Professional Documents

Culture Documents

BERAY

Uploaded by

beraylyatif2Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BERAY

Uploaded by

beraylyatif2Copyright:

Available Formats

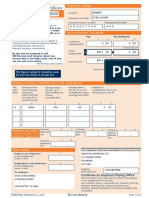

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

120 / ME62966

6 Tax Code at leaving date

2 Employee's National Insurance number 1257L

SS 66 18 50 C

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/ Month 1

3 Title - enter MR, MRS, MISS, MS or other title

MR

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

TEFIK

Week number Month number 8

First or given name(s)

BERAY LYATIF

Total pay to date

£ 722.45 p

4 Leaving date DD MM YYYY

12 11 2023 Total tax to date

£ 0.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee's private address

are those shown at box 7

Total pay in this employment 7 MESSITER HOUSE

LEIRUM STREET

£ p

Total tax in this employment

£ p Postcode

N1 0JL

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on this

form are correct.

459 / BARBERS

Employer name and address

SHARP RAZOR LTD

20-22 WENLOCK ROAD

ISLINGTON

10 Gender. Enter 'X' in the appropriate box LONDON

Male X Female

11 Date of birth DD MM YYYY Postcode

02 05 2001 N1 7GU

Date DD MM YYYY

01 12 2023

To the employee Tax credits

The P45 is in three parts. Please keep this part (Part1A) safe. Tax credits are flexible. They adapt to changes in your life, such

Copies are not available. You might need the information in as leaving a job. If you need to let us know about a change in

part 1A to fill in a Tax Return if you are sent one. your income, phone 0845 300 3900.

Please read the notes in Part 2 that accompany Part 1A.

The notes give some important information about what you To the new employer

should do next and what you should do with Parts 2 and 3 of If your new employee gives you this Part 1A, please return

this form. it to them. Deal with Parts 2 and 3 as normal.

P45(Online) Part 1A HMRC 10/08

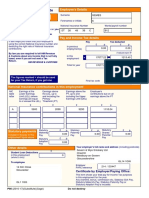

P45 Part 2

Details of employee leaving work

Copy for new employer

5 Student Loan deductions

1 Employer PAYE reference

Office number Reference number

Student Loan deductions to continue

120 / ME62966

6 Tax Code at leaving date

2 Employee's National Insurance number 1257L

SS 66 18 50 C

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/ Month 1

3 Title - enter MR, MRS, MISS, MS or other title

MR

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

TEFIK

Week number Month number 8

First or given name(s)

BERAY LYATIF

Total pay to date

£ 722.45 p

4 Leaving date DD MM YYYY

12 11 2023 Total tax to date

£ 0.00 p

To the employee Claiming Jobseeker's Allowance or

This form is important to you. Take good care of it Employment and Support Allowance (ESA)

and keep it safe. Copies are not available. Please keep Take this form to your Jobcentre Plus office. They will pay you

parts 2 and 3 of the form together and do not alter them any tax refund you may be entitled to when your claim ends,

in any way. or at 5 April if this is earlier.

Going to a new job Not working and not claiming Jobseeker's Allowance or

Give Parts 2 and 3 of this form to your new employer, Employment and Support Allowance (ESA)

or you will have tax deducted using the emergency If you have paid tax and wish claim a refund ask for

code and may pay too much tax. If you do not want form P50 Claiming tax back when you have stopped working

your new employer to know the details on this form, from any HMRC office or Enquiry Centre.

send it to your HM Revenue and Customs (HMRC) office

immediately with a letter saying so and giving the Help

name and address of your new employer. HMRC can

If you need further help you can contact any HMRC office

make special arrangements, but you may pay too

or Enquiry Centre. You can find us in The Phone Book under

much tax for a while as a result of this.

HM Revenue & Customs or go to www.hmrc.gov.uk

Going abroad To the new employer

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom Check this form and complete boxes 8 to 18 in Part 3

and prepare a form P11 Deductions Working Sheet.

from any HMRC office or Enquiry Centre.

Follow the instructions in the Employer Helpbook E13

Day-to-day payroll, for how to prepare a P11 Deductions

Becoming self-employed Working Sheet. Send Part 3 of this form to your HMRC office

You must register with HMRC within three months of

immediately. Keep part 2.

becoming self-employed or you could incur a penalty.

To register as newly self-employed see the The Phone Book

under HM Revenue & Customs or go to www.hmrc.gov.uk

to get a copy of the booklet SE1 Are you thinking of working

for yourself?

