Professional Documents

Culture Documents

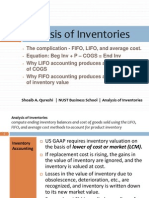

Methods of Inventory Valuation

Uploaded by

hajeer98ss0 ratings0% found this document useful (0 votes)

2 views13 pagesThe document discusses three methods for valuing inventory:

1. First In First Out (FIFO) method, which assumes goods received first are issued first.

2. Last In First Out (LIFO) method, which assumes goods received last are issued first.

3. Weighted average cost method, which calculates a weighted average price per unit based on total inventory costs and quantities.

Examples are provided to illustrate calculating inventory value, cost of goods sold, and closing stock value for each method.

Original Description:

Methods, inventory, valuation

Original Title

METHODS+OF+INVENTORY+VALUATION

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses three methods for valuing inventory:

1. First In First Out (FIFO) method, which assumes goods received first are issued first.

2. Last In First Out (LIFO) method, which assumes goods received last are issued first.

3. Weighted average cost method, which calculates a weighted average price per unit based on total inventory costs and quantities.

Examples are provided to illustrate calculating inventory value, cost of goods sold, and closing stock value for each method.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views13 pagesMethods of Inventory Valuation

Uploaded by

hajeer98ssThe document discusses three methods for valuing inventory:

1. First In First Out (FIFO) method, which assumes goods received first are issued first.

2. Last In First Out (LIFO) method, which assumes goods received last are issued first.

3. Weighted average cost method, which calculates a weighted average price per unit based on total inventory costs and quantities.

Examples are provided to illustrate calculating inventory value, cost of goods sold, and closing stock value for each method.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

METHODS OF INVENTORY VALUATION

LEARNING OBJECTIVES

METHODS OF INVENTORY VALUATION

1. FIRST IN FIRST OUT (FIFO) METHOD.

2. LAST IN FIRST OUT (LIFO) METHOD.

3. WEIGHTED AVERAGE COST/PRICE METHOD

METHODS OF INVENTORY VALUATION

METHODS OF INVENTORY VALUATION

An inventory valuation allows a company to provide a monetary value for items that make

up its inventory.

1. First In First Out (FIFO) Method.

2. Last In First Out (LIFO) Method.

3. Weighted Average Cost/price Method.

FIRST IN FIRST OUT (FIFO)

FIRST IN FIRST OUT (FIFO)

Based on the assumption that the goods that are received first are issued first.

Balance sheet shows ending inventory costed as per approx market price.

“First-In, First-Out” method is easier to understand and implement. It is practically possible

to apply

FIRST IN FIRST OUT (FIFO)

ABC Ltd. Provides you with the following information :

- 1.1.2019 Opening Stock 100 units @ Rs 1.

- 2.1.2019 Purchased 400 units @ Rs 1.50.

- 3.1.2019 Issued 450 units.

-4.1.2019 Purchase 500 units @ Rs 2.06.

-5.1.2019 issued 300 units.

REQUIRED : Compute the value of inventory under FIFO Method

Compute the value of COGS?

Compute the Closing Stock value?

LAST IN FIRST OUT (LIFO)

LAST IN FIRST OUT (LIFO)

Based on assumption that goods that are received last are issued first.

Balance sheet has an inventory costed at old prices.

LIFO method is that the older inventory may stay on the books forever so, It is practically

impossible to apply

LAST IN FIRST OUT (LIFO)

ABC Ltd. Provides you with the following information :

- 1.1.2019 Opening Stock 100 units @ Rs 1.

- 2.1.2019 Purchased 400 units @ Rs 1.50.

- 3.1.2019 Issued 450 units.

-4.1.2019 Purchase 500 units @ Rs 2.06.

-5.1.2019 issued 300 units.

REQUIRED : Compute the value of inventory under LIFO Method

Compute the value of COGS?

Compute the Closing Stock value?

WEIGHTED AVERAGE COST/PRICE METHOD

WEIGHTED AVERAGE COST/PRICE METHOD

Weighted average price is calculated by dividing the total cost of goods in stock by the total

quantity of goods in stock

This weighted price is used for pricing the issues until a new lot is received when a new

weighted average price would be calculated.

