Professional Documents

Culture Documents

Product Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed Overheads

Uploaded by

Harshawardhan GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed Overheads

Uploaded by

Harshawardhan GuptaCopyright:

Available Formats

Test Series: October, 2020

MOCK TEST PAPER

FINAL (OLD) COURSE: GROUP – II

PAPER – 5: ADVANCED MANAGEMENT ACCOUNTING

SUGGESTED ANSWERS/HINTS

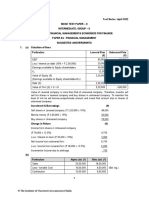

1. (a) Statement of Profitability

Sales Value (`) P / V Ratio Contribution

Product

(%) (`)

A 2,50,000 50 1,25,000

B 4,00,000 40 1,60,000

C 6,00,000 30 1,80,000

Total 12,50,000 4,65,000

Less: Fixed Overheads 5,02,200

Profit / (Loss) (37,200)

Additional Sale Value of each Product

Product Sales Value (`)

A `74,400 (`37,200 ÷ 0.5)

B `93,000 (`37,200 ÷ 0.4)

C `1,24,000 (`37,200 ÷ 0.3)

Additional Total Sales Value maintaining the same Sale – Mix

= `37,200 ÷ 0.372*

= `1,00,000

Total Contribution

* Combined P / V Ratio = 100

Total Sales

Rs. 4,65,000

= 100

Rs.12,50,000

= 37.2%

(b) Product A & B are joint products and produced in the ratio of 1:2 from the same direct

material- C.

© The Institute of Chartered Accountants of India

Production of 40,000 additional units of B results in production of 20,000 units of A.

Calculation of Contribution under existing situation

Particulars Amount (`) Amount (`)

Sales Value:

A – 2,00,000 units @ `25 per unit 50,00,000

B – 4,00,000 units @ `20 per unit 80,00,000 1,30,00,000

Less: Material- C (12,00,000 units@ `5 per 60,00,000

unit)

Less: Other Variable Costs 42,00,000

Contribution 28,00,000

Let Minimum Average Selling Price per unit of A is `X

Calculation of Contribution after acceptance of additional order of ‘B’

Particulars Amount (`) Amount (`)

Sales Value:

A – 2,20,000 units @ ` X per unit 2,20,000 X

B – 4,00,000 units @ `20 per unit 80,00,000

40,000 units @ `15 per unit 6,00,000 2,20,000 X +

86,00,000

Less: Material- C (12,00,000 units x 110%) @ 66,00,000

`5 per unit

Less: Other Variable Costs (`42,00,000 x 46,20,000

110%)

2,20,000 X –

Contribution 26,20,000

Minimum Average Selling Price per unit of A

Contribution after additional order of B = Contribution under existing production

2,20,000 X – 26,20,000 = 28,00,000

2,20,000 X = 54,20,000

54,20,000

X = = `24.64

2,20,000

Minimum Average Selling Price per unit of A is `24.64

(c) Let Cx be the Contribution per unit of Product X.

Therefore Contribution per unit of Product Y =C y=4/5Cx = 0.8Cx

Given F1 + F2 = 1,50,000,

© The Institute of Chartered Accountants of India

F1 = 1,800Cx (Break even volume × contribution per unit)

Therefore F 2 = 1,50,000 – 1,800Cx.

3,000Cx –F1 =3,000 × 0.8Cx – F2 or 3,000Cx – F1 =2,400 Cx-F2 (Indifference point)

i.e., 3,000Cx – 1,800Cx = 2,400Cx – 1,50,000 + 1,800C x

i.e., 3,000Cx = 1,50,000, Therefore C x = `50/- (1,50,000 / 3,000)

Therefore Contribution per unit of X = `50

Fixed Cost of X = F 1 = `90,000 (1,800 × 50)

Therefore Contribution per unit of Y is `50 × 0.8 = `40 and

Fixed cost of Y = F 2 = `60,000 (1,50,000 – 90,000)

The value of F 1 = `90,000, F 2 = `60,000 and X = `50 and `40

(d) Activities P and Q are called duplicate activities (or parallel activities) since they have

the same head and tail events. The situation may be rectified by introducing a

dummy either between P and S or between Q and S or before P or before Q (i.e.

introduce the dummy before the tail event and after the duplicate activity or Introduce

the dummy activity between the head event and the duplicate activity). Possible

situations are given below:

