Professional Documents

Culture Documents

AT-03 (Introduction To Auditing)

Uploaded by

Soremn PotatoheadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AT-03 (Introduction To Auditing)

Uploaded by

Soremn PotatoheadCopyright:

Available Formats

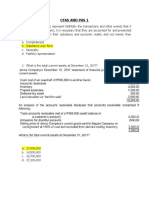

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 46 October 2023 CPA Licensure Examination AT- 03

AUDITING (Auditing Theory) J. IRENEO E. ARAÑAS F. TUGAS C. ALLAUIGAN

INTRODUCTION TO AUDITING

Assurance engagement is one in which a practitioner expresses a conclusion designed to enhance

the degree of confidence of the intended users other than the responsible party about the outcome

of the evaluation or measurement of a subject matter against criteria.

AUDIT is a systematic process of objectively obtaining and evaluating evidence regarding assertions

about economic actions and events to ascertain the degree of correspondence between these

assertions and established criteria and communicating the results thereof. (AAA)

Auditing is a structured process that:

(a) involves the application of analytical skills, professional judgment and professional skepticism;

(b) is usually performed by a team of professionals, directed with managerial skills;

(c) uses appropriate forms of technology and adheres to a methodology;

(d) complies with all relevant technical standards, such as International Standards on Auditing

(ISAs), International Standards on Quality Management (ISQMs), International Financial Reporting

Standards (IFRS), International Public Sector Accounting Standards (IPSAS), and any applicable

international, national or local equivalents; and

(e) complies with required standards of professional ethics. (IFAC)

Types of Audit:

1. Independent Financial Statements Audit

2. Internal Audit

a. Operational Audit

b. Management Audit

c. Financial Audit

3. Government

a. Compliance

b. Financial Audit

c. Performance Audit

-Economy and efficiency

-Effectiveness Audit

Objective of Audit of Financial Statements (FS)

FS Audit enables the auditor to express an opinion whether the financial statements are prepared, in

all material respects, in accordance with an identified financial reporting framework.

General Principles

1. Audit shall be conducted in accordance with Philippine Standards on Auditing.

2. The auditor shall comply with Code of Professional Ethics for Certified Public Accountants.

3. The auditor should plan and perform the audit with an attitude of professional skepticism.

4. Audit enhances credibility of FS by providing a high, but not absolute, level of

assurance.

ABSOLUTE Assurance NOT ATTAINABLE due to the following factors:

▪ Use of judgment (obtaining and evaluating evidence)

▪ Use of selective testing

▪ Inherent limitations of internal control

▪ Evidence available to the practitioner is persuasive rather than conclusive

5. Audit says nothing about the viability of an entity or the stewardship function of the

management.

6. The responsibility for preparing and presenting the financial statements is that of the

management of the entity.

7. Audit does not relieve the management of its responsibilities.

Page 1 of 4 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

INTRODUCTION TO AUDITING AT-03

1. Which of the following statements refers to the definition of auditing?

A. A service activity which function is to provide quantitative information primarily financial in

nature about economic entities that is intended to be useful in making economic decisions.

B. The art of recording, classifying and summarizing in a significant manner and in terms of

money, transactions and events which are in part at least of a financial character and

interpreting the results thereof.

C. The process of identifying, measuring and communicating economic information to permit

informed judgment and decisions by users of the information.

D. A systematic process of objectively obtaining and evaluating evidence regarding assertions

about economic actions and events to ascertain the degree of correspondence between these

assertions and established criteria and communicating the results thereof.

2. Evaluate the following statements:

I. Audit is a branch of accounting.

II. Audit typically provides guarantee that financial data are fairly presented.

A. All statements are true

B. All statements are false

C. Only I and II are true

D. Only III and IV are true

3. Classify which relates more to accounting than auditing:

I. Recording of financial transactions, culminating in the preparation of the financial statements.

II. Evaluation of evidence supporting an assertion.

A. Both

B. Neither

C. I only

D. II only

4. Classify the following statements related to the underlying theories behind the necessity for audit

services:

I. Managers generally have more information about the financial position and operations of the

entity compared to other stakeholders.

