Professional Documents

Culture Documents

Additional Answers Exercises COGM-COGS-JEs PDF

Uploaded by

Nicola Erika EnriquezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Answers Exercises COGM-COGS-JEs PDF

Uploaded by

Nicola Erika EnriquezCopyright:

Available Formats

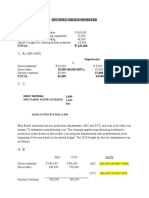

Additional answers:

Multiple choice 1

Total Manufacturing Cost 80,000

RM used 47,000

DL 28,000

Depreciation - FE 1,000

Factory rent 2,000

Factory insurance 500

Materials handling 1,500

OH 5,000

Multiple choice 7

COGS & COGM

DM used 100,000

DL 250,000

DL - Payroll taxes 30,000 280,000

OH

Factory supplies 6,000

Indirect labor 50,000

Machine maintenance and repair 10,000

Factory rent, light and power 24,000

Depreciation of machinery 10,000 100,000

TMC 480,000

WIP, beginning 30,000

TGPIP 510,000

WIP, ending 40,000

TGOGM 470,000

FG, beginning 50,000

TCGAS 520,000

FG, ending 60,000

TCOGS 460,000

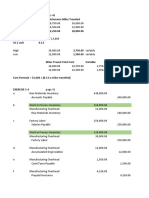

PROBLEM 1-1

ACCOUNT TITLES DEBIT CREDIT

a. Materials 13,500

Accounts payable 13,500

b. Work in process-direct material 17,500

Materials 17,500

c. Factory overhead control 1,800

Materials 1,800

d. Payroll 27,000

Accrued payroll 27,000

Work in process-direct labor 17,000

Factory overhead control 2,000

Selling expense 5,000

Administrative expense 3,000

Payroll 27,000

e. Factory overhead control 2,508

Cash 2,508

f. Factory overhead control 8,500

Accounts payable 8,500

g. Work in process-Factory overhead 14,808

Factory overhead control 14,808

h. Finished goods 60,100

Work in process 60,100

i. Accounts receivable 75,000

Sales 75,000

Cost of goods sold 60,000

Finished goods 60,000

PROBLEM 1-16

Comments

Raw materials used 371,800 Account for the discounts on raw materials; must be deducted to get the net

purchases of raw materials

Direct labor 180,000

Factory - maintenance, power & heat, insurance, depreciation, superintendence,

Factory Overhead 222,500 indirect labor, factory supplies

TCGPIP 858,300

TCOGM 828,300

TGAFS 865,800

COGS 825,800

You might also like

- Job CostingDocument35 pagesJob Costingjpg17100% (2)

- Chapter 5Document12 pagesChapter 5?????0% (1)

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- SummaryDocument30 pagesSummaryAkira Marantal Valdez0% (1)

- Global Tilt Charan en 18828 PDFDocument7 pagesGlobal Tilt Charan en 18828 PDFTim JoyceNo ratings yet

- Bradley CurveDocument21 pagesBradley Curveajm7No ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Done by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoDocument7 pagesDone by Omar Gamal Tawfik 291800293: There Will Under Applied by 8000 SoOmar SoussaNo ratings yet

- Afar 2612 Job Order CostingDocument25 pagesAfar 2612 Job Order Costingcorpnet globalNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Statement COGSDocument2 pagesStatement COGSlaurentinus fikaNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Nones Cost AccountingDocument2 pagesNones Cost AccountingMary Rose NonesNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Factory Overhead 1,000,000 800,000: Problem 1 - The Denmark Company 1. Material CostDocument11 pagesFactory Overhead 1,000,000 800,000: Problem 1 - The Denmark Company 1. Material CostMico NechaldasNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- Bacostmx-1tay2223-Midterms Quiz 1 ReviewerDocument4 pagesBacostmx-1tay2223-Midterms Quiz 1 ReviewerCzarina Jean ConopioNo ratings yet

- Acco 20073 Instructional Materials CompressDocument23 pagesAcco 20073 Instructional Materials CompressNestyn Hanna VillarazaNo ratings yet

- ExercisesDocument7 pagesExercisesMaryjane De GuzmanNo ratings yet

- Practice Problems For Chapter 2 Part 1Document3 pagesPractice Problems For Chapter 2 Part 1Elisha MonteroNo ratings yet

- M4 Answer Key 1 Nad 3Document11 pagesM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNo ratings yet

- Answer Key Midterm Exam Cost Acounting With Solutions PART IIDocument7 pagesAnswer Key Midterm Exam Cost Acounting With Solutions PART IINoel Carpio100% (1)

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- Job Order CostingDocument5 pagesJob Order Costing0322-1975No ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Problem 1Document2 pagesProblem 1Von Andrei MedinaNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Act. 2 Job Order CostingDocument3 pagesAct. 2 Job Order Costing0322-1975No ratings yet

