Professional Documents

Culture Documents

Ato 2011

Uploaded by

kms1978Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ato 2011

Uploaded by

kms1978Copyright:

Available Formats

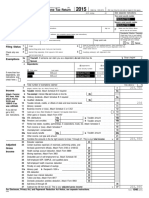

Short tax return for individuals

1 July 2010 to 30 June 2011 2011

Use the Short tax return instructions 2011 to fill in this tax return.

WHEN COMPLETING THIS TAX RETURN

n Print clearly, using a black pen only. YOU CAN LODGE YOUR SHORT TAX RETURN

BY PHONE OR MAIL.

Use BLOCK LETTERS and print one character per box.

84160611

n

By phone – 13 28 65

S M I T H S T By mail – PO Box 9845 in your capital city

n Place X in ALL applicable boxes. For more information, see pages 3–4 of the loose

leaf cover.

n Do not use correction fluid or tape.

Section A: Personal information

1 Are you eligible to use the short tax See page 3 of the loose leaf cover for

Yes No other ways to prepare your tax return.

return? (See pages 1–2 of the loose leaf cover.)

2 Your tax file number (TFN) TF

(See the privacy information on page 52 of the instructions.)

3 Are you an Australian resident? You cannot use the short tax return.

(See page 11 of the instructions.) Yes No RE

4 Your sex Male Female SX

5 Your full name

Title: Mr Mrs Miss Ms Other If lodging by phone NM

and any of these details

Family name have changed, see

page 12 of the instructions.

First given name Other given names

Has any part of your name changed since you last notified the Tax Office?

Your previous family name

No Yes

6 Your postal address Print the address where you want your mail sent.

PA

Suburb/town/locality State/territory Postcode

PC

Country if not Australia

If lodging by phone and any of

these details have changed, see

Has any part of your address changed since you last notified the Tax Office? No Yes page 12 of the instructions.

7 Is your home address different from

No Go to Question 8. Yes Print your home address.

your postal address?

HA

Suburb/town/locality State/territory Postcode

Country if not Australia

Day Month Year

8 Your date

DB

of birth

9 Your daytime phone number PN

10 If you had a spouse at any time during 2010–11, write your spouse’s name (See page 12 of the instructions.)

Family name

SN

First given name Other given names

NAT 8416-06.2011 IN-CONFIDENCE – when completed Page 1

11 Will you need to lodge an Australian

Yes Don’t know No This is my final tax return. FN

tax return in the future?

12 Electronic funds transfer (EFT)

Provide your financial institution details to have your refund paid directly to your account.

It’s faster and simpler to have your refund paid in this way. Write the BSB number, account number and account name below.

(For more information see page 12 of the instructions.)

BSB number (must be six digits) Account number

EF

Account name (for example, JQ Citizen. Do not show the account type, such as cheque, savings, mortgage offset)

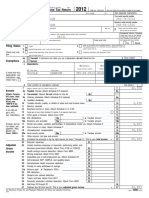

Section B: Income You will need to refer to the instructions to answer these questions correctly.

If a question does not apply to you, leave the answer space blank.

13 Main salary and wage occupation

(See page 13 of the instructions.)

14 Salary and wages (See pages 13–4 of the instructions.) Tax withheld Income

Employer’s Australian business number (ABN) Do not show cents Do not show cents

$ .00 C$ .00 1

, ,

$ .00 D$ .00 1

, ,

$ .00 E$ .00 1

, ,

$ .00 F $ .00 1

, ,

$ .00 G$ .00 1

, ,

15 Employment allowances you received .00 .00

(See pages 14–5 of the instructions.) $ , K$ , 2

16 Newstart, youth allowance, austudy payment

and other such Australian Government $ .00 A$ .00

, , 5

payments (See list on pages 15–6 of the instructions.)

17 Age pension, age service pension, carer

payment and other such Australian Government $ .00 B$ .00 6

, ,

payments (See list on pages 16–7 of the instructions.)

You may be entitled to a tax offset and may need to

complete Questions 33 and 34. See pages 31–2 and 33

of the instructions to determine your eligibility.