TOTAL AVAILABLE STOCK VALUE

WACC =

TOTAL NO OF AVAILABLE STOCK

WEIGHTED AVERAGE COST/PRICE METHOD

ABC Ltd. Provides you with the following information :

- 1.1.2019 Opening Stock 100 units @ Rs 1.

- 2.1.2019 Purchased 400 units @ Rs 1.50.

- 3.1.2019 Issued 450 units.

-4.1.2019 Purchase 500 units @ Rs 2.06.

-5.1.2019 issued 300 units.

REQUIRED : Compute the value of inventory under Weighted average cost Method

Compute the value of COGS?

Compute the Closing Stock value?

You might also like

- HKSI Study Manual L16 Eng PDFDocument208 pagesHKSI Study Manual L16 Eng PDFTTNo ratings yet

- Worldwide Paper Company Cash FlowDocument1 pageWorldwide Paper Company Cash FlowEric Silvani100% (4)

- Libby Financial Accounting Chapter7Document10 pagesLibby Financial Accounting Chapter7Jie Bo Ti0% (2)

- Answersheet For Debt Investment Course in Intermediate AccountingDocument25 pagesAnswersheet For Debt Investment Course in Intermediate AccountingHannahbea LindoNo ratings yet

- JP Morgan Research Report - RBDocument11 pagesJP Morgan Research Report - RBankigoelNo ratings yet

- Ch05 Foreign Exchange MarketDocument6 pagesCh05 Foreign Exchange MarketAbbey CiouNo ratings yet

- Inventory Costing1Document28 pagesInventory Costing1amity_acelNo ratings yet

- Determining The Monetary Amount of Inventory at Any Given Point in TimeDocument44 pagesDetermining The Monetary Amount of Inventory at Any Given Point in TimeParth R. ShahNo ratings yet

- Aerocomp, Inc Case Study Week 7Document2 pagesAerocomp, Inc Case Study Week 7John Patrick LaspiñasNo ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneySimranNo ratings yet

- Course of Business, or (Ii) in The Process of Production For Such Sale, or (Iii) For Consumption in The Production of Goods or Services For SaleDocument3 pagesCourse of Business, or (Ii) in The Process of Production For Such Sale, or (Iii) For Consumption in The Production of Goods or Services For SaleAashray RjNo ratings yet

- Module 4 Valuation of InventoryDocument6 pagesModule 4 Valuation of Inventorykaushalrajsinhjanvar427No ratings yet

- Inventory ValuationDocument12 pagesInventory Valuationcooldude690No ratings yet

- Infonet College: Learning GuideDocument17 pagesInfonet College: Learning Guidemac video teachingNo ratings yet

- 1.1. Inventory Costing Methods Under A Periodic SystemDocument6 pages1.1. Inventory Costing Methods Under A Periodic Systembeth elNo ratings yet

- Inventory Valuation Methods IntroductionDocument1 pageInventory Valuation Methods Introductionwaiting4yNo ratings yet

- Methods of Inventory ValuationDocument1 pageMethods of Inventory Valuationwaiting4y0% (1)

- Valuation & Accounting of InventoryDocument21 pagesValuation & Accounting of InventoryPrasad BhanageNo ratings yet

- Lesson 6Document43 pagesLesson 6Quyen Thanh NguyenNo ratings yet

- Inventory Management: FIFO Is The Acronym For First-In, First-OutDocument3 pagesInventory Management: FIFO Is The Acronym For First-In, First-Outhussnainali shahNo ratings yet

- Inv ValDocument9 pagesInv ValNishanth PrabhakarNo ratings yet

- Afs Slides - Lifo or FifoDocument21 pagesAfs Slides - Lifo or FifoIntisar HyderNo ratings yet

- Maintain Inventory RecordsDocument16 pagesMaintain Inventory Recordsjoy xoNo ratings yet

- Chapter 7Document3 pagesChapter 7amaliakb5No ratings yet

- Tutorial 9 QsDocument7 pagesTutorial 9 QsDylan Rabin PereiraNo ratings yet

- Methods of Valuing Material Issues orDocument12 pagesMethods of Valuing Material Issues orsarojpapuNo ratings yet

