Professional Documents

Culture Documents

Digital India Fund

Uploaded by

coinage capital0 ratings0% found this document useful (0 votes)

6 views1 pagedigital fund

Original Title

digital-india-fund

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdigital fund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageDigital India Fund

Uploaded by

coinage capitaldigital fund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Tata Digital India Fund

(An open ended equity scheme investing in companies in Information Technology Sector)

As on 31st August 2023 PORTFOLIO

INVESTMENT STYLE Company name No. of Market Value % of Name Of The Instrument No. of Market Value % of

Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets

assets in equity/equity related instruments of the Equity & Equity Related Total 738360.24 93.92 Industrial Manufacturing

companies in the Information Technology sector in

India. Commercial Services & Supplies Honeywell Automation India Ltd. 10490 4158.62 0.53

INVESTMENT OBJECTIVE

Firstsource Solutions Ltd. 7776176 12690.72 1.61 Retailing

The investment objective of the scheme is to seek long Redington (India) Ltd. 3263343 5118.55 0.65 Zomato Ltd. 14500000 14152.00 1.80

term capital appreciation by investing atleast 80% of its Electrical Equipment Info Edge (India) Ltd. 169830 7356.19 0.94

net assets in equity/equity related instruments of the

companies in Information Technology Sector in Abb India Ltd. 205572 9007.24 1.15 Matrimony.Com Ltd. 42827 274.76 0.03

India.However, there is no assurance or guarantee that

the investment objective of the Scheme will be Siemens Ltd. 199737 7833.88 1.00 Telecom - Services

achieved.The Scheme does not assure or guarantee any Financial Technology (Fintech) Bharti Airtel Ltd. 5319200 45553.63 5.79

returns.

Pb Fintech Ltd. 2246397 17401.71 2.21 Tata Communications Ltd. 486700 8707.55 1.11

DATE OF ALLOTMENT

IT - Hardware Railtel Corporation Of India Ltd. 2926580 6126.80 0.78

December 28,2015

Netweb Technologies India Ltd. 200000 1692.40 0.22 Name Of The Instrument Quantity Market Value % of

IT - Services Rs. Lakhs Assets

FUND MANAGER

Meeta Shetty (Managing Since 09-Nov-18 and overall Cyient Ltd. 1580043 25870.83 3.29 Foreign Securities And /Or Overseas Etf(S)

experience of 17 years), Arvindkumar Kumaresan Chetty IT - Software IT - Services

(Overseas Investment) (Managing Since 01-Dec-22 and

overall experience of 7 years) Infosys Ltd. 11184598 160549.31 20.42 Sap Se Adr 138500 15995.84 2.03

Tata Consultancy Services Ltd. 3903371 131028.36 16.66 Meta Platforms Class A 54200 13259.33 1.69

BENCHMARK Tech Mahindra Ltd. 5570517 66954.83 8.52 Advanced Micro Devices (amd) Inc 31600 2762.08 0.35

NIFTY IT TRI Ltimindtree Ltd. 1188062 61700.81 7.85 Foreign Securities And /Or Overseas

NAV HCL Technologies Ltd. 4983886 58418.62 7.43 Etf(S) Total 32017.25 4.07

Direct - IDCW : 40.3199 Persistent Systems Ltd. 374596 20118.43 2.56

Direct - Growth : 40.3199 Wipro Ltd. 3701694 15117.72 1.92 Repo 430.00 0.05

Regular - IDCW : 35.4688

Regular - Growth : 35.4688

Coforge Ltd. 260000 14212.77 1.81 Portfolio Total 770807.49 98.04

Sonata Software Ltd. 1213792 12690.80 1.61 Cash / Net Current Asset 15478.79 1.96

FUND SIZE Zensar Technologies Ltd. 1266467 6673.65 0.85 Net Assets 786286.28 100.00

Rs. 7862.86 (Rs. in Cr.) Newgen Software Technologies Ltd. 728428 6256.83 0.80

MONTHLY AVERAGE AUM

Birlasoft Ltd. 1137460 5797.63 0.74

Mphasis Ltd. 227249 5519.42 0.70

Rs. 7746.6 (Rs. in Cr.)

