Professional Documents

Culture Documents

Tobin RES1956

Uploaded by

Socorro Burgos CastroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tobin RES1956

Uploaded by

Socorro Burgos CastroCopyright:

Available Formats

The Interest-Elasticity of Transactions Demand For Cash

Author(s): James Tobin

Reviewed work(s):

Source: The Review of Economics and Statistics, Vol. 38, No. 3 (Aug., 1956), pp. 241-247

Published by: The MIT Press

Stable URL: http://www.jstor.org/stable/1925776 .

Accessed: 27/02/2013 07:21

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

The MIT Press is collaborating with JSTOR to digitize, preserve and extend access to The Review of

Economics and Statistics.

http://www.jstor.org

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

The Review of Economics and Statistics

VOLUME XXXVIII AUGUST I956 NUMBER 3

THE INTEREST-ELASTICITY OF TRANSACTIONS

DEMAND FOR CASH

James Tobin

ONE traditionallyrecognizedsourceof de- active money, the amount of cash holdings

mand for cash holdings is the need for needed for a given volume of transactions is

transactions balances, to bridge the gaps in taken as determined by the institutions and

time between the receipts and the expenditures conventions governing the degree of synchroni-

of economic units. By virtually common con- zation of receipts and expenditures. To take a

sent, this transactions demand for cash has simple example, suppose that an individual re-

been taken to be independent of the rate of in- ceives $ioo the first of each month, but dis-

terest. The relationship, if any, between the tributes a monthly total outlay of $ioo evenly

demand for cash holdings and the rate of in- through the month. His cash balance would

terest has been sought elsewhere-- in inelas- vary between $ioo on the first of each month

ticities or uncertaintiesof expectations of future and zero at the end of the month. On the aver-

interest rates. An exception is Professor Han- age his cash holdings would equal $50, or I/24

sen, who has argued that even transactions of his annual receipts and expenditures. If he

balances will become interest-elastic at high were paid once a year this ratio would be >2

enough interest rates.' Above some minimum, instead of I/24; and if he were paid once a

he conjectures, the higher the interest rate the week it would be I/I04.

more economical of cash balances transactors The failure of receipts and expenditures to

will be. be perfectly synchronized certainly creates the

The purpose of this paper is to support and need for transactions balances. But it is not

to elaborate Professor Hansen's argument. obvious that these balances must be cash. By

Even if there were unanimity and certainty cash I mean generally acceptable media of pay-

that prevailinginterest rates would continue un- ment, in which receipts are received and pay-

changed indefinitely,so that no motive for hold- ments must be made. Why not hold transac-

ing cash other than transactions requirements tions balances in assets with higher yields than

existed, the demand for cash would depend in- cash, shifting into cash only at the time an out-

versely on the rate of interest. The reason is lay must be made? The individual in the pre-

simply the cost of transactions between cash ceding example could buy $ioo of higher-yield-

and interest-bearing assets.2 ing assets at the beginning of the month, and

In traditional explanations of the velocity of gradually sell these for cash as he needs to

'Alvin H. Hansen, Monetary Theory and Fiscal Policy

make disbursements. On the average his cash

(New York, I949), 66-67. holdings would be zero, and his holdings of

2 importance of these costs in explaining the demand other assets $5o. The advantage of this pro-

for cash has been explicitly analyzed by W. J. Baumol,

"The Transactions Demand for Cash: An Inventory Theo-

cedure is of course the yield. The disadvantage

retic Approach," Quarterly Journal of Economics, LVI (No- is the cost, pecuniary and non-pecuniary, of

vember I952), 545-56, a paper which I should have read be- such frequent and small transactions between

fore writing this one but did not. Baumol is mainly inter-

ested in the implications of his analysis for the theory of the

cash and other assets. There are intermediate

transactions velocity of money at a given rate of interest, possibilities, dividing the $5o average transac-

while the focus of this paper is on the interest-elasticity of tions balances between cash and other assets.

the demand for cash at a given volume of transactions.

