Professional Documents

Culture Documents

Gauteng Accounting Grade 11 September 2021 QP and Memo

Uploaded by

lindort00Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gauteng Accounting Grade 11 September 2021 QP and Memo

Uploaded by

lindort00Copyright:

Available Formats

Downloaded f rom St anmorephysics.

1 com

2021

ACCOUNTING

GRADE 11

CONTROL TEST THREE

DURATION: 1.5 HOURS

23 SEPTEMBER 2021

INSTRUCTIONS AND INFORMATION

1 You are provided with a question paper and answer sheet

2 This question paper comprises of THREE Compulsory questions.

3 Make use of the time allocation given.

4 Non- programmable calculators may be used.

5 A BLUE/BLACK PEN may be used

6 Show workings to earn part-marks

TIME

QUESTION TOPIC MARKS

ALLOCATED

1 Cash Budget and Projected Income Statement

25 23

2 Cash Budget

62 55

3 Inventory

13 12

TOTAL 100 90 minutes

This question paper consists of 6 pages

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics.

2 com

QUESTION 1: CASH BUDGET AND PROJECTED INCOME STATEMENT

(25 marks;23 minutes )

1.1 CONCEPTS ON BUDGETS

1.1.1 Explain the difference between the cash budget and a projected income. (2)

1.1.2 Mention two expenses that will not be included under payments in the Cash (2)

Budget.

1.2 CASH BUDGET AND PROJECTED INCOME STATEMENT

The information provided was taken from the records of Majozi Stores their financial

period ended on 30 June 2021.

m

REQUIRED

co

Indicate amounts in the appropriate blocks for the Cash Budget and Projected (21)

s.

Income Statement for the month ending 31 July 2021.

c

si

hy

Example: An amount of R2 200 for rates and taxes for July 2021, will be transferred

to the account of Johannesburg Municipality at the end of the month.

ep

or

JULY 2021

m

Cash Budget Projected Income Statement

No.

an

Receipt Payment Income Expense

Example R2 200 R2 200

st

om

TRANSACTIONS:

fr

1.2.1 The expected cash sales for July 2021 were estimated to be R90 000. The

profit mark-up is 60% on cost.

d

de

1.2.2 Rent income for the year amounted to R72 000, rent will increase by 10% on

the 1st of July 2021.

oa

1.2.3 Goods were sold on credit for R60 000 in June, debtors are expected to pay

l

wn

in July and they will be allowed a discount of R3 000.

do

1.2.4 On 1 July 2021, R9 000 will be paid for a 6-month advertising contract.

1.2.5 An old laptop will be sold at a loss for to an employee in July for R1 800.The

cost price of the laptop was R8 000, the accumulated depreciation amounted

to R5 500.

1.2.6 An instalment of R8 450 on the loan will be paid on 25 July 2021.R450 of this

amount is the interest on loan.

1.2.7 An insurance premium of R2 500 per month is expected to reduce by 10%, on

1 July 2021.

25

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics.

3 com

QUESTION 2 : CASH BUDGET (62 marks; 55 minutes )

PHAKISO TRADERS

You are provided with an incomplete Cash Budget of Phakiso Traders for the period

1 July 2021 to 31 August 2021. The business is owned by M Phakiso.

REQUIRED:

2.1 Calculate the credit sales for June 2021 and then complete the Debtors' Collection Schedule (8)

for August 2021.

2.2 Calculate the missing amounts indicated by a question mark in the Cash Budget and

also take into account the amounts from the information provided. (40)

m

2.3 Refer to Information E and M. The workers are dissatisfied with the increases they

co

will be receiving in August 2021. They have threatened the management with the

s.

strike action if their concerns are not addressed.

c

si

2.3.1 Give TWO reasons why the workers are dissatisfied, use figures or indicators

hy

to support your answer (4)

ep

2.3.2 By making reference to the cash budget, explain why you would agree with the

wage increase offered by Phakiso, provide ONE point. (2)

or

m

2.4 Respond to the following questions by referring to INFORMATION A:

an

2.4.1 Phakiso decided to offer trade discounts to special customers in July 2021.

st

In your opinion, has this benefitted the business? Provide figures to support

om

your answer. (2)