II. In theory, the will and wishes of the shareholders should be operationalized by management

but problems exist with respect to goal congruence.

A. Both are related to the agency theory

B. Both are related to the information asymmetry theory

C. Agency theory, information asymmetry

D. Information asymmetry, agency theory

5. Which best describes the representations by management, explicit or otherwise, that are embodied

in the financial statements, as used by the auditor to consider the different types of potential

misstatements that may occur.

A. Financial statement assertions

B. Notes to the financial statements

C. Audit evidence

D. Disclosure requirements

6. Which is a type of audit is performed to determine whether an entity’s financial statements are

fairly presented in accordance with an identified financial reporting framework.

A. Financial statement audit

B. Compliance audit

C. Operational audit

D. Internal audit

7. The results the auditor’s work is communicated through the:

A. Audit engagement letter.

B. Management letter.

C. Audit report.

D. Notes to the financial statements.

8. Financial statements need to be prepared in accordance with one, or a combination of:

A. PFRS

B. Other authoritative basis

C. IFRS

D. All of the answers.

Page 2 of 4 0915-2303213 www.resacpareview.com

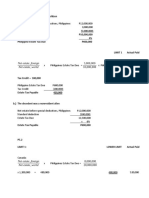

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

INTRODUCTION TO AUDITING AT-03

9. Evaluate theWD following statements related to the purpose of audit engagements:

I. Provide government agencies, such as BIR with basis for assessments.

II. To prove accuracy and reliability of financial statements.

III. Enhance the degree of confidence of intended users of the financial statements.

IV. To obtain reasonable assurance about whether the financial statements are free from material

misstatements, due to fraud and error.

A. All statements are true

B. All statements are false

C. Only I and II are true

D. Only III and IV are true

10. Classify the following types of audits:

• This type of audit involves a review of an organization’s procedures to determine whether the

organization has adhered to specific procedures, rules or regulations set down by some higher

authority.

• This type of audit involves a review of an organization’s procedures and methods for the

purpose of evaluating efficiency and effectiveness of operations, identifying areas for

improvement, and making recommendations to improve performance.

A. Both are operations audits

B. Both are compliance audits

C. Operations, compliance

D. Compliance, operations

11. Which is/are overall responsibilities of the internal audit function?

I. Serve as an independent assurance and consulting activity designed to add value and

improve the company's operations.

II. Assess the company's methods for safeguarding its assets and, as appropriate, verify the

existence of the assets.

A. Both

B. Neither

C. I only

D. II only

12. Which internal audit activity directly contributes to the improvement of the organization’s

governance process

I. Evaluating the effectiveness of internal controls over financial reporting

II. Evaluating the design of ethics-related activities

A. Both

B. Neither

C. I only

D. II only

13. Engagement risk is influenced by the risks associated with the following, except:

A. Nature and form of the subject matter

B. Nature and form of the criteria applied to the subject matter

C. Nature and extent of the process used to collect and evaluate evidence

D. Unreasonably low professional fee

14. Classify the following types of audits:

• This is an independent appraisal activity established within an entity as a service to the entity.

• This type of audit goes beyond the usual financial statement audit, to include audits of

compliance with laws and regulations, operations of governmental entities, and the proper

disbursement and management of public funds.

A. Both are operations audit

B. Both are government audits

C. Operations, government

D. Government, operations

15. To provide for the greatest degree of independence in performing internal auditing functions, an

internal auditor most likely should report to

A. Board of Directors. C. Corporate Controller.

B. Vice-President for Finance. D. Corporate Stockholders.

16. An operating committee of a company's board of directors that is in-charge of overseeing

financial reporting and disclosure.

