Professional Documents

Culture Documents

Credit and Collection Quiz 1 Reviewer.

Uploaded by

Subscribe to Kimmus pleaseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit and Collection Quiz 1 Reviewer.

Uploaded by

Subscribe to Kimmus pleaseCopyright:

Available Formats

Credit – Ability to obtain a certain amount of money with a promise Family Corporation – Investor’s POV – Sila Mamumuhunan

to pay at a definite time

Stock – Equity Market

- Walang nakukulong

Can earn thru: Capital Share/Capital Gains and Dividends

Negotiable Instrument: (Pwedeng Makulong)

Bonds – Debt Market

1. Promissory Note - A promissory note, sometimes referred

Can earn thru: Interest

to as a note payable, is a legal instrument, in which one

party promises in writing to pay a determinate sum of -Maturity Period – You can get principal amount

money to the other, either at a fixed or determinable

future time or on demand of the payee, under specific - Contract – Can be quarterly/yearly

terms and conditions.

Per Quarter Makukuha interest per year ang interest

2. Current Account – Checking account

Interest First ang bigay bago ang capital

Draw against insufficient funds (DAIF) - If a transaction draws

money from a bank account while the account balance is lower than Company sells shares of stocks to have funds for capital

the amount drawn, the account will thus be in the insufficient funds

Breach of Contract – Di pagsunod sa kontrata

status.

Dead Person is not equal to Dead Utang

Draw against unfunded funds (DAUF) - If a transaction draws money

from a bank account while the account balance is zero. Writeoff or Condonation – gagamitin pag namatay yung may utang

CRECOM – Credit Committee To avoid problems: Before pautang, have group life insurance

CASA - Current account savings accounts Para yung pera mapupunta muna sa inutangan and then yung

matitira is ibabalik sa pamilya nung namatay.

ESTAFA – Isang talbog ng cheke

Example: 100k yung insurance, May 50k na utang yung namatay.

Syndicated Estafa – Madaming talbog ng cheke Yung 50k mapupunta muna sa inutungan and then yung 50k dun sa

pamilya ng namatay. Win-Win Situation

Credit as Financing (Interrelated Activity of Business)

Net Proceeds – 100k inutang. May 10% interest. 90K na lang

ipapautang pero 100k yung need mo bayaran.

1. Investing (Capital) – Lifeblood of Business

2. Operating – Day-to-Day Operations Pawnshop – Registered to BSP

a. Includes AR and AP

3. Financing (Credit) – Face Value - Quasi Financial Institution

- Pawner, Pawnee, Pawn

5cs of Credit

Pawn Ticket – Receipt – Papel De ahensya

1. Character – Face Value, borrower’s reputation or track

Proceed – Mas mababas sa tunay na halaga ng alahas

record for repaying debts

2. Capacity – Work/Networth/Portfolio, borrower’s ability to Sangla Tubos

repay a loan

3. Capital - Capital contributions indicate the borrower’s level Over Redemption - Remata

of investment, which can make lenders more comfortable Lagpas ng Redemption Period

about extending credit.

4. Collateral - gives the lender the assurance that if the Principal – Borrower

borrower defaults on the loan, the lender can get

something back by repossessing the collateral. Mga ari- Co – Maker – Solidary Liable

arian

Guarantor – Not Solidary Liable

5. Condition – Terms, The conditions of the loan, such as the

interest rate and the amount of principal, influence the

lender’s desire to finance the borrower.

