Professional Documents

Culture Documents

04-01 - Financial Analysis (Dragged) 20

Uploaded by

Salsabila Aufa0 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

04-01 - Financial Analysis (dragged) 20

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pages04-01 - Financial Analysis (Dragged) 20

Uploaded by

Salsabila AufaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

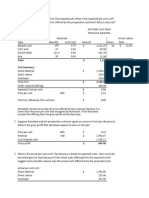

Total Asset Turnover Ratio

• Total Asset Turnover Ratio represents the

amount of sales generated per dollar invested in

the firm s assets.

Total Assets Sales $2, 700 million

= = = 1.37 times

Turnover Total Assets $1, 971 million

Peer-group total asset turnover = 1.15 times

Fixed Asset Turnover Ratio

• Fixed asset turnover ratio measures firm s

efficiency in utilizing its fixed assets (such as

property, plant and equipment).

Fixed Asset Sales $2, 700 million

= = = 2.03 times

Turnover Net Plant and Equipment $1, 327 million

Peer-group fixed asset turnover = 1.75 times

Asset Management Efficiency Ratios:

Summary

The following grid summarizes the efficiency of

Boswell s management in utilizing its assets to

generate sales. Overall, the managers utilized the

firm s total investment in assets efficiently.

Asset Utilization Efficiency Boswell Peer Group Assessment

Total asset turnover 1.37 1.15 Good

Fixed asset turnover 2.03 1.75 Good

Receivables turnover 16.67 14.60 Good

Inventory turnover 5.36 7.0 Poor

You might also like

- Finance Management Group ActivityDocument22 pagesFinance Management Group ActivityHarsh SrivastavaNo ratings yet

- 2.3.2 Financial Ratios and Their Interpretation Table 2.3: Different Financial Ratios SL - No. Category Types of Ratio InterpretationDocument8 pages2.3.2 Financial Ratios and Their Interpretation Table 2.3: Different Financial Ratios SL - No. Category Types of Ratio InterpretationAnkur AroraNo ratings yet

- Pertemuan 2 The Concepts of Sales and ExpensesDocument24 pagesPertemuan 2 The Concepts of Sales and ExpensesSofyan AliNo ratings yet

- Evaluating A Firm's Financial Performance (Ratio Analysis)Document64 pagesEvaluating A Firm's Financial Performance (Ratio Analysis)numlit1984No ratings yet

- Chapter02 1Document43 pagesChapter02 1Hazel HizoleNo ratings yet

- Operational Efficiency RatioDocument8 pagesOperational Efficiency RatioJohnpert ToledoNo ratings yet

- Purpose of Understanding Financial AnalysisDocument5 pagesPurpose of Understanding Financial AnalysisMaya SariNo ratings yet

- Finance BBS3rd (Autosaved) 12Document29 pagesFinance BBS3rd (Autosaved) 12Ramesh GyawaliNo ratings yet

- Unit - 6 محاسبه اداريهDocument47 pagesUnit - 6 محاسبه اداريهsuperstreem.9No ratings yet

- Financial Statements A ND AnalysisDocument43 pagesFinancial Statements A ND AnalysisJMNo ratings yet

- Financial Ratios FormulaDocument4 pagesFinancial Ratios FormulaKamlesh SinghNo ratings yet

- Ms & Oracle Project Ex DDocument53 pagesMs & Oracle Project Ex DA.D. Home TutorsNo ratings yet

- Business Ratios For AssessmentDocument6 pagesBusiness Ratios For AssessmentLan Phương ĐặngNo ratings yet

- Note Taking - Corporate Finacial Statement AnalysisDocument4 pagesNote Taking - Corporate Finacial Statement AnalysisTrần Thiện Ngọc ĐàiNo ratings yet

- Chapter 3Document8 pagesChapter 3NHƯ NGUYỄN LÂM TÂMNo ratings yet

- Creating A Successful Financial Plan Chapter 11Document39 pagesCreating A Successful Financial Plan Chapter 11Taseen AhmeedNo ratings yet

- Accounting Principles: Second Canadian EditionDocument36 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Formula Sheet - Finance - VTDocument11 pagesFormula Sheet - Finance - VTmariaajudamariaNo ratings yet

- Topic 13 Financial Statement AnalysisDocument32 pagesTopic 13 Financial Statement AnalysisAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- BA 569 Financial RatiosDocument7 pagesBA 569 Financial RatiosMariaNo ratings yet

- Calculative & Dis Aggregating ROA and ROCEDocument12 pagesCalculative & Dis Aggregating ROA and ROCEShefali MalikNo ratings yet

- Midterm II-1Document46 pagesMidterm II-1Josh MagatNo ratings yet

- Ra 3Document38 pagesRa 3Mikx LeeNo ratings yet

- Chapter 3 - Analysis of Financial StatementsDocument9 pagesChapter 3 - Analysis of Financial StatementsJean EliaNo ratings yet

- Bank Ratio Analysis v.2Document30 pagesBank Ratio Analysis v.2moe.jee6173100% (1)

- Ratio AnalysisDocument46 pagesRatio AnalysisPsyonaNo ratings yet

- Financial Statement AnalysisDocument38 pagesFinancial Statement AnalysisRoyal HikariNo ratings yet

