Professional Documents

Culture Documents

Training Report Project On Icici Bank

Training Report Project On Icici Bank

Uploaded by

cricketbuzz65Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Training Report Project On Icici Bank

Training Report Project On Icici Bank

Uploaded by

cricketbuzz65Copyright:

Available Formats

lOMoARcPSD|32875405

Training report - Project On ICICI BAnk

Bachelors of Business Administration (Guru Gobind Singh Indraprastha University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

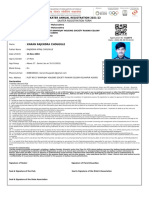

SUMMER TRAINING REPORT

On

Consumer Perception towards Services

Offered by ICICI Prudential Life Insurance

Submitted in partial fulfillment for the award of degree of

Bachelor of Business Administration

(2020-2023)

Under the supervision of: Submitted By:

Ms. Poonam Kunal Aggarwal

(Training Head) BBA 3rd Year

Roll No: 201003177

Panipat Institute of Engineering & Technology, Samalkha

Affiliated to Kurukshetra University, Kurukshetra

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

DECLARATION

This is to certify that I Kunal Aggarwal, student of Panipat Institute of Engineering &

Technology studying in BBA 5th Semester, Roll No- 201003177 has prepared a project

report entitled “Consumer Perception towards Services Offered by ICICI Prudential

Life Insurance” for the partial fulfillment of degree of Bachelor of Business

Administration from Kurukshetra University, Kurukshetra.

I hereby declare that the project report submitted to the Kurukshetra University,

Kurukshetra is a record of an original work done by me under the guidance of Mr. Ashish

(Assistant Professor, Department of Business Studies).

The matter presented in this project work has not been submitted by me for the award of

any Degree or diploma/ associateship/ fellowship and similar degree or any other institute.

Signature of Candidate

Kunal Aggarwal

University Roll No- 201003177

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

ACKNOWLEDGEMENT

Gratitude of highest order is expressed to Dr. Rohit Garg (Head & Assistant Professor,

Department of Business Studies, PIET) for encouragement and support during my

project. His care, endless support and trust motivate me for opportunity to achieve. This

project could not be completed without his insight and achieve.

I am neither expert nor a trend spotter. I am a management student with foundations of

management principles and theories who is keen in different industries, it's happening

mainly in ICICI Prudential Life Insurance.

I am highly obliged to Mrs. Poonam, my prime internal guide for her invaluable support;

guidance and knowledge that she has shared with me thereby aiding me in making this

project a success along with other employees who provided their utmost working

knowledge, which has broaden my area of interest and benefited mostly in completing the

project.

I am highly grateful to my project guide Mr. Ashish (Assistant Professor, Department

of Business Studies, PIET) for his inspiring guidance and blessings for fulfilling the

project report. I am very grateful to Mr. Ashish for his research advice, knowledge and

many insightful discussion and suggestions.

Lastly, I thank faculty and staff members of P.I.E.T, Panipat which gave me an opportunity

regarding training purpose and helped me in building some experience in my career.

Kunal Aggarwal

University Roll No- 201003177

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

COMPANY CERTIFICATE

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

EXECUTIVE SUMMARY

The main purpose of the study is to identify the Consumer Perception towards Services Offered

by ICICI Prudential Life Insurance which will help the company to make its marketing strategy.

The study will help the company to make strategies and new products/plans and emphasize on

their weaker areas. Also, the brand Image of various other companies will be known which will

help the company to identify its competitors and find where their competitor stands out in the mind

of the consumer. Most of the people have invested in Life Insurance and need more emphasis on

more Returns and Transparency in the Insurance Industry.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

INDEX

CHAPTER TOPIC PAGES

NUMBER

CHAPTER 1 1) INTRODUCTION 07-33 Pages

1.1) Introduction to the Industry 08-15 Pages

1.2) Introduction to the Company 16-29 Pages

1.3) Introduction to the Topic 30-33 Pages

CHAPTER 2 2) LITERATURE REVIEW 34-39 Pages

CHAPTER 3 3) RESEARCH METHODOLOGY 40-44 Pages

3.0) Research methodology

3.1) Statement of the problem

3.2) Justification of the study

3.3) Objectives of the study

3.4) Scope of the study

3.5) Research design

3.6) Collection of data

3.7) Sources of data collection

3.8) Sampling technique

3.9) Analytical tool used in study

3.10) Limitations of study

CHAPTER 4 4) ANALYSIS & INTERPRETATION 45-56 Pages

CHAPTER 5 5) FINDINGS, SUGGESTION & CONCLUSION 57-61 Pages

5.1) Findings

5.2) Conclusion

5.3) Suggestion

BIBLIOGRAPHY/ REFERENCES 62-64 Pages

ANNEXURE 65-67 Pages

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

CHAPTER 1

INTRODUCTION

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

1.1) INTRODUCTION TO THE INDUSTRY

As finance is the lifeblood for all economic activities, one aspect of financial arena, which plays a

very important role, is the Insurance. Insurance is the outcome of Man’s search for safety and

security, and to find out ways and means to minimize the hardship, which are beyond his control.

Because of the economic reforms introduced by our government we can see that due to this

Globalization and privatization there is enormous increase in the private sector players queuing in

the insurance sector. This entry of Private players has enhanced the competitiveness and Quality

of service with many innovated products.

The insurance industry provides protection against financial losses resulting from a variety of

perils. By purchasing insurance policies, individuals and businesses can receive reimbursement for

losses due to car accidents, theft of property, and fire and storm damage; medical expenses;

and loss of income due to disability or death.

The insurance industry consists mainly of insurance carriers (or insurers) and insurance agencies

and brokerages. In general, insurance carriers are large companies that provide insurance and

assume the risks covered by the policy. Insurance agencies and brokerages sell insurance

policies for the carriers. While some of these establishments are directly affiliated with a insurer

and sell only that carrier’s policies, many are independent and are thus free to market the policies

of a variety of insurance carriers. In addition to supporting these two primary components, the

insurance industry includes establishments that provide other insurance-related services, such as

claims adjustment or third-party administration of insurance and pension funds.

Insurance carriers assume the risk associated with annuities and insurance policies and assign

premiums to be paid for the policies. In the policy, the carrier states the length and conditions

of the agreement, exactly which losses it will provide compensation for, and how much will be

awarded. The premium charged for the policy is based primarily on the amount to be awarded in

case of loss, as well as the likelihood that the insurance carrier will actually have to pay.

In order to be able to compensate policyholders for their losses, insurance companies invest

the money they receive in premiums, building up a portfolio of financial assets and income-

producing real estate which can then be used to pay off any future claims that may be brought.

There are two basic types of insurance carriers.

Direct insurance carriers offer a variety of insurance policies. Life insurance provides financial

protection to beneficiaries—usually spouses and dependent children—upon the death of

the insured. Disability insurance supplies a preset income to an insured person who is unable

to work due to injury or illness, and health insurance pays the expenses resulting from

accidents and illness.

An annuity (a contract or a group of contracts that furnishes a periodic income at regular

intervals for a specified period) provides a steady income during retirement for the remainder

of one’s life. Property-casualty insurance protects against loss or damage to property

resulting from hazards such as fire, theft, and natural disasters.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Liability insurance shields policyholders from financial responsibility for injuries to others or

for damage to other people’s property. Most policies, such as automobile and

homeowner’s insurance, combine both property-casualty and liability coverage. Companies

that underwrite this kind of insurance are called property-casualty carriers.

