Professional Documents

Culture Documents

Tugas Akutansi Biaya 1 & 2

Uploaded by

Aal ArmandOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas Akutansi Biaya 1 & 2

Uploaded by

Aal ArmandCopyright:

Available Formats

UNIVERSITAS TEKNOLOGI NUSANTARA

FAKULTAS EKONOMI

TERAKRIDITASI BAN-PT

Program Studi : Manajemen

Jl. Raya Pemda Pangkalan III No, 66 Keradenan Pasir Jambu

Sukaraja Phone (0251) 7502137 Kode Pos 16710 Bogor – JAWA BARAT

Program Studi: Manajemen MK/Semester : Akutansi Biaya/ 2 (dua)

Nama : Arman Setiadi Dosen : Agus Setyawan., SE., M.Ak

NIM : 02111110007 Hari/Tanggal : Sabtu 19 Maret 2022

JAWABAN TUGAS 19 MARET 2022

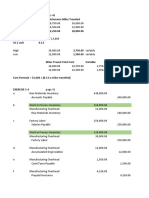

SOAL 1 Dr Payroll 20.000.000

Cr.Accrued Payroll 19.000.000

Dr.Accured Payroll 19.000.000

Cr.Cash 19.000.000

Dr.Work in procces 10.000.000

Dr.Factory Overhead control 5.000.000

Dr Selling and marketing expense 2.500.000

Dr.General and Administration expense 2.500.000

Cr .Payroll 20.000.000

SOAL 2

a PT MUMU

For The Period Ended Januari,31,2011

Direct material,bginning . . . . . . 10.000.000

Net Purchase :

Purchase 18.000.000

Purchase discount -360.000

Net Purchase : 17.640.000

Cost of goods available for used 27.640.000

Direct material,ending -6.875.000

-6.875.000

Direct material used 20.765.000

Direct Labor 39.235.000

Manufacturing overhead applied 41.679.000

Estimated total manufacturing cost 101.679.000

Work in proces, bgininng 25.700.000

Work in proces, ending -12.379.000

Estimated cost of goods manufactured 115.000.000

Finish goods,bgininng 30.000.000

Finish goods,ending -18.041.000

Estimated cost of goods sold 126.959.000

Manufacturing overhead : -5.709.000

Indirect labor 12.670.000 121.250.000

Indirect material used 10.800.000

Depreciation expense-machine 5.000.000

Insurance expense-factory 4.000.000

Other manufacturing overhead 2.000.000

Utilities expense 1.500.000

Total manufacturing overhead

Manufacturing overhead applied 35.970.000

Overapplied faktory overhead 41.679.000

{5709000}

b Period cost :

Selling salaries expense 8.750.000

General and administrative salaries expense 6.500.000

Commission expense 5.505.000

Depreciation expense- machine 1.500.000

Utilities expense 1.025.000

total period cost 23.280.000

SOAL 3

a & b Metode Aljabar :

Persamaan Aljabar :

0= 18.000 - Alpha + 0,1 Beta + 0,1 Gamma

0= 29.160 + 0,2 Alpha - Beta + 0,1 Gamma

0= 45.000 + 0,2 Alpha - Gamma

Dari persamaan di atas diperoleh Alpha = 27.000, Beta = 39.600 dan Gamma = 50.400

Producttion Departement Service Departement

Description

Xenia Yahoo Alpha Beta Gamma

FOH

185.000 82.500 18.000 29.160 45.000

before

Allocation :

Alpha 6.750 =

9.400 = 35% x 25% x -27.000 5.400 = 20% 5.400 = 20%

27.000 27.000 x 27.000 x 27.000

Beta 15.840 = 3.960 =

19.000 = 50% 40% x 10% x -39.600 -

x 39.600 39.600 39.600

Gamma 22.680 = 5.040 = 50.400 =

17.640 = 35% 45% x 10% x 10% x -50.400

x 50.400 50.400 50.400 50.400

FOH after

231.890 127.770 0 0 0

allocation

Normal

1.000 1.500

Capacity

FOH rate 231,89 85,18

FOH fixed

139,13 51,11

rate ( 3/5)

