Professional Documents

Culture Documents

CH 05

Uploaded by

lauhouian20Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 05

Uploaded by

lauhouian20Copyright:

Available Formats

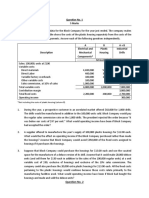

Example—Comtek Sound, Inc.

DVD Players CD Players

Budgeted sales for current year 50,000 units 200,000 units

DLH required for each unit 2 DLH 2DLH

DM cost per unit $90 $50

DL cost per unit $20 $20

Total MOH costs for the current year are estimated to be $10,000,000. The company applies

MOH to products based on DLH.

The company has been losing bids to supply CD players, its main product, to lower priced

competitors, while winning all bids to supply DVD players, its secondary product.

ABC information:

Estimated

Activity and Activity Measures OH cost Expected Activity

Total . DVD CD .

.

Labor related (DLH) $ 800,000 500,000 100,000 400,000

Machine related (MH) 2,100,000 1,000,000 300,000 700,000

Machine setups (setups) 1,600,000 4,000 3,000 1,000

Production orders (orders) 3,150,000 1,200 800 400

Parts administration (part types) 350,000 700 400 300

General factory (MH) 2,000,000 1,000,000 300,000 700,000

$10,000,000

1. Determine the POHR under the current system.

2. How will you describe the current system?

3. Compute the unit cost for each product.

4. Determine the POHRs of the six ABC cost pools.

5. Compute the unit cost for each product.

5-18 Cost hierarchy.

SharpPitch, Inc., manufactures karaoke machines for several well-known companies. The machines

differ significantly in their complexity and their manufacturing batch sizes. The following costs

were incurred in 2014:

a. Indirect manufacturing labor costs such as supervision that supports direct manufacturing labor,

$950,000

b. Procurement costs of placing purchase orders, receiving materials, and paying suppliers related

to the number of purchase orders placed, $675,000

c. Cost of indirect materials, $180,000

d. Costs incurred to set up machines each time a different product needs to be manufactured,

$450,000

e. Designing processes, drawing process charts, and making engineering process changes for

products, $315,000

f. Machine-related overhead costs such as depreciation, maintenance, and production engineering,

$975,500 (These resources relate to the activity of running the machines.)

g. Plant management, plant rent, and plant insurance, $578,000

Required:

1. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or

facility-sustaining. Explain each answer.

2. Consider two types of karaoke machines made by SharpPitch, Inc. One machine, designed for

professional use, is complex to make and is produced in many batches. The other machine,

designed for home use, is simple to make and is produced in few batches. Suppose that

SharpPitch needs the same number of machine-hours to make each type of karaoke machine and

that Forrester allocates all overhead costs using machine-hours as the only allocation base. How,

if at all, would the machines be miscosted? Briefly explain why.

3. How is the cost hierarchy helpful to SharpPitch in managing its business?

You might also like

- MBA 620 Week 2 Homework ANSWER SHEETDocument6 pagesMBA 620 Week 2 Homework ANSWER SHEETphoebeNo ratings yet

- Should Barbour Drop Product T-2Document33 pagesShould Barbour Drop Product T-2Vias TikaNo ratings yet

- ABCQuestionsDocument4 pagesABCQuestionsAdiltufail AdilNo ratings yet

- Decision MakingDocument33 pagesDecision Makingali100% (1)

- Bab Vii BalandcorcardDocument17 pagesBab Vii BalandcorcardCela Lutfiana100% (1)

- Acc 301 Week 5Document9 pagesAcc 301 Week 5Accounting GuyNo ratings yet

- Activity-based costing reveals product cost distortionsDocument3 pagesActivity-based costing reveals product cost distortionsRavinesh PrasadNo ratings yet

- Activity Based Costing and Activity Based Management - ProblemDocument3 pagesActivity Based Costing and Activity Based Management - Problemkiara kiesh FosterNo ratings yet

- Okr Presentation Hugo EkipaDocument27 pagesOkr Presentation Hugo EkipaPradita SetiabudiNo ratings yet

- Relevant Decision FactorsDocument7 pagesRelevant Decision FactorsFreya Dela Calzada0% (1)

- Managerial Accounting Solutions Ch3Document12 pagesManagerial Accounting Solutions Ch3Marwan Al-Asbahi75% (4)

- PDF Dominion Motors and Controls Case Analysis DDDocument3 pagesPDF Dominion Motors and Controls Case Analysis DDsaifrahmanNo ratings yet

- ABC analysis improves costing accuracyDocument43 pagesABC analysis improves costing accuracyKate CygnetNo ratings yet

