Professional Documents

Culture Documents

Department of Transport: Checkpost Tax E-Receipt

Uploaded by

Kk king vishwakarmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

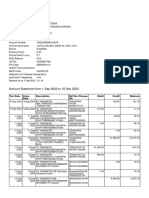

Department of Transport: Checkpost Tax E-Receipt

Uploaded by

Kk king vishwakarmaCopyright:

Available Formats

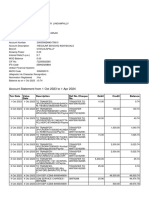

Receipt Printing Date : GOVERNMENT OF DL1LAJ3448

UTTAR PRADESH

DL1LAJ3448 / 17-OCT-2023

17-OCT-2023 01:44:13

01:42 PM, / 17-OCT-2023 01:42 PM,

DL1LAJ3448 / 17-OCT-2023 01:42

PM Department of Transport / 17-OCT-2023 01:42 PM,

PM, DL1LAJ3448

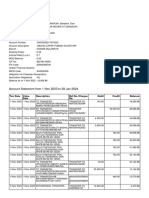

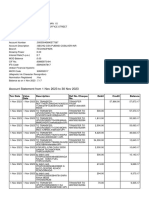

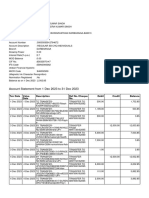

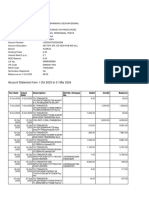

Checkpost Tax e-Receipt

DL1LAJ3448

Registration No.

/ 17-OCT-2023

: DL1LAJ3448

01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

DL1LAJ3448

Receipt No. / 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

: UPT2310174021777

DL1LAJ3448

Payment Date / 17-OCT-2023

: 17-OCT-2023 01:42 PM 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

Owner Name : MAA FURNITURE CO

DL1LAJ3448 / 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

Chassis No. : MAT556004NVN64339 Tax Mode : DAYS

DL1LAJ3448

Vehilce Type / 17-OCT-2023

: GOODS VEHICLE 01:42 PM, DL1LAJ3448

Vehicle Class :/LIGHT

17-OCT-2023

GOODS VEHICLE01:42 PM,

DL1LAJ3448: 8383813872

Mobile No. / 17-OCT-2023 01:42 PM, DL1LAJ3448

Checkpost Name :/ETAWAH

17-OCT-2023 01:42 PM,

Unladen Weight

DL1LAJ3448: NA

Laden Weight : 1630 Kg.

/ 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

Bank Ref. No. : CHN9786695 Payment Mode : ONLINE

DL1LAJ3448 / 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

DL1LAJ3448: NOT

Service Type / 17-OCT-2023

APPLICABILE 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

DL1LAJ3448

Permit Type : / 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

DL1LAJ3448 / 17-OCT-2023 01:42 PM, DL1LAJ3448 Payment

:/17-OCT-2023

17-OCT-2023 01:44:00 PM 01:42 PM,

Confirmation Date

DL1LAJ3448 / 17-OCT-2023 01:42 PM, DL1LAJ3448 /Fees/Tax

Particular

17-OCT-2023 Fine

01:42TotalPM,

DL1LAJ3448

MV Tax( 17-OCT-2023 /TO 17-OCT-2023

18-OCT-2023 ) 01:42 PM, DL1LAJ3448 /100 17-OCT-2023 0 01:42100 PM,

DL1LAJ3448

Grand Total : 100/- (/ ONE

17-OCT-2023

HUNDRED ONLY) 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

Note : 1) This is a computer generated printout and no signature is required.

DL1LAJ3448 / 17-OCT-2023 01:42 PM, DL1LAJ3448 / 17-OCT-2023 01:42 PM,

2) Incorrect mentioning of vehicle class or seating capacity may lead to tax evasion and defaulter shall be liable for penal action.

You will also receive the payment confirmation message.

Scan the QR code for genuinity of the receipt, It should land at https://kms.parivahan.gov.in

site. In case the URL is different, then receipt could be a fake one, please raise a

complain.

You might also like

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalAvnish kumarNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalAvnish kumarNo ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptMadanNo ratings yet

- Online Tax Payment Portal 4863Document1 pageOnline Tax Payment Portal 4863Jk DigitNo ratings yet

- RuioDocument1 pageRuiokm3087940No ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalRoshan ShahNo ratings yet

- Online Tax Payment Portal - 08!11!2023Document1 pageOnline Tax Payment Portal - 08!11!2023kgssrhetoricNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment Portalajmalma7080No ratings yet

- Online Tax Payment Portal2222Document1 pageOnline Tax Payment Portal2222raghavtravels1No ratings yet

- TNG Statement Bengkel MP QRDocument2 pagesTNG Statement Bengkel MP QRfadhlina.alinNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment Portalnitinrawat863No ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptShankar BanrwalNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment Portalvishal kumarNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment Portalminatibehera948No ratings yet

- PPQHSWJ 3 WB78 Upd NDocument5 pagesPPQHSWJ 3 WB78 Upd NjbvcfygbkumarNo ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptAbel TesfeyNo ratings yet

