Professional Documents

Culture Documents

19 Review & Finalisation

Uploaded by

Akash AjayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19 Review & Finalisation

Uploaded by

Akash AjayCopyright:

Available Formats

19.

Review & Finalisation

SUBSEQUENT EVENTS

Events occurring between the date of financial statement and the date of auditor's report, and facts that

become known to the auditor after the date of auditor’s report are called subsequent events. Financial

statements are affected by some events that occur after the date of financial statements. They are of

two kinds:

Adjusting events are those that provide evidence of conditions that existed at the date of

financial statements Eg: Settlement of court case.

Non-adjusting events are those that provide existence of conditions that arose after the date of

FS Eg: Fire causing loss of inventory, dividends declared after the year end.

Active duty: Year end to Auditor’s report signed.

Review management established procedures.

Review minutes of board meeting from date of FS to date of audit report being signed.

Enquire of the management the occurrence of any sub event.

Enquire of the entity’s legal counsel the status of ongoing cases, if any.

Read the latest available interim FS.

Obtain written representation from management regarding completeness of sub events.

Passive duty: Auditor becomes aware of a material subsequent event during

a) Auditor’s report signed to FS issued.

Discuss with management whether FS needs amendment.

If management amends the FS, then extend audit procedures to the items that require

amendment or disclosure and issue a new, unmodified auditor’s report.

If management refuses to amend the FS, then auditor should either: (if not yet

released report) reissue a report with a modified opinion or seek legal advice (if

already released)

b) FS issued to AGM.

Discuss matter with management

If management amends the FS, auditor should issue a new auditor’s report with an

emphasis of matter or other matter para to explain the revision to previously issued

FS.

If management refuses to amend FS, seek legal advice.

GOING CONCERN

ISA 570 objectives:

Obtain sufficient and appropriate audit evidence and conclude on the appropriateness of the

management’s use of going concern basis of accounting.

To conclude the existence of a material uncertainty related to events or conditions that

significantly cast doubt on the going concern status of the entity.

Report according to ISA 570.

Going concern indicators:

i. Financial

Net liability or net current liability position

Indicators of withdrawal of financial support by creditors

Arrears or discontinuance of dividends

Inability to comply with loan agreements

Change from credit to COD terms with suppliers

Inability to obtain new finance

ii. Operational

Loss of key management without replacement

Shortage of imp supplies

Labour difficulties

Loss of major market, key customer, license or main supplier

Mgmt inention to liquidate the entity or cease operations

iii. Other

Non-compliance with capital or other statutory requirements

Uninsured or underinsured catastrophes when they occur

Management’s assessment of entity’s ability to continue as going concern should be at least 12

months from date of FS. Auditor may also enquire of the management its knowledge of events or

conditions beyond the assessment period that threatens its going concern status.

If events or conditions have been identified that cast a significant doubt on the going concern status of

the entity, perform additional audit procedures to obtain evidence for material uncertainty. Such as:

Ask the management to prepare an assessment if they have not already.

Evaluate the reliability of data used for preparation of cash flow forecasts and consider the

assumptions used to make the forecast

Evaluate management’s plan for future action

Consider whether any new info has come to light since the date of assessment

Request a written representation from the management and those charged with governance

about plans for future action and feasibility of these plans.

WRITTEN REPRESENTATIONS

Written statements by management provided to the auditor to confirm certain matters or support other

evidence. It does not include financial statements, assertions or supporting books and records.

Three areas where it is necessary:

i. Several ISAs require written representation, such as, fraud, laws and regulation, going

concern, estimates, sub events.

ii. To support audit evidence relevant to FS if determined by the auditor.

iii. To confirm that the management has fulfilled its responsibility regarding preparation of FS,

that all transactions have been recorded and that all relevant info has been provided to the

auditor.

Obtaining WR

i. Agree procedures at an early stage (eg letter of engagement)

ii. Discuss the content of the letter with management.

iii. Print on the client’s headed paper and to be signed by management.

iv. Dated as close to auditor’s report being signed as possible but not after it.

