Professional Documents

Culture Documents

Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24

Uploaded by

uttamsonowal0840 ratings0% found this document useful (0 votes)

2 views5 pagesFrom uttam sonowal

Original Title

Accountancy-Second-Year-Revised-Syllabus-w.e.f.-Session-2023-24 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFrom uttam sonowal

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views5 pagesAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24

Uploaded by

uttamsonowal084From uttam sonowal

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

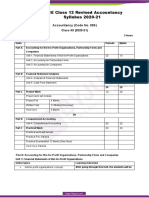

ACCOUNTANCY

REVISED SYLLABUS FOR HIGHER SECONDARY SECOND YEAR COURSE.

W.E.F. SESSION: 2023-24

Theory: 80 marks Time: Three Hours.

Project: 20 Marks

Unit wise Distribution of Marks & Periods:

Part A: Accounting for Partnership Firms (40 Marks)

Units Topics Marks Periods

Unit-I Accounting for Partnership- Basic Concepts 12 30

Unit-II Reconstitution of a Partnership Firm- Admission 10 25

of a Partner

Unit-III Reconstitution of a Partnership Firm- 10 20

Retirement/Death of a Partner

Unit-IV Dissolution of a Partnership Firm 08 20

Total (Part A) 40 95

EITHER

Part B: Company Accounts and Analysis of Financial Statements (40 Marks)

Unit Topics Marks Periods

Unit-I Accounting for Share Capital 10 25

Unit-II Issue and Redemption of Debentures 08 20

Unit-III Financial Statements of a Company 08 15

Unit-IV Analysis of Financial Statements 06 15

Unit-V Accounting Ratios 04 10

Unit - VI Cash Flow Statement 04 10

Total (Part B) 40 95

OR

Part C: Computerised Accounting System (40 Marks)

Unit. Topics Marks Periods

Unit-I Overview of Computerised Accounting System 12 25

Unit-II Using Computerised Accounting System 08 25

Unit-III Graphs and Charts for Business Data 08 20

Unit-IV Accounting Applications of Electronic 12 25

Spreadsheets

Total (Part C) 40 95

Part D Project Work 20 10

Total {Part A+(Part B or Part C)+Part D} 100 200

Unit wise Distribution of Course Contents:-

Part –A: Accounting for Partnership Firms (40 Marks)

Unit-I: Accounting for Partnership- Basic Concepts. Marks: 12

Basic Concepts, Characteristics of Partnership, Partnership Deed, Contents of Partnership

Deed.

Provisions of Indian Partnership Act, 1932 in the absence of Partnership Deed.

Maintenance of Capital Accounts of Partners- Fixed and Fluctuating Capital, Distribution of

Profit among partners, Interest on Capital, Drawings, Interest on drawings , Interest on

Partner’s loan to a firm, Salary/Commission to a partner, Guarantee of Profit to a partner,

Past adjustments.

Preparation of Final Accounts of Partnership Firm.

Unit-II: Reconstitution of a Partnership Firm – Admission of a Partner: Marks-10

Modes of Reconstitution of a Partnership Firm.

Admission of a New Partner- Matters relating to admission of a New Partner, New Profit

Sharing Ratio, Sacrificing Ratio.

Goodwill: Nature, Needs, Factors affecting Goodwill, Methods of valuation, Average profit,

Super Profit and Capitalisation Methods. Accounting treatment of goodwill on admission of

a partner.

Treatment of Accumulated Profits and Losses, Revaluation of assets and Re-assessment of

liabilities.

Adjustment of Capitals, Changes in Profit Sharing Ratio among the existing partners.

Unit-III: Reconstitution of a Partnership Firm- Retirement/ Death of a Partner: Marks-10

Ascertaining the amount due to Retiring/Deceased Partner.

Calculation of New Profit Sharing Ratio and Gaining Ratio. Treatment of Goodwill,

Revaluation of assets and Re-assessment of liabilities, Adjustment of Accumulated Profits

and Losses.

Accounting Treatments.

Unit-IV: Dissolution of Partnership Firm: Marks-08

Meaning and Concept.

Distinctions between dissolution of Partnership and dissolution of a Firm

Accounting Treatments.

EITHER

Part –B: Company Accounts and Analysis of Financial Statements (40 Marks)

Unit-I: Accounting for Share Capital: Marks: 10

Company- Meaning and definitions, features and types.

Share Capital- Meaning, Classification, Nature and Types of shares, Accounting for Issue and

allotment of Equity and Preference shares, Over subscription, Pro-rata allotments, Under

subscription, Calls in Arrears, Calls in Advance. Issue of share at Par, at a Premium and at a

Discount. Issue of shares for consideration other than cash. Accounting for forfeiture of

shares and Re-issue of forfeited shares.

