Professional Documents

Culture Documents

Full Absorption & Variable Costing Methods (Answers)

Uploaded by

Juan Frivaldo0 ratings0% found this document useful (0 votes)

34 views3 pagesjojo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentjojo

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views3 pagesFull Absorption & Variable Costing Methods (Answers)

Uploaded by

Juan Frivaldojojo

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

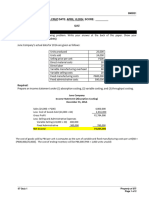

PROBLEM 1

1 a. Unit product cost (full absorption costing)

Year 1 Year 2

Direct materials 11.00 11.00

Direct labor 6.00 6.00

Variable manufacturing overhead 3.00 3.00

Fixed manufacturing overhead

(120,000/ 10,000 units) 12.00

(120,000/ 6,000 units) 20.00

32.00 40.00

b. Income statement (full absorption costing)

Year 1 Year 2

Sales (8,000 units x 50) 400,000.00 400,000.00

Less: Cost of goods sold

Beginning inventory - 64,000.00

Add: Cost of goods manufactured

(10,000 units x 32) 320,000.00

(6,000 units x 40) 240,000.00

Cost of goods available for sale 320,000.00 304,000.00

Less: Ending inventory

(2,000 units x 32) 64,000.00

(0 units x 40) -

256,000.00 304,000.00

Gross margin 144,000.00 96,000.00

Less: Selling and administrative expenses

(8,000 x 4 = 32,000 + 70,000) 102,000.00 102,000.00

Net income (loss) 42,000.00 - 6,000.00

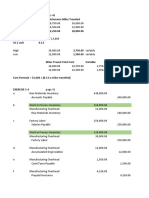

2 a. Unit product cost (variable costing)

Year 1 Year 2

Direct materials 11.00 11.00

Direct labor 6.00 6.00

Variable manufacturing overhead 3.00 3.00

20.00 20.00

b. Income statement (variable costing)

Year 1 Year 2

Sales (8,000 units x 50) 400,000.00 400,000.00

Less: Variable costs

Variable cost of goods sold

(8,000 units x 20) 160,000.00 160,000.00

Variable selling and administrative expenses

(8,000 units x 4) 32,000.00 32,000.00

192,000.00 192,000.00

Contribution margin 208,000.00 208,000.00

Less: Fixed costs

Fixed manufacturing overhead 120,000.00 120,000.00

Fixed selling and administrative expenses 70,000.00 70,000.00

190,000.00 190,000.00

Net income (loss) 18,000.00 18,000.00

3 Reconciliation of variable and full absorption costing income:

Year 1 Year 2

Net income under full absorption costing 42,000.00 - 6,000.00

Add: Fixed overhead in the beginning inventory - 24,000.00

Total 42,000.00 18,000.00

Less: Fixed overhead in the ending inventory 24,000.00 -

Net income under variable costing 18,000.00 18,000.00

Change in inventory (increase/ decrease) 2,000.00 - 2,000.00

Multiply by: Fixed factory overhead cost per unit 12.00 12.00

Difference in income 24,000.00 - 24,000.00

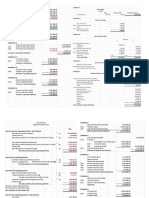

PROBLEM 2

1 Unit product cost (full absorption costing)

Direct materials 120.00

Direct labor 140.00

Variable manufacturing overhead 50.00

Fixed manufacturing overhead

(600,000/ 10,000 units) 60.00

370.00

2 Unit product cost (variable costing)

Direct materials 120.00

Direct labor 140.00

Variable manufacturing overhead 50.00

310.00

PROBLEM 3

1 2,000 units x 60 per unit fixed manufacturing overhead = 120,000

2 Income statement (variable costing)

Sales (8,000 units x 500) 4,000,000.00

Less: Variable costs

Variable cost of goods sold (8000 units x 310)

