Professional Documents

Culture Documents

Ta Da

Ta Da

Uploaded by

lacto.coc0 ratings0% found this document useful (0 votes)

16 views11 pagesOriginal Title

160225 TA DA

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views11 pagesTa Da

Ta Da

Uploaded by

lacto.cocCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

aati DAMODAR VALLEY CORPORATION

SECRETARIAT DEPARTMENT

(By DVC TOWERS: VIP ROAD

KOLKATA-700 054

No. G/TA/REGULATION/99(PT)/ 1070 FEBRUARY 25, 2016

OFFICE MEMORANDUM

Sub: Revised TA, DA Entitlements.

In line with GOI Orders, Corporation, in supersession of its earlier OMs

on the above subject, is pleased to revise the TA and DA, which Is

appended in ANNEXURE-.

The Revised Entitlement will be effective to all tours undertaken on or

after 01.03.2016.

This issues with the concurrence of Finance. .

\

re

(Mm. Biswas)

Additional Secretary

ENCL: AS_ STATED.

DISTRIBUTION:

AS PER LIST

COPY TO:

1, The Member (Finance), DVG, Kolkata.-This has a reference to his

office Diary No.691 dated 27.01.2016.

2. The Director, Commercial Audit, DVC, Kolkata.

3. Sr. PS to Chairman, DVC, Kolkata.

4. Sr. PS to Member-Secretary., DVC, Kolkata.

5. Sr. PS to Member (Technical), DVC, Kolkata.

6. PS to Chief Vigilance Officer, DVC, Kolkata.

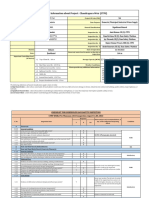

ANNEXURE-

ENTITLEMENT FOR AIR JOURNEY

REMARKS

st

APPROVED RATES

GRADE PAY

I

CHAIRMAN 7 BOARD MEMBERS / CHIEF VIGILANCE OFFICER

BUSINESS CLASS /

CLUB CLASS

RS. 7600 & ABOVE (M4 TO M 10)

ECONOMY CLASS

Restricted to officers

drawing band pay of Rs.

30,500/- & above.

3 RS. 6600/-(M-3) & RS.5650/-(M-2) * ECONOMY CLASS ,500/- & above.

¥ TO BE GRANTED BY HOD/ HOP ON MERIT BASIS.

ENTITLEMENT FOR RAIL JOURNEY

APPROVED RATES

SL GRADE PAY SHATABDI RAJDHANI7 OTHER TRAINS

DURANTO./

EQUIVALENT

PREMIUM |

EXECUTIVE CASS | AC FIRST CLASS | AC FIRST CLLASS

30500/- & ABOVE (M-4 & Above)

RS. 7600 & ABOVE RESTRICTED TO BAND PAY OF RS.

2, [| RS. 5400/- TO Rs.6600/- (M1 - M3) ‘AC CHAIR ACH TIER ACA 1ST CLJACC

3. | RS. 4200 TO Rs. 4400 ,5400(PG),5650(PG) | ACCHAIR ACAI TIER AGA / 15° CLASS JAC

‘AC CHAIR ACH TIER | AC-II TIER ACC

BELOW RS.4200/-

Vi er

= Bie

ENTITLEMENT FOR ROAD JOURNEY

APPROVED RATES

GRADE PAY x CIry I CITY [__OTHER CITIES

‘Oi. | CHAIRMAN BOARD MEMBERS 7 CVO AT ACTUAL.

02. | FS. 100007-& ABOVE (M8 & ABOVE) "ACTUAL FARE BY ANY MEANS OF ROAD TRANSPORT SUBJECT TO PRODUCTION

OF RECEIPT.

05, | RS. 76007-TO RS.89007-(M 4 TO M7) "ACTUAL AC BUS 7 ‘ACTUAL AC BUS / | ACTUAL AC BUS

RESTRICTED TO BAND PAY OF RS.30500/- | NON-AC TAXI NON-AC TAXI NON-AC TAXI

& ABOVE.

