Professional Documents

Culture Documents

UNDP Tourism Poster - A4 - v20220812 - v3

Uploaded by

Odeta LenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UNDP Tourism Poster - A4 - v20220812 - v3

Uploaded by

Odeta LenaCopyright:

Available Formats

TOURISM & HOSPITALITY PULSE

Albania, July 2022

est. 7.3 million est. 3 billion € est. 250.000 jobs

expected foreign visitors total contribution to the Albanian full time equivalent jobs

for 2022, + 18% vs. 2019 economy, +15% vs. 2019 supported

EVOLUTION OF INTERNATIONAL ARRIVALS RECOVERY 2022: the year of recovery

(MoM % change vs. 2019)

Inbound - Internationals Outbound Albanians

100%

60% 51% +20% -2%

Inbound foreigners Outbound domestics

20% (Jan-Jun ‘22 vs.2019) (Jan-Jun ‘22 vs.2019)

9%

-8%

-20%

-2% -7% In 2021 400 million € remained in the

-12%

-60% -36% -41% country, because 1.8 ml Albanians did not

-…

travel internationally, as they did in 2019

-100%

Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun Sep Dec

2020 2021 2022

Fastest growing markets Jan-Jun ‘22 vs ‘19 80% Total

spending

20%

Netherlands +65% Foreigners Domestics

25,321 | Market share 1% Ukraine -5% Source: WTTC Albania, March 2022

11,502 | Share 0.5%

Kosovo +59%

Russia -25%

969,547 | Market share 38% 10,401 | Share 0.4%

Poland +1%

est.70% of all internationals are

Serbia +35%

39,778 | Market share 1.6%

39,455 | Share 1.6%

Albanians or of Albanian heritage

T

Czechia +36%

UK +34% 10,715 | Share 0.4%

Others* +4%

62,362 | Market share 2.4%

8,790 | Share 0.3% Top 5 markets

Italy +24% *Belarus, Latvia, Lithuania,

Estonia, Moldavia

198,031 | Market share 8%)

War affected

Germany +24% markets

73,636 | Market share 3%

38% 11% 8% 8% 8%

Kosovo N. Macedonia Montenegro Italy Greece

+48% passengers (vs.2019)

Legend above 2019 below 2019 Air transport | Share 20%

Visitors as % change from 2019 Non-Residents

Residents

120% enabling the recovery

80% 90%

71% Wizzair alone offers 41 routes in

40% 39%

28% 14 countries from Tirana airport

0%

-19%

-40%

-80% -69% Room Lower occupancy rate

Occupancy rate

-120% Despite the increase in the number of visitors,

Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar Jun

2020 2021 2022

occupancy rates have not yet recovered!

Source: INSTAT, 2022, Accomodation Survey data

TOURISM & HOSPITALITY PULSE

Albania, July 2022

2,200 Hotels 55,000 rooms 120,000 beds

Online booking platform estimated capacity estimated capacity

Source: www.booking.com as of June 2022 (Hotels and Guesthouses only as by booking.com filter)

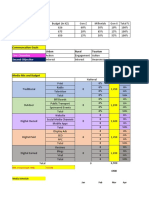

Hotel survey: On July 13 -27,2022 a survey with 217 hotels was conducted in six major touristic destinations

Durres Shkoder Vlore Berat Pogradec As of July 2022, hotels

Tirana

Kavaja Lezhe Sarande Gjirokast. Korce

perceive the current

# of hotels surveyed 31 40 71 23 28 24 season to be worse than

Avg # of Rooms 44 44 24 12 23 45 2019 & 2021 in terms of

bookings!

Price/Room 63€ 51€ 75€ 36€ 43€ 58€

This might be due to:

Occupancy rates (May) 30.4 28.2 30.6 51.2 32.3 67.7 • Increase in the number

Occupancy rates (June) 46.3 45.0 46.0 63.1 42.3 67.9 of Airbnb offer

% of seasonal staff 41% 73% 60% 43% 30% 3% • Reduced spending due

to inflation

% of foreign guests 74% 62% 69% 73% 38% 82%

• Shorter trips because of

% net better-worse* -13% -45% -37% -9% -36% +21% inflation and cheap air

* Net difference between hotels stating 2022 is

better than 2019 and those stating it is worse fares

Compared to 2019, based on reservations how

Note: To be investigated in Sept.’22

do you see this season through a survey with hotels (2nd

wave), survey with Albanian

Airbnb apartments households and focus groups

(% change Q2 ‘22 vs Q2 ’19)

Durres county Hotels' future

+61%(1,297) expectations

50% 12% 24% 12% However, when asked on

Tirana (city) Worse Equal Better Don’t know mid-term expectations,

+79% (2,382) hotels showed optimism!