- CMA CH 5 - Responsibility Centers and Performance Measurement March 2019-1Document39 pagesCMA CH 5 - Responsibility Centers and Performance Measurement March 2019-1Henok FikaduNo ratings yet

- Pusat Prtanggung Jawaban Dan Transfer PricingDocument40 pagesPusat Prtanggung Jawaban Dan Transfer PricingmayaNo ratings yet

- Analysis of Financial Statements: Stice - Stice - SkousenDocument52 pagesAnalysis of Financial Statements: Stice - Stice - SkousenmeshNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Financial Statement Analysis: LECTURE 16 & 17Document23 pagesFinancial Statement Analysis: LECTURE 16 & 17Tasim IshraqueNo ratings yet

- Asset TurnoverDocument1 pageAsset TurnoverNic KnightNo ratings yet

- Ratio Analysis: An IntroductionDocument79 pagesRatio Analysis: An IntroductionSurjo Bhowmick100% (1)

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- Liquidity RatioDocument3 pagesLiquidity RatioMusfequr Rahman (191051015)No ratings yet

- Accounting For ManagersDocument14 pagesAccounting For ManagersHimanshu Upadhyay AIOA, NoidaNo ratings yet

- Accounting & Control: Cost ManagementDocument40 pagesAccounting & Control: Cost ManagementMeriskaNo ratings yet

- Accounting & Control: Cost ManagementDocument40 pagesAccounting & Control: Cost ManagementBusiness MatterNo ratings yet

- Ratio AnalysisDocument13 pagesRatio Analysismuralib4u5No ratings yet

- Ratio Analysis OF: Maruti Suzuki India LimitedDocument13 pagesRatio Analysis OF: Maruti Suzuki India LimitedcoolestguyisgauravNo ratings yet

- Halaman 57 Khotari 2Document7 pagesHalaman 57 Khotari 2Kori NofiantiNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisuaenaNo ratings yet

- Financial Management, Lecture 2, 3 & 4Document32 pagesFinancial Management, Lecture 2, 3 & 4Muhammad ImranNo ratings yet

- 04-01 - Financial Analysis (Dragged) 23Document3 pages04-01 - Financial Analysis (Dragged) 23Salsabila AufaNo ratings yet

- Accounting PrinciplesDocument36 pagesAccounting PrinciplesPrisca ApriliaNo ratings yet

- Ratio Analysis DuPont AnalysisDocument7 pagesRatio Analysis DuPont Analysisshiv0308No ratings yet

- HO 4 Analisis Laporan KeuanganDocument44 pagesHO 4 Analisis Laporan KeuanganChintiaNo ratings yet

- Chapter 8 ProfitabilityDocument90 pagesChapter 8 ProfitabilityAudra Joy San JuanNo ratings yet

- RATIO ANALYSIS Fall 2020 OctDocument7 pagesRATIO ANALYSIS Fall 2020 Octwafa aljuaidNo ratings yet

- Ratio AnalysisDocument31 pagesRatio AnalysisUnique YouNo ratings yet

- Analysis of Financial Statements: Made Gitanadya, Se., MSMDocument18 pagesAnalysis of Financial Statements: Made Gitanadya, Se., MSMLilia LiaNo ratings yet

- Financial Statements and Ratio AnalysisDocument9 pagesFinancial Statements and Ratio AnalysisRabie HarounNo ratings yet

- SOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateDocument2 pagesSOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateRahul KapurNo ratings yet

- Chapter 2 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallDocument47 pagesChapter 2 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallNur SyakirahNo ratings yet

- Garrison Lecture Chapter 11Document57 pagesGarrison Lecture Chapter 11sofikhdyNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- 06 - Time Value of Money - 2Document77 pages06 - Time Value of Money - 2Salsabila AufaNo ratings yet

- Black and Red Geometric Technology Keynote PresentationDocument15 pagesBlack and Red Geometric Technology Keynote PresentationSalsabila AufaNo ratings yet

- 07-01 - An Introduction To Risk and ReturnDocument69 pages07-01 - An Introduction To Risk and ReturnSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 26Document3 pages04-01 - Financial Analysis (Dragged) 26Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 31Document3 pages04-01 - Financial Analysis (Dragged) 31Salsabila AufaNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 8Document3 pages04-01 - Financial Analysis (Dragged) 8Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 11Document6 pages04-01 - Financial Analysis (Dragged) 11Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 19Document3 pages04-01 - Financial Analysis (Dragged) 19Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 15Document3 pages04-01 - Financial Analysis (Dragged) 15Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 4Document3 pages04-01 - Financial Analysis (Dragged) 4Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 18Document3 pages04-01 - Financial Analysis (Dragged) 18Salsabila AufaNo ratings yet

- 04-01 - Financial AnalysisDocument98 pages04-01 - Financial AnalysisSalsabila AufaNo ratings yet

- Latihan UAS Soal 01Document3 pagesLatihan UAS Soal 01Salsabila AufaNo ratings yet

- Assignment Week 1 - CHDocument2 pagesAssignment Week 1 - CHSalsabila AufaNo ratings yet

- Assignment HM5.34 - CHDocument3 pagesAssignment HM5.34 - CHSalsabila AufaNo ratings yet

- Ass 10 03BDocument1 pageAss 10 03BSalsabila AufaNo ratings yet