Other differences between Baumol's model and mine are

The greater the individual sets his average cash

discussed in the Appendix. holding, the lower will be both the yield of his

[24I]

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

242 THE REVIEW OF ECONOMICS AND STATISTICS

transactions balances and the cost of his trans- I

actions. When the yield disadavantage of cash T Y t)dt = Y/2. (2)

is slight, the costs of frequent transactions will

deter the holding of other assets, and average

T(t) is divided between cash C(t) and bonds

cash holdings will be large. However, when the

B(t):

yield disadvantage of cash is great, it is worth

while to incur large transactions costs and keep T(t) = B(t) + C(t) o ? B(t), C(t). (3)

average cash holdings low. Thus, it seems

plausible that the share of cash in transactions Let B and C be average bond holding and cash

balances will be related inversely to the interest holding respectively:

Lrate on other assets. The remainder of the

paper is a more rigorous proof of this possibil-

ity. B= B (t)dt

Let bonds represent the alternative asset in I

which transactions balances might be held.

C =fJe C(t)dt B+ C=T=Y/2. (4)

Bonds and cash are the same except in two re-

spects. One difference is that bonds are not a

medium of payment. The other is that bonds The interest rate per time period is r. Bonds

bear an interest rate.3 There is no risk of de- earn interest in proportionto the length of time

fault on bonds, nor any risk of a change in the they are held, no matter how short.

rate of interest. The problem is to find the relationship be-

A transaction of $x, either way, between tween B (and hence C) and the interest rate r,

bonds and cash is assumed to cost $(a + bx), on the assumption that the individual chooses

where a and b are both positive. Part of the B (t) and C (t) so as to maximize his interest

cost of a transaction is independent of the size earnings, net of transactions costs. The rela-

of the transaction, and part is proportional to tionship may be found in three steps:

that amount.

At the first of each time period (t = o), the i. Suppose that the number of transactions

individual receives $Y. He disburses this at a during the period were fixed at n. Given r,

uniform rate throughout the period, and at the what would be the optimal times (tl, t2, . . .

tn) and amounts of these n transactions?

end of the period (t = i) he has disbursed it

all.4 Thus his total transactions balance, what-

What would be the revenue Rn,from this opti-

ever its composition, T(t) is: mal plan? What are the correspondingvalues

of B and C?

T(t) = Y(i - t). (o t I) (I)

2. Given r, but now considering n variable,

His average transactions balance:

what would be the value of n - call it n *

'I shall assume for convenience that the own-rate of in- for which Rn is a maximum?

terest on cash is zero; if cash bore interest, the argument

would be essentially the same. By "the interest rate" is 3. How does n *, the optimal number of

really meant the difference between the yield on bonds and transactions,depend on r? As n * varies with

the yield on cash.

The argument would be changed only inessentially by r, so will B and C. Also, incidentally, how do

considering instead an individual who receives cash at a n *, B, and C depend on Y, the volume of

uniform rate and must make a single periodic disbursement.

It may not be too far-fetched to claim that, at a given sea-

transactions?

son, almost every transactor in the economy can be approxi-

mated by one of these two models. Either the transactor is

i. The first problem is the optimal timing

accumulating a series of small receipts toward the day and amounts of a given number of transactions.

when large disbursements must be made, or he is gradually Considerthis problem first for the case in which

disbursing in small payments a prior large receipt. At dif- transaction costs are independent of the size

ferent seasons of the year, or month, or week, the same

of transactions (b = o). In this case transac-

transactor may sometimes be of one type and sometimes of

the other. Of course actual transactions balances T(t) need tions costs are fixed by the number of trans-

not decline, or grow, linearly, as assumed in this paper. actions; and, for a given number, the optimal

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

INTEREST-ELASTICITY OF TRANSACTIONS DEMAND 243

schedulingwill be the one which gives the great- Chart i presents two possible ways of schedul-

est interest earnings. ing two transactions. The first way, shown in

If there is one transaction, from cash into Chart ia, is to hold all cash, no bonds, until

bonds, there must be at least a second transac- time t1; to buy B1 bonds at that time; to hold

tion, from bonds back into cash. Bonds cannot these, and earn interest on them, until time t2;

be used for payments, and the entire initial and then to convert them into cash. Total in-

transactions balance must be paid out by the terest earnings are proportional to the shaded

end of the period. area. The second way, shown in Chart ib, is

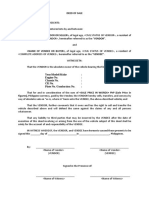

In Chart i, the total transactions balance T to buy the same amount of bonds B1 immedi-

is plotted against time, as in equation (i). ately on receipt of periodic income Y, and to

