Professional Documents

Culture Documents

Om Bhandar 24.09.2023

Uploaded by

ayushbhadani203Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Om Bhandar 24.09.2023

Uploaded by

ayushbhadani203Copyright:

Available Formats

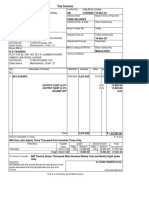

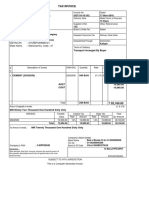

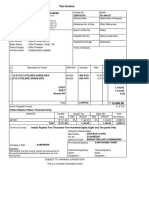

Y e-Invoice

IRN : d679a3561756bd889aeeda4b26c96928d3193a95464a-

cab2d16df36c2f86ab2c

Ack No. : 142313447934009

Ack Date : 24-Sep-23

KHALSA TRADERS Invoice No. e-Way Bill No. Dated

SHOP NO.7, A.M.Y. BARWADDA KT232400297 421372089211 24-Sep-23

DHANBAD - 826004 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 20AIMPS9329N1ZL

State Name : Jharkhand, Code : 20 Reference No. & Date. Other References

E-Mail : jasvinderpalsingh63@gmail.com

Consignee (Ship to)

Buyer's Order No. Dated

Om Bhandar

MASJID PATTI KATRAS Dispatch Doc No. Delivery Note Date

GSTIN/UIN : 20AMYPG4621M1ZU

State Name : Jharkhand, Code : 20

Buyer (Bill to) Dispatched through Destination

Om Bhandar A.M.Y Barwadda Katras

MASJID PATTI KATRAS Bill of Lading/LR-RR No. Motor Vehicle No.

GSTIN/UIN : 20AMYPG4621M1ZU JH10W6268

State Name : Jharkhand, Code : 20 Terms of Delivery

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 HBC SBO 1/2 LTR 15079010 60 BOX 1,052.38 BOX 63,142.80

CGST 1,578.57

SGST 1,578.57

ROUND OFF 0.06

Total 60 BOX Rs 66,300.00

Amount Chargeable (in words) E. & O.E

INR Sixty Six Thousand Three Hundred Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

15079010 63,142.80 2.50% 1,578.57 2.50% 1,578.57 3,157.14

Total 63,142.80 1,578.57 1,578.57 3,157.14

Tax Amount (in words) : INR Three Thousand One Hundred Fifty Seven and Fourteen paise Only

Declaration for KHALSA TRADERS

We declare that this invoice shows the actual price of the

goods described and that all particulars are true and

correct. Authorised Signatory

SUBJECT TO DHANBAD JURISDICTION

This is a Computer Generated Invoice

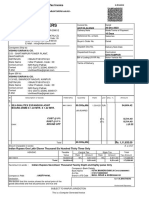

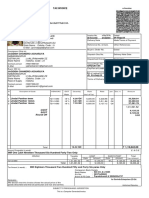

e-Way Bill e-Way Bill

Doc No. : Tax Invoice - KT232400297

Date : 24-Sep-23

IRN : d679a3561756bd889aeeda4b26c96928d3193a95464acab2d16df36c2f86ab2c

Ack No. : 142313447934009

Ack Date : 24-Sep-23

1. e-Way Bill Details

e-Way Bill No. : 421372089211 Mode : 1 - Road Generated Date : 24-Sep-23 12:44 PM

Generated By : 20AIMPS9329N1ZL Approx Distance : 19 KM Valid Upto : 25-Sep-23 11:59 PM

Supply Type : Outward-Supply Transaction Type: Regular

2. Address Details

From To

KHALSA TRADERS Om Bhandar

GSTIN : 20AIMPS9329N1ZL GSTIN : 20AMYPG4621M1ZU

Jharkhand Jharkhand

Dispatch From Ship To

SHOP NO.7, A.M.Y. BARWADDA, DHANBAD - 826004 MASJID PATTI KATRAS

DHANBAD Jharkhand 826004 KATRAS Jharkhand 828113

3. Goods Details

HSN Product Name & Desc Quantity Taxable Amt Tax Rate

Code (C+S)

