Professional Documents

Culture Documents

Accountancy First Year Revised Syllabus W.E.F. Session 2023 24

Uploaded by

sarsengmes0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

Accountancy First Year Revised Syllabus w.e.f. Session 2023 24

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24

Uploaded by

sarsengmesCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

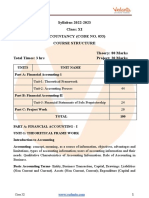

ACCOUNTANCY

REVISED SYLLABUS FOR HIGHER SECONDARY FIRST YEAR COURSE.

W.E.F. SESSION: 2023-24

Theory: 80 marks Time: Three Hours.

Project: 20 Marks

Unit wise Distribution of Marks & Periods:

Unit Topics Marks Periods

PART-A FINANCIAL ACCOUNTING-I (60 Marks)

Unit-1 Introduction to Accounting 10 15

Unit-2 Theory Base of Accounting 10 20

Unit-3 Recording of Business Transactions 20 45

Unit-4 Trial Balance and Rectification of Errors 10 25

Unit-5 Depreciation, Provisions and Reserves 10 25

PART-B FINANCIAL ACCOUNTING-II (20 Marks)

Unit-6 Financial Statements 20 40

PART-C PROJECT WORK 20 10

Total (Part A+ Part B+ Part C) 100 180

Unit wise Distribution of Course Contents:-

Part –A: FINANCIAL ACCOUNTING –I

Unit-1: Introduction to Accounting: Marks: 10

Accounting – Meaning, Objectives, Accounting as a Source of Information, Internal and

External Users of Accounting Information and their needs, Role of Accounting.

Qualitative Characteristics of Accounting Information – (Reliability, Relevance,

Understand ability and Comparability).

Basic Accounting Terms –Account, Debit, Credit, Entity, Asset, Liability, Capital, Expense,

Income, Expenditure, Revenue, Debtors, Creditors, Goods, Cost, Gain, Stock, Purchases,

Sales, Loss, Profit, Voucher, Discount (Trade Discount and Cash Discount), Transaction,

Drawings, Revenue Items, Capital Items.

Unit-2: Theory Base of Accounting: Marks: 10

Generally Accepted Accounting Principles (GAAP): Meaning and Nature.

Basic Accounting Concepts: Business Entity, Money Measurement, Going Concern,

Accounting Period, Cost Concept, Dual Aspect, Revenue Recognition (Realisation), Matching,

Accrual, Full Disclosure, Consistency, Conservatism, Materiality, Objectivity.

Accounting Standards- Needs, Benefits, Limitations, Applicability. Concept of Ind.AS

Goods and Services Tax (GST) - Meaning, Characteristics, and Advantages.

System of Accounting- Single Entry and Double Entry.

Bases of Accounting- Cash Basis, Accrual Basis.

Unit-3: Recording of Business Transactions: Marks: 20

Voucher and Transaction : Origin of Transaction- Source documents and Vouchers,

Preparation of Vouchers, Rules of Debit and Credit (English and American Approach)

Accounting Equation.

Recording of Transactions: Books of Original Entry- Journal, Ledger, Posting from Journal,

Balancing of Accounts, Special Purpose Books: (i) Cash book- Single Column, Double Column,

Triple Column, and Petty Cash book, (ii) Purchases Book, Sales Book, Purchases Returns

Book, Sales Return Book and Journal Proper.

Bank Reconciliation Statements: Meaning, Needs and Preparation.

Unit-4: Trial Balance and Rectification of Errors: Marks: 10

Trial Balance: Meaning, Objectives and Preparation.

Errors: Types of Errors; Errors affecting trial balance; Errors not affecting Trial balance.

Rectification of Errors, Suspense account.

Unit-5: Depreciation, Provisions and Reserves: Marks: 10

Depreciation: Meaning, Features, Causes and Need for charging depreciation, Factors

affecting depreciation. Methods of Depreciation- Straight line Method, Written down value

method, Accounting for Depreciation- charging to asset account, creating provision for

depreciation/accumulated depreciation account, Treatment of disposal of an asset.

Addition/Extension to the existing asset.

