Professional Documents

Culture Documents

04-01 - Financial Analysis (Dragged) 4

Uploaded by

Salsabila AufaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

04-01 - Financial Analysis (Dragged) 4

Uploaded by

Salsabila AufaCopyright:

Available Formats

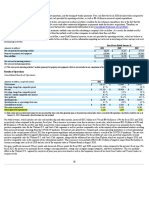

Table 3.1 H. J. Boswell, Inc.

(1 of 2)

Income Statement ($ millions, except per share data) for the Year Ended

December 31, 2016

Sales Blank $2,700.00

Cost of goods sold Blank (2,025.00)

Gross profit Blank $ 675.00

Operating expenses: Blank Blank

Selling expense $(90.00) Blank

General and administrative expense (67.50) Blank

Depreciation and amortization expense (135.00) Blank

Total operating expenses Blank (292.50)

Net operating income (EBIT, or earnings before interest Blank $ 382.50

and taxes)

Interest expense Blank (67.50)

Earnings before taxes Blank $ 315.00

Income taxes Blank (110.25)

Net income Blank $ 204.75

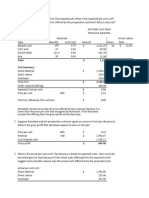

Table 4.1 H. J. Boswell, Inc.

Common-Size Income Statement for the Year Ended

December 31, 2016

Sales Blank 100.0%

Cost of goods sold Blank 75.0%

Gross profits Blank 25.0%

Operating expenses: Blank Blank

Selling expenses 3.3% Blank

General and administrative expense 2.5% Blank

Depreciation and amortization expense 5.0% Blank

Total operating expense Blank 10.8%

Net operating income (EBIT, or earnings before interest and taxes) Blank 14.2%

Interest expense Blank 2.5%

Earnings before taxes Blank 11.7%

Income taxes Blank 4.1%

Net income Blank 7.6%

Table 4.1 Observations

• Table 4.1 created by dividing each entry in the

income statement of Table 3.1 by firm sales for

2016.

Cost of goods sold make up 75% of the firm s sales

resulting in a gross profit of 25%.

Selling expenses account for about 3% of sales.

Income taxes account for 4.1% of the firm s sales.

After all expenses, the firm generates net income of

7.6% of firm s sales.

You might also like

- Ch12 P11 Build A ModelDocument7 pagesCh12 P11 Build A ModelRayudu RamisettiNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- An Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow ChatterjeaDocument881 pagesAn Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow Chatterjeahuhata100% (5)

- Integrative Case 2: Track Software, IncDocument8 pagesIntegrative Case 2: Track Software, IncMohamed Ahmed ZeinNo ratings yet

- COSTCO Case StudyDocument54 pagesCOSTCO Case Studyreshamhira@75% (4)

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Document7 pagesChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarNo ratings yet

- Profitability RatiosDocument3 pagesProfitability RatiosJohn Muema100% (1)

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- 3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbDocument3 pages3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbRey Joyce AbuelNo ratings yet

- IFM11 Solution To Ch09 P11 Build A ModelDocument18 pagesIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNo ratings yet

- WAT-PI Kit-Finance (FinvesT) PDFDocument8 pagesWAT-PI Kit-Finance (FinvesT) PDFcompangelNo ratings yet

- Reliance Money Project ReportDocument75 pagesReliance Money Project ReportPardeep Sharma SNo ratings yet

- CEL 1 TOA Answer Key 1Document12 pagesCEL 1 TOA Answer Key 1Joel Matthew MozarNo ratings yet

- Full Download Book Entrepreneurial Finance PDFDocument41 pagesFull Download Book Entrepreneurial Finance PDFsandra.reimer521100% (16)

- 04-01 - Financial AnalysisDocument98 pages04-01 - Financial AnalysisSalsabila AufaNo ratings yet

- Acounting IDocument10 pagesAcounting Ikitty16.fonsecaNo ratings yet

- Latihan Soal Menghitung RasioDocument4 pagesLatihan Soal Menghitung Rasiobudi purnomoNo ratings yet

- Function of Expense MethodDocument2 pagesFunction of Expense MethodShaneen AdorableNo ratings yet

- Chapter 2, 3 4 Financial Statements (Part 1)Document62 pagesChapter 2, 3 4 Financial Statements (Part 1)Aidil Osman17No ratings yet

- Chapter3 4Document24 pagesChapter3 4kakolalamamaNo ratings yet

- Tugas Maulana Ramadhan 22522014Document17 pagesTugas Maulana Ramadhan 22522014King AzazirNo ratings yet

- Book 1Document4 pagesBook 1pjdevicenteNo ratings yet

- Week 6 Assignment Part 2 (Empty)Document11 pagesWeek 6 Assignment Part 2 (Empty)adomahattafuahNo ratings yet

