProjectHelpForuNo ratings yet

- Strategic Planning Process: Steps in Developing Strategic Plans I. Strategic Planning Process DefinedDocument22 pagesStrategic Planning Process: Steps in Developing Strategic Plans I. Strategic Planning Process DefinedNivithaNo ratings yet

- Strategic Planning Process: Steps in Developing Strategic Plans I. Strategic Planning Process DefinedDocument22 pagesStrategic Planning Process: Steps in Developing Strategic Plans I. Strategic Planning Process Definednavinm87No ratings yet

- Diploma in Primary Education AdministrationDocument78 pagesDiploma in Primary Education AdministrationCat JoeNo ratings yet

- Performance Appraisal System in The Cyprus Civil ServiceDocument23 pagesPerformance Appraisal System in The Cyprus Civil ServiceBETELHEM ABDUSHE0% (1)

- Managerial EconomicsDocument23 pagesManagerial EconomicsMariane RachedNo ratings yet

- Principles of Planning BootcampDocument25 pagesPrinciples of Planning BootcampmominNo ratings yet

- Management 9th Edition Daft Solutions Manual DownloadDocument15 pagesManagement 9th Edition Daft Solutions Manual DownloadGloria Jones100% (18)

- BMG 334 Corporate Management Finals Coverage SummaryDocument18 pagesBMG 334 Corporate Management Finals Coverage SummaryLyra MarquezNo ratings yet

- M2 Notes Part 1Document20 pagesM2 Notes Part 1Akhil SankarNo ratings yet

- "Assignment": World University of BangladeshDocument7 pages"Assignment": World University of BangladeshKhalid HasanNo ratings yet

- Lecture 4 - OMCDocument10 pagesLecture 4 - OMCDorwin RiveraNo ratings yet

- Budgeting and Decision-Making ConceptsDocument6 pagesBudgeting and Decision-Making ConceptsTeererai KaguraNo ratings yet

- PMS #2 Lecture NotesDocument5 pagesPMS #2 Lecture NotesRacheel SollezaNo ratings yet

- Planning and Cybernetic Control PaperDocument19 pagesPlanning and Cybernetic Control PaperEka DarmadiNo ratings yet

- Structuring Strategy for SuccessDocument5 pagesStructuring Strategy for SuccessUday Singh0% (1)

- CHAPTER 17 Organizational Planning and Controlling PDFDocument6 pagesCHAPTER 17 Organizational Planning and Controlling PDFAvril CarrilloNo ratings yet

- Lesson 10 - Financial ManagementDocument8 pagesLesson 10 - Financial ManagementLand DoranNo ratings yet

- Module 2.1 Strategic PlanningDocument16 pagesModule 2.1 Strategic Planningearl bagainNo ratings yet

- Planning and Goal Setting: Management: Concept & ApplicationDocument18 pagesPlanning and Goal Setting: Management: Concept & ApplicationMuhammad Junaid IqbalNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementKeana MendozaNo ratings yet

- Planning-Engineering-Management For PostingDocument23 pagesPlanning-Engineering-Management For PostingChristian J SebellinoNo ratings yet

- Assignment PGPM 11Document17 pagesAssignment PGPM 11Sudeshna BhattacharjeeNo ratings yet

- Chapter 7Document5 pagesChapter 7Cfacfa InNo ratings yet

- Planning Technical Activities GuideDocument40 pagesPlanning Technical Activities GuideKen Andrie Dungaran GuariñaNo ratings yet

- Strategy ImplementationDocument6 pagesStrategy Implementationswatisingla786No ratings yet

- Communication Plan: What Is A Performance Management System?Document9 pagesCommunication Plan: What Is A Performance Management System?Areeba NisarNo ratings yet

- Case Study of PMDocument5 pagesCase Study of PMShahid BhuiyanNo ratings yet

- Planning: Maria Janice C Jarito, MmpaDocument22 pagesPlanning: Maria Janice C Jarito, MmpaMaria Janice JaritoNo ratings yet

- Chapter 3 - Strategy ImplementationDocument6 pagesChapter 3 - Strategy Implementationjalaja munirajuNo ratings yet

- Organization Behaviour Assign FullDocument12 pagesOrganization Behaviour Assign FullkoppineediprakashNo ratings yet