15079010 HBC SBO 1/2 LTR & 15079010 60 NOS 63,142.80 2.50+2.50

Tot.Taxable Amt : 63,142.80 Other Amt : 0.06 Total Inv Amt : 66,300.00

CGST Amt : 1,578.57 SGST Amt : 1,578.57

4. Transportation Details

Transporter ID : Doc No. :

Name : Date :

5. Vehicle Details

Vehicle No. : JH10W6268 From : DHANBAD CEWB No. :

You might also like

- Tax InvoiceDocument1 pageTax Invoicemanmojilo4 bharwadNo ratings yet

- PDFDocument1 pagePDFdhunniNo ratings yet

- AJPL1302Document1 pageAJPL1302shrungar.ornament1No ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPapia ChandaNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Sale Bill 081Document2 pagesSale Bill 081Nilesh PatilNo ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument2 pagesTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceNoman AnsariNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- SRS1Document2 pagesSRS1prasanjitswain8No ratings yet

- 7832 EdvannaparaDocument1 page7832 EdvannaparaSafalsha BabuNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022bhola.vilesh7No ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- Maheshwari Mining PVT LTD: SL No. 1Document1 pageMaheshwari Mining PVT LTD: SL No. 1Karthii AjuNo ratings yet

- Biva 2 PDFDocument1 pageBiva 2 PDFVinayak Trading CompanyNo ratings yet

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDocument1 pageRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakNo ratings yet

- 456Document1 page456KrishaNo ratings yet

- MST 1295Document1 pageMST 1295digital lifeNo ratings yet

- Dans & DehorsDocument1 pageDans & DehorsBhavin MehtaNo ratings yet

- Vishnu Saran & Co. Bill No 5045Document1 pageVishnu Saran & Co. Bill No 5045gopukrishna37No ratings yet

- Bbe 8Document2 pagesBbe 8Sanjay LoyalkaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicecometprinterNo ratings yet

- B No17 PDFDocument1 pageB No17 PDFFSPL HSENo ratings yet

- Creatio Hyd - 1764Document1 pageCreatio Hyd - 1764emamoddin ahemadNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoicetapireg689No ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPadarabinda ParidaNo ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- Description of Goods Amount Per Rate Rate Quantity Hsn/SacDocument1 pageDescription of Goods Amount Per Rate Rate Quantity Hsn/SacAniket GhorpadeNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherDhananjay PatilNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Accounting Voucher PDFDocument2 pagesAccounting Voucher PDFBalbir BaggaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Description of Goods Hsn/Sac Quantity Rate Per AmountDocument1 pageDescription of Goods Hsn/Sac Quantity Rate Per AmountKishoreNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Jiwan Saree House AkmalDocument1 pageJiwan Saree House AkmalEhtesham FaisalNo ratings yet

- Partho Da 3Document1 pagePartho Da 3FOUR SUM ENTERPRISENo ratings yet

- Ut 272 PDFDocument2 pagesUt 272 PDFSatvik ManaktalaNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- Tax Invoice Cum Delivery ChallanDocument2 pagesTax Invoice Cum Delivery ChallanLazzieey RahulNo ratings yet

- Tax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Document2 pagesTax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Risi Spice industriesNo ratings yet

- Tax Invoice - HB-2023-24-7905 - 21-Feb-24Document2 pagesTax Invoice - HB-2023-24-7905 - 21-Feb-24shrungar.ornament1No ratings yet

- BillDocument5 pagesBillBAPPADITTYA PAULNo ratings yet

- Maaza Incentive March 2 Week 2021Document1 pageMaaza Incentive March 2 Week 2021Suhel Gada GNo ratings yet

- 19 Mayur ProductDocument1 page19 Mayur Productchamundaxerox88No ratings yet

- Tax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21Document1 pageTax Invoice: Sudarshan Syndicate 4334/20-21 23-Feb-21ziyan skNo ratings yet

- MTC093Document3 pagesMTC093deepak vashistNo ratings yet

- Inv No-326 OM AgencyDocument1 pageInv No-326 OM Agencymithun jainNo ratings yet

