Professional Documents

Culture Documents

16.4 PP 196 252 Remedies

Uploaded by

EdwinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

16.4 PP 196 252 Remedies

Uploaded by

EdwinCopyright:

Available Formats

5

Remedies

In addressing the remedies to subsidies, three situations, each indicating

a different effect of a subsidy, should be carefully distinguished.1 First,

subsidies of country A can increase the export of product X into the

importing country, country B, causing harm to the domestic producers of

product X in country B. Second, country A’s subsidies can increase the

export of product X into a third country, country C, causing harm to

the export to country C of product X from country B producers. Third,

country A can subsidize domestic producers of product X to restrain

the imports of product X in its domestic market, whereby the subsidy

has the effect of an import barrier.

How can country B respond to these subsidies? Only in the first

situation can country B impose CVDs to offset the effect of the subsidy

in its domestic market. If so, the subsidy of country A could,

evidently, remain in force.2 In situations 2 and 3, country B cannot

respond with CVDs, because the harm does not result from the impor-

tation of the subsidized product X. Of course, in situation 2, country

B may request country C to impose CVDs, but this country might in

fact welcome the subsidization of product X because it improves its

overall welfare.3 So, how should country B respond in situations 2

and 3 if it wishes to protect the interests of its exporters of product

1

See Jackson, above Chapter 2 n. 57, at 280; M. J. Trebilcock and R. Howse, The Regulation

of International Trade, 3rd edn (London: Routledge, 2005), at 263.

2

The protection given by CVDs to domestic producers’ domestic sales might come at

the expense of their export sales, given that the CVDs could divert subsidized products to

other markets in which they compete. P. C. Mavroidis, C. A. Bermann, and M. Wu,

The Law of the WTO: Documents, Cases and Analysis (Egan, MN: West, 2010), at 583–4.

3

As explained (above Chapter 2 n. 22), Article VI:6(b),(c) of the GATT offers a limited

option for country C, in case its own domestic industry is not injured by subsidized

imports (e.g., lack of domestic industry), to impose CVDs so as to protect the interests in

its territory of exporters from country B. This option is never used. See Steinberg and

Josling, above Chapter 4 n. 244, at 381, n. 36.

196

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 197

X? From an economic viewpoint, country B can respond with an

equivalent subsidy to its own producers of product X to neutralize the

competitive disadvantage in countries A and C,4 but this subsidy will

also be prohibited, as an export subsidy, or actionable under the SCM

Agreement.5 Consequently, the only option for country B is to have

recourse to the WTO adjudicating bodies. If a panel concludes that

country A’s subsidization is prohibited or actionable, country A will

have to withdraw the subsidy (prohibited) or at least remove its adverse

effects (actionable). Only if country A does not take these steps might

country B be authorized to adopt countermeasures.

As a result, the SCM Agreement offers two remedies to take action

against prohibited and actionable subsidies granted by other members.

First, in all three situations, country B can follow the multilateral

approach and bring the case before the WTO adjudicating bodies.

Second, subject to a set of procedural and substantive requirements,

country B can unilaterally impose CVDs to offset the effects of the

subsidy in its domestic market (situation 1). The SCM Agreement

clarifies the delineation between these options:

[W]ith regard to the effects of a particular subsidy in the domestic market

of the importing Member, only one form of relief (either a countervailing

duty, if the requirements of Part V are met, or a countermeasure under

Articles 4 or 7) shall be available.6

Country B therefore can, but also should, choose between the unilat-

eral or multilateral option to respond to the injury caused in its domestic

market (situation 1). Yet the SCM Agreement does not prohibit it from

pursuing the unilateral approach to offset the negative effects in its

domestic market (situation 1), alongside the multilateral approach to

address the negative effects of the same subsidy in its export markets

(situations 2 and 3).7

5.1 Multilateral remedies: the WTO dispute settlement system

Members confronted with prohibited and actionable subsidies imposed

by other members may have recourse to the WTO dispute settlement

4

Trebilcock and Howse, above n. 1, at 263.

5

The reciprocal challenges regarding subsidization of Boeing and Airbus provide a good

example.

6

Article 10, footnote 35 of the SCM Agreement.

7

M. Matsushita, T. J. Schoenbaum, and P. Mavroidis, The World Trade Organization: Law,

Practice and Policy, 2nd edn (Oxford University Press, 2006), at 336.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

198 subsidies and countervailing measures

system. The SCM Agreement stipulates specific dispute settlement

procedure rules for prohibited subsidies8 and for actionable subsidies,9

which are specific or additional to the rules of the Dispute Settlement

Understanding (DSU).10 The deadlines, implementation standards,

and potential remedies in case of non-compliance are more stringent

for prohibited subsidies than with regard to actionable subsidies.

5.1.1 Time frame

An accelerated procedure is available to members confronted with

prohibited and actionable subsidies.11 If consultations fail within thirty

days under the prohibited subsidy procedure, the complaining member

may then refer the matter to the Dispute Settlement Body (DSB)12.

Regarding actionable subsidies, the standard term of sixty days applies,

but the panel is also estabilished on its first request and the term for the

panel’s composition is shorter.13 The time limits for the panel procedure

are under both procedures substantially shorter than under the standard

procedure of the DSU,14 and those for the Appellate Body procedure are

shorter with regard to prohibited subsidies.15 Moreover, the time period

for the DSB to decide on the adoption of panel and Appellate Body

reports is shorter.16 Finally, if the subsidizing member has not con-

formed to the DSB’s ruling and recommendations within the time period

indicated by the panel (prohibited subsidies17) or within six months

8 9

Article 4 of the SCM Agreement. Article 7 of the SCM Agreement.

10

The DSU is still relevant insofar as it is not modified by the specific procedure (Appendix

2 DSU and Article 30 of the SCM Agreement).

11

Articles 4 and 7 of the SCM Agreement.

12

Article 4.4 of the SCM Agreement. Hence there is no opportunity for the defending party

to block the first request for the establishment of the panel (Art. 6.1 of the DSU).

13

Article 7.4 of the SCM Agreement. Cf. Articles 4.7, 6, and 8 of the DSU.

14

See Articles 4.6 and 7.5 of the SCM Agreement. Cf. Articles 12, 15, and 16 of the DSU. Under

the prohibited subsidy procedure, the panel may request the assistance of the Permanent

Group of Experts (PGE), composed of five experts elected by the SCM Committee, with

regard to whether the measure in question is a prohibited subsidy (Article 4.5 of the SCM

Agreement). Although reference to the PGE is optional, its determination is binding on

panels (Articles 24.3 and 4.5 of the SCM Agreement). This might explain why no panel has so

far requested the PGE’s determination. See Clarke and Horlick, above Chapter 2 n. 56, at 726;

J. Kazeki, ‘Permanent Group of Experts under the SCM Agreement’, 43:5 Journal of World

Trade (2009), 1031–45, at 1033–4, 1041.

15

See Articles 4.9, 7.7 of the SCM Agreement. Cf. Article 17.5 of the DSU.

16

Articles 4.8, 4.9, 7.6, and 7.7 of the SCM Agreement. Cf. Articles 16.4 and 17.14 of the DSU.

17

The measure will have to be withdrawn without delay (below Chapter 5, section 5.1.3.1.1).

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 199

(actionable subsidies), the affected member will have the right to request

authorization to adopt countermeasures.18

5.1.2 Information gathering

In the case where a complaining member aims at formulating a ‘serious

prejudice’ claim involving actionable subsidies (Part III), it could rely on

a specific procedure to collect information elaborated in Annex V of the

SCM Agreement. This annex reflects the awareness among drafters that

much information which the complaining member needs in order to

demonstrate serious prejudice is in the ‘sole control’ of the subsidizing

country and/or third countries.19 Indeed, the subsidizing member whose

subsidies are challenged might be reluctant to co-operate and third

countries might also not be very keen to provide information on price

and/or volume effects of subsidized imports, given that such subsidized

imports could very well be welfare improving from their perspective.