2.4.2 Comment on the control of the following expenses, quote figures to support

fr

your answer and provide ONE point of advice in EACH case.

d

Delivery costs

de

Advertising costs (6)

oa

INFORMATION

l

wn

A. On 31 July 2021 you compared the budgeted amounts with the actual amounts and

found the following:

do

JULY 2021

BUDGETED ACTUAL

Sales R216 000 R168 000

Cost of sales 144 000 120 000

Gross profit 72 000 48 000

Advertising costs 36 000 46 000

Delivery costs 21 600 25 200

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics.

4 com

B. Sales, cost of sales and debtors' collection

(i) Actual and budgeted sales and cost of sales:

SALES COST OF SALES

R R

BUDGETED ACTUAL BUDGETED ACTUAL

May 210 000 156 000 140 000 104 000

June 246 000 178 200 164 000 118 800

July 216 000 144 000

August 168 000

(ii) 60% of the total sales are for cash.

(iii) Credit sales are collected as follows:

20% collected in the month of sale

70% collected in the first month following the sale

5% collected in the second month following the sale

The balance is written off in the third month following the month of sale

C. Delivery costs

All goods sold are delivered to customers free of charge.

The delivery costs are budgeted at 10% of sales.

D. Stock levels and payments to creditors

The business uses a mark-up of 50% on cost.

The business maintains a fixed-base stock by replacing stock on a monthly basis.

75% of the total purchases are on credit.

Creditors are paid in the month following the month of purchase to take advantage

of a 5% discount.

E Salaries

The workers will receive an increase of 3, 5% in August 2021.

The manager will receive an increase of 10% in August 2021.

The rate of inflation is 6%

F Insurance

The insurance premium is paid at the end of each month.

The monthly premium will increase by 10% on 1 August 2021.

G. Phakiso is expecting to receive R500 000 from the estate of his deceased

uncle during August, at the end of August he will invest 75% into the Fixed

Deposit and the balance will be paid towards the Loan Account

H. Interest on the loan at 11% p.a. is payable monthly. The loan balance on

1 July 2021 was R300 000.

I. The owner of the business will increase the withdrawals in August by R800

cash and will withdraw the trading stock at a cost of R750.

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics.

5 com

J. Telephone expense is expected to increase by R700.

K. Sundry expenses are expected to remain the same over the budget period.

L. Details relating to the delivery expenses and new vehicle

Phakiso thinks that in order to improve his cash flow, he should rather purchase a

delivery vehicle in July 2021 and discontinue using Jozi Deliveries for this service. The

delivery contract ends on 31 August 2021.

Phakiso would have to pay R50 000 deposit through the business bank account in

July. His father has agreed to provide interest-free finance for the balance of the

cost. Phakiso would have to repay his father R12 500 per month over 48 months,

the first instalment will be paid at end of August.

M. Extract from the Cash Budget for the two months ending 31 August 2021

Receipts JULY AUGUST

Cash sales of merchandise 129 600 ?

Collection from debtors ? ?

Rent income 15 000 16 500

Commission income ? ?

Total receipts ? ?

Payments

Cash purchase of trading stock 36 000 ?

Payment to creditors ? 102 600

Salary: Manager 36 000 39 600

Salary: Six workers 66 000 ?

Telephone ? 7 500

Advertising 36 000 24 000

Insurance ? 5 500

Delivery costs (payable to Jozi Deliveries) 21 600 ?

Sundry expenses 6 000 ?

Drawings 50 000 ?

Loan ? ?

Interest on loan 2 750 2 695

Total payments ? ?

Cash surplus/deficit ? ?

Bank balance at beginning of month (20 400) ?

Bank balance at end of month ? ?

62

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics.

6 com

QUESTION 3 : INVENTORY (13 marks; 12 minutes)

MKHWANAZI TRADERS

The information provided below was extracted from the books of Mkhwanazi Traders. The

owner maintained an average mark-up of 40% on cost over the last few years. Their

financial year ended on 28 February 2021.The business uses the periodic inventory

system.