Vlore county Hotels’ expectations in the upcoming three years

+56%(5,694)

Saranda (city) 65% 29% 63%

+44% (2,283) think foreign think domestic tourists think hotel prices

Source: AirDNA.com tourists will increase will increase will increase

Hotels’ perspective

Gov. policies with impact How can the government support?

Reduction of VAT to 6% 66%

Visa Free Program 39%

Increase in the number of flights 31%

Urban Renaissance 23%

Removal of property tax 21%

55% 53% 43% 40% 33%

Promotion Tax Financial Electricity Salary

T

Creation of new airports 17%

None of the above of Albania reduction aid subsidy subsidy

12%

packages

Top 3 challenges Top incentives

Finding and Retaining Staff 56% | Better infrastructure

❶ 55%

54% | Maintaining a good quality of service

Rising Prices

❷ 47% 75% 33% | Cultural/musical activities/festivals

Global changes (Covid, war, etc) need 35% more

❸ 42%

employees 29% | Airport near destination

You might also like

- 4-Cylinder Diesel Engine (2 0 L Engine Common Rail Generation II)Document366 pages4-Cylinder Diesel Engine (2 0 L Engine Common Rail Generation II)closca100% (1)

- By The People: A History of The United StatesDocument36 pagesBy The People: A History of The United StatesAlan DukeNo ratings yet

- 31.29.60.31-Special Purpose Steam TurbineDocument29 pages31.29.60.31-Special Purpose Steam Turbinemansih457No ratings yet

- Vietnam Market Insight: Q4 2019 in VNDDocument16 pagesVietnam Market Insight: Q4 2019 in VNDTuan Nguyen100% (1)

- Roman V GrimaltDocument2 pagesRoman V GrimaltClarence ProtacioNo ratings yet

- Republic Vs de Guzman - DEL ROSARIODocument1 pageRepublic Vs de Guzman - DEL ROSARIOJohn L.No ratings yet

- Results Presentation June 2022Document54 pagesResults Presentation June 2022Karim DehakNo ratings yet

- Africa Day Presentation VDefDocument30 pagesAfrica Day Presentation VDefBernard BiboumNo ratings yet

- GL Bal: Rising Prices Inflate International TradeDocument11 pagesGL Bal: Rising Prices Inflate International TradeBekele Guta GemeneNo ratings yet

- Agri Statistical Factsheet Eu enDocument23 pagesAgri Statistical Factsheet Eu enJovanaNo ratings yet

- Slide 8 BackupDocument11 pagesSlide 8 Backupruchi gulatiNo ratings yet

- Zalando SE - CMD 2021 - Financial Deep DiveDocument16 pagesZalando SE - CMD 2021 - Financial Deep DivehaoNo ratings yet

- Impact of Covid-19 On MigrantsDocument18 pagesImpact of Covid-19 On MigrantssanjithNo ratings yet

- ItaliaDocument2 pagesItaliaFloricaNo ratings yet

- DIGITAL Update MFB Jan 2020 Final PDFDocument7 pagesDIGITAL Update MFB Jan 2020 Final PDFDiana CaducencoNo ratings yet

- ORWE 2Q 2022 Earnings ReleaseDocument12 pagesORWE 2Q 2022 Earnings ReleaseYousif Zaki 3No ratings yet

- Performance Review: First-Quarter 2022Document12 pagesPerformance Review: First-Quarter 2022ZerohedgeNo ratings yet

- DIBOOS Animation Day PIXELATL 2022Document34 pagesDIBOOS Animation Day PIXELATL 2022Jose Luis Farias GomezNo ratings yet

- Pakistan Trade Profile 2020Document2 pagesPakistan Trade Profile 2020Rizal KhalidNo ratings yet

- 71 20220613154537 Belgium2022 - 1 PDFDocument2 pages71 20220613154537 Belgium2022 - 1 PDFRaluca-Esmeralda OrbanNo ratings yet

- COVID-19 - A Global Insight On Travel and Tourism Impacts UNWTO Data PartnersDocument31 pagesCOVID-19 - A Global Insight On Travel and Tourism Impacts UNWTO Data PartnersIvka Shiva MaťašovskáNo ratings yet

- Horlogerie Mondiale 2021 enDocument7 pagesHorlogerie Mondiale 2021 envarunjain0392No ratings yet

- Seychelles: Merchandise TradeDocument2 pagesSeychelles: Merchandise TradestevenNo ratings yet

- Report For 4M.2020Document7 pagesReport For 4M.2020Lao Quoc BuuNo ratings yet

- GPIP Green Industrial ParksDocument26 pagesGPIP Green Industrial ParksAlex LiuNo ratings yet

- Nazara IM - Spark CapitalDocument27 pagesNazara IM - Spark CapitalBBNo ratings yet

- Inditex Finance Report 2020Document18 pagesInditex Finance Report 2020david juNo ratings yet