To obtain such information, the complainant could request the DSB to

initiate the Annex V procedure. Based on some creative legal reasoning, the

Appellate Body decided that this occurs automatically when such a request is

filed at the moment the DSB establishes a panel.20 If so, a representative will

be designated by the DSB to facilitate the information-gathering process. This

has to be completed within sixty days, after which the information is sub-

mitted to the panel. During this process the complainant could request the

subsidizing country for relevant information.21 This could cover information

needed to analyse the adverse effects, to establish the existence and amount of

subsidization, and to gain insight into the value of sales of the subsidized

firms.22,23 Next, third-country Members are also obliged to make available all

relevant information that can be obtained as to the changes in market shares

18

Articles 4.10 and 7.9 of the SCM Agreement. Cf. the ‘reasonable period’ stipulated in

Articles 21.3 and 22.2 of the DSU.

19

Appellate Body Report, US – Large Civil Aircraft, para. 513.

20

The negative consensus rule for DSB decisions is thus not applicable, implying that the

defending party cannot block its establishment. Ibid., para. 524.

21

The Annex V procedure could also be used by the defendant to gather information

showing that the complainant’s like products are also subsidized, which is relevant

under an Article 6.4 of the SCM Agreement analysis. See above Chapter 4, section

4.2.3.4.1.1.1.

22

Paragraph 2 of Annex V of the SCM Agreement.

23

Such a representative was designated in Korea – Commercial Vessels and Indonesia –

Autos. See Panel Report, Korea – Commercial Vessels, Attachment 1. The representative

in Korea – Commercial Vessels decided on several procedural questions raised under the

Annex V procedure.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

200 subsidies and countervailing measures

of the parties as well as concerning prices of the products involved. A balance

is struck between the need for parties to obtain such information and the

burden imposed on third countries.24 Where the subsidizing and/or third-

country member fail to co-operate, the ‘serious prejudice’ claim will be

decided on the basis of available evidence and the panel should ‘draw adverse

inferences’ from such failure when making its determination.25

No similar procedure is established to facilitate a prohibited subsidy

claim (Part II of the SCM Agreement), but this does not seem to hamper

information gathering.26 First, panels’ authority to draw adverse inferences

from non-co-operation a fortiori applies to claims of prohibited subsidies.27

Second, the panel in Korea – Commercial Vessels considered that it could

seek the very same information relevant for a prohibited subsidy claim (e.g.,

the existence of the subsidy) on the basis of Article 13.1 of the DSU. Because

the information would thus be obtained anyway, the same panel decided

that information gathered under the Annex V procedure could also be used

by the complaining member for supporting its claim under Part II (pro-

hibited subsidy).28 In the case of prohibited subsidy claims, complainants

could thus trigger the Annex V procedure by bringing an additional serious

prejudice claim against these subsidies.

5.1.3 Implementation standards and remedies

in case of non-implementation

The SCM Agreement contains specific implementation obligations and

remedies where a successful subsidy claim has been formulated. On both

aspects, the SCM Agreement differentiates between prohibited and action-

able subsidy violations.

5.1.3.1 Prohibited subsidies

5.1.3.1.1 Implementation If the measure is found to be a prohibited

subsidy, the subsidizing member has to ‘withdraw the subsidy without

24

For further details, see paragraph 3 of Annex V of the SCM Agreement.

25

Paragraphs 6 and 7 of Annex V of the SCM Agreement.

26

See also Appellate Body Report, Canada – Aircraft, para. 201. The reason why no such

specific procedure is elaborated regarding prohibited subsidies might be that no adverse

effects should be demonstrated in the case of prohibited subsidies. Yet the information-

gathering procedure could still be relevant, for example, to demonstrate the presence of a

‘subsidy’ under Article 1 of the SCM Agreement.

27

Ibid., para. 202; Panel Report, Korea – Commercial Vessels, para. 7.162.

28

Panel Report, Korea – Commercial Vessels, paras. 7.3–7.5.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 201

delay’.29 In particular, the panel has to specify the time period within

which the measure must be withdrawn. The subsidizing member is thus

not given ‘a reasonable period of time’ to bring its measure in conformity

with WTO rules, as is the case under the DSU. Moreover, the subsidizing

member has no other option than to withdraw the export subsidy,

whereas the DSU leaves it to the losing party to determine how to

bring its measure into compliance with WTO law.30

Obviously, such compliance cannot be achieved simply by replacing the

original subsidy with another subsidy found to be prohibited.31 Likewise,

continued disbursements under an export subsidy programme found

prohibited cannot be justified by referring to a pre-existing contractual

commitment under domestic law to make these payments.32 Yet a highly

sensitive issue is whether the term ‘withdraw’ may in certain instances

encompass repayments of previously disbursed prohibited subsidies.

The panel in Australia – Automotive Leather II (Article 21.5 – US), a case

involving a one-time prohibited subsidy from Australia to a private com-

pany, adopted such an extensive interpretation and required that the

subsidy had to be repaid in full by the company. A central motivation was

to uphold the effectiveness of the multilateral remedy:

If we were to accept the conclusion that ‘withdraw the subsidy’ does not

encompass repayment, then that recommendation, far from providing a

remedy for violations of Article 3.1(a) of the SCM Agreement, would

grant full absolution to Members who grant export subsidies that are

fully disbursed to the recipient before a recommendation to withdraw

the subsidy is issued in dispute settlement, and for which the export

contingency is entirely in the past.33

Indeed, members could simply circumvent the stringent disciplines

on prohibited subsidies by providing non-recurring subsidies if imple-

mentation were not to mandate any form of repayment and thus be

purely prospective in nature. Yet in demanding full repayment of the

subsidy, the panel clearly went beyond the implementation standard

29

Article 4.7 of the SCM Agreement.

30

Cf. Article 19.1 of the DSU and Article 4.7 of the SCM Agreement.

31

Appellate Body Report, US – FSC (Article 21.5 – EC II), para. 83.

32

Appellate Body Report, Brazil – Aircraft (Article 21.5 – Canada), paras. 39–47; Panel

Report, Brazil – Aircraft (Article 21.5 – Canada), para. 6.16; Appellate Body Report,

US – FSC (Article 21.5 – EC), para. 230; Panel Report, US – FSC (Article 21.5 – EC), paras.

8.168–8.170.

33

Panel Report, Australia – Automotive Leather II (Article 21.5 – US), para. 6.38. See also

Panel Report, Canada – Aircraft Credits and Guarantees, para. 7.170.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

202 subsidies and countervailing measures

suggested by the complainant. Indeed, the United States had proposed

repayment only of the ongoing benefit conferred by the subsidy since the

adoption of the panel report (what it called the ‘prospective portion’ of

the subsidy), which had to be calculated by allocating the subsidy

amount over the useful life of productive assets.34 But the panel rejected

this ‘prospective portion’ remedy partly because the SCM Agreement

did not provide any guidance on how complex questions raised under

this interpretation had to be solved.35

The panel’s decision to mandate full repayment of the non-recurring

export subsidy was fiercely criticized by several members and scholars.36

Such retrospective remedy would imply a fundamental departure from the

general principle that WTO law provides only for prospective remedies, as

Article 19.1 of the DSU is generally interpreted.37,38 Moreover, the obliga-

tion to reclaim past subsidies would interfere with private rights, which

might give rise to domestic legal claims and even pose constitutional and

democratic problems in some legal systems.39 In the absence of a clear

textual basis, it seems therefore unlikely that Uruguay Round negotiators

had intended to create this niche area of retroactive remedies.40

34

Australia’s argument in the alternative appeared to be based on the same principle. Panel

Report, Australia – Automotive Leather II (Article 21.5 – US), paras. 6.16, 6.21.