- ACTIVITY BASED COSTING AND ACTIVITY BASED MANAGEMENT - No AudioDocument19 pagesACTIVITY BASED COSTING AND ACTIVITY BASED MANAGEMENT - No AudioAlexis Kaye DayagNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- Comtek Sound Inc. develops activity-based costingDocument11 pagesComtek Sound Inc. develops activity-based costingВадимNo ratings yet

- Sesi 5&6 PraktikDocument6 pagesSesi 5&6 PraktikDian Permata SariNo ratings yet

- Assignment 3Document3 pagesAssignment 3solomon adamuNo ratings yet

- 3 Soal AMB - Des2018Document4 pages3 Soal AMB - Des2018Try WijayantiNo ratings yet

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- Activity-Based Costing SampleDocument16 pagesActivity-Based Costing SampleRam KnowlesNo ratings yet

- ABC Costing Helps Astro Boy Co. Decision MakingDocument3 pagesABC Costing Helps Astro Boy Co. Decision MakingDaiannaNo ratings yet

- Assignement 2Document8 pagesAssignement 2Jerome Moga100% (3)

- ch08Document4 pagesch08ghsoub777No ratings yet

- Duff CoDocument1 pageDuff CoAli HussainNo ratings yet

- Acca f5 Question BankDocument98 pagesAcca f5 Question Banknguyenphuongthao.04012003No ratings yet

- MODULE 6 Mid-Term Exam Review Exercises - F23Document6 pagesMODULE 6 Mid-Term Exam Review Exercises - F23pratibhaNo ratings yet

- Demand (Units) Selling Price Per Unit ($) Cost Per UnitDocument5 pagesDemand (Units) Selling Price Per Unit ($) Cost Per UnitMichael ComunelloNo ratings yet

- Incremental Analysis Problems Set BDocument3 pagesIncremental Analysis Problems Set BPak CareerNo ratings yet

- Name: Student No.: Exercises For Decision MakingDocument7 pagesName: Student No.: Exercises For Decision MakingShohnura FayzulloevaNo ratings yet

- Unit 7 Cost AccountingDocument4 pagesUnit 7 Cost AccountingKimberly A AlanizNo ratings yet

- Assignment 2Document2 pagesAssignment 2BlenNo ratings yet

- Latihan Target CostingDocument7 pagesLatihan Target CostingAlvira FajriNo ratings yet

- WORKSHEET 1 - ProductivityDocument2 pagesWORKSHEET 1 - Productivitylaxmi joshiNo ratings yet

- 会计题目Document10 pages会计题目Poetic YatchyNo ratings yet

- 7 HomeworkDocument3 pages7 HomeworkAdrianna Nicole HatcherNo ratings yet

- Estimate D Expected Activity - Cost Driver Overhea D Activity Centers (And Cost Driver) Costs Total Product X Product YDocument2 pagesEstimate D Expected Activity - Cost Driver Overhea D Activity Centers (And Cost Driver) Costs Total Product X Product YJaniah Aaliyah M. DrakesNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- f5 2014 Jun Q PDFDocument7 pagesf5 2014 Jun Q PDFCynthia ohanusiNo ratings yet

- DAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDocument3 pagesDAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDavidNo ratings yet

- ABC-sample ProblemDocument5 pagesABC-sample ProblemLee Jap OyNo ratings yet

- FACULTY OF COMMERCE & LAW MANAGEMENT ACCOUNTING ASSIGNMENTDocument3 pagesFACULTY OF COMMERCE & LAW MANAGEMENT ACCOUNTING ASSIGNMENTTawanda Tatenda HerbertNo ratings yet

- f5 Exam Kit 2015 16Document9 pagesf5 Exam Kit 2015 16ednaNo ratings yet

- ConAgra Processes Beef Cattle ProductsDocument13 pagesConAgra Processes Beef Cattle ProductsMawaz Khan MirzaNo ratings yet

- Exc 1Document2 pagesExc 1Anonymous OxCDfW1CFVNo ratings yet

- Chapter 4 Examples 9-13Document5 pagesChapter 4 Examples 9-13deniz turkbayragiNo ratings yet

- BDC Preboard Feb 2011 - MasDocument10 pagesBDC Preboard Feb 2011 - Mas1hewlett100% (1)

- CH 08 Illustration ExercisesDocument2 pagesCH 08 Illustration Exerciseslauhouian20No ratings yet

- Cost hierarchy helps SharpPitch analyze product costsDocument14 pagesCost hierarchy helps SharpPitch analyze product costsNCTNo ratings yet

- Lec7 ExerciseDocument5 pagesLec7 Exercise29 4ANo ratings yet

- ACC4206 Advanced Management Accounting - Tutorial Questions on Quality Costing, Target Costing, and Divisional PerformanceDocument3 pagesACC4206 Advanced Management Accounting - Tutorial Questions on Quality Costing, Target Costing, and Divisional PerformancenatlyhNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- Chapter 7 Solutions-2Document9 pagesChapter 7 Solutions-2mackkshellNo ratings yet

