Professional Documents

Culture Documents

Module #02 - Audits of Historical Financial Information

Uploaded by

Rhesus UrbanoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module #02 - Audits of Historical Financial Information

Uploaded by

Rhesus UrbanoCopyright:

Available Formats

Module #02: Audits of Historical Financial Information

Definition of Audit

Auditing is a systematic process of objectively obtaining and evaluating evidence

regarding assertions about economic actions and events to ascertain the degree of

correspondence between assertions and established criteria and communicating the

results to interested users.

a. Systematic process

o an audit follows a logical sequence of procedures

b. Objectively obtaining and evaluating evidence

o an audit requires the gathering and evaluation of evidences to express an opinion

c. Assertions about economic actions and events

o assertions are representation of management, explicit or otherwise, that are

embodied in financial statement components, records, or systems

d. Degree of correspondence between assertions and established criteria

o auditors use standards or benchmarks for purposes of expressing an opinion on

the assertions of management

e. Communicating the results to interested users

o CPAs prepares a report which contains, in writing, the opinion of the CPA

Auditing and Accounting Distinguished

Accounting

Accounting is the process of recording, classifying and summarizing economic

events in a logical manner for the purpose of providing financial information for

decision making.

It is a service activity, the purpose of which is to provide information which is

quantitative in nature to help management in decision making.

Auditing

Auditing is concerned with the determination of whether the recorded accounting

information for the entity properly reflects the economic events that occurred during

the accounting period.

Assurance Services and Audit Services Distinguished

Assurance services assertion-based engagements.

Assurance services is an engagement that expresses an opinion giving assurance to users

of such reports on information which is the responsibility of others.

Assurance service is the broadest concept, while audit is the narrowest.

Type of Audits

A. Financial Statement Audits

o Refers to the gathering of evidence on the assertion embodied in the financial

statements of an entity and using the evidence to determine whether the

assertions adhere to financial reporting frameworks (ex. GAAP).

B. Operational Audits

o A systematic review of an organization’s activities in relation to specified

objectives for the purpose of assessing the performance, identifying

opportunities, recommendation for improvement, and developing for

improvements.

o It is a future-oriented, systematic, and independent evaluation of organizational

activities.

C. Compliance Audits

o Used to determine whether a person or entity has adhered to laws and

regulations.

D. External Audits

o These are audits performed by CPAs who are independent of the organizations

whose assertions are being audited.

E. Internal Audits

o An independent appraisal function established within an organization to examine

and evaluate its activities as a service to the organization.

F. Government Audits

o It involves the determination of whether the government funds are being handled

properly and in compliance with existing laws and whether the government

programs of a particular agency are being conducted efficiently and

economically.

o The Commission on Audit is recognized as the Supreme Audit Institution in the

Republic of the Philippines.

Classified into three main divisions:

1. Compliance Audit

o The examination, audit and settlement in accordance with laws and

regulations.

2. Financial Audit

o Audit of the accounting and financial system and controls to ensure

reliability of recorded financial data.

3. Performance Audit

o An objective examination of the financial and operational

performance of an organization and is oriented towards

opportunities for greater economy, efficiency and effectiveness.

a. Economy and Efficiency Audit (Management Audit) -

appraisal of management performance from a least cost

point of view and the analysis of the cost-benefit

relationship.

b. Effectiveness Audit (Program Results Audit) - the

evaluation of programs, projects and activities to determine

the extent of achievement previously set goals and

objectives.

Objectives and Scope of a Financial Statement Audit

Objectives

The expression of an opinion on the fairness of such financial statements.

The auditor’s report is the medium through which he expresses his opinion or

disclaims an opinion.

He states whether his examination has been made in accordance with the

Philippine Standards on Auditing or PSAs.

o PSAs require the auditor to state whether in his/her opinion the financial

statements are presented in conformity with GAAP.

Scope

The auditor normally determines the scope of an audit in accordance with the

requirements of legislation, regulations or relevant professional bodies.

In the observance of PSAs, the auditor must exercise his judgment in

determining which auditing procedures are necessary in the circumstances to

afford a reasonable basis for his opinion.

Information Risk

1. Remoteness of information users from information provider

2. Potential bias and motives of information provider

3. Voluminous data

4. Complex exchange transaction

Reducing Information Risk:

1. Allows users to verify information

2. User shares information risk with management

3. Have the financial statement audited

Audit Report

The audit report is the means through which the auditor provides reasonable assurance

that the financial statements are fairly stated.

This report is uniform in format and suitably title to avoid confusions regarding the level

of assurance being provided and to differentiate it from other reports which client

management might include with the financial statements.

