Professional Documents

Culture Documents

June

Uploaded by

jeffwork19760 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageJune

Uploaded by

jeffwork1976Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

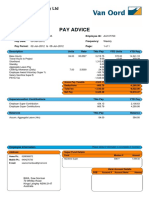

Your pension contribution this pay day has been calculated on 5% of Qualifying

Earnings (£4324.96 - £949.96 = £3375.00) in accordance with Pensions Legislation.

NAME MR JACK HODGSON PAY NO. 102236 PAYE Ref. 023/RTR PAY TO BANK 29/05/2020

TAX PERIOD 8 TAX CODE & BASIS 1034L Cumulative NI NO. FD833519D NI CAT A BANK ACCT NO. XXXX4860

COST CENTRE 142812 CONTRACT HOURS 35 ANNUAL HEADLINE PAY £31,175.00

PAYMENTS UNIT HRLY RATE RATE £ DEDUCTIONS £ EARNINGS & CONTRIBUTIONS £

ALP NOT WORKSHOP 1.00 40.86 NBTS Ticket Loan 74.30

This Payslip YTD

ANNUAL LEAVE 14.00 239.04 Tax 672.00

General PRP 648.60 Ni Paid 388.14 TAXABLE PAY 4,156.21 14,121.35

OUTER LONDON ALLOW 1.00 1.00 96.84 TAX PAID 672.00 2,187.20

Regular Weekday 2.00 17.07 1.50 51.22 NI PAY 4,156.21 14,121.35

Regular Weekday 32.00 17.07 1.00 546.38 NI EE 388.14 1,344.91

Regular Weekday 41.00 17.07 1.25 875.06 NI ER 481.92 1,582.20

Regular Weekend 43.00 17.07 1.50 1,101.30

Rest Day Weekday 1.00 17.07 1.50 25.61

PENSIONABLE PAY 3,375.00 0.00

Rest Day Weekday 18.00 17.07 1.25 384.17

PENSION ER 270.00 989.94

Rest Day Weekend 7.00 17.07 1.50 179.28

SMART DCS Underpin 1.00 -168.75 PENSION EE 0.00 0.00

Shift Adjustment 8.00 17.07 1.00 136.60

BRASS 0.00

AVC 0.00

PREVIOUS EMPLOYMENT FIGURES

TAXABLE PAY 0.00

TAX PAID 0.00

GROSS PAY 4,156.21 DEDUCTIONS 1,134.44 NET PAY 3,021.77

If you have a pay related query please email payrollhelpdesk@networkrail.co.uk or call Central Customer Support on 0330 855 1140

You might also like

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Mortgage Foreclosures, Promissory Notes, and The UCC DWhaleyDocument28 pagesMortgage Foreclosures, Promissory Notes, and The UCC DWhaleyCarrieonic100% (2)

- Tata Business Support Services LTD: 00150785 Amir KhanDocument2 pagesTata Business Support Services LTD: 00150785 Amir KhanAamir KhanNo ratings yet

- Itawamba County School District Direct Deposit StatementDocument1 pageItawamba County School District Direct Deposit StatementHolliday L RuffinNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- 7 Aacb 8 FCDocument1 page7 Aacb 8 FCAmaryNo ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- Credit Report: Shannon CoxDocument60 pagesCredit Report: Shannon CoxShanNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Net Pay 3,146.54Document1 pageNet Pay 3,146.54Meii MeiiNo ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- ECLERX Jun 2021-41926Document1 pageECLERX Jun 2021-41926Prdeep SinghNo ratings yet

- Aged Care Worker PayslipDocument14 pagesAged Care Worker PayslipAnnie LamNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- 2022 11 30 - StatementDocument7 pages2022 11 30 - StatementGiovanni SlackNo ratings yet

- ECLERX Sep 2021-41926Document1 pageECLERX Sep 2021-41926Prdeep SinghNo ratings yet