A. Governance C. Control environment

B. Audit committee D. Management

Page 3 of 4 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

INTRODUCTION TO AUDITING AT-03

17. Evaluate the following statements:

I. The primary audience for the written report issued by the internal auditor at the completion of

an audit should be the external auditors when they intend to rely on the internal auditor’s work.

II. In a broad sense, society benefits from internal auditing because the internal auditor promotes

the efficient and effective use of resources.

A. All statements are true

B. All statements are false

C. Only I is true

D. Only II is true

18. This type of activity is a subset of internal audit that attempts to measure the effectiveness with

which an organizational unit is administered.

A. Economy and efficiency audit

B. Management audit

C. Financial Audit

D. Compliance Audit

19. In government auditing, the three elements of expanded scope auditing are:

A. Goal analysis, audit of operations, audit of systems.

B. Financial and compliance, economy and efficiency, program results.

C. Pre-audit, post-audit, internal audit.

D. National government audit, local government audit, corporation audit.

20. An audit designed to determine the extent to which the desired results of an activity established

by the legislative or other authorizing body are being achieved.

A. Economy audit.

B. Program results audit.

C. Efficiency audit.

D. Financial-related audit.

- END -

Page 4 of 4 0915-2303213 www.resacpareview.com

You might also like

- Department of Accountancy: Page - 1Document18 pagesDepartment of Accountancy: Page - 1Noro0% (1)

- Padua vs. People, G.R. No. 220913, February 04, 2019 FactsDocument3 pagesPadua vs. People, G.R. No. 220913, February 04, 2019 FactsRhea Mae A. SibalaNo ratings yet

- Audit Theo FPB With Answer KeysDocument6 pagesAudit Theo FPB With Answer KeysPj Manez100% (1)

- Auditing TheoryDocument10 pagesAuditing TheoryAnna Mae SanchezNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- At 92 Cpar PW PDFDocument12 pagesAt 92 Cpar PW PDFglcpaNo ratings yet

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolYuki CrossNo ratings yet

- Chapter 1 - Audit: An OverviewDocument78 pagesChapter 1 - Audit: An OverviewMarnelli CatalanNo ratings yet

- AT Quiz 1Document2 pagesAT Quiz 1CattleyaNo ratings yet

- CPAR 1stPBDocument12 pagesCPAR 1stPBMae Danica CalunsagNo ratings yet

- MAR001-1 ExemplarDocument9 pagesMAR001-1 ExemplarAeman SohailNo ratings yet

- Impact of Transformational Leadership on Employee Engagement in Engineering CompaniesDocument3 pagesImpact of Transformational Leadership on Employee Engagement in Engineering CompaniesSafi SheikhNo ratings yet

- A Short Biographical Dictionary of English Literature 1000253406Document465 pagesA Short Biographical Dictionary of English Literature 1000253406Abdul Sami Abdul LatifNo ratings yet

- Doc637541838 612447676Document9 pagesDoc637541838 612447676Brittany RamirezNo ratings yet

- AT PrelimDocument32 pagesAT Prelimfer maNo ratings yet

- Cutting Edge STARTER - New SyllabusDocument6 pagesCutting Edge STARTER - New SyllabusJCarlos LopezNo ratings yet

- Energy Management Systems Manual: (Company Name) AddressDocument48 pagesEnergy Management Systems Manual: (Company Name) AddressRavi ShankarNo ratings yet

- Jurisdiction definedDocument30 pagesJurisdiction definedJeong100% (1)

- 02 Introduction To AuditingDocument3 pages02 Introduction To Auditingrandomlungs121223No ratings yet

- Far Eastern University - Manila: Open Using Adobe Reader and PCDocument5 pagesFar Eastern University - Manila: Open Using Adobe Reader and PCKristine TiuNo ratings yet

- Far Eastern University - Manila: Open Using Adobe Reader and PCDocument5 pagesFar Eastern University - Manila: Open Using Adobe Reader and PCKristine TiuNo ratings yet

- 111年會考 審計學題庫Document15 pages111年會考 審計學題庫張巧薇No ratings yet

- Theories Cash - PpeDocument45 pagesTheories Cash - PpeClene DoconteNo ratings yet

