Professional Documents

Culture Documents

P45 - HM R&C

Uploaded by

dmitrykrylov34Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P45 - HM R&C

Uploaded by

dmitrykrylov34Copyright:

Available Formats

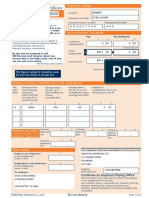

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

7 Last entries on Payroll record/Deductions Working Sheet.

Surname or family name Complete only if tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

First name(s) Week number Month number

Total pay to date

£ p

4 Leaving date DD MM YYYY

Total tax to date

£ p

8 This employment pay and tax. If no entry here, the amounts 12 Employee’s private address

are those shown at box 7.

Total pay in this employment

£ p

Total tax in this employment

p Postcode

£

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Employer name and address

10 Gender. Enter 'X' in the appropriate box

Male Female

11 Date of birth DD MM YYYY Postcode

Date DD MM YYYY

To the employee Tax credits and Universal Credit

The P45 is in 3 parts. Please keep this part (Part 1A) safe. Tax credits and Universal Credit are flexible. They adapt to

Copies are not available. You might need the information in changes in your life, such as leaving a job. If you need to let us

Part 1A to fill in a tax return if you are sent one. know about a change in your income, phone 0345 300 3900.

Please read the notes in Part 2 that accompany Part 1A. To the new employer

The notes give some important information about what you If your new employee gives you this Part 1A, return it to them.

should do next and what you should do with Parts 2 and 3 of Check the information on Parts 2 and 3 of this form is correct

this form. and transfer the information onto the Payroll

P45(Laser-Sheet) Part 1A record/Deductions Working Sheet. 7002359 HMRC 12/15

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

7 Last entries on Payroll record/Deductions Working Sheet.

Surname or family name Complete only if tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

First name(s) Week number Month number

Total pay to date

£ p

4 Leaving date DD MM YYYY

Total tax to date

£ p

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

Parts 2 and 3 of the form together and do not alter them in Employment and Support Allowance (ESA)

any way. Take this form to your Jobcentre Plus office. They will pay you

Going to a new job any tax refund you may be entitled to when your claim ends,

Give Parts 2 and 3 of this form to your new employer, or or at 5 April if this is earlier.

you will have tax deducted using the emergency code and Not working and not claiming Jobseeker's Allowance or

may pay too much tax. If you do not want your new Employment and Support Allowance (ESA)

employer to know the details on this form, send it to your If you have paid tax and wish to claim a refund fill in form

HM Revenue & Customs (HMRC) office immediately with a P50, ‘Claiming tax back when you have stopped

letter saying so and giving the name and address of your working’, go to

new employer. HMRC can make special arrangements, but www.gov.uk/government/publications/income-tax-claiming-

you may pay too much tax for a while as a result of this. tax-back-when-you-have-stopped-working-p50

Going abroad Help

If you are going abroad or returning to a country outside

If you need more help, go to www.gov.uk/topic/personal-tax

the UK fill in form P85, ‘’Leaving the United Kingdom, go to

www.gov.uk/government/publications/income-tax- To the new employer

leaving-the-uk-getting-your-tax-right-p85 Check this form, record the start date and report it to HMRC

Becoming self-employed in the first Full Payment Submission for your employee.

You must register with HMRC within 3 months of becoming Prepare a Payroll record/Deductions Working Sheet. Follow

self-employed or you could incur a penalty. the instructions at www.gov.uk/payroll-software

To register as newly self-employed, go to Keep Part 2.

www.gov.uk/topic/business-tax/self-employed

P45(Laser-Sheet) Part 2 HMRC 12/15

P45 Part 3

New employee details

For completion by new employer

Use capital letters when filling in this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/month 1

7 Last entries on Payroll record/Deductions Working Sheet.

Surname or family name Complete only if tax code is cumulative. If there is an 'X'

at box 6 there will be no entries here.

First name(s) Week number Month number

Total pay to date

£ p

4 Leaving date DD MM YYYY

Total tax to date

£ p

To the new employer You will need these details to complete your Full Payment Submission.

8 New employer PAYE reference 15 Employee's private address

Office number Reference number

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any) 16 Gender. Enter 'X' in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter tax code in use if different to the tax code at box 6.

18 I have prepared a Payroll record/Deductions Working

Sheet in accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/month 1

13 If the tax figure you are entering on Payroll

record/Deductions Working Sheet differs from box 7

please enter the figure here.

