Professional Documents

Culture Documents

Residential Status

Uploaded by

Anjali Krishna SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Residential Status

Uploaded by

Anjali Krishna SCopyright:

Available Formats

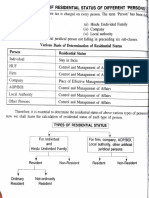

RESIDENTIAL STATUS

For the purpose of taxation, it is residence which is important than citizenship.

Residential status is determined based on previous year.

In the case of individuals and Hindu Undivided Family (HUF), there are 3 types of

residential status:

Resident and ordinarily resident.

Resident but not ordinarily resident

Nonresident.

In case of all other assessees (partnership firm, company, association of persons, local

authority, juridical person, there are 2 types of residential status:

Resident

Non resident.

RESIDENT AND ORDINARILY RESIDENT. SECTION 6(1)

OR

365 DAYS IN TOTAL IN 4 YEARS

PRECEDING THE PREVIOUS YEAR

AND

60 DAYS IN THE PREVIOUS YEAR

SECTION 6 (6): RESIDENT BUT NOT ORDINARILY RESIDENT

NOT IN INDIA IN 9 OUT OF 10

PREVIOUS YEARS PRECEDING THE PY

OR

NOT IN INDIA FOR A PERIOD OF 730

DAYS OR MORE DURING 7 PREVIOUS

YEARS.

SECTION 6(2): STATUS OF HUF: (karta)

RESIDENT- If the control and management of its affairs are situated wholly

in India.

RESIDENT BUT NOT ORDINARILY RESIDENT- if the manager has not

been resident in 9 out of 10 previous years preceding the PY or during 7

previous years preceding the PY not in India for a period of 730 days or more.

SECTION 6(2): STATUS OF ASSOCIATION OF PERSONS:

RESIDENT- if control & management of its affairs is situated in India either

wholly or partly.

NONRESIDENT- if control & management of its affairs is not situated in

India.

SECTION 6(3): STATUS OF COMPANY:

if it is an Indian Company and control and management wholly or

partly in India.

RESIDENT -

if its control and management is situated wholly in India. (foreign co.)

NON RESIDENT- if the control and management is outside India.

SECTION 6(4): STATUS OF STATUTORY CORPORATION, LOCAL

AUTHORITY ETC.:

RESIDENT: if control and management is situated wholly in India.

NON RESIDENT: if control and management is situated outside India.

B.R. Naik v. CIT (1945): the control and management is situated

where directors’ meetings are held.

Calcutta Jute Mills Co. v. Nicholson: even if trading operations are

carried on outside India, if control and management is wholly in

India, the company is resident in India.

POINTS TO REMEMBER

The period of stay need not be continuous.

The date of departure and arrival will be included.

For the following persons, the condition of 182 days alone will be looked: [Explanation I

to Section 6(1)]

Indian citizens who leave India in any PY as a member of crew of Indian ship or for

purposes of employment outside India.

Indian citizen or person of Indian origin engaged outside India in an employment or a

business or profession who comes on a visit to India in any PY.

QUESTIONS:

1. Mr. P an Indian citizen left India on 28th October 2012 for the first time to U.K for the

purpose of employment. He visits India every year and stays here from 15th April to 10th

September since 2015-16. What will be his residential status for the AY 2020-21?

He will not be considered as resident. Because according to the explanation I to

section 6(1), a person who is of Indian origin is engaged in employment outside India and if

visits India in any previous year his stay will not be considered as resident.

2. Mr. X an Indian citizen settled in France visits India for the first time during 2017-18 and

stays for 193 days. Determine his residential status for year 2018-19?

Mr. X will be considered as resident. According to section 6(1), a person can be

considered as resident if he satisfies any one of the conditions, that is, stay of 182 days

or more in previous year or 365 days in 4 preceding years and 60 days in PY. However,

for a person of Indian origin who is settled outside India, if he visits India in any PY, the

rule applicable is as mentioned in Explanation 1 to Section 6(1). For such persons, if

they stay in India for 182 days, then only they will be considered as resident. In the

instant case, Mr. X has stayed in India for 193 days. So he will be considered as resident

and ordinarily resident.