CHART I. - SCHEDULING OF Two TRANSACTIONS

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

244 THE REVIEW OF ECONOMICS AND STATISTICS

hold them until they absolutely must be sold schedule. In general, for n transactions, the

in orderto get the cash necessary for subsequent optimal schedule is to buy at time zero

payments. The revenue from this schedule is n i

proportional to the shaded area in Chart ib, Y bonds, and to sell them in equal in-

n

and is obviously greater than the revenue in stallments of Y/n at times t2 = i/n, t3

Chart ia. The two general principles exempli- t - I ~n - I

fied in the superiority of the second schedule to 2/n, . . . tj n tn= ~n-

.--- The

the first are as follows:

average bond holding, following this schedule,

(a) All conversion from cash into bonds is half of the initial holding:

should occur at time o. Whatever the size

B n-I

of a transaction in this direction, to postpone

2n

it is only to lose interest.

(b) A transaction from bonds into cash Revenue is rB", or:

should not occur until the cash balance is n- I

zero. To make this transaction before it is Rn= Yr. (n2) (6)

2n

necessary only loses interest that would be

earned by holding bonds a longer time. Transaction costs are equal to na, so that net

revenue is:

There are many schedules of two transac-

tions that conform to these principles. Two

Yr-na (n 2) (7)

possibilities are shown in Chart 2. In Chart 2a rn=

2n

the initial transaction is obviously too great,

and the second transaction must therefore be where a is the cost of a transaction. These re-

too early. The optimal schedule is to convert sults are all proved in the Appendix.

half of Y into bonds at time o and to sell them Some modificationin the argument is needed

for cash at time '2.5 to take account of transaction costs propor-

If three transactions are allowed, it is not tional to the size of the transaction. If this cost

necessary to sell all the bonds at one time. Some is b per dollar, then every dollar of cash-bonds-

may be sold at time t2 and the remainder at cash round trip costs 2b, no matter how quickly

time t3. This makes it possible to buy more it is made. The interest revenue from such a cir-

bonds initially. Chart 3 shows the optimal cuit depends, on the other hand, on how long

the dollar stays in bonds. This means that it is

CHART 3.- SCHEDULING OF THREE TRANSACTIONS worth while to buy bonds only if they can be

held long enough so that the interest earnings

exceed 2b. This will be possible at all only if r

exceeds 2b, since the maximum time available

is i. The minimum time for which all bonds

purchased at time zero must be held, in order

to break even, is 2b/r. Holding bonds beyond

that time, so far as transactions needs permit,

will result in interest earnings which are clear

gain. The problem is the same as in the simpler

case without size-of-transaction costs, except

that the effective beginning time is not t1 = o

but t1 = 2b/r, and consequently the effective

beginningtotal transactionsbalance is not Y but

Y[I -(2 b/r) ]. With these modifications, the

solution for the optimal scheduling of n trans-

' For /2 is the value of t2 which maximizes the expres- actions is the same: Put (n - i)/n of the be-

sion representinginterest revenue: rY(i - t2) t2. ginning balance into bonds, and sell these bonds

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

INTEREST-ELASTICITY OF TRANSACTIONS DEMAND 245

for cash in equal installment at n - i equally Yr ( b

of n, which approaches - I _- as n

spaced dates.6 2

For n = 3, the solution is illustrated in Chart becomes indefinitely large. Marginal revenue,

4, which may be compared with Chart 3. In R.n+j -Rn, is a positive decreasing function of

Chart 4 it is assumed that 2b/r = Y2, i.e., that n, which approacheszero as n becomes infinite:

the size of transaction cost per dollar is Y4 of 2

the interest rate. The effective beginning time I _2b

Rn

is thus t1 = ?2, and the effective beginning bal- -RYr2n(n+ I) II r

ance is T(Y2) or Y/2. (n :-2),

(r :-2b) (I

Total cost, na, is simply proportionalto a; and

CHART 4. - SCHEDULING OF TRANSACTIONS marginalcost is a constant.