- CRM Services Payslip for September 2021Document1 pageCRM Services Payslip for September 2021Phagun BehlNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- R12 - Bank Account Transfer Ver 1.0Document644 pagesR12 - Bank Account Transfer Ver 1.0phanisure100% (5)

- Van Oord Australia Pty Ltd pays its employeesDocument1 pageVan Oord Australia Pty Ltd pays its employeesNorman BwaNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNo ratings yet

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocument1 pagePayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Payslip 20200731Document1 pagePayslip 20200731Sg BalajiNo ratings yet

- RFBT-16 (Financial Rehabilitation & Insolvency Act)Document8 pagesRFBT-16 (Financial Rehabilitation & Insolvency Act)Alliah Mae ArbastoNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- 3256 Enache Maria Diana (Em554503@Gmail - Com) Month No 5 2023Document1 page3256 Enache Maria Diana (Em554503@Gmail - Com) Month No 5 2023Ioana MariaNo ratings yet

- Sample 2017Document1 pageSample 2017scribd.recent479No ratings yet

- Mykzhrpayslip 20230303Document1 pageMykzhrpayslip 20230303Cruiser GohNo ratings yet

- Payslip 202403Document1 pagePayslip 202403rashidah hajariNo ratings yet

- 905 Flore, Carmen (Veronicaelena644@yahoo - Com) Month No 6 2019 PDFDocument1 page905 Flore, Carmen (Veronicaelena644@yahoo - Com) Month No 6 2019 PDFCarmen FloreNo ratings yet

- Surat JanjiDocument1 pageSurat JanjiMohd ZNo ratings yet

- 07 10 Notting Hill Operating ReportDocument3 pages07 10 Notting Hill Operating ReportoakmontemgrNo ratings yet

- Ritzio BU - Million Romania - Balanta Mai 2009Document37 pagesRitzio BU - Million Romania - Balanta Mai 2009Ovi ButnaruNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- Pay No. Period EndingDocument1 pagePay No. Period Endingswakie88No ratings yet

- 2010 June Finance Profit LossDocument2 pages2010 June Finance Profit LossblueriverdocNo ratings yet

- Payment StubDocument1 pagePayment Stub4gbvqp5hmrNo ratings yet

- Name: Hilario Estanislau LocatelliDocument1 pageName: Hilario Estanislau LocatelliHilario LocatelliNo ratings yet

- Profit & Loss by Class: Gold Medal Gymnastics Booter ClubDocument4 pagesProfit & Loss by Class: Gold Medal Gymnastics Booter ClubCourtneyHallNo ratings yet

- Payslip - 1Document1 pagePayslip - 1bktsuna0201No ratings yet

- Pay Slip AnalysisDocument1 pagePay Slip Analysisbktsuna0201No ratings yet

- Bugaciu Simona (Simonab@Dentaltech - Ie) Month No 9 2022Document1 pageBugaciu Simona (Simonab@Dentaltech - Ie) Month No 9 2022Simona BudauNo ratings yet

- To Word 01-07-2024 22.40Document1 pageTo Word 01-07-2024 22.40klellymiraculousNo ratings yet

- Payslip MAIN 30-Apr-2023Document1 pagePayslip MAIN 30-Apr-2023TsekeNo ratings yet

- Ranjan KumarDocument2 pagesRanjan KumarRanjan KumarNo ratings yet

- Document (1091)Document1 pageDocument (1091)Rizwan Ahmad KhanNo ratings yet

- Rpt_Pay_Slip_YTD (3)Document1 pageRpt_Pay_Slip_YTD (3)Tomola BlessingNo ratings yet

- Inbound 2512939453390355945Document1 pageInbound 2512939453390355945mmartin3No ratings yet

- PayslipDocument1 pagePayslipprathmeshNo ratings yet

- HRISPayslipDocument1 pageHRISPayslipJohn Carlo D. EngayNo ratings yet

- Pay No. Period EndingDocument1 pagePay No. Period EndingMa Regina ArizoNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- PaySlip 2Document1 pagePaySlip 2nor shahidNo ratings yet