- bdf236-4 en Travel in 2020 VfinaleDocument13 pagesbdf236-4 en Travel in 2020 VfinaleRichard JonesNo ratings yet

- Philippines Trade Profile 2020Document2 pagesPhilippines Trade Profile 2020Rizal KhalidNo ratings yet

- 64 20220613154344 Austria2022 - 1Document2 pages64 20220613154344 Austria2022 - 1Raluca-Esmeralda OrbanNo ratings yet

- Mgt-201 Assignment International Trade, Trends in World Trade and Overview of India'S TradeDocument21 pagesMgt-201 Assignment International Trade, Trends in World Trade and Overview of India'S TradeGable kaura L-2020 -A-16-BIVNo ratings yet

- MEM June 2020 - PPT - 2Document21 pagesMEM June 2020 - PPT - 2Kyaw SithuNo ratings yet

- 96 20220613155343 Croatia2022 PDFDocument2 pages96 20220613155343 Croatia2022 PDFRaluca-Esmeralda OrbanNo ratings yet

- GDP 2020 Q1Document34 pagesGDP 2020 Q1Primedia BroadcastingNo ratings yet

- Horlogerie Mondiale 2022 enDocument7 pagesHorlogerie Mondiale 2022 envarunjain0392No ratings yet

- Sri Lanka Trade Profile 2020Document2 pagesSri Lanka Trade Profile 2020Rizal KhalidNo ratings yet

- Contribution of Agriculture, Industries and Service Sectorto GDP in BangladeshDocument6 pagesContribution of Agriculture, Industries and Service Sectorto GDP in BangladeshlimonextremeNo ratings yet

- Zimbabwe: 2020 Annual Research: Key HighlightsDocument1 pageZimbabwe: 2020 Annual Research: Key HighlightsLisani DubeNo ratings yet

- Cimigo Vietnams Economic Outlook 2022 01 03 22 B3emriDocument19 pagesCimigo Vietnams Economic Outlook 2022 01 03 22 B3emriHoang Nguyen MinhNo ratings yet

- Study Id25745 Cyprus-Statista-DossierDocument91 pagesStudy Id25745 Cyprus-Statista-DossierBobNo ratings yet

- Orange Financial Results: 16 February 2023Document30 pagesOrange Financial Results: 16 February 2023Umar MasaudNo ratings yet

- Philippines: 2020 Annual Research: Key HighlightsDocument1 pagePhilippines: 2020 Annual Research: Key HighlightsDeer ViianNo ratings yet

- Zimbabwe: 2022 Annual Research: Key HighlightsDocument2 pagesZimbabwe: 2022 Annual Research: Key HighlightsRopafadzo MashingaidzeNo ratings yet

- 131 20220613162338 Indonesia2022 PDFDocument2 pages131 20220613162338 Indonesia2022 PDFTempat DataNo ratings yet

- Quang Ninh Research Report 2020Document26 pagesQuang Ninh Research Report 2020Architecte UrbanisteNo ratings yet

- Individual Assignment 4Document8 pagesIndividual Assignment 4vuongquynh1603No ratings yet

- Year 5Document12 pagesYear 5madhavi kherNo ratings yet

- MacroeconomicSituationReport2ndFY2021 22 PDFDocument24 pagesMacroeconomicSituationReport2ndFY2021 22 PDFsha ve3No ratings yet

- Estadisticas Costade MarfilDocument2 pagesEstadisticas Costade MarfilIbai Gonzalez GomezNo ratings yet

- 2020 Financial Performance: Volume (Equivalent Units) Operating Profit Earnings Per Share (Eps)Document2 pages2020 Financial Performance: Volume (Equivalent Units) Operating Profit Earnings Per Share (Eps)eleazarNo ratings yet

- CBRE Forum Q2 2020 - HCMC - ENDocument56 pagesCBRE Forum Q2 2020 - HCMC - ENLê HòaNo ratings yet

- International Trade Report Executive Summary Ultimo PeriodoDocument18 pagesInternational Trade Report Executive Summary Ultimo PeriodotijaNo ratings yet

- Economic Report 5Document19 pagesEconomic Report 5Khoirunisa WulandariNo ratings yet

- Morocco: 2022 Annual Research: Key HighlightsDocument2 pagesMorocco: 2022 Annual Research: Key HighlightsJohn WayneNo ratings yet

- Aviation Connects and Unites Us!: Airbus Global Market Forecast 2021 - 2040Document23 pagesAviation Connects and Unites Us!: Airbus Global Market Forecast 2021 - 2040Samy P.GNo ratings yet

- DC National Tourism Indicators Report - Q2 2021 - ENDocument7 pagesDC National Tourism Indicators Report - Q2 2021 - ENゼンダー・No ratings yet

- ColombiaDocument2 pagesColombiajuanfranc_66No ratings yet

- 2021-01 - International Trade Report (Executive Summary)Document13 pages2021-01 - International Trade Report (Executive Summary)UMİDA JorayevaNo ratings yet