REQUIRED

3.1 Calculate the cost of sales (8)

3.2 Calculate the gross profit (4)

3.3 Provide ONE reason for the drop in the mark-up percentage. (1)

INFORMATION

A Balances/Totals at the end of February:

2021 2020

Trading stock 313 200 394 200

Purchases 2 127 800

Carriage on purchases 87 700

Sales 3 038 500

B. The trading stock amounted to R313 200 after physical stock count.

C. The following transactions were not entered in the books and must be

taken into account:

Trading stock bought on credit from Mongezi Traders for, R 62 000.

Goods costing R 19 400 were sold for R 20 500.

Trading stock with the cost of R 4 200 and selling price of R 6 720 was

taken by the owner for personal use

D.

Financial Indicators 2021 2020

Mark-up percentage 28% 40%

13

TOTAL MARKS : 100

Accounting Grade 11 Control Test Question Paper

Downloaded f rom St anmorephysics. com

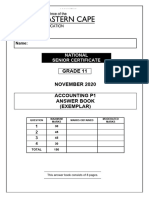

ACCOUNTING GRADE 11

TERM 3

CONTROL TEST 3

2021 SEPTEMBER

NAME OF LEARNER

SCHOOL

DATE

LEARNER’S MODERATED

QUESTION TOPIC MARKS

MARKS MARKS

Cash Budget and Projected

1

Income Statement 25

2 Cash Budget

62

3 Inventory 13

TOTAL 100

This answer book consists of 5 pages.

Downloaded f rom St anmorephysics.

2 com

QUESTION 1 : CASH BUDGET AND PROJECTED INCOME STATEMENT

1.1 CONCEPTS ON BUDGETS

1.1.1 Explain the difference between the cash budget and a projected income

statement.

1.1.2 Mention TWO expenses that will not be included under payments in the Cash

Budget.

1.2 CASH BUDGET AND PROJECTED INCOME STATEMENT

JULY 2021

Cash Budget Projected Income Statement

No.

Receipt Payment Income Expense

Example R2 200 R2 200

1.2.1

1.2.2

1.2.3

1.2.4

1.2.5

1.2.6

1.2.7

21

25

Grade 11 Control Test: 2021 September 23 Answer Book

Downloaded f rom St anmorephysics.

3 com

QUESTION 2: CASH BUDGET

2.1 Debtors’ collection Schedule for July and August 2021

MONTHS CREDIT SALES JULY AUGUST

May 62 400 3 120

June 49 896

July 86 400

August 67 200

1.2 Cash Budget for July and August 2021

JULY 2021 AUGUST 2021

CASH RECEIPTS

Cash sales of merchandise 129 600

Collection from debtors

Rent income 15 000 16 500

Commission income

TOTAL RECEIPTS

CASH PAYMENTS

Cash purchase of trading stock 36 000

Payment to creditors 84 645

Salary: Manager 36 000 39 600

Salary: Six workers 66 000

Telephone 7 500

Advertising 36 000 24 000

Insurance 5 500

Delivery costs (payable to Jozi Deliveries) 21 600

Sundry expenses 6 000

Drawings 50 000

Loan

Interest on loan 2 750 2 695

Total payments

Cash surplus/deficit

Bank balance at beginning of month (20 400) 40

Bank balance at end of month

Grade 11 Control Test: 2021 September 23 Answer Book

Downloaded f rom St anmorephysics.

4 com

2.3.1 Give TWO reasons why the workers are dissatisfied, use figures or indicators

to support your answer

2.3.2 By making reference to the cash budget, explain why you would agree with the

wage increase offered by Phakiso, provide ONE point.

2.4.1 Phakiso decided to offer trade discounts to special customers in July 2021.

In your opinion, has this benefitted the business? Provide figures to support

your answer.

2.4.2 Comment on the control of the following expenses, quote figures to support your answer and

provide ONE point of advice in EACH case.