35

This related to the valuation of the benefit, its allocation over time, and the calculation of

the ‘prospective portion’. Ibid., para. 6.44.

36

This criticism was expressed in the DSB meeting adopting the panel Report (WT/DSB/

M/75, 7 March 2000). For a critical appraisal see G. Goh and A. Ziegler, ‘Retrospective

Remedies in the WTO after Automotive Leather’, 6:3 Journal of International Economic

Law (2003), 545–64; A. Green and M. Trebilcock, ‘The Enduring Problem of World

Trade Organization Export Subsidy Rules’, in K. W. Bagwell, G. A. Bermann, and

P. C. Mavroidis (eds.), Law and Economics of Contingent Protection in International

Trade (Cambridge University Press, 2010), 116–67, at 146–9. Mavroidis, on the other

hand, applauded the panel’s conclusion. See P. C. Mavroidis, ‘Remedies in the WTO

Legal System: Between a Rock and a Hard Place’, 11:4 European Journal of International

Law (2000), 763–813, at 789–90.

37

Mavroidis explains, however, that retrospective remedies were not unheard of in GATT

practice, since several GATT panels recommended repayment of illegally imposed

anti-dumping duties or CVDs. Mavroidis, above n. 36, at 775, 776, and 790.

38

See Panel Report, Australia – Automotive Leather II (Article 21.5 – US), paras. 6.29–6.31.

39

See Goh and Ziegler, above n. 36, at 555–9. At the same time, they correctly acknowledge

that it is a well-established principle of customary international law that a party cannot

rely on domestic law to justify a deviation from its treaty obligations. See also Article 27

of the Vienna Convention. Note already that the ‘prospective portion’ remedy suggested

by the United States in Australia – Automotive Leather II (Article 21.5 – US) is also not

purely prospective in nature.

40

Goh and Ziegler, above n. 36, at 556; see also J. Waincymer, WTO Litigation: Procedural

Aspects of Formal Dispute Settlement (London: Cameron May, 2002), at 644–5.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 203

In the light of these concerns, it should not come as a surprise that

members involved in subsequent implementation cases have explicitly

confined their claims to prospective remedies, and panels – wisely and

correctly – decided that they could not go beyond their request.41 At the

same time it should be stressed that these reports have not explicitly

overturned the interpretation adopted by the panel in Australia –

Automotive Leather II (Article 21.5 – US). Recalling the latter decision,

the panel in Canada – Aircraft Credits and Guarantees observed that it

is still ‘not entirely clear that the WTO dispute settlement system only

provides for prospective remedies in cases involving prohibited export

subsidies’.42

In the Doha Round negotiations, Australia proposed clarifying the

concept of ‘withdrawal’ and, interestingly, its most recent contribution

would, along the lines of the ‘prospective portion’ remedy argument,

allow for repayment of the ongoing benefit since the adoption of the

panel report resulting from a previous non-recurring subsidy.43

Although this would only temper – and not undo – the concerns earlier

raised regarding the panel’s decision in Australia – Automotive

Leather II (Article 21.5 – US),44 such an amendment would ensure that

members are not given carte blanche to offer one-off subsidies, but the

remedy would, at the same time, not be as intrusive as the requirement to

repay the full subsidy amount. Yet no amendment along these lines was

inscribed in the latest Draft Consolidated Chair Text because some

members remain opposed to any provision that would require some

repayment.45

5.1.3.1.2 Remedy in case of non-implementation If the DSB’s

recommendation to withdraw the subsidy is not followed within an

indicated time frame, the injured party may ask to take appropriate

41

Panel Report, Canada – Aircraft (Article 21.5 – Brazil), paras. 5.47–5.48; Panel Report,

Brazil – Aircraft (Article 21.5 – Canada), para. 6.8, n. 17.

42

Panel Report, Canada – Aircraft Credits and Guarantees, para. 7.170; Panel Report,

EC – Large Civil Aircraft, para. 7.281; Panel Report, Brazil – Aircraft (Article 21.5 –

Canada), para. 6.8, n. 17. Observe that the Appellate Body’s description of the ordinary

meaning of ‘withdrawal’ is not explicitly prospective in nature (Appellate Body Report,

Brazil – Aircraft (Article 21.5 – Canada), para. 45).

43

TN/RL/GEN/115/Rev.1, 24 January 2007.

44

See Panel Report, Australia – Automotive Leather II (Article 21.5 – US), paras. 6.22–6.23.

45

Draft Consolidated Chair Text, above Chapter 2 n. 113; TN/RL/W/232, 28 May 2008, Annex B.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

204 subsidies and countervailing measures

countermeasures (Article 4.10 of the SCM Agreement).46 In contrast,

the DSU uses the concept of equivalence (Article 22.4 of the DSU) and

Article 7.8 of the SCM Agreement, on remedies in the context of

actionable subsidies, uses the concept of ‘commensurate with . . . the

adverse effects’. In a footnote, the SCM Agreement clarifies, seemingly

superfluously, that Article 4.10 is not meant to allow countermeasures

that are disproportionate.47 It does not, however, indicate whether

the amount of countermeasures should be based on the amount of the

subsidy or on the amount of the injury to the complaining party (i.e., the

trade effect). Whereas the arbitrators in the first three cases confronted

with this question opted for the ‘amount of the subsidy’ approach, the

arbitrator in US – Upland Cotton explicitly changed track towards a

‘trade effect’ approach.

In the first arbitration dealing with this issue, the arbitrator48 in

Brazil – Aircraft had decided that an amount of countermeasures that

corresponds to the total amount of the subsidy is appropriate when

dealing with a prohibited export subsidy.49 The arbitrator stressed the

different purpose with respect to countermeasures under the DSU:

[T]he purpose of Article 4 is to achieve the withdrawal of the prohibited

subsidy. In this respect, we consider that the requirement to withdraw a

prohibited subsidy is of a different nature than removal of the specific

nullification or impairment caused to a Member by the measure. The

former aims at removing a measure which is presumed under the WTO

Agreement to cause negative trade effects, irrespective of who suffers

those trade effects and to what extent. The latter aims at eliminating the

effects of a measure on the trade of a given Member.50

So, the different nature of prohibited subsidies, as prohibited per se by

the SCM Agreement, would legitimize countermeasures based on the full

subsidy amount and not confined to the actual injury caused to the

complaining party. Otherwise, if the injury is substantially lower than

the subsidy, ‘a countermeasure . . . will have less or no inducement effect

46

The complaining party could request the DSB to authorize the adoption of ‘appropriate’

countermeasures, but the defending party could refer the matter to arbitration if it does not

agree, for instance, that the proposed level is appropriate (Articles 4.10, 4.11 of the SCM

Agreement in conjunction with Article 22.6 of the DSU). The defending party has to

establish a prima facie case that the countermeasures are not appropriate. See Decision by

the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), paras. 2.8–2.9.

47

Footnote 9 of the SCM Agreement

48

Article 22.6 of the DSU and Article 4.11 of the SCM Agreement.

49

Decision by the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), para. 3.60.

50

Ibid., para. 3.48 (footnotes omitted; emphasis in original).