Kpit Technologies Ltd. 349400 4108.59 0.52

TURN OVER Mastek Ltd. 137603 3267.59 0.42

Portfolio Turnover (Equity component only) 21.65%

EXPENSE RATIO** SIP - If you had invested INR 10000 every month

Direct 0.35

1 Year 3 Year 5 Year 7 Year 10 Year Since Inception

Regular 1.72

**Note: The rates specified are actual month end expenses charged Total Amount Invested (Rs.) 1,20,000 3,60,000 6,00,000 8,40,000 NA 9,20,000

as on Aug 31, 2023. The above ratio includes the Service tax on

Investment Management Fees. The above ratio excludes, borrowing Total Value as on Aug 31, 2023 (Rs.) 1,32,409 4,33,128 10,12,008 18,28,655 NA 21,07,673

cost, wherever applicable.

Returns 19.76% 12.39% 21.05% 21.84% NA 21.08%

VOLATILITY MEASURES^ FUND BENCHMARK Total Value of B: NIFTY IT TRI 1,29,828 4,10,266 9,40,399 16,94,016 NA 19,53,583

Std. Dev (Annualised) 19.99 21.13 B: NIFTY IT TRI 15.56% 8.68% 18.03% 19.69% NA 19.15%

Sharpe Ratio 0.99 0.75

Total Value of AB: S&P BSE Sensex TRI 1,28,496 4,40,112 8,84,565 14,19,632 NA 16,39,910

Portfolio Beta 0.89 NA

R Squared 0.94 NA AB: S&P BSE Sensex TRI 13.41% 13.50% 15.53% 14.73% NA 14.73%

Treynor 1.86 NA

(Inception date :28-Dec-2015) (First Installment date : 01-Jan-2016)

Jenson 0.46 NA

^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.69% as Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized. Income Distribution cum capital

on Aug 31, 2023 withdrawals are assumed to be reinvested and bonus is adjusted. Load is not taken in to consideration. For SIP returns, monthly investment of equal amounts invested

For calculation methodology please refer to Pg 85 on the 1st day of every month has been considered.

MINIMUM INVESTMENT / For scheme performance refer pages 69 - 83.

MULTIPLES FOR NEW INVESTMENT *B: Benchmark, AB: Additional Benchmark; For Scheme Risk-O-Meter and Scheme Benchmark Risk-O-Meter please refer page number 84 of Factsheet.

Source: MFI Explorer

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ADDITIONAL INVESTMENT/ Top 10 Holdings Equity Sector Allocation

MULTIPLES FOR EXISTING INVESTORS

Issuer Name % to NAV

Rs. 1,000/- and in multiples of Re. 1/- thereafter. Information Technology 80.38%

Infosys Ltd. 20.42

LOAD STRUCTURE Tata Consultancy Services Ltd. 16.66 Telecommunication 7.68%

Entry Load : Not Applicable Tech Mahindra Ltd. 8.52

Exit Load : 0.25% of NAV if redeemed/switched out before 30 Ltimindtree Ltd. 7.85 Consumer Services 2.77%

days from the date of allotment. HCL Technologies Ltd. 7.43

Bharti Airtel Ltd. 5.79 Capital Goods 2.67%

Cyient Ltd. 3.29 Services 2.26%

Please refer to our Tata Mutual Fund website for

Persistent Systems Ltd. 2.56

fundamental changes, wherever applicable

Pb Fintech Ltd. 2.21 Financial Services 2.21%

Wipro Ltd. 1.92

Total 76.65 0.00% 16.00% 32.00% 48.00% 64.00% 80.00% 96.00%

Market Capitalisation wise Exposure NAV Movement

77.42% Tata Digital India Fund - Reg - Growth NIFTY IT TRI

Large Cap 250

218

Mid Cap 11.07%

186

Small Cap 11.51% 154

122

90

Market Capitalisation is as per list provided by AMFI.

