Professional Documents

Culture Documents

12th Accountancy 2 Blue Print of Question Paper For DA Code

Uploaded by

ecommerce11.20200 ratings0% found this document useful (0 votes)

16 views1 pageBlue print for Q paper

Original Title

1661767521_12th Accountancy 2 blue print of question paper for DA Code

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBlue print for Q paper

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 page12th Accountancy 2 Blue Print of Question Paper For DA Code

Uploaded by

ecommerce11.2020Blue print for Q paper

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

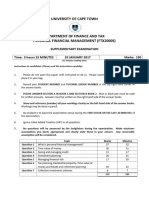

Accountancy II

Blue print of question paper for DA Code

Time:3 hours Theory: 80 Marks

Project/Practical:15 Marks

IA: 05 Marks

Total:100 Marks

1a 10 questions will be set in the question paper.

2a There will be 3 sections in the question paper i.e. Section A, Section B and Section C. Section A

is compulsory for all students and students may choose only one section from section B and

section C.

3a Section A, Section B and Section C. will be set from part I, part II and part III of the syllabus

respectively.

4a There is no word, line or page limit for numerical questions.

5a Use of non-programmable simple calculator is allowed.

Section-A

6. Question no. 1 consist of 16 sub parts i to xvi carrying 2 marks each. This objective type question

may include true false, MCQ, fill in the blanks and one word answer.

7. Question no. 2 to 5 (2 questions will be theoretical and 2 will be numerical) will carry 3 marks

each. Answer of theoretical question should be given in 1 to 2 lines.

8. Question no. 6 consists of 3 sub parts (i,ii,iii )out of which 2 will be numerical and 1 will be

theoretical. (Attempt any 2 Questions) Each question carry 4 marks. Answer of theoretical

question should be given in 2 to 4 lines.

Section B and C

9. Question no.7 consist of 9 sub-parts (i to ix) carrying 2 marks each. This objective type question

may include true false, MCQ, fill in the blanks.

10. Question no. 8 to 9 (out of which one will be numerical and one will be theoretical). Each

question carry 3 marks. Answer of theoretical question should be given in 1 to 2 lines.

11. Question no. 10 consist of 2 sub parts (i,ii) out of which one will be numerical and one will be

theoretical. (Attempt any one question out of two) This question carries 4 marks. Answer of

theoretical question should be given in 2 to 4 lines.

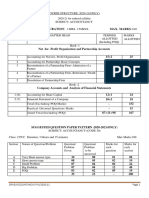

Unit 2 marks 3 marks 4 marks

1 Financial Statements of not– 3 - 1

for-profit Organizations

2 Accounting for partnership 2 1 -

Firms

3 Change in the profit sharing 2 1 -

ratio

4 Admission of a partner 3 1 1

5 Retirement and Death of a 3 1 -

Partner

6 Dissolution of Partnership 3 - 1

Firms

Section-B

7 Accounting for share capital 2 - 1

8 Accounting for debentures 2 1 -

9 Analysis of Financial Statements 3 1 -

10 Cash Flow Statements 2 - 1

Section-C

7 Over view of computerized 2 - 1

accounting system

8 Using computerized 2 1 -

accounting system

9 Accounting using DBMS 3 1 -

10 Accounting application of 2 - 1

electronic spreadsheet

You might also like

- Structure of Accountancy - 12 (2023-24)Document3 pagesStructure of Accountancy - 12 (2023-24)ecommerce11.2020No ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- OCT2018Document6 pagesOCT2018YASMINNo ratings yet

- Made. Est Tap:: OptionsDocument1 pageMade. Est Tap:: OptionsJay KakadiyaNo ratings yet

- 2023-MQP-12330 ACCOUNTANCYrfDocument7 pages2023-MQP-12330 ACCOUNTANCYrftonties 123No ratings yet

- Class 12 ACEBDocument6 pagesClass 12 ACEBMuraleedaaran SrkNo ratings yet

- Final Assignment MAT1005 S3 20 21Document4 pagesFinal Assignment MAT1005 S3 20 21An TrịnhNo ratings yet

- Xi See Acc 2021 Set 2 BPDocument1 pageXi See Acc 2021 Set 2 BPs1672snehil6353No ratings yet

- AccontancyDocument79 pagesAccontancyapi-3703686No ratings yet

- 2023 OL Subject ReportDocument133 pages2023 OL Subject ReportSand FossohNo ratings yet

- Mca311 PDFDocument2 pagesMca311 PDFSimanta KalitaNo ratings yet

- 2016 FTX2000S Supp 25 January 2017 Question-1Document13 pages2016 FTX2000S Supp 25 January 2017 Question-1crctun001No ratings yet

- II PU Accountancy QP-1Document21 pagesII PU Accountancy QP-1anonymousboylostNo ratings yet

- Universiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205Document6 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205ZilchNo ratings yet

- BCA 2 Computer Based Accounting and Financial Management 2015Document4 pagesBCA 2 Computer Based Accounting and Financial Management 2015Jatin SinghNo ratings yet

- Accounting GR 10 Paper - PDFDocument9 pagesAccounting GR 10 Paper - PDFAngel JozanaNo ratings yet

- BA Sem IIIDocument2 pagesBA Sem IIISuprio SahaNo ratings yet

- 402 Information Tech SQPDocument7 pages402 Information Tech SQPTeam gore100% (1)

- It SQP and SolutionsDocument14 pagesIt SQP and SolutionsShaheer HaiderNo ratings yet

