Professional Documents

Culture Documents

ACC124, Assignment

Uploaded by

Valerie Sandico0 ratings0% found this document useful (0 votes)

2 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views4 pagesACC124, Assignment

Uploaded by

Valerie SandicoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Assignment

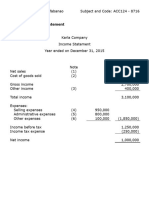

Function of Expense Method:

Youth Company

Income Statement

For the year ended December 31, 2015

Net Sales (1) 7, 700, 000

Cost of sales (2) (5, 000, 000)

Gross income 2, 700, 000

Other income 400, 000

Total income 3, 100, 000

Expenses:

Selling expense (4) 950, 000

Administrative expense (5) 800, 000

Other expenses (6) 100, 000

1, 850, 000

Income Before tax 1, 250, 000

Income Tax (250, 000)

Net income 1, 000, 000

Note 1-Net sales

Sales 7, 850, 000

Sales return & allowances (140, 000)

Sales discounts (10, 000)

Net purchases 7, 700, 000

Cost of sales- Note 2

Inventory beg. 1, 000, 000

Purchases 5, 250, 000

Purchase return & allowances (150, 000)

Purchase discounts (100, 000)

Net purchases 5, 000, 000

Freight in 500, 000

Goods available for sale 6, 500, 000

Inventory end (1, 500, 000)

Cost of sales 5, 000, 000

Note 3- Other income

Rental income 250, 000

Dividend income 150, 000

Total other income 400, 000

Note 4- Selling Expenses

Freight out 175, 000

Salesmen’s commissions 650, 000

Depreciation-store equipment 125, 000

Selling expenses 950, 000

Note 5- Administrative expenses

Officer’s salaries 500, 000

Depreciation- office equipment 300, 000

Administrative expense 800, 000

Note 6-Other expenses

Loss on sale equipment 50, 000

Loss on sale investment 50, 000

Other expense 100, 000

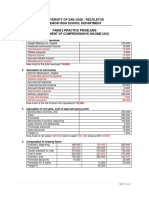

Nature of Expense Method:

Youth Company

Income Statement

For the year ended December 31, 2015

Net Sales (1) 7, 700, 000

Other income (2) 400, 000

Total income 8, 100, 000

Expenses:

Increase in inventory (3) (500, 000)

Net purchases (4) 5, 500, 000

Freight out 175, 000

Salesmen’s commission 650, 000

Depreciation expense (5) 425, 000

Officers expense 500, 000

Other expense (6) 100, 000 6, 850, 000

1, 850, 000

Income Before tax 1, 250, 000

Income Tax (250, 000)

Net income 1, 000, 000

Note 1-Net sales

Sales 7, 850, 000

Sales return & allowances (140, 000)

Sales discounts (10, 000)

7, 700, 000

Other income- Note 2

Rental income 250, 000

Dividend Income 150, 000

400, 000

Note 3- Increase in Inventory

Inventory End 1, 500, 000

Inventory beg. 1, 000, 000

500, 000

Note 4- Net Purchases

Purchases 5, 250, 000

Purchase return & allowances (150, 000)

Purchase discounts (100, 000)

Freight in 500, 000

Net purchases 5, 500, 000

Note 5- Depreciation Expense

Depreciation- office equipment 300, 000

Depreciation- store equipment 125, 000

Depreciation expense 425, 000

Note 6-Other expenses

Loss on sale equipment 50, 000

Loss on sale investment 50, 000

Other expense 100, 000

You might also like

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 4-2 Endless CompanyDocument3 pages4-2 Endless CompanyyayayaNo ratings yet

- Alorica - Ms. Trina - ReviseDocument1 pageAlorica - Ms. Trina - Revisebktsuna0201100% (1)

- Assessment - BSBFIA401Document10 pagesAssessment - BSBFIA401Sabah Khan RajaNo ratings yet

- Quizzes - Chapter 2 - Statement of Comprehensive IncomeDocument6 pagesQuizzes - Chapter 2 - Statement of Comprehensive IncomeAmie Jane Miranda100% (1)

- Mba HW Prob 1Document2 pagesMba HW Prob 1Mercedes JNo ratings yet

- Brown CompanyDocument4 pagesBrown CompanyAdam CuencaNo ratings yet

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiNo ratings yet

- Karla Company Income Statement Year Ended December 31, 2008 NoteDocument8 pagesKarla Company Income Statement Year Ended December 31, 2008 NoteROCHELLE ANNE VICTORIANo ratings yet

- UntitledDocument6 pagesUntitledMarian grace DivinoNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- Karla CompanyDocument2 pagesKarla CompanyCeline Therese BuNo ratings yet

- Synthesis ReportingDocument3 pagesSynthesis ReportingJason Dwight CamartinNo ratings yet

- Statement of Financial Position/Retained EarningsDocument5 pagesStatement of Financial Position/Retained EarningsShane TabunggaoNo ratings yet

- Problem 9-1: Net IncomeDocument16 pagesProblem 9-1: Net IncomeHerlyn Juvelle SevillaNo ratings yet

- Cost of Goods ManufacturedDocument3 pagesCost of Goods ManufacturedLorie RoncalNo ratings yet

