Professional Documents

Culture Documents

Sipev

Uploaded by

rahulkumarpo135Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sipev

Uploaded by

rahulkumarpo135Copyright:

Available Formats

Candlestick patterns explained with examples pdf

Candlestick patterns explained with examples. Explain candlestick patterns. Candlestick patterns explained with examples in tamil pdf.

Financial technical analysis tools that depict daily price movement information that is shown graphically on a candlestick chart Candlestick patterns are a financial technical analysis tool that depicts daily price movement information that is shown graphically on a candlestick chart. A candlestick chart is a type of financial chart that shows the price

movement of derivatives, securities, and currencies, presenting them as patterns. Candlestick patterns typically represent one whole day of price movement, so there will be approximately 20 trading days with 20 candlestick patterns within a month. They serve a purpose as they help analysts to predict future price movements in the market based on

historical price patterns. As for quantity, there are currently 42 recognized candlestick patterns.

All of which can be further broken into simple and complex patterns. Understanding Candlestick Patterns Financial technical analysis is a study that takes an ample amount of education and experience to master. For simplicity, we will be talking about the basic patterns to be aware of when viewing candlestick charts and what the patterns may be

predictive regarding price movements. Before delving into the implications of each pattern, it is important to understand the difference between bullish and bearish patterns. For reference, Bloomberg presents bullish patterns in green and bearish patterns in red. Bearish Patterns Bearish patterns are a type of candlestick pattern where the closing

price for the period of a stock was lower than the opening price. This creates immediate selling pressure for the investor due to a price decline assumption. Bullish Patterns Bullish patterns are a type of candlestick pattern where the closing price for the period of a stock was higher than the opening price. This creates buying pressure for the investor

due to potential continued price appreciation. Bullish Hammer (H) Presented as a single candle, a bullish hammer (H) is a type of candlestick pattern that indicates a reversal of a bearish trend. This candlestick formation implies that there may be a potential uptrend in the market. Some of the identifiable traits and features of a bullish hammer

include the following: A candle with a short body and a long wick (roughly +2x the size of the candle) Little to no wick on the short-end side Can be either red or green, depending on the strength of the price reversal Formed when the open, low, and close are approximately the same price Occurs at the bottom of a downtrend Indicates an upward

trend reversal (price may increase) A bullish candlestick pattern is a useful tool because it may motivate investors to enter a long position to capitalize on the suggested upward movement. Inverted Hammer (IH) Also presented as a single candle, the inverted hammer (IH) is a type of candlestick pattern that indicates when a market is trying to

determine a bottom. As the name suggests, the inverted hammer shares the same design as the bullish hammer candlestick pattern, except it is flipped invertedly.

An inverted hammer candlestick pattern may be presented as either green or red. Green indicates a stronger bullish sign compared to a red inverted hammer. Some of the identifiable traits and features of an inverted hammer include the following: A candle with a short body and a long wick (roughly +2x the size of the candle) Little to no wick on the

short-end side Can either be red or green, depending on the strength of the price reversal Formed when the open, low, and close are approximately the same price Occurs at the bottom of a downtrend Indicates rejection of lower prices (at some specific level) Identifies a favorable entry point Identifies a favorable entry point In comparison, both the

bullish hammer and the inverted hammer candlestick pattern are similar in nature. But each design signifies a slightly different directional trend. Engulfing Line (EL) An engulfing line (EL) is a type of candlestick pattern represented as both a bearish and bullish trend and indicates trend continuation. In order to be a bearish engulfing line, the first

candle must be bullish in nature, while the second candle must be bearish and must be “engulfing” the first bullish candle. Comparatively, a bullish engulfing line consists of the first candle being bearish while the second candle must be bullish and must also be “engulfing” the first bearish candle.