© The Institute of Chartered Accountants of India

2. (a) (i) Calculation of ‘Total Labour Hours’ over the Life Time of the Product

‘Kitchen Care’

The average time per unit for 250 units is

Yx = axb

Y250 = 30 × 250 -0.3219

Y250 = 30 × 0.1691

Y250 = 5.073 hours

Total time for 250 units = 5.073 hours × 250 units

= 1,268.25 hours

The average time per unit for 249 units is

Y249 = 30 × 249 –0.3219

Y249 = 30 × 0.1693

Y249 = 5.079 hours

Total time for 249 units = 5.079 hours × 249 units

= 1,264.67 hours

Time for 250th unit = 1,268.25 hours – 1,264.67 hours

= 3.58 hours

Total Time for 1,000 units = (750 units × 3.58 hours) + 1,268.25 hours

= 3,953.25 hours

(ii) Profitability of the Product ‘Kitchen Care’

Particulars Amount (`) Amount (`)

Sales (1,000 units) 50,00,000

Less:Direct Material 18,50,000

Direct Labour (3,953.25 hours × `80) 3,16,260

Variable Overheads (1,000 units× `1,000) 10,00,000 31,66,260

Contribution 18,33,740

Less: Packing Machine Cost 5,00,000

Profit 13,33,740

© The Institute of Chartered Accountants of India

(iii) Average ‘Target Labour Cost’ per unit

Particulars Amount (`)

Expected Sales Value 50,00,000

Less: Desired Profit (1,000 units × `800) 8,00,000

Target Cost 42,00,000

Less: Direct Material (1,000 units × `1,850) 18,50,000

Variable Cost (1,000 units × `1,000) 10,00,000

Packing Machine Cost 5,00,000

Target Labour Cost 8,50,000

Average Target Labour Cost per unit 850

(`8,50,000 ÷ 1,000 units)

(b) Primal

Minimize

Z = 2x1 − 3x2 + 4x 3

Subject to the Constraints

3x1 + 2x2 + 4x3 ≥ 9

2x1 + 3x2 + 2x3 ≥ 5

−7x1 + 2x2 + 4x3 ≥ − 10

6x1 − 3x2 + 4x3 ≥ 4

2x1 + 5x2 − 3x3 ≥ 3

−2x1 − 5x2 + 3x3 ≥ − 3

x 1, x 2, x 3 ≥ 0

Dual:

Maximize

Z= 9y1 + 5y2 − 10y3 + 4y4 + 3y5 − 3y6

Subject to the Constraints:

3y1 + 2y2 − 7y3 + 6y4 + 2y5 − 2y6 ≤ 2

2y1 + 3y2 + 2y3 − 3y4 + 5y5 − 5y6 ≤ − 3

4y1 + 2y2 + 4y3 + 4y4 − 3y5 + 3y6 ≤ 4

y1, y2, y3, y4, y5, y6 ≥ 0

By substituting y 5−y6= y7 the dual can alternatively be expressed as:

© The Institute of Chartered Accountants of India

Maximize

Z =

9y1 + 5y2 − 10y3 + 4y4 + 3y7

Subject to the Constraints:

3y1 + 2y2 − 7y3 + 6y4 + 2y7 ≤ 2

−2y1 − 3y2 − 2y3 + 3y4 − 5y7 ≥ 3

4y1 + 2y2 + 4y3 + 4y4 − 3y7 ≤ 4

y1, y2, y3, y4 ≥ 0, y7 unrestricted in sign.

3. (a) Statement of Reconciliation - Budgeted Vs Actual Profit

Particulars `

Budgeted Profit 5,19,000

Less: Sales Volume Contribution Planning Variance (Adverse) 52,125

Less: Sales Volume Contribution Operational Variance (Adverse) 93,825

Less: Sales Price Variance (Adverse) 39,600

Less: Variable Cost Variance (Adverse) 29,700

Less: Fixed Cost Variance (Adverse) 15,000

Actual Profit 2,88,750

Workings

Basic Workings

2,00,000units

Budgeted Market Share (in %) = = 50%

4,00,000units

1,65,000units

Actual Market Share (in %) = = 44%

3,75,000units

Budgeted Contribution = `21,00,000 – `12,66,000

= `8,34,000

Rs.8,34,000

Average Budgeted Contribution (per unit) = = `4.17

Rs.2,00,000

Rs.21,00,000

Budgeted Sales Price per unit = = `10.50

2,00,000

Rs.16,92,900

Actual Sales Price per unit = = `10.26

1,65,000

© The Institute of Chartered Accountants of India

Rs.12,66,000

Standard Variable Cost per unit = = `6.33

2,00,000

Rs.10,74,150

Actual Variable Cost per unit = = `6.51

1,65,000

Calculation of Variances

Sales Variances:……….

