Professional Documents

Culture Documents

Viva

Uploaded by

Hasnain Aziz0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pagesViva

Uploaded by

Hasnain AzizCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

The interrelation between earnings management, corporate governance, and Tobin's Q

can be complex and interconnected:

1. Earnings Management and Tobin's Q:

Earnings management practices can affect Tobin's Q, as they may influence

reported earnings, impacting the perceived value of a company in the market.

Aggressive or deceptive earnings management could inflate reported earnings,

potentially leading to a higher Tobin's Q due to a falsely perceived higher market

value. This might lead to overvaluation, affecting investment decisions.

2. Corporate Governance and Earnings Management:

Strong corporate governance can act as a deterrent to unethical earnings

management practices. A robust governance framework with transparent

reporting, independent oversight, and checks and balances can reduce the

likelihood of manipulative reporting.

Effective governance mechanisms can minimize the risk of opportunistic behavior

by management, enhancing the accuracy and reliability of financial statements

and reducing the potential for earnings management.

3. Corporate Governance and Tobin's Q:

Good corporate governance can positively influence Tobin's Q. When a company

demonstrates strong governance practices, it tends to be perceived as more

reliable, trustworthy, and better managed, which can positively impact its market

value and Tobin's Q ratio.

High-quality governance structures that align the interests of stakeholders and

ensure transparency can potentially enhance a company's long-term market

value.

The relationship between these elements is intricate. Ethical corporate governance can

act as a buffer against manipulative earnings practices, potentially impacting a

company's perceived value reflected in Tobin's Q. However, poor governance could lead

to increased opportunities for earnings management, influencing reported earnings and

potentially distorting the market valuation indicated by Tobin's Q.

Understanding these relationships is crucial for investors, regulators, and company

stakeholders as they assess the true worth and potential risks associated with a firm's

reported earnings and market valuation.

The effects of earnings management, particularly concerning discretionary accruals, on

Tobin's Q can be significant:

1. Influence on Market Perception: Earnings management practices involving

discretionary accruals can impact a company's reported earnings. Manipulating these

accruals can distort the true financial position and performance of a firm, potentially

leading to misinterpretations by investors and analysts. Inaccurate or manipulated

earnings may lead to a misjudgment of a company's market value, thereby affecting

Tobin's Q.

2. Potential Overvaluation or Undervaluation: Manipulating discretionary accruals to

artificially increase reported earnings can result in an overvalued perception of a

company. This might lead to an inflated Tobin's Q, which doesn't accurately reflect the

true underlying value of the firm. Conversely, if earnings management through

discretionary accruals artificially deflates reported earnings, it could lead to

undervaluation and a lower Tobin's Q.

3. Long-Term Impact: If earnings management using discretionary accruals is a

continuous practice, it might create an inconsistent or unreliable pattern of reported

earnings. This inconsistency could lead to reduced investor confidence in the company's

financial statements, impacting Tobin's Q and potentially the market valuation.

4. Implications for Investment and Strategic Decision-Making: Inaccurate or

manipulated earnings resulting from discretionary accruals could affect investment

decisions, potentially influencing the allocation of resources, expansion plans, and

overall strategic decision-making by stakeholders. This could have a direct impact on

the firm's growth and, therefore, its Tobin's Q.

Therefore, the manipulation of earnings through discretionary accruals can significantly

impact the market's perception of a company's value, as indicated by Tobin's Q. If

earnings are managed in a manner that distorts the true financial health of the firm, it

could mislead investors and stakeholders, leading to an inaccurate assessment of its true

worth in the market.

Discretionary accruals refer to the estimated portion of accruals in a company's financial

statements that are subject to managerial discretion. Accruals are accounting

adjustments made to match revenues and expenses to the periods in which they are

earned or incurred, irrespective of the cash flow timing. Discretionary accruals

specifically represent those accounting adjustments that are more subject to managerial

judgment and estimation rather than being solely driven by underlying business

transactions.

Here are some key points about discretionary accruals:

1. Managerial Judgment: These accruals involve the use of management's discretion in

making accounting estimates and adjustments. They may include estimates for doubtful

accounts, provisions for future liabilities, or valuations of assets.