P45(Online) Part 2 HMRC 10/08

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

5 Student Loan deductions

1 Employer PAYE reference

Office number Reference number

Student Loan deductions to continue

120 / ME62966

6 Tax Code at leaving date

2 Employee's National Insurance number 1257L

SS 66 18 50 C

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/ Month 1

3 Title - enter MR, MRS, MISS, MS or other title

MR

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

TEFIK

Week number Month number 8

First or given name(s)

BERAY LYATIF

Total pay to date

£ 722.45 p

4 Leaving date DD MM YYYY

12 11 2023 Total tax to date

£ 0.00 p

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8 New Employer PAYE reference 15 Employee's private address

Office number Reference number

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April

Declaration

12 Enter Tax Code in use if different to Tax Code at box 6

18 I have prepared a P11 Deductions Working Sheet in

accordance with the details above.

If week 1 or month 1 applies, enter 'X' in the box below. Employer name and address

Week 1/ Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

figure here

Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45(Online) Part 3 HMRC 10/08

You might also like

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- P45 Part 1A Details of Employee Leaving Work: Office Number Reference NumberDocument3 pagesP45 Part 1A Details of Employee Leaving Work: Office Number Reference Numbermpmplan3No ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- GPGB SS P45Document3 pagesGPGB SS P45Dedu DzmaNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- P45 - Regan LaingDocument3 pagesP45 - Regan LaingbangtantaekNo ratings yet

- P45 94142 (1) BunDocument4 pagesP45 94142 (1) BunCosty DutaNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Bratuadriana 90@Document3 pagesBratuadriana 90@Adelina& KevinNo ratings yet

- P45 (ONLINE) Duc Trong Duong 2Document3 pagesP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- P45 - HM R&CDocument3 pagesP45 - HM R&Cdmitrykrylov34No ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- US Internal Revenue Service: f943 - 1991Document4 pagesUS Internal Revenue Service: f943 - 1991IRS100% (1)

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- US Internal Revenue Service: f943 - 1995Document4 pagesUS Internal Revenue Service: f943 - 1995IRSNo ratings yet

- 2013 R QamarDocument6 pages2013 R Qamarshahswar khanNo ratings yet

- Nicolae Greurus - p60 (2023-24)Document1 pageNicolae Greurus - p60 (2023-24)danielagonciulea6No ratings yet

- US Internal Revenue Service: f943 - 1994Document4 pagesUS Internal Revenue Service: f943 - 1994IRSNo ratings yet

- US Internal Revenue Service: f5884 - 2001Document3 pagesUS Internal Revenue Service: f5884 - 2001IRSNo ratings yet

- Bir 2305Document1 pageBir 2305Fernan EnadNo ratings yet

- Return To Work Establishment Report Form v3Document3 pagesReturn To Work Establishment Report Form v3raymond paul adelantarNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- US Internal Revenue Service: f941 - 2003Document4 pagesUS Internal Revenue Service: f941 - 2003IRSNo ratings yet

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- Full & Final Pay Calculation: Over 12Document4 pagesFull & Final Pay Calculation: Over 12jalalNo ratings yet

- 1600-VT 0322Document3 pages1600-VT 0322Mishelle RamosNo ratings yet

- US Internal Revenue Service: f8861 - 1998Document3 pagesUS Internal Revenue Service: f8861 - 1998IRSNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- How To Read Your Payslip - MonthlyPaid - 2022Document2 pagesHow To Read Your Payslip - MonthlyPaid - 2022VladyslavNo ratings yet

- US Internal Revenue Service: f941 - 2000Document4 pagesUS Internal Revenue Service: f941 - 2000IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2003Document3 pagesUS Internal Revenue Service: f8861 - 2003IRSNo ratings yet

- Office of The Dy District Education Officer (M) Haroonabad: GPS Chak 00/1.R BY6 0 0 0 Description 0 0 0 0 0 0 0 0 1 4Document6 pagesOffice of The Dy District Education Officer (M) Haroonabad: GPS Chak 00/1.R BY6 0 0 0 Description 0 0 0 0 0 0 0 0 1 4Ammar Bin QasimNo ratings yet

- Quarterly Percentage Tax Return: 12 - December 059Document2 pagesQuarterly Percentage Tax Return: 12 - December 059Abby UmipigNo ratings yet

- Change Form - M.phill Qualification AllowanceDocument1 pageChange Form - M.phill Qualification AllowanceMuhammad AzamNo ratings yet

- US Internal Revenue Service: f943 - 1996Document4 pagesUS Internal Revenue Service: f943 - 1996IRSNo ratings yet