- Audit 1Document1 pageAudit 1zennongraeNo ratings yet

- Auditing and Assurance Principle Assignment Week 1 AY 2021-2022Document4 pagesAuditing and Assurance Principle Assignment Week 1 AY 2021-2022Feelingerang MAYoraNo ratings yet

- Chapter 1Document27 pagesChapter 1julita08No ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- AUDITINGDocument12 pagesAUDITINGpepsi 1199No ratings yet

- Module 13 Other Professional ServicesDocument18 pagesModule 13 Other Professional ServicesYeobo DarlingNo ratings yet

- At.02 Introduction To Audit of Historical Financial InformationDocument4 pagesAt.02 Introduction To Audit of Historical Financial InformationAngelica Sanchez de VeraNo ratings yet

- Unit TestDocument6 pagesUnit TestMajoy BantocNo ratings yet

- Auditing Principles CW4-Chapter-1-MCDocument5 pagesAuditing Principles CW4-Chapter-1-MCLorie RoncalNo ratings yet

- Quiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberDocument4 pagesQuiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberExequielCamisaCrusperoNo ratings yet

- Auditor's primary responsibility and assurance servicesDocument14 pagesAuditor's primary responsibility and assurance servicesTricia Mae FernandezNo ratings yet

- The Overview of AuditingDocument4 pagesThe Overview of AuditingJelyn RuazolNo ratings yet

- Aud-90 PWDocument17 pagesAud-90 PWElaine Joyce GarciaNo ratings yet

- Aaconapps2 00-C92pb1aDocument14 pagesAaconapps2 00-C92pb1aJane DizonNo ratings yet

- 92-FIRST PB-AUD ExamDocument11 pages92-FIRST PB-AUD ExamReynaldo corpuzNo ratings yet

- Auditing Chapter 1Document7 pagesAuditing Chapter 1Sigei LeonardNo ratings yet

- Introduction To Auditing: D. An Audit Has A Benefit Only To The OwnersDocument4 pagesIntroduction To Auditing: D. An Audit Has A Benefit Only To The OwnersChristine Mae ManliguezNo ratings yet

- Auditing Theory: Quiz 2Document4 pagesAuditing Theory: Quiz 2KIM RAGANo ratings yet

- Module #02 - Audits of Historical Financial InformationDocument3 pagesModule #02 - Audits of Historical Financial InformationRhesus UrbanoNo ratings yet

- Audit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If TheDocument6 pagesAudit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If Therico mangawiliNo ratings yet

- Auditing Chapter (1) Three Part 2023Document22 pagesAuditing Chapter (1) Three Part 2023Saleh RaoufNo ratings yet

- Chapter 1 Quiz ShetDocument2 pagesChapter 1 Quiz ShetAngela PaduaNo ratings yet

- At 93 PWDocument16 pagesAt 93 PWPrinces Joy De GuzmanNo ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Auditing Theory - 1Document9 pagesAuditing Theory - 1Kageyama HinataNo ratings yet

- Audit II Mid ExamDocument4 pagesAudit II Mid ExamTesfaye SimeNo ratings yet

- ACCTG 14 Final Exam ReviewDocument8 pagesACCTG 14 Final Exam ReviewErineNo ratings yet

- 94-Final PB-AUD - UnlockedDocument13 pages94-Final PB-AUD - UnlockedJessaNo ratings yet

- AUDITDocument16 pagesAUDITjefferson mtemiNo ratings yet

- Prehensive Review-Auditing TheoryDocument71 pagesPrehensive Review-Auditing TheoryemmanvillafuerteNo ratings yet

- Jzanzig - Auditing CH 10 LectureDocument35 pagesJzanzig - Auditing CH 10 LectureTrish CalumaNo ratings yet

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Introduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSDocument8 pagesIntroduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSReynan E. BolisayNo ratings yet