Postcode

£ p

14 New employee's job title or job description Date DD MM YYYY

P45(Laser-Sheet) Part 3 HMRC 12/15

You might also like

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkDan NolanNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkPapa JP JohnNo ratings yet

- P45 (ONLINE) Duc Trong Duong 2Document3 pagesP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongNo ratings yet

- BERAYDocument3 pagesBERAYberaylyatif2No ratings yet

- PrintP45 PDFDocument3 pagesPrintP45 PDFIstoc AngelaNo ratings yet

- 5184 P45 (Online) PDFDocument3 pages5184 P45 (Online) PDFAlejandroe AuditoreNo ratings yet

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 pagesCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- P45 Part 1A Details of Employee Leaving Work: Office Number Reference NumberDocument3 pagesP45 Part 1A Details of Employee Leaving Work: Office Number Reference Numbermpmplan3No ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument3 pagesP45 Part 1A Details of Employee Leaving WorkCaleb PriceNo ratings yet

- Inspired Sisters LTD Online) AUDocument3 pagesInspired Sisters LTD Online) AUthankksNo ratings yet

- P45 68148Document4 pagesP45 68148Эдварт АнтонNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- GPGB SS P45Document3 pagesGPGB SS P45Dedu DzmaNo ratings yet

- P45 94142 (1) BunDocument4 pagesP45 94142 (1) BunCosty DutaNo ratings yet

- P45 - Regan LaingDocument3 pagesP45 - Regan LaingbangtantaekNo ratings yet

- Bratuadriana 90@Document3 pagesBratuadriana 90@Adelina& KevinNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section OneFrancisco Ramirez100% (2)

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Ssp1-Interactive 230910 001341Document3 pagesSsp1-Interactive 230910 001341Tyna MutuligaNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section Onedeepika505No ratings yet

- Student Employees: Income TaxDocument1 pageStudent Employees: Income Tax16479No ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- Ssp1 InteractiveDocument5 pagesSsp1 InteractiveAdam KruzynskiNo ratings yet

- x6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfDocument1 pagex6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfAdemuyiwa OlaniyiNo ratings yet

- RTI Data Item Guide 20-21 v1-1Document57 pagesRTI Data Item Guide 20-21 v1-1chethanNo ratings yet

- Use These Notes To Help You Fill in The Employment Pages of Your Tax ReturnDocument4 pagesUse These Notes To Help You Fill in The Employment Pages of Your Tax ReturnLucca HeartNo ratings yet

- Staten of EarningsDocument7 pagesStaten of EarningsEcaterina DavidovNo ratings yet

- Avis 2018 Revenus 2017Document15 pagesAvis 2018 Revenus 2017Arnaud CalisteNo ratings yet

- Income and AssetsDocument20 pagesIncome and Assetsadeney_nickNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- P 46Document2 pagesP 46Charlotte JamesNo ratings yet

- Payroll Tax Declaration ENGDocument2 pagesPayroll Tax Declaration ENGЕвгений БодякинNo ratings yet

- P60 Single Sheet 2022 To 2023Document1 pageP60 Single Sheet 2022 To 2023Manuel Brites FerreiraNo ratings yet

- CFWB015Document2 pagesCFWB015Yeshaya DorfmanNo ratings yet

- US Internal Revenue Service: F1040ez - 1992Document2 pagesUS Internal Revenue Service: F1040ez - 1992IRSNo ratings yet

- PFF053 Member'SContributionRemittanceForm V03Document12 pagesPFF053 Member'SContributionRemittanceForm V03CA RosarioNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printeugenio02No ratings yet

- Income and AssetsDocument20 pagesIncome and AssetsNk BaghdadNo ratings yet

- US Internal Revenue Service: f943 - 1994Document4 pagesUS Internal Revenue Service: f943 - 1994IRSNo ratings yet

- Worksite Advantage: Section 125 Required Forms PacketDocument7 pagesWorksite Advantage: Section 125 Required Forms PacketTina HughesNo ratings yet

- Federal Tax Return FormDocument8 pagesFederal Tax Return FormKING ZeusNo ratings yet

- Ca 3916Document5 pagesCa 3916GenovevaShtereva100% (1)

- Statutory Sick Pay Claim Form ssp1Document6 pagesStatutory Sick Pay Claim Form ssp1k.a.smithniNo ratings yet

- View Tax Return 2018 PDFDocument16 pagesView Tax Return 2018 PDFRobert GyetwayNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- HMRC RTI Data Item Guide 14-15-V1.2Document27 pagesHMRC RTI Data Item Guide 14-15-V1.2HaeginNo ratings yet

- Philhealth rf1 PDFDocument2 pagesPhilhealth rf1 PDFDimitri Irtimid100% (1)

- US Internal Revenue Service: f943 - 1991Document4 pagesUS Internal Revenue Service: f943 - 1991IRS100% (1)

- MFSA Confirmation NK-1318823 ARTURAS MASLAUSKASDocument1 pageMFSA Confirmation NK-1318823 ARTURAS MASLAUSKASdmitrykrylov34No ratings yet

- Act On The Legalization of Funds No. 49276-17Document1 pageAct On The Legalization of Funds No. 49276-17dmitrykrylov34No ratings yet

- Guarantee DocumentDocument1 pageGuarantee Documentdmitrykrylov34No ratings yet

- Legalization DocumentDocument1 pageLegalization Documentdmitrykrylov34No ratings yet