- LVMH q3 2022Document28 pagesLVMH q3 2022Damilola OdeyemiNo ratings yet

- Air Passenger Forecast - IATADocument17 pagesAir Passenger Forecast - IATAumeshnihalaniNo ratings yet

- ICAO Coronavirus Econ Impact PDFDocument110 pagesICAO Coronavirus Econ Impact PDFGreat WishNo ratings yet

- Lao People's Democratic RepublicDocument2 pagesLao People's Democratic RepublicMR JOHNNY SENGPHACHANNo ratings yet

- General Profile ArubaDocument3 pagesGeneral Profile ArubacayspepeNo ratings yet

- Study - Id11578 - Electric Vehicles Statista DossierDocument68 pagesStudy - Id11578 - Electric Vehicles Statista DossierAksa DindeNo ratings yet

- Cambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapFrom EverandCambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapNo ratings yet

- Lepsl 580 Design Systems For Conflict PreventionDocument4 pagesLepsl 580 Design Systems For Conflict Preventionapi-462898831No ratings yet

- A Comparative Analysis of Life InsuranceDocument41 pagesA Comparative Analysis of Life InsuranceDibyaRanjanBeheraNo ratings yet

- DVS P DL FAQ ChangesGDTLDocument2 pagesDVS P DL FAQ ChangesGDTLTemplateGMZNo ratings yet

- G.R. No. 180245 Case DigestDocument3 pagesG.R. No. 180245 Case DigestMaricel SorianoNo ratings yet

- Application Format For Research Fellow & Research Assistant-2023-TNSJADocument6 pagesApplication Format For Research Fellow & Research Assistant-2023-TNSJAAnnai SagayamNo ratings yet

- Law Society and Others V KordowskiDocument37 pagesLaw Society and Others V KordowskiTarik ProlazNo ratings yet

- CommunismDocument5 pagesCommunismallan_alanaNo ratings yet

- 5 Safety Health ResourcesDocument1 page5 Safety Health ResourcesJojolasNo ratings yet

- SSpolicyDocument3 pagesSSpolicysam999pandaNo ratings yet

- City Limits Magazine, May 2003 IssueDocument52 pagesCity Limits Magazine, May 2003 IssueCity Limits (New York)No ratings yet

- The Central Bank of Ireland Cover-Up - Eamonn Blaneys WebsiteDocument4 pagesThe Central Bank of Ireland Cover-Up - Eamonn Blaneys WebsiteRita CahillNo ratings yet

- Grilles & RegistersDocument19 pagesGrilles & RegistersBelal AlrwadiehNo ratings yet

- F-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Document4 pagesF-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Immigrant & Refugee Appellate Center, LLC100% (1)

- Bài kiểm tra tự luận Lợi nhuận mỗi cổ phiếu - Xem lại bài làmDocument8 pagesBài kiểm tra tự luận Lợi nhuận mỗi cổ phiếu - Xem lại bài làmAh TuanNo ratings yet

- Termination, Drugs and AWOLDocument7 pagesTermination, Drugs and AWOLKupidz_stupid8457No ratings yet

- Appresponse Xpert Administrator Guide.9.0.3.712 00195 02 - Rev 2 PDFDocument216 pagesAppresponse Xpert Administrator Guide.9.0.3.712 00195 02 - Rev 2 PDFEdwin Manolo Mendez SNo ratings yet

- English: Quarter 1 - Module 4 Predicting Possible EndingDocument15 pagesEnglish: Quarter 1 - Module 4 Predicting Possible EndingMichael Jorge BernalesNo ratings yet

- Khalistan MovementDocument18 pagesKhalistan MovementVaibhavvashishtNo ratings yet

- Islamic Personal Law-Ii Gift or Hiba: Ghulam Mujtaba MalikDocument9 pagesIslamic Personal Law-Ii Gift or Hiba: Ghulam Mujtaba MalikJarar AleeNo ratings yet

- Export Management: Difficulties in Export Trade - Fishing in Turbulent WatersDocument2 pagesExport Management: Difficulties in Export Trade - Fishing in Turbulent WatersVIJAYADARSHINI VIDJEANNo ratings yet

- MDCG 2021-5: Medical DevicesDocument18 pagesMDCG 2021-5: Medical DevicesValentin C.No ratings yet

- Editto Di Rotari in Inglese (Da Studiare)Document1 pageEditto Di Rotari in Inglese (Da Studiare)Hilary TaboniNo ratings yet

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- Work of Investment Banking (Repaired)Document12 pagesWork of Investment Banking (Repaired)Shivani Singh ChandelNo ratings yet

- XI MT 1 ICT ResponsesDocument72 pagesXI MT 1 ICT ResponsesMahin AzizNo ratings yet