2. Earnings Management: Discretionary accruals are often associated with earnings

management, as managers might manipulate these figures to achieve specific financial

reporting objectives. For instance, they might adjust discretionary accruals to smooth

reported earnings or meet analyst expectations.

3. Subjectivity: Discretionary accruals involve a level of subjectivity and estimation. They

are based on managerial assessments rather than direct, verifiable transactions.

4. Financial Reporting Impact: The level and nature of discretionary accruals can affect a

company's reported earnings. Aggressive use of discretionary accruals could lead to

inflated or deflated earnings figures, which, in turn, might misrepresent a company's

true financial performance.

5. Analysis in Financial Research: Discretionary accruals are often a focus in financial

research, especially when studying earnings quality, manipulation, or the relationship

between accounting practices and a company's financial health.

Understanding discretionary accruals is important in assessing a company's financial

statements and earnings quality. Excessive or inappropriate use of discretionary accruals

can raise concerns about the reliability and transparency of a company's financial

reporting. Therefore, analysts and investors often scrutinize these accruals to gauge the

potential impact on reported earnings and the company's financial health.

You might also like

- Financial Ratios in ContractsDocument2 pagesFinancial Ratios in ContractsDeyeck VergaNo ratings yet

- Patterns of Earnings ManagementDocument6 pagesPatterns of Earnings ManagementAnis SofiaNo ratings yet

- CHAPTER 9 - Earnings Management SummaryDocument3 pagesCHAPTER 9 - Earnings Management SummaryVanadisa SamuelNo ratings yet

- Analyzing Financial Statements for Business ValuationDocument5 pagesAnalyzing Financial Statements for Business ValuationDardan BalajNo ratings yet

- The Timing of Asset Sales and Earnings MDocument8 pagesThe Timing of Asset Sales and Earnings MRizqullazid MufiddinNo ratings yet

- Group Assignment 4 Earning ManagementDocument6 pagesGroup Assignment 4 Earning Managementcikyayaanosu0% (1)

- Earnings ManagementDocument3 pagesEarnings Managementmiaaudi488No ratings yet

- Creative Accounting: Case Study:WorldcomDocument11 pagesCreative Accounting: Case Study:WorldcomVikash KumarNo ratings yet

- Earnings Management NotesDocument2 pagesEarnings Management Notesrachel 1564No ratings yet

- Earnings ManagementDocument16 pagesEarnings ManagementakfajarNo ratings yet

- Meaning and Types of Earnings Management TacticsDocument5 pagesMeaning and Types of Earnings Management TacticsSofia ArissaNo ratings yet

- DocxDocument7 pagesDocxHeni OktaviantiNo ratings yet

- Fin STM Fraud 2Document6 pagesFin STM Fraud 2Okwuchi AlaukwuNo ratings yet

- Activity-Financial AnalysisDocument2 pagesActivity-Financial AnalysisXienaNo ratings yet

- Updated Report AUDITINGDocument9 pagesUpdated Report AUDITINGJanelleNo ratings yet

- Study Pack 29Document4 pagesStudy Pack 29Sachin KumarNo ratings yet

- Esemen Grup No.2Document5 pagesEsemen Grup No.2Ain ManNo ratings yet

- UntitledDocument4 pagesUntitledWiLliamLoquiroWencesLaoNo ratings yet

- Accct 1Document4 pagesAccct 1Jael AlmazanNo ratings yet

- babe oyeDocument4 pagesbabe oyejashanvipan1290No ratings yet

- Financial Statement Analysis - Chp03 - Summary NotesDocument6 pagesFinancial Statement Analysis - Chp03 - Summary NotesBrainNo ratings yet

- Document 7Document12 pagesDocument 7Ram PagongNo ratings yet

- Finance RiskDocument2 pagesFinance RiskmithunNo ratings yet

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPFrom EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPRating: 4.5 out of 5 stars4.5/5 (3)

- Financial Reporting Quality (Reflective Paper)Document1 pageFinancial Reporting Quality (Reflective Paper)kiana reneeNo ratings yet