18 Australian annuities and superannuation .00

income streams (See pages 17–9 of the instructions.) $ ,

Taxable component Taxed element J $ .00 7

,

Untaxed element N$ .00 7

,

Add up all the amounts .00

19 TOTAL TAX WITHHELD in the ‘Tax withheld’ column. $ , , TX

20 Interest (See page 20 of the instructions.) L $ .00 10

,

21 Dividends from shares Unfranked amounts S$ .00 11

(See page 21 of the instructions.) ,

Franked amounts T$ .00 11

,

Franking credits U$ .00 11

,

22 Small payments you received for your services (totalling less than $5,000) V$ .00 24

(See page 22 of the instructions.) , I

23 TOTAL INCOME Add up all the amounts in the ‘Income’ column. $ .00 TI

, ,

Page 2 IN-CONFIDENCE – when completed

Place your attachments here. Your tax file number (TFN)

Section C: Deductions

Do not show cents

24 Work-related car expenses (See page 23 of the instructions.) A $ .00 S D1

,

Code

25 Work-related clothing expenses (See pages 24–5 of the instructions.) C $ .00 D3

,

letter

26 Other work-related expenses (See pages 25–6 of the instructions.) E $ .00 D5

,

27 Bank account fees (See page 27 of the instructions.) I $ .00 D7

,

28 Gifts and donations of money (See pages 27–8 of the instructions.) J $ .00 D9

,

29 Cost of managing your tax affairs (See page 28 of the instructions.) M$ .00 D10

,

30 TOTAL DEDUCTIONS Add up the deduction amounts. $ .00 TD

, ,

31 TAXABLE INCOME .00

Total income (Question 23) minus total deductions (Question 30)

$ , ,

TT

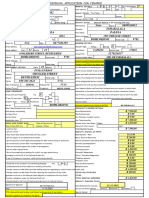

Section D: Tax offsets Do not show cents

Code

32 Dependent spouse, no dependent children (See pages 29–30 of the instructions.) P $ .00 S T1

,

letter

33 Senior Australians

(See pages 31–2 of the instructions.)

Tax offset code N

T2

Veteran code Y

34 Pensioner offset

(See page 33 of the instructions.)

Tax offset code O

T3

If you have completed Question 33 do not complete this question. Veteran code T

35 Australian superannuation income stream S $ .00 T4

(See pages 34–5 of the instructions.) ,

36 Private health insurance (See pages 36 of the instructions.) G $ .00 T5

,

37 Zone (remote area) (See pages 37–8 of the instructions.) R $ .00 T8

, T

38 TOTAL TAX OFFSETS Add up the tax offset amounts. $ .00

, TO

84160711

IN-CONFIDENCE – when completed Page 3

Please read page 39 of the instructions before answering the following questions.

Section E: Medicare levy

39 Medicare levy reduction Number of dependent children

(See page 40 of the instructions.) under the income limit Y M1

Code

40 Medicare levy exemption FULL exemption – number of days V M1

(See pages 41–3 of the instructions.)

letter

HALF exemption – number of days W M1

41 Medicare levy M2

You must answer this question (See pages 43–5 of the instructions.)

surcharge

M2

Did you and all your dependants (including your spouse) Yes You do not have to pay the surcharge.

{

have an appropriate level of private patient hospital cover

for all of 2010–11?

E Number of days you do not

A M2

have to pay the surcharge

No

Number of dependent children D

Section F: Private health insurance policy details

42 Private health insurance policy details Type of

(See page 46 of the instructions.) Health insurer ID Membership number cover

If you had private health insurance of B C PH

any type at any time in 2010–11

you must answer this question. B C PH

Section G: Adjustment

Age

43 Under 18 Income to be taxed at normal rates (using the .00

(See pages 46–7 of the instructions.) calculation on page 47 of the instructions) J $ ,

A1

code

If you were aged under 18 years on 30 June 2011 you must answer this question.

Section H: Income tests

44 Reportable fringe benefits W$ .00 IT1

,

45 Reportable employer superannuation contributions T $ .00 IT2

,

Page 4 IN-CONFIDENCE – when completed

Section I: Spouse details – married or de facto

If you did not have a spouse at any time in 2010–11, go straight to Question 51.

If you had a spouse at any time in 2010–11:

n check that you have answered Question 10 on page 1

n check Questions 46–50 in the instructions to see if you have to answer them.