04. | RS. 5400 TO RS.66007-(M1 TO M3) ‘ACTUAL AC BUS7 ‘ACTUAL AC BUS 7 ACTUAL AC BUS 7 NON-

NON-AC TAXI NON-AC TAXI AC TAXT

05, | RS. 4200 TO RE. 4400 5400 (PG), 5650 (PG) | ACTUAL_AC BUST ‘ACTUAL AC BUS 7 | ACTUAL AC BUST

NON -AC TAXI NON- ACTAXI NON- AC TAXI

06, | BELOW RS.42007- ‘ACTUAL BUS SHARE | ACTUAL BUS / SHARE TAXI7 | ACTUAL BUS / SHARE

TAXI / AUTO-RICKSHAW | AUTO-RICKSHAW ‘TAX! / AUTO-RICKSHAW

(i)__ Mileage allowance for road journeys shall be regulated at the following rates:

(a) For journey performed by own car/taxi-Rs.24 per KM.

(b) For journey performed by auto rickshaw, own scooter etc. - Rs.16 per KM.

(©) Above rate for road mileage allowances are based on 100% DA with rate increment by 25% twice on base rate. The

Rates will be automatically enhanced by 25% from the base rates whenever DA increases by 50%.

(d) The road mileage at all cities shall be limited to 30 KM for one way journey.

Gi) Group A employees at touring station(s) outside the valley area will be eligible to claim Rs.1000/- per day at one

station for incurring expenses for the use of taxi or any other form of transport for discharging his official duties. The

amount of Rs.1000/- may be relaxable by the HoDs/ HoPs up to Rs.2000/ per day in case of exigency.

(iii) The classification of cities as per GOI OM No. 2(13)/2008-E.II (B) dated-29.08.2008 is enclosed as ANNEXURE:II.

ye Sow

-3-

DAILY ALLOWANCE / HOTEL CHARGE ON TOUR

APPROVED RATES

St ‘ACCOMMODATION FOODING SINCIDENTALS | COMPOSIT DA *(N

LIEU OF)

GRADE PAY KH | -VCHY | OTHERS | CITY | VCITY | OTHERS | 285" | 3a6* | 487"

t z 3 4 5 6 7 s 3 10

‘Oi. | CHATRMAN 7 BOARD MEMBERS 7 AT ACTUAL. ‘AT ACTUALS T0007 | 8007- | 600/-

CVO / ED(M 10)

02, | RS. 10000/- & ABOVE (M8RM9) | 7500/- | 80% OF | 60% OF | 1509/- | 1000/- | B00/- | 800/- | 640/- | 480/-

03. | RS. 8900/-(M 7) sso |) (2) azoa- | s007- | 400/- | 6007 | 180/-_| 3607-

04, | RS, 7600 TO RS.8600 (M4 TO M6) | 4500/- To0a/- | 600/- | 300/- | S00/- | 400/- | 300/-

RESTRICTED TO BAND PAY OF

| RS. 30,500/- & ABOVE. |

05. | RS. 5400 to 6600/-(M1 TO M3) 3500/- S00/- | 4007- | 250° | 4007 | 320/- | 260/-

‘06. | RS. 4200 to 4400, 5400(PG), T5007- ao07- | 3007- | 200 | -350/-" | ~300/- | 220/-

5650(P6)

07. | BELOW RS.4200/- To007- [300 |2007- | s80/- | 300/- | 2407- | 200/-

* ADMISSIBLE WHEN AN EMPLOYEE |S NOT STAYING !N HOTEL,

NOTE:

01. Hotel charges will be limited to above prescribed limits subject to production of receipt.

02. Above rates (Hotel charges, Food Charges, Composite DA) are based on 100% neutralization DA.

The rates will be automatically enhanced by 25% from the base rates whenever DA increases by 50%.

03. Places located within the DVC Command Area, New Delhi and Ranchi where DVC Guest House Accommodation Is

available, the same is to be availed. Hotel accommodation is permissible only when DVC Guest House

‘Accommodation is not available subject to production of certificates from Officer-in-Charge of the Guest House by

the touring Employee.

ae

TA ON TRANSFER

COMPOSITE TRANSFER GRANT

GRADE PAY

APPROVED RATES

EMPLOYEES DRAWING GRADE PAY OF RS.4,2007- AND

ABOVE

EMPLOYEES DRAWING GRADE PAYBELOWRS.4200 |

AND UPTO RS.2,800/-

EMPLOYEES DRAWING GRADE PAYBELOW —|

RS.2,800/-

on.