This is shown in detail with the diagram below: As for financial indication, a bearish engulfing line represents a bearish trend continuation (lower prices to come), while a bullish engulfing line suggests a bullish trend continuation (higher prices to come). Harami (HR) The Harami (HR) candlestick is a Japanese candlestick pattern that may suggest

either potential price reversal or bearish/bullish trend continuation. Translated from Japanese, Harami means “pregnant,” shown through the first candle, which is considered “pregnant.” The Harami candlestick is identified by two candles, the first of which being larger than the other “pregnant,” similarly to the engulfing line, except opposite. This is

shown for both a bearish situation and a bullish situation. When there is a bearish Harami candlestick present in the market, this may suggest a potential downward price reversal in the near future. As for a bullish Harami, this candlestick formation may suggest that a bearish trend may be coming to an end, which can result in some upward (bullish)

price reversal. Piercing Line (PL) The piercing line (PL) is a type of candlestick pattern occurring over two days and represents a potential bullish reversal in the market. For further clarification and learning, a bullish reversal would indicate a potential reversal from a downward trend in price to an upward trend in price. Three important

characteristics of the piercing line exist. These being the fact that there must be a downward trend before the pattern, a gap after the first day, and an evident reversal on the second-day candlestick in the pattern. For reference, there is a diagram depicting what a piercing line may look like. Most commonly, the piercing line pattern is located at the

bottom of a downtrend.

Considering prices are experiencing a downward motion, it prompts buyers to influence a trend reversal in order to push prices higher. The positioning of the two candlesticks is important. The second-day candlestick must have an opening lower than the first-day bearish candle.

As mentioned, the downtrend causes buyers to drive the price higher, which should be above 50% of the first-day candlestick. Overall, the piercing line is a lucrative financial analysis candlestick that is much more commonly accepted and studied than other patterns. Related Readings To keep learning and advance your career, the following resources

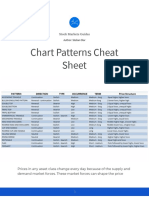

will be helpful: Chart patterns are graphical representations of repeating price action setups that occur quite often in financial markets.

These patterns are formed naturally on trading charts and… there are lots and lots of them. So, for most beginner traders, it’s a serious headache to learn all of these chart patterns and recognize them instantly on a price chart. Of course, some are easier to identify, while some are more complex. Those that are more complex are advanced chart

patterns, and they are, as expected, more difficult to be recognized on charts. But everything has a solution. The only thing a beginner trader needs at the beginning of a trading journey is to survive the first few months and learn as much as possible. And an excellent tool to do that is using cheat sheets. So, to help you take the first steps in the right

direction, here, we will share our advanced cheat sheet candlestick patterns so you can use it whenever you need.

Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download] In essence, advanced chart patterns are not different from standard chart patterns. They signal that the price of an asset is likely to move in a

specific direction based on a repetitive pattern and past data. To make things more organized, you need to remember that chart patterns are categorized into: Bullish reversal patterns Bearish reversal patterns Bullish continuation patterns Bearish continuation patterns Now, the only difference is that advanced candlestick patterns are a bit more

complex to recognize on a price chart than basic candlestick price action patterns. They often have a complex structure and more strict rules on where and when to enter and exit a trade. For example, a Doji candlestick pattern is a basic chart pattern as it is a single candle pattern that can be easily recognized on candlestick charts. However, other

patterns require a more in-depth understanding of the pattern’s structure, meaning, and how to use it properly. Such an example is the Wyckoff pattern, which is not only a chart pattern but also a theory. And when you trade a financial instrument using the Wyckoff pattern, you should know how to locate it and use it to find trading ideas. Another

advanced chart pattern is the Parabolic pattern. Once again, when trading this bearish candlestick pattern, you need to know how to identify the formation of the pattern naturally and know where and when you should enter and exit a position. Notably, harmonic chart patterns can also be classified as advanced candlestick patterns.