- Checkpost TaxDocument1 pageCheckpost Taxeprints51No ratings yet

- GJ MH 46 BB 9579 24 12 23Document2 pagesGJ MH 46 BB 9579 24 12 23motivationalshorts.official12No ratings yet

- NOVOAIR - View Reservation5Document2 pagesNOVOAIR - View Reservation5Saurabh GuptaNo ratings yet

- Raj Sep 23Document1 pageRaj Sep 23Karanvir SidhuNo ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-Receiptkrishan mohanNo ratings yet

- 14 Feb 2023 To 15 May 2023 FCMB StatementDocument8 pages14 Feb 2023 To 15 May 2023 FCMB Statementchris nathanNo ratings yet

- StatementDocument2 pagesStatementSidharth Ranjan PalaiNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalFredric SolomonNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment Portalsonugupta4121No ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptamanNo ratings yet

- UHUM6 B FZCZR VW 1 E1Document6 pagesUHUM6 B FZCZR VW 1 E1Praveen SainiNo ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptDhajendra kumarNo ratings yet

- Checkpost Tax E-ReceiptDocument1 pageCheckpost Tax E-ReceiptangiracomputerNo ratings yet

- KC8 FRJBM SK4 AIs SDocument3 pagesKC8 FRJBM SK4 AIs Spranav19.10.2007No ratings yet

- Autosweep Sept 1-Oct 16Document44 pagesAutosweep Sept 1-Oct 16Genevieve-LhangLatorenoNo ratings yet

- Online Tax Payment PortalDocument1 pageOnline Tax Payment PortalNavdeep ThakranNo ratings yet

- Va XXyfrr DMtzu 6 CsDocument9 pagesVa XXyfrr DMtzu 6 Csvbro9045No ratings yet

- M8 FN RF0 PTV SWD AOwDocument8 pagesM8 FN RF0 PTV SWD AOwsalimmama1919No ratings yet

- UP5763Document1 pageUP5763Knowledge With Sameer KhanNo ratings yet

- Zo 5 QH TMKK HB4 D WH 8Document34 pagesZo 5 QH TMKK HB4 D WH 8dotcnnctNo ratings yet

- Q8 WN FGAW6 A8 TD RAADocument7 pagesQ8 WN FGAW6 A8 TD RAAmaheshdubey730No ratings yet

- UNm Amcj V9 S 7 Q 5 RLDocument3 pagesUNm Amcj V9 S 7 Q 5 RLmaitreyi.rozyNo ratings yet

- 049 E-Way Bill (24.11.2023)Document1 page049 E-Way Bill (24.11.2023)Sandip PurohitNo ratings yet

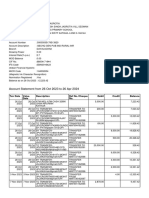

- 20240401152450XXXXXXX1529Document8 pages20240401152450XXXXXXX1529subhranshubiswal78No ratings yet

- Vijay TantiDocument3 pagesVijay TantiAmoghaNo ratings yet

- Yg VHTD NXCO1 GH Aa 7Document15 pagesYg VHTD NXCO1 GH Aa 7puppalasai2001No ratings yet

- 23 /01/2024Document5 pages23 /01/2024manumanojbangaluru26No ratings yet

- Department of Transport: Checkpost Tax E-ReceiptDocument1 pageDepartment of Transport: Checkpost Tax E-ReceiptManjul SinghNo ratings yet

- W 03 VZJ E2 Ro AFVH7Document10 pagesW 03 VZJ E2 Ro AFVH7salimmama1919No ratings yet

- EWB Detail Sales Invoice IER2324KTN002368Document1 pageEWB Detail Sales Invoice IER2324KTN002368lovefoodqsr17No ratings yet

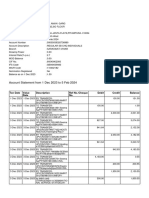

- Statement For The Period From 01/10/2021 To 31/03/2022: Date CHQ NO Naration COD Debit Credit BalanceDocument7 pagesStatement For The Period From 01/10/2021 To 31/03/2022: Date CHQ NO Naration COD Debit Credit BalanceRadan VijayNo ratings yet

- NF7BCJLCZY5EUBWN6879 ETicketDocument3 pagesNF7BCJLCZY5EUBWN6879 ETicketanandNo ratings yet

- OTc0MDg0 0Document1 pageOTc0MDg0 0Andrian DonyNo ratings yet

- LOGS 3 Nov 11-25Document890 pagesLOGS 3 Nov 11-25infoNo ratings yet

- 20240205103357XXXXXXX6980 UnlockedDocument5 pages20240205103357XXXXXXX6980 Unlockedamangraga678No ratings yet

- Statement 159301000008212Document8 pagesStatement 159301000008212Umesh ShengalNo ratings yet

- Balaji GaneshDocument2 pagesBalaji Ganeshwintage23No ratings yet

- Ir 8 S AAPu IJ5 Urk AvDocument14 pagesIr 8 S AAPu IJ5 Urk Av321mohit90No ratings yet

