Professional Documents

Culture Documents

When and How 24 States Legalized Adult-Use Cannabis in The US: A Timeline With Current Tax Rates

Uploaded by

Tony Lange0 ratings0% found this document useful (0 votes)

2K views2 pagesTimeline of states to legalize adult-use cannabis in the U.S. with current tax rates ... as published by Cannabis Business Times: https://www.cannabisbusinesstimes.com/news/us-cannabis-legalization-timeline-adult-use-taxes/

Original Title

When and How 24 States Legalized Adult-Use Cannabis in the US: A Timeline With Current Tax Rates

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTimeline of states to legalize adult-use cannabis in the U.S. with current tax rates ... as published by Cannabis Business Times: https://www.cannabisbusinesstimes.com/news/us-cannabis-legalization-timeline-adult-use-taxes/

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views2 pagesWhen and How 24 States Legalized Adult-Use Cannabis in The US: A Timeline With Current Tax Rates

Uploaded by

Tony LangeTimeline of states to legalize adult-use cannabis in the U.S. with current tax rates ... as published by Cannabis Business Times: https://www.cannabisbusinesstimes.com/news/us-cannabis-legalization-timeline-adult-use-taxes/

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Rank State Legalized Avenue Sales Launch Tax Structure

1 Colorado Nov. 6, 2012 Election (Amendment 64) Jan. 1, 2014 15% Excise Tax; Local Option

2 Washington Nov. 6, 2012 Election (Initiative 502) Jul. 14, 2014 37% Excise Tax; 6.5% Sales

Tax; Local Option

3 Oregon Nov. 4, 2014 Election (Measure 91) Oct. 1, 2015 17% Retail Sales Tax; 3% Local

Option

$50/Ounce Tax Levied From

4 Alaska Nov. 4, 2014 Election (Measure 2) Oct. 29, 2016 Cultivation to Retail on Flower

($800/Pound); Local Option

(Up to $7.50/Ounce)

5 Nevada Nov. 8, 2016 Election (Question 2) Jul. 1, 2017 10% Excise Tax (Retail); 15%

Excise Tax (Wholesale)

6 California Nov. 8, 2016 Election (Proposition 64) Jan. 1, 2018 15% Excise Tax; Sales Tax

(7.25%-10.75%); Local Option

7 Massachusetts Nov. 8, 2016 Election (Question 4) Nov. 20, 2018 10.75% Excise Tax; 6.25% Sales

Tax; Local Option (up to 3%)

8 Maine Nov. 8, 2016 Election (Question 1) Oct. 9, 2020 10% Excise Tax (Retail);

$335/Pound Cultivation Tax

9 Vermont Jan. 22, 2018 Legislature (H.B. 511) Oct. 1, 2022 14% Excise Tax; 6% Sales Tax;

1% Local Option

10 Michigan Nov. 6, 2018 Election (Proposition 1) Dec. 1, 2019 10% Excise Tax; 6% Sales Tax

7% Excise Tax (Wholesale);

11 Illinois Jun. 25, 2019 Legislature (H.B. 1438) Jan. 1, 2020 10% Tax (<35% THC); 25% Tax

(>35% THC); 20% (Infused

Products)

12 Arizona Nov. 3, 2020 Election (Proposition 207) Jan. 22, 2021 16% Excise Tax; 5.6% Sales

Tax; Local Option (1%-4%)

13 Montana Nov. 3, 2020 Election (Initiative 190) Jan. 1, 2022 20% Excise Tax; Local Option

(Up to 3%)

6.625% Sales Tax;

14 New Jersey Nov. 3, 2020 Election (Question 1) Apr. 21, 2022 $1.52/Ounce Social Equity

Excise Fee (SEEF); Location

Option (Up to 2%)

13% Excise Tax; Distribution

15 New York Mar. 31, 2021 Legislature (S.B. 854A) Dec. 29, 2022 THC Tax ($0.03/mg for Edibles;

$0.008/mg for Concentrates;

$0.005/mg for Flower)

12% Excise Tax Until July 1,

16 New Mexico Apr. 12, 2021 Legislature (H.B. 2) Apr. 21, 2022 2025 (Increases to 18% by

2030); 5.125% Sales Tax

17 Virginia Apr. 21, 2021 Legislature (H.B. 2312) *Stalled 21% Excise Tax; 5.3% Sales

Tax; Local Option (Up to 3%)

