The Winning Edge Compiled By: Chhaya Sehgal

Inventory Costing

Inventory is defined as assets that are intended for sale, are in process of being produced for sale or

are to be used in producing goods.

The following equation expresses how a company's inventory is determined:

Beginning Inventory + Net Purchases - Cost of Goods Sold (COGS) = Ending Inventory

In other words, you take what the company has in the beginning, add what they have purchased,

subtract what they've sold and the result is what they have remaining.

Types of Inventory Systems

Perpetual Inventory System: In Perpetual Inventory System detailed records are maintained for the

purchase cost and sale of every item in inventory.

An auto dealer would be a good example of a company that would use a perpetual inventory system.

Advantages of Perpetual inventory systems:

a. Inventory quantities are maintained on a constant basis, normally on a per product basis;

b. Internal control is enhanced by allowing spot checks of inventory quantities on a random

basis at any time;

c. Knowledge of inventory trends is produced in a timely manner so that management can react

to changing trends to avoid stock outs of fast moving items and unnecessary orders of slow

moving items;

d. Due to timely knowledge of inventory trends it may be possible to reduce inventory costs

through better inventory control procedures.

2. Periodic Inventory System: In Periodic Inventory system detailed records are not kept of each

item in inventory. The cost of goods sold is determined periodically at the end of the accounting

period when an inventory is taken.

Advantages of the Periodic Inventory System:

a. Allows firms to determine inventory and cost of goods sold at end of year without recording

the effect (on inventory) of every sale and purchase made throughout the year.

b. Requires no computer system and relatively simple record keeping.

Importance of valuing inventories

For many companies, inventory represents a large (if not the largest) portion of assets and, as

such, makes up an important part of the balance sheet. It is, therefore, crucial for investors who are

analyzing stocks to understand how inventory is valued. The direct impact of inventory value is seen

on the following components:

Current Assets

Total Assets

Gross Profit

1

� The Winning Edge Compiled By: Chhaya Sehgal

Net Profit

General Reserves

Capital

Thus, for companies in which the inventory composes of a sizable portion of the Balance Sheet,

valuation of inventory has a significant and direct impact on Key Financial Ratios.

Inventory Valuation Techniques

A TYPICAL PROBLEM OF INVENTORY ACCOUNTING FOR A FIRM

Following is the data of purchase and sale of inventory for Happy & Lucky Enterprises Ltd. for the

month of May 2006. How will you value the inventory using,

1. FIFO method of costing

2. LIFO method of costing

3. Simple Average method of costing

4. Weighted Average method of Costing

Also state the various differences arising on account of using the different methods of valuation of

inventory.

Date Transactions Units Purchased Units Sold Unit Cost Inventory Units

May 1 Beginning Inventory 700 - $10 700

May 3 Purchase 100 - $ 12 800

May 8 Sale (*1) - 500 ?? 300

May 15 Purchase 600 - $ 14 900

May 19 Purchase 200 - $ 15 1100

May 25 Sale (*2) - 400 ?? 700

May 27 Sale (*3) - 100 ?? 600

May 31 Total 1600 1000 -

1. FIRST IN-FIRST OUT (FIFO) METHOD

A method of valuing your inventory that assumes any inventory you sold was from the first inventory

you purchased. When you cannot specifically identify items of inventory and you purchased

quantities of inventory at different times for different prices, you must use a method, such as FIFO to

determine your cost of goods sold and the value of your remaining inventory.

The FIFO can be explained in laymen terms with the help of the following example:

Trucks delivering inventory pull up at the front door of the warehouse, which also has a back door

that leads to the selling floor. The goods are unloaded from the truck and placed on a conveyor belt

that runs from the front door to the back. As additional goods are delivered during the period, the

conveyor belt carries the first items received to the back door, and they are sent to the selling floor

2

�The Winning Edge Compiled By: Chhaya Sehgal

and sold first. Inventory at the end of the period consists of those items still on the conveyor belt (the

newer items).

Valuation using FIFO Method

Items Effect Date Transaction Units Unit Purchases Cost of Ending

Cost Goods Sold Inventory

(*1) 500 Units Sold

500 Units from 1-May Beginning 500 $10 $5,000 $5,000

Inventory

(*2) 400 Units Sold

200 Units from 1-May Beginning 200 $10 $2,000 $2,000

Inventory

100 Units from 3-May Purchase 100 $12 $1,200 $1,200

100 Units from 15-May Purchase 100 $14 $1,400 $1,400

(*3) 100 Units Sold

100 Units from 15-May Purchase 100 $14 $1,400 $1,400

Ending 600 Units

Inventory

400 Units from 15-May Purchase 400 $14 $5,600 $5,600

200 Units from 19-May Purchase 200 $15 $3,000 $3,000

FIFO TOTAL 1,600 $19,600 $11,000 $8,600

Thus, in the above problem we find that in the FIFO method of accounting, the goods that are bought

first, are sold first.