Buy-back of Shares (Concept only)

Unit-II: Issue and Redemption of Debentures: Marks-08

Debentures: Meaning and Types. Distinctions between Shares and Debentures.

Accounting for Issue of Debentures: Issue of debenture at Par, at a Premium, at a discount,

Over subscription, Issue of Debentures for consideration other than cash, Issue of

debentures as a Collateral Security.

Terms of Issue of Debentures.

Accounting for Interest on Debentures, Writing off Discount/Loss on Issue of Debentures.

Redemption of Debentures- By payment in Lump-Sum, By Payment in Instalments, Purchase

in Open market, by conversion.

Unit-III: Financial Statements of a Company: Marks-08

Financial Statement- Meaning, Nature, Objectives, Types, Uses and Limitations.

Income Statement- Form and Contents.

Balance Sheet- Form and Contents.

Unit-IV: Analysis of Financial Statements: Marks-06

Meaning.

Significance.

Objectives.

Tools of Financial Statement Analysis.

Comparative Statements.

Common Size Statements.

Limitations of Analysis of Financial statements.

Unit-V: Accounting Ratios: Marks-04

Meaning of Accounting Ratios.

Ratio Analysis- Objectives, Advantages, Limitations and Types- Liquidity Ratios, Solvency

Ratios, Activity (Turnover) Ratios and Profitability Ratios.

Unit-VI: Cash Flow Statements: Marks-04

Meaning, Objectives and Benefits of Cash Flow Statements.

Cash and Cash equivalent.

Ascertaining Cash Flow from Operating, Investing and Financing activities.

Preparation of Cash Flow Statements.

OR

Part-C: Computerised Accounting System (CAS) (40 Marks)

Unit-I: Overview of Computerised Accounting System: Marks-12

Concept of Computerised Accounting System.

Types of Computerised Accounting System.

Features of Computerised Accounting System.

Structure of a Computerised Accounting system.

Limitations of Computerised Accounting System.

Accounting Information Systems (AIS)

Unit-II: Using Computerised Accounting System: Marks-08

Steps in installation of CAS, Codification and hierarchy of account heads, Creation of

accounts.

Data entry, Validation and Verification.

Adjusting Entries, Preparation of Financial Statements, Closing entries and Opening entries,

Security features generally available in CAS.

Unit-III: Graphs and Charts for Business Data: Marks-08

Graphs and Charts.

Basic steps for Graphs/Charts/Diagrams Using Excel.

Advantages in using Graphs/Chart.

Unit-IV: Accounting Applications of Electronic Spreadsheets: Marks-12

Concept of an Electronic Spreadsheet (ES).

Features offered by Electronic Spreadsheet (ES)

Application of Electronic Spreadsheet in generating accounting information, Bank

Reconciliation Statement, Asset accounting, Loan repayment schedule, Ratio analysis.

ACCOUNTANCY

PROJECT WORK FOR HIGHER SECONDARY SECOND YEAR COURSE.

Project Work - 20 Marks.

Project Preparation 12 Marks

Project VIVA VOCE 08Marks

Format for Project Work of the subject Accountancy (H.S. Second Year)

Cover Page:-

1. Title of the Project.

2. Information of the student

(Name, Roll No, Registration No, Year)

3. Name of the Supervisor/Guide.

4. Name of the Institution.

5. Year.

Second Page: - Acknowledgement.

Third Page: - Declaration by the students.

Forth Page: - Certificate from Supervisor/Guide.

Certificate from Head of the Institution/Department.

Fifth Page :- Contents/Index.

Main text of the project

References /Bibliography.

PROJECT DESIGN For H.S. Second Year.

Step-I: - Visit the selected Trading Organisation.

Step-II: - Collect the required Accounting or Financial data/ information for the Project Work.

Step-III: - Collect the required source documents

Step-IV: - Select and prepare any one of the following.

(i) Collect Annual Reports: Analyse and interpret (any one of the following):

a) Comparative Income/ Position Statement.

b) Common Size Income/ Position Statement.

c) Ratio Analysis.

d) Any other topic related to financial statement of an organisation

(ii) Accounting for Partnership Firm:

a) Trading and Profit & Loss Account.

b) Profit & loss Appropriation Account.

c) Capital Account.

d) Balance Sheet.

(iii) Using Computerised Accounting System, Prepare Electronic Spreadsheet with

accounting data.

(iv) Any other suitable topic related to content of the syllabus.

Instructions for “Main Text of the Project”

Main text of the project should be framed as follows-

Chapter-I: - Introduction: introduction, objectives of the study, methodology and limitations.

Chapter-II: - Profile of the Organization.

Chapter-III: - Analysis and interpretation of data.

Chapter-IV: - Conclusion.

