Professional Documents

Culture Documents

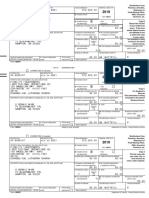

P45 - Regan Laing

Uploaded by

bangtantaekOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P45 - Regan Laing

Uploaded by

bangtantaekCopyright:

Available Formats

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

585 / NY11089

6 Tax Code at leaving date

2 Employee's National Insurance number

1257L

PK601033B

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Laing

Week number Month number 8

First or given name(s)

Regan Total pay to date

£ £1,099.37 p

4 Leaving date DD MM YYYY

Total tax to date

01 11 2022

£ £0.00 p

8 This employment pay and tax. If no entry here, the amounts 12 Employee s private address

are those shown at box 7.

22 Fitzalan Road

Total pay in this employment

Bedale

£ £1,099.37 p North Yorkshire

Total tax in this employment

£ £0.00 p Postcode

DL8 2DX

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

823 Employer name and address

THM402112 Catering

Lightwater Valley Attractions Ltd

36 Drury Lane

10 Gender. Enter 'X' in the appropriate box London

Male Female X

11 Date of birth DD MM YYYY Postcode

16 06 2005 WC2B 5RR

Date DD MM YYYY

23 11 2022

To the employee Tax credits

The P45 is in three parts. Please keep this part (Part 1A) safe. Tax credits are flexible. They adapt to changes in your life, such

Copies are not available. You might need the information in as leaving a job. If you need to let us know about a change in

Part 1A to fill in a Tax Return if you are sent one. your income, phone 0845 300 3900.

Please read the notes in Part 2 that accompany Part 1A. To the new employer

The notes give some important information about what you If your new employee gives you this Part 1A, please return

should do next and what you should do with Parts 2 and 3 of it to them. Deal with Parts 2 and 3 as normal.

this form.

P45 (Online) Part 1

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

585 / NY11089

6 Tax Code at leaving date

2 Employee's National Insurance number

1257L

PK601033B

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Laing

Week number Month number 8

First or given name(s)

Regan Total pay to date

£ £1,099.37 p

4 Leaving date DD MM YYYY

Total tax to date

01 11 2022

£ £0.00 p

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

keep it safe. Copies are not available. Please keep Employment and Support Allowance (ESA)

Parts 2 and 3 of the form together and do not alter them Take this form to your Jobcentre Plus office. They will pay you

in any way. any tax refund you may be entitled to when your claim ends,

Going to a new job or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, Not working and not claiming Jobseeker's Allowance or

or you will have tax deducted using the emergency Employment and Support Allowance (ESA)

code and may pay too much tax. If you do not want If you have paid tax and wish to claim a refund ask for

your new employer to know the details on this form, form P50 Claiming tax back when you have stopped

send it to your HM Revenue & Customs (HMRC) office working from any HMRC office or Enquiry Centre.

immediately with a letter saying so and giving the

name and address of your new employer. HMRC can Help

If you need further help you can contact any HMRC office

make special arrangements, but you may pay too

or Enquiry Centre. You can find us in The Phone Book under

much tax for a while as a result of this.

HM Revenue & Customs or go to www.hmrc.gov.uk

Going abroad

If you are going abroad or returning to a country To the new employer

outside the UK ask for form P85 Leaving the United Kingdom Check this form and complete boxes 8 to 18 in Part 3

from any HMRC office or Enquiry Centre. and prepare a form P11 Deductions Working Sheet.

Becoming self-employed Follow the instructions in the Employer Helpbook E13

You must register with HMRC within three months of Day-to-day payroll, for how to prepare a P11 Deductions

becoming self-employed or you could incur a penalty. Working Sheet. Send Part 3 of this form to your HMRC office

To register as newly self-employed see The Phone Book immediately. Keep Part 2.

under HM Revenue & Customs or go to www.hmrc.gov.uk

to get a copy of the booklet SE1 Are you thinking of working

for yourself?

