Professional Documents

Culture Documents

2023-MQP-12330 ACCOUNTANCYrf

Uploaded by

tonties 123Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023-MQP-12330 ACCOUNTANCYrf

Uploaded by

tonties 123Copyright:

Available Formats

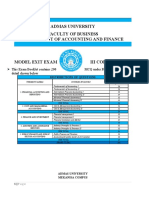

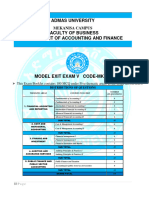

BLUE PRINT

Chapter wise, Weightage of Marks and Typology of questions 22-23

Sub: Accountancy (Code - 30) Class: I PUC

Section wise questions (Excluding POQ)

Cha Total Sec - A Sec - B Sec - C Sec - D Sec - E

Bo pte

Chapter Head Mark (01 mark) (02 (06 (12 (05

ok r

No. s marks) marks) marks) marks

Introduction to

1 04 2 1 - -

Accounting

Theory Base of

2 04 1 1 - -

Accounting

Recording of

3 22 3 1 1 1

Transactions-I

Recording of

4 36 3 - 2 1

Transactions-II

Bank Reconciliation

5 14 - 1 - 1

Statement

Trial Balance and

6 09 2 1 1 -

Rectification of Errors

Depreciation,,

7 14 - 1 - 1

Provisions and Reserves

Accounting for Bills of

8 13 2 - - 1

Exchange

I Total of Part – I 116 13 06 04 05

9 Financial Statements-I 14 - 1 1 -

10 Financial Statements - II 13 1 - - 1

Accounts from

11 Incomplete Records 19 3 - 1 1

Applications of

12 Computers in 03 2 1 - -

Accounting

Computerised

13 07 1 - 1 -

Accounting System

II Total of Part – II 56 07 02 03 02

Grand Total (Part I + II) excluding

152 20 08 07 07

POQ)

POQ (03 Questions of 5 Marks each in

15 - - - - 15

Section E)

Total marks and section wise marks 177 20 16 42 84 15

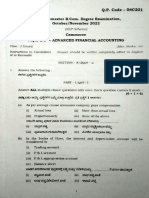

MODEL QUESTION PAPER

FIRST YEAR P.U.C

ACCOUNTANCY (30)

Time: 3 Hours 15 Minutes Max Marks: 100

Instructions:

1.The question paper contains four parts A, B, C. D, and E. Part-A consists of four

sections I, II, III and IV.

2. Provide working notes wherever necessary.

3. 15 minutes extra has been allotted for candidates to read the questions.

4. Figures in the right hand margin indicate full marks.

PART–A

I Choose the correct answer from the choices given: 5x1=5

1.Accounting equation is based on:

(a) Cost concept

(b) Separate entity concept

(c) Dual aspect concept

(d) Accrual concept

2. The objective of preparing trial balance is:

(a) To know the financial position of the business

(b) To know the arithmetical accuracy of books of accounts

(c) To know the profit or loss

(d) None of the above

3. Closing stock is valued at

(a) Cost price

(b) Market price

(c) Sales price

(d) Cost price or Market price whichever is lower

4. The opening capital is ascertained by preparing:

(a) Cash book

(b) Creditors A/C

(c) Debtors A/C

(d) Opening Statement of Affairs

5. Which of the following is not a feature of computer?

(a) Intelligence

(b) Speed

(c) Accuracy

(d) Memory

II Fill in the blanks by choosing the appropriate word/words from those

given in the bracket. 5x1=5

(Three, Sales returns, Customised, Accounting, Posting)

6. ---------- is the language of business.

7. The process of transferring journal entry to individual ledger account

is called-------.

8. Credit note is the basis for recording -------- book.

9. There are --------- parties to a Bill of Exchange.

10. Accounting software can be categorised into ready-to-use, tailor-

made and ------- software.

III Match the following: 5x1=5

11. A B

a. Journal i. Acknowledgement of debt

b. Two column cash book ii. Statement of Affairs

c. Bill of Exchange iii. Printer

d. Accounts from incomplete records iv. Contra entries

e. Output device v. Narration

IV Answer the following questions in ONE word or ONE sentence each:

5x1=5

12. Expand GAAP.

13. Give an example for voucher.

14. Cash book is both a ledger account and subsidiary book. (State

True/False)