You might also like

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Document3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNo ratings yet

- Cbse Accountancy - SrSec - 2022-23Document8 pagesCbse Accountancy - SrSec - 2022-23Sneha DubeNo ratings yet

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocument2 pagesH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNo ratings yet

- Cbse Class 12 Accountancy SyllabusDocument8 pagesCbse Class 12 Accountancy SyllabusKunj PatelNo ratings yet

- CBSE Class 12 Accountancy SyllabusDocument6 pagesCBSE Class 12 Accountancy Syllabusrkmobile58627No ratings yet

- Cbse Class-Xi ACCOUNTANCY (Code No. 055) : Material Downloaded From - 1 / 9Document9 pagesCbse Class-Xi ACCOUNTANCY (Code No. 055) : Material Downloaded From - 1 / 9Dhiraj KrNo ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- CBSE portal provides detailed Accountancy syllabusDocument10 pagesCBSE portal provides detailed Accountancy syllabusDhanbad TalksNo ratings yet

- 19 Accountancy 1Document14 pages19 Accountancy 1Abdullah FaisalNo ratings yet

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Document5 pagesTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- Accountancy (Code No. 055) Class-XII (2018-19)Document7 pagesAccountancy (Code No. 055) Class-XII (2018-19)saurabhNo ratings yet

- 12 Accountancy Eng 2023 24Document5 pages12 Accountancy Eng 2023 24Gaurav KumarNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- Part A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods MarksDocument4 pagesPart A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods Marksapi-243565143No ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- Prachi CUET-UG AccountancyDocument22 pagesPrachi CUET-UG AccountancySmriti Saxena100% (1)

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiNo ratings yet

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- Accountancy (Code No. 055) : Class-XII (2019-20)Document6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNo ratings yet

- 2014 Syllabus 11 AccountancyDocument4 pages2014 Syllabus 11 Accountancyapi-248768984No ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Commerce IIDocument4 pagesCommerce IIAnu BantyNo ratings yet

- ACCOUNTANCY CLASS XI AND XII NOTESDocument10 pagesACCOUNTANCY CLASS XI AND XII NOTESBIKASH166No ratings yet

- Accountancy XI Smart Skills - 2020-21Document106 pagesAccountancy XI Smart Skills - 2020-21daamansuneja2No ratings yet

- 11 Accountancy Eng 2023 24Document3 pages11 Accountancy Eng 2023 24shivam chaudharyNo ratings yet

- 2013 Syllabus 12 AccountancyDocument4 pages2013 Syllabus 12 Accountancybhargavareddy007No ratings yet

- Annual_Plan_Commer_&_Accountancy_2nd_YearDocument4 pagesAnnual_Plan_Commer_&_Accountancy_2nd_Yeardivyamjain185No ratings yet

- Accounting Session SyllabusDocument11 pagesAccounting Session SyllabusMariamNo ratings yet

- Accountancy - Class 11Document151 pagesAccountancy - Class 11Ketan ThakkarNo ratings yet

- Accountancy Class XI Course StructureDocument4 pagesAccountancy Class XI Course StructurecerlaNo ratings yet

- Accountancy - XII Cbse 2013Document35 pagesAccountancy - XII Cbse 2013Zeus GhoshNo ratings yet

- Bba Amity AccountsDocument1 pageBba Amity AccountsDeepak BatraNo ratings yet

- Focus Areas 2020-21 Accountancy CA PDFDocument4 pagesFocus Areas 2020-21 Accountancy CA PDFRanjith R NairNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- Study Material Accountancy Class 11th 2023-24-1Document138 pagesStudy Material Accountancy Class 11th 2023-24-1ganesh100% (1)

- Study Material Accountancy Class 11th 2023-24Document146 pagesStudy Material Accountancy Class 11th 2023-24Drishti ChauhanNo ratings yet

- Corporate AccountingDocument2 pagesCorporate AccountingSunni ZaraNo ratings yet

- Accountancy XIIDocument30 pagesAccountancy XIIrajNo ratings yet

- Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)Document2 pagesAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)singhankit257No ratings yet

- Accountancy curriculum and syllabus for classes XI & XIIDocument5 pagesAccountancy curriculum and syllabus for classes XI & XIISubhas ChakrabartiNo ratings yet

- Xi Accountancy Syllabus 23-24Document8 pagesXi Accountancy Syllabus 23-24GauriNo ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Accountancy Class XI and XII syllabus changesDocument2 pagesAccountancy Class XI and XII syllabus changesAshish GangwalNo ratings yet

- 76829bos61899 FoundationDocument12 pages76829bos61899 Foundationharshinisp1234No ratings yet