2. LAST IN-FIRST OUT (LIFO) METHOD

LIFO is a method of valuing your inventory that assumes any inventory you sold was from the last

inventory you purchased. Under LIFO, the cost of goods sold is based upon the cost of material

bought towards the end of the period, resulting in costs that closely approximate current costs. The

inventory, however, is valued on the basis of the cost of materials bought earlier in the year.

The LIFO can be explained in laymen terms with the help of the following example:

The warehouse has only a front door. Trucks delivering inventory unload at the front door; when

inventory is needed on the selling floor, the clerks have to come to the front door and remove the

closest items (the newer ones). This leaves the ending inventory to be composed of those earliest

purchased items that have been pushed to the back of the warehouse as newer shipments are received.

Valuation using LIFO Method

Items Effect Date Transaction Units Unit Purchases Cost of Ending

Cost Goods Sold Inventory

(*1) 500 Units Sold

100 Units from 3-May Purchase 100 $12 $1,200 $1,200

400 Units from 1-May Beginning 400 $10 $4,000 $4,000

Inventory

(*2) 400 Units Sold

3

� The Winning Edge Compiled By: Chhaya Sehgal

200 Units from 19-May Purchase 200 $15 $3,000 $3,000

200 Units from 15-May Purchase 200 $14 $2,800 $2,800

(*3) 100 Units Sold

100 Units from 15-May Purchase 100 $14 $1,400 $1,400

Ending 600 Units

Inventory

300 Units from 1-May Beginning 300 $10 $3,000 $3,000

Inventory

300 Units from 15-May Purchase 300 $14 $4,200 $4,200

FIFO TOTAL 1,600 $19,600 $12,400 $7,200

So we see from the above example that in LIFO method of valuing inventory, the goods that are

bought last are sold first. So the value of goods sold represents the latest price levels.

3. SIMPLE AVERAGE METHOD

The average cost method of inventory valuation assumes that costs are charged against revenue based

on an average of the number of units acquired at each price level. The resulting average price is

applied to the ending inventory to find the total ending inventory value.

Some merchandise is nearly identical and is carried in large quantities, like lumber, nails, nuts and

bolts or gasoline. If you have a tank on gasoline with say 50 gallons in it, and you add 200 more

gallons, you can't separate the first 50 gallons out from the rest of it. It all just becomes on take with

250 gallons of gasoline in it so companies use the average cost method to account for things like this.

Valuation using Simple Average Method

Date Transactions Units Units Unit Inventory Purchases Simple C.O.G.S. Ending

Purchased Sold Cost Units Average Inventory

Unit Cost

1-May Beginning 700 $10.00 700 $7,000 $10.00

Inventory

3-May Purchase 100 $12.00 800 $1,200 $10.25

8-May Sale (*1) 500 ?? 300 $10.25 $5,125

15-May Purchase 600 $14.00 900 $8,400 $12.75

19-May Purchase 200 $15.00 1,100 $3,000 $13.16

25-May Sale (*2) 400 ?? 700 $13.16 $5,264

27-May Sale (*3) 100 ?? 600 $13.16 $1,316

31-May 600 $13.16 $7,895

Total 1,600 1,000 $19,600 $11,705 $7,895

4. WEIGHTED AVERAGE METHOD

In the Weighted Average Method, weighted average cost per unit for the period is the cost of the

goods available for sale divided by the number of units available for sale. Typically this average is

computed at the end of an accounting period. When the perpetual inventory system is used, the

weighted average method is called the Moving Average method.

4

�The Winning Edge Compiled By: Chhaya Sehgal

The Moving Average method requires that a new weighted average cost must be calculated after each

purchase. The new weighted average is computed in the same way as in the Weighted Average

Inventory Method; that is, the average cost is the cost of the units available for sale after the purchase

divided by the number of units available for sale at that time. This average cost is used to determine

the cost of each sale made prior to the next purchase. The weighted average attempts to correct any

bias that could be caused by unequal lot sizes.