THC Tax ($0.00625/mg for

18 Connecticut Jun. 22, 2021 Legislature (S.B. 1201) Jan. 10, 2023 Flower; $0.0275/mg for

Edibles; $0.009/mg for Other

Products); 6.35% Sales Tax; 3%

Local Tax

19 Rhode Island May. 25, 2022 Legislature (S.B. 2430) Dec. 1, 2022 10% Excise Tax; 7% Sales Tax;

3% Local Tax

6% Adult-Use Retail Tax;

20 Missouri Nov. 8, 2022 Election (Amendment 3) Feb. 3, 2023 4.225% State Sales Tax; Local

Tax (Up to ≈5.8%)

21 Maryland Nov. 8, 2022 Election (Question 4) Jul. 1, 2023 9% Sales-and-Use Tax

22 Delaware Apr. 27, 2023 Legislature (H.B. 1&2) Late 2024? 15% Excise Tax

23 Minnesota May. 30, 2023 Legislature (H.F. 100) Early 2025? 10% Excise Tax

10% Excise Tax; 5.75% Sales

24 Ohio Nov. 7, 2023 Election (Issue 2) Late 2024? Tax; Local Tax (Up to 2.25%)

*Certain provisions in Virginia's legislation that required reenactment were never reenacted.

You might also like

- 2012 H - R Block ProgramDocument11 pages2012 H - R Block ProgramNASJRBNOLAOmbudsmanNo ratings yet

- Strategies For Sourcing Funding For Startup Businesses in NigeriaDocument172 pagesStrategies For Sourcing Funding For Startup Businesses in NigeriaSerges DoviNo ratings yet

- May AsanaDocument1 pageMay AsanaKoshtub VohraNo ratings yet

- Verizon bill detailsDocument8 pagesVerizon bill detailsnitinNo ratings yet

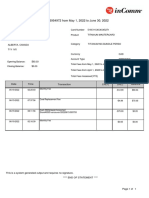

- GST Detail Accrual PDFDocument1 pageGST Detail Accrual PDFCristy Martin YumulNo ratings yet

- BERTHA E BEATY Chime BSDocument4 pagesBERTHA E BEATY Chime BSJim BoazNo ratings yet

- Nelson Caliz Guinea Grass Village Guinea Grass VillageDocument3 pagesNelson Caliz Guinea Grass Village Guinea Grass VillageNelson CalizNo ratings yet

- Stanley C Harris JR Bank StatementDocument3 pagesStanley C Harris JR Bank StatementDamion HollisNo ratings yet

- Antwaun Edgecombe Bank StatementDocument3 pagesAntwaun Edgecombe Bank StatementDamion HollisNo ratings yet

- Description Price Discount Total Excl. Igst Igst Amount (Usd)Document1 pageDescription Price Discount Total Excl. Igst Igst Amount (Usd)mail2me.nazalNo ratings yet

- Snap Ads Transactions — FYND Co. LLC — 2024-02-01—2024-02-29 (1)Document2 pagesSnap Ads Transactions — FYND Co. LLC — 2024-02-01—2024-02-29 (1)Cyrene Joy PonceNo ratings yet

- Skype Monthly Statement 2023-03Document2 pagesSkype Monthly Statement 2023-03MohitNo ratings yet

- LW100316164_REG0000004599669Document4 pagesLW100316164_REG0000004599669dilanisakshiNo ratings yet

- Wireless Invoice 780 952 4303Document1 pageWireless Invoice 780 952 4303Emi MenditaNo ratings yet

- Ficker 2Document12 pagesFicker 2Daniel SchereNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- Amount EnclosedDocument4 pagesAmount EnclosedVicki HillNo ratings yet

- Solid Waste Draft Rate ResolutionsDocument5 pagesSolid Waste Draft Rate Resolutionstawals tawalsNo ratings yet

- Marijuana Tax Revenue States Regulate Marijuana Adult Use PDFDocument5 pagesMarijuana Tax Revenue States Regulate Marijuana Adult Use PDFJoseph PreisterNo ratings yet

- Ficker 1Document18 pagesFicker 1Daniel SchereNo ratings yet

- Hubbard County Truth-in-Taxation Hearing PresentationDocument19 pagesHubbard County Truth-in-Taxation Hearing PresentationShannon GeisenNo ratings yet