- Accounting Quality AnalysisDocument4 pagesAccounting Quality AnalysisBurhan Al MessiNo ratings yet

- PTBCTC - Google Tài liệuDocument2 pagesPTBCTC - Google Tài liệuNguyễn LinhNo ratings yet

- Management Control System: Group 8Document13 pagesManagement Control System: Group 8Farrell P. NakegaNo ratings yet

- Earnings Management: Matthew Blostein Michael Choi Kurtis Holmes Eric Martin Trevor SticklDocument47 pagesEarnings Management: Matthew Blostein Michael Choi Kurtis Holmes Eric Martin Trevor SticklrinaawahyuniNo ratings yet

- Answer KeyDocument6 pagesAnswer KeyClaide John OngNo ratings yet

- Financial StatementDocument5 pagesFinancial StatementGalih ApNo ratings yet

- Bva 1Document3 pagesBva 1najaneNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Earning Management Group AssignmentDocument7 pagesEarning Management Group AssignmentcikyayaanosuNo ratings yet

- Acc Ethics Ch7Document25 pagesAcc Ethics Ch7Tazeem OmerNo ratings yet

- Basanta FinalDocument5 pagesBasanta FinalDirty RajanNo ratings yet

- Accounting Ratios: Inancial Statements Aim at Providing FDocument45 pagesAccounting Ratios: Inancial Statements Aim at Providing FNIKK KICKNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Final Exam PreparationDocument4 pagesFinal Exam PreparationHiếu Nguyễn Minh HoàngNo ratings yet

- Chapter 01 Solutions PalepuDocument3 pagesChapter 01 Solutions Palepuilhamuh67% (6)

- 2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointDocument10 pages2014 3a. Explain Why Operating Leverage Decreases As A Company Increases Sales and Shifts Away From The Break-Even PointHiew fuxiangNo ratings yet

- Financial Statement AnalysisDocument27 pagesFinancial Statement AnalysisJayvee Balino100% (1)

- Advantages of FinancialDocument5 pagesAdvantages of FinancialSaqlain TariqNo ratings yet

- Chapter CRM 6 15Document3 pagesChapter CRM 6 15Selva Bavani SelwaduraiNo ratings yet

- Auditing QuestionsDocument10 pagesAuditing Questionssalva8983No ratings yet

- Our WorkDocument16 pagesOur Workroro522011No ratings yet

- MaterialityDocument7 pagesMaterialityRogers256No ratings yet

- Current Developments in Accounting TheoryDocument8 pagesCurrent Developments in Accounting TheorySheirgene NgNo ratings yet

- Jebv Vol 4 Issue 1 2024 9Document14 pagesJebv Vol 4 Issue 1 2024 9Journal of Entrepreneurship and Business VenturingNo ratings yet

- Case 3 FinalDocument8 pagesCase 3 Finalkyra84No ratings yet

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- Group 1 Chapter 1 The Demand For Auditing and Assurance ServicesDocument23 pagesGroup 1 Chapter 1 The Demand For Auditing and Assurance ServicestristahmncdldyNo ratings yet

- Accounting Ratios: Inancial Statements Aim at Providing FDocument47 pagesAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Honda (Pakistan) : Individual Report On Audit ProcessDocument11 pagesHonda (Pakistan) : Individual Report On Audit ProcesssadiaNo ratings yet

- LM10 Financial Reporting Quality IFT NotesDocument16 pagesLM10 Financial Reporting Quality IFT NotesjagjitbhaimbbsNo ratings yet

- What is Financial ManagementDocument10 pagesWhat is Financial ManagementCamille CornelioNo ratings yet

- Meaning: Business Concern in An Organized Manner. We Know That All Business TransactionsDocument5 pagesMeaning: Business Concern in An Organized Manner. We Know That All Business TransactionsKunika JaiswalNo ratings yet

- Red Flags in Financial AnalysisDocument15 pagesRed Flags in Financial AnalysisHedayatullah PashteenNo ratings yet

- Managerial AccountingDocument7 pagesManagerial Accountinglena moseroNo ratings yet

- CAMESCO Meeting ReportDocument50 pagesCAMESCO Meeting Reportchaolisa1No ratings yet