- BlueprintDocument6 pagesBlueprintYash GuptaNo ratings yet

- Sample Paper - Blue Prints-XI EcoDocument1 pageSample Paper - Blue Prints-XI EcoDj gokul jai kumar.vNo ratings yet

- Model Sample Paper Accountancy II (2023-24) DADocument4 pagesModel Sample Paper Accountancy II (2023-24) DAhappy16082006No ratings yet

- Exemplar 2018 Accounting Grade 10 P2 and MemoDocument35 pagesExemplar 2018 Accounting Grade 10 P2 and MemoKing LasNo ratings yet

- AssignmentDocument2 pagesAssignmentSheeraz AhmadNo ratings yet

- Chap 003Document38 pagesChap 003Corinne ChadwellNo ratings yet

- PSEB Class 11 Accountancy I Syllabus 2021 2022Document5 pagesPSEB Class 11 Accountancy I Syllabus 2021 2022A VNo ratings yet

- 12th Accountacy Model Test PaperDocument5 pages12th Accountacy Model Test PaperJas Singh DevganNo ratings yet

- 141 Basic Applied MathematicsDocument52 pages141 Basic Applied MathematicsRUBENI DAUDINo ratings yet

- Ais205 June 23Document7 pagesAis205 June 23ediza adha0% (1)

- CA Zambia March 2021 Examination Session QaDocument419 pagesCA Zambia March 2021 Examination Session QaSmart SokoNo ratings yet

- School of Business Administration ACC2304: Accounting Principles II Semester: Fall2019 Course SyllabusDocument7 pagesSchool of Business Administration ACC2304: Accounting Principles II Semester: Fall2019 Course SyllabusAmine NaitlhoNo ratings yet

- 2023 MQP 2330 AccountancyDocument15 pages2023 MQP 2330 AccountancyHemanth PariharNo ratings yet

- ADL 14 Ver2+Document9 pagesADL 14 Ver2+DistPub eLearning Solution33% (3)

- Acc GR 10 P2 (A) Exemplar Nov18 Eng QP.Document12 pagesAcc GR 10 P2 (A) Exemplar Nov18 Eng QP.mishomabunda20No ratings yet

- Gr11 Acc June 2018 Question PaperDocument17 pagesGr11 Acc June 2018 Question Paperora mashaNo ratings yet

- HKUGA CollegeDocument8 pagesHKUGA Colleges191056No ratings yet

- 22-23 X2 S4 BAFS P2A MC ExplanationsDocument6 pages22-23 X2 S4 BAFS P2A MC Explanationss191056No ratings yet

- Grade 5 Maths Nov 2018 Questio Papaer8874Document9 pagesGrade 5 Maths Nov 2018 Questio Papaer8874Shane KalakgosiNo ratings yet

- NCE Business Entrepreneurship Education Section B 2021 2022Document12 pagesNCE Business Entrepreneurship Education Section B 2021 2022rianaalyNo ratings yet

- Final Assignment MAT1005Document4 pagesFinal Assignment MAT1005Như HảoNo ratings yet

- CA Inter Audit MTP 1 May 24Document16 pagesCA Inter Audit MTP 1 May 24Sans RecourseNo ratings yet

- Fall 2022 - MTH302 - 1Document2 pagesFall 2022 - MTH302 - 1Kinza LaiqatNo ratings yet

- Aams1773 Quantitative Studies: This Question Paper Consists of 4 Questions On 11 Printed PagesDocument11 pagesAams1773 Quantitative Studies: This Question Paper Consists of 4 Questions On 11 Printed PagesCRYSTAL NGNo ratings yet

- Exam. - 2017: Syllabus and Course Scheme Academic Year 2016-17Document21 pagesExam. - 2017: Syllabus and Course Scheme Academic Year 2016-17DonNo ratings yet

- 1 Book-Keeping IntroductionDocument10 pages1 Book-Keeping IntroductionnonameshockyNo ratings yet

- Financial Analysis QuestionsDocument2 pagesFinancial Analysis Questionsmachariachristine33No ratings yet

- 67-1-2 (Accountancy)Document24 pages67-1-2 (Accountancy)tejNo ratings yet

- Acc Gr11 March 2022 QP and MemoDocument20 pagesAcc Gr11 March 2022 QP and Memonxumalothandolwethu1No ratings yet

- Sample Exam December 2019Document10 pagesSample Exam December 2019miguelNo ratings yet

- Business Accounting SyllabusDocument4 pagesBusiness Accounting Syllabusitsteesha2244No ratings yet

- Accounting - ReviewerDocument89 pagesAccounting - ReviewerRose GonzalesNo ratings yet

- Exam - 2019: Syllabus and Course Scheme Academic Year 2018-19Document21 pagesExam - 2019: Syllabus and Course Scheme Academic Year 2018-19Geeta AhlawatNo ratings yet

- !2022 - Response - Survey Research - EnglishDocument11 pages!2022 - Response - Survey Research - EnglishRaihan Rivellino AdzaniNo ratings yet

- TA112.BQAF - .L Question CMA May 2022 ExaminationDocument8 pagesTA112.BQAF - .L Question CMA May 2022 ExaminationMohammed Javed UddinNo ratings yet

- 67-1-3 (Accountancy)Document24 pages67-1-3 (Accountancy)tejNo ratings yet

- Additional InstructionsDocument4 pagesAdditional InstructionskhanimambaNo ratings yet

- Company Accounts - 1680163720Document644 pagesCompany Accounts - 1680163720Venkat GaneshNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)