Professional Documents

Culture Documents

(TaiZhengWen) Reflection On Money, Interest Rates and Exchange Rates

Uploaded by

443137604Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(TaiZhengWen) Reflection On Money, Interest Rates and Exchange Rates

Uploaded by

443137604Copyright:

Available Formats

(GS804)Reflection on money, interest rates and exchange rates

Name:Tai ZhengWen Student number:22-618685

Money, interest rates, and exchange rates are key concepts in international

finance and macroeconomics, playing a crucial role in shaping international financial

markets and macroeconomic policies. In the process of studying this course, I have

gained a deeper understanding of these concepts and realized their close connections

as well as their impact on the world economy.

Firstly, money is the blood of the economy, flowing throughout the entire

economic system, supporting transactions and investments. In this course, I learned

about the monetary systems of different countries, including fixed exchange rate

systems and floating exchange rate systems, as well as their advantages and

disadvantages. The relationship between money supply and demand has a profound

impact on inflation and the formulation of monetary policy. Understanding the

essence of money and how it affects both domestic and international economies has

helped me better understand the goals of monetary policy, such as stabilizing price

levels and promoting economic growth.

Secondly, interest rates are a key factor in the money market, which directly

affects investment, savings, and money supply. In the course, I learned how the

central bank controls the money supply by adjusting interest rates to achieve

economic policy goals. High interest rates can attract foreign capital inflows, but they

may also lead to an increase in domestic borrowing costs, thereby suppressing

investment. Understanding this trade-off and the role of central banks has given me a

better understanding of the formulation and implementation of monetary policy.

Finally, exchange rate is a core factor in the international financial market, which

determines the relative prices of different national currencies. In this course, I learned

about different types of exchange rate systems, including fixed and floating exchange

rates, as well as their impact on international trade and capital flows. Understanding

how exchange rates are influenced by economic factors and market expectations, as

well as how governments intervene in foreign exchange markets, is crucial for

understanding international trade and financial markets.

Through the study of this course, I not only gained a deeper understanding of

money, interest rates, and exchange rates, but also realized the complex interactive

relationships between them and how they collectively affect international financial

markets and macroeconomic policies. In addition, I also understood the importance of

international cooperation and policy coordination, and gained a clearer understanding

of the operation of the world economy.

You might also like

- Poultry - PACRA Research - Jan'21 - 1611148534Document29 pagesPoultry - PACRA Research - Jan'21 - 1611148534Bakhtawar100% (1)

- Sales Key Account Manager in USA Resume Vicki WestergardDocument2 pagesSales Key Account Manager in USA Resume Vicki WestergardVickiWestergardNo ratings yet

- Safety Audit MethodologyDocument5 pagesSafety Audit MethodologyLalit Kumar Das MohapatraNo ratings yet

- Weekend Media Assessment - 11 - 12 March 2023Document32 pagesWeekend Media Assessment - 11 - 12 March 2023Jonathan BorleyNo ratings yet

- Unit 2 Identification of Business OpportunitiesDocument34 pagesUnit 2 Identification of Business Opportunitiespraveena100% (1)

- Currency Politics: The Political Economy of Exchange Rate PolicyFrom EverandCurrency Politics: The Political Economy of Exchange Rate PolicyRating: 3.5 out of 5 stars3.5/5 (2)

- Stock Market and Foreign Exchange Market: An Empirical GuidanceFrom EverandStock Market and Foreign Exchange Market: An Empirical GuidanceNo ratings yet

- Summary of International Political Economy by Thomas OatleyDocument16 pagesSummary of International Political Economy by Thomas Oatleykinza fattimaNo ratings yet

- (TaiZhengWen) Reflection On Price Level and The Exchange Rate in The Long RunDocument1 page(TaiZhengWen) Reflection On Price Level and The Exchange Rate in The Long Run443137604No ratings yet

- Monetary EconomicsDocument2 pagesMonetary EconomicsEunice BorboryoNo ratings yet

- Impact of The Manipulation of Currency On The Exchange Rate of The CountryDocument17 pagesImpact of The Manipulation of Currency On The Exchange Rate of The Country2h rxNo ratings yet

- Exchange Rate "War Currencies".EditedDocument12 pagesExchange Rate "War Currencies".Edited2h rxNo ratings yet

- NEW REPORT THESIS SyazaDocument22 pagesNEW REPORT THESIS SyazaHazeerah YusoffNo ratings yet

- Economics Research PaperDocument11 pagesEconomics Research PaperSomya GulatiNo ratings yet

- Rey 2016Document30 pagesRey 2016Gülşah SütçüNo ratings yet

- BMC Module 2Document2 pagesBMC Module 2Hannah YanoskiNo ratings yet

- CH Bfi 1Document3 pagesCH Bfi 1Bhebz Erin MaeNo ratings yet

- Econ. 2081: International Economics I Instructor: Dr. Girma Estiphanos The Scope of International EconomicsDocument98 pagesEcon. 2081: International Economics I Instructor: Dr. Girma Estiphanos The Scope of International Economicsseid sufiyanNo ratings yet