- Accounting QuestionsDocument7 pagesAccounting QuestionsleneNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Computing CosgDocument6 pagesComputing CosgAngelica BayaNo ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- Set9 P3Document5 pagesSet9 P3Geriq Joeden PerillaNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Cost Accounting 2018 Edition Pedro Guerrero Solution Manual Cost Accounting 2018 Edition Pedro Guerrero Solution ManualDocument47 pagesCost Accounting 2018 Edition Pedro Guerrero Solution Manual Cost Accounting 2018 Edition Pedro Guerrero Solution ManualKant ColoradoNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Job Order Costing Practice and Lecture QuestionDocument10 pagesJob Order Costing Practice and Lecture QuestionManaal HussainNo ratings yet

- Day 2 - COST - TEMPLATEDocument27 pagesDay 2 - COST - TEMPLATEum23328No ratings yet

- Cost AccountingDocument3 pagesCost Accountingdisturbedguy048No ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- Probs AnswerDocument4 pagesProbs AnswerLABASBAS, Alexidaniel I.No ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Problem 4 CPA-IN-TRANSIT Manufacturing Company: OverheadDocument7 pagesProblem 4 CPA-IN-TRANSIT Manufacturing Company: OverheadCiana SacdalanNo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- Assignment in Costacc: Group 2Document16 pagesAssignment in Costacc: Group 2Love FreddyNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Group 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Document31 pagesGroup 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Carla TalanganNo ratings yet

- EM01Document20 pagesEM01Anonymous B7pghh100% (1)

- Billing System of MEPCO by Iqrash AwanDocument27 pagesBilling System of MEPCO by Iqrash AwanMuhammad Iqrash Awan100% (1)

- NovartisDocument14 pagesNovartisRahul KumarNo ratings yet

- Project Mvfklbls DG LDSLDocument4 pagesProject Mvfklbls DG LDSLNekta PinchaNo ratings yet

- Alpha BetaDocument13 pagesAlpha BetaJoel Christian MascariñaNo ratings yet

- Kumar Mangalam Birla: Committee Report On Corporate GovernanceDocument16 pagesKumar Mangalam Birla: Committee Report On Corporate GovernanceSiddharth SinghNo ratings yet

- Case IbmDocument3 pagesCase IbmEVA SALVATIERRA LOPEZNo ratings yet

- Total Quality Management Unit I GE2022Document52 pagesTotal Quality Management Unit I GE2022standalonembaNo ratings yet

- Performance Appraisal in HCL Info SystemDocument104 pagesPerformance Appraisal in HCL Info SystemGarima Bansal57% (7)

- A6 Share 221 eDocument2 pagesA6 Share 221 eNika Ella SabinoNo ratings yet

- D.A. Setyoko 424366380Document4 pagesD.A. Setyoko 424366380Green Sustain EnergyNo ratings yet

- Boskalis CSR ReportDocument80 pagesBoskalis CSR ReportRayodcNo ratings yet

- Supply ChainDocument13 pagesSupply ChainJobinSibyNo ratings yet

- Ipasa Nyo Po Kami Sa LawDocument79 pagesIpasa Nyo Po Kami Sa LawAnne Thea AtienzaNo ratings yet

- R12 Ap Theory: We Maintain The Following Things at Accounts Payables ModuleDocument22 pagesR12 Ap Theory: We Maintain The Following Things at Accounts Payables ModulerajaNo ratings yet

- DPLZ6-APT&CH - ID-TENDER DOC (01 February) - CompressedDocument229 pagesDPLZ6-APT&CH - ID-TENDER DOC (01 February) - CompressedLuu NamNo ratings yet

- HEC Paris Executive MBA 2014Document24 pagesHEC Paris Executive MBA 2014Ehab Alzabt100% (1)

- Income From PGBPDocument34 pagesIncome From PGBPjagan pawanismNo ratings yet

- CORPORATIONDocument54 pagesCORPORATIONThu ThảoNo ratings yet

- Sales Management ASSIGNMENTDocument8 pagesSales Management ASSIGNMENTSeroney JustineNo ratings yet

- Green Supply Chain and Its Role in Enhancing Competitive Advantag1Document49 pagesGreen Supply Chain and Its Role in Enhancing Competitive Advantag1jamespaul50724No ratings yet

- 6.3 Estimating All-In Rates For Labour: Stage 2Document6 pages6.3 Estimating All-In Rates For Labour: Stage 2mohamedNo ratings yet

- Professional Computing Issues: Chapter 10: Ethics of IT OrganizationsDocument20 pagesProfessional Computing Issues: Chapter 10: Ethics of IT Organizationsرغد ابراهيمNo ratings yet

- CH 26.2 The U.S. Trade in GoodsDocument2 pagesCH 26.2 The U.S. Trade in GoodsL'appel du videNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpDocument5 pagesCOMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpAustin Viel Lagman MedinaNo ratings yet

- Presentation of DTi For MIlESDocument39 pagesPresentation of DTi For MIlESVanessa Claire PleñaNo ratings yet

- Saln-Form - Jan Bryan M. EslavaDocument2 pagesSaln-Form - Jan Bryan M. EslavaJan Bryan EslavaNo ratings yet

- The Power of Selling, V. 1.0 - AttributedDocument683 pagesThe Power of Selling, V. 1.0 - AttributedAlfonso J Sintjago100% (2)