- Money LionDocument4 pagesMoney LionhumleNo ratings yet

- Rewards Summary: Online BankingDocument1 pageRewards Summary: Online Bankingcarol0garber-99560No ratings yet

- Verizon Bill AprilDocument49 pagesVerizon Bill AprilDarius WalkerNo ratings yet

- FreedomBill 20221205Document11 pagesFreedomBill 20221205M A Ahad Bin SerajNo ratings yet

- Billed To: Description Price Discount Total Excl. Vat VAT Amount (Usd)Document1 pageBilled To: Description Price Discount Total Excl. Vat VAT Amount (Usd)mapsreviews.maNo ratings yet

- For Your Stay in San Antonio: 101 15th St. San Francisco, CA 94103 USA +1 617 300 0956Document2 pagesFor Your Stay in San Antonio: 101 15th St. San Francisco, CA 94103 USA +1 617 300 0956Dez Drii MarieNo ratings yet

- Cash App StatementDocument9 pagesCash App StatementBobby AguilarNo ratings yet

- Bank statement summary and transactions for Giselle RosarioDocument3 pagesBank statement summary and transactions for Giselle RosarioCamiloNo ratings yet

- Invoice 8E176486 0005Document1 pageInvoice 8E176486 0005infoNo ratings yet

- Novato Minimum Wage HikeDocument1 pageNovato Minimum Wage HikeWill HoustonNo ratings yet

- American ExpressDocument5 pagesAmerican ExpressKelley100% (1)

- Reference Information: Digi-Key - PrintDocument2 pagesReference Information: Digi-Key - Printbill doughertyNo ratings yet

- ReportsDocument6 pagesReportsEms StevensonNo ratings yet

- Revenue From Adult Use StatesDocument5 pagesRevenue From Adult Use StatesMPPNo ratings yet

- Invoice # 0018Document1 pageInvoice # 0018Robert DanielNo ratings yet

- Greendot Bank StatementDocument8 pagesGreendot Bank StatementMelon ChanceNo ratings yet

- View Your CARRYTEL Account Bill and Cash RewardsDocument3 pagesView Your CARRYTEL Account Bill and Cash RewardsEzzeddineNo ratings yet

- Hi Michael, Here's Your Bill For This MonthDocument11 pagesHi Michael, Here's Your Bill For This MonthClare Molis100% (1)

- Order 111-7224064-3859459Document2 pagesOrder 111-7224064-3859459Rafael Leonidas Rodriguez CastañosNo ratings yet

- SNY April 2022 Poll Release 4-25-22 FINALDocument9 pagesSNY April 2022 Poll Release 4-25-22 FINALWGRZ-TVNo ratings yet

- OdunDocument3 pagesOdunLoco CocoNo ratings yet

- Petroleum Planning & Analysis CellDocument1 pagePetroleum Planning & Analysis CellhimanshuextraNo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Cash App June 2023 Account StatementDocument7 pagesCash App June 2023 Account Statementlorielys0909No ratings yet

- TaxRev - Module 2 - General Principles of Taxation Part 2Document1 pageTaxRev - Module 2 - General Principles of Taxation Part 2Castillo Mike Martin DomiderNo ratings yet

- CA DMV Receipt: 1 MessageDocument1 pageCA DMV Receipt: 1 MessageJuan MoraNo ratings yet

- Arizona 2016 and 2020 Voting Analysis ReportDocument19 pagesArizona 2016 and 2020 Voting Analysis ReportRay BleharNo ratings yet

- Order Details for #112-8313831-9821800Document1 pageOrder Details for #112-8313831-9821800Julio C. Ortiz MesiasNo ratings yet

- MSDI Immigration Enforcement NegDocument54 pagesMSDI Immigration Enforcement NegTruman ConnorNo ratings yet

- Nov 07, 2023 Koodo PaymentReceiptDocument1 pageNov 07, 2023 Koodo PaymentReceiptgarciajuleriNo ratings yet

- PDFDocument19 pagesPDFJose Antonio LopezNo ratings yet

- Florida Motor Fuel Tax Relief Act of 2022Document9 pagesFlorida Motor Fuel Tax Relief Act of 2022ABC Action NewsNo ratings yet

- Account Statement From May 2022 To June 2022Document1 pageAccount Statement From May 2022 To June 2022Brent HladunNo ratings yet

- Varo DocumentDocument7 pagesVaro Documentk alford100% (2)