(Transaction cost per dollar equal to one-fourth There are four possible kinds of solution n *,

interest rate) of which Chart 5 illustrates only one. These are

I

defined by the relation of the interest rate to

volume and costs of transactions, as follows:

I. a > '8 Yr I--) 7* 2 is negative.

In this case, xn will also be negative for all

values of n greater than 2. The optimal

number of transactions is zero, because wr0is

equal to zero.

II. a = '8 Yr( I -

2 7) 2 iS zero. In

r

this case, 7rnwill be negative for all values of

n greater than 2; n * is indeterminate be-

tween the two values o and 2.

III.

The initial purchase of bonds amounts to 23 of

Y/2; half of this purchase is converted back '8 Yr I _ ) > a >- Yr( 2b );

into cash at t2 = 3, and the remainder at t3 n * = 2. Here 7,T is positive for n 2 but

= 5/6. negative for all greater values.

For the general case, the following results

are proved in the Appendix. IV.. I/I2 Yr ( i - 2 a. The optimal

- nfl-I I 4b2A number of transactions n * is (or at least

Bit 2 V-r (n_- 2 ), (r > 2b) may be) greater than 2. This is the case

(8) illustrated in Chart 5.

R - Yr (I _ b(n :-2) (r :-2b) 3. The third step in the argument concerns

2n r (9) the relation of the optimal number of transac-

n -I 2b 2 tions, n *, to the rate of interest r. From (g)

7Tn = Yr i-- ) -na. and (i i) it is apparent that both the total and

2n r

the marginal revenue for a given n will be

(n :-2 ), (r 2b) (IO0)

greater the larger is r. If an increase in r alters

2. The next step is to determine the optimal n * at all, it increases n *. Now B.*, average

number of transactions, i.e., the value of n bond holdings, is for two reasons an increasing

which maximizes5rr in (io). As shown in Chart function of n. As is clear from (8), Bn for given

5, revenue Rn is a positive increasing function n depends directly on r. In addition, Bn, in-

'See Appendix for proof. creases with n; and n * varies directly with r.

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

2A6 THE REVIEW OF ECONOMICS AND STATISTICS

CHART 5. - DETERMINATION OF OPTIMAL NUMBER OF CHART 6. - RELATION OF AVERAGE BOND AND CASH

TRANSACTIONS HOLDINGS TO RATE OF INTEREST

revenue depends directly on Y, the amount of

periodic receipts; but marginal cost a does not.

Consequently n * will be greater, for solutions

in category IV, the greater the volume of trans-

actions Y; and the ratio of cash holdings to Y

will vary inversely with Y. Moreover, the range

of values of r for which the demand for cash is

sensitive to the interest rate (categories II, III,

Thus it is proved that the optimal share of IV) is widened by increases in Y. Small trans-

bonds in a transactions balance varies directly, actors do not find it worth while even to con-

and the share of cash inversely, with the rate of sider holding transactions balances in assets

interest. This is true for rates high enough in other than cash; but large transactors may be

relation to transaction costs of both kinds to quite sensitive to the interest rate. This conclu-

fall in categories II, III, and IV above. Within sion suggests that the transactions velocity of

category I, of course, r can vary without affect- money may be higher in prosperity than in de-

ing cash and bond holdings. pression, even if the rate of interest is constant.

Chart 6 gives an illustration of the relation- But it would not be correct to conclude that,

ship: r,, is the level of the rate of interest which for the economy as a whole, transactions veloc-

meets the condition of category II, which is ity depends directly on the level of money in-

also the boundary between I and III. come. It is the volume of transactions Y rela-

The ratio of cash to total transactions bal- tive to transaction cost a that matters; and in

ances is not independentof the absolute volume a pure price inflation Y and a could be expected

of transactions. In equation (i i), marginal to rise in the same proportion.