Account Receivable – Need makolekta ASAP

Account Payable – Pwede patagalin

You might also like

- No Dues Certificate IssuedDocument3 pagesNo Dues Certificate Issuedmanoj khathumriaNo ratings yet

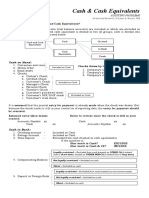

- Audit - Cash and Cash Equivalents PDFDocument15 pagesAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- 06 12 LBO Model Quiz Questions Basic PDFDocument16 pages06 12 LBO Model Quiz Questions Basic PDFVarun AgarwalNo ratings yet

- Case Study SVBDocument4 pagesCase Study SVBAnshula KolheNo ratings yet

- Question Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalDocument12 pagesQuestion Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalBhavya Shrivastava100% (3)

- Business Finance Final TermDocument3 pagesBusiness Finance Final TermClarice TorresNo ratings yet

- What is Cash and Cash EquivalentsDocument3 pagesWhat is Cash and Cash EquivalentsKimNo ratings yet

- Far.03 Cash and Cash EquivalentsDocument8 pagesFar.03 Cash and Cash EquivalentsRhea Royce CabuhatNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- Intermediate Accounting 1Document2 pagesIntermediate Accounting 1kathlenejane.garciaNo ratings yet

- Infographic Explains Stocks vs BondsDocument1 pageInfographic Explains Stocks vs BondsTrisha BugayongNo ratings yet

- Chapters 8 9Document2 pagesChapters 8 9Rena Jocelle NalzaroNo ratings yet

- NU - Audit of Cash and Cash EquivalentsDocument14 pagesNU - Audit of Cash and Cash EquivalentsDawn QuimatNo ratings yet

- Finmar Finals RevDocument6 pagesFinmar Finals RevMae Marie De DiosNo ratings yet

- Banks of QuestionsDocument28 pagesBanks of QuestionsViệt Hưng ĐặngNo ratings yet

- Cash and Cash EDocument3 pagesCash and Cash EShaira BugayongNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Summary of Cash and Cash EquivalentsDocument4 pagesSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Influences on Financial Management: Internal and External SourcesDocument4 pagesInfluences on Financial Management: Internal and External SourcesHarryNo ratings yet

- Chapter1 FINANCIAL ECONOMICS UPFDocument30 pagesChapter1 FINANCIAL ECONOMICS UPFirisyun02No ratings yet

- Cce Part1 Cash and Cash Equivalents CompressDocument2 pagesCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGNo ratings yet

- Penn State Financial Literacy Center GlossaryDocument4 pagesPenn State Financial Literacy Center GlossaryMeghaNo ratings yet

- INTACC - Chapter 1 (1)Document4 pagesINTACC - Chapter 1 (1)MeriiiNo ratings yet

- Cash and Cash Equivalents Lecture NotesDocument2 pagesCash and Cash Equivalents Lecture Notesyna kyleneNo ratings yet

- Cash and Cash Equivalent S: Intermediate Accounting 1 Prepared By: Joseph F. Glorioso, CPADocument46 pagesCash and Cash Equivalent S: Intermediate Accounting 1 Prepared By: Joseph F. Glorioso, CPAJohn SenaNo ratings yet

- Finance BasicsDocument6 pagesFinance BasicsBushra HaqueNo ratings yet

- Banking LawsDocument5 pagesBanking Lawsjamaica deangNo ratings yet

- Sta Clara - Summary Part 1Document49 pagesSta Clara - Summary Part 1Carms St ClaireNo ratings yet

- Business English Vocabulary SlovíčkaDocument11 pagesBusiness English Vocabulary Slovíčkasekeresova.nikolaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash Equivalentsshe lacks wordsNo ratings yet

- Cash and Cash EquivalentsDocument34 pagesCash and Cash EquivalentsJennalyn S. GanalonNo ratings yet

- ResearchDocument3 pagesResearchrmurmatam0583pamNo ratings yet

- Fixed Interest Rate."Document6 pagesFixed Interest Rate."Michelle TNo ratings yet

- Module 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Document6 pagesModule 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Cale Robert RascoNo ratings yet

- Acccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Document7 pagesAcccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Rey HandumonNo ratings yet

- FS Overview: Cash and Cash EquivalentsDocument14 pagesFS Overview: Cash and Cash EquivalentsRommel estrellado100% (1)