- Bank Statement 1 2024Document2 pagesBank Statement 1 2024joelschwartzllcNo ratings yet

- InvoiceDocument1 pageInvoiceachielnarsilNo ratings yet

- 31 Lawmaker Letter Dea ReschedulingDocument5 pages31 Lawmaker Letter Dea ReschedulingTony LangeNo ratings yet

- NORMLvDEA 1994 PetitionDeniedDocument6 pagesNORMLvDEA 1994 PetitionDeniedTony LangeNo ratings yet

- Department of Health and Human Services Marijuana Schedule III Full LetterDocument252 pagesDepartment of Health and Human Services Marijuana Schedule III Full LetterMedicinal ColoradoNo ratings yet

- Cannabis Tax Revenues and Tier 3 Programs Letter Final 2-24-24Document6 pagesCannabis Tax Revenues and Tier 3 Programs Letter Final 2-24-24Tony LangeNo ratings yet

- Assistant Attorneys GeneralDocument13 pagesAssistant Attorneys GeneralTony LangeNo ratings yet

- CalifornaDelivery LawsuitOrderNov2020Document10 pagesCalifornaDelivery LawsuitOrderNov2020Tony LangeNo ratings yet

- Final August 31 Coalition Letter To Governor HochulDocument3 pagesFinal August 31 Coalition Letter To Governor HochulTony LangeNo ratings yet

- 1988 Ruling by Judge Francis Young On Cannabis Rescheduling PetitionDocument69 pages1988 Ruling by Judge Francis Young On Cannabis Rescheduling PetitionTony LangeNo ratings yet

- US Former Attorneys Letter Against Marijuana ReschedulingDocument3 pagesUS Former Attorneys Letter Against Marijuana ReschedulingTony LangeNo ratings yet

- NORMLvDEA 1977Document30 pagesNORMLvDEA 1977Tony LangeNo ratings yet

- Florida2017 MedicalCannabisLawDocument48 pagesFlorida2017 MedicalCannabisLawTony LangeNo ratings yet

- SAFER - Banking.Act RevisedBill 9.19.23Document46 pagesSAFER - Banking.Act RevisedBill 9.19.23Tony LangeNo ratings yet

- Curaleaf Email To UFCW Local 881Document1 pageCuraleaf Email To UFCW Local 881sandydocsNo ratings yet

- FloridaAG Replybrief Aug.2023Document26 pagesFloridaAG Replybrief Aug.2023Tony LangeNo ratings yet

- HF0100.0 - MinnesotaDocument302 pagesHF0100.0 - MinnesotaPatch MinnesotaNo ratings yet

- Curaleaf Email To UFCW Local 881Document1 pageCuraleaf Email To UFCW Local 881sandydocsNo ratings yet

- House of Mary Jane - Formal ComplaintDocument7 pagesHouse of Mary Jane - Formal ComplaintFergus BurnsNo ratings yet

- Green Leaf Medicals LLC WARN NoticeDocument2 pagesGreen Leaf Medicals LLC WARN NoticeTony LangeNo ratings yet

- Motion For Summary JudgmentDocument105 pagesMotion For Summary JudgmentTony LangeNo ratings yet

- Election TallyDocument1 pageElection TallyTony LangeNo ratings yet

- Curaleaf Email To UFCW Local 881Document1 pageCuraleaf Email To UFCW Local 881sandydocsNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet

- CaliforniaDCCvsVerticalBliss 20CHCV00560Document5 pagesCaliforniaDCCvsVerticalBliss 20CHCV00560Tony LangeNo ratings yet

- OCM LawsuitDocument29 pagesOCM LawsuitNick Reisman100% (1)

- Agrios LawsuitFiledDocument23 pagesAgrios LawsuitFiledTony LangeNo ratings yet

- Oklahoma Supreme Court Ruling 2022 Cannabis MeasureDocument15 pagesOklahoma Supreme Court Ruling 2022 Cannabis MeasureTony LangeNo ratings yet

- NLRBorder CuraleafChicagoDocument4 pagesNLRBorder CuraleafChicagoTony LangeNo ratings yet

- OklahomaCannabisBallot ComplaintDocument14 pagesOklahomaCannabisBallot ComplaintTony LangeNo ratings yet

- SmartSafeFlorida AdultCannabisMeasureDocument4 pagesSmartSafeFlorida AdultCannabisMeasureTony LangeNo ratings yet