- Research On EconomyDocument2 pagesResearch On EconomyDonatasNo ratings yet

- FM 3103 Unit I PendingDocument35 pagesFM 3103 Unit I PendingKumardeep SinghaNo ratings yet

- Stability and Instability International Monetary in The SystemDocument11 pagesStability and Instability International Monetary in The SystemJoyce TabiliranNo ratings yet

- Ajax Request HandlerDocument42 pagesAjax Request HandlerLucreciad95No ratings yet

- Usa Policy y GlobalizationDocument11 pagesUsa Policy y GlobalizationmayuNo ratings yet

- The Diplomatic Consequences of Secessionist MovementsFrom EverandThe Diplomatic Consequences of Secessionist MovementsNo ratings yet

- Analysis On The Relationship Between The Evolution of Stock Prices and Exchange Rates in Emerging Markets - Case of RomaniaDocument17 pagesAnalysis On The Relationship Between The Evolution of Stock Prices and Exchange Rates in Emerging Markets - Case of RomaniaDumitrică PaulNo ratings yet

- Impact of Financial Integration On Stock Markets (Indian Context)Document16 pagesImpact of Financial Integration On Stock Markets (Indian Context)Shubham TyagiNo ratings yet

- Seminar DrafDocument16 pagesSeminar DrafSanthe SekarNo ratings yet

- International Eco and Policy Assignment Question 1Document10 pagesInternational Eco and Policy Assignment Question 1Deepak Singh Bisht100% (1)

- 10 IJEFI 10557 Srithilat OkeyDocument8 pages10 IJEFI 10557 Srithilat OkeySm HkmNo ratings yet

- Exchange Rate Thesis TopicsDocument8 pagesExchange Rate Thesis Topicsbethevanstulsa100% (3)

- Monetary System Group 1Document12 pagesMonetary System Group 1sobiric395No ratings yet

- Macro Economics Final Report 2020.Document43 pagesMacro Economics Final Report 2020.Talal AsifNo ratings yet

- (KIRSHNER, Jonathan) Money Is Politcs.Document17 pages(KIRSHNER, Jonathan) Money Is Politcs.Naiara BiliattoNo ratings yet

- Written Report Group 1Document9 pagesWritten Report Group 1sobiric395No ratings yet

- Exchange RatesDocument3 pagesExchange RatesAmikam MediaaNo ratings yet

- Internal FinanceDocument7 pagesInternal Financeakhlaqur rahmanNo ratings yet

- US Monetary PolicyDocument61 pagesUS Monetary PolicySNamNo ratings yet

- Project Foregin Exchange MarketDocument9 pagesProject Foregin Exchange MarketjagrutiNo ratings yet

- Notes - IfM - MergedDocument210 pagesNotes - IfM - MergedNeerajNo ratings yet

- Mishkin (1995)Document9 pagesMishkin (1995)Maesley FernandesNo ratings yet

- Strange, Susan (1971) The Politics of International Currencies. World Politics, Vol. 23, NDocument18 pagesStrange, Susan (1971) The Politics of International Currencies. World Politics, Vol. 23, NFê GrilloNo ratings yet

- Monetary Policy and Economic Growth of NigeriaDocument10 pagesMonetary Policy and Economic Growth of NigeriaEm HaNo ratings yet

- W1L1 TranscriptDocument7 pagesW1L1 Transcriptsumitdwivedi0808No ratings yet

- Foreign Exc RateDocument35 pagesForeign Exc Ratefahd_faux9282No ratings yet

- Nternational Economics and Asis of International Rade: Presented byDocument26 pagesNternational Economics and Asis of International Rade: Presented byShriya ShinNo ratings yet

- Working Paper Series: Money, Banking, and Capital FormationDocument0 pagesWorking Paper Series: Money, Banking, and Capital FormationOmerlatif55No ratings yet

- File 0024 PDFDocument1 pageFile 0024 PDFEd ZNo ratings yet

- Determinants of Interest Rate Pass-Through: Do Macroeconomic Conditions and Financial Market Structure Matter?Document20 pagesDeterminants of Interest Rate Pass-Through: Do Macroeconomic Conditions and Financial Market Structure Matter?runawayyyNo ratings yet

- Exchange Rate Theory - A ReviewDocument43 pagesExchange Rate Theory - A Revieweric3215No ratings yet

- Assignment: Course Title: Assignment TitleDocument3 pagesAssignment: Course Title: Assignment TitleArslan AzamNo ratings yet

- International Economic and Policy - AmityDocument153 pagesInternational Economic and Policy - AmityPrince MalhotraNo ratings yet

- Question: Define and Describe Monetary Analysis and Real Rate of Interest? Monetary AnalysisDocument6 pagesQuestion: Define and Describe Monetary Analysis and Real Rate of Interest? Monetary AnalysisPrecious PearlNo ratings yet

- Globalization and Exchange Rate PolicyDocument14 pagesGlobalization and Exchange Rate Policyparth38No ratings yet

- Importance of International EconomicDocument3 pagesImportance of International Economicrajdeep singh100% (1)