- MBA - 317 15 - Financial and Management Accounting PDFDocument544 pagesMBA - 317 15 - Financial and Management Accounting PDFkiran kumar50% (2)

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- Accountancy Class XI Course Structure and Exam DesignDocument4 pagesAccountancy Class XI Course Structure and Exam Designirfan685No ratings yet

- Higher Secondary AccountancyDocument8 pagesHigher Secondary Accountancysgangwar2005sgNo ratings yet

- Commerce & Accountancy IDocument4 pagesCommerce & Accountancy IAnu BantyNo ratings yet

- Accountancy For Dummies PDFDocument6 pagesAccountancy For Dummies PDFsritesh00% (1)

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- Class 12 Accountancy HHDocument58 pagesClass 12 Accountancy HHkomal barotNo ratings yet

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Business Process AnalysisDocument64 pagesBusiness Process AnalysisPanko MaalindogNo ratings yet

- YOMA Bank (Branch Visit Report)Document8 pagesYOMA Bank (Branch Visit Report)kyawthNo ratings yet

- Lecture 3 Trinity Development Theory and Singapore Economic DevelopmentDocument42 pagesLecture 3 Trinity Development Theory and Singapore Economic DevelopmentBen Neo100% (1)

- TTTCDocument29 pagesTTTCThư ThưNo ratings yet

- Iiqe Paper 1 Pastpaper 20200518Document42 pagesIiqe Paper 1 Pastpaper 20200518Tsz Ngong Ko100% (3)

- CS Form No. 212 Attachment - Work Experience SheetDocument1 pageCS Form No. 212 Attachment - Work Experience SheetCris BringasNo ratings yet

- Recovery in Credit GrantedDocument21 pagesRecovery in Credit GrantedMaria Ysabella Yee80% (5)

- Dun & BradstreetDocument1 pageDun & BradstreetAnonymous FnM14a0No ratings yet

- Experienced IT Professional with 20 Years of ExperienceDocument3 pagesExperienced IT Professional with 20 Years of ExperienceEvans CorpNo ratings yet

- Li & Fung - Final PresentationDocument26 pagesLi & Fung - Final PresentationapoorvsinghalNo ratings yet

- Marketing: DR Jason Pallant Associate Prof Adam KargDocument18 pagesMarketing: DR Jason Pallant Associate Prof Adam KargPrajakta TawdeNo ratings yet

- Chapter 6Document44 pagesChapter 6ying huiNo ratings yet

- Fraud Risk MNGDocument3 pagesFraud Risk MNGsmarty_200388No ratings yet

- ICICIDocument8 pagesICICIAkshayNo ratings yet

- Registration of e Mail Ids and Other KYC DetailsDocument2 pagesRegistration of e Mail Ids and Other KYC DetailsYash KaleNo ratings yet

- Quiz 7Document1 pageQuiz 7vaniiqueNo ratings yet

- Manage production planning and scheduling with APS softwareDocument7 pagesManage production planning and scheduling with APS softwaresheebakbs5144100% (1)

- Business Transaction Questions and AnswersDocument3 pagesBusiness Transaction Questions and AnswersAbdul GaffarNo ratings yet

- MGMT, 12thDocument498 pagesMGMT, 12thGlenny SantosNo ratings yet

- ManagementDocument48 pagesManagementtiniNo ratings yet

- The Future of SaaS: Record Funding Continues Despite PandemicDocument14 pagesThe Future of SaaS: Record Funding Continues Despite PandemicTawfeeg AwadNo ratings yet

- Application LetterDocument9 pagesApplication LetterYash MangadangNo ratings yet

- Location of Enterprise and Steps in Setting SSIDocument44 pagesLocation of Enterprise and Steps in Setting SSImurugesh_mbahit100% (2)

- Nebosh: Management of Health and Safety Unit Ig1Document5 pagesNebosh: Management of Health and Safety Unit Ig1Mohamed Abdullah0% (1)

- Exponent stock overvalued based on discounted cash flow analysisDocument2 pagesExponent stock overvalued based on discounted cash flow analysiskotharik52No ratings yet

- Stella Gainsford ResumeDocument1 pageStella Gainsford Resumeapi-513641486No ratings yet

- The System Development Life CycleDocument3 pagesThe System Development Life CycleAfsana BashirNo ratings yet

- Chapter 1 Tourism Restaurant MarketingDocument25 pagesChapter 1 Tourism Restaurant Marketingsimon canterillNo ratings yet

- LN06-Miller and Modigliani PropositionsDocument27 pagesLN06-Miller and Modigliani PropositionsBowen QinNo ratings yet

- A87ffmercedes Benz - Competitive Forces and Competitive StrategyDocument2 pagesA87ffmercedes Benz - Competitive Forces and Competitive Strategythuyanhvirgo0809100% (1)