46 Your spouse’s details Day Month Year

(See page 49 of the instructions.) Your spouse’s date of birth K SD

Your spouse’s sex Male Did you have a spouse for all of 2010–11? L No Yes

{

Day Month Year

Female If you did not have a spouse for the full year – From M

write the dates you had a spouse between

1 July 2010 and 30 June 2011. To N

47 Your spouse’s 2010–11 taxable income .00 SI

(See page 49 of the instructions.) O$ , ,

48 Your spouse’s share of trust income .00

(See page 49 of the instructions.) T $ ,

49 Your spouse’s income from family trust distribution .00

(See page 50 of the instructions.) U $ ,

Your spouse’s reportable fringe benefits amounts .00

(See page 50 of the instructions.) S $ ,

50 Age pension and other such government payments paid .00

to your spouse in 2010–11 (See page 50 of the instructions.) P $ ,

Exempt pension income your spouse received in 2010–11 .00

(See page 50 of the instructions.) Q $ ,

IN-CONFIDENCE – when completed Page 5

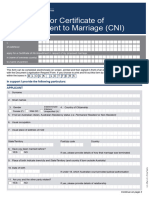

Section J: DECLARATION The tax law imposes heavy penalties for giving false or misleading information.

See the privacy information on page 52 in the instructions.

51 Your declaration

I declare that:

n the information I have provided is true and correct and that I have no other taxable income

n I have the necessary receipts and records – or expect to obtain them within a reasonable time

of lodging this tax return – to support my claims for deductions and tax offsets.

Your signature

Day Month Year

Date

The Tax Office will issue your assessment based on your tax return. However, the Tax Office has some time to review your tax return,

and issue an amended assessment if a review shows inaccuracies that change the assessment. The standard review period is two

years but for some taxpayers it is four years. (See page 7 of the instructions.)

Receipt number

If you are lodging this short tax return by phone, call 13 28 65.

You will be given a receipt number to record here at the end of your call.

For more information on phone lodgment, see pages 3–4 of the loose leaf

cover to the Short tax return for individuals 2011.

Page 6 IN-CONFIDENCE – when completed

IN-CONFIDENCE – when completed Page 7

Page 8 IN-CONFIDENCE – when completed

You might also like

- Tax File Number - Application or Enquiry For Individuals: Section ADocument8 pagesTax File Number - Application or Enquiry For Individuals: Section ARebecca BakerNo ratings yet

- Non-Lodgment Advice: Your Tax File Number (TFN)Document1 pageNon-Lodgment Advice: Your Tax File Number (TFN)Jonathan McDonaldNo ratings yet

- Supplementary Welfare Allowance: Application Form ForDocument8 pagesSupplementary Welfare Allowance: Application Form ForHysen MashadNo ratings yet

- Gov. Walz Tim 2017 Tax Returns - RedactedDocument12 pagesGov. Walz Tim 2017 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Accommodation Details: When To Use This FormDocument10 pagesAccommodation Details: When To Use This FormwoodywheelNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Additional Personal Particulars Information: Part A - Your DetailsDocument10 pagesAdditional Personal Particulars Information: Part A - Your DetailsShah Moontakim NawazNo ratings yet

- Questionnaire AEWV Work Visa Principal ApplicantDocument6 pagesQuestionnaire AEWV Work Visa Principal ApplicantKazandra Cassidy GarciaNo ratings yet

- Tax Change AddressDocument3 pagesTax Change AddressamoszhouNo ratings yet

- Gov. Walz Tim 2009 2010 2011 Tax Returns - RedactedDocument67 pagesGov. Walz Tim 2009 2010 2011 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- 1221 - Additional Personal Particulars InformationDocument10 pages1221 - Additional Personal Particulars InformationBilal AhmedNo ratings yet

- Gov. Walz 2012 Tax Returns - RedactedDocument17 pagesGov. Walz 2012 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2013 Tax Returns - RedactedDocument17 pagesGov. Walz 2013 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument34 pages2016 540 California Resident Income Tax Returnapi-3512139760% (1)

- NWB50014 Add A New Party To An Account 030615Document7 pagesNWB50014 Add A New Party To An Account 030615SumNo ratings yet

- Gov. Walz 2014 Tax Returns - RedactedDocument15 pagesGov. Walz 2014 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Rentshield Tenancy ApplicationDocument6 pagesRentshield Tenancy ApplicationAhmetSencerNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- State Pension (Contributory) : Application Form ForDocument20 pagesState Pension (Contributory) : Application Form ForYvonne ChiltonNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- Maternity Benefit Form Mb1Document16 pagesMaternity Benefit Form Mb1mushubiroesterNo ratings yet