P45 (Online) Part 1

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

585 / NY11089

6 Tax Code at leaving date

2 Employee's National Insurance number

1257L

PK601033B

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

Laing

Week number Month number 8

First or given name(s)

Regan Total pay to date

£ £1,099.37 p

4 Leaving date DD MM YYYY

Total tax to date

01 11 2022

£ £0.00 p

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8 New employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter Tax Code in use if different to the Tax Code at box 6.

18 I have prepared a P11 Deductions Working Sheet in

accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

figure here.

Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45 (Online) Part 1

You might also like

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- Ninja® Foodi™ Smart XL 6-In-1 Indoor Grill Quick Start GuideDocument2 pagesNinja® Foodi™ Smart XL 6-In-1 Indoor Grill Quick Start GuidehawkjohnNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- Escrow AgreementDocument3 pagesEscrow Agreementmadelyn sarmientaNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- Perfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyDocument217 pagesPerfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyChin Mun LoyNo ratings yet

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- Trends Q1-W3Document13 pagesTrends Q1-W3Samano PaodacNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Probability Distributions Summary - Exam PDocument1 pageProbability Distributions Summary - Exam Proy_gettyNo ratings yet

- P45 (ONLINE) Duc Trong Duong 2Document3 pagesP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- Bir 2305Document1 pageBir 2305Fernan EnadNo ratings yet

- Dresses For Every Occasion: Pattern SheetDocument19 pagesDresses For Every Occasion: Pattern SheetManuela IacobNo ratings yet

- P45 Part 1A Details of Employee Leaving Work: Office Number Reference NumberDocument3 pagesP45 Part 1A Details of Employee Leaving Work: Office Number Reference Numbermpmplan3No ratings yet

- GPGB SS P45Document3 pagesGPGB SS P45Dedu DzmaNo ratings yet

- BERAYDocument3 pagesBERAYberaylyatif2No ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- P45 94142 (1) BunDocument4 pagesP45 94142 (1) BunCosty DutaNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Bratuadriana 90@Document3 pagesBratuadriana 90@Adelina& KevinNo ratings yet

- P45 - HM R&CDocument3 pagesP45 - HM R&Cdmitrykrylov34No ratings yet

- US Internal Revenue Service: f8861 - 2003Document3 pagesUS Internal Revenue Service: f8861 - 2003IRSNo ratings yet

- US Internal Revenue Service: f8861 - 1998Document3 pagesUS Internal Revenue Service: f8861 - 1998IRSNo ratings yet

- US Internal Revenue Service: f5884 - 2001Document3 pagesUS Internal Revenue Service: f5884 - 2001IRSNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- US Internal Revenue Service: f8861 - 2005Document3 pagesUS Internal Revenue Service: f8861 - 2005IRSNo ratings yet

- US Internal Revenue Service: f8881 - 2005Document2 pagesUS Internal Revenue Service: f8881 - 2005IRSNo ratings yet

- US Internal Revenue Service: f5884 - 2003Document3 pagesUS Internal Revenue Service: f5884 - 2003IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2002Document3 pagesUS Internal Revenue Service: f8861 - 2002IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2004Document3 pagesUS Internal Revenue Service: f8861 - 2004IRSNo ratings yet

- US Internal Revenue Service: f941 - 2000Document4 pagesUS Internal Revenue Service: f941 - 2000IRSNo ratings yet

- Tilsendt Selvangivelse 2015Document8 pagesTilsendt Selvangivelse 2015Paulius KaminskasNo ratings yet

- US Internal Revenue Service: f8884 - 2003Document4 pagesUS Internal Revenue Service: f8884 - 2003IRSNo ratings yet

- US Internal Revenue Service: f8881 - 2004Document2 pagesUS Internal Revenue Service: f8881 - 2004IRSNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- US Internal Revenue Service: f8881 - 2002Document2 pagesUS Internal Revenue Service: f8881 - 2002IRSNo ratings yet

- US Internal Revenue Service: f8845 - 2002Document3 pagesUS Internal Revenue Service: f8845 - 2002IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1999Document3 pagesUS Internal Revenue Service: f5884 - 1999IRSNo ratings yet

- US Internal Revenue Service: f941 - 2003Document4 pagesUS Internal Revenue Service: f941 - 2003IRSNo ratings yet

