Professional Documents

Culture Documents

FA II - EXERCISES - CHAPTER 4 - Resolution 4.3. and 4.4

Uploaded by

ferrandarnaudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA II - EXERCISES - CHAPTER 4 - Resolution 4.3. and 4.4

Uploaded by

ferrandarnaudCopyright:

Available Formats

FINANCIAL ACCOUNTING II

2022/2023

MSc in Management

CHAPTER 4

RESOLUTION

(EXERCISES 4.3 AND 4.4)

©Contabilidade Financeira II 2022/2023, Iscte

EXERCISE 4.3.

a) Journal entries, during N, for the lessee accounting

Date Description Debit Credit Amount Obs

Initial recognition of PPE – Basic Equipment Financing – Finance

Jun. 1, N 35.000,00 i)

the asset (433) Lease (2513)

Financing – Finance

2.531,30

Lease (2513)

Financing expenses –

Interest expenses 700,00

Sep. 1, N 1st instalment (691)

GOPE – VAT

743,20

Deductible (24322)

Bank Deposits (12) 3.974,50

Financing – Finance

2.581,92

Lease (2513)

Financing expenses –

Interest expenses 649,37

Dec. 1, N 2nd instalment (691)

GOPE – VAT

743,21

Deductible (24322)

Bank Deposits (12) 3.974,50

PPE –

Depreciation Accumulated

Annual depreciation 2.552,08 ii)

expenses – PPE (642) depreciations

(438)

Dec. 31, N

Other accounts

Financing expenses –

Interest of the payable – Accrued

Interest expenses 199,25 iii)

period expenses

(691)

creditors (2722)

i) Can be also recognized on Other Accounts Payable – Investment suppliers (271), as a transitory movement.

ii) Assuming that the asset became available for its intended use on June of N:

Annual depreciation = (35.000/8)/12 x 7 = 2.552,08

iii) Lease liability – 35.000 + (700+649,37) – (3.231,30 x 2) = 29.886,78

Interest expense – 29.886,78 x 0,02 / 3 = 199,25€

©Contabilidade Financeira II 2022/2023, ISCTE-IUL -2-

According to §32 of IFRS 16, “If the lease transfers ownership of the underlying asset to the lessee by the

end of the lease term or if the cost of the right-of-use asset reflects that the lessee will exercise a

purchase option, the lessee shall depreciate the right-of use asset from the commencement date to the

end of the useful life of the underlying asset.”

b) Journal entries for the purchase option by the lessee, at the end of the lease.

Date Description Debit Credit Amount Obs

Financing – Finance

1.050,00

Lease (2513)

Purchase option used

Jun. N+3 GOPE – VAT

by the lessee 241,50

Deductible (24322)

Bank deposits (12) 1.291,50

c) If the asset was acquired without purchase option, what differences would occur in the lessee

accounting at recognition? Justify your answer according to IFRS 16. Prepare the journal entry.

“At the commencement date, a lessee shall measure the lease liability at the present value of the lease

payments that are not paid at that date. The lease payments shall be discounted using the interest rate

implicit in the lease (…)” (§26 of IFRS 16).

Because the residual value is unguaranteed and there is no purchase option, Present Value is computed

only for the 12 rents of 3.231,30.

PV = 3.231,30 x (1+2%)-1 + 3.231,30 x (1+2%)-2 + …. + 3.231,30 x (1+2%)-12 = 34.172,10

Date Description Debit Credit Amount Obs

Initial recognition of PPE – Basic Equipment Financing – Finance

Jun. 1, N 34.172,10

the asset (433) Lease (2513)

©Contabilidade Financeira II 2022/2023, ISCTE-IUL -3-

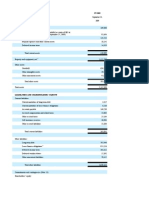

EXERCISE 4.4.

1) Compute Provisions’ carrying amount for years N and N-1. Explain its meaning.

The carrying amount on Provisions (non-current liability) was 1.564.975 euros on 31/12/N and

1.358.333 euros on 31/12/N-1. Those values match with present obligations resulting from past

events and a probable outflow of resources is expected, although time and amount are uncertain

(estimation).

According with §14 of IAS 37, a provision should only be recognized when:

a) an entity has a present obligation (legal or constructive) as a result of a past event;

b) it is probable that an outflow of resources embodying economic benefits will be required to

settle the obligation; and

c) a reliable estimate can be made of the amount of the obligation.

If these conditions are not met, no provision shall be recognised.

