Professional Documents

Culture Documents

PaySlip (October)

Uploaded by

karansharma6900 ratings0% found this document useful (0 votes)

23 views2 pagesOriginal Title

PaySlip (october)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pagesPaySlip (October)

Uploaded by

karansharma690Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

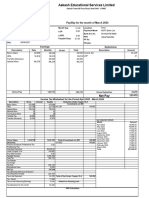

Aakash Educational Services Limited

Aakash Tower,08 Pusa Road, New Delhi - 110005

PaySlip for the month of October 2021

Emp Code F5769 Month Day 31.00 Location Khammam

Name Gattu Sharathkumar 0.00 Payment Mode AXIS Bank Ltd

LOP

Designation Assistant Professor Bank A/c No. 917010040984562

Department Engineering LOPR 0.00

PAN AYEPG0110D

Academic Head - IIT Wing Payable Days 31.00

Role PF No.

DOJ 02/09/2017 PFUAN.

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic Salary 70,224 70,224 70,224 Prof. Tax 200

HRA 35,112 35,112 35,112 Income Tax 77,148

Conveyance Allow 1,600 1,600 1,600

Variable Pay 68,880 68,880

Special Allow 166,522 166,522 166,522

Facility Allow 8,000 8,000 8,000

Medical Allow 1,250 1,250 1,250

Gross Pay 351,588 351,588 Gross Deduction 77,348

Net Pay 274240

Income Tax Worksheet for the Period April 2021 - March 2022

Description Gross Exempt Taxable Deduction Under Chapter VI-A

Basic Salary 840,423 840,423 Investments u/s 80C

HRA 420,211 336,169 84,042 C.E.F 150,000

Special Allow 1,992,892 1,992,892

Facility Allow 95,742 95,742

Medical Allow 14,960 14,960

Conveyance Allow 19,148 19,148

Variable Pay 68,880 68,880

Tax Deducted Details

Month Amount

April 2021 55,979.00

May 2021 55,978.00

June 2021 55,979.00

July 2021 55,978.00

August 2021 55,658.00

September 2021 55,658.00

October 2021 77,148.00

Total 412,378.00

Gross Salary 3,452,256 336,169 3,116,087 Total of Investment u/s 80C 150,000

Deduction U/S 80C 150,000

Previous Employer Professional Tax 0.00 U/S 80D 29,757

Professional Tax 2,400 U/S 80DPS 50,000

Standard Deduction 50,000.00

Under Chapter VI-A 225,000

Any Other Income 0.00

Taxable Income 2,838,687

Total Tax 664,106

Tax Rebate

Surcharge

Tax Due 664,106

Educational Cess 26,564

Net Tax 690,670

Tax Deducted (Previous Employer)

Tax Deducted Till Date 335,230

Tax to be Deducted 355,440 Total of Ded Under Chapter VI-A 229,757

Tax / Month 55,658

Tax on Non-Recurring Earnings 21,490 Interest on Housing Loan

Tax Deduction for this month 77,148

HRA Calculation

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempt HRA

01/04/2021 31/03/2022 480,000 420,211 336,169 395,958 336,169

Total 480,000 420,211 336,169 395,958 336,169

You might also like

- Oct PayslipDocument3 pagesOct PayslipRajanala Vignesh NaiduNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- Aditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Document1 pageAditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Praneeth Sasanka TadepalliNo ratings yet

- OCT 2023 UnlockedDocument2 pagesOCT 2023 UnlockedSWADHIN KUMAR SAHOONo ratings yet

- Aakash PaySlip April 2022Document2 pagesAakash PaySlip April 2022Prateek KwatraNo ratings yet

- PDFReports (4)Document2 pagesPDFReports (4)Zareen SidiquiNo ratings yet

- HTMLReportsDocument3 pagesHTMLReportsparveenaliya697No ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Tax 1 PDFDocument16 pagesTax 1 PDFAli Azhar KhanNo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Payslip March 2022Document1 pagePayslip March 2022sunanda singhNo ratings yet