Volume Contribution Planning* = Budgeted Market Share % × (Actual

Industry Sales Quantity in units –

Budgeted Industry Sales Quantity in

units) × (Average Budgeted

Contribution per unit)

= 50% × (3,75,000 units – 4,00,000

units) × `4.17

= ` 52,125 (A)

(*) Market Size Variance

Volume Contribution Operational** = (Actual Market Share % – Budgeted

Market Share %) × (Actual Industry

Sales Quantity in units) ×

(Average Budgeted Contribution per

unit)

= (44% – 50%) × 3,75,000 units × 4.17

= ` 93,825 (A)

(**) Market Share Variance

Price = Actual Sales – Standard Sales

= Actual Sales Quantity × (Actual Price

– Budgeted Price)

= 1,65,000 units × (`10.26 – `10.50)

= `39,600 (A)

Variable Cost Variances:……….

Cost = Standard Cost for Production – Actual

Cost

= Actual Production × (Standard Cost

per unit– Actual Cost per unit)

= 1,65,000 units × (`6.33 – `6.51)

= `29,700(A)

© The Institute of Chartered Accountants of India

Fixed Cost Variances:……….

Expenditure = Budgeted Fixed Cost – Actual Fixed

Cost

= `3,15,000 – `3,30,000

= `15,000 (A)

Fixed Overhead Volume Variance does not arise in a Marginal Costing system

(b) The Δ ij matrix or Cij – (ui + vj) matrix, where C ij is the cost matrix and (u i + vj) is the

cell evaluation matrix for unallocated cell.

The Δ ij matrix has one or more ‘Zero’ elements, indicating that, if that cell is brought

into the solution, the optional cost will not change though the allocation changes.

Thus, a ‘Zero’ element in the Δ ij matrix reveals the possibility of an alternative

solution.

4. (a) 1. Projected Raw Material Issues (Kg):

‘N’ ‘O’ ‘P’

‘L’ (48,000 units-Refer Note) 60,000 24,000 ---

‘M’ (36,000 units-Refer Note) 72,000 - 54,000

Projected Raw Material Issues 1,32,000 24,000 54,000

Note:

− Based on this experience and the projected sales, the DTSML has budgeted

production of 48,000 units of ‘L’ and 36,000 units of ‘M’ in the sixth period.

= 52,500 x 40% + 45,000 – 18,000 = 48,000

= 27,000 x 40% + 42,000 – 16,800 = 36,000

− Production is assumed to be uniform for both products within each four-week

period.

2. and 3. Projected Inventory Activity and Ending Balance (Kg):

‘N’ ‘O’ ‘P’

Average Daily Usage 6,600 1,200 2,700

Beginning Inventory 96,000 54,000 84,000

Add: Orders Received:

Ordered in 5th period 90,000 - 60,000

Ordered in 6th period 90,000 - -

Sub Total 276,000 54,000 144,000

© The Institute of Chartered Accountants of India

Less: Issues 132,000 24,000 54,000

Projected ending inventory balance 144,000 30,000 90,000

Note:

− Ordered 90,000 Kg of ‘N’ on fourth working day.

− Order for 90,000 Kg of ‘N’ ordered during fifth period received on tenth working

day.

− Order for 90,000 Kg of ‘N' ordered on fourth working day of sixth period

received on fourteenth working day.

− Ordered 30,000 Kg of ‘O’ on eighth working day.

− Order for 60,000 Kg of ‘P’ ordered during fifth period received on fourth

working day.

− No orders for ‘P’ would be placed during the sixth period.

4. Projected Payments for Raw Material Purchases:

Raw Day/Period Day/Period Quantity Amount Day/Period

Material Ordered Received Ordered Due (`) Due

‘N’ 20th/5th 10th /6th 90,000 Kg 90,000 20th/6th

‘P’ 4th/5th 4th /6th 60,000 Kg 60,000 14th/6th

‘N’ 4th/6th 14th /6th 90,000 Kg 90,000 4th/7th

‘O’ 8th/6th 13th /7th 30,000 Kg 60,000 3rd/8th

(b) Following acceptance by early innovators, conventional consumers start followin g

Situation Appropriate Pricing Policy

(i) ‘A’ is a new product for the company and the market Penetration Pricing

and meant for large scale production and long term

survival in the market. Demand is expected to be

elastic.