Valuation using WEIGHTED AVERAGE Method

Date Trans Units Units Unit Inventory Purchases W.A. C.O.G.S. Ending

Purchased Sold Cost Units Unit Inventory

Cost

1-May Beginning 700 $10.00 700 $7,000 $12.25

Inventory

3-May Purchase 100 $12.00 800 $1,200 $12.25

8-May Sale (*1) 500 ?? 300 $12.25 $6,125

15-May Purchase 600 $14.00 900 $8,400 $12.25

19-May Purchase 200 $15.00 1,100 $3,000 $12.25

25-May Sale (*2) 400 ?? 700 $12.25 $4,900

27-May Sale (*3) 100 ?? 600 $12.25 $1,225

31-May 600 $12.25 $7,350

Total 1,600 1,000 $19,600 $12.25 $12,250 $7,350

Weighted Average unit Cost =

(700X$10 + 100X$12 + 600X$14 + 200X$15) / (700 + 100 + 600 + 200) =12.25

Thus in the weighted average method of costing, the value of inventory is determined by computing

the average cost of all units bought during the period.

OTHER METHODS OF INVENTORY VALUATION

In addition to the above discussed methods of inventory costing, other methods of valuing inventory

are as follows:

5. BASE STOCK PRICES METHOD

The base stock refers to the minimum quantity of stock of materials that a firm has to maintain at all

times. Under this method, it is assumed that the minimum stock which must always be carried is in

the nature of fixed assets, and is never realized while the business continues. The minimum stock is

carried at the original cost of acquisition. The quantity of materials in excess of the base stock is

available for production, while the base stock is used only in case of emergency. The excess is priced

in conjunction with one of the other methods of production such as FIFO, LIFO. Thus, this method

cannot be used independently. Moreover, estimation of base stock may be difficult. It can be used in

industries having relatively long processing period, and where the cost of finished product is largely

made up of basic raw materials such as crude oil, hides and so on.

6. STANDARD PRICE METHOD

5

�The Winning Edge Compiled By: Chhaya Sehgal

This method of pricing issues is based on a standard price for a specified period. A standard price is

fixed for each class of materials in advance after proper investigation. The method is suitable where

standard costing is relevant. The difference between actual price and standard price is transferred to

purchase price variance which reveals to what extent actual costs are different from standard material

cost. This method is simple to operate and provide stability in costing system. However, standard

price/cost does not often reflect actual/expected cost but only a notional cost/generalized target. The

stock value does not show actual cost incurrence and, therefore, does not necessarily, confirm to

acceptable principles of stock valuation.

The above mentioned methods are not used as widely as FIFO, LIFO and the weighted average

method of costing.

Impact of choice of valuation system on Profitability

FIFO

Using FIFO technique, the ending inventory is valued close to the current replacement value

So, when the prices go up, inventory is valued at a higher cost

These results in a lower estimate in the cost of goods sold (COGS)

As a result, the net income computed will be higher

Thus, the taxes levied will be more and this would mean a decreased net cash flow

LIFO

Using LIFO technique, the ending inventory is valued close to the least recently bought value

So, when the prices go up, inventory is valued at a lower cost

These results in a higher estimate in the cost of goods sold (COGS)

As a result, the net income computed will be lower

Thus, the taxes levied will be less and this would mean a increased net cash flow

We summarize the advantages and disadvantages of three basic methods as follows:

Method Advantages Disadvantages

Weighted Hard to manipulate Averages may not reflect inflation

average Easy to calculate well

FIFO Hard to manipulate Produces "inventory" profits

Makes physical sense Doesn’t minimize taxes

Good ending inventory valuation

LIFO Minimizes taxes in inflation Easy to manipulate

Reflects current costs Physical flow unrealistic

Bad ending inventory valuation

Can’t use for foreign companies

LIFO liquidation problems

6

�The Winning Edge Compiled By: Chhaya Sehgal

As a final note, many companies will also state that they use the "lower of cost or market". This

means that if inventory values were to plummet, their valuations would represent the market value

(or replacement cost) instead of FIFO, LIFO or average cost.

CHOICE OF A METHOD

Typically the choice of inventory methods for companies is assumed to reflect the tax savings choice

made by the company. Companies choosing to minimize their taxable income choose the LIFO

method of accounting for inventories since the tax code requires the use of this method for financial

reporting purposes in order to be used for tax purposes too. Companies choosing not to minimize

their taxable income or in other words, choosing to maximize their reported income typically are

assumed to select a non-LIFO method, such as FIFO. In the international arena, the choice of

inventory accounting is frequently limited since a lot of the countries in the world do not permit the

LIFO method of accounting. Thus, U.S. Multinational Companies (MNCs) may not be able to select

the LIFO method for international operations.