Learning harmonic chart patterns is far more complex and not favorable for all traders; however, they are also arguably the most accurate and reliable chart patterns, especially for short-term trading techniques. So, if you are keen to learn how to use harmonic chart patterns, we suggest you read our harmonic chart pattern guides and download our

harmonic patterns candlestick cheat sheet. Overall, every chart candlestick pattern you learn will be valuable if you rely on technical analysis to predict price movements in stock, commodity, or forex trading. Nonetheless, you must always use other technical analysis tools to confirm the trade. Those include Fibonacci support and resistance levels,

technical indicators, and trend lines. Mimic how professionals trade. Discover your inner talent. Learn everything you need to know about trading the markets from beginner level to the most advanced, helping you to create critical skills and techniques to you can apply in your trading right away. The following advanced candlestick patterns are the

most common to look out for when using technical analysis to trade financial assets. Developed in 1930 by Richard Wyckoff, the Wyckoff candle pattern is one of the most valuable technical analysis methods to predict future price movements and find market trends. According to the Wyckoff theory, price action moves in a cycle of 4 phases –

markdown, accumulation, markup, and distribution. The bullish and bearish engulfing candlestick pattern is a chart pattern that signals a possible market reversal. It is a two-candle pattern that may occur in either an uptrend or downtrend on any instrument and time frame.

Engulfing patterns come in two types: bullish and bearish. At its core, the bullish island reversal formation suggests that the price action trajectory is due to a change in course. Accordingly, it is classified as a reversal indicator. The Island reversal patterns come in two types: bullish and bearish. The three inside down is a bullish trend reversal chart

pattern made of three consecutive candles – a long bearish candle, followed by a bullish green candlestick that is at least 50% of the size of the first candlestick and a third candle that closes above the second candle. The bullish rectangle is a continuation candlestick pattern that occurs during an uptrend when prices pause before continuing upward.

It is a chart formation developed when the price moves sideways, creating a range, and there’s a temporary equilibrium before the next price movement. Along with the bearish version, they are known among the most accurate continuation candlestick patterns in technical analysis. The upside gap three methods is a bullish continuation chart pattern

that appears during an ongoing uptrend. At basic, the theory behind this classical chart pattern is that the gap represents the profit-taking mode during an existing trend before the rally continues. The pattern is confirmed as soon as the third candlestick fills the gap, and then, the previous trend is likely to continue in the same direction. The three

black crows and three white soldiers chart patterns are bearish or bullish reversal candlestick patterns. Both consist of three consecutive, relatively long candlesticks that occur during an uptrend or downtrend. Traders view three black crows as a potential reversal signal. Bullish and bearish breakaway patterns are multi-candle chart formations that

suggest a market reversal may occur. An actual breakaway is a five-candlestick formation that occurs in either an upward or downward trend and signals a trader to enter a position in the opposite direction. The rising and falling windows are chart patterns that consist of two candles in the same direction with a gap between them. As a gap in trading

is a strong sign of high volatility and new developments in the market, these patterns are considered reliable and accurate in predicting the next price movement.

The bearish and bullish harami candle pattern is a Japanese candlestick formation formed at the bottom (bullish harami) or top (bearish harami) of an ongoing trend and indicates that the trend is likely to reverse.

In appearance, the pattern consists of two candles, one after the other, with the first candle having a long body and short upper and lower wicks and the second candle having a very small body. Clearly, Japanese candlestick patterns are an excellent way to predict future price movements.

They provide signals that will help you understand price action, and ultimately, find trading opportunities. Therefore, you should equip yourself with knowing as many patterns as possible to get a better grasp of how assets’ prices move and learn how to analyze the markets correctly. To start, download our basic Japanese candlesticks chart patterns

cheat sheet where you can find the most widely used and conventional candlestick chart patterns. Additionally, use our free advanced candlestick patterns cheat sheet above to expand your chart patterns knowledge. Mimic how professionals trade. Discover your inner talent. Learn everything you need to know about trading the markets from

beginner level to the most advanced, helping you to create critical skills and techniques to you can apply in your trading right away.

You might also like

- Scalping is Fun! 2: Part 2: Practical examplesFrom EverandScalping is Fun! 2: Part 2: Practical examplesRating: 4.5 out of 5 stars4.5/5 (26)

- How To Read A Candlestick Chart: Reading Candlestick Charts - Talking PointsDocument90 pagesHow To Read A Candlestick Chart: Reading Candlestick Charts - Talking PointsVeljko KerčevićNo ratings yet

- Introduction To Chart PatternsDocument13 pagesIntroduction To Chart PatternsUniqueNo ratings yet

- Forex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?From EverandForex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?Rating: 5 out of 5 stars5/5 (5)