- Simplified SFM Theory Book by CA Jatin Nagpal - CompressedDocument47 pagesSimplified SFM Theory Book by CA Jatin Nagpal - CompressedSatyendraGuptaNo ratings yet

- Source of CreditDocument2 pagesSource of Creditkhaireyah hashim100% (1)

- FinanceDocument5 pagesFinancecrist.jahnskieNo ratings yet

- Accounting For Cash and Cash TransactionDocument63 pagesAccounting For Cash and Cash TransactionAura Angela SeradaNo ratings yet

- Busfin ReviewerDocument4 pagesBusfin ReviewerjeonsnobNo ratings yet

- Intermediate Accounting 1 Cash and Cash Equivalents ReviewDocument17 pagesIntermediate Accounting 1 Cash and Cash Equivalents ReviewClar AgramonNo ratings yet

- Week 3-Lesson 5 - 6 - 7Document4 pagesWeek 3-Lesson 5 - 6 - 7Hong TrnhNo ratings yet

- Week 1 accounting principles and financial statementsDocument3 pagesWeek 1 accounting principles and financial statementsRung'Minoz KittiNo ratings yet

- Fixed Income (Basic Concepts)Document28 pagesFixed Income (Basic Concepts)LUXMI TRADING COMPANYNo ratings yet

- Business Finance ReviewerDocument4 pagesBusiness Finance ReviewerJanna rae BionganNo ratings yet

- Compiled by Birhanu M (MBA-Finance) Page 1Document9 pagesCompiled by Birhanu M (MBA-Finance) Page 1Nigussie BerhanuNo ratings yet

- Philippine Stock Exchange (PSE) :: FinanceDocument3 pagesPhilippine Stock Exchange (PSE) :: FinanceAdrienne Erika MANAIGNo ratings yet

- MAS2 - Group 1Document6 pagesMAS2 - Group 1Cheese ButterNo ratings yet

- Funding sources for entrepreneurs including informal, family, angels, banksDocument2 pagesFunding sources for entrepreneurs including informal, family, angels, banksFlicker LoserNo ratings yet

- 2Document99 pages2Erika Faith HalladorNo ratings yet

- Deposit Liquidity Waiting Periods: Securitization SecurityDocument2 pagesDeposit Liquidity Waiting Periods: Securitization Securitycarlos juarezNo ratings yet

- Bonds Payable ReviewerDocument4 pagesBonds Payable ReviewerHazel TanongNo ratings yet

- Bonds PayableDocument52 pagesBonds PayableJohn Charles Andaya100% (2)

- Cash and Cash Equivalents AccountingDocument2 pagesCash and Cash Equivalents AccountingJustine CruzNo ratings yet

- End of Chapter Exercises - Answers: Chapter 2: Markets and PlayersDocument2 pagesEnd of Chapter Exercises - Answers: Chapter 2: Markets and PlayersYvonneNo ratings yet

- Glossary of Terms Glossary of TermsDocument4 pagesGlossary of Terms Glossary of TermsDaisy Nana MillerNo ratings yet

- Long Term Assets Tangible Assets Intangible Assets Natural ResourcesDocument7 pagesLong Term Assets Tangible Assets Intangible Assets Natural ResourcesGovind GoelNo ratings yet

- Unit 4 Theory & Prob.Document10 pagesUnit 4 Theory & Prob.dasaritejaswini8No ratings yet

- CH 13Document7 pagesCH 13thanhtra023No ratings yet

- Cash & Cash Equivalents, LECTURE &EXERCISESDocument16 pagesCash & Cash Equivalents, LECTURE &EXERCISESNMCartNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersFrom EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNo ratings yet

- Financial Liabilities - Bonds Payable - Practice Set (QUESTIONNAIRE)Document4 pagesFinancial Liabilities - Bonds Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14No ratings yet

- Complaint-In-Intervention (1) AssssDocument4 pagesComplaint-In-Intervention (1) AssssEmilio Ong SorianoNo ratings yet