Aug-20 Aug-21 Aug-22 Aug-23

www.tatamutualfund.com Mutual Fund investments are subject to market risks, read all scheme related documents carefully TATA MUTUAL FUND 36

You might also like

- Fidelity Bank - Statement Template 15Document30 pagesFidelity Bank - Statement Template 15colton gallaharNo ratings yet

- Lessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesDocument18 pagesLessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesJoyce Dick Lam Poon100% (2)

- EY Managing Complexity and Change in A New LandscapeDocument28 pagesEY Managing Complexity and Change in A New Landscape남상욱No ratings yet

- Swot Analysis of The Asset Classes: Real EstateDocument7 pagesSwot Analysis of The Asset Classes: Real EstateMuskan MNo ratings yet

- Global ESG Q2 2023 Flow Report FINAL CorrexDocument41 pagesGlobal ESG Q2 2023 Flow Report FINAL CorrexColoNo ratings yet

- Nifty India Digital Exchange Traded Fun7Document1 pageNifty India Digital Exchange Traded Fun7Henna KadyanNo ratings yet

- Aditya Birla Sun Life Digital India FundDocument11 pagesAditya Birla Sun Life Digital India FundSuman joonNo ratings yet

- Nifty It Jan2022Document1 pageNifty It Jan2022Arati DubeyNo ratings yet

- April 30, 2020: Constituents of NIFTY ITDocument1 pageApril 30, 2020: Constituents of NIFTY ITamitNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Tata Digital India Fund PresentationDocument11 pagesTata Digital India Fund Presentationcoinage capitalNo ratings yet

- DQ Top20 - Meet India's Top 100 IT CompaniesDATAQUESTDocument6 pagesDQ Top20 - Meet India's Top 100 IT CompaniesDATAQUESTkamaraj anishNo ratings yet

- EFY-Top100 Oct09 PDFDocument15 pagesEFY-Top100 Oct09 PDFvenkatesh_1829No ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- ICICI Pru Balanced Fund - (G) ::::::::: GraphDocument13 pagesICICI Pru Balanced Fund - (G) ::::::::: GraphVivek GusaniNo ratings yet

- Case Study: Igate: The Merger With Patni Computer Systems LTDDocument20 pagesCase Study: Igate: The Merger With Patni Computer Systems LTDShone ThattilNo ratings yet

- Company Profile: Indiainfoline MarketsDocument4 pagesCompany Profile: Indiainfoline MarketsDharmesh TrivediNo ratings yet

- IPO Factsheet Infoline Tec Group BerhadDocument2 pagesIPO Factsheet Infoline Tec Group BerhadomnisammmNo ratings yet

- Kaynes Technology India LTD - IPO Note - 11!11!2022Document8 pagesKaynes Technology India LTD - IPO Note - 11!11!2022Manipal SinghNo ratings yet

- Reliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39Document31 pagesReliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39sachinborade11997No ratings yet

- ITC Subsidiary 2023Document510 pagesITC Subsidiary 2023Akhil Mahi KaramchetiNo ratings yet

- Campus Interview Academic Year: 2008-2009: Information TechnologyDocument7 pagesCampus Interview Academic Year: 2008-2009: Information TechnologyRahul DambreNo ratings yet

- TVS Electric Shares PresentationDocument32 pagesTVS Electric Shares Presentationgixodoj234No ratings yet

- ASI Consolidated & PO Issued Apr 22 To Mar 23Document5 pagesASI Consolidated & PO Issued Apr 22 To Mar 23SarathNo ratings yet

- Software Services Relative ValuationDocument5 pagesSoftware Services Relative ValuationSrilekha BasavojuNo ratings yet

- INOVANCE Control Technology Products PLC HMI - 2020 12 04 084832 1 4Document4 pagesINOVANCE Control Technology Products PLC HMI - 2020 12 04 084832 1 4Phuong VietNo ratings yet

- The Impact of Dividend Policy On Shareholders' Wealth: Evidence From IT Sector in IndiaDocument12 pagesThe Impact of Dividend Policy On Shareholders' Wealth: Evidence From IT Sector in IndiaRitesh ChatterjeeNo ratings yet

- Presented by ..: Fedora D'souza Nitin JadhavDocument24 pagesPresented by ..: Fedora D'souza Nitin JadhavCalvin PintoNo ratings yet

- WCE Placements 2021-22Document5 pagesWCE Placements 2021-22Madhawi SharmaNo ratings yet

- Bharti 2airtel 1227851581611151 8Document49 pagesBharti 2airtel 1227851581611151 8Kartik. SolankiNo ratings yet

- GRP SumDocument6 pagesGRP Sumvinod.nvnNo ratings yet

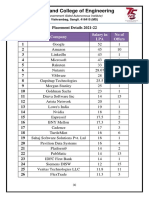

- Walchand College of Engineering: SR No Company Salary in LPA No of OffersDocument4 pagesWalchand College of Engineering: SR No Company Salary in LPA No of OffersEliteNo ratings yet