- What Is A ChartDocument15 pagesWhat Is A ChartSachin ThakurNo ratings yet

- Candlestick PatternDocument6 pagesCandlestick Patterntraining division100% (1)

- Candlestick Pattern Trading Strategies PDFDocument17 pagesCandlestick Pattern Trading Strategies PDFMurali100% (5)

- 2.1 2 Candlestick Patterns Price ActionDocument10 pages2.1 2 Candlestick Patterns Price ActionGwenethvine EscalanteNo ratings yet

- How candlestick charts provide insights into market psychology and trendsDocument37 pagesHow candlestick charts provide insights into market psychology and trendsM Zaid ASNo ratings yet

- Bullish Candlestick PatternsDocument165 pagesBullish Candlestick PatternsBrent DonascoNo ratings yet

- Price and ChartsDocument25 pagesPrice and ChartsRogerio Ferrandis100% (2)

- Chart Technical AnalysisDocument56 pagesChart Technical Analysiscool_air1584956No ratings yet

- Candlestick Archive by McOwidi FXDocument26 pagesCandlestick Archive by McOwidi FXBonnie McOwidiNo ratings yet

- Candlestick Trading For Beginners PDFDocument32 pagesCandlestick Trading For Beginners PDFgoranmok100% (7)

- Click Here For: Full CurriculumDocument76 pagesClick Here For: Full CurriculumSwinlife Winlife100% (1)

- The Art of Candlestick ChartingDocument11 pagesThe Art of Candlestick Chartinganeraz2719No ratings yet

- Advanced Charting and Technical Analysis For Beginners Secret Guide To Read Chart Patterns, Candlestick Patterns, Supply and... (Davis, James E.) (Z-Library)Document82 pagesAdvanced Charting and Technical Analysis For Beginners Secret Guide To Read Chart Patterns, Candlestick Patterns, Supply and... (Davis, James E.) (Z-Library)HotakoNo ratings yet

- 3 Top Price Action SignalsDocument12 pages3 Top Price Action Signalsluiska2008No ratings yet

- What Is Price Action? - Price Action Trading ExplainedDocument11 pagesWhat Is Price Action? - Price Action Trading Explainedmanoj tomerNo ratings yet

- Beginners Guide To Price Action Trading PDFDocument22 pagesBeginners Guide To Price Action Trading PDFAbdiaziz MohamedNo ratings yet

- 7 Trends For StockDocument17 pages7 Trends For StockShamim Ahsan ZuberyNo ratings yet

- Trading SectionDocument36 pagesTrading Sectionshubhamkhirid488No ratings yet

- Candlesticks For Support and Resistance PDF (PDFDrive)Document40 pagesCandlesticks For Support and Resistance PDF (PDFDrive)Raja100% (2)

- Candlestick PatternsDocument20 pagesCandlestick PatternsAbdiaziz MohamedNo ratings yet

- AaaDocument39 pagesAaaVighneshwaran RevivedNo ratings yet

- Section 2: Important Chart Patterns: Inside/Outside ReversalDocument20 pagesSection 2: Important Chart Patterns: Inside/Outside Reversalancutzica2000No ratings yet

- Poliuu JkoDocument30 pagesPoliuu Jkoاندير انديرNo ratings yet

- S&P 500 Index: Line ChartDocument11 pagesS&P 500 Index: Line Chartreena_h_107776No ratings yet

- 7 Popular Technical Indicators and How To Use Them To Increase Your Trading ProfitsDocument19 pages7 Popular Technical Indicators and How To Use Them To Increase Your Trading ProfitsHeiki KanalomNo ratings yet

- A Handbook Of: Technical AnalysisDocument18 pagesA Handbook Of: Technical Analysissurya narayana0% (1)

- Trendstrategisthandbook Optiontrading 110126113245 Phpapp02 PDFDocument130 pagesTrendstrategisthandbook Optiontrading 110126113245 Phpapp02 PDFShailendra Shrestha100% (3)

- LC Unit 2 Chapter 4Document48 pagesLC Unit 2 Chapter 4brigitta kaoruNo ratings yet