15. State any one type of error.

16. What is statement of affairs?

PART –B

V Answer any FIVE questions, each question carries TWO marks. 5 x 2 = 10

17. Define Accounting.

18. State any two Accounting Concepts.

19. State the rules of debit and credit of liabilities.

20. What is Bank Reconciliation Statement?

21. When a suspense account is opened?

22. State any two causes of depreciation.

23. What is capital expenditure?

24. Mention two limitations of computer system.

PART –C

VI Answer any FOUR questions, each question carries SIX marks. 4 x 6 = 24

25. Classify the following into Assets, Liabilities, Capital, Income and

Expenses.

a) Purchases A/C g) Drawings A/C

b) Bank overdraft A/C h) Rent received A/C

c) Capital A/C i) Bills Payable A/C

d) Cash A/C j) Sales A/C

e) Salary A/C k) Stationery A/C

f) Furniture A/C l) Building A/C

26. Enter the following transactions in a simple cash book and balance it.

01-01-21 Balance of cash in hand ₹12,000.

06-01-21 Cash received from Sandhya ₹4,300.

10- 01-21 Cash purchases ₹9,000.

18-01-21 paid commission ₹2,500.

30-01-21 Paid rent ₹5,000.

27. Enter the following transactions in an Analytical Petty Cash Book

under the Imprest System.

01-2-21 Received a cheque from Main Cashier ₹2,500.

09-2-21 Paid for postage ₹370.

14-2-21 Purchased stationery ₹625.

20-2-21 Paid for carriage on goods ₹ 450.

24-2-21 Refreshments to customer ₹550

28. From the following Ledger balances, prepare Trial Balance as on

31-3-2021

Sl No Name of the Account Amount(₹)

1 Machinery A/C 80,000

2 Sales A/C 1,40,000

3 Purchases A/C 1,52,000

4 Capital A/C 1,25,000

5 Cash A/C 92,000

6 Bills Receivable A/C 21,000

7 Creditors A/C 25,000

8 Salary A/C 40,000

9 Bank overdraft A/C 75,000

10 Debtors A/C 30,000

29. From the following information, compute Cost of goods sold.

Stock on 01-04-2021 ₹3,40,000

Stock on 31-03-2022 ₹4,25,000

Purchases during the year ₹16,20,000

Direct Expenses ₹2,00,000

Purchase returns ₹10,000

30. From the following information, find out Credit Sales by preparing

Total Debtors Account.

Debtors as on 01-04-21 ₹1,00,000

Debtors as on 31-03-22 ₹1,45,000

Cash received from Debtors ₹1,20,000

Discount allowed ₹2,000

Bills receivable received from Debtors ₹60,000

31. Explain any six advantages of computerised accounting system.

PART –D

VII Answer any THREE questions, each question carries TWELVE marks.

3 x 12 = 36

32. Journalise the following transactions in the books of Rajani.

01-03-21 Commenced business with Cash ₹1,50,000 and Furniture

₹20,000

02-03-21 Opened Bank A/C with HDFC ₹50,000.

05-03-21 Cash Purchases ₹24,000.

08-03-21 Purchased goods from Harsha ₹16,000.

11-03-21 Sold goods for cash ₹18,000.

13-03-21 Returned goods to Harsha ₹1,000.

16-03-21 Cash withdrawn from bank for personal use ₹5,000.

20-03-21 Cash paid to Harsha ₹14,800 and discount received ₹200.

25-03-21 Received commission ₹2,200.

30-03-21 Paid salary ₹20,000.

33. Enter the following transactions in proper subsidiary books.

01-04-21 Bought goods from Vimala ₹26,000.

05-04-21 Sold goods to Amar ₹18,000.

08-04-21 Purchased goods from Manya ₹12,000.

10-04-21 Sold goods to Bharati ₹8,000.

12-04-21 Returned damaged goods to Vimala ₹1,200.

15-04-21 Received goods returned by Amar ₹600.

18-04-21 Bought goods from Rekha ₹15,000 less 5% discount.

20-04-21 Bharati returned goods ₹500.

23-04-21 Returned damaged goods to Manya ₹1,000

25-04-21 Sold goods to Siri ₹20,000 subject to trade discount of 5%.

27-04-21 Bought goods from Jayanth ₹8800.

28-04-21 Credit sales to Smitha ₹12,500.

34. Prepare Bank Reconciliation Statement of a trader from the following

information as on 31-03-2021.

a) Bank balance as per Cash book ₹48,000.

b) Cheques deposited into bank but not credited ₹4,500.

c) Insurance premium paid by the bank as per standing instruction

₹2,300.

d) Cheques issued but not presented for payment ₹3,200.

e) Bank charges debited in the pass book ₹800.

f) Direct deposit by a customer into trader’s bank account ₹2,800.

g) Interest on investment collected & credited by the bank ₹1,400.