2) Explain the difference between “Provisions” and “Impairments”. Discuss possible elements

of convergence between the two concepts.

According with §10 of IAS 37, a Provision is a liability of uncertain in timing or amount. Therefore,

provisions are recognized as “Liability”, different from other liabilities (such as accounts payable,

salaries and wages payable) due to the uncertain in timing or amount (estimation). Impairments are

losses on Assets, that represent the exceeding amount between the carrying amount and the

recoverable amount.

However, the two concepts converge in the following aspects:

1. They are “Expenses” with impact in the income statement (Provision expenses (67) and

Impairment loss expenses (65));

2. Both values are probable and represent potential losses of uncertain in timing and amount;

3. At the recognition there is no cash outflow, therefore they do not operate any change in the

Statement of Cash Flow.

©Contabilidade Financeira II 2022/2023, ISCTE-IUL -4-

3) Identify if the following statements are True or False:

a. During year N, the company did not recognize any provisions.

FALSE. On year N the company recognize provisions by the amount of 250.000 euros.

b. Provisions disclosed in the statement of financial position are related with clients’

warranties.

FALSE. The amount of 1.564.975 euros registered in the statement of financial position is the best

estimate to support potential losses with legal and tax processes in course (recognized as

Provisions – Lawsuits (293)).

c. During year N no provisions were used.

TRUE. According with note 23 no provisions were used.

d. The company does not disclose any contingent liabilities.

TRUE. According with note 23 “Provisions and contingencies”, the Board decided to disclose that

on 31/12/N there were no contingencies.

4) Journal entries on January, N+1.

No. Description Debit Credit Amount

Provisions – Lawsuits Reversals – Provisions –

a. Provision reversal 250.000

liabilities (293) Lawsuits (7633)

Provision expenses – Provisions –

Provision for company’s

b. Restructuring liabilities Restructuring liabilities 2.000.000

restructuring plan

(677) (297)

©Contabilidade Financeira II 2022/2023, ISCTE-IUL -5-

5) Explain the reason why contingent liabilities should not be recognized and are only

disclosed.

According with §10 of IAS 37 a contingent liability is:

a) a possible obligation that arises from past events and whose existence will be confirmed

only by the occurrence or non-occurrence of one or more uncertain future events not

wholly within the control of the entity; or

b) a present obligation that arises from past events but is not recognised because:

i. it is not probable that an outflow of resources embodying economic benefits will be

required to settle the obligation; or

ii. the amount of the obligation cannot be measured with sufficient reliability.

According with §13 of IAS 37, contingent liabilities are not recognized as liabilities because they

are possible obligations and not probable obligations. Present obligations or a future outflow of

resources need confirmation and a sufficiently reliable estimate of the amount of the obligation

may not be possible. Therefore, contingencies are only disclosed.

©Contabilidade Financeira II 2022/2023, ISCTE-IUL -6-

You might also like

- Leases - Practice QuestionsDocument18 pagesLeases - Practice Questionsosama saleemNo ratings yet

- PVT LTD Comp Balance-Sheet - FY - 22-23Document4 pagesPVT LTD Comp Balance-Sheet - FY - 22-23yogeshbhagat451No ratings yet

- Karora Q2 2022 FSDocument19 pagesKarora Q2 2022 FSprenges prengesNo ratings yet

- q2 2023 Financial Supplement En1112Document9 pagesq2 2023 Financial Supplement En1112Debsingha SirkarNo ratings yet

- q2 2023 Financial Supplement enDocument9 pagesq2 2023 Financial Supplement enDebsingha SirkarNo ratings yet

- Karora Resources FS Q3 2021Document19 pagesKarora Resources FS Q3 2021prenges prengesNo ratings yet

- KRR FS Q1Document17 pagesKRR FS Q1prenges prengesNo ratings yet

- Lagrimas, Sarah Nicole S. - LeasesDocument9 pagesLagrimas, Sarah Nicole S. - LeasesSarah Nicole S. LagrimasNo ratings yet

- Pure Gold Mining CFS Q3 09302022Document23 pagesPure Gold Mining CFS Q3 09302022jeynielmunozNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- FS Gogold 2023 Q3Document17 pagesFS Gogold 2023 Q3Jasdeep ToorNo ratings yet

- Icef Fy-2020-21 3Document8 pagesIcef Fy-2020-21 3Nishikant MishraNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- 6 Supplementary Accounting StatementDocument11 pages6 Supplementary Accounting StatementNithinMannepalliNo ratings yet