APPENDIX

I. Suppose that (I - t2)Y bonds are bought at as the initial purchase, (I - t2) Y, total transaction

time t = o and held until t = t2. From t2 until t3, costs - ignoring those costs, na, which are fixed

(I - t3)Y bonds are held. In general, from t1-1 when the number of transactions is fixed - are

until ti, (i - ti) Y bonds are held, and finally from 2b (i- t2) Y. Consequently, revenue Rn is given by

t.-1 until t., (i - tn) Y bonds are held. After t1,n the following expression:

bond holdings are zero. Every dollar of bonds held

Rn = Y* t2r+(I I-t3) ' (t-t2)r+ ...

from ti-. until ti earns interest in amount (t - (II-t2 *h

t_i)r. Since the total sales of bonds are the same

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

INTEREST-ELASTICITY OF TRANSACTIONS DEMAND 247

It is convenient, for the purposes of this Appendix, l

26 Bn = YX ( I-t,) (ht-ti_1 ) +Yr(I-t2) t1

i=2

to define t1 as equal to-. Then we may write

r

Rnas follows: Y(I-tl)2(n-i) 2Ytl(I-tl) (n-i)

Bn = +

n 2f 2f

Rn = Y{r j=2

Y. ( I -ti)(t t-t 1) (A2)

Y(n-i) (I-tl)2

Bn

= . (A8)

2fl

The ti(i = 2, ... n) are to be chosen so as to maxi-

mize Rn. Setting the partial derivatives equal to

26

zero gives the following set of equations. Substituting - for t1 in (A8) gives (8) in the

r

-2t2+t3 = _4 text, of which (5) is a special case.

t2-2t3+t4 = o

t3-2t4+t5 = o II. The model used in the present paper is much

(A3) the same as that used by Baumol, and the maximiza-

tn-2-2tn-l+tn = 0 tion of my expression (iO) gives essentially the same

tn-1-2 tn = I result as Baumol's equation (2), page 547, and his

expression for R on page 549. There are, however,

The solution to (A3) is: some differences:

i. I permit the number of transactions into cash,

I - ti n-I , to take on only positive integral values, while

t2 = ti +

n Baumol treats the correspondingvariable, I/C, as

2 continuous. Consequently, it is possible to dupli-

t3 = t, +- (I- tl ) (A4 ) cate Baumol's equation (2) exactly only by ignoring

n

differences between n - i, n, and n + i.

2. The present paper proves what Baumol as-

tq = ti + (I-t1 ) sumes, namely that cash withdrawals should be

n equally spaced in time and equal in size.

3. Baumol does not consider the possibility that,

n - I in the general case where the individual has both

receipts and expenditures,the optimal initial invest-

ment is zero. Of the four kinds of solution men-

From (A4) we have: tioned in the present paper, Baumol considers only

case IV. In part this is because he treats the deci-

sion variable as continuous and looks only for the

I~~~~~~ (=2 3, .. .n) (As) regular extremum. But it is also because of his

nqt1=(-t) n

definition of the problem. Baumol's individual, in-

n-i+i stead of maximizing his earnings of interest net of

I -t = + (I-t1). (i=2,3,. .n) (A6) transaction costs, minimizes a cost which includes

n

an interest charge on his average cash balance. This

Substituting (A5) and (A6) in (A2) gives: definition of the problem leads Baumol to overlook

the question whether interest earnings are high

(_-tl)2 n~ enough to justify any investment at all. Baumol's

Rn= Yr 2 (n-i+ I) calculation of interest cost is rather difficult to un-

derstand. By making it proportionalto the average

Yr (-1) n(n-( ) (A7) cash balance, he is evidently regardingas "cost" the

n2 2 sacrifice of earnings as compared with a situation

in which the full transactions balance, which de-

2b

From (A7), substituting - for ti, expression (9) clines gradually from T to zero during the period, is

r invested and cash is held no longer than the split

in the text is easily derived. Equation (6) in the second preceding its expenditure. Since this situa-

text is a special case of (9). tion would require infinitely many financial trans-

actions and therefore infinitely large transactions

B., average bond holding, is obtained from the costs, it hardly seems a logical zero from which to

definition (4) as follows: measure interest costs.