(ii) ‘B’ is a new product for the company, but not for the Market Price or Price Just

market. B’s success is crucial for the company’s Below Market Price

survival in the long term.

(iii) ‘C’ is a new product to the company and the market. Skimming Pricing

It has an inelastic market. There needs to be an

assured profit to cover high initial costs and the

unusual sources of capital have uncertainties

blocking them.

© The Institute of Chartered Accountants of India

(iv) ‘D’ is a perishable item, with more than 80% of its Any Cash Realizable

shelf life over. Value*

(*) this amount decreases every passing day.

5. (a) (i) Total Direct Labour Cost for first 8 batches based on learning curve of 90%

(when the direct labour cost for the first batch is `55,000)

The usual learning curve model is

y = axb

Where

y = Average Direct Labour Cost per batch

for x batches

a = Direct Labour Cost for first batch

x = Cumulative No. of batches produced

b = Learning Coefficient /Index

y = ` 55,000 × (8) –0.152

= ` 55,000 × 0.729

= ` 40,095

Total Direct Labour Cost for first 8 batches

= 8 batches × ` 40,095

= ` 3,20,760

Total Direct Labour Cost for first 7 batches based on learning curve of 90%

(when the direct labour cost for the first batch is ` 55,000)

y = ` 55,000 × (7) –0.152

= ` 55,000 × 0.744

= ` 40,920

Total Direct Labour Cost for first 7 batches

= 7 batches × ` 40,920

= ` 2,86,440

Direct Labour Cost for 8th batch

= ` 3,20,760 – ` 2,86,440

= ` 34,320

10

© The Institute of Chartered Accountants of India

(ii) Statement Showing “Life Time Expected Contribution”

Particulars Amount (`)

Sales (`102 × 16,000 units) 16,32,000

Less: Direct Material and Other Non Labour Related 8,00,000

Variable Costs (`50 × 16,000 units)

Less: Direct Labour * 5,95,320

Expected Contribution 2,36,680

(*) Total Labour Cost over the Product’s Life

= `3,20,760 + (8 batches × `34,320)

= `5,95,320

(iii) In order to achieve a Profit of `5,00,00,000 the Total Direct Labour Cost over

the Product’s Lifetime would have to equal `3,32,000.

Statement Showing “Life Time Direct Labour Cost”

Particulars Amount (`)

Sales (`102 × 16,000 units) 16,32,000

Less: Direct Material and Other Non Labour Related 8,00,000

Variable Costs

(`50 × 16,000 units)

Less: Desired Life Time Contribution 5,00,000

Direct Labour 3,32,000

Average Direct Labour Cost per batch for 16 batches is `20,750 (`3,32,000 /

16 batches).

Total Direct Labour Cost for 16 batches based on learning curve of r% (when

the direct labour cost for the first batch is ` 55,000)

y = ` 55,000 × (16) b

` 20,750 = ` 55,000 × (16) b

0.3773 = (16) b

log 0.3773 = b × log 2 4

log 0.3773 = b × 4 log 2

logr

log 0.3773 = × 4 log 2

log2

log 0.3773 = log r 4

11

© The Institute of Chartered Accountants of India

0.3773 = r 4

4

r = 0.3773

r = 78.37%

(b) Calculation showing Rates for each Activity

Activity Activity Activity No. of Activity

Cost Driver Units Rate

[a] of Activity [a] / [b]

(`) Driver [b] (`)

Providing ATM 1,00,000 No. of ATM Transactions 2,00,000 0.50

Service

Computer 10,00,000 No. of Computer Transactions 25,00,000 0.40

Processing

Issuing 8,00,000 No. of Statements 5,00,000 1.60

Statements

Customer 3,60,000 Telephone Minutes 6,00,000 0.60

Inquiries

Calculation showing Cost of each Product

Activity Checking Accounts Personal Loans Gold Visa

(`) (`) (`)

Providing 90,000 --- 10,000

ATM Service (1,80,000 tr. x 0.50) (20,000 tr. x 0.50)

Computer 8,00,000 80,000 1,20,000

Processing (20,00,000 tr. x 0.40) (2,00,000 tr. x 0.40) (3,00,000 tr. x 0.40)

