Professional Documents

Culture Documents

4 ANNEXUREAITA34VDeMatos2021

4 ANNEXUREAITA34VDeMatos2021

Uploaded by

renette1010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 ANNEXUREAITA34VDeMatos2021

4 ANNEXUREAITA34VDeMatos2021

Uploaded by

renette1010Copyright:

Available Formats

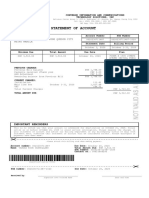

INCOME TAX ITA34

Notice of Assessment

Enquiries should be addressed to SARS:

Contact Centre

ALBERTON

V DE MATOS 1528

11 BLOM STREET Tel: 0800007277 Website: www.sars.gov.za

UITSIG Details

BLOEMFONTEIN

Always quote this

9301 Reference number: 1234567899

reference number

Document number: 65

when contacting

Date of assessment: 2022-02-10 SARS

Year of assessment: 2021

Type of assessment: Original Assessment

Period (days): 365

Payment Due date: 2022-02-10

PRN Number 1000000789

Balance of Account after this Assessment

Description Amount

Amount payable by you to SARS 0.00

Compliance Information

Unprocessed payments 0.00 Provisional taxpayer Y

Selected for audit or verification N

Assessment Summary Information

Previous Assessment Current Assessment Account Adjustments

Taxable income / (Assessed Loss) 470 000.00

Dear V DE MATOS

Your assessment for the 2021 tax year has been concluded and the assessment summary as well as the current balance on your

account are reflected above. Please note that in the case of a debit balance on your account further interest may accrue.

Payments are to be made electronically or at the approved financial institutions. When you make a payment, please use the payment reference

number (PRN). The following payment channels are available to you:

- Via SARS eFiling (www.sars.gov.za)

- Via MobiApp

- Electronically using internet banking (EFT - electronic fund transfer)

- At a branch of one of the following banking institutions: ABSA, Capitec, FNB, Nedbank or Standard Bank.

- For more details on payments process details visit the SARS website (www.sars.gov.za)

A detailed statement of account (including all amounts payable or refundable under any previous assessment, refunds, payments, and interest),

may be requested from SARS through the following channels:

- Electronically via eFiling

- Call the SARS Contact Centre

- At your nearest SARS branch

The reference to additional tax/understatement penalty in this notice of assessment depends upon the circumstances.

(i) If additional tax was imposed before the commencement date of the Tax Administration Act (TAA) then adjustment to that additional tax may be

made by an assessment issued in terms of the TAA after the commencement date of the TAA

(ii) An assessment issued after the date of commencement of the TAA, in respect of any period that preceded the commencement date of the

TAA, may be subject to the imposition of an Understatement Penalty in terms of the TAA as an "understatement" is considered to be a continuing

act or omission in terms of the TAA

Reference Number 1234567899 ITA34_ROPP 2021.02.00

You might also like

- USA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000Document2 pagesUSA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000abooddeleNo ratings yet

- Bill PDFDocument1 pageBill PDFasdasdNo ratings yet

- Statement of AccountDocument3 pagesStatement of AccountComfort NdzumeniNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Bi1000541546 8100183438MHC12021 10012021 1448Document1 pageBi1000541546 8100183438MHC12021 10012021 1448Yuna SyNo ratings yet

- Statement of Account: Vicente Compound Lourdes ST Paranaque Metro ManilaDocument1 pageStatement of Account: Vicente Compound Lourdes ST Paranaque Metro ManilaMark JocsingNo ratings yet

- Httpsget Soa - convergeict.comapiv1accountsoa0020230051973NDL9PP5BUMURPX7CV3CJQY0ZORP9U1VTa3951559 65ad 49bc A81f Dfe1b7Document1 pageHttpsget Soa - convergeict.comapiv1accountsoa0020230051973NDL9PP5BUMURPX7CV3CJQY0ZORP9U1VTa3951559 65ad 49bc A81f Dfe1b7joel sauzaNo ratings yet

- Express Trusts Under Common LawDocument52 pagesExpress Trusts Under Common LawPawPaul Mccoy100% (12)

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- 346055215Document5 pages346055215Azhar SkNo ratings yet

- Ita34 1058123249Document3 pagesIta34 1058123249Bahlakoana NtsasaNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact Centrebra9tee9tiniNo ratings yet

- Notice of AssessmentDocument4 pagesNotice of AssessmentziggyNo ratings yet

- Get NoticeDocument3 pagesGet NoticeLetsoai MalesaNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa 7455: Contact Centrebra9tee9tiniNo ratings yet

- MC Machethe Proof of ResidenceDocument1 pageMC Machethe Proof of ResidencevelyassetsNo ratings yet

- Get NoticeDocument4 pagesGet Noticejohn kolokoNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- Pillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Document4 pagesPillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Spoton AutomotiveNo ratings yet