- Top 10 Candlestick PatternsDocument41 pagesTop 10 Candlestick PatternsRDReaver100% (2)

- Binomo Trader's Guide-ENDocument12 pagesBinomo Trader's Guide-ENsiddharthshinde168No ratings yet

- 6) Chart-Patterns-Cheat-SheetDocument14 pages6) Chart-Patterns-Cheat-SheetKumarVijayNo ratings yet

- Candlesticks 1Document11 pagesCandlesticks 1saied jaberNo ratings yet

- Technical AnalysisDocument30 pagesTechnical Analysisdash.design.proNo ratings yet

- Candlestick Charting BookDocument49 pagesCandlestick Charting BookTe Roopu Netana50% (2)

- Candlestick BookDocument22 pagesCandlestick Bookrajveer40475% (4)

- Technical AnalysisDocument16 pagesTechnical AnalysisIkhwan Nasir IsmailNo ratings yet

- Technical Analysis For Biginners PDFDocument14 pagesTechnical Analysis For Biginners PDFTiksen Ddl100% (1)

- 02 - The Secret To Reading Price Chart Like A ProDocument8 pages02 - The Secret To Reading Price Chart Like A ProISHAN SHARMA100% (1)

- Understanding Market StructureDocument30 pagesUnderstanding Market Structuretosheensaifi100% (1)

- How To Read Stock ChartsDocument36 pagesHow To Read Stock Chartsnayan kumar duttaNo ratings yet

- Learnforextypes of ChartsDocument18 pagesLearnforextypes of Chartslewgraves33No ratings yet

- Essential Guide to Understanding and Trading Chart PatternsDocument12 pagesEssential Guide to Understanding and Trading Chart PatternsJun Yong P100% (1)

- How to Read Stock Charts GuideDocument11 pagesHow to Read Stock Charts GuideKillerman King50% (2)

- Basic of Chart Reading and CandlestickDocument10 pagesBasic of Chart Reading and CandlestickRobin WadhwaNo ratings yet

- Bullish and Bearish Pin Bar PatternsDocument17 pagesBullish and Bearish Pin Bar Patternsneth8704No ratings yet

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Document22 pagesPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Document22 pagesPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- Candlesticks Light The Way To Logical TradingDocument10 pagesCandlesticks Light The Way To Logical TradingKindabul AbdNo ratings yet

- Best Chart PatternsDocument15 pagesBest Chart Patternswim006No ratings yet

- Chart Analysis: by Sunny JainDocument26 pagesChart Analysis: by Sunny JainShubh mangalNo ratings yet

- The Basic Language of Candlestick ChartingDocument20 pagesThe Basic Language of Candlestick ChartingArjun Shantaram Zope100% (1)

- The Systematic Trader Bonus ChapterDocument32 pagesThe Systematic Trader Bonus Chaptersweekiatk50% (2)

- A Practical Guide To Price Action Tradingdocx PDF FreeDocument36 pagesA Practical Guide To Price Action Tradingdocx PDF Freekhatodarapolicestation100% (1)

- A Practical Guide To Price Action TradingDocument36 pagesA Practical Guide To Price Action TradingSanjay M. Parkar100% (11)

- Candlestick BookDocument22 pagesCandlestick BookPrabhu Mohan100% (18)

- 10 Must-Know Bar Patterns for Price Action TradersDocument14 pages10 Must-Know Bar Patterns for Price Action Traderssal8471100% (2)

- Special Technical Report On NCDEX TurmericDocument2 pagesSpecial Technical Report On NCDEX TurmericAngel BrokingNo ratings yet

- Trading Candlestick Patterns Ron WilliamDocument26 pagesTrading Candlestick Patterns Ron Williamgilar_dino86100% (3)

- Candlestick Pattern Full PDFDocument25 pagesCandlestick Pattern Full PDFM Try Trader Kaltim80% (5)

- What You Don't Know About Candlesticks: When Candles Work BestDocument5 pagesWhat You Don't Know About Candlesticks: When Candles Work BestfrancescoabcNo ratings yet

- CMT Level I Sample Exam AnswersDocument14 pagesCMT Level I Sample Exam AnswersZahamish MalikNo ratings yet