- US Internal Revenue Service: I1040 - 1997Document84 pagesUS Internal Revenue Service: I1040 - 1997IRSNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- MGPTaxReturn 2021Document93 pagesMGPTaxReturn 2021KGW NewsNo ratings yet

- rc151 Fill 23eDocument4 pagesrc151 Fill 23eSarena LiNo ratings yet

- US Internal Revenue Service: f709 - 2005Document4 pagesUS Internal Revenue Service: f709 - 2005IRS100% (1)

- rc151 Fill 22eDocument4 pagesrc151 Fill 22etebeck bertran forbitNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-354477702No ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaPritish TandonNo ratings yet

- Rent Supplement: Application Form ForDocument8 pagesRent Supplement: Application Form ForVasile E. UrsNo ratings yet

- Vaf1 Guidance NotesDocument9 pagesVaf1 Guidance NotesAyatmirzaNo ratings yet

- MGPTaxReturn 2019Document49 pagesMGPTaxReturn 2019KGW NewsNo ratings yet

- Application Consent Orders Form 11Document23 pagesApplication Consent Orders Form 11Dave SatterthwaiteNo ratings yet

- Declaration of Service: Part A - General InformationDocument10 pagesDeclaration of Service: Part A - General InformationmistnehaNo ratings yet

- TB Test - N:aDocument2 pagesTB Test - N:aLeon TanNo ratings yet

- Visa Application FormDocument7 pagesVisa Application FormANDREW ODEONo ratings yet

- US Internal Revenue Service: f1040 - 1997Document2 pagesUS Internal Revenue Service: f1040 - 1997IRSNo ratings yet

- Lisa Volpe Archive Cra 20 PDFDocument40 pagesLisa Volpe Archive Cra 20 PDFLISA VOLPENo ratings yet

- US Internal Revenue Service: F1040ez - 1992Document2 pagesUS Internal Revenue Service: F1040ez - 1992IRSNo ratings yet

- ISLU Mortgages Buy To Let - Application Form PDFDocument20 pagesISLU Mortgages Buy To Let - Application Form PDFges176No ratings yet

- Form An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant SocietyDocument16 pagesForm An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant Societyjana a100% (1)

- F020 Application For Concessions Residential Park ResidentsDocument4 pagesF020 Application For Concessions Residential Park ResidentsKENT MORGANNo ratings yet

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- Employee Information SheetDocument7 pagesEmployee Information SheetSiri ChanumoluNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- When To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsDocument10 pagesWhen To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsLyley YAYNo ratings yet

- Directorate General Population Welfare Department: Store Keeper (BPS-08)Document4 pagesDirectorate General Population Welfare Department: Store Keeper (BPS-08)Arbab Usman KhanNo ratings yet

- rc151 Fill 17eDocument4 pagesrc151 Fill 17eKewkew AzilearNo ratings yet

- William AUS 2022Document16 pagesWilliam AUS 2022mdeecash042No ratings yet

- McDaniel 2020Document36 pagesMcDaniel 2020Sue StevenNo ratings yet

- Application Individual Kaizen With IDX Settlement Consent Feb 2015Document1 pageApplication Individual Kaizen With IDX Settlement Consent Feb 2015edwinsibusiso83No ratings yet

- Prentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDocument48 pagesPrentice Halls Federal Taxation 2015 Individuals 28Th Edition Pope Solutions Manual Full Chapter PDFDavidGarciaerfq100% (8)

- Form No Impediment MarriageDocument3 pagesForm No Impediment MarriageE QNo ratings yet

- Bond Lodgement Form SsmpleDocument2 pagesBond Lodgement Form SsmpleJIBEESH01No ratings yet

- Monica Caballero Ortiz - Monica OrtizDocument10 pagesMonica Caballero Ortiz - Monica OrtizLJ Avila LayronNo ratings yet

- St. Mary's University College & Mountbatten Institute: Session One - Introduction To ManagementDocument46 pagesSt. Mary's University College & Mountbatten Institute: Session One - Introduction To ManagementGretaNo ratings yet

- The Art and Science of Stakeholder Management in NGOs - v2Document5 pagesThe Art and Science of Stakeholder Management in NGOs - v2Marlon KamesaNo ratings yet