Limitations of Audit

1. The Nature of Financial Reporting

o Preparation of financial statements involves judgment by management in

applying the applicable financial reporting framework and subjective decisions

or assessment by management involves a range of acceptable interpretations or

judgments.

2. The Nature of Audit Procedures

o Audit procedures will not 100% detect every misstatement.

3. Nature of Audit Evidence Available

o This evidence tends to be persuasive in character rather than conclusive.

4. Timeliness of Financial Reporting

o Users of financial statements expect that the auditor will form his or her opinion

within a reasonable period of time and at a reasonable cost.

You might also like

- Presentation 2Document35 pagesPresentation 2Ma. Elene MagdaraogNo ratings yet

- Auditing and Assurance PrinciplesDocument19 pagesAuditing and Assurance Principleskanroji1923No ratings yet

- Audit An OverviewDocument7 pagesAudit An OverviewStela AnggrainiNo ratings yet

- Auditing Financial StatementsDocument23 pagesAuditing Financial StatementsAimae Inot MalinaoNo ratings yet

- Lesson Number: 02 Topic: Audits of Financial Information Learning ObjectivesDocument18 pagesLesson Number: 02 Topic: Audits of Financial Information Learning ObjectivesDavid alfonsoNo ratings yet

- Audit Term PaperDocument39 pagesAudit Term Papersamuel kebedeNo ratings yet

- Ireneo Chapter 2Document30 pagesIreneo Chapter 2ChristineNo ratings yet

- Introduction To Auditing: Reference: Chapter Two of Audit and Assurance PrincipleDocument25 pagesIntroduction To Auditing: Reference: Chapter Two of Audit and Assurance PrincipleRoyce Maenard EstanislaoNo ratings yet

- 03 Audit of Historical Financial InformationDocument10 pages03 Audit of Historical Financial InformationJohn Patrick AnyayahanNo ratings yet

- Auditing & Assurance Principles-Lesson 1Document12 pagesAuditing & Assurance Principles-Lesson 1Joe P PokaranNo ratings yet

- Audit I-Chapter OneDocument7 pagesAudit I-Chapter Onethedalesh weldeNo ratings yet

- Lesson 2 Auditing OverviewDocument2 pagesLesson 2 Auditing OverviewMark TaysonNo ratings yet

- Mid-Term Exam - IA - Ashilla Nadiya Amany - 2002030013Document7 pagesMid-Term Exam - IA - Ashilla Nadiya Amany - 2002030013Ashilla Nadya AmanyNo ratings yet

- Chapter 7 AuditingDocument25 pagesChapter 7 AuditingMisshtaCNo ratings yet

- Value for Money Audit CharacteristicsDocument11 pagesValue for Money Audit CharacteristicsTharisha RiandaNo ratings yet

- Aud1 & Aud12Document7 pagesAud1 & Aud12Lyka CastroNo ratings yet

- Introduction To Audit and Audit Standard Setting ProcessDocument8 pagesIntroduction To Audit and Audit Standard Setting ProcessIrish SanchezNo ratings yet

- Chapter 2 Audit of Financial StatementsDocument6 pagesChapter 2 Audit of Financial Statementsjhell dela cruzNo ratings yet

- Mistatement IntroDocument6 pagesMistatement IntroGina Bernardez del CastilloNo ratings yet

- AT-03 (Introduction To Auditing)Document4 pagesAT-03 (Introduction To Auditing)Soremn PotatoheadNo ratings yet

- Advanced Audit Course OverviewDocument66 pagesAdvanced Audit Course OverviewAgatNo ratings yet

- PrE 311 - Chapter 1Document6 pagesPrE 311 - Chapter 1John Paul MancillaNo ratings yet

- Introduction To Auditing PDFDocument18 pagesIntroduction To Auditing PDFHazel Bianca GabalesNo ratings yet

- AASC establishes auditing standards in the PhilippinesDocument41 pagesAASC establishes auditing standards in the PhilippinesAltessa Lyn ContigaNo ratings yet

- Chapter 1 Overview of AuditingDocument28 pagesChapter 1 Overview of AuditingTesfaye DesalegnNo ratings yet

- 02 Introduction To AuditingDocument3 pages02 Introduction To Auditingrandomlungs121223No ratings yet

- 10.1007@978 3 319 90521 11Document14 pages10.1007@978 3 319 90521 11Ibtissam EljedaouyNo ratings yet

- Lecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsDocument8 pagesLecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsMaeNo ratings yet