Firms often adopt the LIFO approach for the tax benefits during periods of high inflation, and studies

indicate that firms with the following characteristics are more likely to adopt LIFO - rising prices for

raw materials and labor, more variable inventory growth, an absence of other tax loss carry forwards,

and large size. When firms switch from FIFO to LIFO in valuing inventory, there is likely to be a

drop in net income and a concurrent increase in cash flows (because of the tax savings). The reverse

will apply when firms switch from LIFO to FIFO.

Given the income and cash flow effects of inventory valuation methods, it is often difficult to

compare firms that use different methods. There is, however, one way of adjusting for these

differences. Firms that choose to use the LIFO approach to value inventories have to specify in a

footnote the difference in inventory valuation between FIFO and LIFO, and this difference is termed

the LIFO reserve. This can be used to adjust the beginning and ending inventories, and consequently

the cost of goods sold, and to restate income based upon FIFO valuation.

IMPACT OF INVENTORY COSTING METHODS ON VARIOUS

STATEMENTS OF ACCOUNTS AND RATIOS

If inflation were nonexistent, then all three of the inventory valuation methods would produce the

exact same results. When prices are stable, for example a bakery would be able to produce all of its

loafs of bread at $1, and FIFO, LIFO and average cost would give us a cost of $1 per loaf.

Companies are prevented from getting the best of both worlds. If a company uses LIFO valuation

when it files taxes, which results in lower taxes when prices are increasing, it then must also use

LIFO when it reports financial results to shareholders. This lowers net income and, ultimately,

earnings per share.

7

�The Winning Edge Compiled By: Chhaya Sehgal

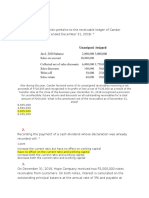

Example

Following is the inventory of Cory's Tequila Co. (CTC). We will see how the different inventory

valuation methods can affect the financial analysis of a company.

Monthly Inventory Purchases*

Month Units Purchased Cost/unit Total Value

January 1,000 $10 $10,000

February 1,000 $12 $12,000

March 1,000 $15 $15,000

Total 3,000 $37,000

Beginning Inventory = 1,000 units purchased at $8 each (a total of 4,000 units)

Income Statement (simplified): January-March*

Item LIFO FIFO Average

Sales = 3,000 units @ $20 each $60,000 $60,000 $60,000

Beginning Inventory 8,000 8,000 8,000

Purchases 37,000 37,000 37,000

Ending Inventory (appears on B/S), *See calculation below 8,000 15,000 11,250

COGS $37,000 $30,000 $33,750

Expenses 10,000 10,000 10,000

Net Income $13,000 $20,000 $15,600

*Note: All calculations assume that there are 1,000 units left for ending inventory:

(4,000 units - 3,000 units sold = 1,000 units left)

What we are doing here is figuring out the ending inventory, the results of which depend on the

accounting method, in order to find out what COGS is. All we've done is rearrange the above

equation into the following:

1. Beginning Inventory + Net Purchases - Ending Inventory = Cost of Goods Sold

LIFO Ending Inventory Cost =1,000 units X $8 each = $8,000

(Remember that the last units in are sold first; therefore, we leave the oldest units for ending

inventory.)

8

�The Winning Edge Compiled By: Chhaya Sehgal

2. FIFO Ending Inventory Cost =1,000 units X $15 each = $15,000

Remember that the first units in (the oldest ones) are sold first; therefore, we leave the newest units

for ending inventory.

3. Weighted Average Cost Ending Inventory =

[(1,000 x 8) + (1,000 x 10) + (1,000 x 12) + (1,000 x 15)]/4000 units = $11.25 per unit

1,000 units X $11.25 each = $11,250

(Remember that we take a weighted average of all the units in inventory.)

Using the information above, we can calculate various performance and leverage ratios. Let's assume

the following:

Assets (not including inventory) $150,000

Current assets (not including inventory) $100,000

Current liabilities $40,000

Total liabilities $50,000

Each inventory valuation method causes the various ratios to produce significantly different results

(excluding the effects of income taxes):

Ratio LIFO FIFO Average Cost

Debt-to-Asset 0.32 0.30 0.31

Working Capital 2.7 2.88 2.78

Inventory Turnover 7.5 4.0 5.3

Gross Profit Margin 38% 50% 44%

As we can see from the ratio results, inventory analysis can have a big effect on the bottom line.

Unfortunately, a company probably won't publish its entire inventory situation in its financial

statements. Companies are required, however, to state in the notes to financial statements what

inventory system they use.