Professional Documents

Culture Documents

Accounting Formula Cheat Sheet

Uploaded by

Marta Fdez-FournierCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Formula Cheat Sheet

Uploaded by

Marta Fdez-FournierCopyright:

Available Formats

258408

Accounting Formula Cheat Sheet

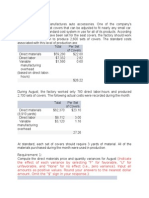

Prime Cost = Direct material costs + Direct labour costs

Conversion Cost = Direct labour + Manufacturing overhead costs

Product costs = Cost of materials (if applicable) + Direct labour + Overheads

Overhead cost = Plant wide rate x Units of the selected allocation base used by each product

!"#$ &'($)' "*')+',-#

Overhead rate = !"#$ &'($)' -.)'&$ /,0"1) +"1)# ") 2,&+.(' +"1)#

3#$.2,$'- ("(42,(15,&$1).(6 "*')+',-

Non-manufacturing overhead absorption rate = 3#$.2,$'- 2,(15,&$1).(6 &"#$

7(81$ &"#$

Cost per unit of output = 398'&$'- "1$81$

7(81$ &"#$ 4:&),8 *,/1' "5 (")2,/ /"##

Cost per unit of output (with scrap value) =

398'&$'- "1$81$

!1))'($ 8')."- &"#$#

Average cost per unit = !1))'($ $"$,/ ';1.*,/'($ 1(.$#

Contribution Margin = Sale Revenue – Variable Costs

<.9'- !"#$#

Break-even points in units = !"($).01$."( 8') 1(.$

<.9'- !"#$#=>,)6'$ 8)"5.$

Units sold for the target profit = !"($).01$."( 8') 1(.$

Total required revenue = Fixed Costs + Variable Costs + Target Profit

!"($).01$."(

Profit-Volume ratio/ Contribution Margin ratio = :,/'#

Profit = (Sales revenue x PV ratio) – Fixed Costs

<.9'- !"#$#

Break-even Sales Revenue (where profit = 0) =

?@ ),$."

398'&$'- :,/'#4A)',B '*'( :,/'#

Percentage Margin of Safety = 398'&$'- :,/'#

>"$,/ <.9'- !"#$#

Break-even number of batches = !"($).01$."( 2,)6.( 8') 0,$&+

!"($).01$."( C,)6.(

Degree of operating leverage = ?)"5.$

:8'&.5.& &"#$ -).*') ,2"1($ 8)"*.-'-

Cost assignment = >"$,/ &"#$ -).*')

* Cost pool

Difference in Operating Profit (Absorption versus Marginal Costing) = Change in Inventory * Fixed Manufacturing Cost

per Unit

If you feel like a term is missing in the glossary, it is most likely defined within the previously given formula.

If you still can see it let us know 😊

%

$

#

"

The formulas we selected are the most important in our view (not all of them)

You might also like

- Divided States: Strategic Divisions in EU-Russia RelationsFrom EverandDivided States: Strategic Divisions in EU-Russia RelationsNo ratings yet

- Checklist for effective report writingDocument25 pagesChecklist for effective report writingOzgeNo ratings yet

- v-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsFrom Everandv-Myb proteins and their oncogenic potential: A study on how two point mutations affect the interaction of v-Myb with other proteinsNo ratings yet

- Lab 5 Functional Programing 2: RecursionDocument3 pagesLab 5 Functional Programing 2: RecursionPhan Minh NhutNo ratings yet

- OSY pr11 VaibhavDocument12 pagesOSY pr11 Vaibhavshrub125ioNo ratings yet

- JavaDocument149 pagesJavaparaschiv_sabinaNo ratings yet

- Marvel Parts Cost AnalysisDocument40 pagesMarvel Parts Cost Analysisyuikokhj0% (2)

- Product EconomicsDocument21 pagesProduct EconomicsRohit VanmoreNo ratings yet

- RTDBDocument88 pagesRTDBrhvenkatNo ratings yet

- Python Essentials 1 BASICS - PE1 - Module 1 Test Exam Answers Python 2.0 - CCNA 7 Exam Answers 2022Document22 pagesPython Essentials 1 BASICS - PE1 - Module 1 Test Exam Answers Python 2.0 - CCNA 7 Exam Answers 2022Sruthi Udayakumar100% (2)