Some insurance policies cover groups of people, ranging from a few to thousands of

individuals. These policies usually are issued to employers for the benefit of their employees or to

unions, professional associations, or other membership organizations for the benefit of their

members. Among the most common policies of this nature are group life and health plans.

Insurance carriers also underwrite a variety of specialized types of insurance, such as real-estate

title insurance, employee surety and fidelity bonding, and medical malpractice insurance.

In addition to individual carrier-sponsored Internet sites, several “lead-generating” sites have

emerged. These sites allow potential customers to input information about their insurance policy

needs. For a fee, the sites forward customer information to a number of insurance companies,

which review the information and, if they decide to take on the policy, contact the customer with

an offer. This practice gives consumers the freedom to accept the best rate.

The insurance industry also includes a number of independent organizations that provide a wide

array of insurance-related services to carriers and their clients. One such service is the

processing of claims forms for medical practitioners. Other services include loss prevention

and risk management. Also, insurance companies sometimes hire independent claims adjusters to

investigate accidents and claims for property damage and to assign a dollar estimate to the claim.

Now in India there are totally 28 players including 14 Life and 14 General Insurance Companies.

And Life Insurance is one of the most common forms of insurance.

ICICI Prudential Life Insurance Company is an emerging star in the Private players with the

competition being Global in nature

BRIEF HISTORY OF INSURANCE:

The business of insurance started with marine business. The first insurance policy was issued in

1583 in England.

Some of the important milestones in the insurance business in India are:

1818: The British introduce to India, with the establishment of the Oriental Life Insurance

Company in Calcutta.

1850: Non-life insurance debuts, with Triton Insurance company.

1870: Bombay Mutual Life Assurance Society is the first India-owned life insurer.

1907: Indian Mercantile Insurance is the first Indian non-life insurer.

1912: The Indian life assurance Companies act enacted to regulate the life insurance business.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

1938: The insurance act, which forms the basis for most current insurance laws, replaces earlier

act.

1956: Life insurance nationalized, government takes over 245 Indian and foreign insurers and

provident societies.

1972: Non-Life insurance nationalized, GIC set up.

1993: Malhotra Committee, headed by former BBI governor R.N. Malhotra, set up to draw up a

blueprint for insurance sector reforms.

1994: Malhotra Committee recommends re-entry for private players, autonomy to PSU insurers.

1997: Insurance regulator IRDA (Insurance Regulatory and Development Authority) set up.

2000: IRDA starts giving licences to private insurers, ICICI Prudential and HDFC Standard Life

first private insurers to sell a policy.

2002: Banks were allowed to sell insurance plans, as TPAs enter the scene, insurers start settling

non-life claims in the cashless mode.

INSURANCE: DEFINITION AND MEANING

FUNCTIONAL DEFINITION:

In the words of R.S. Sharma, “Insurance is a Co-operative device to spread the loss caused by

particular risk over a number of persons who were exposed to it and who agree to insure themselves

against the risk”

CONTRACTUAL DEFINITION:

According to E.W. Patterson, “Insurance is a contract by which one party, for a consideration

called a premium, assures a particular risk of other party ad promises to pay to him or his nominee

a certain or ascertainable sum of money on a specified contingency.

According to the U.S Life Office Management Association Inc (LOMA), Life Insurance is

defined as follows: Life insurance provides a sum of money if the person who is insured dies whilst

the policy is in effect

OTHER TERMS USED IN RELATION TO INSURANCE AND THEIR MEANING:

AGENT: The authorized representative of the insurer, licensed by the concerned authorities like

IRDA to canvass insurance.

BONUS: The yearly share of policy holders profit declared by the company based on its profits

which gets added to the policy amount and is payable upon its maturity.

CLAIM: The amount entitled to the policy holder or his nominee/assignee under a policy contract

in the event of the happening of the contingency insured against.

INSURABLE INTEREST: Evidence suggesting financial losses due to the occurrence of the

event insured against.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

POLICY: The evidence of contract between the insurer and the insured. A stamped sealed and

signed document issued by the insurer to the insured in proof of insuring his life.

PREMIUM: The amount mentioned in the policy contract to be paid by the insurer periodically

to the insure to keep the policy in full force.

INSURANCE IN INDIAN FINANCIAL SYSTEM:

In India insurance is in practice since 12th century as per the records. The first life insurance

company to operate in India the Oriental Life Insurance company was established in 1818 in

Calcutta. However, it was a British company. The first Indian Insurance company, the Bombay

Mutual Life Assurance Society started its operation in 1871. The Indian Life Insurance company

Act was passed in 1928.Subsequently, both of these Acts were merged, and the insurance Act 1938

was promulgated.

Independent India amended the Insurance Act in 1950 and in 1956, the then fiancé minister of the

nation Mr. C D Deshmukh nationalized all insurance companies, 154 Indian Insurance companies

and 75 provident societies. Finally, the life insurance Corporation was born on 1st September 1956.

The story of non-life insurance in India is no different. Though Lloyd’s insurance pioneered the

general Insurance way back in 1688, the first non-life Insurance Company set up shop in India was

the Triton Insurance company of Calcutta. In 1907 the first Indian general insurer the Indian

Mercantile insurance company started its operations.

The New India Assurance Company Limited was incorporated in 1919. After independence the

India Reinsurance Corporation was set up in 1956 and in 1957 the office of the controller of the

insurance was constituted. In 1968, that tariff advisory committee was set up to regulate the

investment of the players and finally in 1972, the non-life insurance business in the country was

nationalized and the general insurance company was formed as holding company with four

subsidiaries, the National Insurance, Oriental Insurance, United India Insurance and the new India

Assurance Company Limited. In the same year the National Insurance Company Limited was

amalgamated with 22 foreign and 11 Indian Insurance companies.

Thus, over a period of two centuries, the Indian insurance industry has gone through the full circle.

From being an open competitive market, it went through nationalization and has been subsequently

liberalized again.

Keeping in mind the national economic and commercial objective of India the government has set

up IRDA on 7th December 1999. Through which the reforms process of the industry got under

way.

INSURANCE IN INDIAN FINANCIAL SYSTEM – ITS IMPORTANCE

Insurance industry is one of the corner stone of any economy and financial System. Insurance

industry contributes its major part in increasing the saving and the fund collected is utilized in

developmental programs.

The Financial sector in our country is in the process of change with the objective o the overall

growth of the economy. The insurance sector as everyone knows constitutes a very important and

vital financial intermediary for the growth of the economy.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Insurance has become part and parcel of the financial system because it:

❖ Reduces the uncertainty of business loses.

❖ Increases business efficiency.

❖ Identifies key men.

❖ Enhances the credit.

❖ Takes care of welfare of the society.

❖ Protect the wealth of the nation.

❖ Helps to attain economic growth.

❖ Reduces the inflation level.

THE ADVANTAGES OF LIFE INSURANCE:

➢ Life insurance is brought not because someone is going to die, but because someone is going

to live.

➢ Life insurance means peace of mind.

➢ Life insurance promises payment of the full sum assured from the moment the first premium

is paid.

➢ Life insurance encourages regular savings and guards against extravagances.

➢ In most cases life insurance possesses a cash value after the first three years.

➢ Life insurance removes the worry of looking after your savings. Experts safely and profitably

invest your money on your behalf by experts.

➢ Life insurance guarantees payment in cash and is backed by the Government of India.