Issuing 4,80,000 80,000 2,40,000

Statements (3,00,000 st. x 1.60) (50,000 st. x 1.60) (1,50,000 st. x 1.60)

Customer 2,10,000 54,000 96,000

Inquiries (3,50,000 min. x 0.60) (90,000 min. x 0.60) (1,60,000 min. x 0.60)

Total Cost [a] `15,80,000 `2,14,000 `4,66,000

Units of 30,000 5,000 10,000

Product [b]

Cost of each 52.67 42.80 46.60

Product [a] /

[b]

12

© The Institute of Chartered Accountants of India

6. (a) Working Notes

1. No. of Customer = 1,900

(5,000 × 40% × 95%)

2. Consumption of Gas = 11,40,000 Metered units

(1,900 × 50 mt.× 12 months)

Gas Supply = 13,41,176 Metered units

{11,40,000 × (100 85)}

3. Cash Inflow

(`)

Rent (1,900 × 4 Quarters × `10) 76,000

Add: Consumption Charge (11,40,000 × `0.4) 4,56,000

Less: Cost of Company (13,41,176 × `0.065) 87,176

Cash Inflow p.a. 4,44,824

One Time Connection Charge = `4,75,000

(`250 × 1,900 customers)

Maximum Capital Project Cost

(Can be to allow the company to provide the service required)

By Following the Concept of Perpetuity

(Investment − `4,75,000) × 17% = `4,44,824

Investment = `30,91,612

(b) The objective of the given problem is to identify the preferences of marriage parties

about halls so that hotel management could maximize its profit.

To solve this problem first convert it to a minimization problem by subtracting all the

elements of the given matrix from its highest element. The matrix so obtained which is

known as loss matrix is given below-

Loss Matrix/Hall

Marriage Party 1 2 3 4

A 0 2,500 X X

B 5,000 0 5,000 12,500

C 7,500 0 10,000 5,000

D 0 5,000 X X

13

© The Institute of Chartered Accountants of India

Now we can apply the assignment algorithm to find optimal solution. Subtracting the

minimum element of each column from all elements of that column-

Loss Matrix/Hall

Marriage Party 1 2 3 4

A 0 2,500 X X

B 5,000 0 0 7,500

C 7,500 0 5,000 0

D 0 5,000 X X

The minimum number of lines to cover all zeros is 3 which is less than the order of

the square matrix (i.e.4), the above matrix will not give the optimal solution.

Subtracting the minimum uncovered element (2,500) from all uncovered elements

and add it to the elements lying on the intersection of two lines, we get the following

matrix-

Loss Matrix/Hall

Marriage Party 1 2 3 4

A 0 0 X X

B 7,500 0 0 7,500

C 10,000 0 5,000 0

D 0 2,500 X X

Since the minimum number of lines to cover all zeros is 4 which is equal to the order

of the matrix, the below matrix will give the optimal solution which is given below-

Loss Matrix/Hall

Marriage Party 1 2 3 4

A 0 0 X X

B 7,500 0 0 7,500

C 10,000 0 5,000 0

D 0 2,500 X X

14

© The Institute of Chartered Accountants of India

Optimal Schedule is-

Marriage Party Hall Revenue (`)

A 2 22,500

B 3 20,000

C 4 20,000

D 1 25,000

Total 87,500

7. (a) If unit variable cost and unit selling price are not constant then the main problem that

would arise while fixing the transfer price of a product would be as follows:

There is an optimum level of output for a firm as a whole. This is so because there is

a certain level of output beyond which its net revenue will not rise. The ideal transfer

price under these circumstances will be that which will motivate these managers to

produce at this level of output.

Essentially, it means that some division in a business house might have to prod uce

its output at a level less than its full capacity and in all such cases a transfer price

may be imposed centrally.

(b) Direct Product Profitability (DPP) is ‘Used primarily within the retail sector, and

involves the attribution of both the purchase price and other indirect costs such as

distribution, warehousing, retailing to each product line. Thus a net profit, as

opposed to a gross profit, can be identified for each product. The cost attribution

process utilises a variety of measures such as warehousing space, transport time to

reflect the resource consumption of individual products.’

Benefits of Direct Product Profitability:

(i) Better Cost Analysis - Cost per product is analysed to know the profitability of a

particular product.

(ii) Better Pricing Decision- It helps in price determination as desired margin can be

added with the actual cost.

(iii) Better Management of Store and Warehouse Space- Space Cost and Benefit

from a product can be analysed and it helps in management of store and

warehouse in profitable way.