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 205

and the subsidizing country may not withdraw the measure at issue’.51

At the same time, the arbitrator recognized that ‘given that export

subsidies usually operate with a multiplying effect (a given amount

allows a company to make a number of sales, thus gaining a foothold

in a given market with the possibility to expand and gain market shares)’,

a calculation based on trade effects could very well produce higher

figures than one based exclusively on the subsidy amount.52 Likewise,

the arbitrators in US – FSC and Canada – Aircraft Credits and

Guarantees based countermeasures on the amount of the subsidy.53

The arbitrator in US – FSC addressed a number of complex issues raised

by this interpretation. What if there are multiple complainants, each

seeking to take countermeasures in an amount equal to the value of the

subsidy? Or, what if another member, subsequent to the EU’s challenge,

aimed to challenge the same measure? In the case of multiple complai-

nants, the arbitrator said that ‘this would certainly have been a consid-

eration to take into account’ in the determination of the appropriateness

of the countermeasures, and thus implicitly indicated that an amount

equal to the value of the subsidy for each member would be considered

inappropriate.54 With regard to the second hypothetical situation, the

arbitrator realized that the ‘allocation issue would arise’ and cited the

EU’s statement indicating that it would ‘voluntarily agree to remove

some of its countermeasures so as to provide more scope for another

Member to be authorized to do the same’.55 In concluding, the arbitrator

emphasized that its finding did not affect the right of other complainants

subsequently to request countermeasures.56

In line with this case law, both parties in US – Upland Cotton had

taken recourse to the ‘amount of the subsidy’ approach. However, the

arbitrator shifted towards the ‘trade effect’ on the complainant as a basis

to calculate the level of countermeasures.57 The arbitrator reached this

conclusion on the basis of the legal requirement that countermeasures

should be ‘appropriate’.58 This would suggest that ‘there should be a

51

Ibid., para. 3.54. 52 Ibid., para. 3.54.

53

Decision by the Arbitrator, US – FSC (Article 22.6 – US), paras. 5.41, 5.49, 6.33 (n. 84),

and 6.35; Decision by the Arbitrator, Canada – Aircraft Credits and Guarantees

(Article 22.6 – Canada), para.

54

Decision by the Arbitrator, US – FSC (Article 22.6 – US), para. 6.27.

55

Ibid., para. 6.29. 56 Ibid., para. 6.63.

57

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – US) (prohibited subsidies),

paras. 4.121–4.138, 4.173–4.181.

58

Further, this was also based on footnote 9, which stipulates that countermeasures should

not be ‘disproportionate’ (see below n. 67). Ibid., paras. 4.135, 4.136.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

206 subsidies and countervailing measures

degree of relationship between the level of countermeasures and the

trade-distorting impact of the measure on the complaining Member’,

and, even though this is not entirely impossible, ‘in most cases, the trade-

distorting impact of the subsidy on one or several other Members would

not necessarily bear any particular relationship to the amount of the

subsidy’.59 Even if ‘the subsidy amount’ approach might seem attractive

from a calculation perspective, the difficulty in measuring trade effects

should not withhold future arbitrators from undertaking this exercise.60

Arbitrators should not reach a precise quantification of the actual trade

effect, but have the flexibility to accept approximations they feel to be

within the bounds of what is appropriate.61

The arbitrator was well aware that previous arbitrators had taken a

different approach, but, at the same time, noticed that they did not

exclude trade effects as a relevant consideration.62 Indeed, the arbitra-

tors in US – FSC and Canada – Aircraft Credits and Guarantees did

not preclude that the level of countermeasures calculated on the basis of

the subsidy amount could be modified upward in the case where adverse

trade effects on the complainant would be higher.63 They recognized

that the injury to the complainant might very well be higher than the

subsidy amount in certain cases.64 Yet these previous arbitrators

fundamentally differed from the arbitrator’s position in US – Upland

Cotton in their conclusion that countermeasures should not be

constrained to trade effects where the subsidy amount turns out to be

larger. They found no such limitation in Article 4 of the SCM Agreement

and considered that such an approach could undermine the inducement

effect of countermeasures.65 By reading into Article 4.9 (‘appropriate’)66

and its footnote (‘not be disproportionate’)67 an obligation to relate

59

Ibid., paras. 4.135–4.136 (emphasis added). As further explained below, the arbitrator,

nonetheless, used the amount of the subsidy as a proxy for part of the trade effect.

60

Ibid., paras. 4.134, 4.137. 61 Ibid., para. 4.137. 62 Ibid., para. 4.133.

63

See Decision by the Arbitrator, US – FSC (Article 22.6 – US), para. 5.21; Decision by the

Arbitrator, Canada – Aircraft Credits and Guarantees (Article 22.6 – Canada), paras.

3.63, 3.114–3.116. See also Decision by the Arbitrator, US – Upland Cotton (Article

22.6 – US) (prohibited subsidies), n. 182.

64

Decision by the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), para. 3.54; Decision

by the Arbitrator, US – FSC (Article 22.6 – US), n. 84, n. 88.

65

See Decision by the Arbitrator, US – FSC (Article 22.6 – US), para. 5.41 (emphasis in

original). The concern over eroding the inducement effect was expressed in Decision by

the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), para. 3.54.

66

The same reference is made in Article 4.10 of the SCM Agreement.

67

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – US) (prohibited subsidies),

para. 4.135. Footnote 9 reads, ‘This expression is not meant to allow countermeasures

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 207

countermeasures to the trade-distorting impact on the complainant, the

arbitrator in US – Upland Cotton foreclosed an upward adaptation of the

level of countermeasures when the trade effect turns out to be lower

than the subsidy amount.

To paraphrase previous case law, the US – Upland Cotton arbitrator

seems to ‘effectively read the specific language’ of Article 4 of the SCM

Agreement ‘out of the text’.68 Indeed, it largely equates the level of

‘appropriate’ countermeasures in the context of prohibited subsidies

to the level explicitly foreseen in the context of actionable subsidy

claims. The latter refers to countermeasures ‘commensurate with the

degree and nature of the adverse effects’.69 This difference in wording

should be given meaning in itself. Moreover, the dissimilarity in word-

ing suggests that in case ‘negotiators have intended to limit counter-

measures to the effect caused by the subsidy on a Member’s trade, they

have used different terms than “appropriate countermeasures”’.70 The

only difference between the level of countermeasures in the context of

prohibited versus actionable subsidies (or other WTO contexts) refers,

in the US – Upland Cotton arbitrator’s reading, to the greater flexibility

for arbitrators to calculate the trade effect when confronted with

prohibited subsidies.71 They might more easily adopt assumptions that

that are disproportionate in light of the fact that the subsidies dealt with under these

provisions are prohibited’ (emphasis added). The latter part could be understood in two

opposing ways. On the one hand, it could mean that countermeasures should not be

disproportionate simply because the subsidies are prohibited in nature. In this reading,

apparently adopted by the Arbitrator in US – Upland Cotton (see above n. 58), footnote 9

would, rather, limit the amount of countermeasures that one might consider appropriate

on the basis of the text of Article 4.10 itself. On the other hand, according to the

Arbitrator in US – FSC, it means that, in determining whether countermeasures are

disproportionate, it should be taken into account that these are prohibited and have to be

withdrawn. In this reading, footnote 9 would, rather, underscore the difference from

countermeasures in the context of actionable subsidies. Decision by the Arbitrator, US –

FSC (Article 22.6 – US), paras. 5.15–5.27, 5.30, 5.43, 5.62.

68

Decision by the Arbitrator, US – FSC (Article 22.6 – US), para. 5.62.

69

Article 7.9 of the SCM Agreement. As indicated below, the Arbitrator in some instances

accepted assumptions that would likely overestimate the real trade effect on the com-

plainant, because it was dealing with countermeasures in the context of prohibited

subsidies. Yet the same Arbitrator also adopted such ‘overestimating’ assumptions in

the context of actionable subsidies (see below Chapter 5, section 5.1.3.2.2).

70

Decision by the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), para. 3.49;

see also Decision by the Arbitrator, US – FSC (Article 22.6 – US), paras. 5.32, 5.48.