FOH

92,76 34.07

variable

UNIVERSITAS TEKNOLOGI NUSANTARA

FAKULTAS EKONOMI

TERAKRIDITASI BAN-PT

Program Studi : Manajemen

Jl. Raya Pemda Pangkalan III No, 66 Keradenan Pasir Jambu

Maaf pak baru sempat ngumpulin tugas yg ini karena kerjanya pulang malem terus pak, sekalilagi saya mohon maaf ya pak.

JAWABAN TUGAS PERTEMUAN KE 5 12 MARET 2022

SOAL 1

a & b. PT. MUMU

COGM and COGS Statement

For The Period Ended December 31 2011

Direct material,bginning 4.000.000

Net purchase 87.000.000

Direct material avaliable for used 91.000.000

Direct material ending -9.000.000

Direct material used 82.000.000

Direct labor 18.000.000

Manufacturing overhead :

Deprecation expense - factory 14.000.000

Other manufacturing overhead 12.000.000

Insurance expense - factory 10.000.000

Indirect labor 8.000.000

Indirect material 6.000.000

Total manufacturing overhead 50.000.000

Total manufacturing cost 150.000.000

Work in process, bginning 70.000.000

Work in process, ending -36.000.000

Cost of goods manufactured 184.000.000

Finish goods, bginning 18.500.000

Finish goods,ending -12.500.000

Cost of goods sold 190.000.000

c. PT. MUMU

Income Statement

For The Period Ended December 31 2011

Sales 240.000.000

Cost of goods sold -190.000.000

Gross profit 50.000.000

Selling and administrative expense -40.000.000

Income for operation 10.000.000

Incom tax expense -500.000

Income before tax 9.500.000

SOAL 2

a. Kuantitas pemesanan yang paling ekonomis = √2x960.000 x 4.000.000

3.750 x 2%

= 320.000

b. Persediaan penyanggah = ( 3.600 - 3.200 ) x 6 = 2.400

c. Titik pemesanan kembali = ( 32.00 x 6 ) + 21.400 = 21.600

d. Persediaan rata-rata = ( 320.000 / 2) + 2.400 = 162.400

e. Persediaan maksimum normal = 320.000 + 2.400 = 322.400

f. persediaan maksimum absolut = 322.400 + (( 3.200 - 2.400 ) x 6 ) = 327.200

g. Frekuensi pemesanan = 960.000 / 320.000 = 3

h. Waktu yang dibutuhkan untu 1x pemesanan = 300 / 3 = 100 hari

i. Biaya pemesanan setahun = 3 x 4.000.000 = 12.000.000

j. Biaya penyimpanan setahun = 320.000 / 2 x 3.750 x 2% = 12.000.000

You might also like

- Dunkin Donut ThesisDocument94 pagesDunkin Donut ThesisPaulo Alomia75% (4)

- MATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessDocument16 pagesMATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessMark James Rico50% (2)

- 0069 OcilabsDocument1 page0069 OcilabsOCI LABSNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- 4.justice and Economic DistributionDocument30 pages4.justice and Economic DistributionMuneer Hussain90% (10)

- Assignment 1. Gucci CaseDocument8 pagesAssignment 1. Gucci Caseafif12No ratings yet

- Sweden India Business Guide 2017Document62 pagesSweden India Business Guide 2017kijekaNo ratings yet

- End of Quiz: BCOST221: COST ACCOUNTING (BSA23) 2nd Sem SY 2021-2022 Enabling Assessment 2Document12 pagesEnd of Quiz: BCOST221: COST ACCOUNTING (BSA23) 2nd Sem SY 2021-2022 Enabling Assessment 2Kc SevillaNo ratings yet