- What Are Functions of A Business ManagerDocument14 pagesWhat Are Functions of A Business ManagerAdeem AshrafiNo ratings yet

- Strategy ImplimentationDocument30 pagesStrategy ImplimentationLove Samani100% (1)

- Guide Questions - Short Term BudgetingDocument3 pagesGuide Questions - Short Term BudgetingAphol Joyce MortelNo ratings yet

- Planning 1Document8 pagesPlanning 1Mwangy PinchezNo ratings yet

- Analyze Need for Strategic Change ManagementDocument9 pagesAnalyze Need for Strategic Change Managementsamridhi chhabraNo ratings yet

- Planning, Organizing & Controlling for Management SuccessDocument4 pagesPlanning, Organizing & Controlling for Management SuccessRashid KanetsaNo ratings yet

- POLC Functions of ManagementDocument11 pagesPOLC Functions of Managementjwilson79100% (12)

- Profit Planning or Budgeting: Control Is The Use of Budget To Control A Firm's ActivitiesDocument30 pagesProfit Planning or Budgeting: Control Is The Use of Budget To Control A Firm's ActivitiesRaven Dumlao OllerNo ratings yet

- School Mapping Strategic PlanningDocument23 pagesSchool Mapping Strategic PlanningMueed HassanNo ratings yet

- There Are Four Main Functions of ManagementDocument13 pagesThere Are Four Main Functions of ManagementNageshwar Voleti100% (1)

- Nature of Control.......Document7 pagesNature of Control.......SayednesarNo ratings yet

- ACT 102 For Students'Document10 pagesACT 102 For Students'Jomair GuroNo ratings yet

- CAS 13 Financial Management Lesson on Forecasting Short-Term RequirementsDocument8 pagesCAS 13 Financial Management Lesson on Forecasting Short-Term RequirementsMyline GabinoNo ratings yet

- HUMAN CAPITAL Lecture 2Document56 pagesHUMAN CAPITAL Lecture 2Florence TitilaykNo ratings yet

- Planning Technical ActivitiesDocument31 pagesPlanning Technical ActivitiesRJ BragaNo ratings yet

- Name Roll No.Document11 pagesName Roll No.Shakeel ShahNo ratings yet

- Orgma Week6Document8 pagesOrgma Week6Frey Angeleigh GalvezoNo ratings yet

- Bec121l Tutorial Task 3Document5 pagesBec121l Tutorial Task 3kamvaNo ratings yet

- CH 03 Management of Insurance Business 1Document26 pagesCH 03 Management of Insurance Business 1tharakaNo ratings yet

- HandoutDocument10 pagesHandoutirisNo ratings yet

- Basic Principles and Practice of Business AdministrationFrom EverandBasic Principles and Practice of Business AdministrationNo ratings yet

- 2: Five Common Types of ManagementDocument3 pages2: Five Common Types of ManagementAhmed Jokar MohamoudNo ratings yet

- Conclusion RecommendationDocument1 pageConclusion RecommendationKimberly PalmeroNo ratings yet

- IssuesDocument1 pageIssuesKimberly PalmeroNo ratings yet

- Labor Management RelationsDocument10 pagesLabor Management RelationsKimberly PalmeroNo ratings yet

- Summer Is A Time For Traveling andDocument2 pagesSummer Is A Time For Traveling andKimberly PalmeroNo ratings yet

- Sylabbus AgreementDocument2 pagesSylabbus AgreementKimberly PalmeroNo ratings yet

- Alternative Solution Case Analysis #2Document1 pageAlternative Solution Case Analysis #2Kimberly PalmeroNo ratings yet

- 6-Managing Labor RelationsDocument4 pages6-Managing Labor RelationsKimberly PalmeroNo ratings yet

- Overtime pay and service charge distribution rules updatedDocument2 pagesOvertime pay and service charge distribution rules updatedKimberly PalmeroNo ratings yet

- History of MathDocument2 pagesHistory of Mathjovit100% (8)

- The Importance of Ensuring Accurate and Appropriate Data CollectionDocument3 pagesThe Importance of Ensuring Accurate and Appropriate Data Collectioncris annNo ratings yet