- Inventory ValuationDocument23 pagesInventory Valuationvkvivekkm163No ratings yet

- Chapter 4 Controlling and Costing Materials InventoryDocument26 pagesChapter 4 Controlling and Costing Materials InventoryRhodoraNo ratings yet

- Lifo FifoDocument7 pagesLifo Fifochandra chhuraNo ratings yet

- Principle of Accounting 2 - Unit 2Document17 pagesPrinciple of Accounting 2 - Unit 2Denekew asmareNo ratings yet

- Lifo FifoDocument3 pagesLifo FifoVenus BhattiNo ratings yet

- FIFO Method For Inventory Valuation May Increase Income Tax Due As Well As Showing True Financial Position of A BusinessDocument2 pagesFIFO Method For Inventory Valuation May Increase Income Tax Due As Well As Showing True Financial Position of A BusinessRashid Rathor100% (1)

- Text5-Accounting For Materials-Student ResourceDocument10 pagesText5-Accounting For Materials-Student Resourcekinai williamNo ratings yet

- Chapter 6 Lecture H-9Document8 pagesChapter 6 Lecture H-9ryanhuNo ratings yet

- Halaman 91-94Document5 pagesHalaman 91-94Rifa AlfiandiNo ratings yet

- Inventory AccountingDocument4 pagesInventory AccountingIndra ThamilarasanNo ratings yet

- Inventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Document9 pagesInventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Abhilash JhaNo ratings yet

- Costing Inventory Through FIFODocument6 pagesCosting Inventory Through FIFOJosh LeBlancNo ratings yet

- 06 InventoriesDocument3 pages06 InventoriesCy MiolataNo ratings yet

- Accounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankDocument95 pagesAccounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankakasagillNo ratings yet

- Chapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document133 pagesChapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Inventory Pricing & Valuation: U.Kalpanadevi Ii-Mba Michael Institute of ManagementDocument17 pagesInventory Pricing & Valuation: U.Kalpanadevi Ii-Mba Michael Institute of Managementyokesh100% (1)

- Inventory Depreciation Expense RecognitionDocument9 pagesInventory Depreciation Expense RecognitionZulu MasukuNo ratings yet

- Inventory ValuationDocument18 pagesInventory ValuationHimanshu Upadhyay AIOA, NoidaNo ratings yet

- Libby 4ce Solutions Manual - Ch08Document66 pagesLibby 4ce Solutions Manual - Ch087595522No ratings yet

- Inventory - Lecture ExamplesDocument6 pagesInventory - Lecture ExamplesAyandiswa NdebeleNo ratings yet

- Accounting For InventoriesDocument29 pagesAccounting For InventoriesLakachew GetasewNo ratings yet

- Inventory ValuationDocument10 pagesInventory ValuationKritika RajNo ratings yet

- Chapter 2 Costing For Materials and LabourDocument15 pagesChapter 2 Costing For Materials and LabourVerrelyNo ratings yet

- Chapter 5Document61 pagesChapter 5FAIZATUL AMLA BT ABDUL HAMID (PUO)No ratings yet

- Valuation of InventoryDocument12 pagesValuation of InventoryChandan SenapatiNo ratings yet

- Presentation 1Document12 pagesPresentation 1Chandan SenapatiNo ratings yet

- Stock ValuationDocument18 pagesStock Valuationdurgesh choudharyNo ratings yet

- Module 1 Inventories(7)没看完Document43 pagesModule 1 Inventories(7)没看完curly030125No ratings yet

- Ch. 2Document46 pagesCh. 2Abdillahi Ibrahim Sh NorNo ratings yet

- Bahan Ajar PersediaanDocument17 pagesBahan Ajar PersediaanKIKY FAUZIYYAH NUR ANNISANo ratings yet

- FIFO VsDocument9 pagesFIFO VswaliNo ratings yet

- One of The Largest Current Assets InventoryDocument15 pagesOne of The Largest Current Assets InventorySaadat ShaikhNo ratings yet

- Exercises On Chapter 6: Accounting Principle - Grade 1 - FCASU - 2 TermDocument5 pagesExercises On Chapter 6: Accounting Principle - Grade 1 - FCASU - 2 TermFintech GroupNo ratings yet