This content downloaded on Wed, 27 Feb 2013 07:21:07 AM

All use subject to JSTOR Terms and Conditions

You might also like

- Tobin 1956Document8 pagesTobin 1956Jorge Alberto Esparza RamosNo ratings yet

- Tobin - The Interest Elasticity of Transactions Demand For CashDocument8 pagesTobin - The Interest Elasticity of Transactions Demand For CashWalter ArceNo ratings yet

- Baumol's Demand For MoneyDocument7 pagesBaumol's Demand For MoneyShofi R Krishna100% (19)

- W.J.Baumol (1952)Document13 pagesW.J.Baumol (1952)rishib3003No ratings yet

- Coursework 13 NovDocument9 pagesCoursework 13 NovharoonkhanNo ratings yet

- The Transactions Demand For Cash: An Inventory Theoretic Approac FDocument15 pagesThe Transactions Demand For Cash: An Inventory Theoretic Approac FCanela DavidNo ratings yet

- Inventory 2Document8 pagesInventory 2Nonso OsakweNo ratings yet

- Unit 8Document19 pagesUnit 8malharchorge990No ratings yet

- University of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Journal of Political EconomyDocument11 pagesUniversity of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Journal of Political EconomyEdgar Diaz NietoNo ratings yet

- Joan Robinson 1970Document10 pagesJoan Robinson 1970megha043kumariNo ratings yet

- 1952 - Baumol - The Transactions Demand For Cash: An Inventory Theoretig ApproachDocument13 pages1952 - Baumol - The Transactions Demand For Cash: An Inventory Theoretig ApproachJuliaNo ratings yet

- Financing Government Through Monetary Expansion and InflationDocument9 pagesFinancing Government Through Monetary Expansion and InflationflowerboyNo ratings yet

- 2 - Money Demand TheoriesDocument8 pages2 - Money Demand Theoriesmajmmallikarachchi.mallikarachchiNo ratings yet

- Monetary EconomicsDocument36 pagesMonetary Economicsrealmadridramos1902No ratings yet

- Chapter 2: The Demand For Money: Learning ObjectivesDocument12 pagesChapter 2: The Demand For Money: Learning Objectiveskaps2385No ratings yet

- 03 Ch3 Money Market - Practice SheetDocument17 pages03 Ch3 Money Market - Practice SheetDhruvi VachhaniNo ratings yet

- Slide 7Document23 pagesSlide 7Shruti PaulNo ratings yet

- Chapter 2: The Demand For Money: Learning ObjectivesDocument12 pagesChapter 2: The Demand For Money: Learning Objectivestech damnNo ratings yet

- Perry Mehrling: What Is Monetary Economics About?Document16 pagesPerry Mehrling: What Is Monetary Economics About?thewolf37No ratings yet

- Baumol TobinDocument7 pagesBaumol TobinmervinNo ratings yet

- Tobin PDFDocument25 pagesTobin PDFVhy Vhy JHNo ratings yet

- Quantity Theory of MoneyDocument10 pagesQuantity Theory of Moneyrabia liaqatNo ratings yet

- Quantity Theory of MoneyDocument9 pagesQuantity Theory of Moneyrabia liaqatNo ratings yet

- Money May1982Document14 pagesMoney May1982Bar RiNo ratings yet

- QTMDocument8 pagesQTMKhalid AzizNo ratings yet

- 1958 - Tobin - Liquidity Preferencesas Behaviour Towards Risk PDFDocument23 pages1958 - Tobin - Liquidity Preferencesas Behaviour Towards Risk PDFDiego ManzurNo ratings yet

- Concept of Money SupplyDocument7 pagesConcept of Money SupplyMD. IBRAHIM KHOLILULLAHNo ratings yet

- Time Value of Money - DamodaranDocument16 pagesTime Value of Money - DamodaranVivek KumarNo ratings yet

- Design Swaps: Default Risk and Innovations of RateDocument12 pagesDesign Swaps: Default Risk and Innovations of RateVivek BadigerNo ratings yet

- Assignment Money Demand Process? First We Understand What Money Function and TypesDocument6 pagesAssignment Money Demand Process? First We Understand What Money Function and TypesKhader MohamedNo ratings yet