- 2023 by National Bank of SamoaDocument1 page2023 by National Bank of Samoadmitrykrylov34No ratings yet

- p45 Form Download PDFDocument1 pagep45 Form Download PDFJohn JohnNo ratings yet

- Your English Pal Business English Lesson Plan Consumer Rights v2Document4 pagesYour English Pal Business English Lesson Plan Consumer Rights v2Yulia PetrishakNo ratings yet

- Caoibes V Caoibes-PantojaDocument1 pageCaoibes V Caoibes-PantojaJames Evan I. ObnamiaNo ratings yet

- Operating Manual For Diesel Engines ABC Type 6/8/12/16DZC: GoedgekeurdDocument3 pagesOperating Manual For Diesel Engines ABC Type 6/8/12/16DZC: GoedgekeurdCristian Ferchiu0% (1)

- 001 History Chapter 8 Class 6Document2 pages001 History Chapter 8 Class 6Basveshwara RisawadeNo ratings yet

- 2020 - UMass Lowell - NCAA ReportDocument79 pages2020 - UMass Lowell - NCAA ReportMatt BrownNo ratings yet

- International Bank For Reconstruction and DevelopmentDocument7 pagesInternational Bank For Reconstruction and DevelopmentbeyyNo ratings yet

- Feb Month - 12 Feb To 11 MarchDocument2 pagesFeb Month - 12 Feb To 11 MarchatulNo ratings yet

- Echavez v. Dozen Construction PDFDocument3 pagesEchavez v. Dozen Construction PDFCathy BelgiraNo ratings yet

- Preamble of The Philippine ConstitutionDocument21 pagesPreamble of The Philippine ConstitutionKriss Luciano100% (1)

- 13 Stat 351-550Document201 pages13 Stat 351-550ncwazzyNo ratings yet

- Adalat System Under Warren HastingsDocument6 pagesAdalat System Under Warren HastingsswarnaNo ratings yet

- Muhannad Evidence 1 Contemporary PresentationDocument24 pagesMuhannad Evidence 1 Contemporary PresentationMuhannad LallmahamoodNo ratings yet

- Newspaper Publication I Ep FDocument3 pagesNewspaper Publication I Ep FRajNo ratings yet

- Rsi - ProfileDocument91 pagesRsi - ProfileNhung TruongNo ratings yet

- 6 Master Plans - ReviewerDocument2 pages6 Master Plans - ReviewerJue Lei0% (1)

- Summary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCDocument2 pagesSummary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCalmira garciaNo ratings yet

- Oracle Receivables An OverviewDocument69 pagesOracle Receivables An OverviewmanukleoNo ratings yet

- Revolut - Double Spends, Withheld Funds, Failed Top-Ups/paymentsDocument17 pagesRevolut - Double Spends, Withheld Funds, Failed Top-Ups/paymentsfoobarNo ratings yet

- Additional Land Title CaseDocument2 pagesAdditional Land Title CaseAure ReidNo ratings yet

- Fin 104 S. 2019 Credit Analysis CollectionDocument52 pagesFin 104 S. 2019 Credit Analysis CollectionJon Paul DonatoNo ratings yet

- Ethnic Networks, Extralegal Certainty, and Globalisation - PeeringDocument23 pagesEthnic Networks, Extralegal Certainty, and Globalisation - PeeringRGinanjar Nur RahmatNo ratings yet

- Relevancy of Facts: The Indian Evidence ACT, 1872Document3 pagesRelevancy of Facts: The Indian Evidence ACT, 1872Arun HiroNo ratings yet

- Deoband Anti Sufi 1 1Document18 pagesDeoband Anti Sufi 1 1Herb NazheNo ratings yet

- Race, Class, and Gender in The United States An Integrated Study 10th EditionDocument684 pagesRace, Class, and Gender in The United States An Integrated Study 10th EditionChel100% (10)

- Semiconductor FundamentalsDocument18 pagesSemiconductor FundamentalsromfernNo ratings yet

- Contoh ImportDocument10 pagesContoh ImportIbella RiyantiNo ratings yet

- River Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Document6 pagesRiver Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Scribd Government DocsNo ratings yet

- Indira Gandhi Work DoneDocument4 pagesIndira Gandhi Work DoneRupesh DekateNo ratings yet

- Excutive Oeder 2023Document1 pageExcutive Oeder 2023Catherine Parinas0% (1)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyFrom EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyRating: 4.5 out of 5 stars4.5/5 (300)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (799)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouFrom EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouRating: 4.5 out of 5 stars4.5/5 (87)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- 7 Secrets to Investing Like Warren BuffettFrom Everand7 Secrets to Investing Like Warren BuffettRating: 4.5 out of 5 stars4.5/5 (121)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessFrom EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessRating: 4.5 out of 5 stars4.5/5 (407)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1026)