Professional Documents

Culture Documents

Attachment 1

Uploaded by

khabrilaalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Attachment 1

Uploaded by

khabrilaalCopyright:

Available Formats

GOVERNMENT OF WEST BENGAL

OFFICE OF THE CHARGE OFFICER & JOINT COMMISSIONER, COMMERCIAL TAXES

BELIAGHATA CHARGE

CHARGE,, DIRECTORATE OF COMMERCIAL TAXES

14, BELIAGHATA ROAD, KOLKATA-700015;

KOLKATA 2nd Building, 5th Floor

To,

GSTIN 19AABCR8255L1ZT

Legal Name TIRUPATI GLOBAL TRADE PRIVATE LIMITED

TradeName TIRUPATI GLOBAL TRADE PRIVATE LIMITED

Ref : -

Scrutiny Case ID : AD1906230009146

Date of case creation: 02/06/2023

Scrutiny for the

01-04-2018 to 31-03-2019

period of :

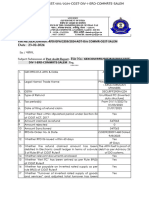

Sub- Discrepancies found during Scrutiny of returns u/s-61 of the CGST Act, 2017 and WBGST Act, 2017

ASMT-10 issued in respect of the Scrutiny Case ID- AD1906230009146).

(to be read as"Attachment-1" to ASMT

The Table below shows the summary of discrepancies noticed during scrutiny of returns (GSTR-3B) furnished

by you with reference to the information available

available, if any, in your GSTR-1, GSTR-2A, GSTR-99 and GSTR

GSTR-9C for the

aforesaid period.

Sl State Tax

Description of discrepancies noticed Integrated Tax Central Tax Cess

No. (WBGST)

1 Tax short paid on outward supply - 3,660.19 3,660.19 -

2 Tax short paid on Inward supply (RCM) - - - -

3 ITC availed in excess - - - -

4 ITC found reversible, if availed 8,47,542.79 1,11,568.90 1,11,568.90 -

Interest payable

5 (for reasons other than those mentioned - - - -

above)

Total amount = 8,47,542.79 1,15,229.09 1,15,229.09 -

The detail figures on basis of which the

these discrepancies have come out can be found in Attachment -2

("Detail of discrepancies.pdf") annexed

ed with this document.

*For Sl No. 1 to Sl No. 4, you are also required to pay interest against such excess claim of ITC and/or less discharged

of tax liability as on date of making payment [[Refer to section-50 of the WBGST Act-2017]..

You are required to reverse such claim of Input Tax Credit along with applicable interest as on date of

payment.

You may accept such discrepancies, and pay the tax, interest and any other amount arising from such

discrepancies and inform the same or furnish an explanation for the discrepancy in FORM GST ASMT-11 to the

undersigned.

Supporting documents/ evidences should be uploaded with your reply as much as the upload limit permits

(5Mb x 4 files) and rest of them, if any, should be mailed to the undersigned from your registered mail id or submitted

in hard copies (duly signed and stamped) at his office.

During your reconciliation, you may find that some of these discrepancies might have already been communicated to

you in any earlier proceedings and you might have already paid such tax, interest or reversed such ITC in those

proceeding or on your own motion. In such cases, you are requested to mention the same in your reply in FORM GST

ASMT-11.

As a result of your reconciliation, your liability to pay tax, interest and/ or reverse ITC may even be more than

what are shown in the above table. You are required to pay the tax, interest and/ or reverse the ITC which may

actually be found payable/ reversible by you during the preparation of your reply to this notice.

You are also required to pay applicable interest, tax-head wise, calculated up to the date of making such

payments with respect to the amounts found payable by you against sl. no. 1 to 4 of the above table. In addition to this,

interest shown payable at sl. no. 5 of the table is also required to be paid.

Please note that your failure to comply with the above requirement within the date mentioned in FORM

GST ASMT-10 will lead to initiation of appropriate actions against you as prescribed in the said Acts, without

making any further reference to you in this regard.

For any query, you may call or mail the undersigned in details given below.

Date: - : 02/06/2023 Name : KUNAL KUMAR

Office Address: Office of the Charge Officer & Joint Commissioner, State Revenue Designation : Assistant Commissioner

: Directorate of Commercial Taxes; 14, Beliaghata Road

: 2nd Building; 5th Floor; Room No. 521

Contact: (033)-71221301 email:- kunal-kumar91@wbcomtax.gov.in

You might also like

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- GST Circulars Issued On 6th July - A SummaryDocument8 pagesGST Circulars Issued On 6th July - A SummaryVijaya ChandNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Unit 4 - GST Liability & Input Tax CreditDocument13 pagesUnit 4 - GST Liability & Input Tax CreditPrathik PsNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Form Itr Acknowledgement Ay 2023 24Document2 pagesForm Itr Acknowledgement Ay 2023 24Sakshi KaleNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- Internal Circular (Restricted Circular For Office Use Only)Document16 pagesInternal Circular (Restricted Circular For Office Use Only)Manish K JadhavNo ratings yet

- Response To SCNDocument2 pagesResponse To SCNshikshadhariwal1No ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Faqs Form Gstr-3B About Form Gstr-3BDocument8 pagesFaqs Form Gstr-3B About Form Gstr-3BAsh WNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Faiqa HamidNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Eturns: After Studying This Chapter, You Will Be Able ToDocument70 pagesEturns: After Studying This Chapter, You Will Be Able ToChandan ganapathi HcNo ratings yet