If WR is not provided:

i. Discuss matter with management.

ii. Re-evaluate the integrity of the management and evaluate its effect on the reliability of

representation and audit evidence.

iii. Take appropriate actions, including determining the impact on auditor’s report.

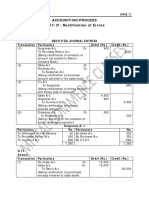

OVERALL REVIEW OF FS

Auditor shall design and perform analytical procedures to assist in forming overall conclusion.

Misstatement – A difference between the reported amount, classification, presentation or disclosure of

FS items and the amount, classification, presentation or disclosure as required by the applicable

financial reporting framework.

An uncorrected misstatement is a misstatement that the auditor has accumulated during the audit that

has not been corrected. The auditor should maintain a schedule of misstatements identified that have

not been corrected.

Individually immaterial ones could aggregate to form a material misstatement.

Auditor is required to communicate the uncorrected misstatements and their effect to those charged

with governance. Auditor should request for them to be corrected and shall also communicate prior

period misstatements. He should ask for a WR from management and those charged with governance,

as to whether they believe it is immaterial (individually or as a whole).

Auditor should document:

i. Amount below which misstatements would be regarded as clearly trivial.

ii. All misstatements accumulated during audit and whether they have been corrected.

iii. The auditor’s conclusion as to whether the uncorrected misstatements are material and the

basis of conclusion.

You might also like

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- 18 Completing The AuditDocument7 pages18 Completing The Auditrandomlungs121223No ratings yet

- Completing The AuditDocument26 pagesCompleting The AuditJuliana ChengNo ratings yet

- Overall Audit ReviewDocument12 pagesOverall Audit ReviewJohn GachuhiNo ratings yet

- Completing The Audit and Post Audit ResponsibilitiesDocument8 pagesCompleting The Audit and Post Audit ResponsibilitiesJBNo ratings yet

- Completing The AuditDocument25 pagesCompleting The AuditJeremy James AlbayNo ratings yet

- Audit Completion ProceduresDocument4 pagesAudit Completion ProceduresDonise Ronadel SantosNo ratings yet

- AT 11 Completing The AuditDocument4 pagesAT 11 Completing The AuditPrincess Mary Joy LadagaNo ratings yet

- Completion and Review (Chapter 9)Document10 pagesCompletion and Review (Chapter 9)Diana TuckerNo ratings yet

- Part 3 Review of Auditing TheoryDocument16 pagesPart 3 Review of Auditing TheoryMae Ann RaquinNo ratings yet

- AC414 - Audit and Investigations II - Audit Finalisation and ReviewDocument26 pagesAC414 - Audit and Investigations II - Audit Finalisation and ReviewTsitsi AbigailNo ratings yet

- Completing the Audit ProceduresDocument19 pagesCompleting the Audit ProceduresThe Brain Dump PHNo ratings yet

- Completing The Audit Post Audit ResponsibilitiesDocument35 pagesCompleting The Audit Post Audit ResponsibilitiesJov E. AlcanseNo ratings yet

- Completing The Audit Engagement: Answers To Multiple-Choice QuestionsDocument4 pagesCompleting The Audit Engagement: Answers To Multiple-Choice QuestionsSabrina Xun SuNo ratings yet

- Completing The AuditDocument8 pagesCompleting The AuditDeryl GalveNo ratings yet

- MANAGEMENT REPRESENTATIONS AUDITDocument14 pagesMANAGEMENT REPRESENTATIONS AUDITJoseph SimudzirayiNo ratings yet

- Completing The Audit: Reference: Sirug, Red. Notes From Handouts On Auditing TheoryDocument12 pagesCompleting The Audit: Reference: Sirug, Red. Notes From Handouts On Auditing TheoryAlex OngNo ratings yet