- Bcom 5 Sem Cost Accounting Compulsory 5494 Summer 2019Document8 pagesBcom 5 Sem Cost Accounting Compulsory 5494 Summer 2019ovais kanojeNo ratings yet

- Statement COGSDocument2 pagesStatement COGSlaurentinus fikaNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- Semi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Document6 pagesSemi-Finals (Intro To Cost Accounting, Cost of Goods Sold, High-Low Method and Regression Analysis, Standard Costing)Alyssa Nichole CastilloNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- 30.00 Points: Raw Materials $ 21,000 Work in Process $ 12,000 Finished Goods $ 31,000Document5 pages30.00 Points: Raw Materials $ 21,000 Work in Process $ 12,000 Finished Goods $ 31,000Mikulas HarvankaNo ratings yet

- 1.3 เฉลย File 1.1 Ch 1 2-2022Document14 pages1.3 เฉลย File 1.1 Ch 1 2-2022Chokthawee RattanawetwongNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- Tugas Cost 1Document3 pagesTugas Cost 1kuriboh997No ratings yet

- Cost Sheet - CWDocument16 pagesCost Sheet - CWkushgarg627No ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- J. Jarvis Trial Balance As at 31 December 2010Document3 pagesJ. Jarvis Trial Balance As at 31 December 2010Ahmad HaqqyNo ratings yet

- MAE - Pratice - Cost Sheet. - QuestionDocument6 pagesMAE - Pratice - Cost Sheet. - QuestionDhairya Mudgal0% (1)

- ASSIGNMENT On Cost AccountingDocument6 pagesASSIGNMENT On Cost AccountingMudassar Gul Bin AshrafNo ratings yet

- Solution Job Order CostingDocument1 pageSolution Job Order Costingaiza eroyNo ratings yet

- PT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFDocument1 pagePT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFBulan julpi suwellyNo ratings yet

- Additional Answers Exercises COGM-COGS-JEs PDFDocument2 pagesAdditional Answers Exercises COGM-COGS-JEs PDFNicola Erika EnriquezNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- CA Inter Costing QFP Solutions Ebook - CA Ganesh BharadwajDocument103 pagesCA Inter Costing QFP Solutions Ebook - CA Ganesh Bharadwajsubasha1a1No ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument39 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialAniket100% (1)

- Jawaban Ex 3-34 AKBB OverheadDocument2 pagesJawaban Ex 3-34 AKBB OverheadRantiyaniNo ratings yet

- Job Order CostingDocument5 pagesJob Order Costing0322-1975No ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Assignment Week 9 - Costing Decision Under UncertaintyDocument9 pagesAssignment Week 9 - Costing Decision Under UncertaintyHanifah Al Fitri SalsabilaNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Balaibo M6 PDFDocument4 pagesBalaibo M6 PDFKarenn Estrañero LuzonNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- Answer Q5Document2 pagesAnswer Q5calebNo ratings yet

- Tugas Akuntansi BiayaDocument6 pagesTugas Akuntansi Biayacathy pisaNo ratings yet

- Mock Test 3 Online AnswerDocument4 pagesMock Test 3 Online AnswerLucia XIIINo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Acco 20073 Instructional Materials CompressDocument23 pagesAcco 20073 Instructional Materials CompressNestyn Hanna VillarazaNo ratings yet

- (RM) (RM)Document2 pages(RM) (RM)Nurul Sabira RahmanNo ratings yet

- IAL Accounting SB2 AnswersDocument91 pagesIAL Accounting SB2 AnswersThaviksha BulathsinhalaNo ratings yet

- COST SHEET OnlineDocument13 pagesCOST SHEET OnlineSoumendra RoyNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Cost Accounting-I806 - Xid-3956721 - 1Document4 pagesCost Accounting-I806 - Xid-3956721 - 1arshiya mittalNo ratings yet

- ACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDocument8 pagesACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDollarNo ratings yet