- Section C Part 2 MCQDocument344 pagesSection C Part 2 MCQSaiswetha BethiNo ratings yet

- Practice ProblemsDocument4 pagesPractice ProblemsshaiwanaNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- Costing Methods ComparisonDocument11 pagesCosting Methods ComparisontutiNo ratings yet

- ABC vs Traditional Costing Reveals Profit TruthDocument3 pagesABC vs Traditional Costing Reveals Profit TruthAbhijit AshNo ratings yet

- Apple - Problem 2Document2 pagesApple - Problem 2ckkuteesaNo ratings yet

- Limiting Factors/Bottleneck Resource/ThroughPut AccountingDocument4 pagesLimiting Factors/Bottleneck Resource/ThroughPut AccountingBisma AsifNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- PowerPC Microprocessor Common Hardware Reference Platform: A System ArchitectureFrom EverandPowerPC Microprocessor Common Hardware Reference Platform: A System ArchitectureRating: 4 out of 5 stars4/5 (1)

- Sap LabsDocument91 pagesSap LabsSachin Singh100% (2)

- MBA Seeks Challenging RoleDocument5 pagesMBA Seeks Challenging RolePriya SharmaNo ratings yet

- CbaDocument4 pagesCbaMuhammad Iqbal SugestiadiNo ratings yet

- Entrepreneur Vs ManagerDocument12 pagesEntrepreneur Vs ManagerHimadhar Sadu100% (1)

- CS435: Introduction To Software Engineering: Dr. M. ZhuDocument56 pagesCS435: Introduction To Software Engineering: Dr. M. Zhurohan pandyaNo ratings yet

- Pay RaisesDocument8 pagesPay RaisesDeKalb OfficersNo ratings yet

- QMS IqaDocument11 pagesQMS IqaMeng Hwi KorNo ratings yet

- Final Report (Leading Change)Document23 pagesFinal Report (Leading Change)Karen May UrlandaNo ratings yet

- Concepts of OrganizingDocument36 pagesConcepts of Organizingajaygoyal2009No ratings yet

- How Internal Auditors Can Use Quality ToolsDocument4 pagesHow Internal Auditors Can Use Quality Toolsimsana minatozaki67% (3)

- Cost Classification Concepts and CategoriesDocument6 pagesCost Classification Concepts and CategoriesDRLNNo ratings yet

- Engineering ManagementDocument1 pageEngineering ManagementShainee Delle PalmeraNo ratings yet

- Project On Employee Absenteeism by NisamDocument54 pagesProject On Employee Absenteeism by Nisammailtonisam86% (35)

- M1 CPR2Document3 pagesM1 CPR2CyNo ratings yet

- Supplier Selection PDFDocument19 pagesSupplier Selection PDFKrishnendu ShawNo ratings yet

- 4 - Discussion - Standard Costing and Variance AnalysisDocument2 pages4 - Discussion - Standard Costing and Variance AnalysisCharles TuazonNo ratings yet

- BPO Consultants and BPO'sDocument17 pagesBPO Consultants and BPO'sSuhas VaishnavNo ratings yet

- Annual Report 2001Document44 pagesAnnual Report 2001scribdaccount67No ratings yet

- Company DescriptionDocument3 pagesCompany DescriptionEmin PaçaNo ratings yet

- Supply Chain Management IntroductionDocument8 pagesSupply Chain Management IntroductionNgọc MaiNo ratings yet

- Solution Manual For Accounting Information Systems 10th Edition by James A HalldocxDocument7 pagesSolution Manual For Accounting Information Systems 10th Edition by James A HalldocxEllen Maskariño100% (1)

- Product Branding and Operational Efficiency at EduMentorDocument81 pagesProduct Branding and Operational Efficiency at EduMentorSarathKumarNo ratings yet

- Penggenalan Huruf HijaiyahDocument15 pagesPenggenalan Huruf HijaiyahMuhammad Nurul azizNo ratings yet

- SCK-F-02 Contract ReviewDocument5 pagesSCK-F-02 Contract ReviewJesus AntónioNo ratings yet

- Fundamentals of Logistics and Supply Chain ManagementDocument17 pagesFundamentals of Logistics and Supply Chain ManagementJatin Arora0% (2)

- "HRM Is The Provision of Leadership and Direction of People in Their Working or Employment Relationship" - Dale VoderDocument8 pages"HRM Is The Provision of Leadership and Direction of People in Their Working or Employment Relationship" - Dale VoderPRANAV RATHINo ratings yet