Professional Documents

Culture Documents

FR 1 Assignment 2 IAS2 05112023 120932am

Uploaded by

AnasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FR 1 Assignment 2 IAS2 05112023 120932am

Uploaded by

AnasCopyright:

Available Formats

BUK – BS (A&F)

Financial reporting 1

Assignement 2

Question 1:

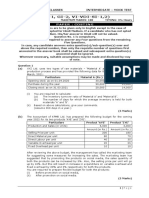

Kidz Party & Co. (KPC) manufactures and sells toys. Following information is available regarding four of its

inventory items as on 31 December 2017:

Items Units Cost per Normal

unit selling price

(Rs.) per unit (Rs.)

Toy cars 10,000 1,250 1,200

Doll houses 5,000 1,800 2,700

Stuffed toys 1,850 1,200 1,900

Minion costumes 870 1,500 2,500

Following information is also available:

(i) A sales order for 3,000 toy cars @ Rs. 1,100 per unit is in hand. The remaining units can be sold at normal

selling price after incurring selling cost of Rs. 150 per unit.

(ii) Doll houses include 1,000 defective units with no scrap value. 20% of the remaining doll houses are

damaged and can be sold at 50% of cost.

(iii) Stuffed toys costing Rs. 420,000 were accidentally damaged and are beyond repair. KPC plans to sell these

toys as scrap. Proceeds from such sale are estimated at Rs. 175,000 and the sale would require

transportation cost of Rs. 6,300.

(iv) All minion costumes have manufacturing faults and can be sold in present condition at Rs. 1,350 per unit.

However, 60% of the units can be rectified at a cost of Rs. 200 per unit after which they can be sold at Rs.

1,600 per unit.

Required:

Calculate the amount at which above inventory items should be carried as on 31 December 2017 in accordance

with IAS 2 ‘Inventories’.

Question 2:

Hammad Limited (HL) imports and supplies three products, Alpha, Gamma and Beta. The opening balances and

transactions for the month of June 2014 are as follows:

Units purchased during Units Sold during the

Opening balance the month month

Items

Invoice value

Qty. Value (Rs.) Qty. Qty. Value (Rs.)

(Rs.)

Alpha 20 60,000 360 920,000 350 1,820,000

Gamma 100 4,800,000 50 2,375,000 70 4,060,000

Beta 30 120,000 490 1,820,000 400 1,640,000

The following information is also available:

i. HL’s bank charges a commission of 0.5% of invoice value for opening the letter of credit.

ii. Import taxes and duties were 23% of the invoice value out of which 40% are refundable/adjustable.

iii. The transportation charges are Rs. 1,500 per trip. 20 units of Alpha, 2 units of Gamma or 15 units of Beta

can be transported in each trip.

iv. All goods are repacked after import. The cost of packing per unit was Rs. 300, Rs. 1,500 and 700

respectively.

v. HL values its stock on first-in, first-out basis.

vi. Average selling costs per unit are Rs. 700, Rs. 1,500 and Rs. 400 respectively.

Required:Compute the value of stock of each product as at 30 June 2014 in accordance with IAS-2 ‘Inventories’.

You might also like

- Ias 40 and Ias 2Document5 pagesIas 40 and Ias 2tmpvd6gw8fNo ratings yet

- IAS 2 Inventory ValuationDocument4 pagesIAS 2 Inventory ValuationSultanNo ratings yet

- CFR Inventories Practice QuestionsDocument3 pagesCFR Inventories Practice Questionstee50% (2)

- Inventory valuation methods and calculationsDocument31 pagesInventory valuation methods and calculationsNela Nafaza100% (1)

- 3.1 CVP QuestionsDocument5 pages3.1 CVP QuestionsKillerNo ratings yet

- PA (Test 2)Document6 pagesPA (Test 2)ANH PHẠM QUỲNHNo ratings yet

- 8.2 Test 2a Revision Questions Part 1 - CVP and Standard CostDocument4 pages8.2 Test 2a Revision Questions Part 1 - CVP and Standard Costđặng nguyệt minhNo ratings yet

- Unit 6-Marginal costingDocument3 pagesUnit 6-Marginal costingkevin75108No ratings yet

- Bài tập inventoryDocument6 pagesBài tập inventoryHoàng Bảo TrâmNo ratings yet

- Questions - Financial AccountingDocument9 pagesQuestions - Financial AccountingMariamNo ratings yet

- As - Inventory Valuation - Fifo - AvcoDocument4 pagesAs - Inventory Valuation - Fifo - AvcoMUSTHARI KHANNo ratings yet

- CVP Practice QuestionsDocument4 pagesCVP Practice QuestionsJahanzaib ButtNo ratings yet

- Budgetary Control Test QuestionsDocument4 pagesBudgetary Control Test QuestionsMehul GuptaNo ratings yet

- Akuntansi Manajemen Asistensi 11 (Decision Making and Relevant Information)Document3 pagesAkuntansi Manajemen Asistensi 11 (Decision Making and Relevant Information)Dian Nur IlmiNo ratings yet

- Inventories Comprehensive ExerciseDocument4 pagesInventories Comprehensive ExerciseBryan FloresNo ratings yet

