Professional Documents

Culture Documents

Buttons ENG

Uploaded by

isabella.desa04Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buttons ENG

Uploaded by

isabella.desa04Copyright:

Available Formats

Buttons Limited

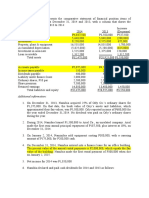

The following is an extract from the financial statements of Buttons Ltd for the year ended

30 September 2009.

Buttons Limited

Statement of Comprehensive Income for year ended 30 September 2009

R

Operating profit 4,657,500

Other operating income 1,700,000

Profit on sale of equipment 300,000

Profit on expropriation of land 1,400,000

Other operating expenses (2,540,000)

Depreciation 2,530,000

Loss on scrapping of machinery 10,000

Profit from operations 3,817,500

Investment income - dividends 20,000

Interest on debentures (15,000)

Profit before tax 3,822,500

Income tax (1,721,000)

Net profit after tax 2,101,500

Buttons Limited

Statement of Financial Position as at 30 September 2009

R R

Assets 2009 2008

Non-current assets 7,450,000 5,850,000

Property, plant and equipment 6,450,000 5,100,000

Investments at costs 1,000,000 750,000

Current Assets 7,000,000 6,000,000

Stock 4,000,000 3,000,000

Debtors 2,000,000 1,500,000

Cash and cash equivalents 1,000,000 1,500,000

Total Assets 14,450,000 11,850,000

Equity and liabilities

Equity and reserves 8,950,000 5,100,000

Issued capital 6,250,000 4,500,000

Reserves 1,150,000 -

Retained earnings 1,550,000 600,000

Non-current liabilities 1,700,000 2,550,000

Debentures 1,500,000 2,500,000

Other interest bearing borrowings 200,000 50,000

Current liabilities 3,800,000 4,200,000

Creditors 2,300,000 3,200,000

SARS 1,500,000 1,000,000

Total equity and liabilities 14,450,000 11,850,000

Further information at 30 September 2009

1. The company had sales of R42 345 600 for the year ended 30 September 2009. Cost

of sales amounted to 78% of this amount.

2. Property, plant and equipment consists of:

2009 2008

Machinery & equipment

Cost 6,300,000 5,500,000

Accumulated depreciation (4,090,000) (3,500,000)

Book Value 2,210,000 2,000,000

Land & buildings

Cost 3,100,000

Revalued cost 4,380,000

Accumulated depreciation (140,000)

Book Value 4,240,000 3,100,000

Total 6,450,000 5,100,000

3. Land and buildings with a cost of R570 000 was expropriated during the year. New

buildings were completed for expansion of operations and taken into use during the

year. On 1 October 2008 the land and buildings were re-valued.

4. A machine having a cost of R1 700 000 and accumulated depreciation of R1 000 000

was sold during the year. A machine with a cost amount of R810 000 was scrapped.

5. Purchase of equipment was for expansion purposes.

6. Issued share capital comprises:

2009 2008

Ordinary share capital 1,800,000 1,500,000

Preference share capital 4,450,000 3,000,000

6,250,000 4,500,000

7. The authorised share capital of the company comprises of 2 000 000 ordinary no par

value shares and 6 000 000 8% non-cumulative no par value preference shares.

During the year the company issued 150 000 ordinary shares at R2 each to raise

funds to partially finance the increase in buildings and equipment. In addition, the

company issued 1 000 000 8% non-cumulative preference shares at R1,45 each to

finance the redemption of debentures.

8. Prior to the redemption, dividends of R151 500 were declared and paid.

9. Reserves comprise the following:

2009 2008

R R

Revaluation reserve 150,000

General reserve 1,000,000

1,150,000 -

Required: Prepare the statement of cash flow according to the direct method, with notes, for

the year ended 30 September 2009 in accordance with IFRS.

You might also like

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- CPA Review Center Final Exam SolutionsDocument16 pagesCPA Review Center Final Exam SolutionsMike Oliver NualNo ratings yet

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Acct 108 Consolidated Financial Statements QuizDocument5 pagesAcct 108 Consolidated Financial Statements QuizGround ZeroNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- Cash Flows from Operating, Investing, & Financing Activities of Lesotho CoDocument4 pagesCash Flows from Operating, Investing, & Financing Activities of Lesotho CoKarlo D. ReclaNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Review Test FarDocument10 pagesReview Test FarEli PinesNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- Current AssetsDocument7 pagesCurrent AssetssyraNo ratings yet

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- Statutory Merger Problem 1Document2 pagesStatutory Merger Problem 1Meleen TadenaNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Financial Statement Analysis for Entity Providing Trial BalanceDocument3 pagesFinancial Statement Analysis for Entity Providing Trial BalanceMansour HamjaNo ratings yet

- Difficult Company Financial PositionDocument9 pagesDifficult Company Financial PositionKyla De los SantosNo ratings yet

- Quiz Chapter 17Document1 pageQuiz Chapter 17Zaira UdtohanNo ratings yet

- FFO ExcerciseDocument1 pageFFO Excercise22MBAB14 Cruz Slith Victor CNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- ABE Company 2021 Year-End Financial BalancesDocument4 pagesABE Company 2021 Year-End Financial Balancesangeline bulacanNo ratings yet

- Accy 47 Drill - ConsolidationDocument1 pageAccy 47 Drill - ConsolidationJoesan AgudaNo ratings yet