- Apple 10-K Report 2022 AnalysisDocument9 pagesApple 10-K Report 2022 AnalysiscarsonkjonesNo ratings yet

- Financial Management Ratio Analysis - 29121289 - Simon ErickDocument7 pagesFinancial Management Ratio Analysis - 29121289 - Simon ErickSimon ErickNo ratings yet

- Profit & Loss AccountDocument12 pagesProfit & Loss AccountSubhadeeptaSahooNo ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- Common Size AnalysisDocument25 pagesCommon Size AnalysisYoura DeAi0% (1)

- Vertical and Horizontal AnalysisDocument4 pagesVertical and Horizontal AnalysisKaren CastroNo ratings yet

- 107 25 Walmart 10 K ExcerptsDocument6 pages107 25 Walmart 10 K Excerptsi wayan suputraNo ratings yet

- Restaurants Activity+#+11Document3 pagesRestaurants Activity+#+11Gabriel OrellanaNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- 2022, Tulane, FM, LeverageDocument6 pages2022, Tulane, FM, LeverageJhonnatan Ruiz EustaquioNo ratings yet

- Du Pont CaseDocument13 pagesDu Pont CaseShubhangi JainNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Session 2 Section 2.3Document9 pagesSession 2 Section 2.3Altamish AyyazNo ratings yet

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversNo ratings yet

- Akbi-Analisa Ratio Keuangan PerusahaanDocument81 pagesAkbi-Analisa Ratio Keuangan PerusahaanCozzy PawerNo ratings yet

- Abc CompanyDocument3 pagesAbc CompanyJOHN MITCHELL GALLARDONo ratings yet

- Finance Questions 4Document3 pagesFinance Questions 4asma raeesNo ratings yet

- Chapter 13Document11 pagesChapter 13MekeniMekeniNo ratings yet

- EFM3 CHMDL 04 FinAnalysisDocument13 pagesEFM3 CHMDL 04 FinAnalysisVeri KurniawanNo ratings yet

- Chapter 3. Financial Statements, Cash Flows, and Taxes: The Annual ReportDocument4 pagesChapter 3. Financial Statements, Cash Flows, and Taxes: The Annual Reporttri wulungganiNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Bill French, Accountant - Case Study Analysis 1Document8 pagesBill French, Accountant - Case Study Analysis 1Shagnik RoyNo ratings yet

- Financial Statement Analysis and Introduction To Loan StructuringDocument3 pagesFinancial Statement Analysis and Introduction To Loan StructuringZihe Hamed WanogoNo ratings yet

- She3 2Document12 pagesShe3 2Daryl FernandezNo ratings yet

- 15 Multiples AnalysisDocument100 pages15 Multiples AnalysisSkander lakhalNo ratings yet

- Pres Ratios DataDocument24 pagesPres Ratios Datasamarth chawlaNo ratings yet

- Financial Plan: Important AssumptionsDocument15 pagesFinancial Plan: Important AssumptionsjehooniesunshineNo ratings yet

- BS Goyal Sons 180122Document66 pagesBS Goyal Sons 180122SANJIT CHAKMANo ratings yet

- CH 04Document8 pagesCH 04ashibhallauNo ratings yet

- Tarea - 3 Bis - Caso Dyaton Products - Formato ADocument8 pagesTarea - 3 Bis - Caso Dyaton Products - Formato AMiguel VázquezNo ratings yet

- Vertical AnalysisDocument1 pageVertical AnalysisKhris Espinili AlgaraNo ratings yet

- Sales Price: Mark-Up On Total Variable Cost Per BatchDocument8 pagesSales Price: Mark-Up On Total Variable Cost Per BatchNikita SharmaNo ratings yet

- Financial Statement Analisys Chapter 17Document37 pagesFinancial Statement Analisys Chapter 17titinNo ratings yet

- Pof AFS SundayDocument32 pagesPof AFS SundayAsad AhmedNo ratings yet

- Carrier Draft ValuationDocument51 pagesCarrier Draft ValuationSergei MoshenkovNo ratings yet

- Carrefour - Condensed Consolidated Financial StatementsDocument43 pagesCarrefour - Condensed Consolidated Financial StatementsThu TrangNo ratings yet

- Alzona Corporation: General AssumptionsDocument2 pagesAlzona Corporation: General Assumptionschintan desaiNo ratings yet

- 1244 - Roshan Kumar Sahoo - Assignment 2Document3 pages1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOONo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- 2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplateDocument8 pages2 Case1 1bFinPlannNEWFashionSHOPS2022 23SolutionTemplatesantiagoNo ratings yet