02.

FOR MORE THAN 20 KM

(BASIC+GP+NPA).

~ ONE MONTH PAY

FOR LESS THAN 20 KM ONE-THIRD OF PAY

(BASIC+GP-+NPA)

B. TRANSPORTATION OF PERSONAL EFFECTS

APPROVED RATES

GRADE PAY BY TRAIN/STEAMER

RATE FOR TRANSPORT BY ROAD | REMARKS

(RS. PER KM.)

EMPLOYEES DRAWING

GRADE PAY OF RS.4,200/-

6000 KG _BY GOODS TRAIN/

4 WHEELER WAGON/

FOR X,Y CLASS CITIES:

45.00 (RS.0,0075 PER KG. PER KM.)

Lower rate for

GRADE PAY BELOW

RS.2,800/-

AND ABOVE 1 SINGLE CONTAINER FOR Z CLASS CITIES: transportation

27.00 (RS.0.0045 PER KG. PER KM.) | of goods by

| road is

EMPLOYEES DRAWING 3000 KE FOR X, ¥ CLASS CITIES:

GRADE PAY OF RS.2,800/- 22.50 (RS.0.0075 PER KG. PER KM.) _| applicable only

FORZC ES: for transfer

13.50 (RS.0.0045 PER KG. PER KM.) an

within "2" class

EMPLOYEES DRAWING 1500 KG FOR X, Y CLASS CITIES: cities.

11.25 (RS.0.0075 PER KG. PER KM.)

FOR Z CLASS CITIES:

6.75 (RS.0.0045 PER KG. PER KM.)

{i Stone

TRANSPORTATION OF CONVEYANCE

APPROVED RATES

GRADE PAY BY TRAIN BY ROAD

‘WHEELER 2WHEELER |

RS.5,400/- (REGULAR) & ABOVE AT ACTUAL FOR ONE MOTOR

CAR / MOTOR CYCLE / SCOOTER

BY TRAIN + ADDITIONAL 25%

FOR PACKING AND HANDLING

CHARGES.

RS.12/-PERKM — | RSG /- PER KM

RS.5,650/-(PG), RS.5/400/- (PG) & BELOW gr qcryal FOR ONE MOTOR

CAR / MOTOR CYCLE / SCOOTER /

MOPED / BICYCLE BY TRAIN +

ADDITIONAL 25% FOR PACKING

AND HANDLING CHARGES.

s+ | RS.3/- PER KM

NOTE:

01. No transfer TA, as mentioned above, is admissible for transfer 9n own interest.

02. Above rates (Transport by Road) are based on 100% DA with rate increment by 25% twice on base rate,

The Rates will be automatically enhanced by 25% from the base rates whenever DA increases by 50%.

j

Meter")

us

TA ENTITLEMENT OF RETIRING EMPLOYEES

‘A._TRANSPORTATION OF CONVEYANCE

APPROVED RATES

SL.NO. GRADE PAY SCALE SCALE

|

Oi, | RS.S,4007- & ABOVE ONE MOTOR CAR ETC. OR ONE MOTOR CYCLE/ | SAME AS PER EXISTING

SCOOTER, OR ONE HORSE EMPLOYEE.

02, | RSS,650/4PG), RS.5.4007- | ONE MOTOR CYCLE/ SCOOTER / MOPED OR SAME AS PER EXISTING

(PG) & BELOW ONE BICYCLE EMPLOYEE.

B. LUMPSUM TRANSFER GRANT AND PACKING ALLOWANCE

01. The composite transfer grant equal to a month’s pay last drawn may be granted in'the case of those

employees who on retirement, settle down at places other than the last station(s) of their duty located

at a distance of or more than 20 Kms. The transfer incidentals and road mileage for journeys between

the residence and the railway station/bus stand etc. at the old and new station, presently admissible are

subsumed in the composite transfer grant and will not be separately admissible.

02. On retirement, OVC Employees, who settle at the last station of duty itself or within a distance of less

than 20 Kms., may be paid one third of the composite transfer grant subject to the condition that a

change of residence is actually involved.