➢ Life insurance is a tax saving product.

➢ Life insurance is free from loss, from theft, fire, misplacement etc.

➢ A life insurance contract is one sided, i.e., always in favor of the insured and his family. One

can withdraw from the contract anytime, but the companies cannot.

➢ Life insurance replaces uncertainty with certainty. It provides a complete, balanced and perfect

hedge against economic threats, which confront all person, the danger of living too long or the

danger of dying soon.

HOW INSURANCE WORKS

Suppose there are 1000 person all aged 35 years and healthy lives. They are insured for one year

against the risk of death. Each person is insured for Rs. 50,000. if the past experience indicates the

4 out of 1000 people die during the year, expected amount claimed to be paid to the family of 4

persons would come to Rs. 2,00,000. the contribution to be paid by the each of the 1000 will come

to Rs.200 per year. Thus, all the 1000 persons share loss caused to the 4 unfortunate families. 996

persons who survived till 1 year have not lost any thing as they have secured peace of mind and a

feeling of security for their family.

While insurance cannot prevent accident or premature death, it can help, protect the family of the

deceased against the loss of income caused by the of the main breadwinner. In return for specified

payments, insurance will provide protection against the insurance of an uncertain event such as

premature death.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

The business of insurance company called insurer is to bring together persons who are exposed to

similar risk, collect contribution (premium) from them on sum equitable basis and pay the losses

(claim) to the unfortunate few who suffer.

NEED FOR THE INSURANCE:

Unlike other avenues of savings where the amount saved with interest is payable only on maturity,

insurance plans provide for payment of the total sum assured along with a bonus, if any, on any

eventuality even before the maturity of the policy. And another advantage of insurance is that an

insurer can avail loans against the security of the policy from the insurance company. Even banks

and other financial institutions advances loans with insurance policies as a collateral security.

To provide for one’s family and perhaps; others in the event of death, especially premature death.

Originally, policies were to provide for short period of time, covering temporary risky situations,

such as sea voyages. As lie insurance became more established, it was realized what a useful tool

it was for a number of situations, including:

➢ Temporary needs/threats;

The original purpose of life insurance remains an important element, namely providing for

replacement of income on death etc.

➢ Regular savings;

Providing for one’s family and oneself, as a medium to long term exercise (through a series

of regular payment of premiums). This has become more relevant in recent times as people

seek financial independence from their family.

➢ Investment;

It is the insurance that builds up the savings of the society and thus safeguard the

economy from the ravages of inflation. Unlike regular saving products, investment

Products are traditionally lump sum investments, where the individual makes one-time

payment.

➢ Retirement;

Provisions for one’s own later years become increasingly necessary, especially in a

changing cultural and social environment. One can buy a suitable insurance policy, which

will provide periodical payments in one’s old age.

WHY SHOULD YOU TAKE INSURANCE?

Insurance is desired to safeguard oneself and one’s family against possible losses on account of

risk and perils. It provides financial compensation for the losses suffered due to the happening of

unforeseen events. By taking life insurance a person can have peace of mind and need not worry

about the financial consequences in case of any untimely death.

Along with the growth of overall population in the country, crossing the benchmark of hundred

crore, there has been a significant awareness for the need for insurance in the other as well as rural

segments and even among the lower middle class and illiterate class of the population.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

We in India have around 30 crore middle class educated and enlightened people who have not

realized that insurance is as necessary as the other basic necessities of life such as food, shelter,

clothing.

MARKET SHARE OF COMPANIES

THE INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

(IRDAI)

Reforms in the Insurance sector were initiated with the passage of the IRDA Bill in

Parliament in December 1999. The IRDAI since its incorporation as a statutory body in April

2000 has fastidiously stuck to its schedule of framing regulations and registering the private sector

insurance companies.

The other decisions taken simultaneously to provide the supporting systems to the insurance

sector and the life insurance companies were the launch of the IRDAI’s online service for issue

and renewal of licenses to agents.

The approval of institutions for imparting training to agents has also ensured that the insurance

companies would have a trained workforce of insurance agents in place to sell their products,

which are expected to be introduced by early next year.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Since being set up as an independent statutory body the IRDAI has put in a

framework of globally compatible regulations. In the private sector 12 life insurance

and 6 general insurance companies have been registered.

FUNCTIONING OF THE IRDAI

❖ To exercise all the powers and functions of controller of insurance.

❖ Protection of the interest of the policy holders.

❖ To issue, renew, modify, withdraw or suspend certificate of registration.

❖ To specify requisite qualification and training for insurance intermediaries and agents.

❖ To promote and regulate professional organizations connected with insurance.

❖ To conduct inspection/investigation etc.

❖ To prescribe method of insurance accounting.

❖ To regulate investment of funds and margins of solvency.

❖ To adjudicate upon dispute.

❖ To conduct inspection and audit of insurers intermediaries and other organization concerned

with insurance.

❖ With a mission of: “protect the interest of the policy holders to regulate promote and ensure

orderly growth of the insurance industry and for matters connected there with or incidental

thereto”.

IRDAI ENABLERS:

In the new market set up, the IRDAI’s role is that of an enabler. The new insurers will conduct

insurance business in India according to the healthy norms prescribed the IRDAI. Regulations for

all insurance intermediaries will specify sales-norms. Guidelines for the code of conduct for the

surveyors and loss assessors will help all concerned. Efficiency will be promoted in the conduct

of insurance business. Professional organizations connected with insurance business will be

regulated. The role of IRDAI, besides regulating the market, it also to develop it. The IRDAI has

the task to promote fair competition in hindrance to monopolistic insurance market. In such a fast-

developing scenario, the prospects appear to be brighter for both insurers and the customers.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

1.2) INTRODUCTION TO THE COMPANY

ICICI Prudential Life Insurance Company is a joint venture between ICICI Bank - one of India's

foremost financial services companies and Prudential plc - a leading international financial

services group headquartered in the United Kingdom. Total capital infusion stands at Rs. 42.72

billion, with ICICI Bank holding a stake of 74% and Prudential plc holding 26%. It began its

operations in December 2001 after receiving approval from Insurance Regulatory Development

Authority (IRDA).

The Company issued its first policy on 12 December 2000. ICICI Prudential Life Insurance is a

joint venture between the ICICI Group and Prudential plc, of the UK. ICICI started off its

operations in 1955 with providing finance for industrial development, and since then it has

diversified into housing finance, consumer finance, mutual funds to be a Virtual Universal Bank

and its latest venture Life Insurance.

ICICI Prudential is the first life insurer in India to receive a National Insurer Financial Strength

rating of AAA (Ind) from Fitch ratings. For three years in a row, ICICI Prudential has been voted

as India's Most Trusted Private Life Insurer, by The Economic Times - AC Nielsen ORG Marg

survey of 'Most Trusted Brands'. As it grows, its distribution, product range and customer base, it

continues to tirelessly uphold its commitment to deliver world class financial solutions to

customers all over India.

FOREIGN PARTNER:

Established in 1848, Prudential plc. Of U.K. has grown to be the largest life insurance and mutual

fund Company in U.K. Prudential plc. Has had its presence in Asia for the past 75 years catering

to over 1 million customers across 11 Asian countries. Prudential is the largest life insurance

company in the United Kingdom (Source: S&P's UK Life Financial Digest, 1998). ICICI and

Prudential came together in 1993 to provide mutual fund products in India and today are the largest

private sector mutual fund company in India.