- 4 Factors That Shape Market TrendsDocument2 pages4 Factors That Shape Market TrendsApril Ann Diwa AbadillaNo ratings yet

- Sustainability 11 03240 v2Document26 pagesSustainability 11 03240 v2MD. MAHMUDUR RAHMAN FAHIMNo ratings yet

- 4 Factors That Shape Market TrendsDocument2 pages4 Factors That Shape Market TrendsApril Ann Diwa AbadillaNo ratings yet

- On Determinat of THB USDDocument9 pagesOn Determinat of THB USDayu cantikNo ratings yet

- Parameters of MPDocument10 pagesParameters of MPJuglaryNo ratings yet

- China Case Study - Currency ManipulationDocument10 pagesChina Case Study - Currency ManipulationNguyên ThảoNo ratings yet

- The Uncovered Interest Rate Parity-A Literature ReviewDocument14 pagesThe Uncovered Interest Rate Parity-A Literature ReviewTrader CatNo ratings yet

- Chapter 4Document42 pagesChapter 4DianaNo ratings yet

- MPRA Paper 64482Document25 pagesMPRA Paper 64482umtsktoceNo ratings yet

- Parameters of Monetary Policy in India Y.V. Reddy: ObjectivesDocument14 pagesParameters of Monetary Policy in India Y.V. Reddy: Objectiveslopa_titanNo ratings yet

- Marketing Strategy For Food BusinessDocument5 pagesMarketing Strategy For Food BusinessCourtney Dela PenaNo ratings yet

- STR PresentationDocument49 pagesSTR PresentationApril ToweryNo ratings yet

- Sample Letter Refund Request Foreclosure Consultants Advanced FeesDocument4 pagesSample Letter Refund Request Foreclosure Consultants Advanced FeesUnemployment HotlineNo ratings yet

- E Commerce Course Outline 2018 SessionDocument14 pagesE Commerce Course Outline 2018 SessionMuhammad Aamir ShahzadNo ratings yet

- Apostila UK: Personal InformationDocument1 pageApostila UK: Personal InformationElena GrigoritaNo ratings yet

- Entrep Mind PowerpointDocument6 pagesEntrep Mind PowerpointLgbtqia BuhiNo ratings yet

- 2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespieNo ratings yet

- Annex A-PBCDocument2 pagesAnnex A-PBCVil Meyushi AlihNo ratings yet

- Delta Beverage - CaseDocument16 pagesDelta Beverage - CaseHasan Md ErshadNo ratings yet

- Structured CreditDocument45 pagesStructured CreditChetan SharmaNo ratings yet

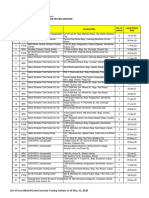

- List of Accredited PETCs As of May 31, 2020Document5 pagesList of Accredited PETCs As of May 31, 2020Butch EnalpeNo ratings yet

- Chapter 3 AssignmentDocument9 pagesChapter 3 AssignmentAnas Omar MuffarrejNo ratings yet

- Correctness by ConstructionDocument3 pagesCorrectness by ConstructionAmnaNo ratings yet

- Proceedings: Drs Learnxdesign 2021Document299 pagesProceedings: Drs Learnxdesign 2021Erik BohemiaNo ratings yet

- Asynchronous Content - Managing Segments and CustomersDocument2 pagesAsynchronous Content - Managing Segments and CustomersbadtranzNo ratings yet

- Unipune M Com Entrance Exam Question PaperDocument10 pagesUnipune M Com Entrance Exam Question PaperKarthic MannarNo ratings yet

- Tender Document - Piave Secondary School Borehole in Nakuru CountyDocument160 pagesTender Document - Piave Secondary School Borehole in Nakuru CountyKiplgat ChelelgoNo ratings yet

- TANGUB BRGY. AOM - HoyohoyDocument3 pagesTANGUB BRGY. AOM - HoyohoyJess KaNo ratings yet

- 1.operations ResearchDocument36 pages1.operations ResearchPiuShan Prasanga Perera100% (1)

- Question Paper For The Position: Audit & Accounts Officer TimeDocument2 pagesQuestion Paper For The Position: Audit & Accounts Officer TimeM A Fazal & Co.No ratings yet

- Pakistan International Airlines, Pia: Strategic ReportDocument21 pagesPakistan International Airlines, Pia: Strategic ReportMuhammad AwaisNo ratings yet

- Ebix Singapore Private Limited and Ors Vs CommitteSC20211309211802221COM438457Document103 pagesEbix Singapore Private Limited and Ors Vs CommitteSC20211309211802221COM438457AYUSHI GOYAL 1750443No ratings yet

- Review Test QuestionsDocument24 pagesReview Test QuestionsKent Mathew BacusNo ratings yet

- Project Report On Consumer Preference Towards Debit Cards and Credit CardsDocument50 pagesProject Report On Consumer Preference Towards Debit Cards and Credit CardsAnil BatraNo ratings yet

- Home Office, Branch, & Agency AccountingDocument13 pagesHome Office, Branch, & Agency AccountingGround ZeroNo ratings yet