Professional Documents

Culture Documents

Payslip Jan 2024 Shehbaz Shakeel Shaikh

Uploaded by

eliajaun71Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip Jan 2024 Shehbaz Shakeel Shaikh

Uploaded by

eliajaun71Copyright:

Available Formats

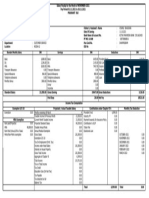

SANSREE AUTOMATION PRIVATE LIMITED

Salary Payslip for the Month of Jan-2024

Name : Shehbaz Shakeel Shaikh Bank Name : Bank Of India

Employee ID : SA000671 ACCOUNT NO : 154429732400869

Designation : Senior Executive Location (CWL) : Navi Mumbai

DOJ / Gender : 08.02.2021 / Male Band : E1

PAN No : CMWPS4535E Days worked in month : 31.00

PF // Pension No* : GN/GGN/3372/403648 LWP Current/Previous Month : 0.00/0.00

Standard Monthly Salary INR Earnings INR Deductions INR

Basic Salary 12,908.00 Basic Salary 12,908.00 Medical Prem. Recoverable 266.67

HRA 2,924.00 HRA 2,924.00 Ee PF contribution 1,549.00

Conveyance Allowance 2,000.00 Conveyance Allowance 2,000.00

Adv Monthly Perfr. bonus 4,813.00 Adv Monthly Perfr. bonus 4,813.00

Medical Allowance 2,000.00 Medical Allowance 2,000.00

BHA Allowance 3,000.00 BHA Allowance 3,000.00

Engagement PB 1,604.00 Engagement PB 1,604.00

Total Standard Salary 29,249.00 Gross Earnings 29,249.00 Gross Deductions 1,815.67

Net Pay 27,433.33

Income Tax Computation

Exemption U/S 10 Projected / Actual Taxable Salary Contribution under Chapter VI A Monthly Tax Deduction

HRA Annual Exemption 35,088.00 Taxable Income till Pr. Month 58,494.00 Provident Fund 18,588.00 April'23 0.00

Current Mth Taxable income 29,247.00 Voluntary PF 0.00 May'23 0.00

Total 35,088.00 Projected Standard Salary 263,223.00 0.00

June'23

HRA Exemption Taxable Ann Perks 0.00 July'23 0.00

* Metro -HRA Rcvd / Proj 35,088.00 NPS ER contribution 0.00

August'23 0.00

Metro - 50% of Basic 77,436.00 Gross Salary 350,964.00

Metro -Rent Paid - 10 % B 80,512.80 September'23 0.00

Standard Deduction 50,000.00

Least of Metro/NMetro is exempt 35,088.00 October'23 0.00

Exemption U/S 10 35,088.00

Tax on Employment (Prof. Tax) 0.00 November'23 0.00

Income under Head Salary 265,876.00 December'23 0.00

Interest on House Property 0.00 January'24 0.00

Gross Total Income 265,876.00 February'24 0.00

Agg of Chapter VI 18,588.00 0.00

Total Income 247,290.00 0.00

Tax on Total Income 0.00 0.00

0.00

Tax Credit 0.00 0.00

Health and Education cess 0.00

Tax payable 0.00

Tax deducted so far 0.00

Balance Tax 0.00 Total 18,588.00 Total 0.00

*This is a computer generated payslip and doesn't require signature or any company seal. All one time payments like PB,taxable LTA,variable pay etc will be subject to one time tax deduction at your applicable tax slab

*The current month pay slip has got generated after consideration of payroll input i.e. compensation letter, flexi declaration, one-timer payment input provided and approved transfers till 24th of this month.

*Refer PF statement in ESS (My HCL) for Pension No. Page 1 of 1

You might also like

- Total Deduction This Perio: Earnings StatementDocument1 pageTotal Deduction This Perio: Earnings StatementPepe DecaroNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- Nonprofit Financial Policies - SAMPLEDocument3 pagesNonprofit Financial Policies - SAMPLEJill Allison Warren100% (8)

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Payroll Training PresentationDocument47 pagesPayroll Training PresentationMarkandeya ChitturiNo ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- US Payroll - 18C PDFDocument286 pagesUS Payroll - 18C PDFSandeep SinghNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- It Recruiters MaterialDocument41 pagesIt Recruiters MaterialSamule Paul100% (2)

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- EWT Fusion Payroll Training Day 2Document54 pagesEWT Fusion Payroll Training Day 2suryakala meduriNo ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- BM2613Document1 pageBM2613Pratik DesaiNo ratings yet