- Assessing Credit Risk Management in Ethiopian BanksDocument17 pagesAssessing Credit Risk Management in Ethiopian BanksUtban AshabNo ratings yet

- ACFDocument9 pagesACFduaa fatimaNo ratings yet

- Internship Report On A Study On SME BankDocument40 pagesInternship Report On A Study On SME BankAbu Hamzah NomaanNo ratings yet

- CH 1, IntroductionDocument65 pagesCH 1, IntroductionSadia AlinNo ratings yet

- KB240211FMDUC - KFS & Sanction LetterDocument10 pagesKB240211FMDUC - KFS & Sanction Letterrudraprasad520No ratings yet

- [ADDITIONAL] CLASS 5 Errington v. Errington [1952] 1 KB 290Document8 pages[ADDITIONAL] CLASS 5 Errington v. Errington [1952] 1 KB 290siddharth guptaNo ratings yet

- CHR Report - 06 August 2023Document30 pagesCHR Report - 06 August 2023Venella PatrickNo ratings yet

- Business Finance Lesson-Exemplar - Module 4Document15 pagesBusiness Finance Lesson-Exemplar - Module 4Divina Grace Rodriguez - Librea100% (1)

- Castillo v. Security BankDocument2 pagesCastillo v. Security BankAnonymous bOncqbp8yi100% (1)

- Maha Sahyog Maha Sandhi 2023-24Document9 pagesMaha Sahyog Maha Sandhi 2023-24Neetish JhaNo ratings yet

- Ii. Loan (C. Simple Loan or Mutuum)Document195 pagesIi. Loan (C. Simple Loan or Mutuum)ErikaAlidioNo ratings yet

- Form 8281 OID Reporting for Publicly Offered Debt InstrumentsDocument4 pagesForm 8281 OID Reporting for Publicly Offered Debt InstrumentsMARSHA MAINESNo ratings yet

- 72 Debt USDocument7 pages72 Debt USfajar sukmanaNo ratings yet

- (1990) 2 SLR (R) 0102Document8 pages(1990) 2 SLR (R) 0102Sulaiman CheliosNo ratings yet

- Angalan V DelanteDocument3 pagesAngalan V DelanteGerald DelgadoNo ratings yet

- Difference Between Banking and NBFI Financial StatementDocument6 pagesDifference Between Banking and NBFI Financial StatementSaad Abu BakarNo ratings yet

- PWC Financing Guide 122022Document382 pagesPWC Financing Guide 122022M Tariqul Islam Mishu100% (1)

- Debt CapitalDocument6 pagesDebt CapitalDaksh GandhiNo ratings yet

- On October 1 2018 Jay Crowley Established Affordable Realty WhichDocument1 pageOn October 1 2018 Jay Crowley Established Affordable Realty WhichAmit Pandey0% (1)

- Upload Actual Proof of Investments GuideDocument13 pagesUpload Actual Proof of Investments Guidevivek htgNo ratings yet

- Abyssinia Bank Charts Noteworthy Profit, Dividend ClimbDocument7 pagesAbyssinia Bank Charts Noteworthy Profit, Dividend ClimbBernabasNo ratings yet

- Advantages of Direct Finance and Indirect Finance in Vietnam 2.1. Direct FinanceDocument3 pagesAdvantages of Direct Finance and Indirect Finance in Vietnam 2.1. Direct FinanceAnh Nguyen Hong QTKD-2TC-18No ratings yet

- Jennifer Williamson Recently Quit Her Job As An Investment Banker PDFDocument1 pageJennifer Williamson Recently Quit Her Job As An Investment Banker PDFhassan taimourNo ratings yet

- Lease Accounting Problems SolutionsDocument5 pagesLease Accounting Problems SolutionsGarp BarrocaNo ratings yet

![[ADDITIONAL] CLASS 5 Errington v. Errington [1952] 1 KB 290](https://imgv2-2-f.scribdassets.com/img/document/722639323/149x198/b0ac9bd153/1713010971?v=1)