Their latest venture ICICI Prudential Life plans to take care of the insurance needs at 26 various

stages of life Prudential plc, one of the UK's leading financial service providers, issued life

insurance policies in Poland prior to World War II through Prudential Assurance Company

Limited and its subsidiary "Przezomosc", a now defunct Polish company in which Prudential

Assurance acquired a controlling interest in 1927.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Pizezomosc continued to issue life policies in Poland until 31 December 1936, and Prudential

Assurance issued life policies in Poland from 1 January 1933 to 31 December 1936. With effect

from 1 January 1937 both companies ceased to accept new life business and the administration of

the two portfolios was combined.

Based on notes of surviving records that existed in Prudential Assurance's London office there

were 4,623 policies in force in Poland at the outbreak of World War II in 1939. Over 33% of these

policies have been settled since the early 1950s despite significant gaps in our records, due in no

small part to their destruction in Poland under Nazi Occupation. The assets of Prudential's Polish

Business were seized by the Nazi occupying authorities, following the invasion of Poland in 1939.

Unlike some major European insurers Prudential did not trade in Nazi occupied Europe.

ICICI Prudential Life Insurance Company is a joint venture between ICICI Bank, a premier

financial powerhouse and prudential plc, a leading international financial services group

headquartered in the United Kingdom. ICICI Prudential was amongst the first private sector

insurance 27 companies to begin operations in December 2000 after receiving approval from

Insurance Regulatory Development Authority (IRDA).

ICICI Prudential's equity base stands at Rs. 9.25 billion with ICICI Bank and Prudential plc

holding 74% and 26% stake respectively. Its Assets Under Management (AUM) at June 30, 2022

were `2,300.72 billion. In FY2015 ICICI Prudential Life became the first private life insurer to

attain assets under management of `1 trillion.

ICICI Prudential Life is also the first insurance company in India to be listed on National Stock

Exchange (NSE) and Bombay Stock Exchange (BSE). For the past seven years, ICICI Prudential

has retained its position as the No.1 private life insurer in the country, with a wide range of flexible

products that meet the needs of the Indian customer at every step in life.

THE ICICI PRUDENTIAL EDGE:

The ICICI Prudential edge comes from its commitment to its customers, in all that it does - be it

product development, distribution, the sales process or servicing. Here's a peek into what makes it

leader.

❖ The products have been developed after a clear and thorough understanding of customers' needs.

It is this research that helped it develop Education plans that offer the ideal way to truly guarantee

child's education, Retirement solutions that are a hedge against inflation and yet promise a fixed

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

income after retirement, or Health insurance that arms one with the funds that one might need to

recover from a dreaded disease.

❖ Having the right products is the first step, but it's equally important to ensure that its customers

can access them easily and quickly. To this end, ICICI Prudential has an advisor base across the

length and breadth of the country, and it partners with leading banks, corporate agents and brokers

to distribute its products.

❖ Robust risk management and underwriting practices form the core of its business. With clear

guidelines in place, it ensures equitable costing of risks, and thereby ensure a smooth and hassle-

free claims process.

❖ Entrusted with helping its customers meet their long-term goals, it adopts an investment

philosophy that aims to achieve risk adjusted returns over the long-term.

❖ Last but not the least, its strong team is given the opportunity to learn and grow, every day in a

multitude of ways. it believes that this keeps them engaged and enthusiastic, so that they can

deliver on their promise to cover customers, at every step-in life.

VISION & VALUES

VISION: THE PURPOSE OF OUR EXISTENCE

To build an enduring institution that serves the protection and long-term saving needs of customers

with sensitivity.

VALUES: THE WAY WE DO THINGS

Our core values are Customer First, Humility, Passion, Integrity, and Boundarylessness. Values

guide our actions and define the way we work. We encourage all our colleagues to exemplify and

role model the Values.

Customer First: Keep customers at the Centre of everything we do

Humility: Be open to learn and change

Passion: Demonstrate infectious energy to win and excel

Integrity: Do the right thing

Boundarylessness: Treat organization agenda as paramount

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

FACT SHEET:

❖ The Company ICICI Prudential Life Insurance Company is a joint venture between ICICI Bank, a

premier financial powerhouse, and Prudential plc, a leading international financial services group

headquartered in the United Kingdom.

❖ ICICI Prudential was amongst the first private sector insurance companies to begin operations in

in the fiscal year 2001 after receiving approval from Insurance Regulatory Development Authority

(IRDA).

❖ On a retail weighted received premium basis (RWRP), it has consistently been amongst the top

companies in the Indian life insurance sector. Its Assets Under Management (AUM) at June 30,

2022 were `2,300.72 billion.

❖ ICICI Prudential Life operates on the core philosophy of customer-centricity. It offers long-term

savings and protection products to meet the different life stage requirements of its customers. It

has developed and implemented various initiatives to provide cost-effective products, superior

quality services, consistent fund performance and a hassle-free claim settlement experience to its

customers.

❖ In FY2015, ICICI Prudential Life became the first private life insurer to attain assets under

management of `1 trillion. ICICI Prudential Life is also the first insurance company in India to be

listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

❖ ICICI Prudential Life is also the only private life insurer in India to receive a National Insurer

Financial Strength rating of AAA (Ind) from Fitch ratings. The AAA (Ind) rating is the highest

rating and is a clear assurance of ICICI Prudential's ability to meet its obligations to customers at

the time of maturity or claims.

❖ For the past seven years, ICICI Prudential Life has retained its leadership position in the life

insurance industry with a wide range of flexible products that meet the needs of the Indian

customer at every step in life.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Year Particulars

FY2001 Company started operations

FY2002 Crossed the mark of 100,000 policies

FY2005 Crossed the mark of 1 million policies

Crossed the mark of 5 million policies

FY2008 Crossed receipt of `100 billion of the total premium

Crossed `250 billion of assets under management

Established subsidiary to undertake pension funds related business

FY2010 company turned profitable - a registered profit of `2.58 billion

Crossed `500 billion of assets under management

FY2012 Started paying dividends

FY2015 Crossed `1 trillion of assets under management

FY2017 First insurance company in India to list on NSE and BSE

FY2021 Crossed `2 trillion of assets under management

SALES DISTRIBUTION

TIED AGENCY:

Tied Agency is the largest distribution channel of ICICI Prudential, comprising a large advisor

force that targets various customer segments. The strength of tied agency lies in an aggressive

strategy of expanding and procuring quality business. With focus on sales & people development,

tied agency has emerged as a robust, predictable and sustainable business model.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

BANK ASSURANCE AND ALLIANCES:

ICICI Prudential was a pioneer in offering life insurance solutions through banks and alliances.

Within a short span of two years, and with nearly a large number of partners, B & A has emerged

as a vital component of the company’s sales and distribution strategy, contributing to

approximately one third of company’s total business.

The business philosophy at B&A is to leverage distribution synergies with our partners and add

value to its customers as well as the partners. Flexibility, adaptation and experimenting with new

ideas are the hallmarks of this channel.

ABOUT THE PROMOTERS:

ICICI Prudential Life Insurance Company Limited (ICICI Prudential Life) is promoted by ICICI

Bank Limited and Prudential Corporation Holdings Limited.

ICICI BANK

ICICI Bank is a leading private sector bank in India. The Bank’s total assets stood at ₹ 17,526.37

billion (US$ 231.2 billion) at March 31, 2022 and profit after tax of ₹ 233.39 billion (US$ 3.1

billion) for the year ended March 31, 2022. ICICI Bank currently has a network of 5,418 Branches

and 13,626 ATMs across India.