Beginning inventory -

Add: Variable manufacturing costs

(10,000 units x 310) 3,100,000.00

Cost of goods avaiable for sale 3,100,000.00

Less: Ending inventory

(2,000 units x 310) 620,000.00 2,480,000.00

Variable selling and administrative expenses

(8,000 units x 20) 160,000.00 2,640,000.00

Contribution margin 1,360,000.00

Less: Fixed costs

Fixed manufacturing overhead 600,000.00

Fixed selling and admin expenses 400,000.00 1,000,000.00

Net income (loss) 360,000.00

Reconciliation of variable and full absorption costing income:

Net income under full absorption costing 480,000.00

Add: Fixed overhead in the beginning inventory -

Total 480,000.00

Less: Fixed overhead in the ending inventory 120,000.00

Net income under variable costing 360,000.00

Change in inventory (increase/ decrease) 2,000.00

Multiply by: Fixed factory overhead cost per unit 60.00

Difference in income 120,000.00

PROBLEM 4

1 The company is using variable costing method. The computations are:

Variable Absorption

costing costing

Direct materials 10.00 10.00

Direct labor 5.00 5.00

Variable manufacturing overhead 2.00 2.00

Fixed manufacturing overhead

(90,000/ 30,000 units) - 3.00

17.00 20.00

Total cost of 5,000 units 85,000.00 100,000.00

2 a. No, the 85,000 is not the correct figure to use, because variable costing is not generally accepted

for external reporting purposes or for tax purpoases.

b. The finished goods inventory account should be stated at 100,000, which represents the absorption

cost of the 5,000 unsold units. Thus, the account should be increased by 15,000 for external

reporting purposes. This 15,000 consists of the amount of fixed manufacturing overhead cost

that is allocated to the 5,000 unsold units under absorption costing:

5,000 units x 3 per unit fixed manufacturing overhead cost = 15,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Absorption Costing QuestionsDocument6 pagesAbsorption Costing Questions田淼No ratings yet

- SCM Chap 3 Probs 1-3Document4 pagesSCM Chap 3 Probs 1-3aj dumpNo ratings yet

- SCM QUIZ7Document2 pagesSCM QUIZ7Krisha Mae Guirigay Dela CruzNo ratings yet

- Exchange of MachineDocument2 pagesExchange of MachineShoebNo ratings yet

- Incremental Analysis InsightsDocument11 pagesIncremental Analysis InsightsannarheaNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Cost-Volume-Profit Analysis: A Managerial Planning ToolDocument19 pagesCost-Volume-Profit Analysis: A Managerial Planning ToolSkyler LeeNo ratings yet

- COST SHEET ANALYSISDocument5 pagesCOST SHEET ANALYSISVasudev ANo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Income Statements for June CompanyDocument3 pagesIncome Statements for June CompanyGoose ChanNo ratings yet

- 4 and 5Document3 pages4 and 5Mela carlonNo ratings yet

- Exercise of VariableDocument10 pagesExercise of VariableAqoon Kaab ChannelNo ratings yet

- Session 25 & 26 - Budgeting and VarianceDocument20 pagesSession 25 & 26 - Budgeting and VarianceVinay PandeyNo ratings yet

- Absorption and Marginal Costing - Additional Question With AnswersDocument14 pagesAbsorption and Marginal Costing - Additional Question With Answersunique gadtaulaNo ratings yet

- Product Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed OverheadsDocument17 pagesProduct Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed OverheadsHarshawardhan GuptaNo ratings yet

- Marginal vs absorption costing reconciliationDocument6 pagesMarginal vs absorption costing reconciliationunique gadtaulaNo ratings yet

- FM New SumsDocument13 pagesFM New SumsINTER SMARTIANSNo ratings yet

- June Company Income StatementsDocument3 pagesJune Company Income StatementsGoose ChanNo ratings yet

- Solution Job Order CostingDocument1 pageSolution Job Order Costingaiza eroyNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- EntornoDocument2 pagesEntornoaggniNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Cash BudgetDocument8 pagesCash BudgetKei CambaNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- Cost and Management Accounting Midsem PrepDocument25 pagesCost and Management Accounting Midsem PrepSrabon BaruaNo ratings yet

- Week 5 Tutorial Solutions for Unit 4 Costing MethodsDocument10 pagesWeek 5 Tutorial Solutions for Unit 4 Costing MethodsSheenam SinghNo ratings yet