- Hindustan Uniliver Ratio Analysis Input Worksheet 2010-2011: Line Item Beginning of YearDocument6 pagesHindustan Uniliver Ratio Analysis Input Worksheet 2010-2011: Line Item Beginning of YearSiddhantNo ratings yet

- 06 - Time Value of Money - 2Document77 pages06 - Time Value of Money - 2Salsabila AufaNo ratings yet

- Black and Red Geometric Technology Keynote PresentationDocument15 pagesBlack and Red Geometric Technology Keynote PresentationSalsabila AufaNo ratings yet

- 07-01 - An Introduction To Risk and ReturnDocument69 pages07-01 - An Introduction To Risk and ReturnSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 26Document3 pages04-01 - Financial Analysis (Dragged) 26Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 31Document3 pages04-01 - Financial Analysis (Dragged) 31Salsabila AufaNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 8Document3 pages04-01 - Financial Analysis (Dragged) 8Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 15Document3 pages04-01 - Financial Analysis (Dragged) 15Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 20Document3 pages04-01 - Financial Analysis (Dragged) 20Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 18Document3 pages04-01 - Financial Analysis (Dragged) 18Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 11Document6 pages04-01 - Financial Analysis (Dragged) 11Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 19Document3 pages04-01 - Financial Analysis (Dragged) 19Salsabila AufaNo ratings yet

- Latihan UAS Soal 01Document3 pagesLatihan UAS Soal 01Salsabila AufaNo ratings yet

- Assignment Week 1 - CHDocument2 pagesAssignment Week 1 - CHSalsabila AufaNo ratings yet

- Assignment HM5.34 - CHDocument3 pagesAssignment HM5.34 - CHSalsabila AufaNo ratings yet

- Ass 10 03BDocument1 pageAss 10 03BSalsabila AufaNo ratings yet

- HFOF Letter To Ivy ClientsDocument1 pageHFOF Letter To Ivy ClientsAbsolute ReturnNo ratings yet

- Recognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationDocument7 pagesRecognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationMikaela LacabaNo ratings yet

- Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Document38 pagesTest Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17 Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Karen CaelNo ratings yet

- Supercomnet Technologies - Shaping Noteworthy ProspectsDocument6 pagesSupercomnet Technologies - Shaping Noteworthy ProspectsFong Kah YanNo ratings yet

- By Geet Arora Bba 3 Year Roll No - 4204Document15 pagesBy Geet Arora Bba 3 Year Roll No - 4204geet882004No ratings yet

- Breaking Into WS 1-HR LBO-Modeling-Test-AnswDocument3 pagesBreaking Into WS 1-HR LBO-Modeling-Test-AnswANo ratings yet

- International Capital MarketsDocument11 pagesInternational Capital MarketsAmbika JaiswalNo ratings yet

- IC Detailed Financial Projections Template 8821 UpdatedDocument27 pagesIC Detailed Financial Projections Template 8821 UpdatedRozh SammedNo ratings yet

- Human Resource AccountingDocument26 pagesHuman Resource AccountingAkshay AsijaNo ratings yet

- Kalkulator SahamDocument16 pagesKalkulator SahamAkbar Hidayatullah ZainiNo ratings yet

- 2 Unit Theories of Forwards & Future PricingDocument60 pages2 Unit Theories of Forwards & Future Pricingvijay kumarNo ratings yet

- Finance & Banking Hounours 1st Year SyllabusDocument11 pagesFinance & Banking Hounours 1st Year SyllabusTOWFIQ TusharNo ratings yet

- Flash Boys MlaDocument4 pagesFlash Boys Mlaapi-461067605No ratings yet

- CementDocument7 pagesCementannisa lahjieNo ratings yet

- 2022 11 22 BJTMDocument2 pages2022 11 22 BJTMfirmanNo ratings yet

- CH 12Document63 pagesCH 12Grace VersoniNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Ben Graham Calculations Template - FinboxDocument8 pagesBen Graham Calculations Template - FinboxDario RNo ratings yet

- United Tractors (UNTR IJ) : Regional Morning NotesDocument5 pagesUnited Tractors (UNTR IJ) : Regional Morning NotesAmirul AriffNo ratings yet

- M & ADocument6 pagesM & AiluaggarwalNo ratings yet

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniLakshya AgarwalNo ratings yet

- Kodak - Financial AnalysisDocument5 pagesKodak - Financial Analysismcruz18No ratings yet

- Netscape's Initial Public OfferingDocument9 pagesNetscape's Initial Public OfferingRasheeq Rayhan100% (1)

- Buscom Quiz: Book Value Fair ValueDocument2 pagesBuscom Quiz: Book Value Fair ValueNairah M. TambieNo ratings yet

- Financial Modeling Course Outline - 16-17Document3 pagesFinancial Modeling Course Outline - 16-17Stella KazanciNo ratings yet