- Chapter 1Document31 pagesChapter 1انيس AnisNo ratings yet

- Objectives: Historical Development of Auditing:: Objective Assertion Suitable CriteriaDocument2 pagesObjectives: Historical Development of Auditing:: Objective Assertion Suitable CriteriaAIDA MACABANTOGNo ratings yet

- Module 2 - Audit, An OverviewDocument8 pagesModule 2 - Audit, An OverviewMAG MAGNo ratings yet

- Introduction To Auditing: 1.1 DefinitionDocument14 pagesIntroduction To Auditing: 1.1 Definitionmokhtar mohaNo ratings yet

- PrE1-001-OVERVIEW OF AUDITINGDocument9 pagesPrE1-001-OVERVIEW OF AUDITINGLaezelie PalajeNo ratings yet

- The Overview of AuditingDocument4 pagesThe Overview of AuditingJelyn RuazolNo ratings yet

- Overview of AuditingDocument54 pagesOverview of AuditingLaezelie PalajeNo ratings yet

- Acctg. Major 6 - Auditing and Internal ControlDocument12 pagesAcctg. Major 6 - Auditing and Internal ControlTrayle HeartNo ratings yet

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- Module 2 - Introduction To FS AuditDocument5 pagesModule 2 - Introduction To FS AuditLysss EpssssNo ratings yet

- AUDIT - An Overview: Kalven Perry T. AgustinDocument17 pagesAUDIT - An Overview: Kalven Perry T. AgustinANGELA THEA BUENVENIDANo ratings yet

- Chapter One An Overview of Auditing: Auditing Principles and Practices IDocument36 pagesChapter One An Overview of Auditing: Auditing Principles and Practices IYehualashet MulugetaNo ratings yet

- Audit of Overview: Auditing IsDocument26 pagesAudit of Overview: Auditing IsMaria BeatriceNo ratings yet

- Auditing CH 1Document20 pagesAuditing CH 1Nigussie BerhanuNo ratings yet

- Audit Principle Chapter-1Document58 pagesAudit Principle Chapter-1Genanaw SemenehNo ratings yet

- Lesson 1-3Document86 pagesLesson 1-3eiraNo ratings yet

- Comprehensive Audit ExamDocument22 pagesComprehensive Audit ExamADIN IHTISYAMUDDINNo ratings yet

- Public Sector Auditing ExplainedDocument17 pagesPublic Sector Auditing ExplainedhezronNo ratings yet

- MODULE 1 - Audit An OverviewDocument4 pagesMODULE 1 - Audit An OverviewgarciarhodjeannemarthaNo ratings yet

- Auditing Techniques and Audit ProgramDocument20 pagesAuditing Techniques and Audit Programgemixon120No ratings yet

- Chapter-One: 1 Introduction - An Overview of Auditing 1.1 Historical Background of Auditing PracticesDocument76 pagesChapter-One: 1 Introduction - An Overview of Auditing 1.1 Historical Background of Auditing PracticesYohannes TesfayeNo ratings yet

- Module - Auditing - Chapter 2Document10 pagesModule - Auditing - Chapter 2Kathleen Ebuen EncinaNo ratings yet

- 2 Marks AuditDocument4 pages2 Marks AuditPrajwal. B ShettyNo ratings yet

- 2019 Answers AuditingDocument16 pages2019 Answers Auditingdhanush.rNo ratings yet

- Activity Sheet - Module 3Document3 pagesActivity Sheet - Module 3Chris JacksonNo ratings yet

- Introduction To AuditingDocument20 pagesIntroduction To AuditingJuliana ChengNo ratings yet

- Overview of Financial Statements Objectives of Financial Statement AuditDocument20 pagesOverview of Financial Statements Objectives of Financial Statement AuditKristine WaliNo ratings yet

- AUDITING PRINCIPLES I - NotesDocument69 pagesAUDITING PRINCIPLES I - Notesyebegashet100% (1)

- Unit I Audit OverviewDocument21 pagesUnit I Audit OverviewMark GerwinNo ratings yet

- Auditing Assurance and PrincipleDocument5 pagesAuditing Assurance and PrincipleSPONGEBOBNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Module #04 - Risk and Rates ReturnDocument13 pagesModule #04 - Risk and Rates ReturnRhesus UrbanoNo ratings yet

- Module #01 - Fundamentals of Assurance ServicesDocument7 pagesModule #01 - Fundamentals of Assurance ServicesRhesus UrbanoNo ratings yet

- Module #03 - The Professional Practice of AccountingDocument6 pagesModule #03 - The Professional Practice of AccountingRhesus UrbanoNo ratings yet