(iv) The Rationalisation of Product Ranges etc.

(c) Target cost is the difference between the estimated selling price of a proposed

product with specified functionality and quality and target margin. This is a cost

management technique that aims to produce and sell products that will ensure the

target margin. It is an integral part of the product design. While designing the

product the company allocates value and cost to different attributes and quality.

Therefore, they use the technique of value engineering and value analysis. The

15

© The Institute of Chartered Accountants of India

target cost is achieved by assigning cost reduction targets to different operations

that are involved in the production process. Eventually, all operations do not achieve

the cost reduction targets, but the overall cost reduction target is achieved through

team work. Therefore, it is said that target costing fosters team work.

(d) (i) The company has done extensive exercise in year-I that can be used as a basis

for budgeting in year-II by incorporating increase in costs / revenue at expected

activity level. Hence, Traditional Budgeting would be more appropriate for the

company in year-II.

(ii) In Traditional Budgeting system budgets are prepared on the basis of previous

year’s budget figures with expected change in activity level and corresponding

adjustment in the cost and prices. But under Zero Base Budgeting (ZBB) the

estimations or projections are converted into figures. Since, sales manager is

unable to substantiate his expectations into figures so Traditional Budgeting

would be preferred against Zero Base Budgeting.

(iii) Zero Base Budgeting would be appropriate as ZBB allows top-level strategic

goals to be implemented into the budgeting process by tying them to specific

functional areas of the organization, where costs can be first grouped, then

measured against previous results and current expectations.

(iv) Zero Base Budgeting allocates resources based on order of priority up to the

spending cut-off level (maximum level upto which spending can be made). In an

organisation where resources are constrained and budget is allocated on

requirement basis, Zero Base Budgeting is more appropriate method of

budgeting.

(e) Random Number Assignment

Daily Demand Days Probability Cumulative Random No.

Probability Assigned

4 4 0.08 0.08 00 − 07

5 10 0.20 0.28 08 − 27

6 16 0.32 0.60 28 − 59

7 14 0.28 0.88 60 − 87

8 6 0.12 1.00 88 − 99

Simulation Table

Day Random No. Demand No. of Cars on Rent Lost

Rent

1 15 5 5 ---

2 48 6 6 ---

16

© The Institute of Chartered Accountants of India

3 71 7 6 1

4 56 6 6 ---

5 90 8 6 2

Total 29 3

29Cars

Average no. of Cars Rented are 5.8

5

Rental Lost equals to 3 Cars

17

© The Institute of Chartered Accountants of India

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 15 Marginal Costing PDFDocument14 pages15 Marginal Costing PDFSupriyoNo ratings yet

- 15 Marginal CostingDocument14 pages15 Marginal CostingHaresh KNo ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Solved Problems: OlutionDocument9 pagesSolved Problems: OlutionSweta PandeyNo ratings yet

- Student Solutions Chapter 8 Cost Volume Profit AnalysisDocument7 pagesStudent Solutions Chapter 8 Cost Volume Profit AnalysisAasir NaQvi100% (1)

- CVP Analysis - Docx Final PDFDocument146 pagesCVP Analysis - Docx Final PDFDivyapratap Singh ChauhanNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- Cost AccountingDocument3 pagesCost AccountingravariyagautamNo ratings yet

- Sba SemDocument9 pagesSba SemChelsa Mae AntonioNo ratings yet

- Full Absorption & Variable Costing Methods (Answers)Document3 pagesFull Absorption & Variable Costing Methods (Answers)Juan FrivaldoNo ratings yet

- Application of Marginal Costing TechniqueDocument7 pagesApplication of Marginal Costing TechniqueKumardeep SinghaNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- 06 Incremental AnalysisDocument11 pages06 Incremental AnalysisannarheaNo ratings yet

- Answer StratcosmaDocument9 pagesAnswer StratcosmaAnne Thea AtienzaNo ratings yet

- Cost Accounting: C S F EOQDocument6 pagesCost Accounting: C S F EOQShehrozSTNo ratings yet

- Costing ProblemsDocument74 pagesCosting Problemsmeenakshimanghani85% (47)

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Numerical Problems - SolutionsDocument19 pagesNumerical Problems - SolutionsVishesh RohraNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Ipcc Cost AnswerDocument13 pagesIpcc Cost AnswerHarsha VardhanNo ratings yet

- Managerial Accounting NotesDocument6 pagesManagerial Accounting NotesMarilou GabayaNo ratings yet