- EMudhra LTD - IPO Note - GEPLDocument4 pagesEMudhra LTD - IPO Note - GEPLHarshad GadekarNo ratings yet

- BhartiDocument9 pagesBhartiabhijitNo ratings yet

- ICICI Prudential Technology FundDocument29 pagesICICI Prudential Technology FundArmstrong CapitalNo ratings yet

- Employers - InfographicDocument3 pagesEmployers - Infographicshisaw44No ratings yet

- Tata Consultancy ServicesDocument7 pagesTata Consultancy ServicesdurendranNo ratings yet

- The Company: Vodafone Idea Limited Is An Indian Telecom OperatorDocument6 pagesThe Company: Vodafone Idea Limited Is An Indian Telecom OperatorSaurabh SinghNo ratings yet

- 19ubbi53 - Cadl Ratio AnalysisDocument11 pages19ubbi53 - Cadl Ratio AnalysisSneha Elizabeth VivianNo ratings yet

- Imports Monitoring System: Ministry of Electronics and Information TechnologyDocument1 pageImports Monitoring System: Ministry of Electronics and Information TechnologyDataNo ratings yet

- GR I Crew XV 2018 TcsDocument18 pagesGR I Crew XV 2018 TcsMUKESH KUMARNo ratings yet

- LLLEEE Electronic IndustryDocument24 pagesLLLEEE Electronic IndustryprimeforenjoyNo ratings yet

- Tata Consultancy ServicesDocument59 pagesTata Consultancy ServicesEntertainment OverloadedNo ratings yet

- Evaluation of Outsource IT OperationsDocument37 pagesEvaluation of Outsource IT OperationsAmol NikamNo ratings yet

- L&T Technology Services Limited Research Insight-2: General OverviewDocument6 pagesL&T Technology Services Limited Research Insight-2: General OverviewDHRUVI KOTHARINo ratings yet

- Passport Stats 13-03-2024 1550 GMTDocument1 pagePassport Stats 13-03-2024 1550 GMTPOYL MOIRANGTHEMNo ratings yet

- L&T Technology Services Limited Research Insight-2: General OverviewDocument6 pagesL&T Technology Services Limited Research Insight-2: General OverviewDHRUVI KOTHARINo ratings yet

- WCE-PLACEMENT-2021-22 19th March 2022Document4 pagesWCE-PLACEMENT-2021-22 19th March 2022HahaHeheNo ratings yet

- 732-733 Kumaran E - ECEDocument2 pages732-733 Kumaran E - ECE6055 - Ragul TNo ratings yet

- TVSE PresentationDocument31 pagesTVSE PresentationRajiv HandaNo ratings yet

- Macquarie On Midcap IT Report Jan 2023 PDFDocument157 pagesMacquarie On Midcap IT Report Jan 2023 PDFchaingangriteshNo ratings yet

- Monthlyportfolio 100523114353Document238 pagesMonthlyportfolio 100523114353Chandrasekar ChandramohanNo ratings yet

- HSL - IT PAck Report - 2021-202108182348354902869Document9 pagesHSL - IT PAck Report - 2021-202108182348354902869SHAIK AHMEDNo ratings yet

- Why Is L&T Betting Big On Defence - Jayant Patil Explains - The Economic TimesDocument12 pagesWhy Is L&T Betting Big On Defence - Jayant Patil Explains - The Economic Timespiyush bhatnagarNo ratings yet

- Tata Technologies IPODocument1 pageTata Technologies IPOaws.rakNo ratings yet

- Fall 2020 - COMI619 - 1 - MC190203547Document17 pagesFall 2020 - COMI619 - 1 - MC190203547mouzma.razaNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Table No. 19 (C)Document438 pagesTable No. 19 (C)cseprmNo ratings yet

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Diluted Eps Including Extraordinary Items: Industry Average Industry MedianDocument12 pagesDiluted Eps Including Extraordinary Items: Industry Average Industry MedianHussainRihabNo ratings yet

- Strategist Speaks - Information TechnologyDocument1 pageStrategist Speaks - Information TechnologyGarvitaNo ratings yet

- Tally Prime - 052544Document31 pagesTally Prime - 052544shrimathimalaiNo ratings yet