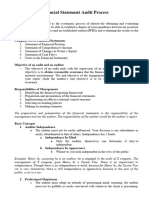

- Module #04 - Financial Statement Audit ProcessDocument9 pagesModule #04 - Financial Statement Audit ProcessRhesus UrbanoNo ratings yet

- Module #05 - Audit PlanningDocument7 pagesModule #05 - Audit PlanningRhesus UrbanoNo ratings yet

- High School Students' Characteristics Predict Science Club MembershipDocument4 pagesHigh School Students' Characteristics Predict Science Club MembershipNorma PanaresNo ratings yet

- 36 Writing Craft Essays by Chuck PalahniukDocument16 pages36 Writing Craft Essays by Chuck PalahniukAndy Ochumba0% (10)

- Cherry Mx1A-Lxxa/B: Housing Colour: KeymoduleDocument5 pagesCherry Mx1A-Lxxa/B: Housing Colour: KeymoduleArtur MartinsNo ratings yet

- Understanding Community Information Needs ResearchDocument18 pagesUnderstanding Community Information Needs Researcherice.researchNo ratings yet

- Mesalazine: Mesalazine (INN, BAN), Also Known As Mesalamine (USAN) or 5-Aminosalicylic AcidDocument4 pagesMesalazine: Mesalazine (INN, BAN), Also Known As Mesalamine (USAN) or 5-Aminosalicylic AcidAnkan PalNo ratings yet

- MemTest86 User Guide UEFIDocument101 pagesMemTest86 User Guide UEFIDani CentNo ratings yet

- Performance Report Sample enDocument4 pagesPerformance Report Sample enAmilaNo ratings yet

- AsteriskNow Manual ConfigurationDocument24 pagesAsteriskNow Manual ConfigurationRufino Victor SaballaNo ratings yet

- ToshibaDocument38 pagesToshibadvishal77No ratings yet

- Isolating Antagonistic BacteriaDocument12 pagesIsolating Antagonistic BacteriaDesy rianitaNo ratings yet

- A Simple Digital Power-Factor CorrectionDocument11 pagesA Simple Digital Power-Factor CorrectionVinoth KumarNo ratings yet

- Question Bank RTOSDocument3 pagesQuestion Bank RTOSjaswanth19907No ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- GEO Center Catalog enDocument20 pagesGEO Center Catalog enEdward KuantanNo ratings yet

- DSP1800 Temperature and Humidity ProbeDocument2 pagesDSP1800 Temperature and Humidity ProbeGerardo SanchezNo ratings yet

- Schools Division Office of BenguetDocument1 pageSchools Division Office of BenguetAna ConseNo ratings yet

- 02 Cruz Vs CabreraDocument3 pages02 Cruz Vs CabreraPaolo Miguel ArqueroNo ratings yet

- The Monster Guide to Candlestick PatternsDocument29 pagesThe Monster Guide to Candlestick PatternsVatsal ParikhNo ratings yet

- Modern Particle Characterization Techniques Image AnalysisDocument46 pagesModern Particle Characterization Techniques Image AnalysisSONWALYOGESHNo ratings yet

- Laporan Tahunan 2009Document179 pagesLaporan Tahunan 2009zalifahshafieNo ratings yet

- Managerial Eco and Accounting FinalDocument16 pagesManagerial Eco and Accounting FinalMichael Paul GabrielNo ratings yet

- Who Moved My CheeseDocument12 pagesWho Moved My CheeseTYAGI PROJECTSNo ratings yet

- Lasco v. UN Revolving Fund G.R. Nos. 109095-109107Document3 pagesLasco v. UN Revolving Fund G.R. Nos. 109095-109107shannonNo ratings yet

- Ruini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectDocument4 pagesRuini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectISSSTNetwork100% (1)

- ChatroomsDocument4 pagesChatroomsAhmad NsNo ratings yet

- 9) - Stategy Formulation at Corporate LevelDocument34 pages9) - Stategy Formulation at Corporate Leveldulshan jeewanthaNo ratings yet

- RESIDENT NMC - Declaration - Form - Revised - 2020-2021Document6 pagesRESIDENT NMC - Declaration - Form - Revised - 2020-2021Riya TapadiaNo ratings yet

- Marketing Syllabus PDFDocument12 pagesMarketing Syllabus PDFSarika RikameNo ratings yet

- Install Fresh & Hot Air AttenuatorsDocument3 pagesInstall Fresh & Hot Air Attenuatorsmazumdar_satyajitNo ratings yet

- Business Description: Executive SummaryDocument4 pagesBusiness Description: Executive SummaryYudhi SugataNo ratings yet