3. Determine the residential status for AY 2014-15 of Varun, an Indian Citizen, who leaves

India for employment in Canada on July 1st, 2013?

Since Varun left India for employment the rule is as in Explanation I to section

6(1). Here PY is 2013-14 (AY being 2014-15). In the PY 2013-14 Varun was in India

for 92 days (April 30 days, May 31 days, June 30 days and 1 day in July). Since he was

not in India for 182 days he cannot be considered as resident.

You might also like

- Residential Status DTDocument21 pagesResidential Status DTshyamiliNo ratings yet

- Residential StatusDocument20 pagesResidential StatusroopamNo ratings yet

- How Do You Determine The Residential Status of A Person Human Being/Company?Document11 pagesHow Do You Determine The Residential Status of A Person Human Being/Company?vikassinghnirwanNo ratings yet

- Concept of Residential StatusDocument7 pagesConcept of Residential StatusJanak DandNo ratings yet

- Residential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita PalDocument17 pagesResidential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita Palsousam2387No ratings yet

- Residential Status and Tax Incidence: Dr. Niti SaxenaDocument11 pagesResidential Status and Tax Incidence: Dr. Niti SaxenaYusufNo ratings yet

- Taxation 13Document14 pagesTaxation 13Ayush RainaNo ratings yet

- Residential Status ppt1Document17 pagesResidential Status ppt1Reddy ReddyNo ratings yet

- Residential Status ppt1Document17 pagesResidential Status ppt1Prasanna ReddyNo ratings yet

- 2 Residential Status PDFDocument10 pages2 Residential Status PDFGiri SukumarNo ratings yet

- Residential Status & TAX AVOIDANCE and Tax Evasion: Department of Management Studies M.A.N.I.TDocument14 pagesResidential Status & TAX AVOIDANCE and Tax Evasion: Department of Management Studies M.A.N.I.THoney SoniNo ratings yet

- Residential Status: Presented ByDocument17 pagesResidential Status: Presented ByRohit SinghNo ratings yet

- RS and ITDocument19 pagesRS and ITRahul Agrawal100% (1)

- Residential Statuts 20216171446260Document23 pagesResidential Statuts 20216171446260Neha singhNo ratings yet

- Residence and Scope of Total Income PDFDocument7 pagesResidence and Scope of Total Income PDFsidharthNo ratings yet

- Sample Numerical Residence and Capital GainsDocument12 pagesSample Numerical Residence and Capital Gainsholy.taporiNo ratings yet

- Residential Status (Individual) : 1. Basic Condition 2. Additional Condition (Subsequent Condition)Document5 pagesResidential Status (Individual) : 1. Basic Condition 2. Additional Condition (Subsequent Condition)Ali NadafNo ratings yet

- Unit 1, Part 2Document10 pagesUnit 1, Part 2Sandip Kumar BhartiNo ratings yet

- It - Lesson 3Document14 pagesIt - Lesson 3Sugandha AgarwalNo ratings yet

- B71fedca 95fa 4b5b B32e A2fa493fbdeaDocument22 pagesB71fedca 95fa 4b5b B32e A2fa493fbdeaRaj DasNo ratings yet

- TaxassignmentDocument7 pagesTaxassignmentMuditNo ratings yet

- 1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee IsDocument14 pages1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee Isdhananjay7No ratings yet

- TaxassignmentDocument7 pagesTaxassignmentMuditNo ratings yet

- Residential Status and Tax IncidenceDocument4 pagesResidential Status and Tax IncidenceAshok Kumar MehetaNo ratings yet

- Residential Status FinalDocument12 pagesResidential Status FinalUgarthi ShankaliaNo ratings yet

- Non Resident Indians Under FEMADocument4 pagesNon Resident Indians Under FEMAgaurav069No ratings yet

- Residential Status and Scope of Total IncomeDocument19 pagesResidential Status and Scope of Total IncomeSamyak JainNo ratings yet

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalNo ratings yet

- Chapter 11 - Residence and Scope of Total Income - NotesDocument14 pagesChapter 11 - Residence and Scope of Total Income - NotesAkshay PooniaNo ratings yet