- 686 Erode 14-11-23 EwinvDocument3 pages686 Erode 14-11-23 EwinvGuruNo ratings yet

- Sales GST 282Document1 pageSales GST 282ashish.asati1No ratings yet

- SM 100 MTDocument8 pagesSM 100 MTChandresh MarthakNo ratings yet

- Bill 15Document1 pageBill 15jay_p_shahNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchershailesh patilNo ratings yet

- 254.thriveni EarthmoversDocument1 page254.thriveni EarthmoversPSR Mining Drilling EquipmentsNo ratings yet

- Sales GST 31Document1 pageSales GST 31ashish.asati1No ratings yet

- Tax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Document2 pagesTax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Rdp 4No ratings yet

- Esso Standard Eastern vs. CommissionerDocument2 pagesEsso Standard Eastern vs. CommissionerlexxNo ratings yet

- DepreciationDocument27 pagesDepreciationraj10420No ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- T2 Ans 1,3 - 4 (PS - ITA)Document5 pagesT2 Ans 1,3 - 4 (PS - ITA)MinWei1107No ratings yet

- Case Digest Taxation 2Document50 pagesCase Digest Taxation 2Pcl Nueva VizcayaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- INCTAXA - Module 1Document26 pagesINCTAXA - Module 1JOVIE KATE MARIE MOLINANo ratings yet

- Govt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDocument16 pagesGovt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDr MaldannaNo ratings yet

- Soriano vs. Secretary of Finance G.R. No. 184450 January 24 2017Document1 pageSoriano vs. Secretary of Finance G.R. No. 184450 January 24 2017Anonymous MikI28PkJcNo ratings yet

- TDS Section ListDocument3 pagesTDS Section Listprince vadgamaNo ratings yet

- Akash - Salary SlipDocument2 pagesAkash - Salary Slipzingo bingoNo ratings yet

- Financial Budget PlanDocument11 pagesFinancial Budget PlanApril Dawn DaepNo ratings yet

- Buy Vs Lease CarDocument6 pagesBuy Vs Lease Caraftab_sweet3024No ratings yet

- TaxInclusive RawDataDocument13 pagesTaxInclusive RawDataleyla0% (1)

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- TAX 2 - COMPLETE - Entire Semlecture and Book Based PDFDocument95 pagesTAX 2 - COMPLETE - Entire Semlecture and Book Based PDFChaze CerdenaNo ratings yet

- SYLLABUS Tax FOR 2023 BARDocument3 pagesSYLLABUS Tax FOR 2023 BARJournal SP DabawNo ratings yet

- Bayag 1Document41 pagesBayag 1Jan Angelo MagnoNo ratings yet

- Commerical License 2022-2023Document2 pagesCommerical License 2022-2023Majdi HalikNo ratings yet

- Mouse PadDocument2 pagesMouse Pad20MA32 - PRABAVATHI TNo ratings yet

- Your Payment Receipt PDFDocument1 pageYour Payment Receipt PDFPrabhat MishrANo ratings yet

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaNo ratings yet

- Payslip From EPS PL ATF Granite Sweet Berries Unit Trust 3Document1 pagePayslip From EPS PL ATF Granite Sweet Berries Unit Trust 3drosarioanalay1607No ratings yet

- Cta Eb CV 01734 D 2019mar29 AssDocument24 pagesCta Eb CV 01734 D 2019mar29 AssAnna Dela VegaNo ratings yet

- GST ChallanDocument2 pagesGST Challanmohammad TabishNo ratings yet

- FAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIDocument6 pagesFAQs Re Submission of Sworn Declaration and COR SLOCPI SLAMCI SLFPIifpauditNo ratings yet

- CIR V Javier and CTA 199 SCRA 824Document5 pagesCIR V Javier and CTA 199 SCRA 824Estelle Rojas TanNo ratings yet

- CIR Vs Pineda DigestDocument1 pageCIR Vs Pineda DigestRoz Lourdiz CamachoNo ratings yet

- Form No. 25Document5 pagesForm No. 25Amit BhatiNo ratings yet