- Audmod6 Completing The AuditDocument10 pagesAudmod6 Completing The AuditJohn Archie AntonioNo ratings yet

- Completing The Audit CycleDocument74 pagesCompleting The Audit CycleIryne Kim PalatanNo ratings yet

- CAC4203 Completion of The AuditDocument49 pagesCAC4203 Completion of The AuditcliffordpradamoyoNo ratings yet

- Pre1 Completing The AuditDocument8 pagesPre1 Completing The AuditMixx MineNo ratings yet

- Completing Audit ProceduresDocument7 pagesCompleting Audit ProceduresyebegashetNo ratings yet

- Notes To FSDocument28 pagesNotes To FSLouisse Homer NarcisoNo ratings yet

- NajirDocument50 pagesNajirnajirahmad.coxsNo ratings yet

- Related Party Transactions (Bsa 550)Document4 pagesRelated Party Transactions (Bsa 550)Hasanur RaselNo ratings yet

- Chapter 10 Completing The AuditDocument8 pagesChapter 10 Completing The AuditKayla Sophia PatioNo ratings yet

- Auditing Theory: Completing The AuditDocument10 pagesAuditing Theory: Completing The AuditAljur SalamedaNo ratings yet

- Audit review and finalisation proceduresDocument10 pagesAudit review and finalisation proceduresHassan AhmedNo ratings yet

- The Audit Process - Final ReviewDocument5 pagesThe Audit Process - Final ReviewFazlan Muallif ResnuliusNo ratings yet

- CPAR AT - Completing The AuditDocument10 pagesCPAR AT - Completing The AuditJohn Carlo CruzNo ratings yet

- Completing The AuditDocument27 pagesCompleting The AuditnikkaaaNo ratings yet

- Completing Audit ProceduresDocument16 pagesCompleting Audit ProceduresMark GerwinNo ratings yet

- Audit Review Subsequent Events & Going ConcernDocument3 pagesAudit Review Subsequent Events & Going ConcernSalim Ahsan RaadNo ratings yet

- Day 15 - SAs - SADocument3 pagesDay 15 - SAs - SAVarun JoshiNo ratings yet

- Audit and Assurance Suggested AnswersDocument8 pagesAudit and Assurance Suggested AnswersMohayman AbdullahNo ratings yet

- Going Concern: Risk Assessment ProceduresDocument2 pagesGoing Concern: Risk Assessment ProceduresDaniela Periñan BerrioNo ratings yet

- Completing the Audit ProceduresDocument3 pagesCompleting the Audit ProceduresneilonlinedealsNo ratings yet

- ) Describe The Audit Procedures That Should Be Performed To Obtain Sufficient Appropriate Evidence That The Subsequent Events Have Been Appropriately Treated in The Financial Statements.Document3 pages) Describe The Audit Procedures That Should Be Performed To Obtain Sufficient Appropriate Evidence That The Subsequent Events Have Been Appropriately Treated in The Financial Statements.Phebieon MukwenhaNo ratings yet

- Review and CommunicationDocument6 pagesReview and CommunicationSanaNo ratings yet

- Financial Events and ConditionsDocument4 pagesFinancial Events and ConditionsFuturamaramaNo ratings yet

- Aas 16 Going ConcernDocument5 pagesAas 16 Going ConcernRishabh GuptaNo ratings yet

- Going Concern Going Concern: International Standard International Standard On Auditing 570 On Auditing 570Document24 pagesGoing Concern Going Concern: International Standard International Standard On Auditing 570 On Auditing 570khalid1173No ratings yet

- Unit 7 - Audit CompletionDocument36 pagesUnit 7 - Audit CompletionOlivia HenryNo ratings yet

- Nama: Dodi Prasetya NIM: 19080694039 Kelas: Akuntansi 2019IDocument3 pagesNama: Dodi Prasetya NIM: 19080694039 Kelas: Akuntansi 2019IDodi PrasetyaNo ratings yet