Nic Shown

-7-

TA ENTITLEMENT FOR MEDICAL PURPOSES

APPROPRIATE RATES

(ii)

cai)

(iv)

(v)

Journey by Rail/road/sea/air.-The patient (DVC employee or member of his/her family) and also

attendant (wherever recommended) entitled to TA plus DA for the period of journey undertaken by

rail, road, sea (Ship, steamer etc.) and air (within and outside the country).No DA for halt.

Journey within same city and the distance travelled is more than 8 KM each way. - Actual conveyance

charges limited to mileage allowance at tour rates for the DVC employee and at half the tour rates to

family members.

SPECIAL PROVISION - Reimbursement of air fare paid in individual cases will be considered on merit

if DVC is satisfied that air travel was absolutely essential and that travel by any other means would

have definitely endangered the life of the patient/involved a risk of serious aggravation of his

condition.

ATTENDANT/ESCORT - T.A. as for family member for journeys both ways, if it is certified that it is

unsafe for the patient to travel unattended and that an attendant/escort is necessary to accompany

him to the place of treatment.

TA as above will also be admissible if it becomes necessary for an attendant/escort to travel again to

fetch the patient and so certified.

howe

A

-8-

TA_ENTITLEMENT FOR ATTENDING SPORTS EVENTS:

APPROVED RATES:

1. TADA FOR ATTENDING INTER-VALLEY TOURNAMENTS:

tt

1.2.

1.3.

Entitlement of journey by air: Not admissible.

Entitlement of journey by Rail: AC Chair car/AC III Tier in any train including Shatabdi / Rajdhani/

Duranto Express for all classes of employees.

Entitlement of journey by Road:

1.3.1. For road journeys commencing from residence/Hars to the Railway station & back, mileage is admissible

@ Rs. 16/KM for actual distance limited to 30 KM, irrespective of availability of railway connectivity.

1.3.2. For road journeys other than mentioned at 1.3.1 above, performed between places connected by rail, the

reimbursement will be restricted to fare in-2nd class Mail/Express trains or at actual, whichever is lower.

However, AC bus Fare at actual will be admissible subject to production of receipt.

1.3.3. For road journey other than mentioned at 1.3.1 above, performed between places where rail connectivity

1.4.

15.

1.6.

is not available, road mileage will be Rs. 12/KM subject to the condition that mileage shall be admissible

at full rate for up to first 25 KM and at half rate beyond that.

Entitlement for DA: Rs. 240 per day as Composite DA for all class of employees

Hotel accommodation: Not admissible as accommodation is arranged by the Organizers.

No other allowances except mentioned above will be admissible.

2. TADA FOR ATTENDING ALL INDIA TOURNAMENTS:

Same as attending Inter Valley Tournaments except the DA rate which will be Rs. 360 per day for all classes of

employees.

NOTE: THE RATES AS MENTIONED ABOVE TO BE ENHANCED BY 25% WHENEVER DA REACHES 150%.

he Dower

-9-

TAON TEMPORARY TRANSFER

APPROVED RATE

01.

02,

In all cases of transfers for short periods not exceeding 180 (ONE HUNDRED EIGHTY) DAYS, the journeys

from the HQRS to the station of deputation and back may be treated as on tour for the purpose of regulating

travelling allowance, daily allowance being paid for the days of halt at that station as under ~

FIRST180DAYS : FULL COMPOSITE DAILY ALLOWANCE.

BEYOND 180 DAYS : NIL.

Temporary transfer on one’s own request shall not entitle him any TA or composite Daily Allowance.

ANNEXURE-II

LIST OF CLASSIFIED CITIES AS PER O.M. Ni [13)/2008-E.1I(B), DATED 29/08/2008 OF G.

ey STATES cries ee a CITIES CLASSIFIED AS “Y”

1 [Andhra Pradesh | Hyderabad (UA) Vijaywada (UA), Warangal (UA), Visakhapatnam (UA),

Guntur

2 | Assam_ Guahati (UA)

3 | Bihar Patna (UA)

4 | Chandigarh Chandigarh

5 _| Chattisgarh Durg-Bhilai Nagar (UA), Raipur (UA)

6_| Delhi —_| Dethi (Ua)

7 | Gujarat ‘Ahmrdabad (UA), Rajkot (UA), Jamnagar (UA), Bhavnagar

(UA), Vadodara (UA), Surat (UA)

8 | Haryana Faridabad

9_| Jammu & Kashmir Srinagar (UA), Jammu (UA)