Provisions and Reserves: Meaning, Importance, Accounting treatment for Provisions for Bad

and Doubtful Debts. Difference between provisions and reserves. Types of Reserves:

Revenue Reserve, Capital Reserve, General Reserve. Specific Reserve and Secret Reserve.

Difference between Revenue Reserve and Capital Reserve

PART-B: FINANCIAL ACCOUNTING-II

Unit-6: Financial Statements: Marks: 20

Financial Statements: Meaning and Users.

Capital expenditure, Revenue expenditure, Capital Receipts and Revenue Receipts.

Trading Account, Profit and Loss Account and Balance Sheet: Needs, Marshalling of Assets

and Liabilities, Horizontal and Vertical Format of Balance Sheet.

Preparation of Trading and Profit and Loss account and Balance Sheet of Sole- Proprietorship

business.

Adjustments in preparation of financial statements with respect to Closing stock,

Outstanding expenses, prepaid expenses, accrued income; Income received in advance,

Depreciation, Bad debts, Provision for doubtful debts, Provision for discount on debtors,

Manager’s Commission, Interest on Capital.

ACCOUNTANCY

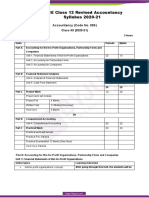

PROJECT WORK FOR HIGHER SECONDARY FIRST YEAR COURSE.

PART-C: PROJECT WORKS - 20 Marks.

Project Preparation 12 Marks

Project VIVA VOCE 08 Marks

Format for Project Work of the subject Accountancy (H.S. First Year)

Cover Page:-

1. Title of the Project.

2. Information of the student

(Name, Roll No, Registration No, Year)

Second Page: - Acknowledgement:

Third Page: - Declaration by the student.

Forth Page: - Certificate from Supervisor/Guide.

Certificate from Head of the Institution.

Fifth Page: - Contents/Index:

Main text of the project

References /Bibliography.

PROJECT DESIGN for H.S. First Year:

Step-I: - Visit any selected Trading Organisation.

Step-II: - Collect the required accounting or financial data/ information for the Project Work.

Step-III: - (Common for all)

(i) Collect the source documents

(ii) Identify the account heads & debit and credit aspects

(iii) Record in journal.

(iv) Post to the respective ledger accounts.

Step-IV: - (any one of the following)

(i) Prepare a trial balance.

(ii) Prepare a cash book.

(iii) Prepare debit/ credit vouchers.

(iv) Prepare a bank reconciliation statement.

(v) Any other suitable accounting process/ practice.

Instructions for “Main Text of the Project”

Main text of the project should be framed as follows-

Chapter-I:- Introduction: Introduction, objectives of the study, methodology and limitations of

the study.

Chapter-II: - Profile of the Organization.

Chapter-III: - Summary of the Report/Project work.

Chapter-IV:- Conclusion.

You might also like

- Cbse Class-Xi ACCOUNTANCY (Code No. 055) : Material Downloaded From - 1 / 9Document9 pagesCbse Class-Xi ACCOUNTANCY (Code No. 055) : Material Downloaded From - 1 / 9Dhiraj KrNo ratings yet

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Document5 pagesAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084No ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- 11 Accountancy Eng 2023 24Document3 pages11 Accountancy Eng 2023 24shivam chaudharyNo ratings yet

- Accountancy curriculum and syllabus for classes XI & XIIDocument5 pagesAccountancy curriculum and syllabus for classes XI & XIISubhas ChakrabartiNo ratings yet

- Part A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods MarksDocument4 pagesPart A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods Marksapi-243565143No ratings yet

- 19 Accountancy 1Document14 pages19 Accountancy 1Abdullah FaisalNo ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Cbse Accountancy - SrSec - 2022-23Document8 pagesCbse Accountancy - SrSec - 2022-23Sneha DubeNo ratings yet

- Xi Accountancy Syllabus 23-24Document8 pagesXi Accountancy Syllabus 23-24GauriNo ratings yet

- Study Material Accountancy Class 11th 2023-24-1Document138 pagesStudy Material Accountancy Class 11th 2023-24-1ganesh100% (1)

- Study Material Accountancy Class 11th 2023-24Document146 pagesStudy Material Accountancy Class 11th 2023-24Drishti ChauhanNo ratings yet

- 2014 Syllabus 11 AccountancyDocument4 pages2014 Syllabus 11 Accountancyapi-248768984No ratings yet

- CBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadDocument9 pagesCBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadBharathi 3280No ratings yet

- ACCOUNTANCY CLASS XI AND XII NOTESDocument10 pagesACCOUNTANCY CLASS XI AND XII NOTESBIKASH166No ratings yet

- Accountancy For Dummies PDFDocument6 pagesAccountancy For Dummies PDFsritesh00% (1)

- Paper 2 FDN Syl2016 PDFDocument289 pagesPaper 2 FDN Syl2016 PDFGovind Rathod100% (1)

- Accountancy Class XI Course Structure and Exam DesignDocument4 pagesAccountancy Class XI Course Structure and Exam Designirfan685No ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Accountancy Class XI Course StructureDocument4 pagesAccountancy Class XI Course StructurecerlaNo ratings yet

- CBSE Accountancy Class 11 Term 1 Objective Question BankDocument141 pagesCBSE Accountancy Class 11 Term 1 Objective Question BankMohammed Roshan73% (11)

- Accountancy - Class 11Document151 pagesAccountancy - Class 11Ketan ThakkarNo ratings yet

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocument2 pagesH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNo ratings yet

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiNo ratings yet

- CBSE portal provides detailed Accountancy syllabusDocument10 pagesCBSE portal provides detailed Accountancy syllabusDhanbad TalksNo ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- Accountancy XI Smart Skills - 2020-21Document106 pagesAccountancy XI Smart Skills - 2020-21daamansuneja2No ratings yet

- Sem-2 For Acca Students Basics of Financial AccountingDocument4 pagesSem-2 For Acca Students Basics of Financial AccountingNidhip ShahNo ratings yet

- Xi AccountancyDocument198 pagesXi AccountancyRajesh Gupta100% (1)

- CBSE Syllabus For Class 11 Accountancy 2022-23 (Revised) PDF DownloadDocument7 pagesCBSE Syllabus For Class 11 Accountancy 2022-23 (Revised) PDF DownloadROARBHAI BHAINo ratings yet

- Paper 2 Study MaterialDocument328 pagesPaper 2 Study MaterialGF BF100% (1)

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- Accounts 1Document24 pagesAccounts 1laale dijaanNo ratings yet

- Higher Secondary AccountancyDocument8 pagesHigher Secondary Accountancysgangwar2005sgNo ratings yet

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Document5 pagesTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNo ratings yet

- 2012 Syllabus 11 AccountancyDocument4 pages2012 Syllabus 11 AccountancyYadira TerryNo ratings yet

- MBA - 317 15 - Financial and Management Accounting PDFDocument544 pagesMBA - 317 15 - Financial and Management Accounting PDFkiran kumar50% (2)

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- ACCOUNTANCY (Code No. 055) : RationaleDocument18 pagesACCOUNTANCY (Code No. 055) : RationaleAditya GawdeNo ratings yet

- Accountancy SrSec 2023-24Document16 pagesAccountancy SrSec 2023-24sarathsivadamNo ratings yet

- Paper 2newDocument328 pagesPaper 2newAnonymous 1ClGHbiT0JNo ratings yet

- Fundamentals of AccountingDocument257 pagesFundamentals of AccountingCeline MontefalcoNo ratings yet

- Fundamentals of AccountingDocument257 pagesFundamentals of Accountingamershareef337100% (4)

- Class: XI: Financial AccountingDocument15 pagesClass: XI: Financial AccountingRavi DuttaNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument13 pagesACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341No ratings yet

- Class 11 Accounts Syllabus Session 2015-16Document7 pagesClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- Financial Accounting Course IntroductionDocument4 pagesFinancial Accounting Course IntroductionApolloniousNo ratings yet

- Accountancy SrSec 2022-23Document16 pagesAccountancy SrSec 2022-23Commerce VIVEKNo ratings yet

- Accountancy (Code No. 055) : Class-XII (2019-20)Document6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Daily Lesson LOG: School Grade Level Teacher Learning Area Teaching Dates and Time SemesterDocument3 pagesDaily Lesson LOG: School Grade Level Teacher Learning Area Teaching Dates and Time SemesterMariel San PedroNo ratings yet