COMMENT ADVICE

(One point ) (One point)

Delivery costs

Advertising costs

6

62

Grade 11 Control Test: 2021 September 23 Answer Book

Downloaded f rom St anmorephysics.

5 com

QUESTION 3: INVENTORY

3.1 Calculate the following :

3.1.1 Calculate the cost of sales

Opening Stock

Purchases

Carriage on purchases

3.1.2 Calculate the gross profit

3.1.3 Provide ONE reason for the drop in the mark-up percentage.

13

TOTAL: 100

Grade 11 Control Test: 2021 September 23 Answer Book

Downloaded f rom St anmorephysics. com

MARKING GUIDELINES

CONTROL TEST - GRADE 11

ACCOUNTING GRADE 11 – 2021 SEPTEMBER

CONTROL TEST : MARKING GUIDELINES

MARKS

QUESTION 1

Cash Budget and Projected Income Statement 25

QUESTION 2

Cash Budget 62

QUESTION 3

Inventory 13

TOTAL MARKS 100

These marking guidelines consist of 3 pages.

Downloaded f rom St anmorephysics.

2 com

QUESTION 1 : CASH BUDGET AND PROJECTED INCOME STATEMENT

1.1 CONCEPTS ON BUDGETS

1.1.1 Explain the difference between the cash budget and a projected income

statement.

Allocate one mark for each explanation ü ü

Cash Budget

• Project or estimate the expected bank balance at end of budget period.

• Project / estimate / monitor / control expected cash receipts and payments

over the budget period.

Projected Income Statement

• Project and estimate the expected net profit for the budgeted period.

• Project / estimate / monitor / control expected income and expenses for 2

budget period.

1.1.2 Mention TWO expenses that will not be included under payments in the

Cash Budget.

• Depreciation ü

• Discount allowed ü

• Loss on sale of an asset

2

• Trading stock deficit

• Bad debts

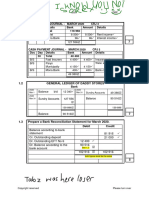

1.2 CASH BUDGET AND PROJECTED INCOME STATEMENT

JULY 2021

Cash Budget Projected Income Statement

No.

Receipt Payment Income Expense

Example R2 200 R2 200

1.2.1 ü90 000 ü90 000 üü56 250

1.2.2 üü6 600 #R 6 600

see cash budget

1.2.3 üü57 000 ü3 000

1.2.4 ü9 000 üü1 500

1.2.5 ü1 800 üü700

1.2.6 ü 8 450 ü450

1.2.7 üü 2 250 #R2 250 21

see cash budget

1.2.2 72 000 x (110/100) ÷ 12 = 6 600

1.2.5 2 500 – 1 800 = 700

8 000 - 5 500 25

#R if the correct answer is written ONLY on the correct side of

PIJ award two marks

Grade 11 Control Test: 2021 September 23 Marking Guidelines

Downloaded f rom St anmorephysics.

3 com

QUESTION 2: CASH BUDGET

2.1 Debtors’ collection Schedule for July and August 2021

MONTHS CREDIT SALES JULY AUGUST

May 62 400 3 120

June üü71 280 49 896 ü3 564

July 86 400 ü17 280 ü60 480

August 67 200 ü13 440

R 70 296 R 77 484

8

1.2 Cash Budget for July and August 2021

JULY 2021 AUGUST 2021

CASH RECEIPTS

Cash sales of merchandise 129 600 üü100 800

Collection from debtors R 70 296 R 77 484

Rent income 15 000 16 500

Commission income

Income from deceased estate üü500 000

TOTAL RECEIPTS R 214 896 R 694 784

CASH PAYMENTS

Cash purchase of trading stock 36 000 üüü28 000

168 000 x 100/150 x 0.25 = 28 000

Payment to creditors 84 645 ü102 600

Salary: Manager 36 000 39 600

Salary: Six workers 66 000 üü68 310

Telephone (Accept 7 500 - two marks) üü6 800 7 500

Advertising 36 000 24 000

Insurance üü5 000 5 500

Delivery costs (payable to Jozi Deliveries) 21 600 üü16 800

Sundry expenses 6 000 ü6 000

Drawings 50 000 üü50 800

Loan (125 000 two marks+ 6 000 one mark) üü6 000 R üü131 000

Interest on loan 2 750 2 695

Fixed deposit üü375 000

Deposit on vehicle ü ü 50 000

Instalment on vehicle ü12 500

Total payments R 406 795 R 870 305

Cash surplus/deficit R (191 899) R (175 521)