- AT-04 (Financial Statements Audit Overview)Document5 pagesAT-04 (Financial Statements Audit Overview)Soremn PotatoheadNo ratings yet

- AT Preweek B93 - QuestionnaireDocument16 pagesAT Preweek B93 - QuestionnaireSilver LilyNo ratings yet

- Auditing Standards and Types of Audit ReportsDocument35 pagesAuditing Standards and Types of Audit ReportsHeart SebNo ratings yet

- Auditing Theory Test BankDocument17 pagesAuditing Theory Test BankJames Louis BarcenasNo ratings yet

- AT Quiz 1 - Audit Services and CPA ProfessionDocument6 pagesAT Quiz 1 - Audit Services and CPA ProfessionDe Chavez May Ann M.No ratings yet

- 07 FS Audit Process - Audit PlanningDocument6 pages07 FS Audit Process - Audit Planningrandomlungs121223No ratings yet

- Audit Overview & Professional StandardsDocument6 pagesAudit Overview & Professional Standardsjaypee.bignoNo ratings yet

- Practice Exercise 1.6Document3 pagesPractice Exercise 1.6leshz zynNo ratings yet

- Practice PeDocument12 pagesPractice PeRhea EnocNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Gantt ChartDocument1 pageGantt ChartSoremn PotatoheadNo ratings yet

- AT-01 (Fundamentals of Auditing & Assurance Services)Document5 pagesAT-01 (Fundamentals of Auditing & Assurance Services)Allan MarquezNo ratings yet

- AT-05 (Quality Management)Document7 pagesAT-05 (Quality Management)Soremn Potatohead100% (1)

- AT-04 (Financial Statements Audit Overview)Document5 pagesAT-04 (Financial Statements Audit Overview)Soremn PotatoheadNo ratings yet

- Junior Accountant Job ApplicationDocument1 pageJunior Accountant Job ApplicationSoremn PotatoheadNo ratings yet

- Bape3 Hi Def Engagement LetterDocument8 pagesBape3 Hi Def Engagement LetterSoremn PotatoheadNo ratings yet

- REFERENCESDocument9 pagesREFERENCESSoremn PotatoheadNo ratings yet

- Fundamentals of HRM Chapter 1 5Document17 pagesFundamentals of HRM Chapter 1 5Soremn PotatoheadNo ratings yet

- Prof Elec ReviewerDocument4 pagesProf Elec ReviewerSoremn PotatoheadNo ratings yet

- Prof Elec ReviewerDocument4 pagesProf Elec ReviewerSoremn PotatoheadNo ratings yet

- Art. 10667Document16 pagesArt. 10667Soremn PotatoheadNo ratings yet

- Mining ReportDocument2 pagesMining ReportSoremn PotatoheadNo ratings yet

- Overview of Cost ManagementDocument1 pageOverview of Cost ManagementSoremn PotatoheadNo ratings yet

- Virtue TheoryDocument1 pageVirtue TheorySoremn PotatoheadNo ratings yet

- CRIMSONVERSEDocument4 pagesCRIMSONVERSESoremn PotatoheadNo ratings yet

- Dalida - Delos Santos Movie ReviewDocument3 pagesDalida - Delos Santos Movie ReviewSoremn PotatoheadNo ratings yet

- Recreational Games DALIDADocument2 pagesRecreational Games DALIDASoremn PotatoheadNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 1Document4 pagesCREDIT TRANSACTION Guaranty Chapter 1Soremn PotatoheadNo ratings yet

- Finmarket ReviewerDocument27 pagesFinmarket ReviewerSoremn PotatoheadNo ratings yet

- MIDTERMDocument14 pagesMIDTERMSoremn PotatoheadNo ratings yet

- CFAs and PAS Financial ReportingDocument19 pagesCFAs and PAS Financial ReportingSoremn PotatoheadNo ratings yet

- RECITATIONDocument3 pagesRECITATIONSoremn PotatoheadNo ratings yet

- RFBT TerminologiesDocument2 pagesRFBT TerminologiesSoremn PotatoheadNo ratings yet