- Leases Robles Empleo Solution Manual - CompressDocument18 pagesLeases Robles Empleo Solution Manual - Compresschnxxi iiNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- Lii Hen - Q1 (2017) 1Document15 pagesLii Hen - Q1 (2017) 1Jordan YiiNo ratings yet

- TOPDocument2 pagesTOPMuhammad Zain ShaikhNo ratings yet

- PSA-NAM App CGA SubDocument3 pagesPSA-NAM App CGA SubMuhammad TariqNo ratings yet

- DCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsDocument1 pageDCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsGolamMostafaNo ratings yet

- Digital Advantage Insurance Company 6-30-22Document115 pagesDigital Advantage Insurance Company 6-30-22georgi.korovskiNo ratings yet

- Project SolutionDocument13 pagesProject Solutionpre.meh21No ratings yet

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- QCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Document10 pagesQCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Swapnil WankhedeNo ratings yet

- Eum Edgenta Sofp & Sopl 2020Document4 pagesEum Edgenta Sofp & Sopl 2020ariash mohdNo ratings yet

- Balance Sheet A2z AccountingDocument21 pagesBalance Sheet A2z AccountingWilson PrashanthNo ratings yet

- PTRY AnalysisDocument5 pagesPTRY AnalysisthesaneinvestorNo ratings yet

- Financials Finstream AY 2022-23Document22 pagesFinancials Finstream AY 2022-23yogiprathmeshNo ratings yet

- FY 2010 HEXA Hexindo+Adiperkasa+TbkDocument39 pagesFY 2010 HEXA Hexindo+Adiperkasa+TbkAnggit DewiNo ratings yet

- Balance Sheet As at 30th Fu.t: SeptemberDocument3 pagesBalance Sheet As at 30th Fu.t: SeptemberDHANU DANGINo ratings yet

- Etats Financiers Interimaires 30-09-2008Document23 pagesEtats Financiers Interimaires 30-09-2008Blog de MalarticNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- (Refer: Paragraph 1.3 Page 3) : Appendix-IDocument56 pages(Refer: Paragraph 1.3 Page 3) : Appendix-IRAJAT SINHANo ratings yet

- Dialog Finance PLC: ConfidentialDocument12 pagesDialog Finance PLC: ConfidentialgirihellNo ratings yet

- Telkom - FS TW I 2023 Eng - RilisDocument113 pagesTelkom - FS TW I 2023 Eng - RilisSyafrizal ThaherNo ratings yet

- CAF 5 Spring 2022Document7 pagesCAF 5 Spring 2022Zia Ur RahmanNo ratings yet

- Clavax Power - TAR - 2023 - Provisional - 10.09Document7 pagesClavax Power - TAR - 2023 - Provisional - 10.09Naresh nath MallickNo ratings yet

- Balance Sheet in ' CroreDocument6 pagesBalance Sheet in ' CroreVarshini KNo ratings yet

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- Ilovepdf MergedDocument5 pagesIlovepdf MergedRaghav AgarwalNo ratings yet

- Receipts and Payments AccountDocument2 pagesReceipts and Payments AccountUmapathi MNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen ValleNo ratings yet

- LAC2023Q3MDAandFinancials 1Document41 pagesLAC2023Q3MDAandFinancials 1sabrinawang0405No ratings yet

- Infosys Annual Report 2015-16Document1 pageInfosys Annual Report 2015-16Gayathree NandigamNo ratings yet

- Problem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesDocument5 pagesProblem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesIsabelle GuillenaNo ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- BPI Condensed FS 3Q 2022Document32 pagesBPI Condensed FS 3Q 2022canlasjazminenicholeNo ratings yet

- 3.nuventures CFS FINALoldDocument32 pages3.nuventures CFS FINALoldNagendra KoreNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- 2017 Vol 2 CH 4 AnsDocument18 pages2017 Vol 2 CH 4 AnsBSANo ratings yet

- PT Astra International TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianDocument135 pagesPT Astra International TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianPASCA/21521220028/NI MADENo ratings yet

- Spreadsheet 9M21Document14 pagesSpreadsheet 9M21Salah HusseinNo ratings yet

- Supplementary Accounting Statement ECPLDocument15 pagesSupplementary Accounting Statement ECPLdeepNo ratings yet

- UBL Interim Financial Statements March 2023 ConsolidatedDocument37 pagesUBL Interim Financial Statements March 2023 Consolidatedabdullahazaim55No ratings yet

