Professional Documents

Culture Documents

Dec 2022 51747565

Uploaded by

Mohan Dass AOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec 2022 51747565

Uploaded by

Mohan Dass ACopyright:

Available Formats

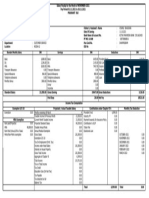

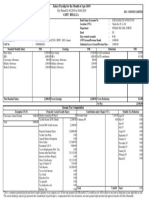

Salary Payslip for the Month of December-2022

Pay Period 01.12.2022 to 31.12.2022

HCL Technologies Ltd.

Rinald Roshan

Employee ID : 51747565 Bank Name & Account No : ICICI Bank 270701506324

Person ID : 51747565 Location (CWL) : ChennaiSEZ-SDB1-U1-GF,1F,2F,3F,4F,5F

Designation : MEMBER TECHNICAL STAFF Department : ERS MMT-MEDICAL-J&J-Surg_

DOJ / Gender : 16.08.2018 / Male Band : E1

PAN No : AYEPR3095C Days worked in month : 22.00

PF // Pension No* : HIL EPF Trust-GN/GGN/5572/407593 LWP Current/Previous Month : 9.00/0.00

UAN No : 101142376822 Sabbatical Leave Current/Previous Mon : 0.00/0.00

Standard Monthly Salary INR Earnings INR Deductions INR

Basic Salary 15,218.00 Basic Salary 10,799.87 Ee PF contribution 1,296.00

HRA 9,119.00 HRA 6,471.55 Ee LWF contribution 20.00

Holiday Allowance 4,166.00 Holiday Allowance 2,956.52

Engagement PB 1,904.00 Engagement PB 1,351.23

Food Wallet 2,000.00 Food Wallet 1,419.35

Medical Prem. Payable 83.33

EPB Recovery QTR -45.33

Total Standard Salary 32,407.00 Gross Earnings 23,036.52 Gross Deductions 1,316.00

Carry Over/ On Hold 21,720.52

Income Tax Computation

Exemption U/S 10 Projected / Actual Taxable Salary Contribution under Chapter VI A Monthly Tax Deduction

Taxable Income till Pr. Month 207,718.44 Provident Fund 17,388.00 April'22 0.00

Current Mth Taxable income 23,036.52 Voluntary PF 0.00 May'22 0.00

Projected Standard Salary 45,997.04 June'22 0.00

Taxable Ann Perks 0.00 July'22 0.00

NPS ER contribution 0.00 August'22 0.00

Gross Salary 276,752.00 September'22 0.00

Standard Deduction 50,000.00

October'22 0.00

Exemption U/S 10 0.00

Tax on Employment (Prof. Tax) 1,250.00 November'22 0.00

Income under Head Salary 225,502.00 December'22 0.00

Int. on House Prop / Other Income 0.00 January'23 0.00

Gross Total Income 225,502.00 February'23 0.00

Agg of Chapter VI 17,388.00 March'23 0.00

Total Income 208,114.00

Tax on Total Income 0.00

Tax Credit 0.00

Health and Education cess 0.00

Tax payable 0.00

Tax deducted so far 0.00

Balance Tax 0.00 Total 17,388.00 Total 0.00

*This is a computer generated payslip and doesn't require signature or any company seal. All one time payments like PB,taxable LTA,variable pay etc will be subject to one time tax deduction at your applicable tax slab

*The current month pay slip has got generated after consideration of payroll input i.e. compensation letter, flexi declaration, one-timer payment input provided and approved transfers till 24th of this month.

*Refer PF statement in ESS (My HCL) for Pension No. Page 1 of 1

You might also like

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- PDFDocument2 pagesPDFkumar Ranjan 22No ratings yet

- SafeKey ACS MPIs On Amex Enabled July 2018Document1 pageSafeKey ACS MPIs On Amex Enabled July 2018Talent BeaNo ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- Reviewer For Bookkeeping NCIIIDocument18 pagesReviewer For Bookkeeping NCIIIAngelica Faye95% (20)

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Statement 2020MTH01 65376297-UnlockedDocument4 pagesStatement 2020MTH01 65376297-UnlockedZaheda BegumNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- Pay Period 01.03.2022 To 31.03.2022: Income Tax ComputationDocument3 pagesPay Period 01.03.2022 To 31.03.2022: Income Tax ComputationParveen SainiNo ratings yet

- Galileo Quick Reference GuideDocument34 pagesGalileo Quick Reference GuideAbdullah AlHashimi100% (3)

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- Pay Period 01.01.2022 To 31.01.2022: Income Tax ComputationDocument3 pagesPay Period 01.01.2022 To 31.01.2022: Income Tax ComputationParveen SainiNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- Amrutha Feb Salary SlipDocument1 pageAmrutha Feb Salary SlipAmrutha H NNo ratings yet

- 35 - Salary Slip FormatDocument1 page35 - Salary Slip FormatAsif Rahman0% (1)

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Convergys India Services Pvt. Ltd. Payslip For The Month of February - 2021Document1 pageConvergys India Services Pvt. Ltd. Payslip For The Month of February - 2021Sandip PandyaNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Mohammad AnisNo ratings yet

- Carrefour UAE 2020Document1 pageCarrefour UAE 2020Genius icloud50% (2)

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- HCL PayslipDocument1 pageHCL PayslipkrishnaNo ratings yet

- RJ0 Ubzy 9 OA6 Ay FidDocument5 pagesRJ0 Ubzy 9 OA6 Ay FidAmitKumar0% (1)

