Professional Documents

Culture Documents

Cost of Goods Manufactured

Uploaded by

Lorie RoncalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Goods Manufactured

Uploaded by

Lorie RoncalCopyright:

Available Formats

FINANCIAL ACCOUNTING VALIX VOL.

1

Chapter 2 - Financial Statements 2009 Ed

FUNCTIONAL METHOD

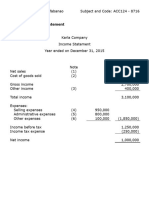

Karla Company

Income Statement

Year ended DECEMBER 31, xxx

Net sales revenue 7,700,000

Cost of sales (5,000,000)

Gross income 2,700,000

Other income 400,000

Total income 3,100,000

Expenses

Distribution costs 950,000

Administrative expenses 800,000

Other expnses 100,000 1,850,000

Income before tac 1,250,000

Income tax (250,000)

Net income 1,000,000

Note 1 - Net sales revenue

Gross sales 7,850,000 175,000

SRA (140,000) 650,000

Sales discounts (10,000) 125,000

Net sales revenue 7,700,000 950,000

Note 2 - Cost of sales

Inventory, Jan 1 1,000,000 500,000

Purchases 5,250,000 300,000

Freight in 500,000 Total 800,000

Purch ret & all (150,000)

Purch idscounts (100,000)

Net purchases 5,500,000 50,000

Goods avail for sale 6,500,000 50,000

Inventory, Dec 31 (1,500,000) Total 100,000

Cost of sales 5,000,000

Note 3 - Other income

Rental income 250,000

Dividend revenue 150,000

Total 400,000

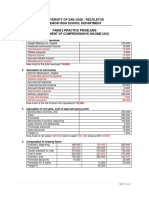

FINANCIAL ACCOUNTING VALIX VOL. 1

Chapter 2 - Financial Statements 2009 Ed

NATURAL METHOD

Karla Company

Income Statement

Year ended DECEMBER 31, xxx

Net sales revenue 7,700,000

Other income 400,000

Total 8,100,000

Expenses

Increase in inventory (500,000)

Net purchases 5,500,000

Freight - out 175,000

Sal;esmens' commissions 650,000

Deprciation 425,000

Officer's salarie4s 500,000

Other expenses 100,000 6,850,000

Income before tac 1,250,000

Income tax (250,000)

Net income 1,000,000

Note 1 - Net sales revenue

Gross sales 7,850,000 5,250,000

Sales returns & allowances (140,000) 500,000

Sales discounts (10,000) (150,000)

Net sales revenue 7,700,000 (100,000)

Net purchases 5,500,000

Note 2 - Other income

Rental income 250,000

Dividend revenue 150,000

400,000 125,000

300,000

Note 3 - Increase in inventory Total 425,000

Inventory,, December 31 1,500,000

Inventory,, January1 1,000,000

Increase in inventory 500,000 50,000

50,000

Total 100,000

FINANCIAL ACCOUNTING VALIX VOL. 1

Chapter 2 - Financial Statements 2009 Ed

XXX COMPANY

Statement of Cost of Goods Manufactured & Sold

Year ended DECEMBER 31, xxx

Raw materials, January 1 200,000

Purchases 3,000,000

Raw materials available for use 3,200,000

Less: Raw materials, December 31 280,000

Raw materials used 2,920,000

Direct labor 950,000

Factory overhead

Indirect labor 250,000

Superintendence 210,000

Light, heat & power 320,000

Rent - factory building 120,000

Repairs &maint3enance4 - machinery 50,000

Factory supplis usede 110,000

Depreciation - machinery 60,000 1,120,000

Total manufacturing cost 4,990,000

Goods in process , January 1 240,000

Total Cost of goods in process 5,230,000

Less: Goods in process, December 31 170,000

COST OF GOODS MANUFACTURED 5,060,000

Add: Finished Goods, Beg 360,000

Total Goods Available for Sale 5,420,000

Less: Finished Goods, End 360,000

COST OF GOODS SOLD 5,060,000

Sales 7,000,000.00

COST OF GOODS SOLD 5,060,000.00

Gross profit 1,940,000.00

Expenses 1,500,000.00

Net income 440,000.00

30% Corporate tax 132,000.00

Net income after tax 308,000.00

You might also like

- Accounting For Business Study GuideDocument154 pagesAccounting For Business Study GuideSheikh Fareed AliNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Oracle Process Manufacturing-Full Outsource Manufacturing For Process Industries PDFDocument98 pagesOracle Process Manufacturing-Full Outsource Manufacturing For Process Industries PDFAhmed100% (1)

- Problem 9-1: Net IncomeDocument16 pagesProblem 9-1: Net IncomeHerlyn Juvelle SevillaNo ratings yet

- Statement of Financial Position/Retained EarningsDocument5 pagesStatement of Financial Position/Retained EarningsShane TabunggaoNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- 4-2 Endless CompanyDocument3 pages4-2 Endless CompanyyayayaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 162.005.exercises and AssignDocument2 pages162.005.exercises and AssignAngelli Lamique50% (2)

- Quiz No 3 Answer KeyDocument11 pagesQuiz No 3 Answer KeyDaniella Mae Elip100% (1)

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Karla Company Income Statement Year Ended December 31, 2008 NoteDocument8 pagesKarla Company Income Statement Year Ended December 31, 2008 NoteROCHELLE ANNE VICTORIANo ratings yet

- 9825Document7 pages9825Adam CuencaNo ratings yet

- Brown CompanyDocument4 pagesBrown CompanyAdam CuencaNo ratings yet

- ACC124, AssignmentDocument4 pagesACC124, AssignmentValerie SandicoNo ratings yet