- 9 Maths Ncert Chapter 15 PDFDocument15 pages9 Maths Ncert Chapter 15 PDFsrideviNo ratings yet

- Journal of Affective Disorders ReportsDocument8 pagesJournal of Affective Disorders ReportsBAISHA BARETENo ratings yet

- List of Publications by James A LitsingerDocument32 pagesList of Publications by James A LitsingerJames LitsingerNo ratings yet

- Darwinian Delusions by Subboor AhmadDocument116 pagesDarwinian Delusions by Subboor AhmadPddfNo ratings yet

- Full Download Ebook PDF Shortell and Kaluznys Healthcare Management Organization Design and Behavior 7th Edition PDFDocument41 pagesFull Download Ebook PDF Shortell and Kaluznys Healthcare Management Organization Design and Behavior 7th Edition PDFroland.montez89697% (33)

- Hbo2 Abt SystemDocument7 pagesHbo2 Abt SystemTony LeeNo ratings yet

- FRUSTRATION TOLERANCE AMONG SENIOR SECONDARY StudentsDocument54 pagesFRUSTRATION TOLERANCE AMONG SENIOR SECONDARY StudentsTurfa Ahmed100% (1)

- Maintenance Journal 171fullDocument85 pagesMaintenance Journal 171fullJorge MartinezNo ratings yet

- Critical P&ID ReviewDocument16 pagesCritical P&ID ReviewkhanasifalamNo ratings yet

- Template FMEA5Document5 pagesTemplate FMEA5Puneet SharmaNo ratings yet

- A Study On The Identity Status of Future English Teachers: Farhana Wan Yunus, Melissa Malik & Azyyati ZakariaDocument8 pagesA Study On The Identity Status of Future English Teachers: Farhana Wan Yunus, Melissa Malik & Azyyati ZakariaAlgie AlbaoNo ratings yet

- Grant Fehring - PCR Lab Final DraftDocument3 pagesGrant Fehring - PCR Lab Final Draftapi-352959799No ratings yet

- EPPS ReportDocument6 pagesEPPS ReportSaria Qasim75% (4)

- Parenting Behaviors and Parental Stress Among Foster ParentsDocument8 pagesParenting Behaviors and Parental Stress Among Foster ParentsCristina TudoranNo ratings yet

- Newbold Sbe8 ch07 GeDocument79 pagesNewbold Sbe8 ch07 GeCamilo sextoNo ratings yet

- Financial Sensitivity AnalysisDocument14 pagesFinancial Sensitivity AnalysisFea SibilityNo ratings yet

- 17-Associate Degree in Geography - 1698052910Document37 pages17-Associate Degree in Geography - 1698052910ayannaeem36052No ratings yet

- Aqa English Language Coursework A LevelDocument6 pagesAqa English Language Coursework A Levelafiwfbuoy100% (2)

- SyllabusDocument4 pagesSyllabusPatrick MessnerNo ratings yet

- Soil PH, Bone Preservation, and Sampling Bias at Mortuary SitesDocument7 pagesSoil PH, Bone Preservation, and Sampling Bias at Mortuary SitesCeilidh Lerwick100% (1)

- Automatic WindowDocument20 pagesAutomatic WindowNornadiahnadhirah MdNadzriNo ratings yet

- A Comparison Study of Mainstream Sustainable-Green Building Rating Tools in The WorldDocument5 pagesA Comparison Study of Mainstream Sustainable-Green Building Rating Tools in The WorldTracy HnilNo ratings yet

- Dissertation Topic Selection FormDocument2 pagesDissertation Topic Selection Formmohammedakbar88No ratings yet

- Sergiu Celibidache Analytical PDFDocument188 pagesSergiu Celibidache Analytical PDFCleiton Xavier100% (1)

- Parul University Offering Industry Oriented MBA ProgramsDocument2 pagesParul University Offering Industry Oriented MBA ProgramsparuluniversityNo ratings yet

- WP Future Consumer 2023 enDocument36 pagesWP Future Consumer 2023 enRaquel Mantovani100% (6)

- ESC PilesDocument84 pagesESC PilesRon SantosNo ratings yet

- Reliability and Validity of The Italian VersionDocument8 pagesReliability and Validity of The Italian VersionIshraq khanNo ratings yet