- Assignment Week 9 - Costing Decision Under UncertaintyDocument9 pagesAssignment Week 9 - Costing Decision Under UncertaintyHanifah Al Fitri SalsabilaNo ratings yet

- 20123400024Document7 pages20123400024Phạm Công KiênNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- Chapter 4 ExercisesDocument23 pagesChapter 4 ExercisesLiza Mae MirandaNo ratings yet

- Income Statement AnalysisDocument6 pagesIncome Statement AnalysisLove IslamNo ratings yet

- Master Minds CA/CWA & MEC/CEC marginal costing solutionsDocument14 pagesMaster Minds CA/CWA & MEC/CEC marginal costing solutionsHaresh KNo ratings yet

- 15 Marginal Costing PDFDocument14 pages15 Marginal Costing PDFSupriyoNo ratings yet

- Act.4-8 Ae23Document6 pagesAct.4-8 Ae23Damian Sheila MaeNo ratings yet

- C.A-I Chapter-5Document4 pagesC.A-I Chapter-5Tariku KolchaNo ratings yet

- 4) Nov 2006 Cost ManagementDocument30 pages4) Nov 2006 Cost Managementshyammy foruNo ratings yet

- Zepher memoDocument2 pagesZepher memoewriteandread.businessNo ratings yet

- Manufacturing Costs and COGSDocument4 pagesManufacturing Costs and COGSNia BranzuelaNo ratings yet

- Abdurehman (40931) .ASSIN 2Document5 pagesAbdurehman (40931) .ASSIN 2Abdurehman Ullah khanNo ratings yet

- Bruno PPE Note - SolutionDocument4 pagesBruno PPE Note - SolutionizzyhowoNo ratings yet

- Chapter 8 Problems Financial StatementsDocument12 pagesChapter 8 Problems Financial StatementsSarah May Tigue TalagtagNo ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Cañas Alexia V Pa1Document4 pagesCañas Alexia V Pa1Joshua BangiNo ratings yet

- Whitney CompanyDocument4 pagesWhitney CompanyRIZA JOY CAÑETE DELARAGANo ratings yet

- Assignment #3-Absorption CostingDocument3 pagesAssignment #3-Absorption CostingRalph Lauren MatiasNo ratings yet

- Aqm TypingDocument1 pageAqm TypingMUHAMMADNo ratings yet

- Asistensi Akmen Ch.8Document12 pagesAsistensi Akmen Ch.8Irham SistiasyaNo ratings yet

- Pasicolan, Mark Joshua BSA 3206: Absorption CostingDocument6 pagesPasicolan, Mark Joshua BSA 3206: Absorption CostingMark Joshua PasicolanNo ratings yet

- ACN 202 Final ReportDocument10 pagesACN 202 Final ReportMohammed Nahiyan MollahNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Proj CostDocument64 pagesProj CostCarlisle ChuaNo ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- IIlustration - Combined Financial StatementsDocument6 pagesIIlustration - Combined Financial StatementsMarion Malabanan100% (1)

- Costing Methods: Absorption vs Variable CostingDocument19 pagesCosting Methods: Absorption vs Variable CostingMah2SetNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Law Office Break Even Analysis Shows 10,147 Clients NeededDocument7 pagesLaw Office Break Even Analysis Shows 10,147 Clients NeededJude Español JorsaNo ratings yet

- Absorption Costing - Diego Company ManufacturesDocument2 pagesAbsorption Costing - Diego Company ManufacturesIshanNo ratings yet

- Pre-Test & Post-TestDocument2 pagesPre-Test & Post-TestJuan FrivaldoNo ratings yet

- Labor Code of The PhilippinesDocument141 pagesLabor Code of The PhilippinesJuan FrivaldoNo ratings yet

- Answers - Accounting For MaterialsDocument6 pagesAnswers - Accounting For MaterialsJuan FrivaldoNo ratings yet

- Answers - Accounting For MaterialsDocument6 pagesAnswers - Accounting For MaterialsJuan FrivaldoNo ratings yet

- Practice 1 - Mgt008Document17 pagesPractice 1 - Mgt008Juan FrivaldoNo ratings yet