- Audit Procedures for Commitments, Contingencies, Estimates, EventsDocument8 pagesAudit Procedures for Commitments, Contingencies, Estimates, EventsArista Yuliana SariNo ratings yet

- Completing The AuditDocument5 pagesCompleting The Auditmrs leeNo ratings yet

- Auditing 4 Chapter 4Document6 pagesAuditing 4 Chapter 4Mohamed DiabNo ratings yet

- Completing The AuditDocument31 pagesCompleting The AuditDenzel AquinoNo ratings yet

- Completing The AuditDocument38 pagesCompleting The AuditMazmurNo ratings yet

- Subsequent Events Definition and Relates Audit ProceduresDocument5 pagesSubsequent Events Definition and Relates Audit ProceduresAyesha RasoolNo ratings yet

- Unit 8 Modaudp 4Document49 pagesUnit 8 Modaudp 4Wihl Mathew ZalatarNo ratings yet

- Quality Control For Audit WorkDocument21 pagesQuality Control For Audit Workmacdonald buzuziNo ratings yet

- Summary Notes AuditDocument24 pagesSummary Notes AuditJay ProNo ratings yet

- Subsiquent EventsDocument8 pagesSubsiquent EventsAsumpta MunaNo ratings yet

- Append To The Audit File After Final Assembly - Others, Including Subsequent Events and Other July 2019Document4 pagesAppend To The Audit File After Final Assembly - Others, Including Subsequent Events and Other July 2019sona abrahamyanNo ratings yet

- Notes To Financial StatementsDocument30 pagesNotes To Financial StatementsJonathan NavalloNo ratings yet

- New Microsoft PowerPoint PresentationDocument48 pagesNew Microsoft PowerPoint PresentationIryne Kim PalatanNo ratings yet

- Responsibilities (Case Answer)Document6 pagesResponsibilities (Case Answer)MonikaChoudhouryNo ratings yet

- Accepting An EngagementDocument4 pagesAccepting An EngagementRalph Ean BrazaNo ratings yet

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- Paper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawsDocument14 pagesPaper 2: Business Laws and Business Correspondence and Reporting Section A: Business LawsNitesh PatelNo ratings yet

- Untitled Presentation-1Document11 pagesUntitled Presentation-1Akash AjayNo ratings yet

- 64572bos51817p1 FNDDocument12 pages64572bos51817p1 FNDSanjai RNo ratings yet

- Merged File Past Year PaperDocument64 pagesMerged File Past Year PaperAkash AjayNo ratings yet

- Paper: 4A Business Economics CA FoundationDocument4 pagesPaper: 4A Business Economics CA FoundationPappuNo ratings yet

- Principles & Practice ofDocument306 pagesPrinciples & Practice ofMishal100% (1)

- CA Foundation Paper 2B Busniess Correspondance AnalysisDocument4 pagesCA Foundation Paper 2B Busniess Correspondance AnalysisAkash AjayNo ratings yet

- CA Foundation Accounting SolutionsDocument117 pagesCA Foundation Accounting SolutionsAkash AjayNo ratings yet

- 0 - 297-Accountancy True False QuestionsDocument19 pages0 - 297-Accountancy True False QuestionsMishal60% (5)

- Merged RTP - CA Foundation AccountsDocument124 pagesMerged RTP - CA Foundation AccountsAkash AjayNo ratings yet

- CA FOUNDATION Nov 2021 Chapter Wise Test SeriesDocument3 pagesCA FOUNDATION Nov 2021 Chapter Wise Test SeriesAkash AjayNo ratings yet

- Fundamentals of AccountingDocument74 pagesFundamentals of AccountingSuresh LamsalNo ratings yet

- FEE STRUCTURE CA Foundation One Chapter One Test SeriesDocument1 pageFEE STRUCTURE CA Foundation One Chapter One Test SeriesAkash AjayNo ratings yet

- Accounting Standards (As) and International Financial Reporting StandardsDocument34 pagesAccounting Standards (As) and International Financial Reporting StandardsSD gamingNo ratings yet