Bank balance at beginning of month (20 400) R (212 299) 40

Bank balance at end of month R (212 299) R (387 820)

Allocate marks if 125 000 and 6 000 are recorded separately. If 6 000 is only written under August, award

2 marks.

2 750 – 2 695 = 55 x 12 ÷ 0.11 = 6 000 repayment of loan.

Grade 11 Control Test: 2021 September 23 Marking Guidelines

Downloaded f rom St anmorephysics.

4 com

2.3.1 Give TWO reasons why the workers are dissatisfied, use figures or

indicators to support your answer

Valid reason ü ü Relevant figure/s P ü

• They will receive an increase of 3.5% (R2 310 or R385 each) while the

bookkeeper will receive an increase of 10% or by R36 000 or from

R30 000 to R39 600. 4

• 3.5% increase is lower compared to the inflation rate of 6%.

2.3.2 By making reference to the cash budget, explain why you would agree

with the wage increase offered by Phakiso, provide ONE point.

Valid reason ü Relevant figure/s P

• The business is experiencing cash flow problems as the bank balance is expected

to be overdrawn at the end of August 2021 by (R348 320) /July (R170 299). check

figures presented in the Cash Budget 2

• The total sales for June were (R67 800) lower than budgeted sales OR

Budgeted R246 000 but sold R178 200.

2.4.1 Phakiso decided to offer trade discounts to special customers in July 2021.

In your opinion, has this benefitted the business? Provide figures to

support your answer.

Valid reason ü Relevant figure/s P

No

• Actual sales were R48 000 lower compared to budgeted OR Budgeted 2

R216 000 but sold R168 000.

• Gross profit was R56 000 compared to the projected amount, R72 000.

2.4.2 Comment on the control of the following expenses, quote figures to support your answer

and provide ONE point of advice in EACH case.

COMMENT(One point ) ADVICE(One point)

Valid comment P P Figures P P Valid point P P

Sales were less than budgeted, so Investigate possible fraud or

actual delivery expenses should inefficiency OR Change the

Delivery have been R16 800 or reduced by delivery firm OR Charge

costs R4 800. customers for the deliveries.

He has overspent by R10 000 Investigate why advertising was

(R36 000 budgeted compared to ineffective OR Improve method

Advertising actual R36 000) OR did not result of advertising.

costs to increase in sales, they were

6

R48 000 lesser than budgeted.

62

Grade 11 Control Test: 2021 September 23 Marking Guidelines

Downloaded f rom St anmorephysics.

5 com

QUESTION 3: INVENTORY

3.1 Calculate the following :

3.1.1 Calculate the cost of sales

Opening Stock P 394 200

Purchases (2 127 800 P+ 62 000 P-19 400 P- 4 200P ) **2 166 200

Carriage on purchases P87 700

2 648 100

Closing Stock P (313 200)

8

Cost of sales one part correct *R 2 334 900

**Allocate four marks to 2 166 200

3.1.2 Calculate the gross profit

Sales (3038 500 + 20 500) PP 3059 000

Cost of sales Check 3.1.1 R (2 334 900)

Gross Profit one part correct R724 100

4

3.1.3 Provide ONE reason for the drop in the mark-up percentage.

• Discounts offered during clearance sales to increase sales

• Discounts to bulk buyers to increase sales 1

• Incorrect calculation of mark-up

• poor control resulted to theft of stock

13

TOTAL: 100

Grade 11 Control Test: 2021 September 23 Marking Guidelines

You might also like

- Grade 11 Control Test Two - Question PaperDocument6 pagesGrade 11 Control Test Two - Question Papertshabalalab818No ratings yet