- GetNotice AspxDocument2 pagesGetNotice Aspxmaria matundaNo ratings yet

- Httpssecure Sarsefiling Co ZaEFDotNetNOTICESGetNoticeWithSummary aspxNoticeGroupID 442105870&NoticeTypeCode IT34&TaxPayerDocument1 pageHttpssecure Sarsefiling Co ZaEFDotNetNOTICESGetNoticeWithSummary aspxNoticeGroupID 442105870&NoticeTypeCode IT34&TaxPayerSiphokazi MdlaloseNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Statement of Account: Assessed TaxDocument2 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Statement of Account: Assessed Taxbra9tee9tiniNo ratings yet

- Et Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408Document2 pagesEt Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408EstherNo ratings yet

- Invoice Number: 78111681212Document2 pagesInvoice Number: 78111681212João Victor de OliveiraNo ratings yet

- Sun Cellular E-Bill-0171889715-2020-12-27Document6 pagesSun Cellular E-Bill-0171889715-2020-12-27アシイナ 江野No ratings yet

- Fact To RemediesDocument2 pagesFact To Remediesmalickayubu9No ratings yet

- MR Lesetja S Monama Stefans Stand No 447 Spitspunt Marble Hall 0450Document1 pageMR Lesetja S Monama Stefans Stand No 447 Spitspunt Marble Hall 0450Katlego BafanaNo ratings yet

- Tax Invoice: State State CodeDocument3 pagesTax Invoice: State State Coderajendra prajapatiNo ratings yet

- Inv-Mfc-00001 UsdDocument2 pagesInv-Mfc-00001 UsdMunim AnisNo ratings yet

- Bill Summary: Mr. Vaibhav ChinchulkarDocument2 pagesBill Summary: Mr. Vaibhav ChinchulkarVaibhav ChinchulkarNo ratings yet

- Generalized Statement For ConsumerDocument8 pagesGeneralized Statement For ConsumerHaris RizwanNo ratings yet

- Terp Asia Construction Corp.: Statement of AccountDocument4 pagesTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoNo ratings yet

- Telephone No Amount Payable Due Date: Pay NowDocument3 pagesTelephone No Amount Payable Due Date: Pay NowJAYNo ratings yet

- Sars PDFDocument2 pagesSars PDFmushava nyokaNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemIra MejiaNo ratings yet

- SVFSDFDocument1 pageSVFSDFK JayNo ratings yet

- FCD Westpac Business Bank Savings StatementDocument3 pagesFCD Westpac Business Bank Savings StatementMadison MooreNo ratings yet

- Mr. Sumit Sharma: Rs 1,230.74 Rs 0.00 Rs - 593.01 Rs 0.00 Rs 737.73Document3 pagesMr. Sumit Sharma: Rs 1,230.74 Rs 0.00 Rs - 593.01 Rs 0.00 Rs 737.73sumit sharmaNo ratings yet

- RedirectDocument2 pagesRedirectSatyam PathakNo ratings yet

- TDS39229 2021Document1 pageTDS39229 2021Alika DebNo ratings yet

- Bi1000541546 8100183438MHC12021 10012021 1448Document1 pageBi1000541546 8100183438MHC12021 10012021 1448Yuna SyNo ratings yet

- Reminder To Submit Supporting Documents - 341337027Document1 pageReminder To Submit Supporting Documents - 341337027bra9tee9tiniNo ratings yet

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- Invoice: Swifserv Customer Services Co. # INV-000020Document1 pageInvoice: Swifserv Customer Services Co. # INV-000020ginaNo ratings yet

- Bill 1 1537699319 1 86790957Document4 pagesBill 1 1537699319 1 86790957Bens ReceivablesNo ratings yet

- Invoice INV318Document2 pagesInvoice INV318shecamazicaNo ratings yet

- West City Central School: Statement of AccountDocument4 pagesWest City Central School: Statement of AccountJulie Ann Bruzon GocelaNo ratings yet

- eFPS Payment DetailsDocument3 pageseFPS Payment DetailsPoofNo ratings yet

- Coha - Cuenta de CompensaciónDocument2 pagesCoha - Cuenta de CompensaciónDiana CárdenasNo ratings yet

- Statement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaDocument1 pageStatement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaKhristin AllisonNo ratings yet

- SARS Tax ClearenceDocument1 pageSARS Tax ClearenceLelo MkhizeNo ratings yet

- Invoice 23001479Document1 pageInvoice 23001479Laxman AdhikariNo ratings yet

- Get Letteruc 2Document1 pageGet Letteruc 2tesfayehussin263No ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Airtel Bill (2-1-2015 To 1-2-2015)Document35 pagesAirtel Bill (2-1-2015 To 1-2-2015)paras17No ratings yet