- Payslip SummaryDocument2 pagesPayslip SummaryVyas Keshini100% (1)

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Ranjan KumarDocument2 pagesRanjan KumarRanjan KumarNo ratings yet

- Shubha KDocument1 pageShubha Kjyothi sNo ratings yet

- 20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipDocument1 page20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipKaran SharmaNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- November Salary PayslipDocument1 pageNovember Salary PayslipPrashant RajNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Salary slip Conneqt business solutionDocument1 pageSalary slip Conneqt business solutionbittu yoNo ratings yet

- Subramani PayslipDocument2 pagesSubramani PayslipMr. HarshaNo ratings yet

- Sgs India Private Limited Full and Final For The Month of Mar 2021Document2 pagesSgs India Private Limited Full and Final For The Month of Mar 2021Saket JhaNo ratings yet

- Conneqt Business Solutions Limited: 318667 Bhushan JadhavDocument1 pageConneqt Business Solutions Limited: 318667 Bhushan JadhavBhushan JadhavNo ratings yet

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- Deepika3Document1 pageDeepika3chanduazad8808No ratings yet

- Bigbasket SonuDocument1 pageBigbasket SonuSonuNo ratings yet

- PAYSLIP FOR MAY 2019Document2 pagesPAYSLIP FOR MAY 2019kumar Ranjan 22No ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Dec 2022 51747565Document1 pageDec 2022 51747565Mohan Dass ANo ratings yet

- January 2023pdfDocument1 pageJanuary 2023pdfrabichakraborty50No ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- Xxapg Sa PayslipDocument1 pageXxapg Sa PayslipAbdullah AlghamdiNo ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- PaySlip DecDocument2 pagesPaySlip Deckaransharma690No ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- February 2023Document1 pageFebruary 2023Pradeep Kumar malikNo ratings yet

- 383870964-Bigbasket bangaloreDocument1 page383870964-Bigbasket bangalorekreetika kumariNo ratings yet

- Kristina - MAY 22Document1 pageKristina - MAY 22bktsuna0201No ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- HTMLReports 12Document1 pageHTMLReports 12Umesh SainiNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- GA55Document2 pagesGA55Kulish JoshiNo ratings yet

- DeepikaDocument1 pageDeepikachanduazad8808No ratings yet

- MHODocument4 pagesMHOSum WhosinNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Payslip For: JAN-2022: Louis Berger SASDocument1 pagePayslip For: JAN-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- July 08Document1 pageJuly 08anon-99145No ratings yet

- JulyDocument1 pageJulyArif AnuarNo ratings yet

- MarchDocument1 pageMarchSushmita BaraikNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- IUPAC Naming Brain TeasersDocument15 pagesIUPAC Naming Brain Teasersdny001No ratings yet

- PaySlip DecDocument2 pagesPaySlip Deckaransharma690No ratings yet

- PaySlip DecDocument2 pagesPaySlip Deckaransharma690No ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- 05 # Salt AnalysisDocument5 pages05 # Salt Analysisbruh pogNo ratings yet

- PaySlip DecDocument2 pagesPaySlip Deckaransharma690No ratings yet

- PaySlip (October)Document2 pagesPaySlip (October)karansharma690No ratings yet

- 6th Chemistry Book - Vol-2Document118 pages6th Chemistry Book - Vol-2karansharma690100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Jesc101 PDFDocument16 pagesJesc101 PDFYunusNo ratings yet

- Language of ChemoDocument20 pagesLanguage of Chemokaransharma690No ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Vendor Registration Form: Vill-Rampurwa, Ram Nagar, Hardoi Rod, Sitapur (U.P.) 261001Document4 pagesVendor Registration Form: Vill-Rampurwa, Ram Nagar, Hardoi Rod, Sitapur (U.P.) 261001accountsNo ratings yet

- Solution Manual For Intermediate Accounting 19th Edition by Stice PDFDocument18 pagesSolution Manual For Intermediate Accounting 19th Edition by Stice PDFADNo ratings yet