PRUDENTIAL CORPORATION HOLDINGS LIMITED

Prudential Corporation Holdings Limited is an indirect wholly owned subsidiary of Prudential plc.

Prudential plc provides life and health insurance and asset management in Asia and Africa. The

business helps people get the most out of life, by making healthcare affordable and accessible and

by promoting financial inclusion.

Prudential protects people’s wealth, helps them grow their assets, and empowers them to save for

their goals.

The business has more than 18 million life customers and is listed on stock exchanges in London

(PRU), Hong Kong (2378), Singapore (K6S) and New York (PUK). Prudential is not affiliated in

any manner with Prudential Financial, Inc. a company whose principal place of business is in the

United States of America, nor with The Prudential Assurance Company Limited, a subsidiary of

M&G plc, a company incorporated in the United Kingdom.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

CORPORATE SOCIAL RESPONSIBILITY:

CSR has been a long-standing commitment at the ICICI Group and forms an integral part of the

Company’s activities. The Group’s contribution to social sector development includes several

pioneering interventions and is implemented through the involvement of stakeholders within the

Company, the Group and the broader community.

ICICI Prudential Life’s CSR objective is to proactively support meaningful socio-economic

development in India and enable a larger number of people to participate in and benefit from

India’s economic progress. This is based on the belief that growth and development are effective

only when they result in wider access to opportunities and benefit a broader section of society.

The Company’s CSR activities are primarily focused in the areas of education, health, skill

development and sustainable livelihood, financial inclusion, capacity building for CSR and other

activities as the Company may choose to support in fulfilling its CSR objectives.

The Company supports programs and initiatives keeping “protection” as the core proposition and

cornerstone of all its CSR initiatives since “protection” is core to the Company’s business. The

CSR policy of the Company sets the framework guiding the Company’s CSR activities.

The CSR committee is the governing body that articulates the scope of CSR activities and ensures

compliance with the CSR policy.

Recent CSR Activities are-

➢ In March 2019, ICICI Prudential Life Insurance geared up for a CSR initiative with a

campaign named "Suna Kya? Body Ka Alarm" (transl. Listen to your body) in association

with Times Spotlight. This initiative is urging Indian people to pay attention to their body

signs and encourages them to be prepared financially. The company has also partnered with

SRL diagnostics for discounted health check-up packages.

➢ In March 2020, ICICI Prudential Life Insurance partnered with Times of India for

conducting the Mission Healthy India Survey 2020 to find out if people were paying

attention to the signs their body gives that can help them catch the onset of a critical illness

early. This awareness initiative from the company urges people to take good care of their

health and be financially prepared against any uncertainty.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

MANAGEMENT PROFILE

BOARD OF DIRECTORS

The ICICI Prudential Life Insurance Company Limited Board comprises reputed people from the

finance industry both from India and abroad.

• Mr. M. S. Ramachandran

(Chairman, Independent Director)

• Mr. Anup Bagchi

(Director)

• Mr. Sandeep Batra

(Director)

• Mr. Benjamin Bulmer

(Director)

• Mr. Dilip Karnik

(Independent Director)

• Mr. R. K. Nair

(Independent Director)

• Mr. Dileep Choksi

(Independent Director)

• Ms. Vibha Paul Rishi

(Independent Director)

• Mr. N. S. Kannan

(Managing Director & CEO)

MANAGEMENT

• Mr. N. S. Kannan

(Managing Director & Chief Executive Officer)

• Mr. Judhajit Das

(Chief Human Resources)

• Mr. Amit Palta

(Chief Distribution Officer)

• Mr. Satyan Jambunathan

(Chief Financial Officer)

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

• Mr. Deepak Kinger

(Chief Risk & Compliance Officer)

• Mr. Manish Kumar

(Chief Investments Officer)

• Mr. Souvik Jash

(Appointed Actuary)

• Ms. Sonali Chandak

(Company Secretary)

LIFE INSURANCE PLANS & POLICY

Life insurance plans from ICICI Prudential Life helps you secure your family’s financial future

and also fulfil their dreams and aspirations. So, wait no more. Sabse Pehle choose from our wide

range of plans to lead a worry-free life now and forever.

#SabsePehleLifeInsurance

TERM INSURANCE PLANS

ICICI PRU IPROTECT SMART TERM PLAN

❖ Get life cover to protect your loved ones at affordable rates

❖ Get cash payout up to 1 crore on first diagnosis of 34 critical illnesses (optional)

❖ Accidental death benefits up to 2 crore (optional)

❖ Tax benefits^ up to 54,600 under Section 80C and 80D of the Income Tax Act

❖ Get covered till the age of 99 years and flexibility to pay for limited term

ICICI PRU IPROTECT RETURN OF PREMIUM

❖ Ensure right life cover to protect yourself adequately at every life-stage

❖ Get 105% of your premium back or get monthly income from age 60 on survival/maturity

❖ Get claim payout on diagnosis of 64 critical illnesses (optional)

❖ Accidental death benefit covers up to 2 crore (optional)

❖ Tax benefit as per prevailing tax law

ICICI PRU SARAL JEEVAN BIMA

❖ Life cover to secure your family

❖ Tax benefits as per prevailing tax laws

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

ICICI PRU PRECIOUS LIFE

❖ Cover for individuals with existing health problems

❖ Choose to receive the benefit amount as a lump sum or as monthly income or a combination of

both

❖ Option to enhance safety net with Accidental Death Benefit

ICICI PRU LIFE RAKSHA

❖ Security of your loved ones’ future even in your absence

❖ Tax benefits

ICICI PRU POS - LIFE RAKSHA

❖ Security of your loved ones’ future even in your absence

❖ Tax benefits

ICICI PRU LOAN PROTECT PLUS

❖ Protection against loan liability for your loved ones

❖ Premium payment as per your comfort

❖ Tax benefits

HEALTH INSURANCE PLANS

ICICI PRU HEART/CANCER PROTECT

❖ Get the claim amount on diagnosis

❖ No restrictions on your choice of hospital

❖ Waiver of future premium for Minor conditions of Cancer or Heart for full policy term

❖ Get tax benefits^ up to 7,800 under Section 80D of the Income Tax Act

UNIT LINKED INSURANCE PLANS

ICICI PRU SIGNATURE (ONLINE)

❖ Financial protection for your loved ones with life insurance cover

❖ Return of mortality and policy administration charges

❖ Enjoy policy benefits till 99 years of age with Whole Life policy term option

❖ Withdraw money regularly from your policy with SWP

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

ICICI PRU SIGNATURE

❖ Financial protection for your loved ones with life insurance cover

❖ Return of Total Premium Allocation Charges more than once

❖ Value Benefit to reward higher premiums

❖ Enjoy policy benefits till 99 years of age with Whole Life policy term option

❖ Systematic withdrawal plan to withdraw money regularly from your policy

ICICI PRU SMART KID WITH SMART LIFE

❖ Grow your money manifold for child's big day with market investment

❖ Take out money anytime at key educational milestones of your child

❖ Policy will continue uninterrupted ‘even in absence of parents

❖ Tax benefits under Section 10(10D) and 80C

ICICI SINGLE PREMIUM POLICY PRU ONE WEALTH

❖ Invest only once and enjoy benefits for entire policy term

❖ 100% amount invested in wide range of funds

❖ Choice of multiple funds

❖ Up to 10 times life cover to protect your loved ones

❖ Tax benefits^ on premiums paid and maturity benefit under Sec 80C and Sec 10(10D) of IT Act,

1961

ICICI PRU LIFE-TIME CLASSIC

❖ Life cover to protect your loved ones

❖ Various choice of funds to invest and grow your money (equity, debt or balanced funds)

❖ Choice of 4 portfolio strategies

❖ Get Loyalty Additions & Wealth Boosters by just staying invested in the plan

❖ Get tax benefits under Section 80C of Income Tax Act 1961, up to 46,800

ICICI PRU GUARANTEED WEALTH PROTECTOR

❖ No risk to capital: 101% Money back guarantee

❖ Life cover to protect your loved ones

❖ Loyalty Additions and Wealth Boosters for staying invested for the policy term

And Much more…….