- PEER On PERSDocument44 pagesPEER On PERSRuss LatinoNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- GP Fund Calculation Formula Sheet For GP Fund StatementDocument4 pagesGP Fund Calculation Formula Sheet For GP Fund StatementLucky KhanNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- 2022 Hospitality ReportDocument13 pages2022 Hospitality ReportIvan HerreraNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- Document Retention Policy TemplateDocument14 pagesDocument Retention Policy TemplateOm Prakash - AIPL(QC)No ratings yet

- Anuja Tejinkar3Document1 pageAnuja Tejinkar3javed9890No ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- HCL PayslipDocument1 pageHCL PayslipkrishnaNo ratings yet

- Labor Economics 7Th Edition Borjas Solutions Manual Full Chapter PDFDocument34 pagesLabor Economics 7Th Edition Borjas Solutions Manual Full Chapter PDFphualexandrad39100% (9)

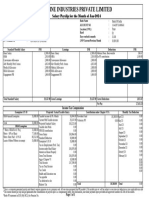

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

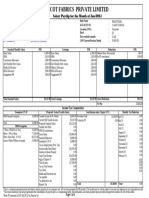

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- AUG 2023 PaySlipDocument1 pageAUG 2023 PaySlipts.hcltechbee2022No ratings yet

- Payslip - Mar 2018Document1 pagePayslip - Mar 2018malikasindhuNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Nov 2022 51747565Document1 pageNov 2022 51747565Mohan Dass ANo ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- Dec 2022 51747565Document1 pageDec 2022 51747565Mohan Dass ANo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- HTMLReportsDocument3 pagesHTMLReportsparveenaliya697No ratings yet

- Apr 2019Document1 pageApr 2019amit bhallaNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Revenue LipcksDocument1 pageRevenue LipcksArPit GuptaNo ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- Dec PayslipDocument1 pageDec Payslipnegishilpa051No ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Siraparapu Balaji-payslip-Jun-2023Document1 pageSiraparapu Balaji-payslip-Jun-2023svnet vizagNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- Rajiv Verma - Income Tax Computation StatementDocument2 pagesRajiv Verma - Income Tax Computation StatementRajiv VermaNo ratings yet

- BM2613Document1 pageBM2613Pratik DesaiNo ratings yet

- PAYSLIP FebDocument3 pagesPAYSLIP FebPraveen SainiNo ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- FNF SlipDocument1 pageFNF SlipHimanshu MaheshwariNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- Salary Slip Format For 25000Document2 pagesSalary Slip Format For 25000Pandit nishant kumar Shukla (Nishant shukla)No ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26Document1 pageEmployee Name - (EE & ER) - PDOC-Date Paid-2023-02-26William JoeNo ratings yet

- Philippine Bank of Communications vs. NLRCDocument13 pagesPhilippine Bank of Communications vs. NLRCRachel GreeneNo ratings yet

- N&A CP - Event 20181230Document17 pagesN&A CP - Event 20181230Harith FadhilaNo ratings yet

- BERAYDocument3 pagesBERAYberaylyatif2No ratings yet

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (38)

- Managerial Accounting: Job Order CostingDocument75 pagesManagerial Accounting: Job Order Costingsouayeh wejdenNo ratings yet

- City of Rayne 2015 Budget Final Amend and Approved 2015 2016Document39 pagesCity of Rayne 2015 Budget Final Amend and Approved 2015 2016Theresa RichardNo ratings yet

- PPP Documentation Checklist 2Document1 pagePPP Documentation Checklist 2opus57No ratings yet

- Script Toefl Test 6Document7 pagesScript Toefl Test 6Parmenas ObajaNo ratings yet

- Social Security System ThesisDocument7 pagesSocial Security System Thesismelanierussellvirginiabeach100% (2)

- Shuttlers Metropolitan ReportDocument7 pagesShuttlers Metropolitan ReportAkinyemi SilasNo ratings yet

- ABS CBN Vs TajanlangitDocument22 pagesABS CBN Vs TajanlangitKristina Domingo100% (1)

- Chart of AccountsDocument40 pagesChart of AccountsUsman ZafarNo ratings yet

- Module 8 Sss Acd Pacturan CjaDocument7 pagesModule 8 Sss Acd Pacturan CjaCzarina JaneNo ratings yet

- GL Owners - JTDocument50 pagesGL Owners - JTSuneet GaggarNo ratings yet

- Job Order Costing 1Document46 pagesJob Order Costing 1Rajib Ali bhuttoNo ratings yet

- Shipping Industry Almanac 2012 - Final PDFDocument516 pagesShipping Industry Almanac 2012 - Final PDFEmmanuelMicheNo ratings yet

- Check Stubs 3.0Document3 pagesCheck Stubs 3.0maliktaimoorsurahNo ratings yet

- M2 Audit Working PaperDocument6 pagesM2 Audit Working PaperCheesy MacNo ratings yet