- Gr11 ACC P2 (ENG) June 2022 Question PaperDocument11 pagesGr11 ACC P2 (ENG) June 2022 Question PaperKarla LeemansNo ratings yet

- Gr11 ACC P2 (ENG) June 2022 Question PaperDocument11 pagesGr11 ACC P2 (ENG) June 2022 Question Paperora masha100% (1)

- Accounting p1 Prep Sept 2022 QP EngDocument13 pagesAccounting p1 Prep Sept 2022 QP Engrifumo579No ratings yet

- Acc G11 Ec Nov 2022 P1 QPDocument10 pagesAcc G11 Ec Nov 2022 P1 QPTshenoloNo ratings yet

- Accounting p1 Sep 2022Document13 pagesAccounting p1 Sep 2022nonoandiswa96No ratings yet

- Acc Gr11 March 2022 QP and MemoDocument20 pagesAcc Gr11 March 2022 QP and Memonxumalothandolwethu1No ratings yet

- ACCOUNTING P1 GR10 QP NOV2019 - Eng DDocument16 pagesACCOUNTING P1 GR10 QP NOV2019 - Eng Dprincemaika68No ratings yet

- GR 11 Accounting P2 (English) November 2022 Question PaperDocument14 pagesGR 11 Accounting P2 (English) November 2022 Question Paperphafane2020No ratings yet

- Ilovepdf MergedDocument15 pagesIlovepdf MergedRakib KhanNo ratings yet

- FINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionDocument5 pagesFINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionRakib KhanNo ratings yet

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- CA Zambia June 2022 Q ADocument394 pagesCA Zambia June 2022 Q AChanda LufunguloNo ratings yet

- Midterm Test - Code 1 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 1 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- Accounting P1 May-June 2023 EngDocument12 pagesAccounting P1 May-June 2023 EngKaren ErasmusNo ratings yet

- Surname Q2-ADocument33 pagesSurname Q2-ALovely Anne Dela CruzNo ratings yet

- ACCOUNTING P2 GR11 QP NOV2022 - EnglishDocument10 pagesACCOUNTING P2 GR11 QP NOV2022 - Englishora mashaNo ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- AP 202 Audit of ReceivableDocument4 pagesAP 202 Audit of ReceivableJai BacalsoNo ratings yet

- Midterm Test - Code 40 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 40 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- 2023 Grade 11 Written Report QPDocument5 pages2023 Grade 11 Written Report QPfiercestallionofficialNo ratings yet

- Competency Exam ABC Fs 2022Document5 pagesCompetency Exam ABC Fs 2022j.dimaporo.540424No ratings yet

- Accounting P1 Nov 2021 EngDocument12 pagesAccounting P1 Nov 2021 EngnicholasvhahangweleNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Accn P2 QP Ansbk Memo GR11 Nov2020 Eng DDocument32 pagesAccn P2 QP Ansbk Memo GR11 Nov2020 Eng Dlindort00No ratings yet

- Midterm Test - Code 4 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 4 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- ACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishDocument13 pagesACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishmulisanembaheNo ratings yet

- BANOShenieLynn IA3 CD1 Assignment5Document6 pagesBANOShenieLynn IA3 CD1 Assignment5Shenie Lynn BanoNo ratings yet

- Accounting P1 Nov 2021 EngDocument11 pagesAccounting P1 Nov 2021 EngLloydNo ratings yet

- CA Zambia Qa March 2022Document406 pagesCA Zambia Qa March 2022Johaness Boneventure100% (1)

- Accounting GR 10 Paper - PDFDocument9 pagesAccounting GR 10 Paper - PDFAngel JozanaNo ratings yet

- ACCOUNTING P1 GR12 AB SEPT - EnglishDocument11 pagesACCOUNTING P1 GR12 AB SEPT - EnglishSthockzin EntNo ratings yet

- ACCOx 131 EcDocument10 pagesACCOx 131 EcSinazo XhosaNo ratings yet

- Accountancy Master Test 4 PDFDocument5 pagesAccountancy Master Test 4 PDFRaghav PrajapatiNo ratings yet