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

TRADITIONAL PLANS

ICICI PRU SUKH SAMRUDDHI

❖ Choice to avail benefits as either Income or Lump sum

❖ Life cover for financial protection of your loved ones

❖ Option to receive income on any date of your choice with ‘Save the Date

❖ Option to accumulate income and withdraw it later as per your convenience with Savings Wallet

❖ Tax benefits may be applicable on premiums

ICICI PRU GUARANTEED INCOME FOR TOMORROW (LONG-TERM)

❖ Guaranteed Income to help you achieve your long-term goals

❖ Option to get back 110% of total premiums paid

❖ Life insurance cover for financial security of your family

❖ Tax benefits may be applicable on premiums paid and benefits received as per the prevailing tax

laws

ICICI PRU GUARANTEED INCOME FOR TOMORROW

❖ Guaranteed benefits in the form of lump sum or regular income to achieve your life goals

❖ Option to receive guaranteed income from 2nd year onwards

❖ Life insurance cover for financial security of your family

❖ Tax benefits may be applicable on premiums paid and benefits received as per prevailing tax laws

ICICI PRU CASH ADVANTAGE

❖ Your family gets financial protection through life cover

❖ Guaranteed cash benefits

❖ You get Bonus, if any, for staying invested

❖ Tax benefits^ on premium paid and benefits received

ICICI PRU SAVINGS SURAKSHA ENDOWMENT PLAN

❖ Life cover to protect your loved ones

❖ Guaranteed Maturity Benefit and Guaranteed Additions

❖ Get Reversionary and Terminal Bonus, if any, over and above the maturity benefits of the policy

❖ Tax benefits^ on premiums paid and benefits received as per Income Tax Act 1961

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

ICICI PRU LAKSHYA WEALTH

❖ Get lump sum on maturity along with protection throughout the policy term

❖ Increase your savings with applicable 4S Guaranteed Value Benefits

❖ Get Regular Additions added to your corpus throughout the policy term

❖ Tax benefits may be applicable on premiums paid and benefits received as per prevailing tax laws

ICICI PRU LAKSHYA LIFELONG INCOME

❖ Enjoy regular income till 99 years of age

❖ Life cover till 99 years of age to secure your family’s future

❖ Enjoy tax benefits on premiums paid and benefits received as per prevailing tax laws

RETIREMENT PLANS

ICICI PRU GUARANTEED PENSION PLAN FLEXI

❖ A regular-pay deferred annuity plan that helps you gradually build the retirement savings and

provide guaranteed income for life

❖ Flexible premium paying terms and deferment periods

❖ Meet your healthcare and lifestyle needs through additional payout options

❖ Financial security for your family even in your absence, with the Waiver of Premium feature

❖ Annuity plan can cover either single or joint

ICICI PRU GUARANTEED PENSION PLAN

❖ Single premium plan to get guaranteed income for life with the option to defer income by up to 10

years

❖ Lock in the current interest rates for the annuity to be received later

❖ Annuity plan can cover either single or joint life

❖ Flexible payout options to suit your need

❖ Tax benefits on premium paid u/s 80 CCC of Income Tax Act, 1961

ICICI PRU SARAL PENSION PLAN

❖ Pay just once and get a guaranteed lifelong income

❖ Continue pension for spouse after you with the Joint Life option

❖ Purchase Price is returned to your nominee

❖ Option to avail a loan against your policy

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

ICICI PRU EASY RETIREMENT SINGLE PREMIUM PENSION PLAN

❖ Build your retirement corpus as per your risk appetite and get rewarded with pension boosters

❖ Protect your savings from market downturns through an Assured Benefit

❖ Pay premium only once and get regular pension post retirement

And Much More including riders, group, urban and rural plans.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

1.3) INTRODUCTION TO THE TOPIC

The insurance policy is the contract between the insured and the insurer which specifies the risks

covered exclusions if any and benefits reimbursed on the happening of the event. Earlier the

majority of people do not care about the important of having insurance. But now a days, majority

of people own at least one insurance policy in order to protect own benefits. India is one of the

emerging economies of the world and the insurance sector is the important sectors which play a

very crucial role in promoting saving among people by selling a large range of products.

Insurance sector also contributes in sustaining and promoting the financial market and support the

development of the national economy. Prior to year 2000, Life Insurance Corporation of India

(LIC) has monopoly over Life Insurance industry in India. LIC was nationalized in 1956. The

structure of Indian insurance has transformed during past two decades from a monolithic to a

highly competitive. Globalization and Liberalization created competitive environment in the

country by allowing private insurance players having alliance with foreign insurance experts in the

life insurance market in India.

The Insurance Regulatory and Development Authority Act 1999 (IRDA Act) was passed by

parliament of India to regulate and promote insurance market in India. At present there are twenty

four players (one public and twenty three private) in life insurance market performing their

operations in Indian insurance market and offering different type of products to the customers.

Due to the advancement of the information technology, Consumers are now more aware of the

options available in services market and the service provider. Due to rising consumer awareness

and entry of private life insurance companies in Indian life insurance market, customers’

expectation and perception of quality of services from the life insurance companies have also

changed. It is not easy for any player to survive in the market for long-term without fulfilling the

expectations of the customers. Under this situation insurance companies are now trying to change

their focus from product orientation to customer orientation. In today’s cut-throat competition

service quality play an important role to attract and retain customers. Quality has become a

strategic tool in obtaining efficiency in operations and improved performance in business. Quality

has a positive impact on profitability, market share, and return on investment, customer

satisfaction, and future purchase intentions (Rust and Oliver, 1994).

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Information technology have empowered the globe is providing quick and access to information

and services to customers in all companies including insurance. Insurance companies have realized

that competition can be well managed by differentiating the quality of service which in turn helps

in establishing and sustaining satisfying relationships with policyholders.

According to Kotler (2000) “service delivery is the major driving force to business sustainability.

This is due to the fact that customers derive their perceptions of service quality on the levels of

satisfaction they experience with a particular business Customers will give business high marks

for its service when it meet or exceed their service desires” With a greater choice and an increasing

awareness, there is a continuous increase in the customers’ expectations and they demand better

quality service. Therefore, to sustain in the market, service quality becomes a most critical

component of competitiveness for Life Insurance companies.

CONSUMER PERCEPTION

Customer awareness is a marketing perception that includes a consumer’s impression,

consciousness or willingness about a concern. It is affected through advertising, personal

experience and other channels. The profitability of business and success or failure depends on

customer perception. It is three stages procedure that interprets raw incentives into meaningful

information i.e. disclosure, responsiveness and analysis. In other terms, it is how a purchaser see’s

specific brand which whatever he or she had been also to recognize through watching the goods,

its advancements, feedback etc.