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- US Internal Revenue Service: F940ez - 1994Document4 pagesUS Internal Revenue Service: F940ez - 1994IRSNo ratings yet

- Same-Day Worksheet 1010Document2 pagesSame-Day Worksheet 1010Hans GadamerNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Lozada Vs MendozaDocument4 pagesLozada Vs MendozaHarold EstacioNo ratings yet

- Franieboy Ponce, BSIT-1, - DAY 2 ACTIVITYDocument2 pagesFranieboy Ponce, BSIT-1, - DAY 2 ACTIVITYFrancisco PonceNo ratings yet

- Unleash Your Inner Millionaire: Achieve Wealth, Success, and Prosperity by Reprogramming Your Subconscious MindDocument20 pagesUnleash Your Inner Millionaire: Achieve Wealth, Success, and Prosperity by Reprogramming Your Subconscious MindMariana PopaNo ratings yet

- Jeoparty Fraud Week 2022 EditableDocument65 pagesJeoparty Fraud Week 2022 EditableRhea SimoneNo ratings yet

- Net Present Value AnalysisDocument6 pagesNet Present Value AnalysisAmna Khalid100% (1)

- Transport System in Living ThingsDocument40 pagesTransport System in Living ThingsHarijani SoekarNo ratings yet

- Glint 360 Design GuideDocument2 pagesGlint 360 Design GuidebNo ratings yet

- Rock Type Identification Flow Chart: Sedimentary SedimentaryDocument8 pagesRock Type Identification Flow Chart: Sedimentary Sedimentarymeletiou stamatiosNo ratings yet

- SAi Sankata Nivarana StotraDocument3 pagesSAi Sankata Nivarana Stotrageetai897No ratings yet

- Block-1 Communication IGNOUDocument81 pagesBlock-1 Communication IGNOUr kumarNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- Pentagram Business PlanDocument13 pagesPentagram Business PlantroubledsoulNo ratings yet

- John Wick 4 HD Free r6hjDocument16 pagesJohn Wick 4 HD Free r6hjafdal mahendraNo ratings yet

- ISO 9001 QuizDocument4 pagesISO 9001 QuizGVS Rao0% (1)

- Coaching Manual RTC 8Document1 pageCoaching Manual RTC 8You fitNo ratings yet

- Cigna Fourth Quarter 2015 Form 10 KDocument148 pagesCigna Fourth Quarter 2015 Form 10 KDaniel KerouacNo ratings yet

- Café Management System Full and Final ReportDocument18 pagesCafé Management System Full and Final ReportMuhammad Xalman Xhaw100% (3)

- R. K. NarayanDocument9 pagesR. K. NarayanCutypie Dipali SinghNo ratings yet

- SyerynDocument2 pagesSyerynHzlannNo ratings yet

- TAX Report WireframeDocument13 pagesTAX Report WireframeHare KrishnaNo ratings yet

- Pr1 m4 Identifying The Inquiry and Stating The ProblemDocument61 pagesPr1 m4 Identifying The Inquiry and Stating The ProblemaachecheutautautaNo ratings yet

- Life Without A Centre by Jeff FosterDocument160 pagesLife Without A Centre by Jeff Fosterdwhiteutopia100% (5)

- Hotel BookingDocument1 pageHotel BookingJagjeet SinghNo ratings yet

- Composition PsychologyDocument1 pageComposition PsychologymiguelbragadiazNo ratings yet

- 11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Document2 pages11-03-25 PRESS RELEASE: The Riddle of Citizens United V Federal Election Commission... The Missing February 22, 2010 Judgment...Human Rights Alert - NGO (RA)No ratings yet

- Class 11 Class Biology Syllabus 2011-12Document5 pagesClass 11 Class Biology Syllabus 2011-12Sunaina RawatNo ratings yet

- Research Methods in Accounting & Finance Chapter 5Document27 pagesResearch Methods in Accounting & Finance Chapter 5bikilahussenNo ratings yet

- English Unit 7 MarketingDocument21 pagesEnglish Unit 7 MarketingKobeb EdwardNo ratings yet

- 173544avaya Aura AES 7-0 JTAPI Programmers GuideDocument88 pages173544avaya Aura AES 7-0 JTAPI Programmers GuideAhmed SakrNo ratings yet

- High-Performance Cutting and Grinding Technology For CFRP (Carbon Fiber Reinforced Plastic)Document7 pagesHigh-Performance Cutting and Grinding Technology For CFRP (Carbon Fiber Reinforced Plastic)Dongxi LvNo ratings yet