- The Quantity Theory of Money A RestatementDocument20 pagesThe Quantity Theory of Money A RestatementErnesto MoriartyNo ratings yet

- Session 6 - Money Market EquilibriumDocument8 pagesSession 6 - Money Market EquilibriumNikhil kumarNo ratings yet

- Niehans Money and Barter 223562Document12 pagesNiehans Money and Barter 223562LuisNo ratings yet

- TOBIN - Liquidity Preference As Behavior Towards RiskDocument23 pagesTOBIN - Liquidity Preference As Behavior Towards RiskLujan GNo ratings yet

- Reviewer in MonetaryDocument3 pagesReviewer in MonetaryBaby Lyca ManaloNo ratings yet

- Money Banking and The Financial System 2nd Edition Hubbard Solutions ManualDocument26 pagesMoney Banking and The Financial System 2nd Edition Hubbard Solutions ManualJoshuaSnowexds100% (48)

- Modern Money Mechanics Meccaniche Monetarie ModerneDocument40 pagesModern Money Mechanics Meccaniche Monetarie ModerneAmerican Kabuki100% (7)

- Factors Affecting The Income Velocity of Money in The Commonwealth PDFDocument20 pagesFactors Affecting The Income Velocity of Money in The Commonwealth PDFmaher76No ratings yet

- Financial - Management Book of Paramasivam and SubramaniamDocument21 pagesFinancial - Management Book of Paramasivam and SubramaniamPandy PeriasamyNo ratings yet

- Exchange Rates and The Balance of Payments: Reconciling An Inconsistency in Post Keynesian TheoryDocument27 pagesExchange Rates and The Balance of Payments: Reconciling An Inconsistency in Post Keynesian TheoryGregor SchwindelmeisterNo ratings yet

- Demand For MoneyDocument6 pagesDemand For MoneySarvesh KulkarniNo ratings yet

- 08 Zero Sum Game PDFDocument9 pages08 Zero Sum Game PDFAdnan KamalNo ratings yet

- Money Banking and The Financial System 2nd Edition Hubbard Solutions ManualDocument36 pagesMoney Banking and The Financial System 2nd Edition Hubbard Solutions Manualbonusredhot98cgt100% (19)

- Rabin A Monetary Theory - 131 135Document5 pagesRabin A Monetary Theory - 131 135Anonymous T2LhplUNo ratings yet

- Unit5 MoneyDocument34 pagesUnit5 Moneytempacc9322No ratings yet

- CF UpDocument68 pagesCF Upsabey22991No ratings yet

- The Monetary Transmission Mechanism: The Credit ViewDocument5 pagesThe Monetary Transmission Mechanism: The Credit ViewAnonymous T2LhplUNo ratings yet

- Money and Output: Correlation or Causality?: Scott FreemanDocument7 pagesMoney and Output: Correlation or Causality?: Scott FreemanRicardo123No ratings yet

- Rabin A Monetary Theory 31 35Document5 pagesRabin A Monetary Theory 31 35Anonymous T2LhplUNo ratings yet

- EAE 401 Notes TOPIC ONE JUNE 2021 CLASSDocument15 pagesEAE 401 Notes TOPIC ONE JUNE 2021 CLASSHeymasha 019No ratings yet

- Money and Banking - 10&11 PDFDocument8 pagesMoney and Banking - 10&11 PDFDebabrattaNo ratings yet

- KupnovDocument20 pagesKupnovkurdiausha29No ratings yet

- Milton Friedman - The Demand For MoneyDocument7 pagesMilton Friedman - The Demand For MoneyanujasindhujaNo ratings yet

- Presentation EcoDocument9 pagesPresentation EcoDipayan DebnathNo ratings yet

- Chapter 3 (Unit 1)Document21 pagesChapter 3 (Unit 1)GiriNo ratings yet

- Velocity of Money Function For India: Analysis and InterpretationsDocument13 pagesVelocity of Money Function For India: Analysis and InterpretationsBhairavi UvachaNo ratings yet