- Solutions Chapter 5Document13 pagesSolutions Chapter 5Laila Al Suwaidi100% (2)

- Prelim ReviewerDocument19 pagesPrelim ReviewerMah2SetNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- SolutionDocument3 pagesSolutionHilary GaureaNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Acc 112 - Partnership DissolutionDocument27 pagesAcc 112 - Partnership DissolutionJIYAN BERACISNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Learning Activity 3 Sensitivity AnalysisDocument3 pagesLearning Activity 3 Sensitivity AnalysisjessNo ratings yet

- 6 LeveragesDocument9 pages6 LeveragesAishu SathyaNo ratings yet

- Direct Costing 4Document3 pagesDirect Costing 4Hasan AhmmedNo ratings yet

- Managerial Accounting-Solutions To Ch07Document7 pagesManagerial Accounting-Solutions To Ch07Mohammed HassanNo ratings yet

- Data Regarding Units Are As Follows:: CaseacasebcasecDocument4 pagesData Regarding Units Are As Follows:: CaseacasebcasecJessalyn DaneNo ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- Costing English Answer 14.07.2020Document12 pagesCosting English Answer 14.07.2020Prathmesh JambhulkarNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Some More Problems On Application of Marginal Costing in Decision MakingDocument10 pagesSome More Problems On Application of Marginal Costing in Decision MakingBharat ThackerNo ratings yet

- Cost Volume Profit Analysis Lecture NotesDocument27 pagesCost Volume Profit Analysis Lecture NotesbiggykhairNo ratings yet

- CH 2 Cost-Volume-Profit RelationshipsDocument24 pagesCH 2 Cost-Volume-Profit RelationshipsMona ElzaherNo ratings yet

- M03Document4 pagesM03Anne Thea AtienzaNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Document12 pagesAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- Arr MethodDocument13 pagesArr MethodYogalakshmi RNo ratings yet

- Break-Even Occurs Between The Production Volume Interval of 20,000 To 30,000Document6 pagesBreak-Even Occurs Between The Production Volume Interval of 20,000 To 30,000kripsNo ratings yet

- Joint Product & By-ProductDocument14 pagesJoint Product & By-ProductMuhammad azeem100% (1)

- CRPC MCQsDocument5 pagesCRPC MCQsHarshawardhan GuptaNo ratings yet

- Wealth TaxDocument113 pagesWealth TaxHarshawardhan GuptaNo ratings yet

- Form PDF 531666420180723Document7 pagesForm PDF 531666420180723Harshawardhan GuptaNo ratings yet

- 1 PBDocument4 pages1 PBHarshawardhan GuptaNo ratings yet

- REFERENCERDocument24 pagesREFERENCERHarshawardhan GuptaNo ratings yet

- CA Final Mock Test For Nov 2020 NewDocument1 pageCA Final Mock Test For Nov 2020 NewHarshawardhan GuptaNo ratings yet

- Maharashtra National Law University, Nagpur: (Established by Maharashtra Act No. VI of 2014)Document12 pagesMaharashtra National Law University, Nagpur: (Established by Maharashtra Act No. VI of 2014)Harshawardhan GuptaNo ratings yet

- The National Law Institute University, Bhopal: Courses of Study 1 B.A.LL.B. (Hons.)Document12 pagesThe National Law Institute University, Bhopal: Courses of Study 1 B.A.LL.B. (Hons.)Harshawardhan GuptaNo ratings yet

- About The University: Information BrochureDocument10 pagesAbout The University: Information BrochureHarshawardhan GuptaNo ratings yet

- Information For CLAT 2022 Brochure About The University:: Page 1 of 14Document14 pagesInformation For CLAT 2022 Brochure About The University:: Page 1 of 14Harshawardhan GuptaNo ratings yet

- Hr-Unit IvDocument18 pagesHr-Unit IvHarshawardhan GuptaNo ratings yet

- Life of Guru NanakDocument259 pagesLife of Guru NanakHarshawardhan GuptaNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingDocument8 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingHarshawardhan GuptaNo ratings yet

- The Unknown Life of Jesus ChristDocument52 pagesThe Unknown Life of Jesus ChristHarshawardhan Gupta100% (1)

- Avataran - G DE Kalbermatten - HindiDocument312 pagesAvataran - G DE Kalbermatten - HindiHarshawardhan GuptaNo ratings yet

