Professional Documents

Culture Documents

Apr 2019

Uploaded by

amit bhallaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apr 2019

Uploaded by

amit bhallaCopyright:

Available Formats

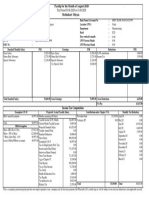

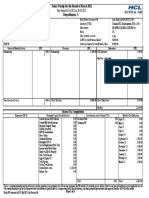

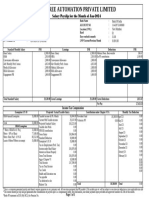

Salary Payslip for the Month of Apr-2019

Pay Period 01.04.2019 to 30.04.2019 HCL COMNET LIMITED

AMIT BHALLA

Employee ID : 51460803 Bank Name & Account No : ICICI BANK LTD 107001527829

Person ID : 51460803 Location (CWL) : Noida-Sec-58, A-104

Designation : TEAM LEADER Department : INDIAB- DEL-DEL-NORTH

DOJ / Gender : 26.06.2013 / Male Band : E0

PAN No : BTCPB0648D Days worked in month : 30.00

PF // Pension No : HCL Comnet PF Trust-025203 // RPFC - HCL Comnet LWP Current/Previous Month : 0.00/0.00

UAN No : 100080004243 Sabbatical Leave Current/Previous Mon : 0.00/0.00

Standard Monthly Salary INR Earnings INR Deductions INR

Basic Salary 15,500.00 Basic Salary 15,500.00 Ee ESI contribution 202.00

HRA 4,000.00 HRA 4,000.00 Ee PF contribution 612.00

Conveyance Allowance 800.00 Conveyance Allowance 800.00

Holiday Allowance 1,300.00 Holiday Allowance 1,300.00

Medical Allowance 1,200.00 Medical Allowance 1,200.00

Total Standard Salary 22,800.00 Gross Earnings 22,800.00 Gross Deductions 814.00

Net Pay 21,986.00

Income Tax Computation

Exemption U/S 10 Projected / Actual Taxable Salary Contribution under Chapter VI A Monthly Tax Deduction

Conveyance Annual Exempt 9,600.00 Months remaining till March 10 Provident Fund 7,344.00 April'19 0.00

Taxable Income till Pr. Month 22,800.00 Voluntary PF 0.00 May'19 0.00

Total 9,600.00

June'19 0.00

Current Mth Taxable income 22,800.00

July'19 0.00

Projected Standard Salary 22,8000.00 August'19 0.00

Taxable Ann Perks 0.00 September'19 0.00

Annual Medical Exemption 0.00 October'19 0.00

Gross Salary 273,600.00 November'19 0.00

Exemption U/S 10 9,600.00 December'19 0.00

Tax on Employment (Prof. Tax) 0.00 0.00

January'20

Income under Head Salary 253,152.00

February'20 0.00

Interest on House Property 0.00

March'20 0.00

Gross Total Income 253,152.00

Agg of Chapter VI 7,344.00

Total Income 245,808.00

Tax on Total Income 0.00

Tax Credit 0.00

Education Cess 0.00

Tax payable 0.00

Tax deducted so far 0.00

Balance Tax 0.00 Total 7,344.00 Total 0.00

*This is a computer generated payslip and doesn't require signature or any company seal. All one time payments like PB,taxable LTA,variable pay etc will be subject to one time tax deduction at your applicable tax slab

*The current month pay slip has got generated after consideration of payroll input i.e. compensation letter, flexi declaration, one-timer payment input provided and approved transfers till 24th of thismonth.

You might also like

- SodaPDF-converted-PAYSLIP - Umashankar VDocument1 pageSodaPDF-converted-PAYSLIP - Umashankar VCyriac JoseNo ratings yet

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- AUG 2023 PaySlipDocument1 pageAUG 2023 PaySlipts.hcltechbee2022No ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- Pay Period 01.03.2022 To 31.03.2022: Income Tax ComputationDocument3 pagesPay Period 01.03.2022 To 31.03.2022: Income Tax ComputationParveen SainiNo ratings yet

- Pay Period 01.02.2022 To 28.02.2022: Income Tax ComputationDocument3 pagesPay Period 01.02.2022 To 28.02.2022: Income Tax ComputationParveen SainiNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- PAYSLIP FebDocument3 pagesPAYSLIP FebPraveen SainiNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- Latha R (KT083) - PayslipDocument1 pageLatha R (KT083) - Paysliprangaswamy8194No ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- Pay Period 01.01.2022 To 31.01.2022: Income Tax ComputationDocument3 pagesPay Period 01.01.2022 To 31.01.2022: Income Tax ComputationParveen SainiNo ratings yet

- Payslip - Mar 2018Document1 pagePayslip - Mar 2018malikasindhuNo ratings yet

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocument1 pagePayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNo ratings yet

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (1)

- Payslip MSR Augt2021Document3 pagesPayslip MSR Augt2021B.GOUTHAM SABARIESNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- Revenue LipcksDocument1 pageRevenue LipcksArPit GuptaNo ratings yet

- HCL PayslipDocument1 pageHCL PayslipkrishnaNo ratings yet

- PaySlip MSR Sept2021Document3 pagesPaySlip MSR Sept2021B.GOUTHAM SABARIESNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- Nov 2022 51747565Document1 pageNov 2022 51747565Mohan Dass ANo ratings yet