- Impact of adverse macro on auditDocument7 pagesImpact of adverse macro on auditAli OptimisticNo ratings yet

- CPA Handbook CoverageDocument10 pagesCPA Handbook CoverageMadison DolnyNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsReymark MutiaNo ratings yet

- Written QuestionsDocument33 pagesWritten QuestionsLet it beNo ratings yet

- Independent Auditor'S Report: Responsibilities For The Audit of The Consolidated Financial Statements Section of OurDocument10 pagesIndependent Auditor'S Report: Responsibilities For The Audit of The Consolidated Financial Statements Section of OurMicka EllahNo ratings yet

- Siyb Ar 2018 FinalDocument37 pagesSiyb Ar 2018 FinalAbir BaigNo ratings yet

- 08_Handout_1(CFAS)Document12 pages08_Handout_1(CFAS)laurencedechosa907No ratings yet

- Past Papers Practice (ICAP QS) - H.O # 3Document5 pagesPast Papers Practice (ICAP QS) - H.O # 3Saif SiddNo ratings yet

- 003 LONG QUIZ - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument4 pages003 LONG QUIZ - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou PanisalesNo ratings yet

- B3Document12 pagesB3issa adiemaNo ratings yet

- SECFiling 3025241Document667 pagesSECFiling 3025241Mohamed Bin IerousNo ratings yet

- Audit Eunice Cheatsheet (Autosaved) PrintDocument8 pagesAudit Eunice Cheatsheet (Autosaved) PrintEric OngNo ratings yet

- Accounting and Cost Allocation ManualDocument53 pagesAccounting and Cost Allocation ManualESSU Societas Discipulorum LegisNo ratings yet

- University of Santo Tomas Alfredo M. Velayo College of AccountancyDocument4 pagesUniversity of Santo Tomas Alfredo M. Velayo College of AccountancyChni Gals0% (1)

- AUD Flashcards Flashcards - QuizletDocument16 pagesAUD Flashcards Flashcards - QuizletDieter LudwigNo ratings yet

- Chapter4 - Conceptual FrameworkDocument13 pagesChapter4 - Conceptual FrameworkGloria UmaliNo ratings yet

- Francis - 2011 - A Framework For Understanding and Researching Audit Quality - Abdul AzisDocument28 pagesFrancis - 2011 - A Framework For Understanding and Researching Audit Quality - Abdul AzisMiftahul khairNo ratings yet

- Auditor's Report - Sole PropDocument3 pagesAuditor's Report - Sole PropRonn Robby Rosales100% (1)

- Far 01aDocument9 pagesFar 01aRaquel Villar DayaoNo ratings yet

- ConFras NotesDocument11 pagesConFras Notesdexter gentrolesNo ratings yet

- AUD610Document202 pagesAUD610Raja AinNo ratings yet

- Financialreport PttFR2019en 12marchDocument210 pagesFinancialreport PttFR2019en 12marchJanna GunioNo ratings yet

- Ventura, Mary Mickaella R - p.44 - Statement of Financial PositionDocument6 pagesVentura, Mary Mickaella R - p.44 - Statement of Financial PositionMary VenturaNo ratings yet

- CPA POP QuizDocument28 pagesCPA POP QuizKeanu TevesNo ratings yet

- All ExamsDocument135 pagesAll Examsfaith050883% (6)

- PKF Littlejohn Component Auditor InstructionsDocument53 pagesPKF Littlejohn Component Auditor InstructionsHenry CamiloNo ratings yet

- V1 Exam 2 Morning PDFDocument53 pagesV1 Exam 2 Morning PDFSairaNo ratings yet

- Assignment ON Cadbury Report AND The RecomendationsDocument9 pagesAssignment ON Cadbury Report AND The RecomendationsSonam LodayNo ratings yet

- AUDDocument20 pagesAUDJay GamboaNo ratings yet