- Assets: Aditional InformationDocument16 pagesAssets: Aditional Informationleeyaa aNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- L1-Dec 2012 Financial ReportingDocument23 pagesL1-Dec 2012 Financial ReportingMetick MicaiahNo ratings yet

- Cfas ActivitiesDocument10 pagesCfas ActivitiesAntonNo ratings yet

- Lax Co Cash Flows 2020Document4 pagesLax Co Cash Flows 2020moreNo ratings yet

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezNo ratings yet

- Auditing Problem - Preweek: Cordillera Career Development College College of AccountancyDocument42 pagesAuditing Problem - Preweek: Cordillera Career Development College College of AccountancyGi Ne VaNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- FAR1 SolutionsDocument8 pagesFAR1 SolutionsJoebin Corporal LopezNo ratings yet

- Statement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Document4 pagesStatement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Jayash KaushalNo ratings yet

- 8 1-8 3Document2 pages8 1-8 3syraNo ratings yet

- CHAPTER-46-CASH-FLOW-COMPREHENSIVEDocument8 pagesCHAPTER-46-CASH-FLOW-COMPREHENSIVECheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- INTACC CHAPTER 49-50Document17 pagesINTACC CHAPTER 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Advanced Acct - II ProblemsDocument4 pagesAdvanced Acct - II ProblemsSamuel DebebeNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Motherson SumiDocument18 pagesMotherson SumivishalNo ratings yet

- Final Fertilizer ReportDocument35 pagesFinal Fertilizer ReportAadiMalikNo ratings yet

- Synopsis On Capital StructureDocument11 pagesSynopsis On Capital StructureSanjay MahadikNo ratings yet

- Natco Medicine CompanyDocument12 pagesNatco Medicine CompanyPawan SoniNo ratings yet

- A212 - Individual Assignment #2 - InstructionsDocument2 pagesA212 - Individual Assignment #2 - InstructionsTeo Sheng100% (1)

- Master Budget With AnswersDocument13 pagesMaster Budget With AnswersCillian Reeves75% (4)

- Ratio Analysis - Ashokleyland SUDHEERDocument83 pagesRatio Analysis - Ashokleyland SUDHEERArun Kumar100% (3)

- Data Monitor Report - Soft DrinksDocument26 pagesData Monitor Report - Soft DrinksKhushi SawlaniNo ratings yet

- Indian Accounting Standard (Ind AS) 27 Consolidated and Separate Financial StatementsDocument44 pagesIndian Accounting Standard (Ind AS) 27 Consolidated and Separate Financial Statementsmchauhan1991No ratings yet

- Lynn Piggery FinalDocument9 pagesLynn Piggery FinalWana HaglerNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Module 1 Chapter 2 Accounting ProcessDocument116 pagesModule 1 Chapter 2 Accounting ProcessADITYAROOP PATHAKNo ratings yet

- ØHPK14/C 67/1/1: Series SET 1Document24 pagesØHPK14/C 67/1/1: Series SET 1Ethan GomesNo ratings yet

- Teori Akuntansi Aset Dan KewajibanDocument36 pagesTeori Akuntansi Aset Dan KewajibanCharis SubiantoNo ratings yet

- Solution - Questions To Be Prepared For The MicrosoftDocument3 pagesSolution - Questions To Be Prepared For The Microsoftlalith4uNo ratings yet

- Basic Acctg Homework - 1 PDFDocument3 pagesBasic Acctg Homework - 1 PDFChe MerluNo ratings yet

- V35 C11 539leavDocument11 pagesV35 C11 539leavd1234d100% (1)

- ADVANCE CREDIT BANK (A RURAL BANK) CORP - HTMDocument2 pagesADVANCE CREDIT BANK (A RURAL BANK) CORP - HTMJim De VegaNo ratings yet

- Equity Method: Amortization of Allocated ExcessDocument4 pagesEquity Method: Amortization of Allocated ExcesseiaNo ratings yet

- Sugar MillDocument26 pagesSugar MillRaman AhitanNo ratings yet

- Acct 602-Discussion 2Document2 pagesAcct 602-Discussion 2Michael LipphardtNo ratings yet

- 12 Fabm 2 Module 2 of First Quarter OlshcoDocument33 pages12 Fabm 2 Module 2 of First Quarter OlshcoPrincess Alyssa BarawidNo ratings yet

- 144084533r33 PDFDocument10 pages144084533r33 PDFRAJ TUWARNo ratings yet

- Project Report - JGB JCB Works and ServiDocument10 pagesProject Report - JGB JCB Works and Servinatraj kumarNo ratings yet

- Mergers and AcquisitionDocument20 pagesMergers and Acquisitionkako12345No ratings yet

- Analysis of Financial StatementsDocument67 pagesAnalysis of Financial StatementsAbdul BasitNo ratings yet

- Balance Sheet VerticalDocument22 pagesBalance Sheet VerticalberettiNo ratings yet

- Silo (Q4 - 2016)Document91 pagesSilo (Q4 - 2016)Wihelmina DeaNo ratings yet

- Fdocuments - in Project Report of Oscb 11Document41 pagesFdocuments - in Project Report of Oscb 11MANASI MAHARANANo ratings yet

- UNIT 1 Indian Financial SystemDocument50 pagesUNIT 1 Indian Financial Systemamol_more37No ratings yet