- Corruption Indias Enemy Within CP SrivastavaDocument248 pagesCorruption Indias Enemy Within CP SrivastavaHarshawardhan GuptaNo ratings yet

- Optimal Control Development System For ElectricalDocument7 pagesOptimal Control Development System For ElectricalCRISTIAN CAMILO MORALES SOLISNo ratings yet

- Vr31a OmDocument5 pagesVr31a OmrudydanielleNo ratings yet

- Post Quiz Threads PDFDocument5 pagesPost Quiz Threads PDFshubham_narkhedeNo ratings yet

- No 1 Method ValidationDocument2 pagesNo 1 Method ValidationdanaciortanNo ratings yet

- Background of The Study: Than IdealDocument3 pagesBackground of The Study: Than IdealClint CamilonNo ratings yet

- Financial Accounting Report (Partnership - Group 2)Document20 pagesFinancial Accounting Report (Partnership - Group 2)syednaim0300No ratings yet

- Chapter 10 - Process CostingDocument83 pagesChapter 10 - Process CostingXyne FernandezNo ratings yet

- 1.vedantu - Class 3 To 5 - BrochureDocument1 page1.vedantu - Class 3 To 5 - BrochureDeepak SharmaNo ratings yet

- Series Portable Oscilloscopes: Keysight DSO1000A/BDocument15 pagesSeries Portable Oscilloscopes: Keysight DSO1000A/BNestor CardenasNo ratings yet

- Approaches To Curriculum DesigningDocument20 pagesApproaches To Curriculum DesigningCristel CatapangNo ratings yet

- IsaqbDocument26 pagesIsaqbSyed HussainiNo ratings yet

- MOEMS 2020 Questions Paper Division EDocument20 pagesMOEMS 2020 Questions Paper Division EHarleenaDivs50% (4)

- SOM-based Generating of Association RulesDocument5 pagesSOM-based Generating of Association RulesKishor PeddiNo ratings yet

- Parts Catalog MAXSYM400iDocument70 pagesParts Catalog MAXSYM400iAntonio CoelhoNo ratings yet

- 3PM - Project Management Method - Sales MessagingDocument5 pages3PM - Project Management Method - Sales Messagingberuang kutubNo ratings yet

- Prose 2 - Lost Spring - Important QADocument5 pagesProse 2 - Lost Spring - Important QADangerous GamingNo ratings yet

- Filled System Temperature Recorders & Recorder Controllers: SpecificationDocument2 pagesFilled System Temperature Recorders & Recorder Controllers: SpecificationdencryNo ratings yet

- Morphometric Characterization of Jatropha Curcas Germplasm of North-East IndiaDocument9 pagesMorphometric Characterization of Jatropha Curcas Germplasm of North-East IndiafanusNo ratings yet

- Time Series Data Analysis For Forecasting - A Literature ReviewDocument5 pagesTime Series Data Analysis For Forecasting - A Literature ReviewIJMERNo ratings yet

- External Gear Pumps For Open Loop Hydraulic SystemsDocument2 pagesExternal Gear Pumps For Open Loop Hydraulic SystemsBlashko GjorgjievNo ratings yet

- SRMDocument4 pagesSRMinocente333No ratings yet

- Super 6 Comprehension StrategiesDocument1 pageSuper 6 Comprehension StrategiesrosypatelNo ratings yet

- Advanced Communication SystemDocument13 pagesAdvanced Communication SystemZohaib AhmadNo ratings yet

- Acr On Clean-Up DriveDocument7 pagesAcr On Clean-Up DriveRichard ToliaoNo ratings yet

- Lean ConstructionDocument37 pagesLean ConstructionMohamed Talaat ElsheikhNo ratings yet

- The Man Who Named The CloudsDocument7 pagesThe Man Who Named The Cloudsapi-302345936No ratings yet

- Datasheet Double Solenoid Valve DMV 12Document7 pagesDatasheet Double Solenoid Valve DMV 12flatron445No ratings yet

- Shallow FoundationsDocument44 pagesShallow FoundationsAjay SinghNo ratings yet

- P16mba7 1Document4 pagesP16mba7 1Vishalatchi MNo ratings yet

- ( (2004) Yamamuro & Wood) - Effect of Depositional Method On The Undrained Behavior and Microstructure of Sand With SiltDocument10 pages( (2004) Yamamuro & Wood) - Effect of Depositional Method On The Undrained Behavior and Microstructure of Sand With SiltLAM TRAN DONG KIEMNo ratings yet