71

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (prohibited

subsidies), paras. 4.22, 4.107, 4.119; Decision by the Arbitrator, US – Upland Cotton

(Article 22.6 – United States) (actionable subsidies), para. 4.55.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

208 subsidies and countervailing measures

would overestimate the trade effect on the complainant. Apparently, any

difference between both sets of countermeasures would simply result

from the inaccuracy of the economic modelling exercise to calculate

trade effects. It seems highly doubtful that this was the difference

intended by negotiators. Lastly, a higher level of countermeasures in

the case of prohibited subsidies corresponds to the generally stricter

stance on these subsidies under the SCM Agreement. It relates the level

of countermeasures to the gravity of the wrongful act.72 For all these

reasons, the previous case law seems to be on more solid grounds in

concluding that countermeasures should not be limited to the trade

effect on the complainant. Nonetheless, the ‘trade effect’ approach

endorsed by the arbitrator in US – Upland Cotton merits some further

scrutiny, as future arbitrators will likely align themselves to this new

approach.

In implementing this ‘trade effect’ approach, the arbitrator in

US – Upland Cotton explained that, similarly to any export subsidy,

the subsidized export credit support could be expected to affect both the

volume of trade and the price at which trade takes place.73 By stimulating

additional US exports and inflating the price in target markets, such

‘illegally subsidized competition’ generates ‘adverse effects upon pro-

ducers and exporters in the rest of the world’.74 They will lose sales to

US subsidized competitors in the target markets (i.e., the volume effect)

and will have to sell remaining sales at the depressed price (i.e., the price

effect). The economic damage on the complainant was not to be based on

the welfare effects caused by the export subsidies (i.e., how much worse

off it makes the complainant in welfare terms), but on their allocation

effects (i.e., the potential amount and value of trade affected by the

export subsidy).75

To calculate the volume effect, displacement of both domestic pro-

duction and third-country exports was measured on the basis of the

additional US exports that were generated by the subsidy programme.

Equating displacement with additional exports assumed that US export

subsidies did not create additional demand.76 Turning to the price effect,

72

For a detailed elaboration of this argument see Decision by the Arbitrator, US – FSC

(Article 22.6 – US), paras. 5.22–5.24, 5.39–5.41, 5.61.

73

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (prohibited

subsidies), para. 4.183.

74

Ibid., para. 4.183. 75 Ibid., n. 212.

76

To the extent that additional demand occurred, the measurement of additionality would

overestimate the displacement. Ibid., para. 4.191.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 209

the arbitrator decided to take the subsidy amount (i.e., the interest

rate subsidy77) as a proxy for the global revenue loss due to the price

effect. It was well aware that this was only a rough approximation,

which would very likely overestimate the actual loss.78 Because the

arbitrator decided that countermeasures should be equivalent to the

trade-distorting impact on the complainant (i.e., Brazil), the figures of

both the volume and price effect were apportioned to Brazil’s market

share.79 Adding price and volume effects on Brazil, the arbitrator

reached a level of nearly US$150 million.80

To reach this conclusion, the arbitrator in essence relied on the calcu-

lations made by Brazil for its claim based on the subsidy amount. Brazil had

argued that the subsidized export credit support conferred a double benefit:

an interest rate subsidy (IRS), affording foreign importers discounted

financing, and ‘additionality benefits’, affording US exporters greater export

quantities than under market conditions (additionality).81 Rightly refuting

that these could be considered as distinct benefits,82 the arbitrator tactfully

used both elements for its trade effect calculation: the IRS as proxy for the

price effect and additionality as measurement of the volume effect. By

subsequently apportioning these trade effects to the market share of the

complainant, the final level of countermeasures was substantially lower than

the calculation based on the full subsidy amount. To fit the subsidy amount

calculations into its trade effect approach, the arbitrator had had to adopt a

set of rather unrealistic assumptions, but underscored the latitude in calcu-

lating the appropriate level of countermeasures when a prohibited subsidy

finding was at stake.83

77

The subsidy amount of the export credit guarantees was calculated on the basis of the

Ohlin model (ibid., paras. 4.209, 4.232, 4.233).

78

Ibid., paras. 4.196–4.198.

79

No apportionment was made for the trade-distorting impact on Brazil’s domestic

market because it was assumed that all adverse effects affected domestic producers

(and not importers). Only adverse effects in third markets were apportioned using

Brazil’s share in world trade.

80

The amount of countermeasures changes annually based on a formula developed by the

Arbitrator. See Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United

States) (prohibited subsidies), Annex 4.

81

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (prohibited

subsidies), paras. 4.139–4.147.

82

Ibid., paras. 4.147–4.148, n. 199. The benefits presented by Brazil are indeed two sides of

the same coin: the interest rate subsidy to foreign importers generates the additional

sales for US exporters.

83

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (prohibited

subsidies), paras. 4.192, 4.198, 4.201.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

210 subsidies and countervailing measures

In conclusion, all arbitrators agreed that the purpose of countermeasures

under Article 4 of the SCM Agreement is, as under the DSU,84 to induce

compliance.85 The objective is not to compensate the complainant for

non-compliance, but to induce the subsidizing member to withdraw the

condemned export subsidies.86 The arbitrator in Canada – Aircraft Credits

and Guarantees further specified that the purpose of the countermeasures

is not to induce the complainant to deter the payment of prohibited

subsidies in the future, and thus beyond the level of subsidies that

were found prohibited by the panels and Appellate Body (deterrent

argument).87 Although the arbitrator in US – Upland Cotton accepted

that ‘inducing compliance’ is the purpose of countermeasures, it stressed

that this purpose should not have an impact on the level of permissible

countermeasures.88

The new approach implies that the WTO dispute settlement system

will present a less forceful and effective instrument for developing

countries to challenge prohibited export subsidies. Given their relatively

low share in trade, the level of countermeasures might be insufficient to

induce compliance on the part of the complainant where they challenge

prohibited export or local content subsidies. Surely this is similar to the

level of countermeasures in case of non-implementation of other types of

WTO obligation. Yet the ‘subsidy amount’ approach had the unique

84

Appellate Body Report, US – Continued Suspension, para. 309; Report by the Arbitrator,

EC – Bananas III (US) (Article 22.6 – EC), para. 6.3.

85

Decision by the Arbitrator, US – FSC (Article 22.6 – US), paras. 5.52, 5.57; Decision by

the Arbitrator, Canada – Aircraft Credits and Guarantees (Article 22.6 – Canada), paras.

3.47–3.48; Decision by the Arbitrators, Brazil – Aircraft (Article 22.6 – Brazil), paras.

3.44, 3.54, 3.57 and 3.58.

86

For instance, the United States unsuccessfully argued before the Arbitrator in US –

Upland Cotton that the purpose of countermeasures was to ‘rebalance rights and

obligations’. Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – US)

(prohibited subsidies), para. 4.108.

87

Decision by the Arbitrator, Canada – Aircraft Credits and Guarantees, paras. 3.108–3.113.

88

The Arbitrator observed that inducing compliance ‘appears rather to be the common

purpose of retaliation measures in the WTO dispute settlement system’. In those other

contexts, countermeasures are also not above the level of trade effects. Decision by the

Arbitrator, US – Upland Cotton (Article 22.6 – US) (prohibited subsidies), para. 4.112. See

also Decision by the Arbitrator, US – FSC (Article 22.6 – US), para. 5.60. In contrast, the

Arbitrator in Canada – Aircraft Credits and Guarantees had increased (by 20 per cent)

the level of countermeasures calculated on the basis of the amount of the subsidy in

order to induce compliance because Canada had indicated that it did not intend to

withdraw the export subsidy. Decision by the Arbitrator, Canada – Aircraft Credits and

Guarantees, paras. 3.121–3.122.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 211

advantage that the level of countermeasure, and thus the inducement

effect, did not depend on the market share of the complainant.89

5.1.3.2 Actionable subsidies

5.1.3.2.1 Implementation The legal obligations on the subsidizing

country regarding actionable subsidies are somewhat less stringent. Article

7.8 of the SCM Agreement allows the respondent to choose between two

implementation options.90 It ‘shall take appropriate steps to remove the

adverse effects or shall withdraw the subsidy’.91 The subsidizing country is

therefore not required to withdraw the subsidy as long as it removes its

adverse effects, which should be done within six months from the date when

the DSB adopts the panel or Appellate Body report. Implementation will

thus normally require some positive action by the respondent member so as

to withdraw the subsidy or remove its adverse effects.92 Action is not limited

to subsidies granted in the past and which formed the basis of the panel’s

reaching the conclusion of serious prejudice. In case of recurring annual

payments, implementation extends to subsidies maintained after the time

period examined by the panel, as long as they continue to have adverse

effects.93 A mere change in the legal basis on which such subsidies are

provided does not imply compliance.94

5.1.3.2.2 Remedy in case of non-implementation In case of non-

compliance, the complainant could request authorization to take

countermeasures ‘commensurate with the degree and the nature of the

adverse effects’ (Article 7.9 of the SCM Agreement). Hence the level of

countermeasures can certainly not be based on the subsidy level. In essence,

this conforms to the new ‘trade effect’ approach regarding prohibited

subsidies endorsed by the arbitrator in US – Upland Cotton.