35. On 1st April, 2018, Devi Ltd., purchased a machinery for ₹50,000

and spent ₹10,000 for its installation. On 30-09-2020 the machinery

was sold for ₹42500 and purchased a new machinery for ₹80,000.

Depreciation is charged at 10% p.a. under straight line method.

Accounts are closed on 31st March every year.

Show a) Machinery A/C &

b) Depreciation A/C for three years.

36. On 1st April 2021, Priya sold goods to Lakshmi on credit for ₹26,000

and drew a three months bill for the amount. Lakshmi accepted the

bill. After acceptance, the bill was endorsed to Veena. The bill was

honoured on the due-date.

Pass journal entries in the books of Drawer, Acceptor and Endorsee.

37. From the following Trial Balance, prepare Trading and Profit and Loss

Account for the year ending 31-03-2022 and the Balance Sheet as on

that date.

Name of the Account Debit(₹) Credit(₹)

Opening stock 20,000

Drawings and Capital 4,000 86,000

Investment 10,000

Purchase and sales 80,000 1,60,000

Returns 800 1,200

Bank overdraft 22,800

Buildings 86,000

Machinery 20,000

Wages 10,000

Commission received 8,000

Rent 18,800

Cash in hand 23,400

Interest on investment 10,000

Salary 15,000

TOTAL 2,88,000 2,88,000

Adjustments:

a) Stock as on 31-03-2022 was valued at ₹45,500.

b) Depreciate machinery by 10%.

c) Make a provision for doubtful debts at 5% on debtors.

d) Salary outstanding ₹2,500.

38. Vanitha kept her books under incomplete records. She provides you

the following information.

Particulars 01-04-2021 31-03-2022

Cash 20,000 40,000

Bills Receivable 10,000 20,000

Debtors 25,000 35,000

Stock 25,000 35,000

Furniture 20,000 20,000

Machinery 25,000 25,000

Bills Payable 5,000 10,000

Creditors 20,000 30,000

Land 80,000 80,000

During the year she has withdrawn ₹15,000 for her personal use.

She has also introduced additional capital of ₹20,000.

Adjustments:

a) Depreciate Machinery by ₹2,500.

b) Appreciate Building by 20%.

c) Outstanding Wages 1,000.

d) Provide for doubtful debts at 5% on debtors.

Prepare: i) Statement of Profit or Loss for the year ended 31-03-22

ii) Revised Statement of Affairs as on that date.

Part – E

(Practical Oriented Questions)

VIII Answer any TWO questions, each question carries FIVE marks.

2 x 5 = 10

39. Write the Accounting Equation and find out the missing figures.

Sl No Assets Liabilities Capital

a 2,25,000 1,35,000 ?

b ? 2,65,000 75,000

c 4,30,000 ? 1,25,000

40. Draft a specimen of Credit Voucher.

41. Prepare Machinery A/C for two years with imaginary figures under

Written Down Value Method.

xxxxxxxxxxxxxx

You might also like

- ARE144 Core ReviewDocument50 pagesARE144 Core Reviewshanmuga8950% (2)

- 2023 MQP 2330 AccountancyDocument15 pages2023 MQP 2330 AccountancyHemanth PariharNo ratings yet

- Accountancy MCQ PDFDocument11 pagesAccountancy MCQ PDFINSPIRATIONS ACADEMY0% (2)

- Pre Final Quiz 4Document8 pagesPre Final Quiz 4MARC JOHN ILANONo ratings yet

- Part - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsDocument16 pagesPart - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsVANSH KARELNo ratings yet

- Sa110 Notes 2016Document6 pagesSa110 Notes 2016coolmanzNo ratings yet

- All QuestionDocument37 pagesAll QuestionOUSMAN SEIDNo ratings yet

- Birla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IDocument2 pagesBirla Institute of Technology and Science, Pilani: X First Semester, 2017-2018 Evaluative Tutorial IArjun Jaideep BhatnagarNo ratings yet

- Tally Q.Paper1Document6 pagesTally Q.Paper1praveenpaulvargheseNo ratings yet

- Reviewer From Idk WhereDocument10 pagesReviewer From Idk WherePATRICIA SANTOSNo ratings yet

- Accounting Question BanksDocument130 pagesAccounting Question BanksLinh Trần Khánh100% (1)

- Acc Xi See QP With BP, Ms-17-30Document15 pagesAcc Xi See QP With BP, Ms-17-30AmiraNo ratings yet

- M Ma Ayy 2 20 00 05 5 Q Q& &A Ass: Question Papers and Examiner's AnswersDocument35 pagesM Ma Ayy 2 20 00 05 5 Q Q& &A Ass: Question Papers and Examiner's AnswersMuhammad Yasir GondalNo ratings yet