- 40 Costing SummaryDocument21 pages40 Costing SummaryQueasy PrintNo ratings yet

- Answer All Questions. All Necessary Working Should Be Shown ClearlyDocument2 pagesAnswer All Questions. All Necessary Working Should Be Shown ClearlymasyatiNo ratings yet

- Research Framework: Variable Items Code QuestionsDocument3 pagesResearch Framework: Variable Items Code QuestionsMohammad ZandiNo ratings yet

- Adobe Framemaker 9 For Beginners Adobe Framemaker 9 For BeginnersDocument53 pagesAdobe Framemaker 9 For Beginners Adobe Framemaker 9 For BeginnersEkala XuhalxNo ratings yet

- Half Yearly As Practicals QpaperDocument4 pagesHalf Yearly As Practicals QpaperRajarathinam GopalakrishnanNo ratings yet

- The Pennsylvnia State University: Department of Industrial & Manufacturing EngineeringDocument3 pagesThe Pennsylvnia State University: Department of Industrial & Manufacturing Engineeringlinjun19920901No ratings yet

- Laborator 10. Mos CraciunDocument32 pagesLaborator 10. Mos CraciunacpcalinNo ratings yet

- Economics Chapter 3Document17 pagesEconomics Chapter 3josmiskoNo ratings yet

- Calculating WACC and Cost of Equity for Capital Investment DecisionDocument14 pagesCalculating WACC and Cost of Equity for Capital Investment Decisionsamuel_dwumfourNo ratings yet

- De Jean-Paul BARBET, Directeur Du Marché Des Entreprises Gérer Vos ExcédentsDocument9 pagesDe Jean-Paul BARBET, Directeur Du Marché Des Entreprises Gérer Vos ExcédentsSionfoungo KoneNo ratings yet

- Method A - Identifying Price Point and Margins - Variable Costs Are KnownDocument5 pagesMethod A - Identifying Price Point and Margins - Variable Costs Are KnownEng Abdulahi HajiNo ratings yet

- Vibration Roller Assembly Parts CatalogDocument220 pagesVibration Roller Assembly Parts Catalognkr4726923100% (3)

- Project Proposals - Hardware and Software ExamplesDocument6 pagesProject Proposals - Hardware and Software ExamplesDindin WatotoNo ratings yet

- Kunci Jawaban Kieso-Gc1Document22 pagesKunci Jawaban Kieso-Gc13.7 MNo ratings yet

- Ratio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivDocument3 pagesRatio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivSheikh WickyNo ratings yet

- Variance FormulasDocument2 pagesVariance FormulasKhurramIftikharNo ratings yet

- Chapter 13Document77 pagesChapter 13mas_999No ratings yet

- Painting Estimate Form: Interior CostsDocument2 pagesPainting Estimate Form: Interior CostsRibhi HamdanNo ratings yet

- MT Alarm Quick Reference GuideDocument11 pagesMT Alarm Quick Reference GuidePaky PakicNo ratings yet

- PHP NotesDocument38 pagesPHP NotessujathalaviNo ratings yet

- Shortcut Menu CommandsDocument3 pagesShortcut Menu CommandsHammad ZaidiNo ratings yet

- Unit 9 - B1 - RMDocument11 pagesUnit 9 - B1 - RMTrang Lý QuỳnhNo ratings yet

- R R R R: BA 440 Final Formula SheetDocument3 pagesR R R R: BA 440 Final Formula SheetVasantha NaikNo ratings yet

- Market Value Calculation: Sample Company, IncDocument12 pagesMarket Value Calculation: Sample Company, IncOmi VaidyaNo ratings yet

- Alcatel Omnipcx Enterprise: AccviewDocument16 pagesAlcatel Omnipcx Enterprise: AccviewAriel BecerraNo ratings yet

- PHP Practical FileDocument18 pagesPHP Practical FileTushar ThammanNo ratings yet