- Econ Notes 3Document13 pagesEcon Notes 3Engineers UniqueNo ratings yet

- TR 2582-18-01 - 352Document11 pagesTR 2582-18-01 - 352ırmak erolNo ratings yet

- SOA FUEL (AutoRecovered)Document18 pagesSOA FUEL (AutoRecovered)Jesslie Joy Pablico-BanayoNo ratings yet

- GF24 - Final Export 01Document52 pagesGF24 - Final Export 01nataliafreedom555No ratings yet

- Design by Allison Hoffman: Presents The 2012 Amigurumi Calendar ProjectsDocument3 pagesDesign by Allison Hoffman: Presents The 2012 Amigurumi Calendar ProjectsMaika PardoNo ratings yet

- Economic Essays Grade 12Document56 pagesEconomic Essays Grade 12pleasuremaome06No ratings yet

- Yanis Varoufakis Against EqualityDocument26 pagesYanis Varoufakis Against EqualityHugo Tedjo SumengkoNo ratings yet

- Aircontrol 20Document28 pagesAircontrol 20Fer De La VegaNo ratings yet

- Civ GD Q68922 21Document1 pageCiv GD Q68922 21Adhe L ShethiadyNo ratings yet

- Worksheet Unit 3 SupplyDocument4 pagesWorksheet Unit 3 SupplyPriya Yadav100% (1)

- EBC1 Week 4 Student WorksheetDocument3 pagesEBC1 Week 4 Student WorksheetCarmel Debora Siregar -No ratings yet

- Survey of Accounting 7th Edition Warren Solutions ManualDocument35 pagesSurvey of Accounting 7th Edition Warren Solutions Manualandrefloresxudd100% (25)

- Dexretail-Capo-LED ColourDocument8 pagesDexretail-Capo-LED ColourFarag MohamedNo ratings yet

- RTI Act MANUAL 4 (1) (B)Document30 pagesRTI Act MANUAL 4 (1) (B)Boddu ThirupathiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageNiyas Bin Abdul AzeezNo ratings yet

- SWOT Analysis of Robotic Vacuum CleanerDocument7 pagesSWOT Analysis of Robotic Vacuum Cleanerhilalcrypto67No ratings yet

- Motor Vehicle Deed of Sale - PhilippinesDocument2 pagesMotor Vehicle Deed of Sale - PhilippinesEmily Esguerra VerdeNo ratings yet

- AccountancyDocument4 pagesAccountancyAbhijan Carter BiswasNo ratings yet

- Mega Shine Payungallo UAS BingDocument12 pagesMega Shine Payungallo UAS BingMega Shine PayungalloNo ratings yet

- Case OnlinkDocument1 pageCase OnlinkNikita SemkinNo ratings yet

- Lecture 4 Notes Econ1020Document10 pagesLecture 4 Notes Econ1020Farah Abdel AzizNo ratings yet

- Non-Current Assets Held For Sale: CA51016 - 2MA1Document21 pagesNon-Current Assets Held For Sale: CA51016 - 2MA1The Brain Dump PHNo ratings yet

- RPT Maths 6Document5 pagesRPT Maths 6shaminiNo ratings yet

- Ch. 1 CVP Re RevDocument20 pagesCh. 1 CVP Re Revsolomon adamuNo ratings yet

- Sampel RFP - Pak RailwayDocument47 pagesSampel RFP - Pak RailwaySohail Wahab (E&I)No ratings yet

- Cost of Production and Organization of IndustryDocument3 pagesCost of Production and Organization of IndustryAnonymous SecretNo ratings yet

- HSI Brochure GeesaDocument16 pagesHSI Brochure GeesaTuấn Phan QuốcNo ratings yet

- Business Plan - CADERP SAASDocument4 pagesBusiness Plan - CADERP SAASAdegboyega Moses SegunNo ratings yet

- Bcog-171 June 2022Document4 pagesBcog-171 June 2022SanjeetNo ratings yet

- Whitecroft Education Brochure 2Document14 pagesWhitecroft Education Brochure 2Yasmeen AmrNo ratings yet

- Forecasting Long Range Dependent Time Series With Exogenous Variable Using ARFIMAX ModelDocument4 pagesForecasting Long Range Dependent Time Series With Exogenous Variable Using ARFIMAX ModelKrishna SarkarNo ratings yet