Customer awareness or perception as a concept is of universal concern for all economies of the

world. In the context of a booming Indian economy and unprecedented growth being witnessed by

Insurance industry - especially life insurance -, it would be interesting to examine this concept in

depth. Perception is defined as “the process by which an individual receives, selects, organizes,

and interprets information to create a meaningful picture of the world”.

Perception is the process by which an individual select, organizes and interprets information to

create a meaningful picture of the world. Individuals act and react on the basis of their perceptions,

not on the basis of objective reality. Hence, for a marketer to know the customers’ perception is

more important than their knowledge of objective reality with high life insurance businesses

offering comparable rules.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

Product variation is tough in progressively reasonable market. Therefore, insurance businesses in

India are now moving from a manufactured goods centered method to a purchaser centered

strategy. The effort is on increasing consumer fulfillment by improved purchaser preservation,

loyalty and profitability. Through online insurance people no information more about the policy

and they can avoids spending more time for it, which indulges them for not seeking the help of

intermediaries.

Competition between the Life Insurance Corporation of India and the private sector insurers

continues to intensify. While innovative products have been underpinning private insurers’

premium growth, the threat of losing market share has also led to more aggressive pushes by LIC

to stay competitive such as to develop new distribution channels like bancassurance. As a result,

though LIC lost significant market share to private companies in the post-liberalization period, it

still retains a commanding position in the life insurance segment.

While, most of the product innovations came from the private players initially, LIC joined the race

soon in order to protect its turf. While LIC still dominates in segments like endowments and

moneyback policies, private insurers have already wrested a significant share of the annuity and

pension products market. Such intense competition has resulted in faster premium growth as well

as deeper penetration for the entire market.

At the same time, the profile of Indian customer is also evolving. Customers are more actively

managing their financial assets and are increasingly looking to integrated financial solutions that

can offer stability of returns along with more comprehensive protection. Insurance has emerged as

an attractive and stable investment alternative that offers total protection for life, health as well as

wealth. These factors have contributed to changes in demand for insurance products. While

traditional life insurance products like individual insurance, whole life insurance and term life

insurance continue to remain popular to this day, new products such as single premium,

investment-linked, retirement products, variable life and annuity products are on a growth

trajectory.

What consumers think about a product and what it actually is affects their actions. Individuals

make decisions and take actions based on what they perceive to be reality is very important to

marketers to understand the whole notion of perception and is related concepts, so they can more

readily determine what factors influence consumers to buy. The companies are trying to trigger

growth in rural areas. They are identifying the fact that rural people are now in the better position

with disposable income.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

The low rate finance availability has also increased the affordability of purchasing the insurance

products by the rural people. Marketer should understand the price sensitivity of a consumer in a

rural area. The buying behavior of the rural consumers in India is influenced by several factors,

such as socio-economic conditions, cultural environment, literacy level, occupation, geographical

location, extensive efforts on the part of sellers, exposure to the media, etc.

The Indian insurance industry continued to face various problems such as low penetration and low

premium to GDP ratio. Growth was also hampered by the existing customer perception that life

insurance was a tax saving tool. In present Indian market, the investment habits of Indian

consumers are changing very frequently.

The consumer’s perception towards Life Insurance Policies is positive. It developed a positive

mind sets for their investment pattern, in insurance policies. Still some actions are needed for

developing insurance market. Insurance industry has to go ahead.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

CHAPTER 2

LITERATURE

REVIEW

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

2) REVIEW OF LITERATURE

Seth (2020) states that insurance industries in India are using social media in marketing operations

only, to tell their customers about the launch of a new product or any milestone achieved. The

research has been conducted by keeping in mind the situation of the COVID-19 pandemic and this

further can be extended on a larger level by studying more social media channels.

Also, demographic factors influence the behavior while making a buying decision of an insurance

policy. Yadav, (2019)

Samarasinghe et al. (2018) in their study attempted to explore determinant of service quality of

Life Insurance Business. Analysis of the Study revealed that employee of Insurance company

communication styles; behavior and financial strength pay more consideration in purchasing life

insurance policy. The intangible factors which were not considered by SERVQUAL scale

developed by Parasuraman and Colleagues to test service quality have influenced here the

customers to satisfy with life insurance policies.

Consumer behavior and satisfaction are feebly correlated in the case of motor insurance; says Das

(2017), it would be imperative to research whether this holds in the case of the life insurance

industry or not.

Pragati and Monica made evaluation of financial performance of selected private general insurance

companies in India using earning and profitability parameters of CARAMEL model. Claim

incurred ratio, expense ratio, combined ratio, underwriting result ratio and investment income ratio

have been calculated and one-way canvased. The results of the study suggest that private general

insurance companies should focus more on the reduction of expenses and increase investment

income. (Monica, 2017)

It has been observed by Delafrooz (2017)) that increased use of social media to sell causes the

increased use of social media by consumers.

Mangayarkarasi (2015) in her study conducted that there was enhanced concentrate on the client

and personal firms centered lots of attention on extensively coaching their agents for his or her

purpose. Before easing, distribution was entirely through individual agents. When the gap up the

arena for personal participation, several new channels of distribution have opened.

Makhulo (2014) says that social media has changed the way people communicate and share

information globally. Social media is being used for communication, transaction, and relationship

building in insurance companies. Increased use of social media is also helpful in gaining a

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

competitive advantage against competitors in terms of higher brand awareness and building a

brand image.

Prakash and Sugumaran (2014) assessed the perceptions and expectations of customers in

SERVQUAL parameters with reference to Life Insurance Companies in Chennai, India. The study

concluded the expectation levels of customers on the factor’s communications; competence,

reliability, security and courtesy are significantly higher.

Anjor et al (2014) evaluated the impact of service quality and customer satisfaction by using model

of SERVQUAL with five dimensions (Parsuraman et al 1988) from the five cities of Uttar Pradesh

and concluded that “the expectations are higher than perception in terms of service quality in

insurance sector”.

Shamsher Singh et al. (2014) studied the customer’s perceptions towards Service Quality of Life

insurance companies in Delhi NCR Region.

The findings of study show four major factors which influence customer perception of service

quality namely, tangibility, responsiveness, assurance, convenience, and empathy. Study found

that expect age of respondents the demographic factors had no significant impact on the customer

perceptions of service quality.

Kuldeep Chaudhary et al. (2014) examined the expected and perceived service quality in Life

Insurance Corporation of India. The results showed that there exists a significant negative gap in

service quality expected and perceived by the customers of the Life Insurance Companies.

Dr. Ashfaque Ahmed (2013) in his study “perception of life insurance policies in rural India”

reveled that there is low level of awareness and understanding of life insurance products. There

are various factors that influence consumer thinking when they are planning to invest in insurance

scheme. Most of the customers show their interest in life insurance having higher risk coverage

and also for good return with safety. The roles played in perception of life insurance policies in

rural market by members of the family varies with knowledge parameters as well as with the typed

of products and sometimes with the company name also. While several psychological variables

are useful in obtaining into consumer’s perception towards buying life insurance policies in rural

areas. The insurance company name also plays an important role in purchasing.

Pramod Kumar Singhal and Assitha Gupta (2013) in the study ‘Assessment of Service Quality in

Insurance Sector – A Case Study of Private Companies of Haryana State, assessed service quality

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

in insurance sector using SERVQUAL scale, the study concluded that the people have a negative

impression towards the private insurance companies.