- Latihan Soal AMLDocument3 pagesLatihan Soal AMLSaskia ArumNo ratings yet

- Integrated Accounting SystemDocument4 pagesIntegrated Accounting SystemKitty CattyNo ratings yet

- 7.7.3 Sample Interim CalculationDocument5 pages7.7.3 Sample Interim CalculationDanielNo ratings yet

- Aspek Keuangan BenangDocument12 pagesAspek Keuangan Benangabdul manafNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- The Good EggDocument6 pagesThe Good EggMichael BataanNo ratings yet

- Channel Strategies in The FMCG Sector Marketing EssayDocument12 pagesChannel Strategies in The FMCG Sector Marketing EssayAditya GuptaNo ratings yet

- Radiant Manpower Service - PresentationDocument10 pagesRadiant Manpower Service - PresentationjswldeepNo ratings yet

- Summer Internship Project Company: Edelweiss Stock Broking Ltd. Proect Title: An Analysis of Investment Avenues Prevailing in IndiaDocument11 pagesSummer Internship Project Company: Edelweiss Stock Broking Ltd. Proect Title: An Analysis of Investment Avenues Prevailing in IndiaDEBALINA SENNo ratings yet

- Understanding Preferential Allotment of Securities: Pavan Kumar VijayDocument54 pagesUnderstanding Preferential Allotment of Securities: Pavan Kumar VijayAakash MehtaNo ratings yet

- Customer Satisfaction in The Indian Banking SectorDocument69 pagesCustomer Satisfaction in The Indian Banking SectorKpramod YadavNo ratings yet

- Fundamentals of Marketing ProjectDocument7 pagesFundamentals of Marketing ProjectYash TradersNo ratings yet

- AMIR VI Other Sustainability Assessment Methods 20 - 220926 - 135926Document105 pagesAMIR VI Other Sustainability Assessment Methods 20 - 220926 - 135926Mostafa TaghaviNo ratings yet

- Rana Khalid CV 2020-Converted - 3Document2 pagesRana Khalid CV 2020-Converted - 3Rana FaizanNo ratings yet

- From Potato Chips To Computer Chips: Features of Korea's Economic DevelopmentDocument41 pagesFrom Potato Chips To Computer Chips: Features of Korea's Economic DevelopmentBUINo ratings yet

- MIS Strategic Plan For Tesla MotorsDocument11 pagesMIS Strategic Plan For Tesla MotorsRintu Adhikary33% (3)

- NIBCO's "Big Bang": An SAP Implementation: Novi Yuningsih Prawistri PuspitasariDocument25 pagesNIBCO's "Big Bang": An SAP Implementation: Novi Yuningsih Prawistri PuspitasarinovijoenNo ratings yet

- Operations Management: An Integrated ApproachDocument11 pagesOperations Management: An Integrated Approachsam heisenbergNo ratings yet

- Chapter 3Document8 pagesChapter 3abdfaz951No ratings yet

- FDI GuidelinesDocument3 pagesFDI GuidelinesAnkur BhattNo ratings yet

- Robert K. Schaeffer - After Globalization-Routledge (2021)Document416 pagesRobert K. Schaeffer - After Globalization-Routledge (2021)Leonardo ChagasNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelVrinda TayadeNo ratings yet

- CEI Planet Spring 2023Document16 pagesCEI Planet Spring 2023CEINo ratings yet

- DLCPM00312970000023340 NewDocument6 pagesDLCPM00312970000023340 NewAnshul KatiyarNo ratings yet

- TariffsDocument17 pagesTariffsChad HallbergNo ratings yet

- DissertatioC BDocument16 pagesDissertatioC BKumar SwamyNo ratings yet

- Refuz ComerciantDocument6 pagesRefuz ComerciantAllii BăăNo ratings yet

- Accounting For ManagersDocument9 pagesAccounting For ManagersAbdul Hadi SheikhNo ratings yet