- Financial Planning CalculatorDocument8 pagesFinancial Planning CalculatorJuan FrivaldoNo ratings yet

- Module 2 Saving BudgetingDocument31 pagesModule 2 Saving BudgetingJuan FrivaldoNo ratings yet

- Module 1 Financial PlanningDocument12 pagesModule 1 Financial PlanningJuan FrivaldoNo ratings yet

- Practice 2 - MGT008Document9 pagesPractice 2 - MGT008Juan FrivaldoNo ratings yet

- Module 5 Fraud - ScamDocument40 pagesModule 5 Fraud - ScamJuan FrivaldoNo ratings yet

- K-12 Financial Literacy Guide Helps Students Make Smart Money ChoicesDocument55 pagesK-12 Financial Literacy Guide Helps Students Make Smart Money ChoicesJuan Frivaldo100% (1)

- Module 3 Debt ManagementDocument33 pagesModule 3 Debt ManagementJuan FrivaldoNo ratings yet

- 6.1 Closing Entries: Name of CompanyDocument2 pages6.1 Closing Entries: Name of CompanyJuan FrivaldoNo ratings yet

- Module 6 Consumer ProtectionDocument16 pagesModule 6 Consumer ProtectionJuan FrivaldoNo ratings yet

- 6.1 Closing Entries: Name of CompanyDocument2 pages6.1 Closing Entries: Name of CompanyJuan FrivaldoNo ratings yet

- ACT121 - Topic 3Document4 pagesACT121 - Topic 3Juan FrivaldoNo ratings yet

- Reviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborDocument3 pagesReviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborJuan FrivaldoNo ratings yet

- Cda - Social Audit ReportDocument58 pagesCda - Social Audit ReportJuan FrivaldoNo ratings yet

- ACT121 - Topic 2Document2 pagesACT121 - Topic 2Juan FrivaldoNo ratings yet

- 1.1 Definition of Cost Accounting: Alfonso T. Yuchengco College of BusinessDocument3 pages1.1 Definition of Cost Accounting: Alfonso T. Yuchengco College of BusinessJuan FrivaldoNo ratings yet

- ACT121 - Topic 5Document5 pagesACT121 - Topic 5Juan FrivaldoNo ratings yet

- Chapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdDocument14 pagesChapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdJuan FrivaldoNo ratings yet

- Acc 204 Accounting For Overhead by GuererroDocument9 pagesAcc 204 Accounting For Overhead by GuererroJuan FrivaldoNo ratings yet

- Module Program For BEST Webinar Workshop v2Document5 pagesModule Program For BEST Webinar Workshop v2Juan FrivaldoNo ratings yet

- Schedule and Procedure For The Filing of Annual Financial Statements, General Information Sheet and Other Covered ReportsDocument11 pagesSchedule and Procedure For The Filing of Annual Financial Statements, General Information Sheet and Other Covered ReportsRoderick RiveraNo ratings yet

- Annex D - Sec MC 28-2020Document1 pageAnnex D - Sec MC 28-2020Juan Frivaldo100% (2)

- Acc 35 Managerial Accounting Course Syllabus: Finance & Accounting Department, J. Gokongwei School of ManagementDocument4 pagesAcc 35 Managerial Accounting Course Syllabus: Finance & Accounting Department, J. Gokongwei School of ManagementyaneeNo ratings yet

- 2021notice BOTDFDocument1 page2021notice BOTDFvanessa_3No ratings yet

- Registration of Domestic Corporation - SecDocument6 pagesRegistration of Domestic Corporation - SecJuan FrivaldoNo ratings yet

- Handouts Vat On ImportationDocument2 pagesHandouts Vat On ImportationAldrin Giray MagpayoNo ratings yet

- Insurance Chapter Outline on Legal Principles and Contract RequirementsDocument14 pagesInsurance Chapter Outline on Legal Principles and Contract RequirementsWonde BiruNo ratings yet

- ECOZI 2016 Newsletter FinalDocument8 pagesECOZI 2016 Newsletter FinalMutsa MvududuNo ratings yet

- English Philippines Coin Series 1958-1979Document26 pagesEnglish Philippines Coin Series 1958-1979maria pelliasNo ratings yet