- Assignment ProblemsDocument5 pagesAssignment ProblemsRamesh SigdelNo ratings yet

- End Term Exam Managerial Cost Accounting Part BDocument16 pagesEnd Term Exam Managerial Cost Accounting Part Bguru balajiNo ratings yet

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- II Internal Test - Accounting For Management - Important QuestionsDocument3 pagesII Internal Test - Accounting For Management - Important QuestionsSTARBOYNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Budgeting Tute 2Document4 pagesBudgeting Tute 2Maithri Vidana KariyakaranageNo ratings yet

- Quiz Management Accounting - VIDocument31 pagesQuiz Management Accounting - VILav SharmaNo ratings yet

- DPM 205 Financial Management AssignmentDocument2 pagesDPM 205 Financial Management Assignmentmulenga lubembaNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Master Budget Cash Flow ProjectionsDocument9 pagesMaster Budget Cash Flow Projections신두No ratings yet

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNo ratings yet

- Inventory Valuation - Review Questions (2022)Document4 pagesInventory Valuation - Review Questions (2022)jaturaNo ratings yet

- Lecture 4 - Practice QuestionDocument8 pagesLecture 4 - Practice QuestionBhunesh KumarNo ratings yet

- Best Company records data cost analysis problemsDocument2 pagesBest Company records data cost analysis problemsJenine Quiambao100% (1)

- Group Work - Inventory Cost Flow and LCNRVDocument2 pagesGroup Work - Inventory Cost Flow and LCNRVKawhileonard LeonardNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Business Finance 2Document10 pagesBusiness Finance 2acegutierrezNo ratings yet

- Diwalich - 5 Business Arithmetic Board 1Document5 pagesDiwalich - 5 Business Arithmetic Board 1Zaid miyaNo ratings yet

- BUDGETINGDocument7 pagesBUDGETINGuma selvarajNo ratings yet

- 10 Questions Inventories 3Document2 pages10 Questions Inventories 3bernadeth.lorzanoNo ratings yet

- Best Company Records Costing Problems SolutionsDocument2 pagesBest Company Records Costing Problems SolutionsFerb CruzadaNo ratings yet

- Practice Transfer Pricing ExamplesDocument4 pagesPractice Transfer Pricing ExamplesHashmi Sutariya100% (1)

- Far Quiz 4Document6 pagesFar Quiz 4Shiela Jane CrismundoNo ratings yet

- MCS Additional InputsDocument6 pagesMCS Additional InputsHarshit AnandNo ratings yet

- Marginal Costing Numericals PDFDocument7 pagesMarginal Costing Numericals PDFSubham PalNo ratings yet

- 123consignment LogicalDocument19 pages123consignment LogicalkamalkavNo ratings yet

- Asistensi 2Document2 pagesAsistensi 2CatherineNo ratings yet

- Required: Prepare A Variable-Costing Income Statement For The Same PeriodDocument2 pagesRequired: Prepare A Variable-Costing Income Statement For The Same PeriodFarjana AkterNo ratings yet

- InventoriesDocument7 pagesInventoriesDenisse Leigh100% (1)

- IAS2 (Inventory) - QuestionsDocument4 pagesIAS2 (Inventory) - QuestionsKhurram Sheraz86% (7)

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- MITTAL COMMERCE CLASSES MOCK TEST COSTINGDocument5 pagesMITTAL COMMERCE CLASSES MOCK TEST COSTINGPlanet ZoomNo ratings yet

- Review Questions Break Even Analysis, Costing Calculations & BudgetingDocument9 pagesReview Questions Break Even Analysis, Costing Calculations & BudgetingrkailashinieNo ratings yet

- MID Term ExamDocument2 pagesMID Term ExamDAN NGUYEN THENo ratings yet

- Addtl Budgeting Problems Aug 22Document2 pagesAddtl Budgeting Problems Aug 22MedhaNo ratings yet

- Tally Inventory Sum 3Document9 pagesTally Inventory Sum 3suresh kumar10No ratings yet

- PRELEC1 Exercise Worksheet Unit 01Document3 pagesPRELEC1 Exercise Worksheet Unit 01Ann Diane Renz DongsalNo ratings yet

- (Backup) (Backup) FA1 Revision 2019Document32 pages(Backup) (Backup) FA1 Revision 2019Hiền nguyễn thuNo ratings yet

- Inventory Valuation - Additional Question Set: QuestionsDocument3 pagesInventory Valuation - Additional Question Set: QuestionsDheeraj singhNo ratings yet

- Caf 5 Far-IDocument5 pagesCaf 5 Far-IYahyaNo ratings yet

- Certificate in Accounting and Finance Stage Examination: Inventory Valuation and Cash FlowsDocument86 pagesCertificate in Accounting and Finance Stage Examination: Inventory Valuation and Cash FlowsS Usama S75% (8)

- 13 - IND AS 41 - Agriculture (R)Document14 pages13 - IND AS 41 - Agriculture (R)S Bharhath kumarNo ratings yet

- Cost Accounting Test 2Document3 pagesCost Accounting Test 2Faizan Sir's TutorialsNo ratings yet