- Namma Kalvi 11th Accountancy Question Bank and Worksheet em 216265Document112 pagesNamma Kalvi 11th Accountancy Question Bank and Worksheet em 216265SabirNo ratings yet

- QUESTION 1 - Multiple Choice (15 Marks)Document24 pagesQUESTION 1 - Multiple Choice (15 Marks)Juanita AddinallNo ratings yet

- Model Exam (Aa)Document38 pagesModel Exam (Aa)tsionfisseha3No ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- 11th AccountancyDocument13 pages11th AccountancyNarendar KumarNo ratings yet

- 22-23 X2 S4 BAFS P2A MC ExplanationsDocument6 pages22-23 X2 S4 BAFS P2A MC Explanationss191056No ratings yet

- HKUGA CollegeDocument8 pagesHKUGA Colleges191056No ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- Final Exam - Introduction To Accounting Set 1 - QuestionsDocument7 pagesFinal Exam - Introduction To Accounting Set 1 - Questionsrizman AimanNo ratings yet

- Chapter 4 SolutionDocument104 pagesChapter 4 SolutionJames Clear0% (1)

- OL Accounting P1Document181 pagesOL Accounting P1Luqman KhanNo ratings yet

- Financial Accounting AssignmentDocument11 pagesFinancial Accounting AssignmentAnish Agarwal0% (1)

- AF121: Introduction To Accounting Information SystemsDocument15 pagesAF121: Introduction To Accounting Information SystemsShikhaNo ratings yet

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Document3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNo ratings yet

- 22 AccountancyDocument5 pages22 AccountancySubhas ChakrabartiNo ratings yet

- Accountancy XI Smart Skills - 2020-21Document106 pagesAccountancy XI Smart Skills - 2020-21daamansuneja2No ratings yet

- 11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)Document17 pages11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)nishvanprabhuNo ratings yet

- 101 Fac EngDocument23 pages101 Fac EngjamespotheadNo ratings yet

- Materials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesDocument12 pagesMaterials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesMiruna CiteaNo ratings yet

- Mgt101 PApers SOlvedDocument19 pagesMgt101 PApers SOlvedcs619finalproject.com83% (6)

- S. D. Jain Modern School, Surat: AccountancyDocument6 pagesS. D. Jain Modern School, Surat: AccountancyAyushi PathakNo ratings yet

- 2016 ACCT2111 Midterm KeyDocument10 pages2016 ACCT2111 Midterm KeyAnn MaNo ratings yet

- BCA 2 Computer Based Accounting and Financial Management 2015Document4 pagesBCA 2 Computer Based Accounting and Financial Management 2015Jatin SinghNo ratings yet

- ABM 2 Exam 2 v1 2023 StudentDocument10 pagesABM 2 Exam 2 v1 2023 StudentdwacindyfjNo ratings yet

- Principles of Accounting Past Paper 1Document6 pagesPrinciples of Accounting Past Paper 1Muhannad AliNo ratings yet

- Finals 2019Document4 pagesFinals 2019GargiNo ratings yet

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanNo ratings yet

- ContentsDocument11 pagesContentsWossen meseleNo ratings yet

- Adobe Scan Sep 02, 2023Document10 pagesAdobe Scan Sep 02, 2023Arpitha RamNo ratings yet

- ACC 2103 FWA Revision - V2 - Q Then KEY - 201810-DIFDocument23 pagesACC 2103 FWA Revision - V2 - Q Then KEY - 201810-DIFfalnuaimi001No ratings yet

- CHAPTER 6 - PPTDocument42 pagesCHAPTER 6 - PPTmeahangela.labadan.23No ratings yet

- Am 3Document2 pagesAm 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Namma Kalvi 11th Accountancy Model Questin Paper EM 221452Document8 pagesNamma Kalvi 11th Accountancy Model Questin Paper EM 221452sharonjamesappuNo ratings yet

- ACCOUNTANCYDocument5 pagesACCOUNTANCYSahil SahuNo ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Vgu Obrw Halftime Mock ExamDocument9 pagesVgu Obrw Halftime Mock ExamSour CandyNo ratings yet

- FINL101-Last Year Paper and MemoDocument6 pagesFINL101-Last Year Paper and MemoNcediswaNo ratings yet

- 01b-Preparation of Financial Statement-Class Work (New)Document10 pages01b-Preparation of Financial Statement-Class Work (New)Deepika SonuNo ratings yet