- Accounting p2 Gr11 QP Nov2020 - EnglishDocument12 pagesAccounting p2 Gr11 QP Nov2020 - Englishleslietee192006No ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- Tutorial Letter 001/3/2021: Semester 1 and 2Document11 pagesTutorial Letter 001/3/2021: Semester 1 and 2Danielle Toni Dee NdlovuNo ratings yet

- Accounting P1 Nov 2021 Answer Book EngDocument11 pagesAccounting P1 Nov 2021 Answer Book EngnicholasvhahangweleNo ratings yet

- Accounting Grade 11 Revision Term 1 - 2023Document15 pagesAccounting Grade 11 Revision Term 1 - 2023sihlemooi3No ratings yet

- FIA131 Supplementary and Special Assessment May June 2022Document9 pagesFIA131 Supplementary and Special Assessment May June 2022Joshua CloeteNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Accounting GR 11 Acc T3 Wk7 Budgets ConsolidateDocument5 pagesAccounting GR 11 Acc T3 Wk7 Budgets Consolidatesihlemooi3No ratings yet

- Accounts Receivable MaterialDocument4 pagesAccounts Receivable Materialkookie bunnyNo ratings yet

- 06.1 - Liabilities PDFDocument5 pages06.1 - Liabilities PDFDonna AbogadoNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Acc G11 Ec Nov 2022 P2 AbDocument8 pagesAcc G11 Ec Nov 2022 P2 AbTshenoloNo ratings yet

- AP - A05 Audit of LiabilitiesDocument7 pagesAP - A05 Audit of LiabilitiesJane DizonNo ratings yet

- 2021 Accounting Examination PaperDocument38 pages2021 Accounting Examination Paperzacrasheed2No ratings yet

- Pup Auditofreceivable1 Bsa4 2Document6 pagesPup Auditofreceivable1 Bsa4 2Makoy BixenmanNo ratings yet

- Exercise Week 2 - Cash and ReceivablesDocument4 pagesExercise Week 2 - Cash and Receivablesnatasha karyadiNo ratings yet

- Accounting P1 May-June 2021 EngDocument14 pagesAccounting P1 May-June 2021 EngdanNo ratings yet

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDocument3 pagesDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNo ratings yet

- HKMU BAFS 2022 P2A Question EngDocument11 pagesHKMU BAFS 2022 P2A Question EngJaeeeNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Bank Reconciliations MemoDocument15 pagesBank Reconciliations Memolindort00No ratings yet

- G10 Algebra Checkpoint Test 2 MEMODocument2 pagesG10 Algebra Checkpoint Test 2 MEMOlindort00No ratings yet

- ACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 ANSWER BOOK NOVEMBER 2020 - Englishlindort00No ratings yet

- LIFE SCIENCES P1 GR11 QP NOV2019 - Eng DDocument16 pagesLIFE SCIENCES P1 GR11 QP NOV2019 - Eng Dlindort00No ratings yet

- Accounting P2 GR 11 Exemplar Nov 2019 Memo EngDocument10 pagesAccounting P2 GR 11 Exemplar Nov 2019 Memo Englindort00No ratings yet

- Mathematics 2020 P1 MemoDocument17 pagesMathematics 2020 P1 Memolindort00No ratings yet

- Mathematics 2019 P2 MemoDocument13 pagesMathematics 2019 P2 Memolindort00No ratings yet

- ACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJDocument9 pagesACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJlindort00No ratings yet

- Accounting May-June 2019 EngDocument18 pagesAccounting May-June 2019 Englindort00No ratings yet

- Accn P2 QP Ansbk Memo GR11 Nov2020 Eng DDocument32 pagesAccn P2 QP Ansbk Memo GR11 Nov2020 Eng Dlindort00No ratings yet

- This Study Resource Was: Accounting 201 Name Comprehensive Problem (100 Points) Due: Tuesday, 4/18/2017Document3 pagesThis Study Resource Was: Accounting 201 Name Comprehensive Problem (100 Points) Due: Tuesday, 4/18/2017GraceCaoileNo ratings yet