- LQ 2Document19 pagesLQ 2Soremn PotatoheadNo ratings yet

- RFBT LQ 1 and 2Document20 pagesRFBT LQ 1 and 2Edith DalidaNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 2Document4 pagesCREDIT TRANSACTION Guaranty Chapter 2Soremn PotatoheadNo ratings yet

- RFBT LQ AgencyDocument6 pagesRFBT LQ AgencySoremn PotatoheadNo ratings yet

- CREDIT TRANSACTION Deposit Chapter 4Document1 pageCREDIT TRANSACTION Deposit Chapter 4Soremn PotatoheadNo ratings yet

- Medieval Art: A Rich Period of Religious and Architectural AchievementsDocument12 pagesMedieval Art: A Rich Period of Religious and Architectural AchievementsSoremn PotatoheadNo ratings yet

- CAS 101 - Lesson 1 W - ActivitiesDocument11 pagesCAS 101 - Lesson 1 W - ActivitiesSoremn PotatoheadNo ratings yet

- Answer Sheet Answer Sheet: SY 2019-2020 SY 2019-2020Document2 pagesAnswer Sheet Answer Sheet: SY 2019-2020 SY 2019-2020Toga MarMarNo ratings yet

- Republic of the Philippines Batangas State University Taxation and Land Reform ExamDocument5 pagesRepublic of the Philippines Batangas State University Taxation and Land Reform ExamMeynard MagsinoNo ratings yet

- IIPDocument47 pagesIIParnabb_16No ratings yet

- 11 Republic vs. Marcopper Mining Corp Cd1Document2 pages11 Republic vs. Marcopper Mining Corp Cd1Leigh AllejeNo ratings yet

- What You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)Document26 pagesWhat You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)8thestate50% (2)

- 231 PC00165 - Cerificate English PDFDocument1 page231 PC00165 - Cerificate English PDFrajenrao51777564No ratings yet

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNo ratings yet

- COM 4 HSC - Korean WarDocument10 pagesCOM 4 HSC - Korean Warmanthan pujaraNo ratings yet

- Article Practive Sheet LatestDocument3 pagesArticle Practive Sheet LatestNahian NishargoNo ratings yet

- Long Range Surveillance Sensor: Key FeaturesDocument2 pagesLong Range Surveillance Sensor: Key FeaturesThinkDefenceNo ratings yet

- Arvin Lloyd D. SuniegaDocument3 pagesArvin Lloyd D. SuniegaApril Joy Sumagit HidalgoNo ratings yet

- Trade Rutes of EuropeDocument1 pageTrade Rutes of EuropeNico BelloNo ratings yet

- UcspDocument4 pagesUcspEla AmarilaNo ratings yet

- Trash Essay Emma LindheDocument2 pagesTrash Essay Emma Lindheapi-283879651No ratings yet

- Mrs. Pringle's Dinner Party ChaosDocument30 pagesMrs. Pringle's Dinner Party ChaosMatet Recabo MataquelNo ratings yet

- PSCD Corp Vs CaDocument3 pagesPSCD Corp Vs CaDel Rosario MarianNo ratings yet

- Avarice Sheet PDFDocument1 pageAvarice Sheet PDFNainoa NaffNo ratings yet

- 10 Basics of Ethical CommunicationDocument8 pages10 Basics of Ethical CommunicationsujzNo ratings yet

- Chain of LightDocument10 pagesChain of LightHs MichaelNo ratings yet

- Unit Test 09Document3 pagesUnit Test 09GeorgeArgentineNo ratings yet

- Case StudyDocument2 pagesCase StudyPragya BiswasNo ratings yet

- Artikel Corporate Governance, Internal Control and The Role of Internal Auditors - ZhangDocument22 pagesArtikel Corporate Governance, Internal Control and The Role of Internal Auditors - ZhangBudi MahendNo ratings yet