- Synthesis ReportingDocument3 pagesSynthesis ReportingJason Dwight CamartinNo ratings yet

- Karla CompanyDocument2 pagesKarla CompanyCeline Therese BuNo ratings yet

- Comprehensive IncomeDocument9 pagesComprehensive IncomeJesiah PascualNo ratings yet

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- AnsweredASS17 AccountingDocument2 pagesAnsweredASS17 Accountingvomawew647No ratings yet

- UntitledDocument6 pagesUntitledMarian grace DivinoNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Lor, 6-1,6-2Document7 pagesLor, 6-1,6-2KC Hershey Lor100% (4)

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Conceptual Framework Valix 2019 8-1, 9-1 PDFDocument6 pagesConceptual Framework Valix 2019 8-1, 9-1 PDFTenshi Aina SantosNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Ujian 1 AdvDocument33 pagesUjian 1 AdvaraNo ratings yet

- Group 6 05 Quiz 1Document4 pagesGroup 6 05 Quiz 1Angela Fye LlagasNo ratings yet

- CH 14 - Translation SolutionDocument3 pagesCH 14 - Translation SolutionJosua PranataNo ratings yet

- ABC Sample ProbDocument4 pagesABC Sample ProbangbabaeNo ratings yet

- Intacc Quiz 1Document6 pagesIntacc Quiz 1Rhea YugaNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- Inventory ValuationDocument6 pagesInventory ValuationJane Bagui LaluñoNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- For Year Ending December 31, 2018: Lakeside Company Income StatementDocument8 pagesFor Year Ending December 31, 2018: Lakeside Company Income StatementMark Christian Cutanda VillapandoNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Accounting AssignmentDocument5 pagesAccounting AssignmentVivek SinghNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- Quiz3 SolutionDocument2 pagesQuiz3 SolutionLorifel Antonette Laoreno TejeroNo ratings yet

- AUDPROB CHPT 5 and 61Document30 pagesAUDPROB CHPT 5 and 61Jem ValmonteNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- 4-6 Dahlia CompanyDocument1 page4-6 Dahlia CompanyyayayaNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Ia3 22 23Document5 pagesIa3 22 23Gabriel Trinidad SonielNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Prelim L1 Assignment TestDocument3 pagesPrelim L1 Assignment TestEMELY EMELYNo ratings yet

- Practice of Cost Volume Profit Breakeven AnalysisDocument4 pagesPractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- PagesDocument82 pagesPagesEslam EltaweelNo ratings yet

- Eco 2Document6 pagesEco 2Shubh PalanNo ratings yet

- Session 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurDocument48 pagesSession 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurBabusona SahaNo ratings yet

- Ifrs at A Glance: IAS 16 Property Plant and EquipmentDocument4 pagesIfrs at A Glance: IAS 16 Property Plant and EquipmentRjan LGNo ratings yet

- T3 Accounting ConceptsDocument54 pagesT3 Accounting ConceptsAngelNo ratings yet

- Xii Acc Kvs Ro Agra 2021-22 Term 1Document98 pagesXii Acc Kvs Ro Agra 2021-22 Term 1Ashley NoelNo ratings yet

- Qwer AsdfDocument20 pagesQwer AsdfThetHeinNo ratings yet

- 09 Chapter 1Document20 pages09 Chapter 1Salman AminNo ratings yet

- Substantive Test of LiabilitiesDocument42 pagesSubstantive Test of LiabilitiesAldrin John TungolNo ratings yet

- Chapter Ii - Review of Related Literature and StudiesDocument2 pagesChapter Ii - Review of Related Literature and StudiesClaude Geoffrey L. EscanillaNo ratings yet

- DHL-Juan Pichardo 6.2Document1 pageDHL-Juan Pichardo 6.2domexxpetNo ratings yet

- Homework - Sectioin 3&4 - SolutionDocument25 pagesHomework - Sectioin 3&4 - Solutioncherri blos59No ratings yet

- Cpa PNG (Code of Ethics)Document47 pagesCpa PNG (Code of Ethics)Thomas Kay100% (1)

- All CoursesDocument19 pagesAll CoursesWei Xiang TanNo ratings yet

- Lecturing C Meeting 01 - Paper F3 PDFDocument34 pagesLecturing C Meeting 01 - Paper F3 PDFchrislinNo ratings yet

- ACC 201 Accounting Cycle WorkbookDocument70 pagesACC 201 Accounting Cycle Workbookarnuako25% (20)

- CH 08 Alt ProbDocument8 pagesCH 08 Alt ProbAlAshNo ratings yet

- Aset TetapDocument9 pagesAset TetapMAYONA MEGAHTANo ratings yet

- Oracle Integration Pack For Peoplesoft General Ledger 2.5 - Implementation GuideDocument142 pagesOracle Integration Pack For Peoplesoft General Ledger 2.5 - Implementation GuidesandeeptcsNo ratings yet

- Module 3 - Overview of The Audit ProcessDocument2 pagesModule 3 - Overview of The Audit ProcessLysss EpssssNo ratings yet

- Audit Process QuestionsDocument18 pagesAudit Process QuestionskesianaNo ratings yet

- Theory ABCDocument13 pagesTheory ABCMae Dela PenaNo ratings yet

- Khandelwal Agencies Pvt. LTD.: GST - InvoiceDocument6 pagesKhandelwal Agencies Pvt. LTD.: GST - InvoiceSabuj SarkarNo ratings yet

- Transcript 1820115Document2 pagesTranscript 1820115Wasifa Tahsin AraniNo ratings yet

- ICFE IntroductionDocument27 pagesICFE IntroductionGordonLee100% (3)