89

At least insofar as the trade effect on the complainant was not higher than the amount of

the subsidy.

90

Many interpretative questions left unanswered in the SCM Agreement will have to be

solved by the panels in the compliance procedure in EC – Large Civil Aircraft and US –

Large Civil Aircraft.

91

Emphasis added. See also Appellate Body Report, US – Upland Cotton (Article 21.5 – Brazil),

para. 236.

92

Ibid., para. 237.

93

The Appellate Body also drew a parallel with CVD investigations. In the latter case, even

though CVD determination is based on ‘the injury determined to exist in the past, the

remedial measures are prospective’. Ibid., paras. 238–239.

94

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (actionable

subsidies), paras. 3.18–3.20.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

212 subsidies and countervailing measures

The level of countermeasures should correspond95 to the degree

(quantitative element) and nature (qualitative element – i.e., the specific

type of adverse effects) of the adverse effects as they present themselves

in the case at hand.96 Applied to the US – Upland Cotton case, the level of

countermeasures was assessed in relation to the findings of significant

price suppression (Article 6.3(c) of the SCM Agreement). This included

not only the portion of price suppression resulting from subsidization

that renders it ‘significant’, but the entirety of price suppression.97

Further, only the impact on the complainant and not on the rest of the

world should be considered.98

In sum, the level of countermeasure has to correspond to the adverse

effects endured by the complaining member. This implies that arbitra-

tors cannot avoid quantification of the adverse effect caused by subsi-

dization, which should be done sufficiently precisely that corresponding

countermeasures can be decided on. To calculate the adverse effects on

Brazil of challenged US domestic cotton subsidies (i.e., marketing loans

and countercyclical payments), the arbitrator simulated a counterfactual

situation involving the permanent removal of these subsidies. This gave

an indication of what the world price and output levels would have been

in the case where subsidies had been removed. A similar counterfactual

analysis based on economic modelling has been suggested by several

economists to properly conduct the causality determination under the

‘serious prejudice’ test (Article 6.3 of the SCM Agreement).99 The

Appellate Body has likewise emphasized the relevance of such economic

modelling to decide on a ‘serious prejudice’ claim.100 For this reason as

95

Exact or precise equality is not required. Ibid., para. 4.39.

96

Ibid., paras. 4.40–4.48. The clear difference in the wording compared with Article 4.10

(prohibited subsidies) confirmed that ‘the terms of Article 7.9 . . . are intended to closely

tailor, in all cases, the countermeasures to the legal basis for the underlying findings’.

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (action-

able subsidies), para. 4.55.

97

This is similar to the imposition of CVDs, which can only be imposed if subsidization is

above a de minimis level but a positive determination thereof does not affect the level of

CVDs. Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States)

(actionable subsidies), paras. 4.98–4.107.

98

See also Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States)

(actionable subsidies), paras. 4.80–4.92.

99

See Vandenbussche, above Chapter 4 n. 332, at 211–17; Steinberg and Josling, above

Chapter 4 n. 244, at 391–2 and 402–8; Sapir and Trachtman, above Chapter 4 n. 326,

at 201–5.

100

See above Chapter 4, section 4.2.3.5.3.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 213

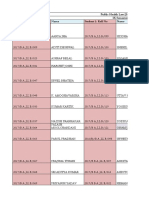

Price

Supply curve

P’

A B

P

C

Q Q’ Quantity

A = Sales value B + C = Reduced

effect production effect

Figure 5.1 US – Upland Cotton, adverse effects on producers in the rest of the world.a

a

This figure was presented by Brazil in the Arbitration procedure and included in the

final report. Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United

States) (actionable subsidies), para. 4.128.

well, the arbitrator’s quantification conducted in US – Upland Cotton

deserves some further discussion.

Figure 5.1 was advanced by Brazil as a graphic illustration of the adverse

effects on producers in the rest of the world caused by the challenged US

domestic cotton subsidies. The supply curve of a cotton-producing country

in the rest of the world is depicted and the United States is considered a

‘large country’ in the production of cotton, since changes in its output

levels affect the world price of cotton (significant price suppression on

the world market). With the US domestic subsidies in place (i.e., the actual

situation), the world price is at P and Q is the quantity produced by the

cotton producing country in question. Without the US subsidies (i.e., the

counterfactual situation), the world price would be higher (P', Figure 5.1),

which would induce the producing country in question to produce more

cotton (Q', Figure 5.1). On this basis, Brazil disentangled two types of

adverse effect caused by the suppression of the world market cotton price,

namely a so-called ‘sales value effect’ (A, Figure 5.1) and a ‘reduced

production effect’ (B + C, Figure 5.1). The arbitrator accurately observed

that the sum of both effects is larger than the total negative effect on

producer welfare in the rest of the world.101 Indeed, the loss in ‘producer

surplus’ in the actual situation (i.e., the subsidy situation) is represented by

the sum of the areas A and B. Area A represents the loss of selling the actual

level of cotton (Q, Figure 5.1) at a suppressed price (P) and area B represents

the loss of not producing an additional quantity of cotton (Q'–Q,

101

See above Chapter 1, section 1.1.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

214 subsidies and countervailing measures

Figure 5.1). Area C, on the other hand, represents the opportunity cost of

the resources that would be needed to produce such additional quantity of

cotton (Q'–Q, Figure 5.1). In the actual situation (i.e., the subsidy situation),

these resources are employed elsewhere in the economy and therefore

do not represent a cost to the rest of the world. Hence the adverse

effects calculated by Brazil were larger than the loss in producer welfare.

Importantly, the arbitrator accepted that adverse effects may have a wider

meaning than producer surplus, and found support thereto in the text

of Article 6.3(c) of the SCM Agreement, in particular in its reference

to ‘lost sales’.102 Notice that the effect on consumer welfare is not consid-

ered relevant at all, since the focus of Part III on actionable subsidies is

confined to adverse effects on foreign producers. Under the perfect-market

assumption, the overall benefit to foreign consumers’ welfare resulting

from the suppressed cotton price would be larger than the loss on

foreign producers’ welfare (A+B, Figure 5.1). This could also be seen in

Figure 5.2, into which the information from Figure 5.1 is integrated on

the right hand side.103

Turning to the effective calculation of the adverse effects (+A, +B, +C

in Figure 5.1; +a*, +b*, +c*, +d* in Figure 5.2), the arbitrator agreed

with Brazil’s demand and supply log-linear displacement model. This

quantifies percentage changes (e.g., in the world market price) from

an initial baseline equilibrium in which all cotton subsidies are in place.

Both parties, however, fundamentally disagreed on the value of key

parameters.104 Evidently Brazil defended parameters that maximized

the adverse effect resulting from US subsidization (+A, +B, +C in

Figure 5.1; +a*, +b*,+c*, +d* in Figure 5.2), whereas the United States

took the opposite view. Their difference in argument could be illus-

trated on the basis of Figure 5.2, which disentangles the effect of the

removal of US subsidization on the US market and the rest of the world.