- DPL Annual Report 2022 23 PagesDocument1 pageDPL Annual Report 2022 23 Pagesworkf17hoursformeNo ratings yet

- Robinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700Document30 pagesRobinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700bob LastNo ratings yet

- Macro Mid 1 SolutionDocument4 pagesMacro Mid 1 SolutionMd. Sakib HossainNo ratings yet

- IFMR Capital: Securitizing Microloans For Non-Bank InvestorsDocument30 pagesIFMR Capital: Securitizing Microloans For Non-Bank Investorsakash srivastavaNo ratings yet

- Bank Alfalah Limited Internship ReportDocument67 pagesBank Alfalah Limited Internship Reportbbaahmad89No ratings yet

- Bank Statement 1)Document4 pagesBank Statement 1)hbh2n8tgs4No ratings yet

- Financial RatioDocument21 pagesFinancial RatioAbiola BabajideNo ratings yet

- FM 415 - Quiz #1Document4 pagesFM 415 - Quiz #1Rose Gwenn VillanuevaNo ratings yet

- Chapter 1 & 2Document33 pagesChapter 1 & 2ENG ZI QINGNo ratings yet

- AB Bank - 2022Document131 pagesAB Bank - 2022Mostafa Noman DeepNo ratings yet

- Activity - 09Document6 pagesActivity - 09Mahra AlMazroueiNo ratings yet

- Karakteristik Uang Elektronik Dalam Sistem PembayaranDocument33 pagesKarakteristik Uang Elektronik Dalam Sistem PembayaranDicky KurniawanNo ratings yet

- PNB ChallanDocument1 pagePNB ChallanAnkana RamolaNo ratings yet

- CH 14Document42 pagesCH 14maxhaakeNo ratings yet

- VM Mortgage Professional ResumeDocument2 pagesVM Mortgage Professional Resumeapi-240684563No ratings yet

- NABL FeesDocument6 pagesNABL FeesDWTL PARBHANINo ratings yet

- The Next Five Years: What Investors Can ExpectDocument52 pagesThe Next Five Years: What Investors Can ExpectJonNo ratings yet

- PCE Trial Exam 1Document55 pagesPCE Trial Exam 1Kenny Chen68% (22)

- The Abcs of Abs: Portfolio Strategy ResearchDocument20 pagesThe Abcs of Abs: Portfolio Strategy ResearchYusuf Utomo100% (2)

- Worsksheet #1Document4 pagesWorsksheet #1Sharmin ReulaNo ratings yet

- FINA3303 Lecture 4 Post PDFDocument26 pagesFINA3303 Lecture 4 Post PDFTsui KelvinNo ratings yet

- Special Journals - Quiz 36Document8 pagesSpecial Journals - Quiz 36Joana TrinidadNo ratings yet

- CIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityDocument2 pagesCIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityMaria haneffNo ratings yet

- BAFB3013 Financial ManagementDocument9 pagesBAFB3013 Financial ManagementSarah ShiphrahNo ratings yet

- Directors Report To The Shareholders of Idlc Finance Limited 2019 944529Document9 pagesDirectors Report To The Shareholders of Idlc Finance Limited 2019 944529sajibarafatsiddiquiNo ratings yet

- PROPERTIES READY FOR SALE As of MARCH 31 2023Document9 pagesPROPERTIES READY FOR SALE As of MARCH 31 2023Lee ViosaNo ratings yet

- Retail Banking SystemsDocument4 pagesRetail Banking Systemssheik abdullahNo ratings yet

- Valuation Analysis: Judson W. Russell, PH.D., CFA University of North Carolina-CharlotteDocument86 pagesValuation Analysis: Judson W. Russell, PH.D., CFA University of North Carolina-CharlottepafitNo ratings yet

- Your Business Advantage Checking Bus Platinum Privileges: Account SummaryDocument6 pagesYour Business Advantage Checking Bus Platinum Privileges: Account SummaryN N100% (1)

- Admas University College Faculty of Business Department of AccountingDocument3 pagesAdmas University College Faculty of Business Department of AccountingtemedebereNo ratings yet

- BAB 2024 CH06 - Cost Volume Profit Analysis-Add - Issue.Document74 pagesBAB 2024 CH06 - Cost Volume Profit Analysis-Add - Issue.mini3110No ratings yet

- Cash and Cash Equivalent QuizDocument3 pagesCash and Cash Equivalent QuizApril Rose Sobrevilla DimpoNo ratings yet