- Model Exit Exam 6Document19 pagesModel Exit Exam 6tame kibruNo ratings yet

- Xi Acts Ca (2022 23)Document197 pagesXi Acts Ca (2022 23)sara VermaNo ratings yet

- Level 1&2 Text Book V2 - Batch 2Document91 pagesLevel 1&2 Text Book V2 - Batch 2Banyar Thiha ZawNo ratings yet

- Quiz 1 Sample 7 SolvedDocument6 pagesQuiz 1 Sample 7 SolvedFami FamzNo ratings yet

- MB 0041 PDFDocument14 pagesMB 0041 PDFNathan ArokiaNo ratings yet

- 11th PrincipalsofAccounting Model PaperDocument6 pages11th PrincipalsofAccounting Model PaperShawn ParkerNo ratings yet

- XI MCQs Prepared by ExpertsDocument66 pagesXI MCQs Prepared by ExpertsAdrian RoyNo ratings yet

- Namma Kalvi 11th Accountancy MCQ Test Question Paper EM 221528Document18 pagesNamma Kalvi 11th Accountancy MCQ Test Question Paper EM 221528Kanishka S IX-ENo ratings yet

- Resilience of Hyderabad Residential Market During COVID-19Document5 pagesResilience of Hyderabad Residential Market During COVID-19Celestine DcruzNo ratings yet

- Cash Journal: Manage A Company S Cash TransactionDocument9 pagesCash Journal: Manage A Company S Cash TransactionSachin SinghNo ratings yet

- Poc AdamjeeDocument67 pagesPoc AdamjeePREMIER INSTITUTENo ratings yet

- PT RulesDocument47 pagesPT RulesdewanibipinNo ratings yet

- Toyota Shaw Vs CA DigestDocument2 pagesToyota Shaw Vs CA Digestda_sein32No ratings yet

- Kgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGDocument10 pagesKgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGPradeep Kumar VaddiNo ratings yet

- Introduction To GSTDocument38 pagesIntroduction To GSTMitul KapoorNo ratings yet

- 201 Marketing ManagementDocument34 pages201 Marketing ManagementPrajal DalalNo ratings yet

- HRM Assignment 1Document5 pagesHRM Assignment 1Laddie LMNo ratings yet

- Ibm 5Document4 pagesIbm 5Shrinidhi HariharasuthanNo ratings yet

- Hapter Quiz EntrepreneurshipDocument10 pagesHapter Quiz EntrepreneurshipStan DitonaNo ratings yet

- INFOSYSDocument9 pagesINFOSYSSai VasudevanNo ratings yet

- Foreign Exchange Rate MarketDocument92 pagesForeign Exchange Rate Marketamubine100% (1)

- CIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Document2 pagesCIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Emil BautistaNo ratings yet

- Accounting Chapter 9 NotesDocument2 pagesAccounting Chapter 9 NotesAmy HancellNo ratings yet

- Nota Principle of CorporateDocument145 pagesNota Principle of CorporateAhmad MustapaNo ratings yet

- Foreign Exchange TranscationDocument7 pagesForeign Exchange TranscationBooth NathNo ratings yet

- Customer Relationship ManagementDocument5 pagesCustomer Relationship ManagementAbhinandan JenaNo ratings yet

- Piece Work - WikipediaDocument5 pagesPiece Work - WikipediaBrayan Anderson Chumpen CarranzaNo ratings yet

- Bachelor of Business Administration Third Semester Regular Examination, Tabulation Sheet No. 3 September 2022Document210 pagesBachelor of Business Administration Third Semester Regular Examination, Tabulation Sheet No. 3 September 2022sauravNo ratings yet

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document37 pages(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalNo ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Primus - Abap FactoryDocument2 pagesPrimus - Abap FactorySambhajiNo ratings yet

- Problems of Sugar IndustryDocument3 pagesProblems of Sugar IndustrySumit GuptaNo ratings yet

- FoodpandaDocument10 pagesFoodpandaMd. Solaiman Khan ShafiNo ratings yet

- Calgary Cooperative Funeral Services - Business PlanDocument21 pagesCalgary Cooperative Funeral Services - Business PlanastuteNo ratings yet

- Impact of Oil Prices On The Stock MarketDocument18 pagesImpact of Oil Prices On The Stock MarketDhruv AghiNo ratings yet

- Updated Transit Capital Project Prioritization List 2022 - Route AheadDocument8 pagesUpdated Transit Capital Project Prioritization List 2022 - Route AheadDarren KrauseNo ratings yet

- Bahasa Indonesia RidhoDocument3 pagesBahasa Indonesia RidhoRidho FirdausmanNo ratings yet