- Unit - 1 Residential Status: Prepared By: Ms. Mandeep KaurDocument37 pagesUnit - 1 Residential Status: Prepared By: Ms. Mandeep KaurSresth VermaNo ratings yet

- Tax Residential Status and Its Effect On Tax IncidenceDocument10 pagesTax Residential Status and Its Effect On Tax IncidenceAtul AgrawalNo ratings yet

- Residential Status of An AssesseeDocument9 pagesResidential Status of An Assesseetanisha negiNo ratings yet

- Residential StatusDocument18 pagesResidential StatusShruti DoshiNo ratings yet

- Residential Status and Tax IncedenceDocument46 pagesResidential Status and Tax IncedenceAmit YadavNo ratings yet

- Corporate Tax Planning: Unit IDocument35 pagesCorporate Tax Planning: Unit ILavanya KasettyNo ratings yet

- Residential StatusDocument7 pagesResidential Statusjames17stevensNo ratings yet

- Residential Status Under The Income Tax ActDocument3 pagesResidential Status Under The Income Tax Actchaitali yadavNo ratings yet

- Residential Status: PersonDocument9 pagesResidential Status: PersonHitesh ParmarNo ratings yet

- Basic Framework of Tax Law in IndiaDocument19 pagesBasic Framework of Tax Law in IndiaNavu NijjarNo ratings yet

- Residential StatusDocument40 pagesResidential StatusSankalp ShuklaNo ratings yet

- Income TaxDocument14 pagesIncome Taxankit srivastavaNo ratings yet

- DEFNTONSDocument20 pagesDEFNTONSVaishnavi CNo ratings yet

- 3rd Sem Taxation Ppt-3.Pdf328Document34 pages3rd Sem Taxation Ppt-3.Pdf328Harpreet SinghNo ratings yet

- Residential Status in IndiaDocument14 pagesResidential Status in IndiaKhudadad NabizadaNo ratings yet

- Residential Status of An AssesseeDocument5 pagesResidential Status of An AssesseeKishore KNo ratings yet

- Law of Taxation Rules For Determining Residential Status: ProblemsDocument13 pagesLaw of Taxation Rules For Determining Residential Status: ProblemsgeethammaniNo ratings yet

- Residentail StatusDocument11 pagesResidentail StatusRashmi JayaprakashNo ratings yet

- Residential Status Cma IndaDocument10 pagesResidential Status Cma IndaKiran ChristyNo ratings yet

- Residential Status DC 2023-24Document11 pagesResidential Status DC 2023-24avinashhpv7785No ratings yet

- Residential StatusDocument20 pagesResidential StatusShivangiNo ratings yet

- Law of Taxation Law of Taxation Class Notes CompressDocument48 pagesLaw of Taxation Law of Taxation Class Notes CompressThrishul MaheshNo ratings yet

- Residence in IndiaDocument7 pagesResidence in IndiaSuryaNo ratings yet

- DT - Unit 1Document17 pagesDT - Unit 1coc74coc74cocNo ratings yet

- Chapter-2 Residential StatusDocument5 pagesChapter-2 Residential StatusBrinda RNo ratings yet

- Prepared By: Sikha Sadani Assistant Professor, IITMDocument39 pagesPrepared By: Sikha Sadani Assistant Professor, IITMTANYANo ratings yet

- Residential Status: Vaibhav BanjanDocument14 pagesResidential Status: Vaibhav BanjanAnmolNo ratings yet

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonDocument8 pagesSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersondipxxxNo ratings yet

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document47 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Samata BohraNo ratings yet

- Present Indian: Indian Citizenship, Indian Passport and Visa free travelFrom EverandPresent Indian: Indian Citizenship, Indian Passport and Visa free travelRating: 5 out of 5 stars5/5 (1)

- Park FunDocument44 pagesPark FunsarmasanuNo ratings yet

- Breaking News, U.SDocument3 pagesBreaking News, U.SLja CsaNo ratings yet

- Feats and Prestige ClassesDocument21 pagesFeats and Prestige ClassesSeth FretwellNo ratings yet

- The Climb Autobiography of Chris FroomeDocument1,106 pagesThe Climb Autobiography of Chris FroomeJuan Carlos Lara Gallego33% (3)