- Candlestick Patterns: Daily ChartDocument30 pagesCandlestick Patterns: Daily Chartzulfikar Salim0% (2)

- Binary Option Book Strategies PDDocument16 pagesBinary Option Book Strategies PDAsad Khalif Omar100% (1)

- What The MACD Indicator Is and How It WorksDocument6 pagesWhat The MACD Indicator Is and How It WorksAkingbemi MorakinyoNo ratings yet

- Reversal Patterns GuideDocument6 pagesReversal Patterns GuidemejiasidNo ratings yet

- Japanese candlestick patterns guide for binary options tradersDocument25 pagesJapanese candlestick patterns guide for binary options tradersfrankolett100% (2)

- Bollinger Band Oscillator (9.7.2012)Document7 pagesBollinger Band Oscillator (9.7.2012)SubramanianNo ratings yet

- List of Shareholders and Shares Due To Transfer To The IEPF 2010Document25 pagesList of Shareholders and Shares Due To Transfer To The IEPF 2010Mukesh KumarNo ratings yet

- Candlestick Pattern CheatDocument1 pageCandlestick Pattern CheatEmanuel SuprihadiNo ratings yet

- 10 Price Action Bar Patterns You Must KnowDocument22 pages10 Price Action Bar Patterns You Must Knowjhonthor100% (1)

- Technical Analysis Workshop Series Session One Trend IndicatorsDocument61 pagesTechnical Analysis Workshop Series Session One Trend IndicatorsSriranga G H100% (1)

- Part 2Document129 pagesPart 2khanhtung2009No ratings yet

- Ichimoku Charts by David LintonDocument76 pagesIchimoku Charts by David LintonKannan Srinivasan100% (1)

- Introducing The Relative Strength Indes (RSI)Document5 pagesIntroducing The Relative Strength Indes (RSI)moneyvidyaNo ratings yet

- Inner Circle Trader - How Professionals Use IndicatorsDocument5 pagesInner Circle Trader - How Professionals Use Indicatorsleonardo3192No ratings yet

- Thesis RSIDocument19 pagesThesis RSInywd806033No ratings yet

- Ichimoku Kinko Hyo - A Concise Guide to This Powerful Trend-Following IndicatorDocument13 pagesIchimoku Kinko Hyo - A Concise Guide to This Powerful Trend-Following IndicatorMian Umar RafiqNo ratings yet

- Ticker ChartDocument22 pagesTicker ChartMody DiabNo ratings yet

- 24 Most Powerful Candlestick Patterns PDF DownloadDocument54 pages24 Most Powerful Candlestick Patterns PDF Downloadnasiruabdullahi135a1No ratings yet

- Top 6 Bollinger Bands® Trading Strategies: Learn How (/)Document20 pagesTop 6 Bollinger Bands® Trading Strategies: Learn How (/)bhavin shahNo ratings yet

- Top 5 Intraday Trading Indicators Most Accurate IndicatorsDocument5 pagesTop 5 Intraday Trading Indicators Most Accurate IndicatorsGeorge GougoulidisNo ratings yet

- CourseOutline TAMDocument5 pagesCourseOutline TAMJyoti BudhiaNo ratings yet

- Top 10 Candlestick Patterns - CandlestickgeniusDocument2 pagesTop 10 Candlestick Patterns - CandlestickgeniusPrabhu MohanNo ratings yet

- Kwitansi Pembayaran Rumah Sakit MedikaDocument1 pageKwitansi Pembayaran Rumah Sakit MedikaRyskaNo ratings yet

- Prajwal TradesDocument392 pagesPrajwal TradesSaheb ChakrobortyNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Kleptopia: How Dirty Money Is Conquering the WorldFrom EverandKleptopia: How Dirty Money Is Conquering the WorldRating: 3.5 out of 5 stars3.5/5 (25)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (17)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (2)

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- The Finance Curse: How Global Finance Is Making Us All PoorerFrom EverandThe Finance Curse: How Global Finance Is Making Us All PoorerRating: 4.5 out of 5 stars4.5/5 (18)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (69)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)