EUS represents the actual US export curve of cotton (with the initial

world equilibrium price PW and output QTRADE), and E'US represents

the counterfactual situation in which US domestic subsidies are

102

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (action-

able subsidies), para. 4.129.

103

The change in welfare to the rest of the world is the sum of the changes in consumer

surplus (+a*, +b*,+d*,+e*, +f*; Figure 5.2) and producer surplus (-a*, -b*; Figure 5.2)

and is thus positive (+d*,+e*, +f*; Figure 5.2). Areas c* and d* in Figure 5.2 (which are

depicted as area C in Figure 5.1) are not part of the producer welfare calculus.

104

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (action-

able subsidies), paras. 4.130–4.134.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

US WORLD MARKET REST OF THE WORLD

DROW SROW

PUS DUS PW

PROW

E’US

S’US EUS

PW + S

a b c –S P’W

ef SUS a* b*

d g h i PW d* e* f*

c*

IROW

Q’US QUS QUS Q’TRADE QTRADE QTRADE QROW Q’ROW QROW

S = subsidy per unit output = marketing loan subsidies + (0.4 x countercyclical payments)

QUS

Trade level between US and ROW with subsidy = QTRADE ( )

Trade level between US and ROW after removal subsidy = Q’TRADE ( )

‘Adverse effects’ to ROW from subsidy = +a*, +b*, +c*, +d* = US$2.905 billion

World price with subsidy = PW

World price after removal subsidy = P’W

% ∆ price in case removal = 9.38%

∆ Total welfare WORLD in case removal = +c, +f, +h, +i, –d*, –e*, –f* > 0

Figure 5.2 US – Upland Cotton, the effect of the removal of the US domestic cotton subsidy.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

216 subsidies and countervailing measures

removed. The removal of challenged US domestic cotton subsidies

would thus shift the US supply curve upward (from SUS to S'US), also

generating a shift in the US export supply curve (from EUS to E'US).

Hence a new equilibrium would emerge, with a higher world market

price (P'W) and lower trade level between the United States and the rest

of the world (Q'TRADE).

A preliminary question was the choice of the reference period to

conduct this counterfactual analysis. Obviously this was not a trivial

question, given that not only the level of subsidies but also their impact

could very well vary over time, depending on economic or other factors.

Brazil, on the one hand, proposed marketing year (MY) 2005 as this

marked the end of the implementation period, whereas the United States

suggested that average prices of the last three years (MY 2005–7) would

be more representative. Both parties had a clear interest in suggesting

their respective reference period because the cotton price was much

higher in MY 2006 and 2007 than in MY 2005, which implied inter

alia that countercyclical payments were lower in the latter two years.

The arbitrator agreed with Brazil that the end of the implementation

period is in ‘principle legitimate’, certainly in this case because the price

in MY 2005 corresponded to the prices covered by the findings of the

panels.105 Hence MY 2005 was taken as the reference period, even

though the objective according to the arbitrator is to fix an amount in

countermeasures that corresponds to ‘the actual continued adverse

effects of the measure’ in the future.106 In principle, countermeasures

should therefore not correspond with the level of adverse effects under

the past period covered by the panel proceedings.

With regard to the parameters to be included in the model, Brazil

proposed numbers that maximized the adverse effects of subsidization

in MY 2005, whereas the United States adduced arguments for the

opposite. A pivotal element was the value of the different supply and

demand elasticities, which indicate the responsiveness of, respectively,

production and demand to a price change. The arbitrator accorded

with Brazil in using short-term elasticities – which are relatively more

inelastic – as this recognized that consumers as well as producers in the

rest of the world would incur adjustment costs when subsidies were

removed.107 As it would take time to adjust fully to the removal of

subsidies, and these adjustment costs were partly due to subsidization

itself (e.g., the low world price induced low investment levels), the use

105 106 107

Ibid., para. 4.118. Ibid., para. 4.117. Ibid., para. 4.144.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 217

of short-term elasticities was considered appropriate.108 Next, the arbi-

trator also agreed with all Brazil’s suggested elasticities, which were

relatively (i.e., compared with the US figures) inelastic for US demand

(DUS, Figure 5.2), the ‘rest of the world’ demand (DROW, Figure 5.2),

and supply in the rest of the world (SROW, Figure 5.2), but elastic

for US supply (SUS, Figure 5.2).109 Hence, in the case of the removal of

US domestic subsidies, the market would, in relative terms, respond as

follows: US producers would strongly cut back their level of production

due to the lower price they receive (P'W < PW + S, Figure 5.2), whereas

total demand as well as supply in the rest of the world subsidies would

in the short run react only moderately to the higher world market price

(P'W, Figure 5.2) by, respectively, decreasing consumption and increas-

ing production. The arbitrator had found support in the economic

research for Brazil’s proposed elasticities, although it admitted that

‘this is not by any means overwhelming’.110 In addition to elasticities,

another important parameter was the coupling factor, which refers

to the production stimulation effect that a subsidy has relative to

revenue from the market.111 Although there was ‘hardly any economet-

ric evidence’, the arbitrator again accorded with Brazil’s suggested

coupling factor.112 Finally, it was considered relevant that farmers’

production decisions are based on expectations on the cotton price at

the end of the year.113 Given that subsidy amounts also varied with the

cotton price, expectations on cotton prices triggered expectations on the

level of subsidies that would be received. Because statistical analysis

showed that forecasts based on future cotton prices, as suggested by the

United States, were more accurate than those based on lagged prices, as

108

Ibid., paras. 4.144–4.147.

109

This is illustrated in Figure 5.2 by depicting relatively steep curves for DUS, DROW and

SROW and a relatively flat curve for SUS.

110

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (action-

able subsidies), para. 4.162.

111

Countercyclical payments were decoupled from actual production levels, and based on

historical base area and historical programme yield. One extra dollar of subsidies in the

form of countercyclical payments therefore generated a lower production incentive

than a dollar rise in the market price, implying that the coupling factor is lower

than one.

112

Brazil proposed a coupling factor that was evidently higher than the number suggested

by the United States. Decision by the Arbitrator, US – Upland Cotton (Article 22.6 –

United States) (actionable subsidies), paras. 4.164–4.178.

113

Cotton production decisions are made at the beginning of the calendar year, but

marketing only starts at the end of the year.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

218 subsidies and countervailing measures

proposed by Brazil, the arbitrator opted for the inclusion of future

cotton prices in the model.114

On the basis of these parameters (i.e., elasticities, coupling factor,

price expectations), the arbitrator reran the log-linear displacement model

and found that the world price would have been higher by 9.38 per cent in the

counterfactual ‘no-subsidy’ situation. Furthermore, total adverse effects of

those subsidies in MY 2005 on the rest of the world (+A, +B, +C in Figure 5.1;

+a*, +b*,+c*, +d* in Figure 5.2) were estimated at US$2.905 billion.115 Given

that Brazil’s share of cotton production in the rest of the world was 5.1 per

cent in MY 2005, the level of countermeasures considered commensurate

with the degree and nature of adverse effects on Brazil was determined at

US$147.3 million.116

The arbitrator’s decision in US – Upland Cotton offers an interesting

example of how economic models could be used to quantify the trade

effects of subsidization. This enabled the arbitrator to figure out that

the price-suppressing effect of US cotton subsidies amounted to nearly

10 per cent. As mentioned above, several scholars have called for the use

of such economic modelling to establish the causation element under

the ‘serious prejudice’ threshold of Article 6.3 of the SCM Agreement.117

In the light of this plea, two relevant aspects of the arbitrator’s decision

should be highlighted in conclusion.