- P 5 Um 3 Yw V7 GQWM HeqDocument4 pagesP 5 Um 3 Yw V7 GQWM Heqnitin patidarNo ratings yet

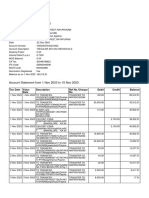

- Account Statement From 8 Nov 2023 To 21 Nov 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 8 Nov 2023 To 21 Nov 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancemsaroha50No ratings yet

- Detailed StatementDocument6 pagesDetailed Statementgovind.laxminarayan03No ratings yet

- FC EZKh NG47 VW 8 GQ NDocument10 pagesFC EZKh NG47 VW 8 GQ NSHARAD AGRAWALNo ratings yet

- Rosario Jordana, 14dec 1351 RiohachaDocument2 pagesRosario Jordana, 14dec 1351 RiohachaDiegoNo ratings yet

- Easter in South KoreaDocument8 pagesEaster in South KoreaДіана ГавришNo ratings yet

- PERDEV2Document7 pagesPERDEV2Riza Mae GardoseNo ratings yet

- Ez 14Document2 pagesEz 14yes yesnoNo ratings yet

- Sbi Rural PubDocument6 pagesSbi Rural PubAafrinNo ratings yet

- How To Make A Detailed OutlineDocument8 pagesHow To Make A Detailed OutlineIvan Clark PalabaoNo ratings yet

- Lecture 7 - Conditions of Employment Pt. 2Document55 pagesLecture 7 - Conditions of Employment Pt. 2Steps RolsNo ratings yet

- Decline of Mughals - Marathas and Other StatesDocument73 pagesDecline of Mughals - Marathas and Other Statesankesh UPSCNo ratings yet

- Agara Lake BookDocument20 pagesAgara Lake Bookrisheek saiNo ratings yet

- Mboce - Enforcement of International Arbitral Awards - Public Policy Limitation in KenyaDocument100 pagesMboce - Enforcement of International Arbitral Awards - Public Policy Limitation in KenyaIbrahim Abdi AdanNo ratings yet

- Wordlist Unit 7Document4 pagesWordlist Unit 7Anastasiia SokolovaNo ratings yet

- Code of Civil Procedure: Recording of Evidence by Court/Court CommissionerDocument12 pagesCode of Civil Procedure: Recording of Evidence by Court/Court CommissionercahirenrajaNo ratings yet

- AKL - Pert 2-2Document2 pagesAKL - Pert 2-2Astri Ririn ErnawatiNo ratings yet

- Class Program: HUMSS 11-MarxDocument2 pagesClass Program: HUMSS 11-MarxElmer PiadNo ratings yet

- Comparative AnalysisDocument5 pagesComparative AnalysisKevs De EgurrolaNo ratings yet

- BÀI TẬP TRẮC NGHIỆM CHUYÊN ĐỀ CÂU BỊ ĐỘNGDocument11 pagesBÀI TẬP TRẮC NGHIỆM CHUYÊN ĐỀ CÂU BỊ ĐỘNGTuyet VuNo ratings yet

- IMTG-PGPM Student Manual - Google DocsDocument12 pagesIMTG-PGPM Student Manual - Google DocsNADExOoGGYNo ratings yet

- World Atlas Including Geography Facts, Maps, Flags - World AtlasDocument115 pagesWorld Atlas Including Geography Facts, Maps, Flags - World AtlasSaket Bansal100% (5)

- Anderson v. Eighth Judicial District Court - OpinionDocument8 pagesAnderson v. Eighth Judicial District Court - OpinioniX i0No ratings yet

- Estimating Guideline: A) Clearing & GrubbingDocument23 pagesEstimating Guideline: A) Clearing & GrubbingFreedom Love NabalNo ratings yet

- Swepp 1Document11 pagesSwepp 1Augusta Altobar100% (2)

- Accounting For Revenue and Other ReceiptsDocument4 pagesAccounting For Revenue and Other ReceiptsNelin BarandinoNo ratings yet

- Periodical Test - English 5 - Q1Document7 pagesPeriodical Test - English 5 - Q1Raymond O. BergadoNo ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- Eve Berlin PDFDocument2 pagesEve Berlin PDFJeffNo ratings yet

- What Is OB Chapter1Document25 pagesWhat Is OB Chapter1sun_shenoy100% (1)

- Construction Design Guidelines For Working Within and or Near Occupied BuildingsDocument7 pagesConstruction Design Guidelines For Working Within and or Near Occupied BuildingsAthirahNo ratings yet

- Appleby, Telling The Truth About History, Introduction and Chapter 4Document24 pagesAppleby, Telling The Truth About History, Introduction and Chapter 4Steven LubarNo ratings yet

- TolemicaDocument101 pagesTolemicaPrashanth KumarNo ratings yet

- Santos vs. Reyes: VOL. 368, OCTOBER 25, 2001 261Document13 pagesSantos vs. Reyes: VOL. 368, OCTOBER 25, 2001 261Aaron CariñoNo ratings yet

- Tok SB Ibdip Ch1Document16 pagesTok SB Ibdip Ch1Luis Andrés Arce SalazarNo ratings yet