- ch4 HorrgernDocument27 pagesch4 HorrgernMahmoud MohamedNo ratings yet

- BGR Annual Report 2020Document180 pagesBGR Annual Report 2020Sam vermNo ratings yet

- 20 007 Tax Accounting Unravelling Mystery Income Taxes Second Revised Edition Final PrintDocument32 pages20 007 Tax Accounting Unravelling Mystery Income Taxes Second Revised Edition Final Printmolladagim19No ratings yet

- Chapter 12 Government GrantsDocument19 pagesChapter 12 Government GrantsHammad Ahmad82% (11)

- 1 - 1 Identifying Business TransactionsDocument5 pages1 - 1 Identifying Business TransactionsChristian Oliveros100% (1)

- Comprehensive Accounting Cycle Review Problem 1Document13 pagesComprehensive Accounting Cycle Review Problem 1api-270882496No ratings yet

- 19 Common Financial Analyst Interview Questions and AnswersDocument12 pages19 Common Financial Analyst Interview Questions and AnswersCharish Jane Antonio CarreonNo ratings yet

- Income Statement (Annual and Monthly Comparative Analysis)Document1 pageIncome Statement (Annual and Monthly Comparative Analysis)Kidus DawitNo ratings yet

- Corporate Finance 3rd Edition by Berk DeMarzo ISBN Test BankDocument38 pagesCorporate Finance 3rd Edition by Berk DeMarzo ISBN Test Bankcarl100% (24)

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document6 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Doughty IncNo ratings yet

- Aqa Accn4 W Ms Jun12Document15 pagesAqa Accn4 W Ms Jun12zahid_mahmood3811No ratings yet

- 1 Financial Statements Other Than SCFDocument15 pages1 Financial Statements Other Than SCFYassin DyabNo ratings yet

- Cost-Volume-Profit Analysis: Part-A QuestionsDocument10 pagesCost-Volume-Profit Analysis: Part-A QuestionsAtiq RehmanNo ratings yet

- STEWARD Resort: PAMALICAN RESORT, INC. (Amanpulo)Document8 pagesSTEWARD Resort: PAMALICAN RESORT, INC. (Amanpulo)Rachel Las MariasNo ratings yet

- Accounting For Merchandising ActivitiesDocument53 pagesAccounting For Merchandising ActivitiesalmorsNo ratings yet

- SALARY SLIP August 2021Document1 pageSALARY SLIP August 2021Lal krishnanNo ratings yet

- Chapter 3 Test BankDocument60 pagesChapter 3 Test BankHaider EjazNo ratings yet

- Rental Property Income Statement and Balance SheetDocument1 pageRental Property Income Statement and Balance SheetCentury 21 Sweyer and Associates71% (7)

- A1 Basic Financial Statement Analysis Q8Document3 pagesA1 Basic Financial Statement Analysis Q8bernard cruzNo ratings yet

- GAAP and Accounting StandardsDocument43 pagesGAAP and Accounting Standardssvasvasv daNo ratings yet

- p1 52Document52 pagesp1 52Xeniya Morozova Kurmayeva67% (3)

- Chapter 2 Nca Held For Sale and Discontinued OperationsDocument14 pagesChapter 2 Nca Held For Sale and Discontinued Operationslady gwaeyngNo ratings yet

- Module - 6: Planning and Evaluating OperationDocument57 pagesModule - 6: Planning and Evaluating OperationAdarsh ShrivastavaNo ratings yet

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Byke Annual Report 2016 17Document93 pagesByke Annual Report 2016 17gvs_2No ratings yet

- P2 5aDocument2 pagesP2 5aFarra AmaliaNo ratings yet

- Problem 8 ACCA101Document28 pagesProblem 8 ACCA101Nicole FidelsonNo ratings yet

- Ramji Bai VasavaDocument9 pagesRamji Bai Vasavaajatc6048100% (1)

- Project DatasetDocument201 pagesProject Datasetapi-350428425No ratings yet