- CEO Turnover, Corporate Tax Avoidance and Big Bath AccountingDocument50 pagesCEO Turnover, Corporate Tax Avoidance and Big Bath AccountingSaadBourouisNo ratings yet

- Problem Set I - Calculate ROE for Eastover and SouthamptonDocument4 pagesProblem Set I - Calculate ROE for Eastover and SouthamptonJoel Christian MascariñaNo ratings yet

- Foundations of Financial Management Canadian 8th Edition Block Test BankDocument54 pagesFoundations of Financial Management Canadian 8th Edition Block Test Bankxeniaeira988100% (20)

- Group 2 Cw2Document10 pagesGroup 2 Cw2Worlanyo Philip AmevuvorNo ratings yet

- Solution Manual Financial Institution Management 3rd Edition by Helen Lange SLM1085Document8 pagesSolution Manual Financial Institution Management 3rd Edition by Helen Lange SLM1085thar adelei100% (1)

- Final Vinod Maxycon Pharmacutical CompanyDocument66 pagesFinal Vinod Maxycon Pharmacutical Companysaini jiNo ratings yet

- FM Mid Term Notes SajinJDocument25 pagesFM Mid Term Notes SajinJVishnu RC VijayanNo ratings yet

- Apar FormatDocument26 pagesApar Formatpeace2047No ratings yet

- Accounting definitions and objectives (40chDocument23 pagesAccounting definitions and objectives (40chAkame SanzeninNo ratings yet

- BMBA Media Presentation July 2012Document4 pagesBMBA Media Presentation July 2012ShakilNo ratings yet

- Ucits FSA PDFDocument35 pagesUcits FSA PDFnekougolo3064No ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- Standard Costing and Variance AnalysisDocument6 pagesStandard Costing and Variance AnalysisBarby Angel100% (3)

- Advanced Final 2018 2019 2eDocument10 pagesAdvanced Final 2018 2019 2eFlorenzOpingaNo ratings yet

- CIDB L5 LP04 Finance and Business PlanningDocument86 pagesCIDB L5 LP04 Finance and Business PlanningMohd Zailani Mohamad Jamal0% (1)

- Cost of Capital Estimation TechniquesDocument16 pagesCost of Capital Estimation TechniquesVineet AgarwalNo ratings yet

- Transfer of Intangible Property To Foreign Subsidiary - LTR 1321018Document24 pagesTransfer of Intangible Property To Foreign Subsidiary - LTR 1321018taxcrunchNo ratings yet

- ENGG MNGT NEWpptDocument23 pagesENGG MNGT NEWpptRonald VilladolidNo ratings yet

- Chapter 15Document7 pagesChapter 15Shadin ANo ratings yet

- Creating Starting Business Plan VentureDocument24 pagesCreating Starting Business Plan VenturesagartolaneyNo ratings yet

- Bankr. L. Rep. P 69,989 in Re Eugene C. Mullendore and Kathleen Boren Mullendore, Debtors. Kathleen Boren Mullendore and Katsy Mullendore Mecom v. United States, 741 F.2d 306, 10th Cir. (1984)Document10 pagesBankr. L. Rep. P 69,989 in Re Eugene C. Mullendore and Kathleen Boren Mullendore, Debtors. Kathleen Boren Mullendore and Katsy Mullendore Mecom v. United States, 741 F.2d 306, 10th Cir. (1984)Scribd Government DocsNo ratings yet

- Auditing Internal ControlsDocument25 pagesAuditing Internal ControlsSarah BalisacanNo ratings yet

- CHANDANDocument48 pagesCHANDANChandan HaldarNo ratings yet

- TransactionHistory 3030939087Document2 pagesTransactionHistory 3030939087Aina AerynaNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- City Bank internship report analyzes training policiesDocument44 pagesCity Bank internship report analyzes training policieszarin rahmanNo ratings yet

- Accounting For Share Capital (2019-20)Document20 pagesAccounting For Share Capital (2019-20)niyatiagarwal25No ratings yet