- USOnline PayslipDocument2 pagesUSOnline PayslipDhundiDhakalNo ratings yet

- Dec 2022 51747565Document1 pageDec 2022 51747565Mohan Dass ANo ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- ECLERX Jul 2021-41926Document1 pageECLERX Jul 2021-41926Prdeep SinghNo ratings yet

- ECLERX Apr 2021-41926Document1 pageECLERX Apr 2021-41926Prdeep SinghNo ratings yet

- Consolidated Construction Consortium Limited Vs HiSCDocument17 pagesConsolidated Construction Consortium Limited Vs HiSCKushagra VermaNo ratings yet

- Reading 54 Pricing and Valuation of Interest Rates and Other SwapsDocument2 pagesReading 54 Pricing and Valuation of Interest Rates and Other SwapsNeerajNo ratings yet

- OL 2 The Negotiable Instruments Act, 1881Document26 pagesOL 2 The Negotiable Instruments Act, 1881Akshay PooniaNo ratings yet

- Macroeconomics Canadian 7th Edition Abel Test BankDocument13 pagesMacroeconomics Canadian 7th Edition Abel Test Banksinapateprear4k100% (26)

- Intro To Tax ManagementDocument55 pagesIntro To Tax ManagementJam HailNo ratings yet

- SalarySlip PrasarDocument1 pageSalarySlip Prasarsimanchaladdair1No ratings yet

- Raffles Fact SheetDocument5 pagesRaffles Fact SheetsergejNo ratings yet

- Pertemuan 1 6-40.XlsbDocument27 pagesPertemuan 1 6-40.XlsbLintang UtomoNo ratings yet

- Investment Analysis and Portfolio Management (ACFN 632)Document62 pagesInvestment Analysis and Portfolio Management (ACFN 632)habtamuNo ratings yet

- Application FormDocument11 pagesApplication FormkpyyvwkqbzNo ratings yet

- Thai baht investment risksDocument2 pagesThai baht investment risksChristian PiguerraNo ratings yet

- How To Measure Company ReturnsDocument11 pagesHow To Measure Company ReturnsnpapadokostasNo ratings yet

- Bodea BrochureDocument7 pagesBodea BrochureTANVI AGRAWALNo ratings yet

- Check Stub Template-1-2Document118 pagesCheck Stub Template-1-2Liza GeorgeNo ratings yet

- Exercise Foreign Exchange Market - SOLVEDDocument3 pagesExercise Foreign Exchange Market - SOLVEDamer_wah100% (1)

- (Dissol) Advanced Level Questions, Additional Questions-6Document5 pages(Dissol) Advanced Level Questions, Additional Questions-6Gyro SplashNo ratings yet

- Amaia PampangaDocument1 pageAmaia PampangadusteezapedaNo ratings yet

- The Savers-Spenders Theory of Fiscal Policy: by N. GDocument10 pagesThe Savers-Spenders Theory of Fiscal Policy: by N. Gmaba424No ratings yet

- New Prudential Guidelines July 1 2010 (Final)Document66 pagesNew Prudential Guidelines July 1 2010 (Final)tozzy12345No ratings yet

- Chapter12 SM NewDocument2 pagesChapter12 SM NewNazirul HazwanNo ratings yet

- ECS Mandate Form IDBI - Annexure2Document1 pageECS Mandate Form IDBI - Annexure2Vasudevan NagarajanNo ratings yet

- 0 - Anjali Sah AccountancyDocument16 pages0 - Anjali Sah AccountancySushmita BarlaNo ratings yet

- B V M Engineering College Vallabh VidyanagarDocument9 pagesB V M Engineering College Vallabh VidyanagarShish DattaNo ratings yet

- Review of Usual End-Of-Period Adjustments, Closing Entries, & Reversing EntriesDocument4 pagesReview of Usual End-Of-Period Adjustments, Closing Entries, & Reversing EntriesmyrangelicNo ratings yet

- Ernst & Young Islamic Funds & Investments Report 2011Document50 pagesErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)