- Rating Rationale-CRISILDocument6 pagesRating Rationale-CRISILSagar KansalNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- BULLS BEARS - India Valuations Handbook-20221006-MOSL-PG048Document48 pagesBULLS BEARS - India Valuations Handbook-20221006-MOSL-PG048coinage capitalNo ratings yet

- SIP KARO NISCHINT RAHO (For MOAMC Schemes) - November 2022Document14 pagesSIP KARO NISCHINT RAHO (For MOAMC Schemes) - November 2022coinage capitalNo ratings yet

- Steps To Access Microsoft Teams With O365 AccountDocument4 pagesSteps To Access Microsoft Teams With O365 Accountcoinage capitalNo ratings yet

- Investment Product Guide December 2022Document113 pagesInvestment Product Guide December 2022coinage capitalNo ratings yet

- India Strategy 3qfy23 20230109 Mosl RP Pg0240Document240 pagesIndia Strategy 3qfy23 20230109 Mosl RP Pg0240coinage capitalNo ratings yet

- PRO0xxx FG Pension V4 BrochureDocument8 pagesPRO0xxx FG Pension V4 Brochurecoinage capitalNo ratings yet

- C12 - Mutual Funds and ETFDocument40 pagesC12 - Mutual Funds and ETFTrần Minh PhươngNo ratings yet

- CDN Select Universe Bond Etf: HorizonsDocument4 pagesCDN Select Universe Bond Etf: HorizonsCelestien LaperierreNo ratings yet

- JournalDocument199 pagesJournalVenkat GVNo ratings yet

- ETF Vs Index FundsDocument2 pagesETF Vs Index FundsNishi Avasthi100% (1)

- Alpha or Assets? - Factor Alpha vs. Smart BetaDocument12 pagesAlpha or Assets? - Factor Alpha vs. Smart Betakishore13No ratings yet

- Setting The Record Straight: Truths About Indexing: Vanguard Research January 2018Document12 pagesSetting The Record Straight: Truths About Indexing: Vanguard Research January 2018TBP_Think_TankNo ratings yet

- Phase 2 - 420 & 445Document60 pagesPhase 2 - 420 & 445SNo ratings yet

- IPSF Submission Process Online 2018-19 PDFDocument69 pagesIPSF Submission Process Online 2018-19 PDFChanakya GorlaNo ratings yet

- Riti Jewelry GOLD SAVINGS SCHEMEDocument3 pagesRiti Jewelry GOLD SAVINGS SCHEMERaghu.G100% (3)

- XSP Annual Report Equity en CADocument300 pagesXSP Annual Report Equity en CAxaveoneNo ratings yet

- Account Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueDocument22 pagesAccount Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueFerguson TchayaNo ratings yet

- Summary - Reading 23Document5 pagesSummary - Reading 23derek_2010No ratings yet

- Study Notes For NISM Series V - A: Mutual Fund Distributors Exam (Earlier - AMFI Exam)Document38 pagesStudy Notes For NISM Series V - A: Mutual Fund Distributors Exam (Earlier - AMFI Exam)Dixith GandheNo ratings yet

- Tài Chính Cá NhânDocument2 pagesTài Chính Cá NhânNguyen Thi HangNo ratings yet

- Obstacles To International InvestmentDocument113 pagesObstacles To International InvestmentNimish Patankar100% (6)

- Investment Test BankDocument273 pagesInvestment Test BankMarwa Deria.0% (1)

- Axis Triple Advantage Fund BrochureDocument2 pagesAxis Triple Advantage Fund Brochure9990100447No ratings yet

- An Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFDocument24 pagesAn Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFJsNo ratings yet

- Amity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "Document60 pagesAmity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "ryotsuNo ratings yet

- Mutual Fund Risk & ReturnDocument27 pagesMutual Fund Risk & Returnshubham yadavNo ratings yet

- NISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)Document162 pagesNISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)janardhanvn100% (3)

- Philip Green CVDocument8 pagesPhilip Green CVPhilip GreenNo ratings yet

- 2 15Document78 pages2 15MarketsWikiNo ratings yet

- Giverny CapitalDocument18 pagesGiverny CapitalAnonymous Ht0MIJNo ratings yet

- Essentials of Economics 5th Edition Hubbard Solutions Manual Full Chapter PDFDocument34 pagesEssentials of Economics 5th Edition Hubbard Solutions Manual Full Chapter PDFalbertkaylinocwn100% (12)