- 9825Document7 pages9825Adam CuencaNo ratings yet

- Comprehensive IncomeDocument9 pagesComprehensive IncomeJesiah PascualNo ratings yet

- AnsweredASS17 AccountingDocument2 pagesAnsweredASS17 Accountingvomawew647No ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Presentation of Financial Statement Income StatementDocument5 pagesPresentation of Financial Statement Income Statementgerald almencionNo ratings yet

- Comprehensive Income ModuleDocument5 pagesComprehensive Income ModuleMich Jerald MendiolaNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Conceptual Framework Valix 2019 8-1, 9-1 PDFDocument6 pagesConceptual Framework Valix 2019 8-1, 9-1 PDFTenshi Aina SantosNo ratings yet

- Prelim L1 Assignment TestDocument3 pagesPrelim L1 Assignment TestEMELY EMELYNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- 06 Quiz 1Document1 page06 Quiz 1Angelo MorenoNo ratings yet

- 4-6 Dahlia CompanyDocument1 page4-6 Dahlia CompanyyayayaNo ratings yet

- PAS 1 Application - SCIDocument43 pagesPAS 1 Application - SCICzanelle Nicole EnriquezNo ratings yet

- Comprehensive AccountingDocument5 pagesComprehensive AccountingAnn Kea GuillepaNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Answers FAR - CASE ANALYSISDocument4 pagesAnswers FAR - CASE ANALYSISJaquelyn ClataNo ratings yet

- Draft SciDocument5 pagesDraft SciMariella Antonio-NarsicoNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba RugiRictu SempakNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Pateros Catholic SchoolDocument4 pagesPateros Catholic Schooljohn nathanNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Corp AccountsDocument8 pagesCorp AccountsShreyNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Assignment 5.1Document1 pageAssignment 5.1Evie MarionetteNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Document2 pagesNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellNo ratings yet

- Problem 2-6 (Book)Document11 pagesProblem 2-6 (Book)Cherry Doong CuantiosoNo ratings yet

- Problem 2-6 (Book)Document12 pagesProblem 2-6 (Book)Lara FloresNo ratings yet

- Trugo Activity SCFDocument4 pagesTrugo Activity SCFmoreNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- Officers' Salaries Officers' SalariesDocument6 pagesOfficers' Salaries Officers' SalariesCaptain ObviousNo ratings yet

- Revision Q&ADocument5 pagesRevision Q&ADylan Rabin PereiraNo ratings yet

- Income Tax AustraliaDocument9 pagesIncome Tax AustraliaAbdul HadiNo ratings yet

- It Q2Document4 pagesIt Q2Calix CasanovaNo ratings yet

- TablesDocument3 pagesTablesJPNo ratings yet

- Train Law: Saliant Topics inDocument4 pagesTrain Law: Saliant Topics incrookshanksNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ManjunathNo ratings yet

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryNo ratings yet

- Accounts Payable: To Short Pay An Invoice or NotDocument8 pagesAccounts Payable: To Short Pay An Invoice or NotAccounts Payable Now and Tomorrow100% (6)

- Airtel Bill For The Month of June'20Document2 pagesAirtel Bill For The Month of June'20Piyush MittalNo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Tax Review Syllabus 2023 Bar Part 1 8.24.22Document7 pagesTax Review Syllabus 2023 Bar Part 1 8.24.22Deanne KimberlyNo ratings yet

- 2020 Tax ReturnDocument16 pages2020 Tax ReturnTbahajBayan100% (1)

- Mudule 5 Lecture 2Document28 pagesMudule 5 Lecture 2mmNo ratings yet

- LANDMARK Tax Judgement in FAVOUR of Indian Seafarers Dec 2016Document6 pagesLANDMARK Tax Judgement in FAVOUR of Indian Seafarers Dec 2016सचिनरावतNo ratings yet

- Form PDF 674816100160622Document10 pagesForm PDF 674816100160622Hasan KhanNo ratings yet

- cLUBBING OF iNCOMEDocument18 pagescLUBBING OF iNCOMEDipinderNo ratings yet

- PO FormatDocument3 pagesPO FormatSanjeev KhannaNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- Tran Hoai Anh Bai Tap Chap 4Document16 pagesTran Hoai Anh Bai Tap Chap 4Vũ Nhi AnNo ratings yet

- Residence Status and Tax LiabilityDocument14 pagesResidence Status and Tax LiabilityDrafts StorageNo ratings yet

- Taxacctgcenter - ph-3 Reforms On Documentary Stamp Tax DST Under TRAIN RA 10963 PhilippinesDocument3 pagesTaxacctgcenter - ph-3 Reforms On Documentary Stamp Tax DST Under TRAIN RA 10963 PhilippinesRegs AccexNo ratings yet

- PDFDocument2 pagesPDFParesh GawandNo ratings yet

- STATEMENT OF ACCOUNT RevisedDocument2 pagesSTATEMENT OF ACCOUNT RevisedJose VillarealNo ratings yet

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- Form No. 15G: Part - IDocument3 pagesForm No. 15G: Part - ImohanNo ratings yet

- AnswersDocument3 pagesAnswersYahya ZafarNo ratings yet

- Assignment 2Document2 pagesAssignment 2Ekta GhongeNo ratings yet