- Westwood TRSH Neg Hendrickson SemisDocument80 pagesWestwood TRSH Neg Hendrickson SemisEmronNo ratings yet

- Why Marijuana Should Be Legalized in the PhilippinesDocument8 pagesWhy Marijuana Should Be Legalized in the PhilippinesDaniel MontesaNo ratings yet

- Just Say No (For Now) : The Ethics of Illegal Drug Use: Mathieu DoucetDocument21 pagesJust Say No (For Now) : The Ethics of Illegal Drug Use: Mathieu DoucetMichelleNo ratings yet

- Ohio Medical Marijuana 2023 ReportDocument68 pagesOhio Medical Marijuana 2023 ReportSarah McRitchieNo ratings yet

- Cannabis Bill Clean DraftDocument294 pagesCannabis Bill Clean DraftHNNNo ratings yet

- How Pop Culture Affects The Marijuana IndustryDocument2 pagesHow Pop Culture Affects The Marijuana IndustryMISBAHUS SAD TUSHARNo ratings yet

- Thesis Statement Against Legalizing WeedDocument5 pagesThesis Statement Against Legalizing WeedBecky Goins100% (1)

- Jane Napat Position PaperDocument11 pagesJane Napat Position PaperJosie Jane NapatNo ratings yet

- Marijuana Legalization Research Paper ConclusionDocument7 pagesMarijuana Legalization Research Paper Conclusiongvw6y2hvNo ratings yet

- Marijuana Business Plan ExampleDocument38 pagesMarijuana Business Plan ExampleOltion JaupajNo ratings yet

- Cannabis e A Economia - EmmanuelleDocument40 pagesCannabis e A Economia - EmmanuelleLeandro CardozoNo ratings yet

- Interview Part 1 - PoliciesDocument30 pagesInterview Part 1 - Policiesjinlu97lolNo ratings yet

- Fall in Love and Skydiving: Taking Risks in RelationshipsDocument7 pagesFall in Love and Skydiving: Taking Risks in Relationshipsgeralden hampongNo ratings yet

- Good GovernanceDocument3 pagesGood Governancevincent manuelNo ratings yet

- New York City's First Cannabis Boss Wants To Combat Cannaphobia' - TDocument1 pageNew York City's First Cannabis Boss Wants To Combat Cannaphobia' - Tedwinbramosmac.comNo ratings yet

- Group 1Document13 pagesGroup 1MPSU AVSEGROUPNo ratings yet

- 15 Annotated Bibliography (Final)Document8 pages15 Annotated Bibliography (Final)ethanNo ratings yet

- Final PaperDocument7 pagesFinal Paperapi-645825872No ratings yet

- Police Agree To Stop Cannabis Arrests - The Mail & GuardianDocument3 pagesPolice Agree To Stop Cannabis Arrests - The Mail & GuardianPoison LadyNo ratings yet

- Weighing The Pros and ConsDocument4 pagesWeighing The Pros and ConsVernie Villamor OntingNo ratings yet

- Americans Overwhelmingly Say Marijuana Should Be Legal For Recreational or Medical UseDocument3 pagesAmericans Overwhelmingly Say Marijuana Should Be Legal For Recreational or Medical UseMade Deni Dinatha. WNo ratings yet

- Paradigm Shift EssayDocument15 pagesParadigm Shift Essayapi-608886638No ratings yet

- Impact of Recreational Marijuana Legalization On CrimeDocument11 pagesImpact of Recreational Marijuana Legalization On CrimemafmortensonNo ratings yet

- Legaliztion of Marijuana'Document2 pagesLegaliztion of Marijuana'ANA ROSE CIPRIANONo ratings yet

- Routine ActivitiesDocument7 pagesRoutine ActivitiesHilmark MistalNo ratings yet

- Legalization of Medical Marijuana Risks in PHDocument2 pagesLegalization of Medical Marijuana Risks in PHNathalie GetinoNo ratings yet

- The Debate On The Legalization of MarijuanaDocument4 pagesThe Debate On The Legalization of MarijuanakelleybrawnNo ratings yet

- Marijuana in The United StatesDocument4 pagesMarijuana in The United StatesParas khuranaNo ratings yet

- EappDocument4 pagesEappchocominnnnNo ratings yet

- Alice Kwak Medical MarijuanaDocument47 pagesAlice Kwak Medical Marijuanaminorj47No ratings yet