- EFPS Home EFiling and Payment System Geopile TCVPDocument1 pageEFPS Home EFiling and Payment System Geopile TCVPrHea sindoLNo ratings yet

- Electricity Bill Receipt May-20Document1 pageElectricity Bill Receipt May-20Kishan MauryaNo ratings yet

- Good Standing EXTREME SUPPLIES AND PROJECTSDocument1 pageGood Standing EXTREME SUPPLIES AND PROJECTSmalumasusu4No ratings yet

- Ht2329i003260837 1Document4 pagesHt2329i003260837 1Chegg tutorsNo ratings yet

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- 1 Jan, 2019 Prophet Elvis MbonyeDocument16 pages1 Jan, 2019 Prophet Elvis MbonyeCollins100% (1)

- Muslim PhilosophyDocument8 pagesMuslim PhilosophyHumza MalikNo ratings yet

- United States Design Patent (10) Patent No.:: USD639,239 SDocument9 pagesUnited States Design Patent (10) Patent No.:: USD639,239 S155No ratings yet

- Acknowledgement Receipt: Republic of The Philippines Province of Guimaras Municipality of SibunagDocument8 pagesAcknowledgement Receipt: Republic of The Philippines Province of Guimaras Municipality of SibunagJOHN PHILIP NAVANo ratings yet

- Unit 2 System Startup and ShutdownDocument20 pagesUnit 2 System Startup and ShutdownRichie BallyearsNo ratings yet

- Part 2Document98 pagesPart 2Juvaira IggoNo ratings yet

- Moot Court Tutorial 1Document8 pagesMoot Court Tutorial 1rushi sreedharNo ratings yet

- Financial Education Services: Compensation Plan OverviewDocument15 pagesFinancial Education Services: Compensation Plan OverviewAnwar BrooksNo ratings yet

- Transportation Law ReviewerDocument40 pagesTransportation Law ReviewerJannus YodicoNo ratings yet

- N.K. Sodhi, J. (Presiding Officer), Arun Bhargava and Utpal Bhattacharya, MembersDocument10 pagesN.K. Sodhi, J. (Presiding Officer), Arun Bhargava and Utpal Bhattacharya, Membersrahul dadhichNo ratings yet

- 1 HotelDocument1 page1 HotelhoneyNo ratings yet

- Location Entry CodesDocument25 pagesLocation Entry CodesKitso SekotsweNo ratings yet

- Principles of Tasawwuf-MYDocument5 pagesPrinciples of Tasawwuf-MYNasif Akbar MulyadiNo ratings yet

- ME 6301 Engineering ThermodynamicsDocument6 pagesME 6301 Engineering Thermodynamicskarthi100% (1)

- Aia Around The World Plus IIDocument8 pagesAia Around The World Plus IIJun Rui ChngNo ratings yet

- BLM Fire Holiday Farm Closure MapDocument1 pageBLM Fire Holiday Farm Closure MapSinclair Broadcast Group - EugeneNo ratings yet

- Research Paper Topics Law EnforcementDocument4 pagesResearch Paper Topics Law Enforcementegvy37az100% (1)

- 8 Land - Bank - of - The - Phils. - v. - Perez PDFDocument10 pages8 Land - Bank - of - The - Phils. - v. - Perez PDFEffy SantosNo ratings yet

- Ang Dambana NG Katuparan: During The 160 Birthday of The National HeroDocument15 pagesAng Dambana NG Katuparan: During The 160 Birthday of The National HeroAdan NunungNo ratings yet

- Senarai Ikut Bas - 05.10PMDocument2 pagesSenarai Ikut Bas - 05.10PMDonat CoklatNo ratings yet

- Disciplinary Policy Adopted 12Document8 pagesDisciplinary Policy Adopted 12api-659596621No ratings yet

- Understanding Thai Politics PDFDocument19 pagesUnderstanding Thai Politics PDFΑνδρέας ΓεωργιάδηςNo ratings yet

- Tuition Reimbursement AgreementDocument3 pagesTuition Reimbursement AgreementAzmyNo ratings yet

- Filipino 12: Pagpapala Sa PangingisdaDocument13 pagesFilipino 12: Pagpapala Sa PangingisdaLea MarceloNo ratings yet

- Guzman V IbeaDocument2 pagesGuzman V IbeaseraphinajewelineNo ratings yet

- Telebap v. ComelecDocument1 pageTelebap v. ComelecJulius Robert JuicoNo ratings yet

- WomensTeam SeasonTicket TermsConditions 23241676987354648Document9 pagesWomensTeam SeasonTicket TermsConditions 23241676987354648RatkoMRNo ratings yet

- Gore Vidal Inventing A Nation PDFDocument3 pagesGore Vidal Inventing A Nation PDFMelanieNo ratings yet

- IC Simple Action Plan Example 8595Document4 pagesIC Simple Action Plan Example 8595Long Nguyễn HoàngNo ratings yet