- 168222-2013-First Lepanto Taisho Insurance Corp. V.Document3 pages168222-2013-First Lepanto Taisho Insurance Corp. V.John Kyle LluzNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- DRC-03 (4) Applicability and Procedure To Pay Additional TaxDocument3 pagesDRC-03 (4) Applicability and Procedure To Pay Additional Taxevertry27387No ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- New - Functionalities - Compilation - July 2022Document4 pagesNew - Functionalities - Compilation - July 2022AmanNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Bureau of Internal Revenue Quezon City March 2, 2011: Republic of The Philippines Department of FinanceDocument3 pagesBureau of Internal Revenue Quezon City March 2, 2011: Republic of The Philippines Department of FinanceBret MonsantoNo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document16 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017j0d3No ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- Refund of IGST On Export of Goods PDFDocument7 pagesRefund of IGST On Export of Goods PDFCA Rahul ModiNo ratings yet

- 1maple v. CIRDocument26 pages1maple v. CIRaudreydql5No ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- CASE DOCTRINES - 2020 Jurisprudence Updates (SC and CTA Cases)Document12 pagesCASE DOCTRINES - 2020 Jurisprudence Updates (SC and CTA Cases)Carlota VillaromanNo ratings yet

- Document 1Document2 pagesDocument 1gstceraslmNo ratings yet

- Mismatch in Tax Liabilities-No Longer A Factual ConcernDocument4 pagesMismatch in Tax Liabilities-No Longer A Factual ConcernKunwarbir Singh lohatNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- Tax LawDocument32 pagesTax Lawgilbert213No ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Sunil ShahNo ratings yet

- Statement of FactsDocument32 pagesStatement of FactsThe Ultra IndiaNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Travel Reservation August 18 For FREDI ISWANTODocument2 pagesTravel Reservation August 18 For FREDI ISWANTOKasmi MinukNo ratings yet

- Document 2 - Wet LeasesDocument14 pagesDocument 2 - Wet LeasesDimakatsoNo ratings yet

- The Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Document170 pagesThe Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Marcelo100% (2)

- EREMES KOOKOORITCHKIN v. SOLICITOR GENERALDocument8 pagesEREMES KOOKOORITCHKIN v. SOLICITOR GENERALjake31No ratings yet

- Advanced Stock Trading Course + Strategies Course CatalogDocument5 pagesAdvanced Stock Trading Course + Strategies Course Catalogmytemp_01No ratings yet

- Agara Lake BookDocument20 pagesAgara Lake Bookrisheek saiNo ratings yet

- Webinar2021 Curriculum Alena Frid OECDDocument30 pagesWebinar2021 Curriculum Alena Frid OECDreaderjalvarezNo ratings yet

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Marketing Plan11Document15 pagesMarketing Plan11Jae Lani Macaya Resultan91% (11)

- Conflict Resolution in ChinaDocument26 pagesConflict Resolution in ChinaAurora Dekoninck-MilitaruNo ratings yet

- The Cult of Shakespeare (Frank E. Halliday, 1960)Document257 pagesThe Cult of Shakespeare (Frank E. Halliday, 1960)Wascawwy WabbitNo ratings yet

- The State of Iowa Resists Anna Richter Motion To Expunge Search Warrant and Review Evidence in ChambersDocument259 pagesThe State of Iowa Resists Anna Richter Motion To Expunge Search Warrant and Review Evidence in ChambersthesacnewsNo ratings yet

- Teaching Resume-Anna BedillionDocument3 pagesTeaching Resume-Anna BedillionAnna Adams ProctorNo ratings yet

- Monopolistic CompetitionDocument4 pagesMonopolistic CompetitionAzharNo ratings yet

- TRASSIR - Video Analytics OverviewDocument30 pagesTRASSIR - Video Analytics OverviewJhonattann EscobarNo ratings yet

- MhfdsbsvslnsafvjqjaoaodldananDocument160 pagesMhfdsbsvslnsafvjqjaoaodldananLucijanNo ratings yet

- Chapter 06 v0Document43 pagesChapter 06 v0Diệp Diệu ĐồngNo ratings yet

- Schedules of Shared Day Companies - MITCOEDocument1 pageSchedules of Shared Day Companies - MITCOEKalpak ShahaneNo ratings yet

- Final Annexes Evaluation Use Consultants ApwsDocument51 pagesFinal Annexes Evaluation Use Consultants ApwsSure NameNo ratings yet

- Mavel Francis TurbinesDocument2 pagesMavel Francis TurbineszecaroloNo ratings yet

- Enochian Tablets ComparedDocument23 pagesEnochian Tablets ComparedAnonymous FmnWvIDj100% (7)

- Ez 14Document2 pagesEz 14yes yesnoNo ratings yet

- Memorandum1 PDFDocument65 pagesMemorandum1 PDFGilbert Gabrillo JoyosaNo ratings yet

- PERDEV2Document7 pagesPERDEV2Riza Mae GardoseNo ratings yet

- Department of Planning and Community Development: Organizational ChartDocument5 pagesDepartment of Planning and Community Development: Organizational ChartkeithmontpvtNo ratings yet

- Test Bank: Corporate RestructuringDocument3 pagesTest Bank: Corporate RestructuringYoukayzeeNo ratings yet

- Vietnam PR Agency Tender Invitation and Brief (Project Basis) - MSLDocument9 pagesVietnam PR Agency Tender Invitation and Brief (Project Basis) - MSLtranyenminh12No ratings yet

- BB Winning Turbulence Lessons Gaining Groud TimesDocument4 pagesBB Winning Turbulence Lessons Gaining Groud TimesGustavo MicheliniNo ratings yet

- LAW REFORMS COMMISSION KERALA Final Report Vol IDocument211 pagesLAW REFORMS COMMISSION KERALA Final Report Vol ISampath BulusuNo ratings yet

- Ground Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BDocument1 pageGround Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BAbegail Dela CruzNo ratings yet