- PDFDocument2 pagesPDFkumar Ranjan 22No ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Pay Slip For April 2019: Integrated Decisions and Systems India Private LimitedDocument1 pagePay Slip For April 2019: Integrated Decisions and Systems India Private LimitedANANT LONENo ratings yet

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Document1 pageKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- April 2023 - UnlockedDocument2 pagesApril 2023 - Unlockedajinkya jagtapNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- Salary PDFDocument2 pagesSalary PDFAjay KharwarNo ratings yet

- Earning Rate Amount (RS.) Deductions Amount (RS.)Document2 pagesEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarNo ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Gapminder WebsiteDocument2 pagesGapminder WebsitejenieNo ratings yet

- Call Front Spread - Call Ratio Vertical Spread - The Options PlaybookDocument3 pagesCall Front Spread - Call Ratio Vertical Spread - The Options PlaybookdanNo ratings yet

- Ortiz, John Paul HRM 1-4Document5 pagesOrtiz, John Paul HRM 1-4John Paul Aguilar OrtizNo ratings yet

- Course Outline - Principles of Marketing BcomDocument4 pagesCourse Outline - Principles of Marketing Bcomwairimuesther506No ratings yet

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Document3 pagesICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Tarif Customs Clearance Di SurabayaDocument2 pagesTarif Customs Clearance Di SurabayaAlvinBurhaniNo ratings yet

- Vietnam Tax Legal HandbookDocument52 pagesVietnam Tax Legal HandbookaNo ratings yet

- NCP 31Document14 pagesNCP 31Arunashish MazumdarNo ratings yet

- Report On "E-Banking and Customer Satisfaction-: A Comprehensive Study On Sonali Bank Limited."Document37 pagesReport On "E-Banking and Customer Satisfaction-: A Comprehensive Study On Sonali Bank Limited."ঘুম বাবুNo ratings yet

- Tck-In Day 9Document3 pagesTck-In Day 9Julieth RiañoNo ratings yet

- Oceanic Bank - Letter From John Aboh - CEODocument1 pageOceanic Bank - Letter From John Aboh - CEOOceanic Bank International PLCNo ratings yet

- Philippine School of Business Administration Accounting 309: Accounting For Business CombinationDocument35 pagesPhilippine School of Business Administration Accounting 309: Accounting For Business CombinationLorraineMartinNo ratings yet

- Methods of Note IssueDocument8 pagesMethods of Note IssueNeelabh KumarNo ratings yet

- Homeroom Pta Financial ReportDocument1 pageHomeroom Pta Financial ReportRoxanne Tiffany Dotillos SarinoNo ratings yet

- Brta Payment For Learner HeavyDocument3 pagesBrta Payment For Learner HeavymotiarbspNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- 1 Women's Entrepreneurship and Economic Empowerment (Sample Proposal)Document3 pages1 Women's Entrepreneurship and Economic Empowerment (Sample Proposal)ernextohoNo ratings yet

- Logistics and Supply Chain Innovation Bridging The Gap Between Theory and Practice PDFDocument432 pagesLogistics and Supply Chain Innovation Bridging The Gap Between Theory and Practice PDFSanjay SudhakaranNo ratings yet

- COBECON - Math ProblemsDocument16 pagesCOBECON - Math ProblemsdocumentsNo ratings yet

- Jetblue Airlines: (Success Story)Document23 pagesJetblue Airlines: (Success Story)Mantombi LekhuleniNo ratings yet

- Department of Business Administration, Faculty of Management, Maharaja Krishnakumarsinhji Bhavnagar University, BhavnagarDocument31 pagesDepartment of Business Administration, Faculty of Management, Maharaja Krishnakumarsinhji Bhavnagar University, BhavnagarChaitali Suvagiya SolankiNo ratings yet

- Find Solutions For Your Homework: Books Study Writing Flashcards Math Solver InternshipsDocument8 pagesFind Solutions For Your Homework: Books Study Writing Flashcards Math Solver InternshipsAbd ur Rehman BodlaNo ratings yet

- Bay' Al-TawarruqDocument12 pagesBay' Al-TawarruqMahyuddin Khalid67% (3)

- Name: Grade: SubjectDocument5 pagesName: Grade: SubjectArkar.myanmar 2018100% (1)

- Efqm Excellence Model: December 2013Document15 pagesEfqm Excellence Model: December 2013thelearner16No ratings yet

- Question : Andalas University, Faculty of EconomicsDocument1 pageQuestion : Andalas University, Faculty of EconomicsNaurah Atika DinaNo ratings yet

- Manpower, Consultant and HR Companies of UAEDocument5 pagesManpower, Consultant and HR Companies of UAENaeem Uddin95% (20)

- Lee Case StudyDocument2 pagesLee Case StudyRodolfo Mapada Jr.100% (2)

- Checkpoint Exam 2 (Study Sessions 10-15)Document11 pagesCheckpoint Exam 2 (Study Sessions 10-15)Bảo TrâmNo ratings yet

- MBUS Assignment (APPLE)Document1 pageMBUS Assignment (APPLE)Shaw MingNo ratings yet