- Vietnam Logistics Industry PDFDocument39 pagesVietnam Logistics Industry PDFPhạmThanhThủy100% (1)

- NSAC BASIC A&A COURSE, INTRO TO CO-OP ACCOUNTINGDocument34 pagesNSAC BASIC A&A COURSE, INTRO TO CO-OP ACCOUNTINGroytanladiasanNo ratings yet

- Cash Receipt TemplateDocument1 pageCash Receipt TemplateTemecco BufordNo ratings yet

- AWESOME Forex Trading Strategy (Never Lose Again)Document8 pagesAWESOME Forex Trading Strategy (Never Lose Again)Lobito Solitario85% (27)

- Deloitte Data Migration Strategy - Gx-d-dash-Dec2016Document6 pagesDeloitte Data Migration Strategy - Gx-d-dash-Dec2016VamshisirNo ratings yet

- Tracking Stocks and Informational Asymmetries: An Analysis of Liquidity and Adverse SelectionDocument17 pagesTracking Stocks and Informational Asymmetries: An Analysis of Liquidity and Adverse SelectionEleanor RigbyNo ratings yet

- Bulgaria en SBADocument15 pagesBulgaria en SBAChiculita AndreiNo ratings yet

- Singapore Real Estate ForumDocument2 pagesSingapore Real Estate Forumhouse_singaporeNo ratings yet

- Table 1 - Recommended Etfs: Financial Products ResearchDocument3 pagesTable 1 - Recommended Etfs: Financial Products ResearchBobNo ratings yet

- FINS2624 Problem Set 1Document2 pagesFINS2624 Problem Set 1Isy0% (1)

- CLVDocument46 pagesCLVMallika TandonNo ratings yet

- 1558063928887q2LhA3o4bMk7ldb6 PDFDocument2 pages1558063928887q2LhA3o4bMk7ldb6 PDFsravanNo ratings yet

- Impact of Chinese Goods On Indian EconomyDocument9 pagesImpact of Chinese Goods On Indian EconomySagar AgarwalNo ratings yet

- Operation FloodDocument3 pagesOperation Floodscarlett23No ratings yet

- التكنولوجيا المالية في دول الخليج بين حداثة الظاهرة وسرعة الاستيعابDocument17 pagesالتكنولوجيا المالية في دول الخليج بين حداثة الظاهرة وسرعة الاستيعابcompta gfNo ratings yet

- The 83+ Best Coal Jokes - UPJOKEDocument1 pageThe 83+ Best Coal Jokes - UPJOKEoloveder.2509No ratings yet

- Economics: Paper 2281/01 Multiple ChoiceDocument6 pagesEconomics: Paper 2281/01 Multiple Choicemstudy123456No ratings yet

- Paylater SH7Document3 pagesPaylater SH7MunniNo ratings yet

- Dec - 55 2009 II (Labour Welfare)Document16 pagesDec - 55 2009 II (Labour Welfare)bkeerthanaNo ratings yet

- Group ADocument3 pagesGroup ANisha Agarwal 3No ratings yet

- Tata Nano Vs Maruti Suzuki Alto 800Document108 pagesTata Nano Vs Maruti Suzuki Alto 800rahulsogani123No ratings yet

- Income Tax Calculator 2018-2019Document1 pageIncome Tax Calculator 2018-2019Muhammad Hanif SuchwaniNo ratings yet

- Week 11 Activity-Global CityDocument2 pagesWeek 11 Activity-Global CityCecilia Micole M. De GulaNo ratings yet

- Procurement in Service SectorDocument22 pagesProcurement in Service SectorNajmiLwyneNo ratings yet

- Dhirubhai Ambani Dhirubhai Ambani: A Legendary EntrepreneurDocument10 pagesDhirubhai Ambani Dhirubhai Ambani: A Legendary EntrepreneurAjay KaundalNo ratings yet

- TSE Trading MethodologyDocument74 pagesTSE Trading Methodologyorenmax123No ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- The CEO X factor: Secrets for Success from South Africa's Top Money MakersFrom EverandThe CEO X factor: Secrets for Success from South Africa's Top Money MakersNo ratings yet