- The Effect of External Factors On Industry Performance: The Case of Lalibela City Micro and Small Enterprises, EthiopiaDocument14 pagesThe Effect of External Factors On Industry Performance: The Case of Lalibela City Micro and Small Enterprises, Ethiopiaone loveNo ratings yet

- Board Resolution LEPOPHIL10 Change of SignatoriesDocument4 pagesBoard Resolution LEPOPHIL10 Change of Signatoriesrjyparraguirre824382% (17)

- Investor Presentation PDFDocument15 pagesInvestor Presentation PDFLakshay DhaliaNo ratings yet

- Ketaki - Book ReviewDocument4 pagesKetaki - Book ReviewjalmahalNo ratings yet

- Industry Analysis For RetailDocument5 pagesIndustry Analysis For RetailPratik AhluwaliaNo ratings yet

- Maximum Mark: 60: Cambridge International Advanced Subsidiary and Advanced LevelDocument8 pagesMaximum Mark: 60: Cambridge International Advanced Subsidiary and Advanced Leveltafadzwa tandawaNo ratings yet

- Risk AssesmentDocument47 pagesRisk AssesmentMohd ObaidullahNo ratings yet

- Exp19 Excel Ch02 Cap Appliances InstructionsDocument2 pagesExp19 Excel Ch02 Cap Appliances Instructionsdylandumont1314No ratings yet

- Implementation Guide 1111: Standard 1111 - Direct Interaction With The BoardDocument3 pagesImplementation Guide 1111: Standard 1111 - Direct Interaction With The BoardGemanta Furi BangunNo ratings yet

- Full Absorption & Variable Costing Methods (Answers)Document3 pagesFull Absorption & Variable Costing Methods (Answers)Juan FrivaldoNo ratings yet

- Staff Management System Documentation Carrera Palo GotladeraDocument7 pagesStaff Management System Documentation Carrera Palo GotladeraJusteen ChamNo ratings yet

- Principles of Marketing:: Marketing Myopia: Brand ExperiencesDocument6 pagesPrinciples of Marketing:: Marketing Myopia: Brand ExperiencesKhả LộNo ratings yet

- NCR Companies 2023Document4 pagesNCR Companies 2023Bryan ObcianaNo ratings yet

- Introduction To Chemguard PDFDocument2 pagesIntroduction To Chemguard PDFjoana ramirezNo ratings yet

- AUTHORITY - LETTER - Airtel DLTDocument2 pagesAUTHORITY - LETTER - Airtel DLTSubodh JhaNo ratings yet

- Dissertation Report Flipkart Marketing StategiesDocument46 pagesDissertation Report Flipkart Marketing StategiesAvneesh KumarNo ratings yet

- Presentation 1Document22 pagesPresentation 1Varun RanganathanNo ratings yet

- HRDocument8 pagesHROreo FestNo ratings yet

- Spring MVC NotesDocument6 pagesSpring MVC NotesVKM2013No ratings yet

- Compliance InfographicDocument1 pageCompliance InfographicJohn N. AllegroNo ratings yet

- FASTag - Statement10287302636201802218131871Document2 pagesFASTag - Statement10287302636201802218131871அன்புடன் அஸ்வின்No ratings yet

- List of Topics For Economics ThesisDocument6 pagesList of Topics For Economics ThesisKhuram Shehzad Jafri100% (1)

- 325-Article Text-827-1-10-20230117Document11 pages325-Article Text-827-1-10-20230117Vicky AndriNo ratings yet

- Yamaha Supply ChainDocument7 pagesYamaha Supply ChainkagneyNo ratings yet

- Union Budget 2023 SummaryDocument98 pagesUnion Budget 2023 SummaryBhupendra SinghNo ratings yet

- CHANG CHANG DONG HAI - DISCH LIST - InicialDocument21 pagesCHANG CHANG DONG HAI - DISCH LIST - InicialjulianoNo ratings yet

- ORGB24 G24 BNT GroupActivity FinalBusinessReport Group3Document10 pagesORGB24 G24 BNT GroupActivity FinalBusinessReport Group3orozcokyriel.caNo ratings yet

- Ecogain EBI Eng 2022 17mayDocument37 pagesEcogain EBI Eng 2022 17mayPrakhar AroraNo ratings yet