- Case StudyDocument9 pagesCase StudyVedasri RachaNo ratings yet

- Nov 2022 51747565Document1 pageNov 2022 51747565Mohan Dass ANo ratings yet

- Payslip - Mar 2018Document1 pagePayslip - Mar 2018malikasindhuNo ratings yet

- Revenue LipcksDocument1 pageRevenue LipcksArPit GuptaNo ratings yet

- PAYSLIP FebDocument3 pagesPAYSLIP FebPraveen SainiNo ratings yet

- AUG 2023 PaySlipDocument1 pageAUG 2023 PaySlipts.hcltechbee2022No ratings yet

- Pay Period 01.02.2022 To 28.02.2022: Income Tax ComputationDocument3 pagesPay Period 01.02.2022 To 28.02.2022: Income Tax ComputationParveen SainiNo ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- Adobe Scan Nov 23, 2021Document4 pagesAdobe Scan Nov 23, 2021Addy mamatNo ratings yet

- Convergys India Services Pvt. Ltd. Payslip For The Month of October - 2021Document2 pagesConvergys India Services Pvt. Ltd. Payslip For The Month of October - 2021Nand kishore guptaNo ratings yet

- Payslip December 2023Document1 pagePayslip December 2023rajusingh05071992No ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Final FNFDocument3 pagesFinal FNFbhagender singhNo ratings yet

- Payslip October 2023Document1 pagePayslip October 2023rajusingh05071992No ratings yet

- Payslip November 2023Document1 pagePayslip November 2023rajusingh05071992No ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- PayslipDocument1 pagePayslipprathmeshNo ratings yet

- SodaPDF-converted-PAYSLIP - Umashankar VDocument1 pageSodaPDF-converted-PAYSLIP - Umashankar VCyriac JoseNo ratings yet

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Payslip March 2024Document1 pagePayslip March 2024rajusingh05071992No ratings yet

- Apr 2019Document1 pageApr 2019amit bhallaNo ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet

- Earning For The Month - April 2023: Jubilant Foodworks LTDDocument1 pageEarning For The Month - April 2023: Jubilant Foodworks LTDnishankithkumarNo ratings yet

- May 2022Document1 pageMay 2022Areeba KhanNo ratings yet

- May Salary SlipDocument1 pageMay Salary Slipaishamansuri9867No ratings yet

- PPL Brokers Setup and Usage: April 2020Document24 pagesPPL Brokers Setup and Usage: April 2020saxobobNo ratings yet

- Unknown 7Document16 pagesUnknown 7wanrahman.vspNo ratings yet

- Tax Ordinance No. 2021-22Document3 pagesTax Ordinance No. 2021-22Evangeline PalitayanNo ratings yet

- Induction ReportDocument30 pagesInduction Reportpushpesh1984No ratings yet

- Schedule of Benef Its: Savings Account Effective January 1, 2022Document2 pagesSchedule of Benef Its: Savings Account Effective January 1, 2022Aniket DubeyNo ratings yet

- KM 53 Pan-Philippine Hwy, Calamba, Laguna 4027 Philippines: Subject Code Description Section Schedule Room UnitsDocument1 pageKM 53 Pan-Philippine Hwy, Calamba, Laguna 4027 Philippines: Subject Code Description Section Schedule Room UnitsJohn Matthew Del RosarioNo ratings yet

- Popularity of Credit Cards Issued by Different BanksDocument25 pagesPopularity of Credit Cards Issued by Different BanksNaveed Karim Baksh75% (8)

- RFID Customer Care: Tag NumberDocument2 pagesRFID Customer Care: Tag NumberJethro VillahermosaNo ratings yet

- Invitation To Take The Goethe-Zertifikat B2 (Modular) Examination Your Customer Number: 0060699610Document1 pageInvitation To Take The Goethe-Zertifikat B2 (Modular) Examination Your Customer Number: 0060699610Rahiji KunNo ratings yet

- Allahabad Bank - Internet Banking System 6 PDFDocument1 pageAllahabad Bank - Internet Banking System 6 PDFarjunv_14No ratings yet

- Sheriff Seth 09063 Bank of BarodaDocument47 pagesSheriff Seth 09063 Bank of Barodasinghsanjeev00% (1)

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1No ratings yet

- Errors in Trial BalanceDocument8 pagesErrors in Trial BalanceBipin BhanushaliNo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- Mzumbe Uni. Bachelor Degree Progammes 2014 2015Document46 pagesMzumbe Uni. Bachelor Degree Progammes 2014 2015DennisEudes50% (2)

- Value of SupplyDocument16 pagesValue of Supplyhariom bajpaiNo ratings yet

- FASTag Application FormDocument4 pagesFASTag Application FormPurav PatelNo ratings yet

- Bersamin Tax CasesDocument2 pagesBersamin Tax CasesJustine EspinolaNo ratings yet

- Objection Handling: 1 No NeedDocument11 pagesObjection Handling: 1 No NeedManish LohiaNo ratings yet

- Uob Uniringgit Rewards Programme Redemption FormDocument4 pagesUob Uniringgit Rewards Programme Redemption FormShirley LzyNo ratings yet

- Export Process Flow-FCL PDFDocument8 pagesExport Process Flow-FCL PDFRonakkumar PatelNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City First DivisionDocument55 pagesRepublic of The Philippines Court of Tax Appeals Quezon City First DivisionYna YnaNo ratings yet