- Animaccord v. Schedule A (Albright) - Order Granting PIDocument14 pagesAnimaccord v. Schedule A (Albright) - Order Granting PISarah BursteinNo ratings yet

- Aligarh Muslim University: Faculty of LawDocument8 pagesAligarh Muslim University: Faculty of LawHanzalaahmedNo ratings yet

- Enterprise computing systems and informationDocument53 pagesEnterprise computing systems and informationTrxtr GiananNo ratings yet

- Spa-To Withdraw Bank DepositDocument2 pagesSpa-To Withdraw Bank DepositLizza Bartolata100% (1)

- SOP - 02 - Procedures Policy Statement - Rev02Document4 pagesSOP - 02 - Procedures Policy Statement - Rev02HasnainNo ratings yet

- BAMCUP Feasibility StudyDocument48 pagesBAMCUP Feasibility StudyBlessie VillaruelNo ratings yet

- Process CostingDocument20 pagesProcess CostingJanak DandNo ratings yet

- Grace Strux Beton PDFDocument33 pagesGrace Strux Beton PDFmpilgirNo ratings yet

- Marketing Management Rubric PDFDocument6 pagesMarketing Management Rubric PDFNguyen AnhNo ratings yet

- 384 Yearbook EngDocument83 pages384 Yearbook EngwizzytrippzNo ratings yet

- Rise Tax Mock QP With SolutionDocument18 pagesRise Tax Mock QP With SolutionEmperor YasuoNo ratings yet

- 01 - Process Control IntroDocument16 pages01 - Process Control IntroqaNo ratings yet

- WP ConfigDocument2 pagesWP ConfigRafael AndradeNo ratings yet

- Characteristics of The TourismDocument4 pagesCharacteristics of The TourismRay KNo ratings yet

- ANGKAS Digital MarketingDocument22 pagesANGKAS Digital Marketingkeith100% (1)

- C11 Social EntrepreneurshipDocument28 pagesC11 Social Entrepreneurshiphuzailinsyawana100% (1)

- M.I. Cement Factory Limited (MICEMENT) : Income StatementDocument15 pagesM.I. Cement Factory Limited (MICEMENT) : Income StatementWasif KhanNo ratings yet

- Assignment 1 Front SheetDocument12 pagesAssignment 1 Front SheetDinh DoNo ratings yet

- The Informal Sector and Covid-19 Economic Impacts: The Case of Bahia, BrazilDocument14 pagesThe Informal Sector and Covid-19 Economic Impacts: The Case of Bahia, BrazilYago AlvesNo ratings yet

- TBChap 010Document112 pagesTBChap 010alaamabood6No ratings yet

- Organization Culture and Open Innovation: A Quadruple Helix Open Innovation Model ApproachDocument8 pagesOrganization Culture and Open Innovation: A Quadruple Helix Open Innovation Model ApproachAyi Ayi WaeNo ratings yet

- GDP Assignment FinalDocument5 pagesGDP Assignment FinalZakia Jalil17% (6)

- Chapter 1: Introduction To Business MarketingDocument14 pagesChapter 1: Introduction To Business MarketingWilliam RafelNo ratings yet

- AC1025 Commentary 2018Document57 pagesAC1025 Commentary 2018violapoonNo ratings yet

- Viva Results - MAIN LIST - Fall 2021 - 2nd Intake - Notice - 9ep 21Document35 pagesViva Results - MAIN LIST - Fall 2021 - 2nd Intake - Notice - 9ep 21Shubho Dev nathNo ratings yet

- Oracle IFRS Solution ERP FinalDocument44 pagesOracle IFRS Solution ERP FinalJai SoniNo ratings yet

- My3 Pay Monthly Sims: E - Phones, Broadband & Sim Only DealsDocument4 pagesMy3 Pay Monthly Sims: E - Phones, Broadband & Sim Only DealsJames PattersonNo ratings yet

- Career Testing Services Pakistan: Assistant Sub Station Attendant (ASSA) (Open Merit) Eligibility CriteriaDocument3 pagesCareer Testing Services Pakistan: Assistant Sub Station Attendant (ASSA) (Open Merit) Eligibility CriteriaM. UsamaNo ratings yet

- Sme 5Document4 pagesSme 5Ayesha KhanNo ratings yet