- Iec 60065 A1-2005Document18 pagesIec 60065 A1-2005Paul DavidsonNo ratings yet

- Classic Wedding Quote Gabriella Haddad & Michael Al-Mallou October-December 2021 PDFDocument1 pageClassic Wedding Quote Gabriella Haddad & Michael Al-Mallou October-December 2021 PDFmichaelNo ratings yet

- 1classic Greek SaladDocument6 pages1classic Greek SaladEzekiel GumayagayNo ratings yet

- Assorting DiamondDocument8 pagesAssorting DiamondLove NijaiNo ratings yet

- Edgar Allan Poe - A DreamDocument1 pageEdgar Allan Poe - A DreamItha Shin ChanchythaNo ratings yet

- Tombs & Terrors Fantasy Role PlayingDocument109 pagesTombs & Terrors Fantasy Role PlayingDomênico GayNo ratings yet

- Fuji Xerox Mono MFP Tel: 63346455 / 63341373 Fax: 63341615 / SMS/Whatsapp - 8777 6955 / Wechat ID - BizgramSG Bizgram Asia Pte Ltd (ROC :200903547Z) Shop & Collection : 1 Rochor Canal Road, # 05-49 / 50 Simlim Square, Singapore 188504.Document10 pagesFuji Xerox Mono MFP Tel: 63346455 / 63341373 Fax: 63341615 / SMS/Whatsapp - 8777 6955 / Wechat ID - BizgramSG Bizgram Asia Pte Ltd (ROC :200903547Z) Shop & Collection : 1 Rochor Canal Road, # 05-49 / 50 Simlim Square, Singapore 188504.Bizgram AsiaNo ratings yet

- Six Halloween Themed Sub-ClassesDocument6 pagesSix Halloween Themed Sub-ClassesRennik McCaig100% (1)

- EN Specification Sheet VEGAMET 862Document2 pagesEN Specification Sheet VEGAMET 862Nithiananthan ArunasalamNo ratings yet

- Frigate Flyer Air LiftDocument1 pageFrigate Flyer Air LiftDubistWhite100% (1)

- FCE Use of English Solved 1Document25 pagesFCE Use of English Solved 1isabelllArchNo ratings yet

- 11 Sewing Patterns For Womens Dresses Other Pretty Projects PDFDocument46 pages11 Sewing Patterns For Womens Dresses Other Pretty Projects PDFmynameisgook67% (3)

- The Colbert Report: Download Episodes of Dexter Watch Dexter Episodes OnlineDocument5 pagesThe Colbert Report: Download Episodes of Dexter Watch Dexter Episodes Onlinepraitk5No ratings yet

- Anushka GNM YmtDocument3 pagesAnushka GNM YmtPreetam ParabNo ratings yet

- EE Band Perusal BK1Document68 pagesEE Band Perusal BK1Alfredo Arrautt100% (4)

- Travelling Var 2 IntDocument3 pagesTravelling Var 2 IntOlga MaslennikovaNo ratings yet

- Play The Queen S Indian DefenceDocument518 pagesPlay The Queen S Indian Defenceazazel100% (3)

- Train To PakistanDocument7 pagesTrain To Pakistanvineela_13120% (1)

- Choose The Present Perfect or Past SimpleDocument2 pagesChoose The Present Perfect or Past Simplememolkan100% (1)

- Genesys Talents Expanded V5.0 GkV2.0Document77 pagesGenesys Talents Expanded V5.0 GkV2.0Em Stewart100% (1)

- MSX Computing - Nov 1984Document52 pagesMSX Computing - Nov 1984Buleste100% (1)

- John Deere 850D LCDocument28 pagesJohn Deere 850D LCForomaquinasNo ratings yet

- Netflix Final Case.Document16 pagesNetflix Final Case.ScribdTranslationsNo ratings yet

- Starcade Sidepanel PDFDocument7 pagesStarcade Sidepanel PDFJesusMoyaLopezNo ratings yet

- EVENT BRIEF - SWOT AnalysisDocument4 pagesEVENT BRIEF - SWOT AnalysisDHLA SHS Teacher 6No ratings yet

- Julius Caesar SummaryDocument2 pagesJulius Caesar SummaryAmAr MoHit Jaiswal100% (1)