- Os Lab Part 2Document31 pagesOs Lab Part 2Krishnendu MisraNo ratings yet

- Practice - Enter An Expenditure Batch: WorkbookDocument9 pagesPractice - Enter An Expenditure Batch: WorkbookSAlah MOhammedNo ratings yet

- PedefeDocument6 pagesPedefealb66albNo ratings yet

- 2010-09-02 235812 EurondaDocument6 pages2010-09-02 235812 EurondaKylie TarnateNo ratings yet

- UIU Trimester Summer 2014 CSE 6007 Design PatternsDocument19 pagesUIU Trimester Summer 2014 CSE 6007 Design PatternsataulbariNo ratings yet

- Practice Exams - Job Costing SystemsDocument4 pagesPractice Exams - Job Costing SystemsRafael GarciaNo ratings yet

- Revision Progress Test 1 - Investment Appraisal: Answer 1Document7 pagesRevision Progress Test 1 - Investment Appraisal: Answer 1samuel_dwumfourNo ratings yet

- Fundamental ProgrammingDocument5 pagesFundamental ProgrammingkalashnikoNo ratings yet

- Lecture 5-QHDocument25 pagesLecture 5-QHVĩnh PhongNo ratings yet

- JUnit A Starter GuideDocument23 pagesJUnit A Starter GuideJB RainsbergerNo ratings yet

- ShellDocument50 pagesShellGouravNo ratings yet

- IBM Mainframes: COBOL Training Class-4Document12 pagesIBM Mainframes: COBOL Training Class-4ravikiran_8pNo ratings yet

- C QuestionDocument65 pagesC QuestionJamuna12No ratings yet

- Question (1) :-AnswerDocument72 pagesQuestion (1) :-Answerprofessor_manojNo ratings yet

- Project Framework 2020 enDocument99 pagesProject Framework 2020 enDaniel EstupiñanNo ratings yet

- Practice - Use Expenditure Inquiry: WorkbookDocument10 pagesPractice - Use Expenditure Inquiry: WorkbookSAlah MOhammedNo ratings yet

- Python Cheat Sheet for Language Syntax & Common TasksDocument1 pagePython Cheat Sheet for Language Syntax & Common TasksdypthaNo ratings yet

- CH 5Document3 pagesCH 5AnonymousNo ratings yet

- PHP AssignmentDocument7 pagesPHP AssignmentademahmedbekarNo ratings yet

- Sl-Ii (Co309U) Practicals: "Post" "Number" "Number" "Submit" "Submit"Document15 pagesSl-Ii (Co309U) Practicals: "Post" "Number" "Number" "Submit" "Submit"Nikita MandhanNo ratings yet

- I. Shareware Ii. PHP: Informatics Practices (065) Sample Question Paper - 1Document17 pagesI. Shareware Ii. PHP: Informatics Practices (065) Sample Question Paper - 1Arjun PrasadNo ratings yet

- Be Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItDocument11 pagesBe Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItGreen XchangeNo ratings yet

- Stock MarketDocument47 pagesStock MarketswastikNo ratings yet

- Chapter 12 - Human Resource ManagementDocument5 pagesChapter 12 - Human Resource ManagementMarta Fdez-FournierNo ratings yet

- Chapter 16 - Promoting Effective CommunicationDocument6 pagesChapter 16 - Promoting Effective CommunicationMarta Fdez-FournierNo ratings yet

- Academic Calender Sbe 2022-2023 Student Draft 0Document2 pagesAcademic Calender Sbe 2022-2023 Student Draft 0Marta Fdez-FournierNo ratings yet

- CrocsDocument2 pagesCrocsMarta Fdez-FournierNo ratings yet

- Plastics Recycling Business PlanDocument30 pagesPlastics Recycling Business PlanDawit TesfaNo ratings yet

- Analyzing transactional processes and costs in supply chainsDocument2 pagesAnalyzing transactional processes and costs in supply chainsYvonne Ng Ming HuiNo ratings yet

- COS Improvement and CR2P Explanation V13Document26 pagesCOS Improvement and CR2P Explanation V13keweishNo ratings yet

- Assurance 2020 Question Bank + Vietnam PiLsDocument192 pagesAssurance 2020 Question Bank + Vietnam PiLsAnh NguyenNo ratings yet