- Osm ProjectDocument14 pagesOsm ProjectADi SEPTIAWANNo ratings yet

- Analysis of The Factors Affecting Devident PolicyDocument12 pagesAnalysis of The Factors Affecting Devident PolicyJung AuLiaNo ratings yet

- BBM Group ReportDocument72 pagesBBM Group ReportKhoi Nguyen DangNo ratings yet

- Tally Practical (B) - 1Document3 pagesTally Practical (B) - 1Bhaavya GuptaNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 6Document7 pagesBUS 5111 - Financial Management - Written Assignment Unit 6LaVida LocaNo ratings yet

- Using Advertising and Promotion To Build BrandsDocument33 pagesUsing Advertising and Promotion To Build BrandsMuhammad Awais SabirNo ratings yet

- New Retail Banking Black Book Project. WordDocument64 pagesNew Retail Banking Black Book Project. WordSahil JoshiNo ratings yet

- 5th StrategicDocument13 pages5th StrategicJorame BermoyNo ratings yet

- Toppers Trading Institute Course SyllabusDocument4 pagesToppers Trading Institute Course SyllabusArpita BhansaliNo ratings yet

- Analysis of Performance of Franklin India Blue Chip FundDocument20 pagesAnalysis of Performance of Franklin India Blue Chip FundPRITAM PATRANo ratings yet

- Poultry Farm Business Plan in NepalDocument10 pagesPoultry Farm Business Plan in Nepalsapkotaparu77No ratings yet

- RP1488Document55 pagesRP1488snigdhar2025No ratings yet

- Lesson On MARKET STRUCTUREDocument37 pagesLesson On MARKET STRUCTUREJohn eric CatayongNo ratings yet

- Leverage 01Document22 pagesLeverage 01savani margeshNo ratings yet

- Marketing Case Study AnswersDocument5 pagesMarketing Case Study AnswerstigersarNo ratings yet

- 205-SC-OSCM-01 - Services Operations Management-I SolvedDocument13 pages205-SC-OSCM-01 - Services Operations Management-I SolveddGNo ratings yet

- Lupin Annual ReportDocument478 pagesLupin Annual ReportAnirban LahiriNo ratings yet

- Business Management: Chapter 9Document2 pagesBusiness Management: Chapter 9Javier BallesterosNo ratings yet

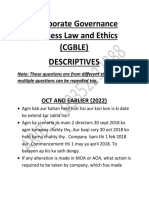

- PP Descriptives-CGBLEDocument12 pagesPP Descriptives-CGBLEMisbah IlyasNo ratings yet

- Block 2Document82 pagesBlock 2Shreya PansariNo ratings yet

- Heavy Water Pool ManagementDocument9 pagesHeavy Water Pool ManagementssrinivasanNo ratings yet

- Inv. Ch-5&6-1Document76 pagesInv. Ch-5&6-1Mahamoud HassenNo ratings yet

- Percentage Change - Worksheet: Skill Group A - Calculator 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12)Document9 pagesPercentage Change - Worksheet: Skill Group A - Calculator 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12)erin zietsmanNo ratings yet

- 30 Stock Trading Jobs and Vacancies in Noida, Uttar Pradesh - 9 June 2023Document1 page30 Stock Trading Jobs and Vacancies in Noida, Uttar Pradesh - 9 June 2023Rajiv GulatiNo ratings yet

- Updated Quiz BeeDocument11 pagesUpdated Quiz Beedandy boneteNo ratings yet

- Federal Investment Proclamation No. 769/2012 SummaryDocument28 pagesFederal Investment Proclamation No. 769/2012 SummaryMelese BelayeNo ratings yet

- Business Math 2nd Quarter Week 1-2Document21 pagesBusiness Math 2nd Quarter Week 1-2Mariano Mariano Mariano MarianoNo ratings yet

- Accounting Grade 11 Term 3 Week 4 - 2020Document6 pagesAccounting Grade 11 Term 3 Week 4 - 2020adriana espinoza de los monterosNo ratings yet

- Uthm Pme Talk - Module 2Document23 pagesUthm Pme Talk - Module 2emy syafiqahNo ratings yet