- 2020 CMA P1 A3 InventoryDocument54 pages2020 CMA P1 A3 InventoryLhenNo ratings yet

- Financial Reports Analysis: Faculty of Commerce "English Section" - Level IV - Course Code: ACC 401Document44 pagesFinancial Reports Analysis: Faculty of Commerce "English Section" - Level IV - Course Code: ACC 401AHMED ALAWADYNo ratings yet

- Bridget Dindi Method of Stock EvaluationDocument3 pagesBridget Dindi Method of Stock EvaluationBridget DindiNo ratings yet

- Module 4 Inventory and Biological AssetsDocument19 pagesModule 4 Inventory and Biological AssetsAndrea Miles VasquezNo ratings yet

- Reporting and Interpreting Cost of Goods Sold and InventoryDocument40 pagesReporting and Interpreting Cost of Goods Sold and InventoryPedroNo ratings yet

- Indian Equities:: Digital Transformation As Private Goes PublicDocument25 pagesIndian Equities:: Digital Transformation As Private Goes PublicDilip KumarNo ratings yet

- Paper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryDocument24 pagesPaper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryAkela FatimaNo ratings yet

- Learning Curve & Target Costing QuizDocument4 pagesLearning Curve & Target Costing QuizNadir IshaqNo ratings yet

- PEA202 Lec#7 Profit & LossDocument27 pagesPEA202 Lec#7 Profit & LossZekria Noori AfghanNo ratings yet

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- IAS 16 by FFQADocument9 pagesIAS 16 by FFQAMohammad Faizan Farooq Qadri Attari0% (1)

- Hussman Is Not That Bad. BEWARE.Document3 pagesHussman Is Not That Bad. BEWARE.Pradeep KandasamyNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyShakti RupiniNo ratings yet

- The Equity Method of Accounting For Investments: Chapter OneDocument40 pagesThe Equity Method of Accounting For Investments: Chapter Onerendy adiwigunaNo ratings yet

- MCQs Chapter 5Document3 pagesMCQs Chapter 5Gia LâmNo ratings yet

- ICER CourseDocument20 pagesICER CourseOussama ChaoukiNo ratings yet

- Financial Instruments-Equity Instruments of Another EntityDocument7 pagesFinancial Instruments-Equity Instruments of Another EntityElla MontefalcoNo ratings yet

- Arna - Icmd 2009 (B13)Document4 pagesArna - Icmd 2009 (B13)IshidaUryuuNo ratings yet

- SEBI (Delisting of Equity Shares) (Amendment) Regulations, 2015Document11 pagesSEBI (Delisting of Equity Shares) (Amendment) Regulations, 2015Shyam SunderNo ratings yet

- Intermediate Accounting 3 - Chap 10-12 Answer KeyDocument7 pagesIntermediate Accounting 3 - Chap 10-12 Answer KeyKrisselyn ReigneNo ratings yet

- TPT550 - ExerciseDocument2 pagesTPT550 - ExerciseAzriNo ratings yet

- Capital StructureDocument15 pagesCapital StructuremakeyourcosmosNo ratings yet

- Portfolio Optimization: Stephen Boyd EE103 Stanford UniversityDocument34 pagesPortfolio Optimization: Stephen Boyd EE103 Stanford UniversitywoelfertNo ratings yet

- Sob Diploma Final Exam TT May-Aug 2023Document43 pagesSob Diploma Final Exam TT May-Aug 2023Sarah MuthoniNo ratings yet

- Interest Theory SolutionsDocument38 pagesInterest Theory Solutionsshivanithapar13No ratings yet

- Quant Factsheet March 2021Document34 pagesQuant Factsheet March 2021Raghu RamanNo ratings yet

- Amazon Logistica 2019Document78 pagesAmazon Logistica 2019Laura Gomez SánchezNo ratings yet

- Analisis Perbedaan Kualitas Akrual Dan Persistensi Laba Sebelum Dan Sesudah Konvergensi IfrsDocument15 pagesAnalisis Perbedaan Kualitas Akrual Dan Persistensi Laba Sebelum Dan Sesudah Konvergensi IfrsDillaNo ratings yet