10 _| Jharkhand _ [Jamshedpur (UA), Dhanbad (UA), Ranchi (UA)

11 | Karnataka Bengaluru (UA) Belgaum (UA); Hubli-Dharwad, Mangalore (UA), Mysore

(UA)

12_| Kerala Kozhikode (UA), Kochi (UA), Thiruvananthapuram (UA)

13_| Madhya Pradesh Gwalior (UA), Indore (UA), Bhopal (UA), Jabalpur (UA)

14 | Maharastra Greater Mumbai (UA) | Amravati, Nagpur (UA), Aurangabad (UA), Nasik (UA),

Bhiwani (UA), Pune (UA), Solapur, Kohlapur (UA)

15 | Orissa Cuttack (UA), Bhubaneswar (UA)

16 _| Punjab Amritsar (UA), Jalandhar (UA), Ludhiana

17_| Pondicherry Pondicherry (UA)

18 | Rajasthan Bikaner, Jaipur, Jodhpur (UA), Kota (UA)

19 | Tamil Nadu Chennai (UA) Salem (UA), Tiruppur (UA), Coimbatore (UA) Tiruchirappalli

[ (UA), Madurai (UA)

20_| Uttarakhand Dehradun (UA)

21, | Uttar Pradesah Moradabad, Meerut (UA), Gaziabad, Aligarh, Agra (UA),

Bareilly (UA), Lucknow (UA), Kanpur (UA), Allahabad (UA),

Gorokhpur, Varanasi (UA)

22 | West Bengal Kolkata (UA) Asansol (UA)

NOTE: The remaining cities/towns in various States/UTs which are not covered by classification as “x” or “Y"

are classified as “2”. !

Ale. Sean

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- SVI - Temghar TreatmentDocument42 pagesSVI - Temghar Treatmentlacto.cocNo ratings yet

- SIV VEAP NWA Sept23Document77 pagesSIV VEAP NWA Sept23lacto.cocNo ratings yet

- SI - Dam Safety Management - NWADocument45 pagesSI - Dam Safety Management - NWAlacto.cocNo ratings yet

- Spillway & Diversion Headwork by GNB SirDocument30 pagesSpillway & Diversion Headwork by GNB Sirlacto.cocNo ratings yet

- 5 LazyDocument31 pages5 Lazylacto.cocNo ratings yet

- 3 Bhura BillaDocument31 pages3 Bhura Billalacto.cocNo ratings yet

- 1.2 Bhediya AayaDocument33 pages1.2 Bhediya Aayalacto.cocNo ratings yet

- 2 Green GoldDocument18 pages2 Green Goldlacto.cocNo ratings yet

- Conditions of Contract by SC SirDocument24 pagesConditions of Contract by SC Sirlacto.cocNo ratings yet

- Port, Dock, HarbourDocument8 pagesPort, Dock, Harbourlacto.cocNo ratings yet

- Tender by SC SirDocument11 pagesTender by SC Sirlacto.cocNo ratings yet

- MeenDocument31 pagesMeenlacto.cocNo ratings yet

- 1.1 BhediyaDocument65 pages1.1 Bhediyalacto.cocNo ratings yet

- GeM Bidding 5733400Document6 pagesGeM Bidding 5733400lacto.cocNo ratings yet

- DBA Tilaiya Technical PaperDocument9 pagesDBA Tilaiya Technical Paperlacto.cocNo ratings yet

- Transport Policy in DVC HQDocument3 pagesTransport Policy in DVC HQlacto.cocNo ratings yet

- JIR CTPS WeirDocument12 pagesJIR CTPS Weirlacto.cocNo ratings yet

- Vehicle Old OrderDocument3 pagesVehicle Old Orderlacto.cocNo ratings yet

- Eqv) For The Pool of HOP, DVC, Maithon For A Period of Two (02) YearsDocument1 pageEqv) For The Pool of HOP, DVC, Maithon For A Period of Two (02) Yearslacto.cocNo ratings yet

- Vendor Listing in Eba. DTDDocument2 pagesVendor Listing in Eba. DTDlacto.cocNo ratings yet

- HR Revised Transport Policy All DVCDocument6 pagesHR Revised Transport Policy All DVClacto.cocNo ratings yet