S.Pushpalatha P. Hima Jagathi (2013) are discussed that rural market is vibrant and holds

tremendous potential for growth of insurance schemes with easy premium. The marketing

challenge lies in creating insurance awareness and the identified agents for promoting life

insurance. The preferential factors for opting insurance can be identified as tax planning and risk

cover in spite of various factors like financial compensation, maximum return and financial safety.

There is a major demand for traditional policies than newly emerged plans such as ULIPS and

children plans. Agent’s behavior along with brand image made the respondents to choose an

insurance company and to select an appropriate plan.

Ramanathan, K.V. (2011) research has resulted in the development of a reliable and valid

instrument for assessing customer perceived service quality, awareness level, and satisfaction level

of customers towards life insurance industry. Here, service quality needs to be measured using a

six dimensional hierarchal structure consisting of assurance, competence, personalized financial

planning, corporate image, tangibles and technology dimensions.

Epetimehin M Festus (2011) discussed about importance of marketing segmentation as a tool for

improving customer satisfaction and retention in insurance service delivery. This paper suggested

that in spite of egalitarian approach that underpins the marketing of insurance, market

segmentation may be used to better serve the needs of their customer.

Selvavinayagam, K. and Mathivanan, R. (2010) article has revealed that the competitive climate

in the Indian insurance market has changed dramatically over the last few years. At the same time,

changes have been taking place in the government regulations and technology. The expectations

of policyholders are also changing. The existing insurance companies have to introduce many new

products in the market, which have competitive advantage over the products of life insurance

companies.

Yusuf et al. (2009) found that the attitudes of Nigerians towards Insurance institution and services

were mostly negative because of their poor quality services rendered to the customers.

Senthilet al., (2009) concluded in their article, “Critical success factors of agents in Life Insurance

Services” that agents are the real success of Life Insurance products. The study focused on the

identification of critical success factors of the agents, the impact of factors on their performance,

and the discriminated success factors among the agents of public and private sector players. The

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

study concluded that the important critical success factors of agents are service diversity, service

quality, trust, communication, and customization.

All the above mentioned factors have a significant and positive impact on their performance. The

important discriminated factors among the agents of public and private players are the

customization and service quality. The agents of public players are far better in the above factors

compared to their counterparts (i.e. agents of private sector players).

Praveen Sahu, Gaurav Jaiswal and Vijay Kumar Panday (2009) in their article, “A Study of Buying

Behavior of Consumers towards Life Insurance Company”, Prestige institute of Management and

Research, Gwalior, revealed that in present Indian market, the investment habits of Indian

consumers are changing very frequently. The individuals have their own perception towards

various types of investment plans.

Vijaykumar A. (2007) in his article entitled "Globalization of Indian Insurance sector-issues and

challenges" found that the success of the insurance industry will primarily depend upon meeting

the rising expectations of the consumers who will be the king in the liberalized insurance market

in future.

Namasivayam et al., (2006), examined the socioeconomic factors that are responsible for purchase

of life insurance policies and the preference of the policyholders towards various types of policies

of LIC. From the analysis, the study concluded that factors such as age, educational level and sex

of the policyholders are insignificant, but income level, occupation and family size are significant

factors.

According to Lovelock et al (2006) if a firm wants to retain customer, they are needed to provide

better quality of services to their customers through quality improvement programs and should

continuously enhance benefits desired by customers. At the same time, productivity improvement

efforts reduce the cost. The customers are satisfied with the firm if the services deliver by

organizations are better than their competitors.

Sharma (2005) performed a study on ‘Insurance perspective in Eastern-up’ with the objective of

probing into the reasons or the factors behind the purchase of the insurance product. It was found

that according to 93.86% of respondents’ insurance policies are considered indispensable for risk

protection.

Raman and Gayatri (2004) have observed the customers’ awareness towards new insurance

companies. They found that 53% of the respondents belong to the age group below 30, 24% to the

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

age group 31-40, 2% belong to the age group of 41-50 and the rest of the respondents belong to

the group of ‘above 50’.

They also observed that a large percentage of the insured respondents (32%) are professional, and

56% of the respondents are married. It is also found that 52% of the respondents have taken a

policy to cover risk and 44% of them to avoid tax and the remaining to invest their surplus amount

A study conducted by Patil (2003) revealed that the insurance coverage of agricultural groups and

agricultural labor is very low. The performance of children-related policies such as Jeevan Kishore,

Jeevan Balya, etc., is very poor except the children money back policy, which has also not been

contributing significantly. The demonstration of product features by the agents is not satisfactory.

Bhave Ashis (2002) in his study revealed that to keep existing customer is costly than to win new

ones. Major attributes of customer satisfaction are product quality, product packaging, keeping

delivery commitments, price, responsiveness and ability to resolve complaints and reject report

and overall communication, accessibility and attitude.

Zeithmalet al., (2000) revealed that, due to the heavy competition, service quality has become an

important tool to measure the service quality and recognized as a key factor to popular area of

academic investigation and has been in maintaining sustainable competitive advantage and

satisfying relationships with customers.

Augustyn and Ho (1998) concluded the SERVQUAL model was the most useful tool for defining

customer satisfaction.

Keaveney (1995) classified customers’ reasons for switching service providers into eight general

categories, such as pricing, inconvenience, core service failure, failed service encounters, response

to failed service, competition, ethical problems and involuntary switching.

Lehtinen and Lehtinen (1991) again included three components-” interactive, physical, and

corporate qualities”.

According to Carman (1990), “the items used to measure service quality should reflect the specific

service setting under investigation, and that it is necessary in this regard to modify some of the

items and add or delete items as required”.

A. Parsuraman, Leonard L. Berry, and Valarie A. Zeithaml, (1988) in their research explained

about development of 22-item instrument in the measurement of service quality perceptions of

customers in service and retail firms, which was known as “SERVQUAL”.

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

In exploratory research based on the focus groups the authors identified 10 determinants of service

quality that included tangibles, reliability, responsiveness, access, competence, courtesy,

credibility, security, communication, and understanding the customer and later on they find that

some dimensions are overlapping so they reduced into five dimensions namely tangibles,

reliability, responsiveness, assurance and empathy.

The authors proposed that SERVQUAL scale can use in vast range of service and retail firms to

measure the customer expectations and perceptions of service quality as it had a variety of potential

applications.

The definitions of service quality imply the identification and satisfaction of customer needs and

requirements. “The service quality can be defined as the difference between predicted or expected

service and perceived service. In the services marketing literature, service quality has been

reported as a second order construct, being composed of several first-order variables”

(Parasuraman, 1985).

A satisfied insurance customer is not necessarily a loyal one, according to the first world Insurance

Report, a groundbreaking international study of over 10,000 insurance customers, insurers and

distributors released by Capgemini, one of the World’s foremost providers of consulting,

Technology and outsourcing services and the European financial Management and Marketing

Association (FEMA) today (www.capgemini.com/world insurance report).

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

CHAPTER 3

RESEARCH

METHODOLOGY

Downloaded by Cricket Buzz (cricketbuzz65@gmail.com)

lOMoARcPSD|32875405

3) RESEARCH METHODOLOGY

Every project work is based on certain methodology, which is a way to systematically solve the

problem or attain its objectives. It is a very important guideline and lead to completion of any

project work through observation, data collection and data analysis.