First, the model used by the arbitrator is what is called by economists a

‘calibrated model’, in which specific assumptions are made about the equili-

brium process that links these variables in a specific way, without empirically

testing their validity.118 Although the basic characteristics of the model could

therefore be questioned, the arbitrator was confident about relying on the

demand and supply log-linear displacement model proposed by Brazil

because the United States had likewise employed this model (with its own

114

The Arbitrator requested the parties to provide the root mean square error (RMSE) of

their forecasts, and this was lower if future prices were used. Another reason for

accepting expectations about future prices was that the one-year lagged prices are not

known at the moment farmers make their production decision. See Decision by the

Arbitrator, US – Upland Cotton (Article 22.6 – United States) (actionable subsidies),

paras. 4.186–4192.

115

This consisted of a sales value effect (+A in Figure 5.1; +a* in Figure 5.2) and reduced

production effects (+B, +C in Figure 5.1; +b*,+c*, +d* in Figure 5.2). Ibid., para. 4.193.

116

Ibid., para. 4.195. Recall that the Arbitrator had decided that only the amount of adverse

effects for the complaining party should be taken into consideration for determining

the level of countermeasures.

117

See above Chapter 4, section 4.2.3.5.3. 118 See above Chapter 4, section 4.2.3.5.3.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 219

set of parameters), and the compliance panel had used simulations of the

model to support its findings.119

Second, the parameter choice (e.g., elasticities, coupling factor, price

expectations) included in the model was, as illustrated above, subject to

strong disagreement among the parties. Importantly, the economic

studies on which both relied varied widely in their calculations of

these parameters. For example, the adverse effects on Brazil on the

basis of US calculations in the same model were five times smaller than

the arbitrator’s figure (US$30.4 million instead of US$147.5 million).

Overall, the arbitrator relied on Brazil’s values, not so much because

economic studies were on average in line with those values, but because

the use in some studies of these values implied that they were not

inappropriate.120 Although the arbitrator held that there was less flexi-

bility for calculating countermeasures under actionable subsidy than

prohibited subsidy claims,121 the parameters proposed by the complain-

ing member were accepted as long as it was not demonstrated that

they were inappropriate. However, the burden of making a prima facie

case under Article 6.3 of the SCM Agreement clearly rests on the

complaining member. Arguably, less leeway will be given to the param-

eters proposed by the complainant. At the same time, the standard under

Article 6.3 only requires that price suppression is ‘significant’, which

might very well also be the case on the basis of the defendant’s param-

eters. For instance, the Appellate Body in US – Upland Cotton (Article

21.5 – Brazil) considered that the range of price effects resulting from all

simulations would fall within the panel’s view of what constitutes

significant price suppression.122

5.1.3.3 Non-actionable subsidies

Although non-actionable subsidies were allowed until the end of the

1990s, the SCM Agreement provided a limited multilateral remedy to

challenge such green light subsidies if they caused ‘serious adverse

effects’ to other members’ domestic industry, ‘such as to cause damage

119

Panel Report, US – Upland Cotton (Article 21.5 – Brazil), para. 10.222; Decision by the

Arbitrator, US – Upland Cotton (Article 22.6 – United States) (actionable subsidies),

paras. 4.132–4.133.

120

Decision by the Arbitrator, US – Upland Cotton (Article 22.6 – United States) (action-

able subsidies), paras. 4.119, 4.147, 4.163, 4.178.

121

Ibid., para. 4.55.

122

Appellate Body Report, US – Upland Cotton (Article 21.5 – Brazil), paras. 365, 435. See

above Chapter 4, section 4.2.4.2

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

220 subsidies and countervailing measures

which would be difficult to repair’.123 Hence the threshold for the

complainant was clearly higher than in case of actionable subsidies

(referring to ‘adverse effects’) and only harm to the domestic industry

could be addressed. If consultations failed, it was up to the SM

Committee, and thus not a panel, to decide whether this threshold was

met.124 The SCM Committee could ‘recommend’ modifying the pro-

gramme in such a way as to remove these effects. If the recommendations

were not followed within six months, the SCM Committee could author-

ize countermeasures ‘commensurate with the nature and degree of the

effects determined to exist’.125

5.2 Unilateral remedies: countervailing measures

Instead of following the multilateral avenue described above, a member is

allowed to opt for the unilateral approach and to levy CVDs on imported

products for the purpose of offsetting specific subsidies bestowed on the

manufacture, production or export of those goods.126 The SCM Agreement

disciplines this unilateral approach; CVDs may only be imposed pursuant to

an investigation in accordance with the procedural and substantive obliga-

tions stipulated in Part V of the SCM Agreement. Part V aims ‘at striking a

balance between the right to impose countervailing duties to offset subsidi-

zation that is causing injury, and the obligations that members must respect in

order to do so’.127 To impose CVD measures correctly, the CVD investigation

has to be conducted in conformity to the procedural disciplines and should

reach a positive determination of three substantive elements: (i) the existence

of a specific subsidy, (ii) injury to the domestic industry producing the like

product, and (iii) a causal link between the subsidized import and the injury.

5.2.1 Procedural requirements

The thrust of the procedural disciplines is to ensure that the CVD

investigation is conducted in an objective manner, giving equal

123

Article 9.1 of the SCM Agreement (emphasis added).

124

Article 9.3 of the SCM Agreement. 125 Article 9.4 of the SCM Agreement.

126

Appellate Body Report, US – Carbon Steel, para. 73; Panel Report, US – Countervailing

Measures on Certain EC Products, para. 7.41. See also Articles 10 (footnote 36), 19.1 of

the SCM Agreement and Article VI:3 of the GATT. For S&D treatment on the

disciplines on CVDs, see below Chapter 6, section 6.1.3. For the normative discussion

on the disciplines on CVDs, see below Chapter 18.

127

Appellate Body Report, US – Carbon Steel, para. 74.

https://doi.org/10.1017/CBO9781139046589.009 Published online by Cambridge University Press

remedies 221

opportunity to different stakeholders to defend their opposing interests.

This ‘due process’ requirement is explicitly stipulated with regard to the

injury determination. By virtue of Article 15.1 of the SCM Agreement,

the investigating authority has to make an ‘objective examination’ of

the matter. According to the case law, this standard ‘requires that the

domestic industry, and the effects of (subsidized) imports be investigated

in an unbiased manner, without favouring the interests of any interested

party, or group of interested parties, in the investigation’.128 Before going

into these ‘due process’ requirements, the disciplines on the initiation

and duration of CVD investigations are introduced.

5.2.1.1 Initiation and duration

The SCM Agreement strengthened the standing requirements for

initiating a CVD investigation.129 An investigation can be initiated either

by or on behalf of the domestic industry or by the authorities of their

own accord.130 It is made ‘by or on behalf of the domestic industry’, if the

petition is supported by domestic producers whose collective output

accounts for more than 50 per cent of total production of the like product

produced by that portion of the domestic industry that expressed its

view, either for or against. If, however, domestic producers supporting

the petition account for less than 25 per cent of total domestic produc-

tion of the like product, national authorities may not initiate an inves-

tigation.131 Thus, to prevent the CVD procedure being captured by the

interests of some producers, a sufficiently important part of the domestic

industry must have expressed support for the application.132 Only ‘in

special circumstances’ can the authorities decide to initiate an investi-

gation without an application by the domestic industry.133

The application by the domestic industry should contain sufficient

evidence of the existence of the three substantive elements: a subsidy,

injury, and a causal link between the subsidized imports and the alleged

injury.134 The authorities have to review the accuracy and adequacy of

this evidence to determine whether the evidence is sufficient to justify the

128

Panel Report, EC – Countervailing Measures on DRAM Chips, para. 7.274.

129

See also Anderson and Husisian, above Chapter 2 n. 80, at 322.

130

Articles 11.1 and 11.6 of the SCM Agreement.

131

Article 11.4. The rationale of the domestic producers that elect to support an investigation is

considered irrelevant (Appellate Body Report, US – Offset Act (Byrd Amendment), paras.