- Small Works - 6 Solicitation - RFQ 05 Section VI - Returnable SchedulesDocument25 pagesSmall Works - 6 Solicitation - RFQ 05 Section VI - Returnable SchedulesAbdulraheem SalmanNo ratings yet

- Mac Midterm ExamDocument5 pagesMac Midterm ExamBEA CATANEONo ratings yet

- Reducing Customer Waiting Time of CommerDocument50 pagesReducing Customer Waiting Time of CommerDr. Abhay K SrivastavaNo ratings yet

- INNOVATION Proposal TemplateDocument7 pagesINNOVATION Proposal TemplateAmor DionisioNo ratings yet

- AOM No. 2022-001 (21-22) - Audit of Accounts and Transactions Brgy. San Leonardo, BambangDocument27 pagesAOM No. 2022-001 (21-22) - Audit of Accounts and Transactions Brgy. San Leonardo, BambangGilbert D. AfallaNo ratings yet

- 09.01.01.07 KNA Supplier Quality Manual Rev 0Document22 pages09.01.01.07 KNA Supplier Quality Manual Rev 0Marco SánchezNo ratings yet

- Admitro - Admin Panel HTML TemplateDocument2 pagesAdmitro - Admin Panel HTML TemplateGeorges AmichiaNo ratings yet

- Audit AR Aging Reports & InvoicesDocument2 pagesAudit AR Aging Reports & InvoicesAbhijith BalachandranNo ratings yet

- Star Trac E-TRx ManualDocument46 pagesStar Trac E-TRx ManualCleiton ProfetaNo ratings yet

- Dissertation Les Restos Du CoeurDocument5 pagesDissertation Les Restos Du CoeurPaperWritingServiceSuperiorpapersOmaha100% (1)

- Logistical Interfaces With ProcurementDocument7 pagesLogistical Interfaces With ProcurementJaymark CasingcaNo ratings yet

- Bain Packaging CaseDocument8 pagesBain Packaging CaseThanh Phu TranNo ratings yet

- Aleksandra Rakocevic CV EngDocument7 pagesAleksandra Rakocevic CV EngAleksandra RakočevićNo ratings yet

- Aim and Objective of Construction ManagementDocument2 pagesAim and Objective of Construction ManagementShubham Dua67% (3)

- Contract Monitoring ChecklistDocument1 pageContract Monitoring ChecklistHesham HassaanNo ratings yet

- OBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Document1 pageOBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Stenris AnthonyNo ratings yet

- Brand Positioning StrategiesDocument29 pagesBrand Positioning StrategiesМалика КамалNo ratings yet

- Toán NG D NG - Nhóm MATH - Week 1Document2 pagesToán NG D NG - Nhóm MATH - Week 1Uyển Nhi Lê ĐoànNo ratings yet

- Audit and Assurance June 2009 Past Paper (Question)Document6 pagesAudit and Assurance June 2009 Past Paper (Question)Serena JainarainNo ratings yet

- Gujarat State Fertilizers and Chemicals IR Officer Job DescriptionDocument4 pagesGujarat State Fertilizers and Chemicals IR Officer Job DescriptionPraveenNo ratings yet

- SACPMPC Safety Report Summary Key PointsDocument2 pagesSACPMPC Safety Report Summary Key PointsSalman AlfarisiNo ratings yet

- Activity-Based Costing ExplainedDocument22 pagesActivity-Based Costing Explained万博熠No ratings yet

- The Information System: An Accountant's PerspectiveDocument16 pagesThe Information System: An Accountant's PerspectivevvNo ratings yet

- Bank of Baroda Leadership ChallengesDocument8 pagesBank of Baroda Leadership ChallengesShubham PriyamNo ratings yet

- A Strategic Framework For The Survival of The Quantity Surveying ProfessionDocument32 pagesA Strategic Framework For The Survival of The Quantity Surveying Professionpedro WhyteNo ratings yet

- By Laws Amended As at 1 July 2022 PDFDocument364 pagesBy Laws Amended As at 1 July 2022 PDFJING YI LIMNo ratings yet