- US Internal Revenue Service: f943 - 1991Document4 pagesUS Internal Revenue Service: f943 - 1991IRS100% (1)

- US Internal Revenue Service: f8845 - 2003Document3 pagesUS Internal Revenue Service: f8845 - 2003IRSNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- GP-100 Software User Guide This Software Only Supports Windows SystemDocument1 pageGP-100 Software User Guide This Software Only Supports Windows SystemJohn HenryNo ratings yet

- Bloomberg Businessweek USA - August 10 2020Document70 pagesBloomberg Businessweek USA - August 10 2020Boki VaskeNo ratings yet

- Quiet Healing CentreDocument12 pagesQuiet Healing CentredoliamahakNo ratings yet

- Fundamental of Image ProcessingDocument23 pagesFundamental of Image ProcessingSyeda Umme Ayman ShoityNo ratings yet

- Aileen Flores Lesson Plan 2021Document8 pagesAileen Flores Lesson Plan 2021Sissay SemblanteNo ratings yet

- A Guide To Facts and Fiction About Climate ChangeDocument19 pagesA Guide To Facts and Fiction About Climate ChangeANDI Agencia de Noticias do Direito da Infancia100% (1)

- Vitamins and Minerals Lecture NotesDocument9 pagesVitamins and Minerals Lecture NotesJoymae Olivares Tamayo100% (1)

- General Specification (Building) 30-01-21 198-380Document183 pagesGeneral Specification (Building) 30-01-21 198-380shujaNo ratings yet

- ABB Surge Protection - PV ApplicationDocument2 pagesABB Surge Protection - PV ApplicationPeter Vas VasNo ratings yet

- Lab Report# 07: To Analyze The Effect of Parallel Compensation On Reactive Power Flow of Transmission LineDocument11 pagesLab Report# 07: To Analyze The Effect of Parallel Compensation On Reactive Power Flow of Transmission Linemuhammad irfanNo ratings yet

- Physics Topic - 5 - Exam - With - AnsDocument7 pagesPhysics Topic - 5 - Exam - With - AnssamerNo ratings yet

- Help Utf8Document8 pagesHelp Utf8Jorge Diaz LastraNo ratings yet

- Small Business Management Entrepreneurship and Beyond 6th Edition Hatten Solutions ManualDocument36 pagesSmall Business Management Entrepreneurship and Beyond 6th Edition Hatten Solutions ManualketmieoilstoneqjdnwqNo ratings yet

- Safety Data Sheet According To EEC-Regulation 91/155/EECDocument6 pagesSafety Data Sheet According To EEC-Regulation 91/155/EECANIBALLOPEZVEGANo ratings yet

- Kotak Mahindra Bank: Presented by Navya.CDocument29 pagesKotak Mahindra Bank: Presented by Navya.CmaheshfbNo ratings yet

- C2-Forecasting Demand & SupplyDocument31 pagesC2-Forecasting Demand & SupplyPRITHIVI KUMAR A R 1522554No ratings yet

- EC Ch04 Building An E-Commerce PresenceDocument72 pagesEC Ch04 Building An E-Commerce PresenceUdhaya ShatisNo ratings yet

- vct49xyi-SPEC 2003.12.121Document374 pagesvct49xyi-SPEC 2003.12.121Micu Adrian DanutNo ratings yet

- Roxas Claire B. Science Technology and Society 09 Activity 1Document1 pageRoxas Claire B. Science Technology and Society 09 Activity 1Eldrick Neil Reyes100% (1)

- Our Proper Home Garbage Disposal GuideDocument7 pagesOur Proper Home Garbage Disposal GuideNovelNo ratings yet

- QuestionsDocument3 pagesQuestionsRajani NairNo ratings yet

- Top Tips For Marriage Habits For A Happy Marriage 2019Document2 pagesTop Tips For Marriage Habits For A Happy Marriage 2019Marcel Henri Pascal Patrice Moudiki KingueNo ratings yet

- 1.buying, Having, BeingDocument31 pages1.buying, Having, BeingAmmar AliNo ratings yet

- Vis DK 25 Programming GuideDocument210 pagesVis DK 25 Programming GuideshrihnNo ratings yet